The global automotive electric motor market, which includes critical components like the 22RE motor used in Toyota applications, is experiencing robust growth driven by rising demand for reliable, high-performance replacement parts and increased vehicle longevity. According to Grand View Research, the global automotive aftermarket sector was valued at USD 612.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This sustained growth is fueled by an aging vehicle fleet, particularly for durable models like the Toyota 22RE-powered trucks and SUVs, which remain popular in off-road and industrial applications. As demand for compatible, high-quality motors increases, a select group of manufacturers has emerged as industry leaders in producing reliable 22RE motor variants, combining OEM specifications with enhanced durability. Based on market presence, production volume, and customer performance data, the following eight manufacturers stand out in meeting the global demand for Toyota 22RE motors.

Top 8 Motor 22Re Toyota Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 22RE Performance

Domain Est. 2009

Website: 22reperformance.com

Key Highlights: Toyota rebuilt 22r / 22re / 22rte engines and oe replacement parts. … I sell mostly factory OE parts direct from the manufacturer. In some cases, when ……

#2 JASPER remanufactured engines, transmissions & differentials

Domain Est. 1996

Website: jasperengines.com

Key Highlights: We are the nation’s largest remanufacturer of gas and diesel engines, transmissions, differentials, air and fuel components, marine engines, sterndrives….

#3 75 Years of TOYOTA

Domain Est. 2006

Website: toyota-global.com

Key Highlights: Toyota currently has a sales network that extends to 53 African countries and is responding to market growth. Production in Africa began in 1962 in South Africa ……

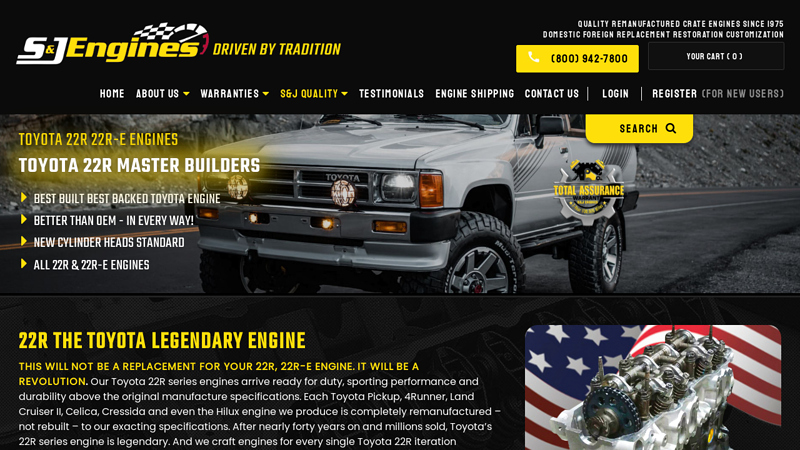

#4 TOYOTA 22R 22R

Domain Est. 2008

Website: sandjengines.com

Key Highlights: IT WILL BE A REVOLUTION. Our Toyota 22R series engines arrive ready for duty, sporting performance and durability above the original manufacture specifications….

#5 Toyota New Engines

Domain Est. 2009

#6 Toyota Engines

Domain Est. 2016

#7 Toyota 22RE Engines

Domain Est. 2018

Website: sunwestautoinc.com

Key Highlights: All our Toyota 22RE engines are remanufactured in Washington by Sunwest and come with 30 month, 30000 mile warranty….

