The global audio amplifier market is experiencing steady growth, driven by rising demand for high-fidelity sound systems in consumer electronics, automotive audio, and professional audio applications. According to a 2023 report by Mordor Intelligence, the market is projected to grow at a CAGR of approximately 6.8% from 2023 to 2028, fueled by advancements in semiconductor technology and increasing adoption of energy-efficient amplifier designs. Among these, MOSFET (Metal-Oxide-Semiconductor Field-Effect Transistor) amplifiers have gained prominence due to their superior linearity, low distortion, and thermal stability—qualities that make them ideal for high-end audio equipment. As manufacturers continue to innovate in response to these market dynamics, a select group of companies has emerged as leaders in developing and producing high-performance MOSFET amplifiers. Drawing on market insights and product performance metrics, here are the top seven MOSFET amplifier manufacturers shaping the future of audio amplification.

Top 7 Mosfet Amplifier Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

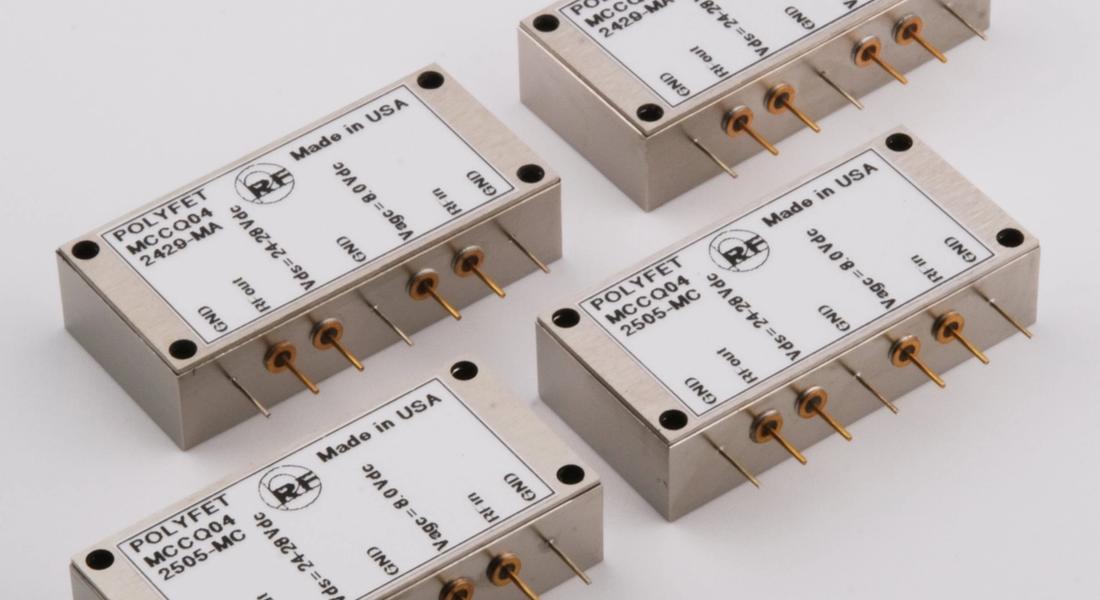

#1 Polyfet RF Devices

Domain Est. 1996

Website: polyfet.com

Key Highlights: Leading manufacturer of RF power transistors, amplifier modules, and evaluation amplifiers. High-performance RF solutions for commercial and aerospace ……

