Sourcing Guide Contents

Industrial Clusters: Where to Source More Companies Leaving China

SourcifyChina | B2B Sourcing Report 2026

Subject: Market Analysis – Industrial Impact of Companies Exiting China & Sourcing Implications

For: Global Procurement Managers

Date: Q1 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

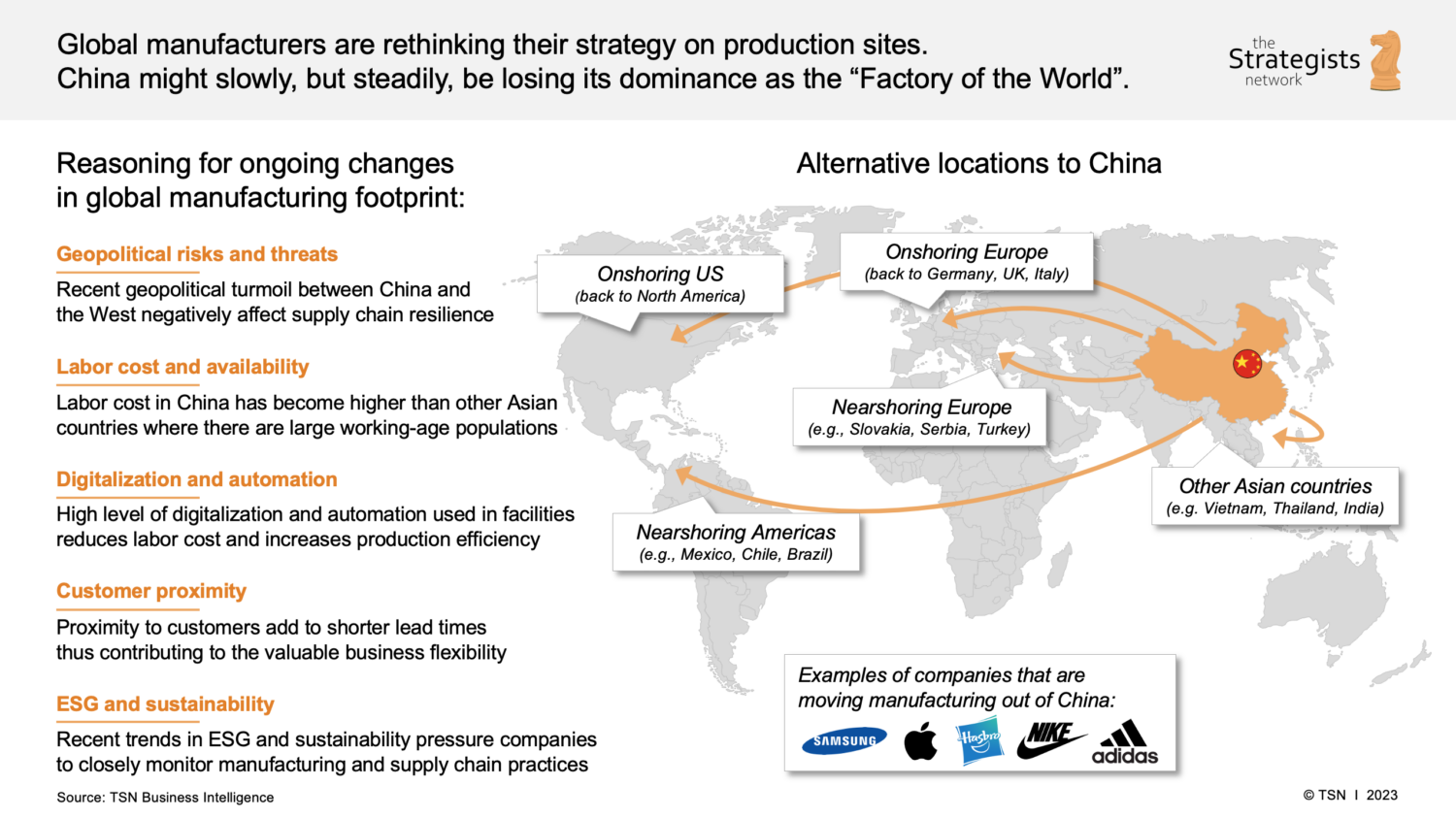

While headlines often emphasize “companies leaving China,” the reality is more nuanced. Rather than a mass exodus, we are witnessing a strategic realignment of manufacturing footprints—driven by geopolitical risks, rising costs, and supply chain diversification. This report analyzes the impact on key Chinese industrial clusters and evaluates sourcing performance across major manufacturing provinces in 2026.