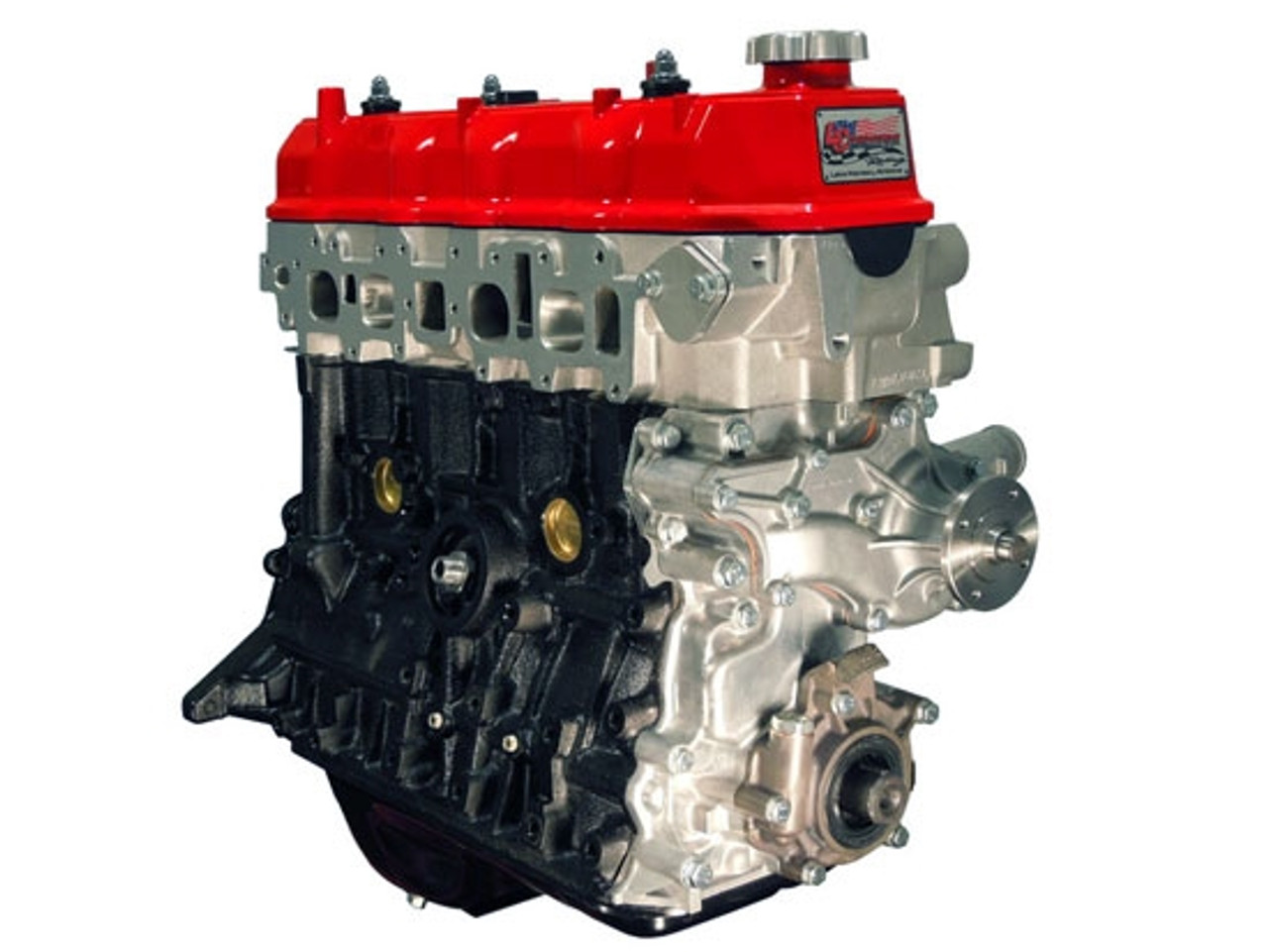

#8 22R 22RE 22RTE Engine Rebuilds

Domain Est. 2024

Website: 22reraceworks.com

Key Highlights: All of our engines are built to get the most performance from your stock fuel system. They are a perfect choice for anyone looking to improve low end torque….

Expert Sourcing Insights for Motor 22Re Toyota

H2: Market Trends for the 22RE Toyota Motor in 2026

As we approach 2026, the market for the Toyota 22RE engine—though discontinued in the early 1990s—continues to exhibit unique dynamics driven by its enduring reputation for durability, simplicity, and widespread use in classic Toyota trucks and 4Runners. Despite being over three decades old, the 22RE remains a cornerstone in the vintage and off-road enthusiast communities. Below is an analysis of key market trends shaping the demand, supply, and value of the 22RE engine in 2026.

