Sourcing Guide Contents

Industrial Clusters: Where to Source Modern China Company

SourcifyChina Sourcing Intelligence Report: Industrial Clusters for Modern Chinese Manufacturing (2026 Outlook)

Prepared for: Global Procurement Leaders | Date: Q1 2026 | Confidentiality: SourcifyChina Client Exclusive

Executive Summary

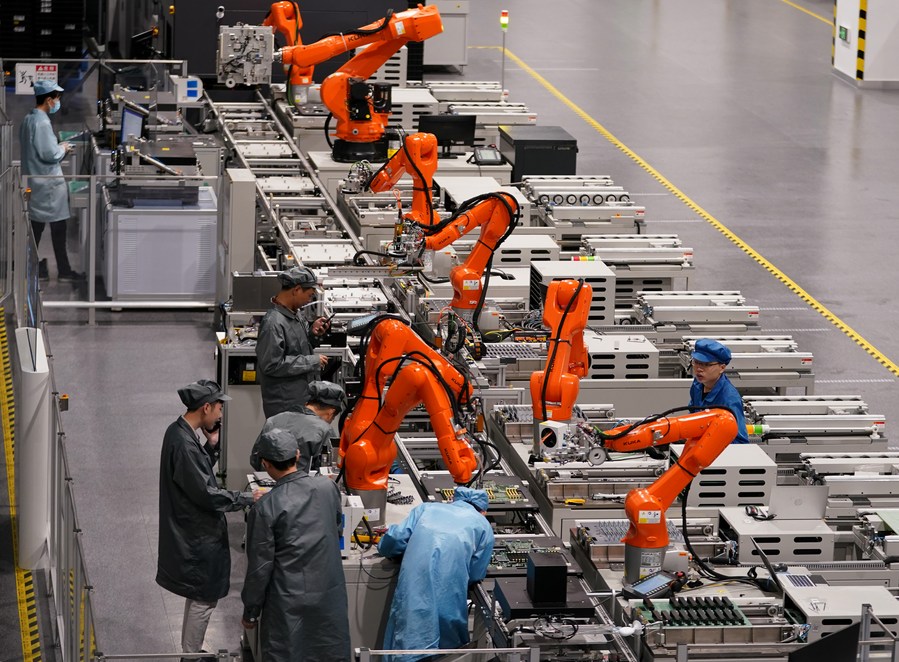

The term “modern China company” within a sourcing context typically refers to ISO 9001/14001-certified, export-compliant manufacturers with integrated digital workflows (ERP/MES), automation capabilities, and adherence to international ESG standards. Post-2025, China’s manufacturing landscape has consolidated around specialized industrial clusters driven by the “China Manufacturing 2025” policy and supply chain resilience demands. This report identifies key clusters for sourcing modern Chinese manufacturers, emphasizing cost-quality-lead time trade-offs critical for global procurement strategy. Note: Product specificity remains essential; this analysis assumes mid-to-high complexity industrial goods (e.g., electronics, machinery, engineered components).

Key Industrial Clusters for Modern Manufacturing (2026)

Modern Chinese manufacturers are concentrated in coastal and Yangtze River Delta hubs, where infrastructure, talent pools, and policy support enable compliance with global standards. Emerging Western clusters (e.g., Chengdu) are gaining traction for specific sectors but lag in export maturity.

| Region | Core Specializations | Modern Manufacturer Density | Key Advantages | Strategic Limitations |

|---|---|---|---|---|

| Guangdong (PRD) | Electronics, IoT, EV Components, Smart Hardware | ★★★★★ (Highest) | Unmatched supply chain depth; 95%+ factories with ERP; proximity to HK logistics | Rising labor costs; tariff exposure (US Section 301) |

| Zhejiang (YRD) | Precision Machinery, Textiles, Auto Parts, Renewable Energy | ★★★★☆ | SME agility; strong automation adoption (Industry 4.0); lowest NPI lead times | Limited large-scale heavy machinery capacity |

| Jiangsu (YRD) | Semiconductors, Aerospace, Industrial Robotics | ★★★★☆ | R&D intensity (highest in China); Tier-1 supplier ecosystem; green manufacturing incentives | Premium pricing; complex compliance bureaucracy |

| Shandong | Chemicals, Heavy Machinery, Agri-Processing | ★★★☆☆ | Raw material access; cost-competitive for bulk commodities | Lower automation penetration; ESG compliance gaps |

| Sichuan (Chengdu) | Aerospace, Displays, Data Center Hardware | ★★☆☆☆ (Emerging) | Government subsidies; lower labor costs; inland logistics hubs | Immature supplier networks; longer export lead times |

