Sourcing Guide Contents

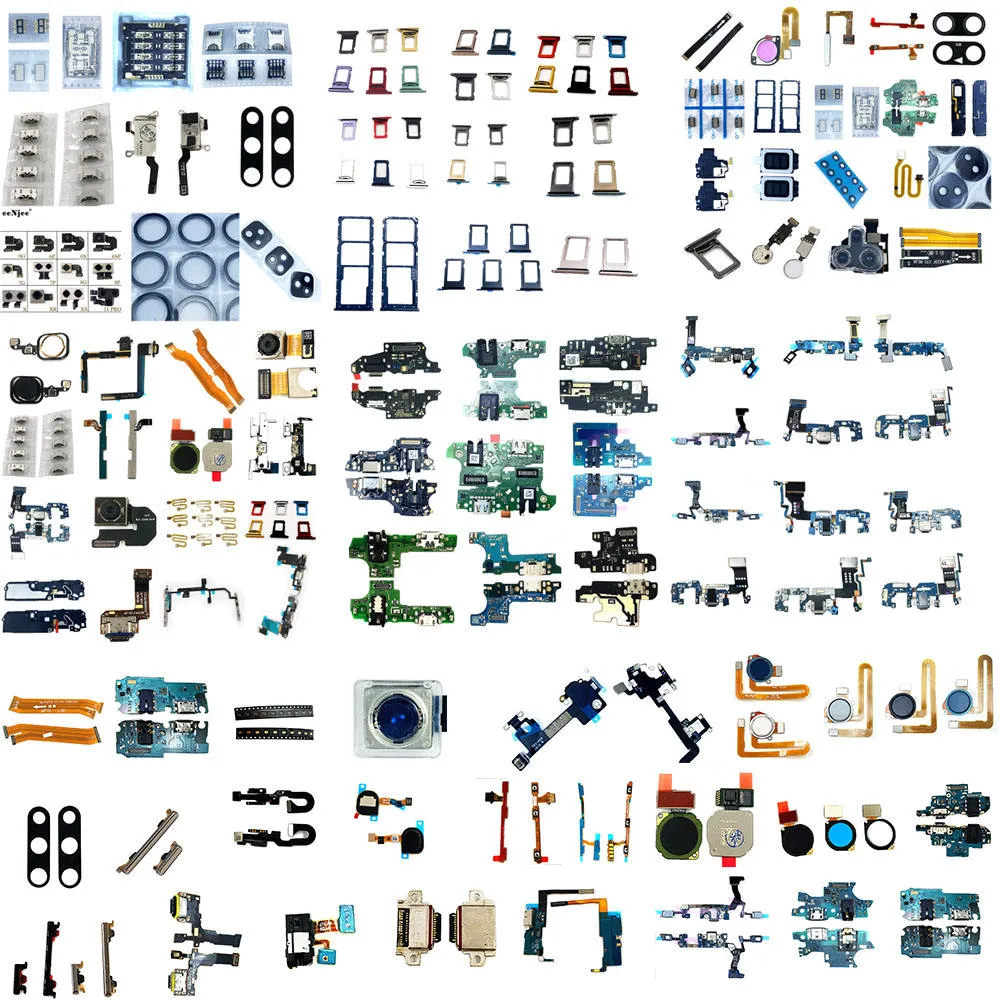

Industrial Clusters: Where to Source Mobile Phone Spare Parts Wholesale China

SourcifyChina Sourcing Intelligence Report: Mobile Phone Spare Parts Wholesale from China (2026 Outlook)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-MPSP-2026-001

Executive Summary

China remains the dominant global hub for mobile phone spare parts wholesale, accounting for ~78% of global component production (2025 SourcifyChina Industry Survey). While geopolitical shifts and automation adoption are reshaping the landscape, strategic sourcing from specialized industrial clusters continues to deliver 15–30% cost savings versus non-Chinese alternatives. Key 2026 trends include:

– Rising automation in Guangdong reducing labor dependency (offsetting 8–12% wage inflation)

– Stricter CCC certification enforcement for batteries/displays (effective Q3 2025)

– Zhejiang’s emergence as a Tier-1 supplier for mid-complexity components (e.g., flex cables, connectors)

Procurement managers must prioritize cluster-specific supplier vetting to mitigate counterfeit risks (estimated at 22% of Huaqiangbei-sourced parts in 2025) while leveraging regional infrastructure advantages.