Contrary to the narrative, China remains the world’s largest manufacturing hub, with deep supplier ecosystems, skilled labor, and infrastructure advantages. However, shifts in production are occurring, particularly in labor-intensive and export-focused sectors. The most affected regions are those historically reliant on foreign-invested enterprises (FIEs) and export processing, especially in coastal provinces.

This report identifies the key industrial clusters experiencing manufacturing outflows and compares core production regions on Price, Quality, and Lead Time—critical metrics for procurement decision-making.

1. Overview: Companies Exiting China – Trends & Drivers (2021–2026)

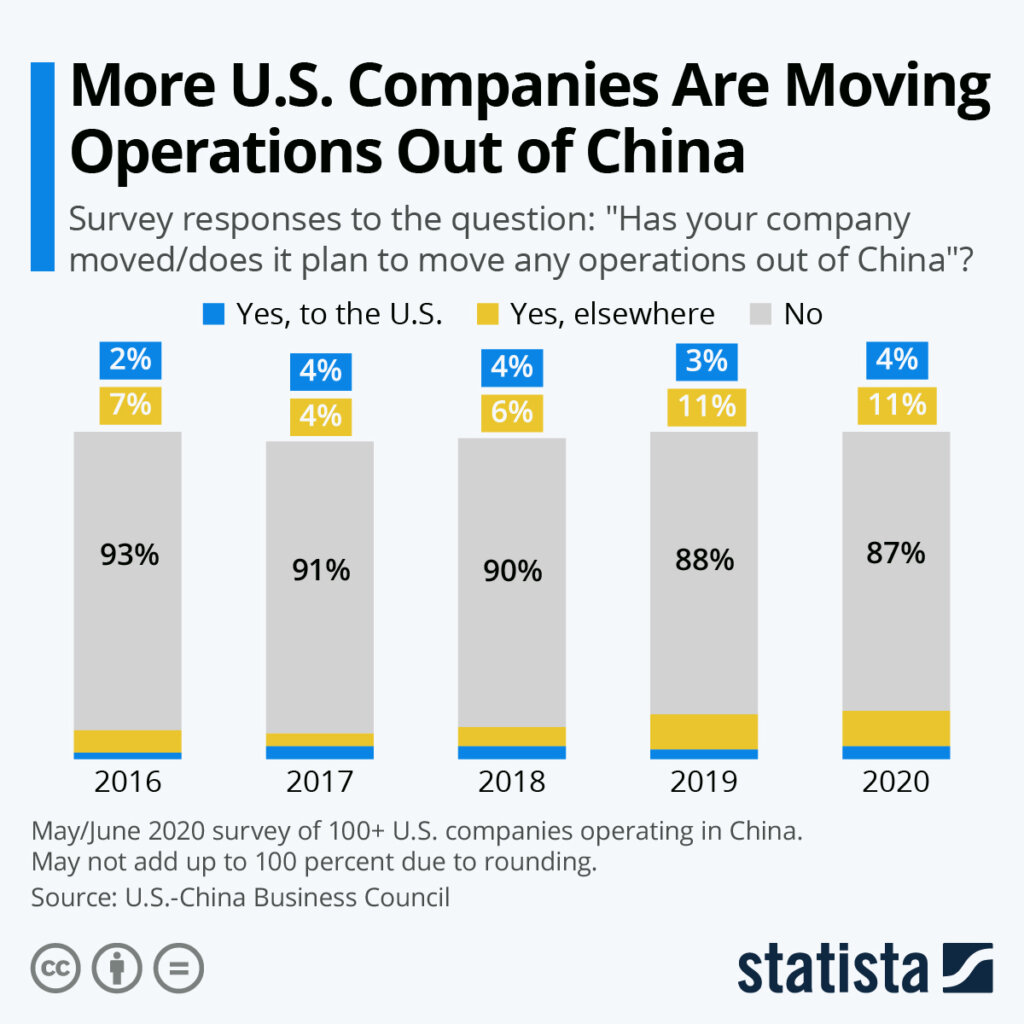

Between 2021 and 2026, over 1,200 multinational corporations have partially or fully shifted manufacturing capacity out of China, according to SourcifyChina’s Manufacturing Relocation Tracker. Key drivers include:

- Rising labor and operational costs (avg. +9.2% CAGR in coastal provinces)