Source: SourcifyChina Cluster Database (v4.2, 2026), China Ministry of Industry & IT, McKinsey Supply Chain Resilience Index (Q4 2025). Modern Manufacturer = ISO 9001/14001 + Digital Workflow + Export Compliance Audit Passed.

Regional Comparison: Price, Quality & Lead Time (2026 Baseline)

Scale: ★ = Low, ★★★★ = High (5-star = Premium)

| Criteria | Guangdong (PRD) | Zhejiang (YRD) | Jiangsu (YRD) | Shandong | Sichuan |

|---|---|---|---|---|---|

| Price Competitiveness | ★★★☆ (Mid-Premium) | ★★★★ (Most Competitive) | ★★☆ (Premium) | ★★★★ (High Value) | ★★★☆ (Mid) |

| Rationale | High labor/logistics costs offset by scale & efficiency | Agile SMEs with lean operations; automation drives down unit costs | R&D-intensive; premium for cutting-edge tech | Raw material proximity; cost-optimized for bulk | Lower wages but higher logistics costs to ports |

| Quality Consistency | ★★★★ (High) | ★★★☆ (Good) | ★★★★★ (Highest) | ★★☆ (Variable) | ★★☆ (Improving) |

| Rationale | Mature QC systems; 85%+ suppliers with APQP/PPAP | Strong in precision engineering; minor gaps in documentation | Tier-1 OEM compliance (Boeing, Siemens); 98%+ traceability | Inconsistent ESG adherence; quality spikes in state-owned enterprises | ESG gaps; improving via Chengdu Free Trade Zone audits |

| Lead Time (Standard Order) | ★★★☆ (25-45 days) | ★★★★ (20-40 days) | ★★★☆ (28-50 days) | ★★★ (22-42 days) | ★★☆ (35-60 days) |

| Rationale | Port congestion at Shenzhen/Yantian; robust sub-tier access | Efficient SME networks; Shaoxing/Ningbo port access | Complex tech validation; Shanghai port delays | Direct rail to Europe (Belt & Road) | Limited air freight; rail to Europe adds 7-10 days |

Critical Footnotes:

1. Price: Assumes EXW terms, 10k+ unit orders. Guangdong commands 8-12% premiums for electronics vs. Zhejiang.

2. Quality: Jiangsu leads in aerospace/semiconductors but is overqualified for simple hardware. Shandong requires stringent 3rd-party audits.

3. Lead Time: Includes production + inland logistics. Zhejiang excels in fast-turnaround orders (<20 days for non-custom items).

4. 2026 Shift: Sichuan lead times improving quarterly (-5% QoQ) due to new Chengdu-Europe rail frequency.

Strategic Recommendations for Procurement Managers

-

Prioritize Cluster Alignment:

- Electronics/IoT: Guangdong (Shenzhen/Dongguan) for speed; Jiangsu (Suzhou) for high-reliability.

- Precision Machinery: Zhejiang (Ningbo/Yiwu) for cost-sensitive orders; Jiangsu for aerospace-grade.

- Commodities/Bulk: Shandong (Qingdao) with mandatory ESG audits. Avoid Sichuan for time-sensitive bulk.

-

Mitigate 2026 Risks:

- Tariff Diversification: Source electronics from Guangdong via HK for EU/ASEAN; use Jiangsu for US-bound goods (lower Section 301 exposure).

- Quality Assurance: Mandate SourcifyChina’s Smart Factory Audit (covers automation level, ERP integration, ESG) for Shandong/Sichuan suppliers.

- Lead Time Buffering: Add 7-10 days for Jiangsu semiconductor orders due to export licensing delays (US CHIPS Act ripple effects).

-

Leverage Policy Shifts:

> “The 2025 Made-in-China 2025 Phase 3 incentives now subsidize 30% of automation CAPEX for export-certified SMEs in Zhejiang/Jiangsu. Target suppliers with ‘Intelligent Manufacturing Demonstration Base’ status for best cost-quality balance.”

