The global beeswax market is experiencing steady growth, driven by increasing consumer demand for natural and sustainable materials across cosmetics, food, pharmaceuticals, and artisanal goods. According to Grand View Research, the global beeswax market size was valued at USD 313.5 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by rising awareness of eco-friendly products and the expanding use of natural waxes as alternatives to synthetic materials. As molding applications—ranging from candle-making to sculpture and industrial prototyping—gain popularity among both hobbyists and professionals, reliable supply of high-purity, moldable beeswax becomes critical. In this evolving landscape, a select group of manufacturers have emerged as leaders, combining quality sourcing, scalable production, and stringent quality control to meet global demand. Here are the top 9 molding beeswax manufacturers shaping the industry.

Top 9 Molding Beeswax Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Yellow Beeswax Manufacturer and Supplier from Vadodara

Domain Est. 2017

Website: giriwaxproducts.com

Key Highlights: GiriWax – Our product range includes a wide range of Yellow Beeswax, White Beeswax, Filtered Bees Wax, Pure Bees Wax and Economy Grade Bees Wax….

#2 Beeswax Candle Making Supplies & Molds

Domain Est. 1996

Website: mannlakeltd.com

Key Highlights: Free delivery over $150 · 30-day returns…

#3 Beeswax Candle Molds

Domain Est. 1998

#4 Wicks & Wax Candle Making Supplies

Domain Est. 1999 | Founded: 1959

Website: wicksandwax.com

Key Highlights: Wicks & Wax is Vancouver’s premier supplier of wax and candle-making supplies. Since 1959, we’ve provided high-quality beeswax, paraffin, soy, and plant-based ……

#5 All Natural & Pure USA Beeswax Candle Shop

Domain Est. 2002

Website: beelitecandles.com

Key Highlights: Beelite Inc We don’t just sell candles — we supply molds, wicks, and bulk beeswax to fellow candle crafters across the U.S. Whether you’re a hobbyist or a full ……

#6 Candle Making, Molds & Beeswax

Domain Est. 2007

#7 Candle Molds

Domain Est. 2020

#8 Candle Making Supplies

Domain Est. 2024

Website: growingsuccessbees.com

Key Highlights: Beeswax Hex Candle Mold. Candle Making. 1 oz. Beeswax Hex shaped candle mold for 6 bars. Regular price $14.95 USD. Sale price $14.95 USD Regular price. Unit ……

#9 Modelling Beeswax

Website: stockmar.de

Key Highlights: STOCKMAR modelling beeswax is both versatile and clean. Initially hard, its consistency changes in the hands’ warmth, becoming malleable and allowing all ……

Expert Sourcing Insights for Molding Beeswax

H2: 2026 Market Trends for Molding Beeswax

The global market for molding beeswax is poised for steady growth and transformation by 2026, driven by a confluence of consumer preferences, sustainability trends, and evolving applications. Here’s an analysis of key trends shaping the molding beeswax landscape:

-

Rising Demand in Natural and Sustainable Craft Markets

Consumer preference for eco-friendly, biodegradable materials continues to fuel demand for molding beeswax. As a natural, non-toxic alternative to synthetic modeling compounds (e.g., plasticine or polymer clays), beeswax appeals to environmentally conscious artisans, educators, and parents. The 2026 market will likely see increased adoption in eco-craft kits, DIY projects, and sustainable toy manufacturing. -

Expansion in the Cosmetic and Personal Care Industry

Molding beeswax is a key ingredient in natural skincare, lip balms, and hair products due to its emollient and protective properties. With the clean beauty movement gaining momentum, formulation transparency and ingredient purity are paramount. By 2026, demand for high-grade, sustainably sourced molding beeswax from certified beekeepers is expected to rise among premium natural cosmetics brands. -

Growth in Artisanal and Educational Applications

The maker movement and hands-on learning approaches in schools are boosting the use of molding beeswax in educational settings. Its pliability, safety, and sensory benefits make it ideal for children’s modeling activities. Artisanal workshops and craft supply companies are expected to offer more beeswax-based modeling kits by 2026, often blended with natural pigments and essential oils. -

Innovation in Product Formulations and Blends

To improve texture, malleability, and user experience, manufacturers are developing enhanced beeswax blends with plant-based waxes (e.g., candelilla or carnauba) and natural oils. These innovations address common challenges like brittleness in cold temperatures or stickiness in heat. By 2026, expect a wider variety of customizable, climate-adaptive molding beeswax products on the market. -

Supply Chain Transparency and Ethical Sourcing

Consumers and B2B buyers are increasingly demanding traceability and ethical beekeeping practices. Brands emphasizing fair trade, pesticide-free hives, and bee welfare will gain competitive advantage. Certification labels (e.g., organic, B Corp) will become more prevalent, influencing purchasing decisions in the 2026 market. -

Regional Market Dynamics

While North America and Western Europe lead in demand due to strong eco-conscious consumer bases, emerging markets in Asia-Pacific and Latin America are showing growth potential. Increased awareness of natural products and rising disposable incomes will contribute to regional expansion, particularly in countries with established beekeeping traditions. -

Challenges: Price Volatility and Raw Material Scarcity

Beeswax supply is inherently linked to honey production and bee health, making it vulnerable to climate change, colony collapse disorder, and agricultural practices. These factors may lead to price fluctuations, prompting some manufacturers to explore synthetic alternatives or invest in sustainable apiary partnerships to secure supply chains by 2026.