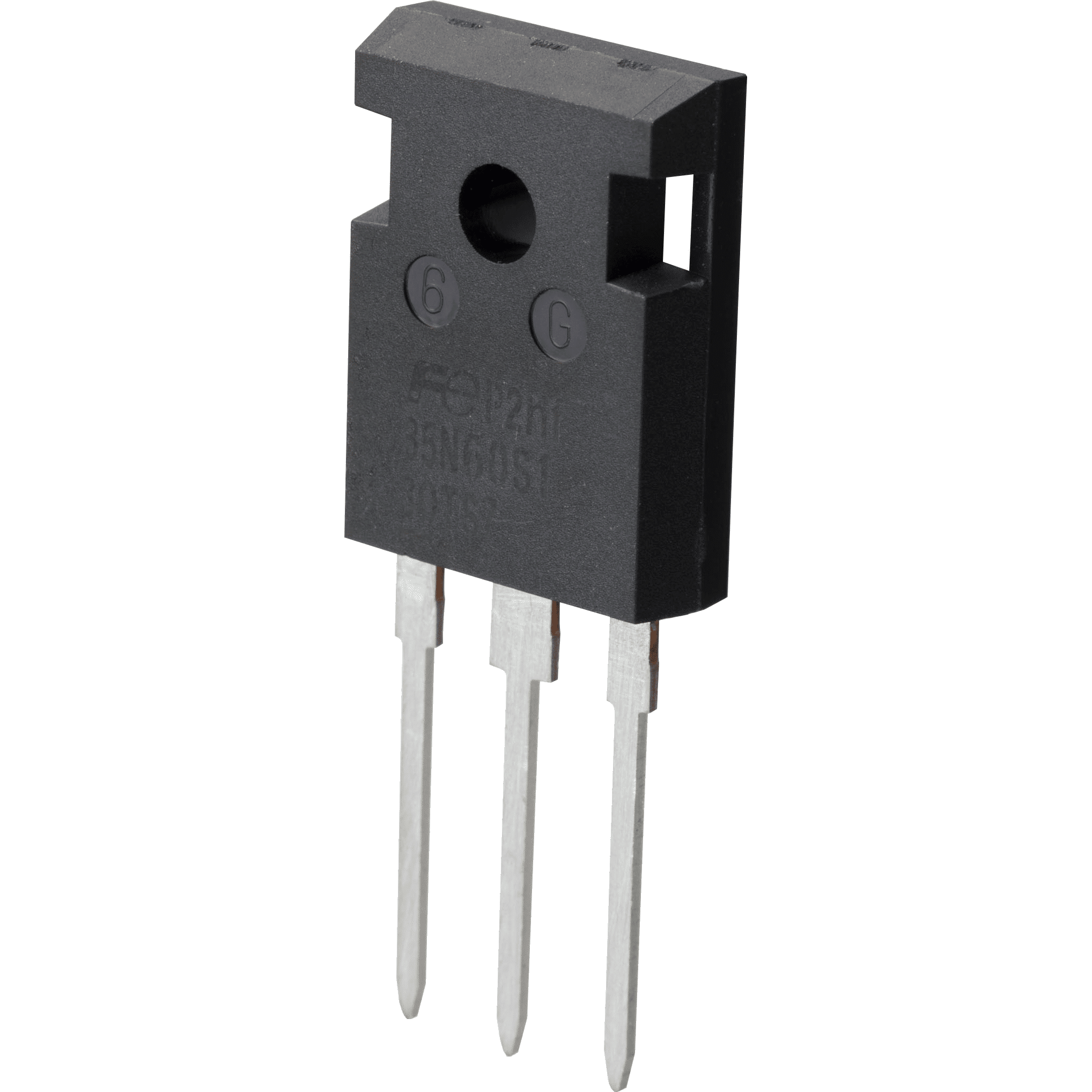

#2 Power MOSFETs

Domain Est. 1999

Website: infineon.com

Key Highlights: As the world’s leading manufacturer and supplier with over 40 years of excellence in power MOSFETs, Infineon offers an extensive portfolio for all segments….