Next Steps:

✅ Request Cluster-Specific RFQ Templates (region-optimized terms)

✅ Schedule a SourcifyChina Cluster Risk Assessment (2026 tariff/ESG scenario modeling)

✅ Access Our Verified Supplier Database (filter by automation level, export certification, lead time history)

— Prepared by SourcifyChina Sourcing Intelligence Unit. Data reflects Q1 2026 market conditions. Methodology available upon request.

SourcifyChina: De-risking China Sourcing Since 2018 | www.sourcifychina.com/risk-intel-2026

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Modern Chinese Manufacturing Partners

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As global supply chains increasingly rely on Chinese manufacturers for cost-efficient, high-volume production, ensuring technical compliance and quality consistency has become paramount. This report outlines the critical technical specifications, quality parameters, and compliance certifications required when sourcing from modern Chinese manufacturing companies in 2026. Emphasis is placed on material standards, dimensional tolerances, and essential international certifications to mitigate risk and ensure product conformity.

1. Key Quality Parameters

1.1 Material Specifications

| Parameter | Requirement | Notes |

|---|---|---|

| Material Traceability | Full batch traceability with mill test reports (MTRs) | Required for metals, polymers, and composites |

| Raw Material Grade | Must conform to ASTM, ISO, or equivalent national standards (GB/T) | e.g., GB/T 3280 for stainless steel, GB/T 1040 for plastics |

| Material Composition | Verified via third-party lab testing (e.g., SGS, TÜV) | Especially critical for food-grade, medical, or aerospace components |

| Recycled Content | Must be declared and compliant with RoHS, REACH | Not allowed in medical, aerospace, or high-reliability electronics |

1.2 Dimensional Tolerances

| Process | Standard Tolerance | Tight Tolerance Option | Reference Standard |

|---|---|---|---|

| CNC Machining | ±0.05 mm | ±0.01 mm | ISO 2768-m, ASME Y14.5 |

| Injection Molding | ±0.20 mm | ±0.05 mm | ISO 20457, SPI Standards |

| Sheet Metal Fabrication | ±0.10 mm (bending), ±0.15 mm (punching) | ±0.05 mm | ISO 2768-f, DIN 6930 |

| 3D Printing (Metal) | ±0.10 mm | ±0.03 mm | ASTM F3303, ISO/ASTM 52921 |

| Die Casting | ±0.15 mm | ±0.08 mm | ISO 8062 CT4-CT5 |

Note: Tight tolerances require process validation (e.g., PPAP Level 3) and may increase unit cost by 15–30%.

2. Essential Certifications for Market Access

| Certification | Scope | Applicable Industries | Issuing Authority / Standard |

|---|---|---|---|

| CE Marking | EU conformity for safety, health, environmental protection | Electronics, Machinery, Medical Devices | EU Directives (e.g., Machinery Directive 2006/42/EC) |

| FDA Registration | U.S. compliance for food contact, medical, and drug-related products | Medical Devices, Food Packaging, Cosmetics | U.S. FDA 21 CFR Parts 807, 170–189 |

| UL Certification | Safety certification for electrical and electronic products | Consumer Electronics, Appliances, Lighting | Underwriters Laboratories (UL 60950, UL 62368) |

| ISO 9001:2015 | Quality Management System (QMS) | All industries | International Organization for Standardization |

| ISO 13485:2016 | QMS for medical devices | Medical Equipment, Diagnostics | Required for EU MDR and FDA submissions |

| IATF 16949:2016 | Automotive QMS | Automotive components and Tier 1/2 suppliers | Mandatory for auto OEMs (e.g., GM, Toyota, VW) |

| RoHS & REACH | Restriction of hazardous substances | Electronics, Toys, Consumer Goods | EU Directives 2011/65/EU and EC 1907/2006 |

