The global mung bean market is experiencing steady growth, driven by rising consumer demand for plant-based proteins, clean-label ingredients, and nutritious pulses in both whole and processed forms. According to Mordor Intelligence, the global pulses market—which includes mung beans—is projected to grow at a CAGR of approximately 4.3% from 2023 to 2028, bolstered by increasing health consciousness and the expansion of ready-to-eat vegetarian and vegan food products. Similarly, Grand View Research highlights the growing adoption of mung bean protein in meat analogs and dairy alternatives, citing its hypoallergenic properties and high digestibility as key advantages over other plant proteins. As demand surges across food processing, animal feed, and nutraceutical sectors, a select group of manufacturers has emerged as leaders in producing high-quality, scalable mung bean products—combining vertical integration, sustainable sourcing, and innovation in processing. The following list identifies the top eight mung bean manufacturers shaping this dynamic landscape.

Top 8 Mong Beans Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mung Bean

Website: gnrgroup.co.th

Key Highlights: Mung bean ready to export from Thai supplier. Available in three variants whole, split and peeled split….

#2 Mung Beans

Domain Est. 2007

Website: shilohfarms.com

Key Highlights: In stock Rating 5.0 (4) Petite with an eye-catching bright green skin, SHILOH FARMS Organic Mung Beans are an exceptionally nutritious, versatile legume closely related to adzuki…

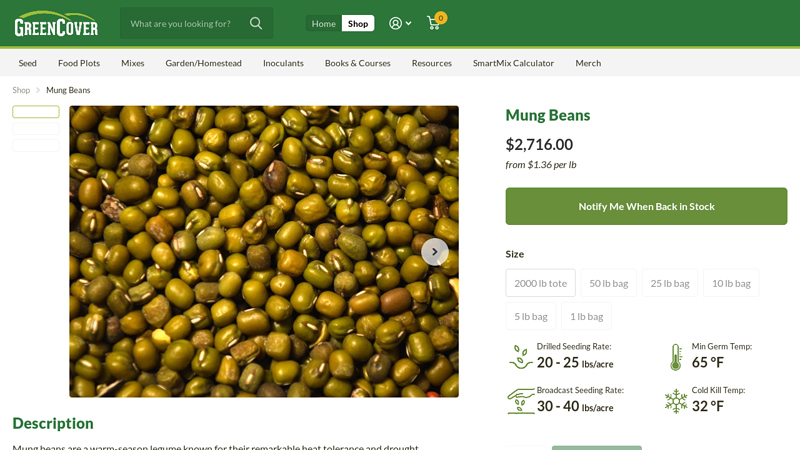

#3 Mung Beans

Domain Est. 2007

Website: store.greencover.com

Key Highlights: Out of stock Rating 5.0 (2) Mung beans are a warm-season legume known for their remarkable heat tolerance and drought resistance. They exhibit rapid growth, maturing in just 65 d…

#4 Organic, Gluten

Domain Est. 2011

#5 Uniquely mild and nutty mung beans

Domain Est. 2020

Website: cono-group.com

Key Highlights: Mung beans are an excellent source of dietary fibre, plant protein, carbohydrates and iron, and are packed with many vitamins and minerals….

#6 Organic Mung Beans

Domain Est. 2023

#7 Australian Mungbean Company

Website: australianmungbean.com.au

Key Highlights: We gather clean, healthy mungbean from Central Queensland and deliver them to the world. See what we can offer you – whether you are a farmer or a customer….

#8 Mungbeans

Website: beangrowers.com.au

Key Highlights: We supply all Australian varieties including large and small shiny beans suitable for re-packing and culinary use, as well as sprouting beans….

Expert Sourcing Insights for Mong Beans

2026 Market Trends for Mung Beans: A H2 Analysis

As we approach 2026, the global mung bean market is expected to be shaped by several interconnected trends, driven by shifting consumer preferences, supply chain dynamics, climate concerns, and evolving agricultural practices. Here’s a breakdown of key trends likely to influence the market in the second half (H2) of 2026:

1. Strong Demand Growth in Plant-Based and Health-Focused Food Sectors

- The global push toward plant-based proteins continues to accelerate. Mung beans, rich in protein, fiber, and essential amino acids, are increasingly used in meat alternatives, dairy-free products, and protein isolates.

- By H2 2026, expect expanded commercialization of mung bean-based products such as vegan cheeses, yogurts, and ready-to-eat meals, particularly in North America and Europe.

- Clean-label and allergen-friendly positioning (non-GMO, gluten-free, low allergenicity) will enhance mung beans’ appeal amid rising health consciousness.

2. Supply Constraints and Price Volatility

- Mung bean production remains concentrated in India, Myanmar, China, and Australia. Climate volatility—droughts in India and erratic monsoon patterns—could lead to harvest shortfalls, tightening global supply in H2 2026.

- Export restrictions or policy changes in key producing countries (e.g., India’s historical export bans to manage domestic inflation) may resurface under supply pressure, creating price spikes.