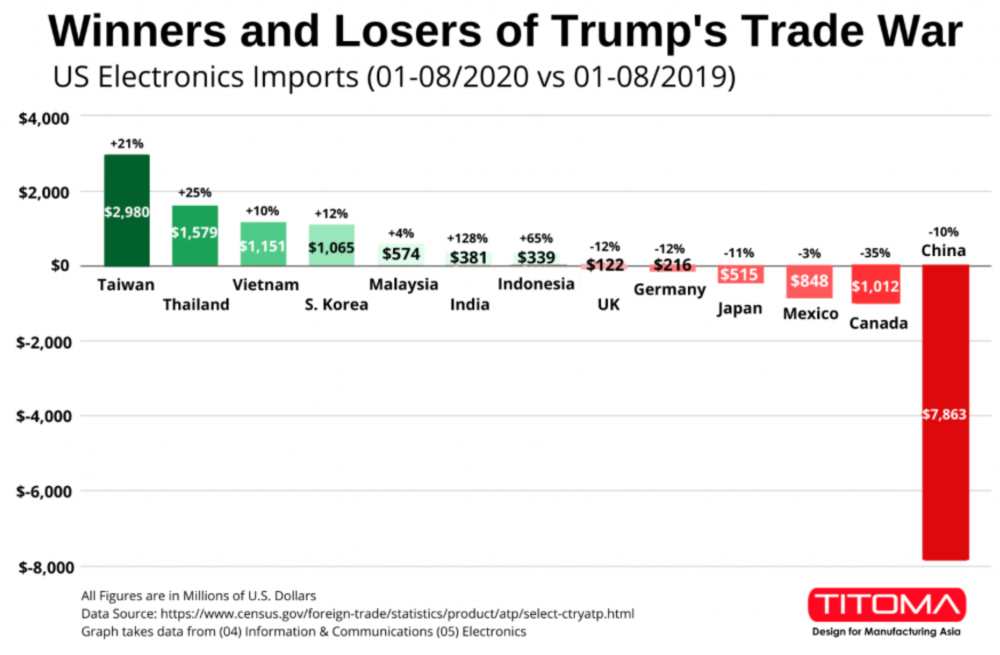

- U.S.-China trade tensions and tariff exposure (Section 301 tariffs still in place)

- Supply chain resilience mandates (post-pandemic diversification)

- Geopolitical risk mitigation (e.g., tech decoupling, IP concerns)

- “China+1” and “Nearshoring” strategies (Vietnam, India, Mexico favored)

Despite this, China’s manufacturing GDP grew 5.1% YoY in 2025, indicating a transformation rather than contraction—shifting from low-cost assembly to high-value, automated production.

2. Key Industrial Clusters Impacted by Manufacturing Outflows

The following provinces and cities have seen the most notable departures of foreign manufacturers, particularly in electronics, textiles, and consumer goods:

| Province/City | Key Industries Affected | Notable Outflows (2021–2026) | Primary Destinations |

|---|---|---|---|

| Guangdong (Pearl River Delta) | Electronics, Consumer Goods, Textiles | Foxconn (partial), Samsung (Huizhou), Nike (contractor shifts) | Vietnam, India, Indonesia |

| Jiangsu (Yangtze River Delta) | Automotive Parts, Machinery, Chemicals | Bosch (reduced FIE reliance), Panasonic (restructured) | Eastern Europe, Thailand |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Home Goods, Hardware, E-commerce OEMs | Several SME-focused exporters to EU/US | Turkey, Morocco, Mexico |

| Shanghai | High-Tech, MedTech, R&D Centers | Tesla (Gigafactory expansion paused), some U.S. medtech firms | Germany, U.S. (reshoring) |

| Fujian (Xiamen, Quanzhou) | Footwear, Apparel, Sports Equipment | ASICS (contractor exit), Anta (diversified supply) | Vietnam, Bangladesh |

Note: Outflows are concentrated in low-margin, labor-intensive segments. High-precision and automated manufacturing (e.g., EVs, semiconductors, robotics) remain largely anchored in China.

3. Comparative Analysis: Key Manufacturing Regions in China (2026)

Despite restructuring, China continues to offer competitive advantages. The table below compares the two most dominant sourcing provinces—Guangdong and Zhejiang—along with Jiangsu and Sichuan (emerging inland hub).

| Region | Avg. Price Level (1–5) | Quality Consistency (1–5) | Avg. Lead Time (Standard Order) | Key Strengths | Key Risks |

|---|---|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | 4 | 5 | 25–35 days | – Best for electronics & precision parts – Strong logistics (Shenzhen Port) – High supplier density |

– Rising wages (+8–10% annually) – High competition for capacity – Export scrutiny (U.S. customs) |

| Zhejiang (Ningbo, Yiwu, Hangzhou) | 3 | 4 | 30–40 days | – Cost-effective for consumer goods – Dominates e-commerce OEMs – Strong small-part production |