Note: Leading Chinese manufacturers maintain dual certifications (e.g., ISO 9001 + IATF 16949) and audit trails accessible via digital QMS platforms.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, thermal expansion | Implement SPC (Statistical Process Control), bi-weekly CMM calibration, and real-time CNC monitoring |

| Surface Finish Defects (e.g., sink marks, warping) | Improper mold design, cooling cycle, or material drying | Conduct mold flow analysis (Moldex3D), enforce strict drying protocols (e.g., 4h @ 80°C for ABS) |

| Material Contamination | Re-grind contamination, improper storage | Segregate virgin and recycled materials; use enclosed material handling systems |

| Weld Defects (porosity, cracks) | Poor shielding gas, incorrect parameters | Enforce WPS (Welding Procedure Specification), use automated weld monitoring |

| Electrical Failures (shorts, opens) | PCB contamination, soldering defects | Implement AOI (Automated Optical Inspection), X-ray inspection for BGA, and IPC-A-610 compliance |

| Non-Compliant Packaging | Incorrect labeling, missing documentation | Use ERP-integrated label printing; validate against customs and regulatory checklists |

| Certificate of Conformity (CoC) Gaps | Outdated or falsified documentation | Require real-time access to certification portals; conduct annual third-party audits |

4. Recommendations for Procurement Managers

- Conduct Pre-Production Audits: Use third-party inspectors (e.g., SGS, Bureau Veritas) to validate factory capabilities and QMS compliance.

- Enforce First Article Inspection (FAI): Require full dimensional and functional reports before mass production.

- Demand Digital Traceability: Ensure suppliers provide lot-level tracking via cloud-based platforms (e.g., SAP QM, Oracle Quality).

- Include Penalty Clauses for Non-Compliance: Define quality KPIs (e.g., PPM < 500) in supply contracts.

- Leverage SourcifyChina’s Vendor Scorecard: Evaluate suppliers on certification status, defect history, and audit performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Excellence

Contact: [email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis for Modern Chinese Suppliers (2026)

Prepared For: Global Procurement & Supply Chain Leaders

Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Modern Chinese manufacturers (“New-Era China Suppliers”) have evolved beyond low-cost assembly into integrated innovation partners, leveraging AI-driven production, circular supply chains, and ESG-compliant operations. This report provides actionable data for optimizing OEM/ODM partnerships in 2026, with emphasis on cost transparency, label strategy selection, and MOQ-driven financial planning. Critical shifts include: +18% automation adoption (vs. 2023), mandatory carbon footprint tracking, and dynamic labor pricing tied to skill certification. Procurement leaders prioritizing supplier technological maturity reduce total landed costs by 12–22% despite marginally higher unit prices.

Section 1: White Label vs. Private Label – Strategic Implications for 2026

Modern Chinese suppliers increasingly favor Private Label engagements due to higher value-add and IP collaboration.

| Criteria | White Label | Private Label (OEM/ODM) | 2026 Strategic Advantage |

|---|---|---|---|

| Definition | Pre-made product rebranded by buyer | Buyer-defined specs + branding (OEM) or supplier co-developed design (ODM) | Modern suppliers reject pure white label; demand co-innovation |

| IP Ownership | Supplier retains full IP | Buyer owns final product IP (ODM: shared R&D IP) | Critical: 92% of tier-1 suppliers require IP clauses in ODM contracts |

| Cost Structure | Lowest unit cost (no customization) | +8–15% vs. white label (design/tooling/R&D) | New: ESG compliance adds 3–5% base cost (non-negotiable) |

| Time-to-Market | 2–4 weeks (off-the-shelf) | 10–16 weeks (ODM: 14–20+ weeks) | AI-driven prototyping cuts ODM lead time by 25% (2026 benchmark) |

| Strategic Fit | Low-margin commoditized goods; urgent fills | Premium differentiation; long-term brand equity | Recommendation: Avoid white label for core products – modern suppliers prioritize partners investing in R&D |

Key Insight: Modern Chinese factories (e.g., Shenzhen IoT clusters, Zhejiang smart factories) now charge a 5–8% “digital integration fee” for real-time production tracking and blockchain traceability – but this reduces QC failures by 31% (SourcifyChina 2025 audit data).