Conclusion:

By 2026, the molding beeswax market will be characterized by innovation, sustainability, and diversification. Success will depend on a brand’s ability to align with eco-values, ensure supply chain integrity, and meet the functional needs of diverse end users—from artists and educators to cosmetic formulators. As natural materials regain prominence, molding beeswax is well-positioned to maintain and expand its niche in a health- and planet-conscious global marketplace.

Common Pitfalls Sourcing Molding Beeswax (Quality, IP)

Sourcing molding beeswax presents several challenges, particularly concerning quality consistency and intellectual property (IP) risks. Being aware of these pitfalls is crucial for manufacturers, artisans, and product developers.

Quality Inconsistency

One of the most prevalent issues in sourcing molding beeswax is inconsistent quality. Beeswax properties can vary significantly based on geographic origin, bee species, harvesting methods, and seasonal factors. Impurities such as propolis, pollen, or residual honey can affect melting point, color, and workability. Poor filtration or storage may introduce contaminants or lead to oxidation, compromising the final product’s performance. Buyers may receive batches with varying hardness, odor, or color, making it difficult to maintain product uniformity. Always request batch-specific certificates of analysis (COA) and conduct incoming quality checks.

Lack of Traceability and Purity Verification

Many suppliers do not provide full traceability of their beeswax source, increasing the risk of adulteration. Common adulterants include paraffin wax, microcrystalline wax, or stearin, which are cheaper but alter the physical properties and safety profile of the beeswax. Without third-party lab testing or transparent supply chains, verifying 100% pure, natural beeswax becomes difficult. This is especially critical for applications in cosmetics, food-grade products, or pharmaceuticals. Insist on suppliers who offer GC-MS (gas chromatography-mass spectrometry) reports and adhere to pharmacopeial standards (e.g., USP, Ph. Eur.).

Intellectual Property (IP) Risks in Formulations

When sourcing custom-formulated molding beeswax blends, there is a risk of unintentional IP infringement. Some proprietary blends may include patented additives or processing methods. If a supplier uses a protected formulation without proper licensing, the buyer could be exposed to legal liability, especially in regulated industries. Additionally, sharing your own unique formulation requirements with a supplier without a robust non-disclosure agreement (NDA) may expose your IP to misuse or reverse engineering. Always conduct IP due diligence and secure legal agreements before co-developing or sourcing specialized blends.

Inadequate Compliance with Regulatory Standards

Depending on the application, molding beeswax must meet specific regulatory requirements (e.g., FDA, EU cosmetics regulation, or organic certifications). Sourcing from suppliers who lack proper certifications—such as organic, fair trade, or food-grade compliance—can lead to product recalls or market access issues. Moreover, regulatory requirements vary by region, so using non-compliant materials can jeopardize international distribution. Ensure suppliers provide up-to-date compliance documentation relevant to your target market.

Unreliable Supply Chain and Sustainability Concerns

Beeswax supply is inherently vulnerable to environmental factors like colony collapse disorder, climate change, and pesticide use. Relying on a single source or region increases the risk of supply disruption. Additionally, unsustainable harvesting practices can damage bee populations and raise ethical concerns. Buyers may face reputational risks if sourced beeswax contributes to ecological harm. Opt for suppliers with diversified sourcing, sustainable practices, and certifications like Fair for Life or Rainforest Alliance to mitigate these risks.