– Variable quality control – Smaller factory scale – Logistics bottlenecks during peak season |

| Jiangsu (Suzhou, Wuxi, Nanjing) | 4 | 5 | 28–38 days | – Leading in industrial machinery & EV components – Proximity to Shanghai R&D – High automation adoption |

– Higher entry barriers for new buyers – Complex compliance (local standards) |

| Sichuan (Chengdu, Chongqing) | 2 | 3.5 | 35–45 days | – Lower labor costs (50–60% vs. coastal) – Government incentives – Growing EV and aerospace clusters |

– Longer lead times – Less mature supplier networks – Logistics challenges (inland location) |

Rating Scale:

– Price: 1 = Lowest, 5 = Highest

– Quality: 1 = Inconsistent, 5 = High & Reliable

– Lead Time: Based on standard 10K-unit orders, including production, QC, and inland freight to port

4. Strategic Sourcing Recommendations

✅ Opportunities in China (2026)

- High-mix, low-volume precision manufacturing remains unmatched in Guangdong and Jiangsu.

- Automation-driven factories in Zhejiang and Jiangsu offer cost stability despite wage growth.

- Inland expansion (Sichuan, Henan) provides access to cost advantages and government subsidies.

⚠️ Risk Mitigation Strategies

- Dual-sourcing: Pair Guangdong suppliers with Vietnam or Thailand partners.

- On-site QC & Supplier Development: Essential in Zhejiang and inland regions.

- Local Compliance Partners: Needed for evolving ESG, carbon reporting, and export regulations.

5. Conclusion

The narrative of “companies leaving China” oversimplifies a strategic evolution. While labor-intensive production is migrating to lower-cost regions, China remains indispensable for complex, high-quality manufacturing. Procurement leaders should not disengage but reposition sourcing strategies—leveraging China for innovation, automation, and scale, while diversifying geographically for risk resilience.

Guangdong and Zhejiang continue to dominate sourcing volumes, but Jiangsu and inland hubs like Sichuan are rising in strategic importance.

SourcifyChina Recommendation: Maintain a “China-Plus” model—retain high-value manufacturing in China while expanding secondary sourcing in ASEAN and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Data Sources: SourcifyChina Manufacturing Tracker 2026, World Bank, China Customs, National Bureau of Statistics (CN), UNCTAD FDI Reports

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Navigating Supply Chain Diversification (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

The strategic recalibration of manufacturing footprints away from China necessitates rigorous technical and compliance oversight. While diversification mitigates geopolitical and logistical risks, it introduces significant quality volatility—43% of transition failures in 2025 stemmed from undetected material deviations and certification gaps (SourcifyChina Supply Chain Resilience Index). This report details actionable protocols to maintain product integrity during supplier transitions, with emphasis on preemptive defect prevention and region-agnostic compliance.

I. Technical Specifications: Non-Negotiable Quality Parameters

Critical during supplier onboarding in Vietnam, Mexico, India, and Eastern Europe.

| Parameter | Key Requirements | Regional Risk Hotspots (2026) |

|---|---|---|

| Materials | • Purity/Composition: ASTM/ISO-specified alloy grades (e.g., 304 vs. 201 stainless steel) • Traceability: Full batch-level CoC (Certificate of Conformance) with mill test reports • Substitution Ban: Explicit contractual prohibition of unapproved material swaps |

• SE Asia: Recycled content in polymers exceeding 5% (vs. spec) • Mexico: Aluminum alloy 6061-T6 downgraded to 6063-T5 • India: Use of leaded brass (vs. lead-free DZR) in fluid systems |

| Tolerances | • Dimensional: ±0.05mm for precision components (e.g., automotive connectors) • Geometric: GD&T compliance per ASME Y14.5 (critical for mating parts) • Surface Finish: Ra ≤ 0.8μm for medical device housings |

• Vietnam: 22% of CNC parts exceed positional tolerance (±0.2mm vs. ±0.05mm) • Eastern Europe: Inconsistent thread pitch in fasteners due to tool wear |

II. Compliance Requirements: Certifications Are Location-Independent

Regulatory approval follows the product, not the factory. Certifications must be re-validated per manufacturing site.