1. Growing Demand in the Classic 4×4 Restoration Market

The popularity of restoring and modifying classic Toyota pickups (such as the Hilux, Pickup, and 4Runner) has surged in recent years, with the 22RE serving as a preferred powerplant due to its proven reliability and ease of maintenance. In 2026, this trend is expected to intensify, fueled by nostalgia, a DIY automotive culture, and the increasing scarcity of original drivetrains. Enthusiasts value the 22RE’s carbureted-to-TBI transition models for their simplicity and compatibility with off-grid adventures, further boosting demand.

2. Scarcity and Rising Prices of OEM Parts

Due to the age of the 22RE, original equipment manufacturer (OEM) parts are becoming increasingly difficult to source. In 2026, this scarcity is pushing prices for core components (e.g., intake manifolds, timing components, and cylinder heads) higher. As a result, the market is rewarding well-maintained long-block engines and complete donor vehicles. Vehicles equipped with the 22RE, particularly low-mileage examples from California or dry climate regions, are fetching premium prices at auctions and private sales.

3. Growth in Aftermarket Support and Modernization Kits

To meet demand and extend the engine’s viability, the aftermarket sector is responding with upgraded components such as performance camshafts, fuel injection conversion kits (e.g., EFI swaps), and improved cooling systems. By 2026, companies like Cruiser Outfitters, South Bay 4×4, and Trail Tough are offering bolt-on modernization packages that integrate the 22RE with modern ECUs and sensors, bridging the gap between vintage reliability and improved drivability. These kits are increasingly popular among restomod builders, enhancing the engine’s market relevance.

4. Environmental and Regulatory Pressures

In certain regions, particularly in states with strict emissions regulations (e.g., California), registering vehicles with older engines like the 22RE is becoming more challenging. In 2026, this regulatory environment is pushing owners toward engine swaps or compliance upgrades. However, the 22RE’s relative simplicity makes it a candidate for smog-legal modifications, and some states still grandfather in pre-1975 emissions standards for older vehicles, preserving its usability in many areas.

5. Competition from Engine Swaps (e.g., 3.4L V6, 22RTE, or Electric Conversions)

While the 22RE remains popular, it faces growing competition from engine swaps. The 3.4L V6 (5VZ-FE) swap remains dominant for those seeking more power, and in 2026, hybrid and electric conversion kits are beginning to enter the vintage Toyota scene. However, purists and budget-conscious builders still favor retaining or rebuilding the 22RE, preserving its cultural and mechanical significance.

6. Digital Marketplace Expansion

Platforms like eBay, Craigslist, Facebook Marketplace, and specialized forums (e.g., Yotatech, IH8MUD) continue to facilitate the 22RE ecosystem. In 2026, AI-driven part matching and blockchain-based vehicle history verification are emerging tools that enhance buyer confidence and streamline transactions for used engines and components.

Conclusion

By 2026, the Toyota 22RE engine market is characterized by a blend of scarcity, nostalgia, and innovation. While no longer in production, the 22RE thrives due to strong community support, robust aftermarket development, and its legendary status in the off-road world. Its value is likely to remain stable or increase, particularly for low-mileage, complete, or professionally rebuilt units. As long as vintage Toyota culture endures, the 22RE will continue to be a sought-after engine in the global automotive restoration landscape.

Common Pitfalls Sourcing a 22RE Toyota Motor (Quality & IP Concerns)

Sourcing a replacement or rebuild 22RE Toyota engine—especially from third-party or international suppliers—can be fraught with risks related to quality and intellectual property (IP). Being aware of these pitfalls is crucial to avoid costly repairs, downtime, or legal complications.

Poor Manufacturing Quality and Substandard Materials

One of the most frequent issues is receiving engines made with inferior materials or poor workmanship. Some suppliers, particularly in gray-market channels, use low-grade castings, undersized components, or recycled parts that don’t meet OEM specifications. This can lead to premature wear, oil consumption, or catastrophic failure under normal operating conditions.