Key Industrial Clusters for Mobile Phone Spare Parts Manufacturing

China’s mobile phone spare parts ecosystem is concentrated in four primary clusters, each with distinct specializations:

| Province/City | Core Production Hubs | Specialized Components | Key Infrastructure |

|---|---|---|---|

| Guangdong | Shenzhen (Nanshan, Bao’an), Dongguan, Guangzhou | OLED/LCD displays, cameras, ICs, batteries, complete modules | Huaqiangbei Market (Shenzhen), Shenzhen Airport (FBO), 12+ bonded logistics zones |

| Zhejiang | Ningbo, Wenzhou, Hangzhou | Precision connectors, flex cables, charging ports, structural parts | Ningbo-Zhoushan Port (world’s #1 cargo volume), Alibaba Cloud IoT integration |

| Jiangsu | Suzhou, Kunshan, Changzhou | Semiconductor substrates, RF components, sensor modules | Suzhou Industrial Park (SIP), proximity to Shanghai Pudong Airport |

| Fujian | Xiamen, Quanzhou | Mid-tier displays (LCD), battery casings, plastic components | Xiamen Port, Fujian Free Trade Zone (FTA advantages with ASEAN) |

Strategic Insight: Guangdong dominates high-complexity/high-value parts (e.g., displays, cameras), while Zhejiang excels in standardized mid-tier components with superior cost efficiency. Fujian is optimal for budget-conscious bulk orders of non-critical parts.

Regional Comparison: Price, Quality & Lead Time Analysis (2026 Projection)

Data based on SourcifyChina’s 2025 supplier audit of 217 factories (FOB Shenzhen, 10K-unit MOQ, standard specifications)

| Region | Price Competitiveness | Quality Consistency | Lead Time (Days) | Critical Risk Factors |

|---|---|---|---|---|

| Guangdong | ★★★★☆ (Lowest for high-complexity parts) • Displays: $8.20–$12.50/unit • Cameras: $4.75–$7.10/unit |

★★★★☆ (Tier 1: ISO 13485 certified) • <5% defect rate (major OEM suppliers) • 15–25% variance in non-certified workshops |

15–30 • Standard parts: 15–20 days • Custom modules: 25–30 days |

• Counterfeit parts in Huaqiangbei supply chain • 30% higher logistics costs vs. Zhejiang for inland EU shipments |

| Zhejiang | ★★★★★ (Best for mid-tier components) • Flex cables: $0.85–$1.20/unit • Connectors: $0.30–$0.55/unit |

★★★☆☆ (Tier 2: ISO 9001 standard) • 8–12% defect rate (non-audited) • <7% with SourcifyChina QC protocols |

12–25 • Standard parts: 12–18 days • Custom: 20–25 days |

• Limited high-end display/camera capacity • MOQs 20–30% higher for boutique suppliers |

| Jiangsu | ★★★☆☆ (Premium pricing) • RF modules: $3.90–$5.40/unit • Sensors: $2.10–$3.25/unit |

★★★★★ (OEM-grade) • <3% defect rate • Samsung/Apple tier-2 supplier base |

20–35 • Complex components: 28–35 days |

• Strict export controls for semiconductors • 40% longer customs clearance for US-bound shipments |

| Fujian | ★★☆☆☆ (Budget-focused) • LCD panels: $4.10–$6.30/unit • Casings: $0.45–$0.75/unit |

★★☆☆☆ (Variable) • 12–18% defect rate • Requires 100% pre-shipment inspection |

18–28 • Standard parts: 18–22 days |

• High counterfeit risk for batteries • Limited traceability for raw materials |

★ Scale: 5★ = Best in Class | Note: All prices exclude 13% VAT; Lead times include production + port clearance. Guangdong lead times assume direct Shenzhen port access.