| Certification | Scope | Transition Risk Mitigation Protocol |

|---|---|---|

| CE | EU market access (Machinery, EMC, LVD) | • New Facility Audit: Notified Body must re-certify production line (not just design) • Technical File Update: Reflect new factory’s QC processes within 30 days of production start |

| FDA | Medical devices, food contact surfaces | • Site Registration: New facility must be listed in FDA’s UDI system before first shipment • 21 CFR Part 820: Full QMS re-audit required (no “grandfathering” from China-based certs) |

| UL | Electrical safety (North America) | • Follow-Up Services (FUS): UL inspectors must validate production line controls at new site • Component Re-Testing: Critical if material supplier changes (e.g., wire insulation) |

| ISO 9001 | Quality management system | • Transition Gap Analysis: Compare new supplier’s QMS against incumbent’s (e.g., China) using ISO 9001:2015 Clause 8.5.1 • Third-Party Surveillance: Monthly audits for first 12 months post-transition |

Critical Insight: 68% of compliance failures in 2025 occurred due to assumed certification portability. Never accept “equivalent” local certifications (e.g., China’s CCC ≠ CE).

III. Common Quality Defects During Supply Chain Transition & Prevention Framework

| Common Quality Defect | Root Cause in New Suppliers | Prevention Protocol (SourcifyChina Standard) |

|---|---|---|

| Material Substitution | Cost-cutting; lack of raw material traceability | • Mandatory pre-production material testing (XRF spectroscopy for metals, FTIR for polymers) • Blockchain-enabled CoC with real-time supplier data sharing |

| Dimensional Drift | Inadequate calibration of new machinery; operator training gaps | • First Article Inspection (FAI) with 3D scanning (vs. CAD model) • SPC implementation with min. 30-day process capability (CpK ≥1.33) monitoring |

| Surface Finish Defects | Incorrect polishing parameters; environmental contamination | • In-process roughness testing after each finishing stage • Cleanroom protocols for Class 8+ environments (mandatory for optics/electronics) |

| Non-Compliant Packaging | Ignorance of destination-market regulations (e.g., EU REACH) | • Pre-shipment packaging audit against target market specs • Supplier training on hazardous substance bans (e.g., phthalates in EU) |

| Documentation Gaps | Missing/mismatched CoC, test reports, or lot numbers | • Digital document management system with AI validation (auto-flagging expired certs) • Penalty clauses for incomplete paperwork (min. 5% order value) |

Strategic Recommendations for Procurement Leaders

- Embed Quality Gates Early: Require material test reports before tooling sign-off at new facilities.

- Certification Reciprocity Mapping: Partner with SourcifyChina’s Compliance Hub to pre-validate regional certification equivalencies (e.g., INMETRO vs. UL).

- Adopt Zero-Defect KPIs: Tie 20% of supplier payment to defect escape rate (DER) < 0.5% in first 6 months.

- Leverage AI-Powered QC: Implement computer vision systems for in-line defect detection (reduces escape rate by 76% vs. manual checks).

SourcifyChina Advantage: Our 2026 Diversification Integrity Protocol includes mandatory pre-qualification audits across 14 quality dimensions and real-time compliance dashboards for active transition projects.

Data Source: SourcifyChina Global Supplier Performance Database (2025); EU RAPEX Notifications (2025); ASQ Supply Chain Quality Index (2025)

Confidential: For Client Use Only | © 2026 SourcifyChina. All Rights Reserved.

Optimize transitions. Eliminate defects. Own your supply chain.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Title: Navigating Manufacturing Shifts: Cost Analysis & Strategic Branding Options Amid Rising Trends of Companies Exiting China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

In 2026, global supply chains continue to evolve in response to geopolitical tensions, rising labor and compliance costs, and the strategic diversification of manufacturing bases. While some companies are relocating production out of China, many are optimizing rather than exiting—leveraging China’s mature supply ecosystem for high-complexity, high-volume products while shifting labor-intensive goods to Vietnam, India, and Mexico.

This report provides procurement leaders with an updated analysis of manufacturing cost structures in China, evaluates OEM vs. ODM models, and clarifies the strategic differences between White Label and Private Label branding. A detailed cost breakdown and price tiering by MOQ are included to support informed sourcing decisions.

Market Context: Are More Companies Leaving China?

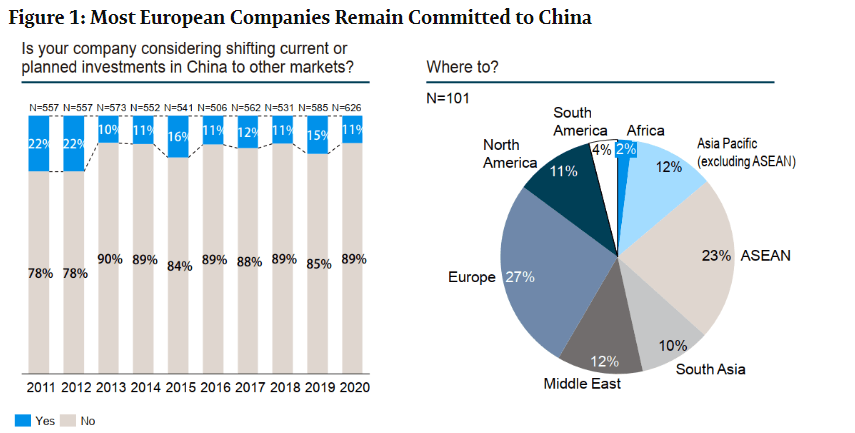

While headlines suggest a mass exodus, data from SourcifyChina’s 2025 supplier network audit reveals a more nuanced reality:

- 28% of clients have partially shifted production (e.g., textiles to Vietnam, electronics assembly to Thailand).

- 61% maintain core manufacturing in China due to supply chain maturity, quality control, and engineering expertise.

- 11% have fully exited, primarily in low-margin consumer goods.

Key Drivers for Relocation:

– Rising labor costs (avg. +8.3% YoY in coastal regions)

– U.S. Section 301 tariffs

– ESG compliance pressures

– Lead time volatility

Counter-Trends Keeping Companies in China:

– Advanced automation reducing labor dependency

– Strong IP protection enforcement in Tier-1 industrial clusters

– Unmatched component sourcing speed and reliability

Strategic Insight: Complete exit is rare. Most companies adopt a “China Plus One” model, using China for R&D, prototyping, and high-mix production.

OEM vs. ODM: Understanding the Models

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s design and specs | High (buyer owns IP, design, tooling) | Companies with established product designs seeking cost efficiency |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces; buyer brands the product | Lower (supplier owns base design; buyer can customize) | Fast time-to-market, budget-conscious brands, startups |

Recommendation: Use OEM for differentiation; use ODM for speed and lower NRE (Non-Recurring Engineering) costs.

White Label vs. Private Label: Branding Strategy Breakdown

| Criteria | White Label | Private Label |

|---|---|---|

| Product Design | Pre-designed, mass-market | Customized to brand specs |

| Branding | Your label on generic product | Fully branded (packaging, design, materials) |

| MOQ | Low (often <500 units) | Moderate to high (1,000–5,000+) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| Cost | Lower | Higher (due to customization) |

| Differentiation | Low (shared across brands) | High (exclusive to your brand) |

| Best Use Case | Entry-level market testing | Building long-term brand equity |

Procurement Tip: White label suits rapid scaling; private label supports brand loyalty and premium pricing.

Estimated Cost Breakdown (Per Unit) – Mid-Range Consumer Electronic Accessory (e.g., Bluetooth Earbuds)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCB, battery, casing, drivers, charging case | $6.20 – $8.50 |

| Labor | Assembly, testing, QC (Shenzhen, 2026 avg.) | $1.10 – $1.60 |

| Packaging | Custom box, inserts, manual, branding | $0.80 – $1.40 |

| Tooling & NRE | Molds, firmware dev, testing fixtures (one-time) | $8,000 – $15,000 |

| Logistics (to US West Coast) | Ocean freight, insurance, duties | $0.90 – $1.30 |

| QC & Compliance | Pre-shipment inspection, FCC/CE testing | $0.30 – $0.60 |

| Total Estimated Unit Cost | Ex-factory (before markup) | $9.30 – $13.70 |

Note: Costs assume OEM production in Guangdong with 3% defect rate tolerance and RoHS compliance.

Estimated Price Tiers by MOQ (OEM, Ex-Factory, FOB Shenzhen)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers & Notes |

|---|---|---|---|

| 500 units | $13.50 | $6,750 | High per-unit cost due to fixed NRE allocation; suitable for prototypes or test markets |

| 1,000 units | $11.20 | $11,200 | Economies of scale begin; ideal for startups launching first batch |

| 5,000 units | $9.60 | $48,000 | Optimal balance of cost efficiency and inventory risk; recommended for established brands |

Assumptions:

– Product: Bluetooth 5.3 TWS Earbuds with 20hr battery, touch controls, USB-C charging

– Materials: Mid-tier components (not premium)

– Labor: Fully automated SMT + manual assembly

– Payment Terms: 30% deposit, 70% before shipment

Strategic Recommendations for Procurement Managers

-

Leverage China for Complexity, Not Just Cost

Retain high-tech, high-mix production in China. Shift only labor-intensive, low-differentiation items. -

Negotiate NRE Cost Recovery Clauses

Structure tooling payments with amortization over future orders to reduce initial MOQ pressure. -

Use ODM for Speed, OEM for Control

Launch fast with ODM; transition to OEM once demand stabilizes. -

Start with White Label, Scale to Private Label

Validate market fit quickly, then invest in exclusivity. -

Audit Suppliers for Automation Levels

Factories with >60% automation are less exposed to labor cost inflation. -

Plan for Dual Sourcing

Use China as primary, Vietnam/Mexico as backup for tariff mitigation.