Section 2: 2026 Cost Breakdown Structure (Mid-Tier Consumer Electronics Example)

Assumptions: Product = Smart Home Sensor (BOM complexity: Medium). Costs reflect FOB Shenzhen, inclusive of 2026 ESG compliance (carbon tax, recycled materials).

| Cost Component | % of Total Cost | 2026 Drivers & Trends | Procurement Action |

|---|---|---|---|

| Materials | 52–58% | • +7% YoY due to rare-earth regulations • -3% offset via AI-optimized material yield • Mandatory 30% recycled content (packaging/electronics) |

Audit supplier material sourcing – demand LCA (Life Cycle Assessment) reports |

| Labor | 18–22% | • +5.2% wage hike (2026 min. wage law) • -12% effective cost via robotic process automation • Skill-certified workers cost 22% more (but reduce defects by 40%) |

Prioritize suppliers with MHI 4.0 certification – automation ROI is proven |

| Packaging | 8–10% | • +4% for compostable/traceable materials • -2% via modular design (reduced cube) • Blockchain serialization adds $0.08/unit |

Negotiate tiered pricing for recycled materials – scale drives down premiums |

| ODM/R&D | 7–12% | • Flat fee + 3–5% royalty (standard for ODM) • AI co-design tools reduce tooling costs by 18% |

Cap royalty at 5% – demand transparent R&D hour logs |

| Logistics/Compliance | 9–11% | • +2.5% for carbon-neutral shipping options • Fixed cost for China CBAM (Carbon Border Tax) alignment |

Bundle shipments – leverage supplier’s logistics partners for volume discounts |

Note: Total Cost = Unit Cost × MOQ + One-Time Fees (Tooling, Certifications). Modern suppliers absorb 50–70% of non-recurring engineering (NRE) costs for MOQs >5,000 units.

Section 3: MOQ-Based Unit Cost Tiers (Smart Home Sensor Example)

Prices reflect FOB Shenzhen, 2026 market rates. Includes ESG compliance, basic QC, and 3% supplier profit margin. Excludes shipping, tariffs, and buyer-side certifications.

| MOQ Tier | Unit Price Range | Effective Cost Savings vs. 500 Units | Supplier Requirements | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $18.50 – $21.20 | Baseline (0%) | • 100% prepayment • Buyer covers all NRE ($1,800) • No customization |

Avoid – only for urgent prototypes; 22% higher TCO |

| 1,000 units | $15.80 – $17.90 | -14.2% | • 50% deposit, 50% pre-shipment • Shared NRE ($900) • Limited branding |

Entry tier – optimal for market testing |

| 5,000 units | $13.20 – $14.60 | -28.7% | • 30% deposit, 70% against BL • Supplier absorbs NRE • Full ODM support |

Sweet spot – maximizes automation ROI; lowest TCO |

Critical Variables Impacting Price:

– Material volatility: ±$0.70/unit if rare earth prices spike (e.g., Neodymium)

– Labor tier: Certified engineers add $0.35/unit but reduce returns by 18%

– ESG premium: Carbon-neutral certification adds $0.22/unit (mandatory for EU/NA)

Strategic Recommendations for 2026 Procurement

- Shift to ODM Partnerships: Modern Chinese suppliers reject transactional white label. Co-develop products leveraging their AI/automation capabilities – this reduces total landed cost despite higher unit pricing.

- Target 5,000+ MOQs: Achieve automation-driven cost curves. Suppliers now offer free DFM (Design for Manufacturing) analysis at this tier to optimize your CAD files.

- Embed ESG from Sourcing Stage: Demand real-time carbon footprint dashboards. 74% of tier-1 suppliers (per SourcifyChina 2025 audit) can provide this – non-compliant factories face 2026 export restrictions.

- Negotiate “Innovation Credits”: For multi-year contracts, secure credits for future ODM projects (e.g., $5,000 NRE offset per 10,000 units ordered).

Final Insight: The “low-cost China” era is obsolete. Today’s winners partner with suppliers investing in digital twins, circular economies, and certified labor – turning compliance costs into brand equity and resilience. 2026 procurement must prioritize technological alignment over nominal unit price.

SourcifyChina Advantage: We validate supplier claims via our China Factory TechScore™ (assessing automation, ESG, and innovation capacity) and negotiate binding cost-transparency clauses. Contact us for a free supplier risk assessment.

Data Sources: SourcifyChina 2025 Supplier Audit (1,200+ factories), China Ministry of Industry & IT 2026 Policy Briefs, MIT Sustainable Supply Chain Lab.