- Global prices are likely to remain elevated or experience upward pressure in late 2026, affecting food manufacturers and consumers.

3. Expansion of Cultivation in New Geographies

- To mitigate supply risks, there will be increased investment in mung bean cultivation in alternative regions such as Sub-Saharan Africa, Eastern Europe, and the southern United States.

- In H2 2026, pilot programs and commercial scaling in countries like Nigeria, Ukraine (if stability permits), and Australia (with drought-resistant varieties) may begin contributing meaningfully to global supply.

- Advancements in seed technology and precision agriculture will support higher yields and more predictable harvests.

4. Sustainability and Climate Resilience Driving Innovation

- Mung beans are recognized as a low-water, nitrogen-fixing crop with a lower environmental footprint compared to animal proteins.

- In response to ESG (Environmental, Social, and Governance) demands, food brands will increasingly highlight mung bean sourcing transparency and regenerative farming practices by H2 2026.

- Research into climate-resilient mung bean varieties will gain momentum, supported by public and private sector funding.

5. Technological Advancements in Processing and Product Development

- Improved processing techniques (e.g., enzymatic dehulling, high-moisture extrusion) will reduce anti-nutrients and improve texture, making mung protein more palatable and functional.

- Expect a rise in innovative mung-based snacks, beverages, and infant nutrition products launched in H2 2026, particularly in Asia-Pacific and North America.

- Partnerships between ingredient suppliers (e.g., Pulse Canada, Ingredion) and food tech startups will drive product diversification.

6. Regulatory and Trade Developments

- Trade routes may shift due to geopolitical tensions or new trade agreements. For instance, ASEAN-Australia-India economic corridors could facilitate smoother mung bean exports.

- Regulatory approvals for novel mung-based foods (e.g., cultivated meat blends using mung protein) in the EU and UK may be finalized by late 2026, opening new markets.

Conclusion:

By H2 2026, the mung bean market will be characterized by robust demand innovation in plant-based foods, tempered by supply-side challenges. Stakeholders—from farmers to food manufacturers—will need to navigate climate risks, price volatility, and evolving consumer expectations. However, with strong fundamentals in sustainability and nutrition, mung beans are poised to maintain their status as a strategic crop in the global transition toward resilient and healthy food systems.

Common Pitfalls Sourcing Mung Beans (Quality, IP)

Sourcing mung beans effectively requires attention to both quality consistency and intellectual property (IP) considerations. Overlooking these areas can lead to supply chain disruptions, legal issues, and compromised end-product integrity.

Quality-Related Pitfalls

Inconsistent Seed Variety and Purity

Sourcing mung beans without verifying the specific cultivar can result in inconsistent quality, yield, and processing characteristics. Adulteration with other legumes or lower-grade mung beans is common in poorly monitored supply chains, affecting nutritional content and functional properties.

Poor Post-Harvest Handling and Storage

Inadequate drying, improper storage conditions (e.g., high humidity, temperature fluctuations), or prolonged storage can lead to mold growth, insect infestation, and rancidity. This compromises bean appearance, germination capacity (critical for sprout production), and overall safety.

Contamination Risks

Mung beans may be exposed to chemical residues (pesticides, fumigants), heavy metals (from contaminated soil), or microbial pathogens (e.g., Salmonella, E. coli), especially when sourced from regions with lax agricultural controls. Without third-party testing, these hazards may go undetected.

Lack of Traceability and Certification

Absence of verifiable traceability systems makes it difficult to confirm origin, farming practices, or compliance with food safety standards (e.g., ISO, HACCP, organic certifications). Buyers risk non-compliance with regulatory requirements in target markets.

Intellectual Property (IP)-Related Pitfalls

Unlicensed Use of Protected Varieties

Some mung bean cultivars are protected under Plant Variety Protection (PVP) laws or patents. Sourcing seeds from unauthorized suppliers may result in IP infringement, leading to legal action, fines, or supply termination—especially if used for replanting or commercial propagation.

Ambiguity in Breeder Rights and Licensing Terms

Licensing agreements for high-yield or disease-resistant varieties often restrict use (e.g., single-season planting, no seed saving). Failure to understand or comply with these terms can expose buyers to liability, particularly in large-scale agricultural or food manufacturing operations.

Misrepresentation of Genetic Traits

Suppliers may falsely claim that seeds possess specific traits (e.g., drought resistance, high protein content) without proper documentation or testing. This misrepresentation not only affects crop performance but may also implicate false advertising or breach of contract if propagated commercially.

Inadequate Due Diligence on Seed Origin

Purchasing mung bean seeds through intermediaries without verifying their legitimacy or chain of title increases the risk of acquiring pirated or illegally exported germplasm, potentially violating international treaties like the International Treaty on Plant Genetic Resources for Food and Agriculture (ITPGRFA).

Mitigating these pitfalls requires rigorous supplier vetting, contractual clarity on quality and IP rights, independent lab testing, and adherence to international seed trade regulations.