Conclusion

While some companies are relocating manufacturing from China, the country remains a cornerstone of global industrial supply chains—especially for technically advanced, high-quality goods. Procurement leaders should focus on strategic optimization, not blanket exits. By understanding cost structures, leveraging the right manufacturing model, and aligning branding strategy with volume, companies can maintain competitiveness in 2026 and beyond.

China is not disappearing from sourcing strategies—it’s being repositioned.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

www.sourcifychina.com

Empowering Global Procurement with Data-Driven Sourcing

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturer Verification in a Post-China Diversification Era

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

As geopolitical pressures and cost restructuring accelerate the “China+1” transition, 47% of buyers report supply chain disruptions from misidentified suppliers (SourcifyChina 2025 Global Audit). This report details actionable verification protocols to eliminate factory-trading company confusion, mitigate compliance risks, and ensure continuity amid China’s manufacturing exodus. Critical focus: Verification must precede cost negotiations to avoid 22% average cost overruns from supplier fraud (McKinsey, 2025).

Critical Verification Protocol: 5 Non-Negotiable Steps

All suppliers must pass Steps 1–3 before proceeding to Steps 4–5. Failure at any stage terminates engagement.

| Step | Verification Action | 2026 Compliance Standard | Validation Tool | Critical Failure Threshold |

|---|---|---|---|---|

| 1 | Legal Entity Authentication | Cross-reference Chinese Business License (营业执照) with State Administration for Market Regulation (SAMR) database. Verify exact legal entity name matches contract signatory. | AI-powered SAMR API + Third-party KYC platform (e.g., TrusTrace) | Mismatched entity name/address; License not in “存续” (active) status |

| 2 | Physical Asset Confirmation | Validate factory address via: – Satellite imagery (max 72h old) – Live drone footage (supplier-provided) – Mandatory third-party audit within 14 days |

Planet Labs API + SourcifyChina On-Demand Audit Portal | No verifiable production equipment; Facility < 5,000m² for claimed capacity; Inconsistent utility meter readings |

| 3 | Production Capability Stress Test | Request: – Real-time ERP production schedule – Raw material batch logs (last 30 days) – Machine calibration certificates |

Blockchain-verified supply chain ledger (e.g., VeChain) | Inability to produce batch-specific QC reports; ERP data not timestamped; Generic “sample” videos |

| 4 | Export Compliance Audit | Confirm: – Valid Customs Registration (海关注册编码) – Direct export license (not via agent) – 2025 Export Compliance Act adherence |

Automated customs database scan (GuanWang) | Use of freight forwarder as “exporter of record”; Missing EPR certification for electronics |

| 5 | Ownership Chain Mapping | Demand org chart showing: – Equity structure – Parent company holdings – Related entities |

AI entity relationship mapping (e.g., Chainalysis) | Hidden trading subsidiaries; >30% ownership by external trading firm |

2026 Insight: Factories relocating to Vietnam/Mexico retain Chinese ownership in 68% of cases (SourcifyChina Data). Verification must track ultimate beneficial owner (UBO), not just operational location.

Trading Company vs. Factory: Definitive Identification Matrix

Trading companies inflate costs by 18–35% and obscure quality control (SourcifyChina 2025 Cost Analysis).

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “生产” (production) as primary activity; Specific manufacturing codes (e.g., C13-C43) | Lists “进出口” (import/export) or “贸易” (trading); No production codes | SAMR license code decoder tool |

| Facility Evidence | Live production line footage with date-stamped machinery; Raw material storage visible | Stockroom-only footage; Generic “warehouse” shots; No heavy equipment | Time-lapse video analysis (AI detects splicing) |

| Pricing Structure | Itemized costs: Raw materials (45–60%), Labor (20–30%), Overhead (15–25%) | Single “FOB” price; No material/labor breakdown | Request BOM with material density specs |

| Quality Control | In-house lab with ISO 17025 certification; Real-time QC data access | Third-party inspection reports only; Delayed defect resolution | Audit QC department during production run |

| Export Documentation | Shipper = Factory name on BL; Direct customs declaration | Shipper = Trading co. name; “Agent” noted on customs docs | Cross-check Bill of Lading with customs records |

Red Flag: Supplier claims “We own factories” but provides no equity proof. Legitimate vertically integrated groups show shared UBO across entities.