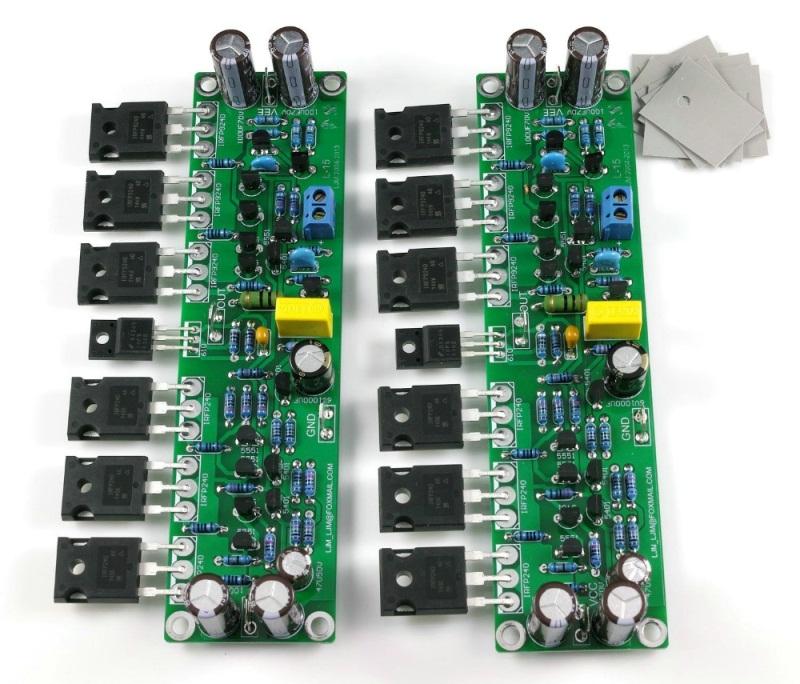

#3 MOSFETs

Domain Est. 1986

Website: ti.com

Key Highlights: TI’s NexFET™ MOSFETs offer a wide range of N-channel and P-channel power modules and discrete power-supply solutions. Our highly-integrated MOSFETs support ……

#4 Si MOSFETs

Domain Est. 1999

Website: onsemi.com

Key Highlights: Si MOSFETs control current flow between source and drain terminals via gate voltage. They’re widely used in power amplifiers, voltage regulators, and switching ……

#5 Wolfspeed:

Domain Est. 2007

Website: wolfspeed.com

Key Highlights: Meet your OBC and DC/DC converter needs with less. New Gen 4 MOSFETs enable greater efficiency and multi-sourcing flexibility for automotive system designers….

#6 High

Domain Est. 2015

Website: agdproduction.com

Key Highlights: 100% Dual Mono amplifier, entirely built around GaN power semiconductors, used both in its power modules and in its newly developed, ultra-low-noise GaN power ……

#7 Exicon Lateral MOSFETS

Website: exicon.info

Key Highlights: EXICON lateral MOSFETs are designed specifically for high fidelity integrated and power amplifiers. Launched in 1993 and improved in 2015….

Expert Sourcing Insights for Mosfet Amplifier

2026 Market Trends for MOSFET Amplifiers

The MOSFET (Metal-Oxide-Semiconductor Field-Effect Transistor) amplifier market is poised for significant evolution by 2026, driven by advancements in semiconductor technology, shifting consumer demands, and emerging applications. Here’s a detailed analysis of the key trends expected to shape the landscape:

1. Dominance of High-Efficiency and Class-D Amplification

By 2026, Class-D MOSFET amplifiers will solidify their position as the dominant topology, particularly in consumer electronics and automotive audio. Continuous improvements in MOSFET switching speed and low on-resistance (Rds(on)) enable higher efficiency (often exceeding 90%), reduced heat dissipation, and compact form factors. This trend is fueled by the global push for energy efficiency in devices ranging from smart speakers to EV infotainment systems.

2. Integration of Smart Features and Digital Control

MOSFET amplifiers are increasingly incorporating digital signal processing (DSP) and smart control capabilities. By 2026, expect widespread adoption of amplifiers with built-in DSP for real-time audio optimization, impedance matching, and thermal management. IoT integration will allow remote monitoring and control, especially in professional audio and industrial applications. This fusion of analog power and digital intelligence enhances performance and system adaptability.

3. Growth in Automotive and Electric Vehicle (EV) Applications

The automotive sector will be a major growth driver. As EVs demand lightweight, energy-efficient components, MOSFET-based audio amplifiers are ideal for premium sound systems and active noise cancellation. The trend toward in-cabin experience enhancement, including immersive audio and voice assistants, will accelerate MOSFET amplifier adoption in vehicles. Additionally, 48V mild-hybrid architectures will require robust MOSFET solutions capable of handling higher voltage rails.

4. Advancements in Wide Bandgap Semiconductors

While traditional silicon MOSFETs remain prevalent, the integration of wide bandgap (WBG) materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) will gain traction by 2026. These materials offer superior switching performance, higher temperature tolerance, and reduced losses. Though currently more expensive, their use in high-end audio and industrial amplifiers will grow as production scales and costs decrease.

5. Miniaturization and System-in-Package (SiP) Solutions

Demand for compact, high-performance audio systems is pushing manufacturers toward highly integrated MOSFET amplifier modules. By 2026, SiP and multi-chip module (MCM) approaches will be common, combining MOSFETs, gate drivers, protection circuits, and thermal management in a single package. This enables faster time-to-market and improved reliability in space-constrained applications like wearables and portable audio.