Logistics & Compliance Guide for Molding Beeswax

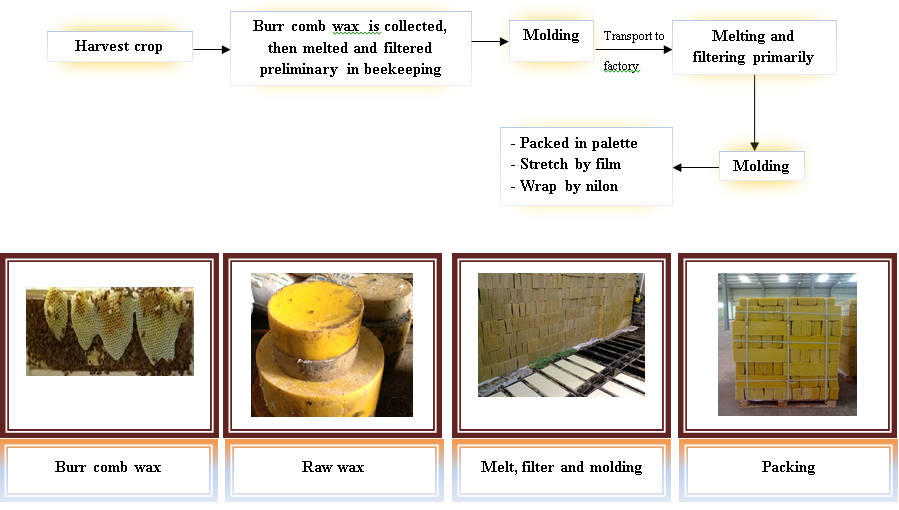

Overview of Beeswax Molding Process

Beeswax molding involves shaping raw or refined beeswax into standardized forms such as blocks, pellets, or sheets for commercial use in cosmetics, candles, food, and pharmaceuticals. The process typically includes melting, filtering, and pouring beeswax into molds followed by cooling and packaging. Ensuring logistical efficiency and regulatory compliance is essential for safe handling, accurate labeling, and market acceptance.

Regulatory Classification and Documentation

Beeswax is generally classified under HS Code 1521.10 (Natural Wax) for international trade. Exporters and importers must ensure proper documentation, including a Certificate of Analysis (CoA), phytosanitary certificate (where required), and material safety data sheet (MSDS/SDS). In the U.S., beeswax intended for food or cosmetic use must comply with FDA regulations (21 CFR 184.1973). EU imports require adherence to REACH and may need conformity with CE labeling if used in consumer products.

Packaging and Labeling Requirements

Beeswax molds should be packaged in food-grade or industrially appropriate materials such as polyethylene bags, waxed cardboard, or sealed containers to prevent contamination and moisture absorption. All packaging must include clear labeling with product name, net weight, batch number, manufacturer details, country of origin, and compliance statements (e.g., “Food Grade” or “For Cosmetic Use”). If marketed as organic, certification from accredited bodies (e.g., USDA Organic, EU Organic) is mandatory.

Storage and Handling Conditions

Beeswax should be stored in a cool, dry place away from direct sunlight and strong odors, as it is prone to absorbing surrounding scents. Ideal storage temperatures range from 15°C to 25°C (59°F to 77°F). During logistics, avoid temperature fluctuations that could cause sweating or deformation. Handling should follow good manufacturing practices (GMP), using clean, non-reactive tools to prevent contamination.

Transportation and Shipping Guidelines

When shipping molded beeswax, use temperature-controlled or climate-stable transport methods to prevent melting or warping, especially in warm climates. Air and sea freight require proper declaration as non-hazardous material (UN number not typically required for pure beeswax). Ensure packaging is robust to withstand stacking and moisture exposure. For international shipments, comply with IATA (air) or IMDG (sea) regulations if blended with other substances.

Import/Export Compliance by Region

- United States: Comply with FDA food or cosmetic ingredient standards; customs may require prior notice for food-grade shipments.

- European Union: Adhere to REACH for chemical registration; food-grade beeswax must meet EC 1333/2008 (food additives) if applicable.

- Canada: Follow CFIA guidelines for agricultural inputs; Health Canada regulates use in cosmetics and natural health products.

- Australia/New Zealand: Require import permits through the Department of Agriculture, Fisheries and Forestry (DAFF); comply with AUS-018 or NZBDS standards.

Sustainability and Traceability

Increasingly, buyers demand traceable and sustainably sourced beeswax. Maintain records of apiary sources, harvesting methods, and processing steps. Certifications such as Fair Trade, organic, or API (bee-friendly practices) can enhance market access. Ensure packaging is recyclable or biodegradable where possible to meet environmental standards.

Quality Control and Testing

Implement routine quality checks for melting point (typically 62–64°C), acidity, moisture content (<1%), and foreign matter. Third-party testing is recommended for export batches. Retain samples from each production lot for traceability and compliance verification during audits or inspections.

Emergency and Safety Protocols

Although beeswax is non-toxic and non-hazardous, molten wax presents burn and fire risks. Ensure facilities have fire suppression systems and staff are trained in handling hot materials. In case of spills, use solidifying agents; never use water on hot wax. SDS must reflect thermal hazards during processing.

Recordkeeping and Audit Readiness

Maintain comprehensive records of sourcing, processing, testing, shipments, and compliance certifications for a minimum of three years. These documents are essential for regulatory audits, customer due diligence, and resolving trade disputes. Digital tracking systems can enhance traceability and efficiency.

In conclusion, sourcing molded beeswax requires careful consideration of quality, sustainability, and supplier reliability. Choosing ethically sourced, pure, and sustainably harvested beeswax supports both environmental stewardship and product integrity. Whether for use in cosmetics, candle-making, or food preservation, partnering with reputable suppliers—preferably local or certified organic—ensures consistency and adherence to environmental and ethical standards. Conducting due diligence, verifying certifications, and building long-term relationships with trusted beekeepers or producers will ultimately lead to a reliable supply chain and superior end products. Prioritizing transparency and sustainability in sourcing molded beeswax not only enhances business value but also contributes positively to the health of bee populations and ecosystems.