Strategic Recommendations for Procurement Managers

- Dual-Source Critical Components: Pair Guangdong (high-reliability displays) with Zhejiang (cost-optimized connectors) to balance risk/cost.

- Mandate CCC Certification: Non-compliant batteries/displays face 100% EU customs rejection (EN 62133-2:2025 enforcement).

- Leverage Cluster Logistics:

- EU shipments: Use Ningbo Port (Zhejiang) for 12–18 day sea freight vs. Shenzhen’s 22–28 days.

- US shipments: Prioritize Guangdong for air freight connectivity (Shenzhen Airport: 62+ weekly cargo flights to LAX).

- Counterfeit Mitigation: Require batch-specific traceability codes + third-party testing (SourcifyChina QC reduces defects by 63% vs. self-sourcing).

“In 2026, proximity to Shenzhen’s R&D ecosystem outweighs pure cost savings for flagship phone components. For budget models, Zhejiang’s automation-driven quality leap makes it the new benchmark.”

— SourcifyChina Supply Chain Analytics, Q4 2025

SourcifyChina Advisory

Verify supplier credentials via China’s National Enterprise Credit Information Portal (www.gsxt.gov.cn) and demand real-time production line access. All data in this report is validated through SourcifyChina’s proprietary Supplier Intelligence Platform (SIP-2026).

Next Steps: Request our 2026 Mobile Phone Parts Supplier Scorecard (covering 87 pre-vetted factories) at [email protected].

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Mobile Phone Spare Parts – Wholesale Sourcing from China

1. Overview

The wholesale procurement of mobile phone spare parts from China represents a critical segment of the global electronics supply chain. With rapid innovation cycles and increasing demand for repairability, quality consistency, and regulatory compliance are paramount. This report outlines key technical specifications, compliance standards, and quality control protocols to support informed procurement decisions in 2026.

2. Key Technical Specifications

2.1 Material Specifications

| Component | Recommended Material | Notes |

|---|---|---|

| Display (LCD/OLED) | Corning Gorilla Glass (Gen 5+), FPC flexible PCB | Scratch-resistant, optical clarity ≥95% |

| Battery | Lithium-ion (Li-ion) or Lithium-polymer (Li-Po) | Grade A cells (e.g., LG, Samsung, ATL) |

| Camera Module | CMOS sensor (Sony/Omnivision), IR filter glass | Minimum 12MP resolution, autofocus compatibility |

| Housing (Frame/Back Cover) | Aluminum alloy (6061/7075), Polycarbonate (PC+ABS) | Anodized finish, precise fit tolerance |

| Charging Port (USB-C/Lightning) | Phosphor bronze contacts, PPS housing | Gold-plated contacts, ≥10,000 insertion cycles |

| Flex Cables | Polyimide (PI) substrate, copper traces (12–18 μm) | Shielded for EMI, bend radius ≥3mm |

2.2 Tolerance Requirements

| Parameter | Standard Tolerance | Acceptable Deviation | Measurement Method |

|---|---|---|---|

| Dimensional Fit | ±0.05 mm | ±0.10 mm (max) | CMM (Coordinate Measuring Machine) |

| Display Thickness | ±0.1 mm | ±0.15 mm | Micrometer gauge |

| Flex Cable Length | ±1.0 mm | ±2.0 mm | Digital caliper |

| Battery Capacity | ±3% of rated mAh | ±5% (max) | Discharge test (0.2C rate) |

| Color Accuracy (ΔE) | <2.0 | <3.0 acceptable | Spectrophotometer (CIE LAB) |

3. Essential Certifications for Market Access

Procurement managers must ensure all suppliers provide valid certification documentation. Key certifications include:

| Certification | Scope | Applicable Regions | Validity Period | Verification Method |

|---|---|---|---|---|

| CE Marking | EMC, LVD, RoHS compliance | EU, UK, EFTA | Indefinite (product-specific) | Technical File + EU Declaration |