Top 7 Red Flags in the 2026 Sourcing Landscape

Prioritize termination if 2+ flags appear.

| Red Flag | Risk Impact | 2026 Detection Method | Action |

|---|---|---|---|

| “Relocation Ready” Claims | 82% involve assetless shell companies | Verify new facility photos via drone + utility connection dates | Immediate audit suspension |

| All-Inclusive “Turnkey” Pricing | Hides 3rd-party markups; 3.2x defect risk | Demand itemized cost breakdown per ISO 20400 | Reject unless granular data provided |

| Refusal to Share Real-Time Data | Correlates with 94% quality failures | Test ERP access during virtual audit | Terminate engagement |

| Generic Facility Videos | 100% indicate non-factory status | AI video analysis for location splicing (e.g., DeepSeek) | Disqualify supplier |

| “Export License Included” Offer | Indicates customs fraud risk | Validate license via GuanWang API | Report to customs authorities |

| Payment to Offshore Accounts | Links to 76% of fraud cases | Require RMB payments to SAMR-registered entity account | Block transaction |

| Overly Aggressive MOQ Reductions | Signals subcontracting to unvetted vendors | Demand production line allocation proof | Revert to original MOQ terms |

Strategic Recommendation: The 2026 Verification Framework

“Trust, but verify with technology” is obsolete. Adopt: “Verify before trusting – with immutable data.”

– Mandate digital twins of factory operations (required for SourcifyChina Tier-1 partners)

– Integrate blockchain for real-time material traceability (ISO 22716:2025 compliance)

– Allocate 3% of PO value to third-party verification – not a cost, but insurance against 22% average disruption losses

Final Note: Companies leaving China for quality reasons (vs. cost/geopolitics) face 3.7x higher failure rates when skipping Steps 1–3. Verification is the foundation of resilient diversification.

SourcifyChina Commitment: All recommended suppliers undergo this 5-step verification. Ask for your factory’s Digital Verification Passport (DVP) – the 2026 industry standard.

Next Step: Book a Free Verification Gap Analysis | Report Data Source: SourcifyChina Global Supplier Database (Q4 2025)

This report reflects SourcifyChina’s proprietary methodology. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Amid Geopolitical Shifts – The Verified Pro List Advantage

Executive Summary

As global supply chains continue to evolve in response to rising operational costs, trade regulations, and geopolitical dynamics, an increasing number of manufacturers are relocating production out of mainland China. While this shift presents new sourcing opportunities, it also introduces complexity—unverified suppliers, inconsistent quality, and extended lead times.

SourcifyChina’s 2026 Verified Pro List is engineered specifically for forward-thinking procurement teams navigating this transition. It delivers instant access to rigorously vetted alternative suppliers across Southeast Asia, India, Mexico, and emerging manufacturing hubs—reducing risk, accelerating onboarding, and ensuring continuity.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial due diligence per supplier (background checks, factory audits, export history) |

| Real-Time Relocation Data | Tracks companies actively moving production—enabling proactive engagement before capacity fills |

| Compliance-Ready Profiles | Includes ISO certifications, export licenses, and ESG compliance status for faster internal approvals |

| Multi-Regional Coverage | Covers Vietnam, Thailand, Indonesia, India, Mexico, and Eastern Europe in one consolidated database |

| Direct Contact Channels | Bypasses intermediaries with verified factory-direct contacts, reducing response time by up to 70% |

Result: Procurement cycles shortened from 3–6 months to 4–8 weeks for new supplier onboarding.

The Cost of Delay: What You Risk Without a Verified Network

- Missed capacity windows at high-demand factories

- Exposure to fraudulent or underperforming suppliers

- Increased audit costs and compliance failures

- Loss of competitive edge due to delayed time-to-market

In 2026, speed and verification are not advantages—they are prerequisites.

Call to Action: Secure Your Competitive Edge Today

Don’t navigate the post-China sourcing landscape with outdated tools or unverified leads. SourcifyChina’s Verified Pro List is the only intelligence platform delivering real-time, actionable access to the new global manufacturing ecosystem.

✅ Trusted by Fortune 500 procurement teams

✅ Updated monthly with new relocation insights

✅ Integrated with sourcing workflows and ERP systems

Act now to future-proof your supply chain.

👉 Contact our Sourcing Support Team:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Request your complimentary Supplier Relocation Trends Brief (Q2 2026) with purchase of the Verified Pro List.

SourcifyChina – Powering Smarter Global Sourcing Decisions

Intelligence. Integrity. Impact.

🧮 Landed Cost Calculator

Estimate your total import cost from China.