6. Sustainability and Eco-Design Focus

Environmental regulations and consumer preferences will push manufacturers toward eco-friendly designs. This includes reducing the use of hazardous materials, improving recyclability, and enhancing energy efficiency. MOSFET amplifiers with low standby power and high efficiency contribute directly to meeting global energy standards such as ENERGY STAR and EU Ecodesign.

7. Regional Market Diversification

Asia-Pacific, led by China, Japan, and South Korea, will remain the largest market due to robust electronics manufacturing and consumer demand. However, North America and Europe will see strong growth in premium audio and automotive segments. Emerging markets in India and Southeast Asia will also contribute through expanding middle-class adoption of smart audio devices.

In conclusion, by 2026, the MOSFET amplifier market will be characterized by smarter, more efficient, and highly integrated solutions, driven by innovation in materials, design, and application-specific demands. Companies that embrace digital integration, sustainability, and emerging mobility trends will be best positioned to capitalize on these developments.

Common Pitfalls When Sourcing MOSFET Amplifiers: Quality and Intellectual Property Risks

Sourcing MOSFET amplifiers—whether as discrete components or integrated modules—can be fraught with challenges, particularly concerning product quality and intellectual property (IP) protection. Overlooking these aspects can lead to performance failures, legal disputes, and reputational damage. Below are key pitfalls to avoid.

Inadequate Quality Verification

Many suppliers, especially those from less-regulated markets, may offer MOSFET amplifiers that appear to meet specifications on paper but fail under real-world conditions. Buyers often assume datasheet values are accurate and reliable, but counterfeit or substandard components may exhibit poor thermal stability, inconsistent gain, or premature failure. Skipping independent testing or relying solely on supplier-provided certifications increases the risk of integrating unreliable parts into end products.

Source Reliability and Counterfeit Components

Sourcing from unauthorized distributors or gray-market channels significantly increases the likelihood of receiving counterfeit MOSFET amplifiers. These may be recycled, remarked, or completely fake devices that do not meet original performance standards. Counterfeits can lead to system malfunctions, safety hazards, and costly recalls. Always verify the supply chain and prefer franchised distributors or direct manufacturer sourcing.

Lack of Compliance and Certification Documentation

Reputable MOSFET amplifiers should comply with international standards such as RoHS, REACH, and ISO 9001. However, some suppliers provide falsified or incomplete documentation. Failing to audit compliance records may expose your company to regulatory penalties and market access restrictions, especially in industries like medical, automotive, or aerospace.

Intellectual Property Infringement Risks

Using or sourcing MOSFET amplifier designs that incorporate patented circuitry, topology, or manufacturing techniques without proper licensing can lead to IP litigation. This is especially risky when working with generic or “compatible” amplifier modules whose design origins are unclear. Reverse-engineered products may infringe on existing patents held by major semiconductor manufacturers, resulting in legal action, injunctions, or financial damages.

Insufficient Due Diligence on Design Ownership

When sourcing custom or semi-custom MOSFET amplifier modules, ensure that the design rights are clearly defined in contracts. Ambiguity over IP ownership—especially if the supplier developed the design—can prevent future modifications, second sourcing, or product scaling. Always include clauses that specify IP transfer or licensing rights in procurement agreements.

Overlooking Long-Term Availability and Support

MOSFET amplifiers used in long-lifecycle products must be available for years. Sourcing from vendors without proven product longevity or obsolescence management can lead to supply disruptions. Additionally, lack of technical support or detailed application notes can hinder integration and troubleshooting, increasing time-to-market and development costs.

By addressing these quality and IP-related pitfalls proactively—through rigorous supplier vetting, independent testing, legal review of designs, and clear contractual terms—companies can mitigate risks and ensure reliable, compliant, and legally sound sourcing of MOSFET amplifiers.

Logistics & Compliance Guide for MOSFET Amplifier

This guide outlines the key logistics and compliance considerations for the transportation, handling, and regulatory adherence of MOSFET amplifiers, whether in manufacturing, distribution, or end-use applications.