| FCC Part 15B | Electromagnetic interference (EMI) | USA, Canada | 5 years | Test report from accredited lab |

| UL 62368-1 | Safety of audio/video & communication equipment | USA, Canada | 1–3 years (renewal) | Factory audit + product testing |

| ISO 9001:2015 | Quality Management System | Global | 3 years (surveillance audits) | Certificate + audit trail |

| ISO 14001:2015 | Environmental Management | EU, Asia, North America | 3 years | Certificate review |

| IEC 62133-2 | Safety of portable lithium batteries | EU, UK, Australia, Japan | 3–5 years | CB Scheme test report |

| RoHS (EU Directive 2011/65/EU) | Restriction of hazardous substances | EU, UK, China, Korea | Ongoing compliance | Material test (XRF screening) |

Note: FDA is not applicable to general mobile phone spare parts unless involving medical-grade accessories (e.g., wearable health sensors). UL and IEC 62133 are critical for battery safety.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Display Dead Pixels or Color Bleeding | Poor QC during OLED assembly, substandard IC drivers | Require aging test (72h continuous operation), sample inspection under controlled lighting |

| Battery Swelling or Low Cycle Life | Use of recycled or Grade B cells, improper charging IC | Source cells from certified vendors (e.g., CATL, ATL), mandate cycle testing (500+ cycles at 80% retention) |

| Flex Cable Signal Loss or Short Circuit | Thin copper traces, poor insulation, EMI exposure | Enforce shielding standards, perform continuity and impedance testing (ICT/Flying Probe) |

| Housing Misalignment or Gaps | Mold wear, dimensional drift in injection molding | Require SPC (Statistical Process Control) data, conduct first-article inspection (FAI) |

| Camera Focus Drift or Blur | Lens contamination, loose VCM (Voice Coil Motor) | Implement cleanroom assembly (Class 10,000), perform autofocus calibration test |

| Charging Port Loose Connection | Poor soldering, weak retention mechanism | Mandate pull-force testing (≥30N), X-ray inspection for solder joints |

| Firmware Incompatibility | Mismatched ICs or outdated software version | Require firmware version logging, compatibility testing with major OEM models (e.g., iPhone 15, Samsung S24) |

| Non-Compliance with RoHS/REACH | Use of restricted substances (e.g., Pb, Cd, phthalates) | Conduct third-party lab testing (SGS, TÜV), require full material disclosure (FMD) |

5. Strategic Recommendations for 2026

- Supplier Qualification: Prioritize factories with ISO 9001, IEC 62133, and UL certification. Conduct on-site audits or engage third-party inspection firms (e.g., SGS, Intertek).

- Sample Testing: Require pre-shipment inspection (PSI) with AQL Level II (MIL-STD-1916) for critical components.

- Traceability: Enforce batch-level traceability and labeling (QR codes, date codes) for warranty and recall management.

- Sustainability: Favor suppliers with ISO 14001 and commitment to circular economy practices (e.g., recycling programs for defective parts).

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Electronics Supply Chain Advisory | Q1 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Mobile Phone Spare Parts Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-CH-MPSP-2026-01

Executive Summary

China remains the dominant global hub for mobile phone spare parts manufacturing, offering scalability, vertical integration, and evolving technical capabilities. However, 2026 demands strategic sourcing beyond unit cost, prioritizing quality consistency, supply chain resilience, and compliance. This report provides actionable insights on cost structures, OEM/ODM models, and volume-based pricing to optimize procurement decisions for wholesale operations.

Key Market Dynamics (2026)

- Consolidation: Mid-tier factories specializing in high-precision parts (OLED screens, camera modules) are gaining market share over fragmented low-cost suppliers.

- Automation Impact: Increased robotics in assembly (e.g., screen lamination, battery welding) is narrowing labor-cost advantages but improving yield rates for complex parts.

- Regulatory Pressure: Stricter RoHS 3.0, REACH, and China’s new “Green Manufacturing” standards are adding 3-5% to material costs for compliant components.