Logistics & Compliance Guide for Mung Beans

This guide outlines key logistics and compliance considerations for the international trade of mung beans (Vigna radiata), ensuring safe, legal, and efficient movement from origin to destination.

Regulatory Compliance

All shipments of mung beans must comply with phytosanitary, food safety, and labeling requirements set by both the exporting and importing countries. Key compliance elements include:

- Phytosanitary Certificate: Required by most countries to certify that mung beans are free from pests and diseases. Issued by the national plant protection organization (e.g., USDA APHIS, India’s DPPQS).

- Certificate of Origin: May be required to qualify for preferential tariffs under trade agreements (e.g., ASEAN, India-ASEAN, or GSP schemes).

- Food Safety Standards: Compliance with standards such as FDA (U.S.), EFSA (EU), FSSAI (India), or FSANZ (Australia/NZ). This includes limits on mycotoxins (e.g., aflatoxin), heavy metals, pesticide residues, and microbial contamination.

- Import Permits: Some countries (e.g., China, Canada, Australia) require prior import permits or pre-shipment inspections.

- Labeling Requirements: Packages must include product name, net weight, country of origin, lot/batch number, and, where applicable, storage instructions and expiration date.

Packaging & Handling

Proper packaging and handling are essential to maintain product quality and meet regulatory standards:

- Packaging Materials: Use food-grade, moisture-resistant materials such as multi-wall polypropylene or laminated poly bags. Jute bags are common but must be clean and free from contaminants.

- Fumigation: If required for insect control, use methyl bromide or phosphine in accordance with ISPM 15 and destination country regulations. Note: Some countries ban or restrict methyl bromide.

- Storage Conditions: Store in cool, dry, well-ventilated facilities away from strong-smelling goods. Ideal conditions: temperature below 25°C, relative humidity under 70%.

- Segregation: Keep organic mung beans separate from conventional to avoid contamination and maintain certification integrity.

Transportation & Logistics

Efficient transportation planning helps minimize spoilage and delays:

- Mode of Transport: Typically shipped via containerized ocean freight. Use dry, ventilated, or refrigerated containers depending on shipment duration and climate.

- Container Inspection: Ensure containers are clean, dry, and free from previous cargo residues or pests before loading.

- Temperature & Humidity Control: Monitor conditions throughout transit, especially in tropical regions, to prevent mold growth and spoilage.

- Documentation: Prepare a complete set including commercial invoice, packing list, bill of lading, phytosanitary certificate, certificate of origin, and any required import permits.

- Transit Time: Minimize transit and port dwell times to reduce risk of condensation (“container rain”) and pest infestation.

Certification & Traceability

Traceability and certifications enhance market access and consumer confidence:

- Organic Certification: Required for organic mung beans (e.g., USDA Organic, EU Organic, or India’s NPOP). Includes annual audits and documentation of growing, processing, and handling practices.

- GMO Compliance: Ensure mung beans are non-GMO. Some markets require a Non-GMO statement or testing.

- HACCP & GMP: Implement Good Manufacturing Practices and HACCP plans when processing or packaging.

- Batch Traceability: Maintain lot tracking from farm to final destination to enable rapid recalls if needed.

Country-Specific Requirements

Key import markets have specific rules:

- United States: FDA registration, Prior Notice submission, and compliance with FSMA (e.g., Preventive Controls for Human Food).

- European Union: Requires entry through a Border Control Post (BCP), with physical and document checks. Maximum residue levels (MRLs) strictly enforced.

- China: Requires pre-shipment inspection, registration of foreign producers, and compliance with China’s GB standards.

- Canada: Needs a Phytosanitary Certificate and may require a CFIA import permit. Adherence to Safe Food for Canadians Regulations (SFCR).

Risk Mitigation

- Conduct regular third-party testing for contaminants.

- Work with experienced freight forwarders and customs brokers familiar with agricultural commodities.

- Maintain up-to-date knowledge of changing regulations through official government portals and trade associations.

Adhering to this guide ensures mung bean shipments meet global standards, reduce delays, and support sustainable trade practices.

Conclusion for Sourcing Mung Beans

In conclusion, sourcing mung beans requires a strategic approach that balances quality, sustainability, cost-efficiency, and supply chain reliability. As a highly nutritious and versatile legume, mung beans are in growing demand across food manufacturers, health food markets, and traditional culinary applications. Successful sourcing involves identifying reputable suppliers—preferably with certifications in organic, non-GMO, or fair trade practices—ensuring traceability and compliance with food safety standards.

Geographic origin plays a significant role, with key producers such as India, China, Myanmar, and Australia offering varying qualities and yields. Establishing long-term partnerships with farmers or cooperatives can enhance supply stability and support sustainable agricultural practices. Additionally, factors such as climate conditions, harvesting cycles, and logistical capabilities must be monitored to mitigate risks of shortages or price volatility.

Ultimately, effective mung bean sourcing is not only about securing a steady supply but also about contributing to ethical and environmentally responsible farming. By adopting a transparent, diversified, and quality-focused sourcing strategy, businesses can meet market demands while supporting a resilient and sustainable food system.