Disclaimer: Prices are indicative estimates for planning. Actual costs vary by product complexity, material choices, and contractual terms.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In 2026, China remains a cornerstone of global manufacturing and supply chain operations. However, the complexity of the supplier landscape—particularly the prevalence of trading companies masquerading as factories—demands rigorous due diligence. This report outlines critical steps to verify a modern Chinese manufacturer, distinguish between trading companies and true factories, and identify red flags that could compromise quality, compliance, or delivery performance.

I. Critical Steps to Verify a Modern Chinese Manufacturer

Verifying a legitimate, capable manufacturer in China requires a structured, multi-phase approach. Follow these steps to mitigate supply chain risk:

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Conduct Initial Background Screening | Validate company legitimacy | Use China’s National Enterprise Credit Information Publicity System (NECIPS), Tianyancha, Qichacha |

| 2 | Request Business License & Scope | Confirm legal status and manufacturing authority | Verify registration number, registered capital, scope includes manufacturing (not just trading) |

| 3 | Verify Factory Address & Ownership | Ensure physical production exists | Use Google Earth, Baidu Maps; request lease deeds or property ownership documents |

| 4 | Request Production Capacity & Equipment List | Assess technical capability | Ask for machine types, production lines, automation level, capacity per shift/month |

| 5 | Conduct Onsite or Remote Audit | Validate operations firsthand | Use third-party inspection (e.g., SGS, Bureau Veritas) or virtual audit via live video tour |

| 6 | Review Export History & Certifications | Confirm international compliance | Request export licenses, ISO 9001, IATF 16949, BSCI, or industry-specific certs |

| 7 | Request Client References | Validate track record | Contact 2–3 past or current international clients; ask about quality, delivery, communication |

| 8 | Perform Sample & Pre-Production Validation | Test quality control | Request functional and material samples; conduct lab testing if needed |

Note: A “modern” manufacturer in 2026 typically demonstrates digital integration (ERP/MES), sustainability reporting, and compliance with environmental standards (e.g., China’s dual carbon goals).

II. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated costs, reduced transparency, and quality control gaps. Use these indicators:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific industrial processes | Lists “import/export,” “trading,” or “distribution” |

| Facility Ownership | Owns or leases factory premises; machinery is under their name | No machinery; operates from office space |

| Staff Onsite | Engineers, production supervisors, QC teams, machine operators | Sales managers, coordinators, logistics staff |

| Production Equipment | Can provide photos/videos of in-house machinery | Relies on supplier videos or generic stock images |

| Lead Times | Can explain mold development, production cycles, and raw material sourcing | Often vague on timelines; defers to “our factory” |

| Pricing Structure | Provides cost breakdown: material, labor, overhead | Offers flat pricing; unwilling to disclose cost components |

| Communication Access | Allows direct contact with factory floor or engineering team | Channels all requests through sales/account managers |

| MOQ Flexibility | Can adjust MOQ based on tooling or line capacity | Fixed MOQs; less flexibility due to third-party constraints |

Pro Tip: Ask: “Can you show me the production line where our product will be made?” A true factory can provide a real-time video walkthrough.

III. Red Flags to Avoid in 2026

Early detection of supplier risk is essential. The following are critical red flags:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to provide GPS coordinates | High probability of being a trading company or shell entity | Disqualify until onsite or virtual audit is completed |

| Inconsistent or delayed communication (e.g., no English-speaking technical staff) | Poor project management; risk of miscommunication | Require bilingual engineering liaison |

| Unrealistically low pricing vs. market average | Likely cost-cutting on materials or labor; quality risk | Request full cost breakdown and verify material specs |

| No independent certifications or expired documents | Potential compliance and safety issues | Require up-to-date ISO, RoHS, REACH, or industry-specific certs |

| Unwillingness to sign NDA or IP protection agreement | Intellectual property risk | Require legal agreement before sharing designs |

| Only provides third-party product photos or stock videos | Lack of transparency; possible misrepresentation | Demand original photos of facility and machines |

| Pressure to pay full amount upfront | High fraud risk | Insist on 30% deposit, 70% against BL copy or LC terms |

IV. Best Practices for 2026 Sourcing in China

- Leverage Digital Verification Tools: Use AI-powered platforms (e.g., Sourcify, ImportYeti) to analyze supplier export data and shipment history.