Inaccurate Core Rebuilds or Refurbishment

Many “remanufactured” 22RE engines are not rebuilt to factory standards. Critical tolerances such as crankshaft alignment, cylinder wall finish, and valve seating may be overlooked. Some rebuilders reuse worn camshafts, pistons, or bearings to cut costs, drastically reducing engine longevity and performance.

Misrepresentation of Engine Origin or Authenticity

Counterfeit or “clone” engines are a growing problem. Some suppliers falsely advertise engines as genuine Toyota or OEM-remanufactured when they are actually assembled from non-Toyota parts. These engines may carry fake or misleading branding and lack traceability, making warranty claims difficult or impossible.

Lack of Intellectual Property Compliance

Using unauthorized copies of Toyota-engineered components raises IP concerns. Some manufacturers produce exact replicas of Toyota parts (e.g., cylinder heads, intake manifolds) without licensing, infringing on Toyota’s design patents and trademarks. Purchasing such engines may expose buyers to legal risk, especially in regulated markets or commercial applications.

Inadequate Documentation and Traceability

Reputable suppliers provide engine serial numbers, rebuild certifications, and compliance documentation. Many low-cost sources offer little to no paperwork, making it difficult to verify the engine’s history, compliance with emissions standards, or eligibility for registration in certain regions.

Warranty Limitations and Enforcement Issues

Engines sourced from unofficial channels often come with limited or unenforceable warranties. If a defect emerges, the supplier may be unreachable or located in a jurisdiction with weak consumer protections, leaving the buyer responsible for repair costs.

Conclusion

To mitigate these risks, always source 22RE engines from authorized Toyota dealers, certified remanufacturers, or reputable suppliers with verifiable track records. Request documentation, verify part authenticity, and ensure compliance with both quality standards and IP regulations. Investing in a properly sourced engine saves money and headaches in the long run.

Logistics & Compliance Guide for 22RE Toyota Engine

This guide outlines key logistics considerations and compliance requirements when transporting, importing, exporting, or handling a 22RE engine from a Toyota vehicle. Proper planning ensures timely delivery, avoids legal issues, and maintains engine integrity.

Engine Specifications and Identification

The 22RE is a 2.4L inline-four gasoline engine produced by Toyota from the early 1980s to the mid-1990s, commonly found in vehicles such as the Toyota Pickup (Hilux), 4Runner, and early Land Cruiser Prado models. Correct identification is critical for compliance and logistics documentation.

- Engine Code: 22RE

- Displacement: 2,366 cc

- Fuel Type: Gasoline

- Cooling System: Water-cooled

- Emissions Configuration: Varies by model year and market (e.g., U.S. vs. non-U.S.)

Ensure the engine’s Vehicle Identification Number (VIN) or engine serial number is recorded and matches documentation to prevent customs or registration issues.

Packaging and Handling Requirements

Proper packaging protects the engine during transit and meets carrier and regulatory standards.

- Drain Fluids: Remove all engine oil, coolant, and fuel before shipment to comply with hazardous materials regulations.

- Seal Openings: Cap all ports (oil, coolant, intake, exhaust) to prevent contamination and fluid leakage.

- Mounting: Secure the engine on a sturdy wooden pallet using straps or bolts to prevent shifting.

- Weather Protection: Wrap in water-resistant material or place in a crate if shipped overseas or exposed to weather.

- Labeling: Clearly mark “Fragile,” “This Side Up,” and include handling instructions.

Use crated shipping for international transport or long domestic hauls to ensure protection.

Domestic Transportation (U.S. and Canada)

When moving the 22RE engine within North America, adhere to carrier and transportation regulations.

- Freight Classification: Typically falls under NMFC code 122390 (Engines, Internal Combustion) with a Class 70 freight rating.

- Carrier Requirements: Use freight carriers experienced in automotive parts; LTL (Less-Than-Truckload) is common for single engines.

- Hazardous Materials: If any residual fuel or oil remains, it may be classified as hazardous (DOT regulations). Always drain fluids completely to avoid HAZMAT classification.

- Insurance: Declare the engine’s full value and purchase appropriate freight insurance.