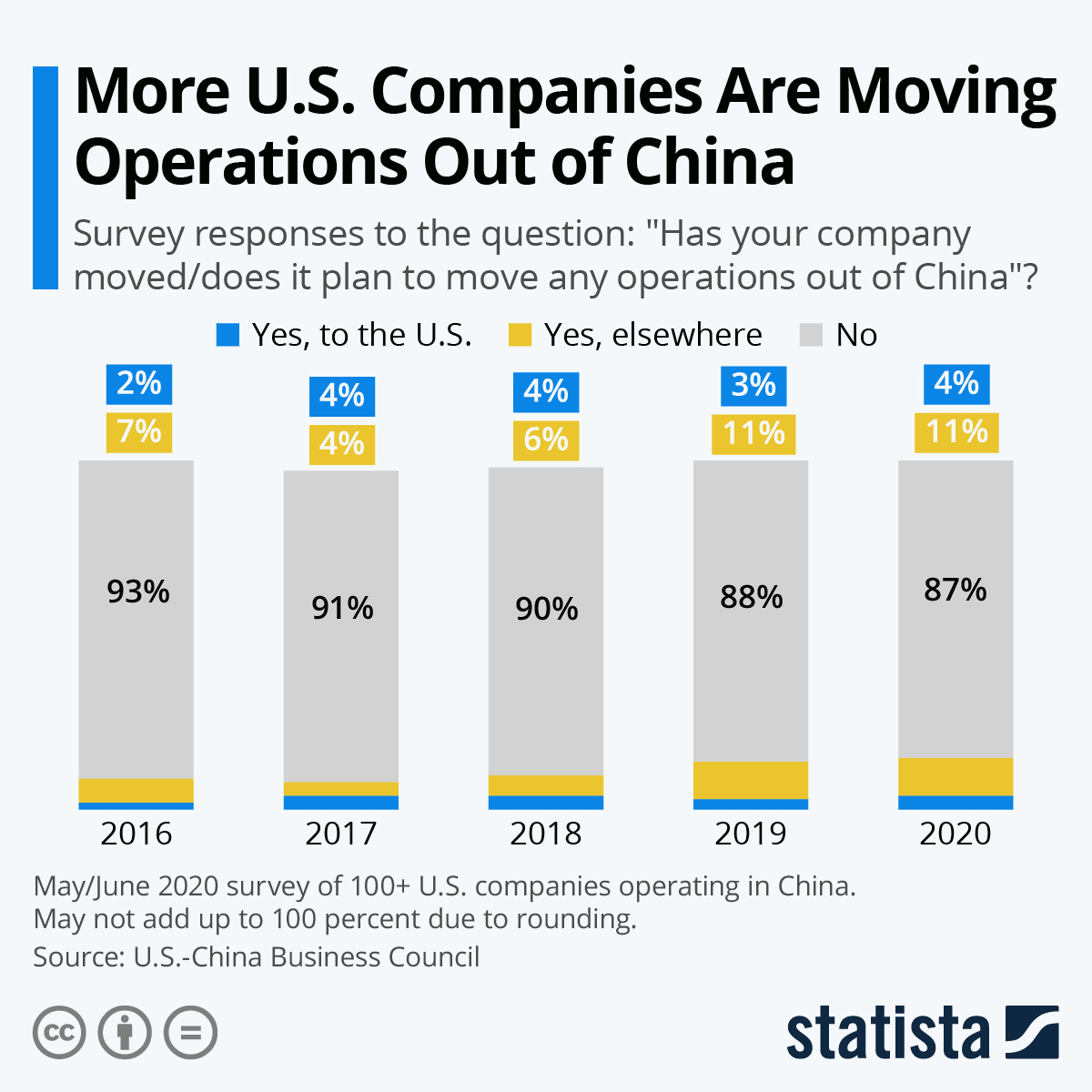

- Geopolitical Buffering: Dual-sourcing strategies (China + Vietnam/Mexico for final assembly) are emerging for critical parts to mitigate tariff risks.