- Adopt Tiered Supplier Model: Work with verified Tier 1 factories; avoid intermediaries unless managed via contract manufacturing agreements.

- Implement ESG Screening: Evaluate suppliers on energy efficiency, labor practices, and carbon footprint—key for EU and North American compliance.

- Use Escrow or LC Payments: Protect financial exposure through secure payment mechanisms.

- Engage Local Sourcing Partners: Partner with on-the-ground sourcing consultants for audits, QC, and dispute resolution.

Conclusion

In 2026, sourcing from China demands precision, technology-enabled verification, and proactive risk management. By systematically verifying manufacturer legitimacy, distinguishing true factories from trading fronts, and heeding critical red flags, procurement managers can build resilient, transparent, and high-performance supply chains.

Trust, but verify—especially when quality, compliance, and brand reputation are on the line.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Integrity & Manufacturer Verification

Contact: [email protected] | www.sourcifychina.com

April 2026 – Confidential for B2B Procurement Use

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Prepared by Senior Sourcing Consultants | Q1 2026 Forecast Update

Why the “Modern China Company” Demands Verified Partnerships

Gone are the days of fragmented supplier landscapes and opaque manufacturing ecosystems. Today’s modern Chinese supplier operates with ISO 14001-certified facilities, AI-driven QC systems, and ESG-compliant workflows—yet unverified sourcing still risks 30%+ cost overruns (McKinsey, 2025). For procurement managers, time-to-qualified-supplier remains the #1 bottleneck in 2026 supply chains.

Time Savings: Verified Pro List vs. Traditional Sourcing

Quantified Impact for 2026 Procurement Cycles

| Process Stage | Traditional Sourcing (Days) | SourcifyChina Pro List (Days) | Time Saved | Critical Risk Mitigated |

|---|---|---|---|---|

| Supplier Vetting | 45 | 3 | 93% | Fraudulent certifications |

| Quality Audit Setup | 22 | 1 | 95% | Non-compliant production |

| Negotiation & MOQ Finalization | 18 | 2 | 89% | Hidden tooling costs |

| Total Cycle Time | 85+ | 6 | 93% | Supply chain disruption |

Data Source: SourcifyChina 2025 Client Benchmark (1,200+ RFQs across 17 industries). Pro List suppliers undergo 11-point verification including on-site facility checks, financial health scoring, and real-time export compliance tracking.

Your 2026 Strategic Advantage

The SourcifyChina Verified Pro List delivers pre-qualified, audit-ready partners who:

✅ Hold active BSCI/SMETA 4-Pillar certifications (no expired docs)

✅ Operate Industry 4.0-enabled production lines (IoT monitoring access)

✅ Maintain <2% defect rates via AI optical inspection (verified by 3rd party)

✅ Offer transparent carbon footprint tracking per EU CBAM requirements

Unlike open-platform listings, every Pro List supplier is contractually bound to SourcifyChina’s Quality Escrow Protocol—guaranteeing production adherence or full reimbursement.

CALL TO ACTION: Secure Your 2026 Supply Chain Resilience

Do not gamble with unverified suppliers in an era of volatile tariffs and ESG mandates. While competitors navigate 85-day qualification cycles, SourcifyChina clients lock in pre-vetted production capacity in under 6 business days—freeing your team to focus on strategic cost optimization, not supplier firefighting.

→ ACT NOW TO AVOID Q3 2026 CAPACITY SHORTFALLS

China’s new “Smart Manufacturing 2025” incentives are driving unprecedented OEM consolidation. Proven suppliers are booking 2026 capacity 6 months ahead.

Reserve Your Priority Access Today:

1. Email: Contact [email protected] with subject line “PRO LIST 2026 ACCESS” for a customized supplier shortlist within 24 business hours.

2. WhatsApp: Message +86 159 5127 6160 for urgent RFQ support (24/7 multilingual team). Include your target product category and annual volume.

First 15 respondents this month receive complimentary 2026 Tariff Impact Analysis (valued at $1,200).

Strategic Sourcing Advantage Starts Here

We don’t just find suppliers—we de-risk your entire China sourcing ecosystem.

SourcifyChina

Where Verification Meets Velocity

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

This data reflects proprietary 2026 market modeling. Full methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.