International Shipping and Customs Compliance

Shipping a 22RE engine across borders requires strict adherence to import/export regulations.

- Export Documentation:

- Commercial Invoice (with detailed engine description, value, and country of origin)

- Bill of Lading (for sea freight) or Air Waybill (for air freight)

-

Export Declaration (e.g., U.S. Electronic Export Information via AES if value exceeds $2,500)

-

Import Requirements:

- Verify destination country’s import rules for used automotive parts.

- Some countries restrict or tax used engines; others require emissions or safety certifications.

-

Provide proof of ownership or bill of sale.

-

HS Code Example:

- U.S. HTSUS: 8407.34.00 (Spark-ignition internal combustion piston engines)

-

Verify local tariff codes in destination country.

-

EPA and DOT (U.S. Exports):

- Engines intended for road use may be subject to U.S. Environmental Protection Agency (EPA) regulations if exported for re-installation.

- Used engines exported for recycling or dismantling are generally exempt.

Emissions and Environmental Regulations

Compliance with environmental standards is essential, especially in regulated markets.

- U.S. EPA Regulations:

- Rebuilt or used engines installed in motor vehicles may need to meet Clean Air Act standards.

- Engines sold for “off-road” or “collector vehicle” use may have exemptions.

-

Avoid tampering with original emissions equipment (e.g., EGR, PCV systems) to remain compliant.

-

California Air Resources Board (CARB):

- Engines imported into or sold in California must comply with CARB rules.

-

Used engines may require a “G” or “H” Executive Order (EO) number for legal installation.

-

EU and Other Regions:

- Check local emissions directives (e.g., Euro norms) — the 22RE typically does not meet modern standards and may be restricted.

Import Restrictions and Prohibited Markets

Certain countries ban or restrict the import of used engines.

- Examples:

- China: Strict limits on used automotive parts; requires special permits.

- India: High tariffs and import barriers on used engines.

- Brazil: Requires INMETRO certification for automotive components.

- Africa and Middle East: Some nations allow used engines but impose high duties.

Always verify import policies with local customs authorities or a licensed customs broker.

Documentation Checklist

Ensure all paperwork is complete and accurate:

- Engine serial number and VIN (if applicable)

- Bill of Sale or Proof of Ownership

- Commercial Invoice (with declared value)

- Packing List

- Certificate of Origin (if required)

- Export Declaration (e.g., AES filing for U.S. exports)

- Import Permit (if required by destination country)

Best Practices for Compliance and Logistics

- Use a Licensed Freight Forwarder: Especially for international shipments.

- Verify End Use: Clearly state if the engine is for repair, restoration, off-road use, or scrap.

- Consult Local Authorities: Contact customs or environmental agencies in both origin and destination countries.

- Retain Records: Keep copies of all shipping and compliance documents for at least three years.

By following this guide, you can ensure seamless logistics and full regulatory compliance when handling a Toyota 22RE engine.

Conclusion for Sourcing a 22RE Toyota Motor:

Sourcing a 22RE engine for a Toyota vehicle requires careful consideration of several key factors to ensure reliability, compatibility, and long-term performance. After evaluating various options—such as new, used, remanufactured, and crate engines—it is clear that remanufactured or low-mileage used engines from reputable suppliers offer the best balance of cost, quality, and availability. Engines pulled from well-maintained donor vehicles, especially from regions with low corrosion (e.g., “dry climate” or “smog-friendly” states), tend to have fewer issues and longer service lives.

It is crucial to verify the engine’s history, including maintenance records, absence of overheating or oil consumption problems, and compatibility with the intended vehicle model (e.g., pickup truck, 4Runner). Additionally, sourcing from trusted suppliers or salvage yards with return policies and warranties provides added security.

In conclusion, while the 22RE is a durable and legendary powerplant, successful sourcing depends on due diligence. Prioritizing engine condition over price alone, ensuring proper fitment, and investing in professional installation will maximize reliability and deliver years of dependable service—upholding the reputation of the 22RE as one of Toyota’s most trustworthy four-cylinder engines.