Product Classification and Regulatory Overview

MOSFET amplifiers fall under electronic amplification equipment and are subject to various international and regional regulations. Key classifications include:

– HS Code: Typically 8543.70 (Amplifiers) or 8517.62 (Transmitting apparatus incorporating sound recording) depending on function and integration.

– ECCN (Export Control Classification Number): Often classified under 3A001 or 5A991, depending on frequency, power output, and encryption features. Verify with BIS (Bureau of Industry and Security) for export compliance.

– RoHS Compliance: Must comply with EU Directive 2011/65/EU restricting hazardous substances (e.g., lead, cadmium, mercury).

– REACH: Registration, Evaluation, Authorization, and Restriction of Chemicals (EC 1907/2006) applies to material content.

– WEEE: Waste Electrical and Electronic Equipment Directive requires proper end-of-life disposal and labeling.

Packaging and Handling Requirements

Proper packaging ensures product integrity during transit:

– Use anti-static packaging materials (e.g., shielded bags, conductive foam) to protect sensitive MOSFET components from electrostatic discharge (ESD).

– Include moisture barrier bags (MBB) if shipping to humid environments or for long-term storage.

– Secure internal components with foam inserts to prevent mechanical shock or vibration damage.

– Label packages with “Fragile,” “This Side Up,” and “ESD Sensitive” indicators.

– Include desiccant packs if moisture sensitivity is a concern.

Shipping and Transportation Logistics

Ensure safe and compliant shipment via air, sea, or ground:

– Temperature Control: Avoid exposure to extreme temperatures. Store and ship within -10°C to +60°C unless specified otherwise.

– Humidity: Maintain relative humidity below 80% to prevent condensation and corrosion.

– Air Freight: Comply with IATA regulations; MOSFET amplifiers are generally non-hazardous but must be declared as electronic equipment.

– Sea Freight: Use moisture-resistant packaging and consider container desiccants to mitigate salt air and humidity.

– Ground Transport: Secure units to prevent shifting; use cushioned vehicles for long-distance hauls.

Import and Export Compliance

Adhere to international trade regulations:

– Prepare accurate commercial invoices, packing lists, and certificates of origin.

– Obtain necessary export licenses if the amplifier meets technical criteria under export control regimes (e.g., EAR, ITAR).

– Verify destination country regulations (e.g., CE marking in Europe, FCC certification in the U.S.).

– Maintain records of compliance documentation for at least five years.

Electromagnetic Compatibility (EMC) and Safety Standards

Ensure product meets regional safety and interference requirements:

– FCC Part 15 (U.S.): Must comply with radiated and conducted emissions limits.

– CE Marking (EU): Requires conformity with EMC Directive 2014/30/EU and Low Voltage Directive 2014/35/EU.

– IEC/EN 61000 Series: Electromagnetic compatibility standards for industrial environments.

– UL/CSA Standards: Safety certifications for North America (e.g., UL 62368-1 for audio/video equipment).

End-of-Life and Environmental Compliance

Follow environmental best practices:

– Provide WEEE-compliant take-back options or recycling instructions.

– Label products with appropriate recycling symbols (e.g., crossed-out wheelie bin).

– Avoid using substances banned under RoHS or REACH.

– Partner with certified e-waste recyclers for disposal of defective or returned units.

Quality Assurance and Documentation

Maintain compliance through rigorous documentation:

– Keep records of component sourcing, particularly for conflict minerals (e.g., tantalum, tin).

– Provide user manuals including safety warnings, compliance marks, and disposal guidance.

– Conduct periodic audits to ensure ongoing adherence to logistics and regulatory standards.

By following this guide, stakeholders can ensure the safe, legal, and environmentally responsible handling of MOSFET amplifiers throughout the supply chain.

In conclusion, sourcing a MOSFET amplifier requires careful consideration of several key factors including power requirements, frequency response, efficiency, thermal management, and application-specific needs such as audio fidelity or switching performance. When selecting a supplier or manufacturer, reliability, technical support, and component authenticity should be prioritized. Whether sourcing discrete components for custom designs or integrated amplifier modules, ensuring compatibility with existing systems and adherence to industry standards is essential. Additionally, evaluating cost, lead times, and availability will help in making an informed decision that balances performance, quality, and budget. Ultimately, a well-sourced MOSFET amplifier contributes significantly to the overall efficiency, durability, and performance of the electronic system in which it is implemented.