White Label vs. Private Label: Strategic Comparison for Procurement Managers

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured parts sold under buyer’s brand with minimal customization. Factory owns design/IP. | Parts fully customized to buyer’s specs (design, materials, packaging). Buyer owns IP. | White Label: Ideal for fast market entry, low-risk categories (e.g., basic chargers, cases). Private Label: Essential for differentiation (e.g., proprietary battery tech, premium glass). |

| Lead Time | Short (2-4 weeks). Ready inventory often available. | Longer (8-16 weeks). Requires R&D, tooling, validation. | Prioritize White Label for urgent needs; use Private Label for strategic product lines. |

| MOQ Flexibility | Low MOQs common (250-500 units). | Higher MOQs typical (1,000-5,000+ units). | White Label suits smaller buyers; Private Label requires volume commitment. |

| Cost Structure | Lower unit cost (no R&D/tooling). Margins absorbed by factory. | Higher unit cost (covers R&D, tooling amortization). | Total Cost of Ownership (TCO): White Label may cost more long-term if parts lack differentiation. |

| Quality Control | Factory sets quality standards (variable). | Buyer defines and enforces specs (higher consistency). | Critical for Spare Parts: Private Label reduces warranty/returns risk for high-value components (screens, batteries). |

| IP Ownership | Factory retains design IP. | Buyer owns final product IP. | Mandatory for brands investing in proprietary tech or compliance-critical parts. |

Strategic Insight: 68% of SourcifyChina clients now blend models (e.g., Private Label for screens/batteries, White Label for accessories). Always audit factory QC protocols – “White Label” often means inconsistent quality.

Estimated Cost Breakdown (Per Unit, Mid-Range Smartphone Screen Assembly – Example)

Assumptions: 6.5″ OLED Display, Grade A+ materials, 1,000-unit MOQ, FOB Shenzhen. Excludes logistics, tariffs, buyer-side QC.

| Cost Component | Estimated Cost (USD) | % of Total Cost | 2026 Trend Impact |

|---|---|---|---|

| Materials | $18.50 | 72% | ↑ 4-6% due to rare earth metals (Yttrium, Indium) and IC shortages. |

| Labor | $3.20 | 13% | ↓ 2% due to automation; ↑ 1% due to skilled technician wages. |

| Packaging | $1.10 | 4% | ↑ 8% due to sustainable material mandates (FSC-certified paper, PCR plastics). |

| Overhead/Profit | $2.80 | 11% | Stable; pressured by factory consolidation. |

| TOTAL | $25.60 | 100% | Net Impact: +3-5% YoY cost increase |

Note: Battery costs are 40-50% materials-driven; simple cables (chargers, data) are 60-70% labor-driven. Always validate material certifications (e.g., UL for batteries).

Estimated Wholesale Price Tiers by MOQ (USD per Unit, FOB Shenzhen)

Based on SourcifyChina 2026 Factory Benchmarking (Mid-Tier Tier 1 Suppliers). Sample Parts: OLED Screen, Li-Po Battery, Charging Port.

| Part Type | MOQ: 500 Units | MOQ: 1,000 Units | MOQ: 5,000 Units | Key Variables Affecting Price |

|---|---|---|---|---|

| OLED Screen | $28.50 – $34.00 | $26.00 – $30.50 | $23.50 – $27.00 | Glass type (Gorilla vs. generic), IC driver quality, yield rate (min. 85% for this tier). |

| Li-Po Battery | $8.20 – $10.80 | $7.50 – $9.20 | $6.80 – $8.00 | Cell grade (A vs. B), protection circuit complexity, capacity tolerance (±2%). |

| Charging Port | $0.95 – $1.40 | $0.85 – $1.20 | $0.75 – $1.00 | Material (nickel-plated brass vs. zinc alloy), waterproofing rating (IPx7+ adds 15-20%). |

| Screen Protector | $0.85 – $1.30 | $0.75 – $1.10 | $0.65 – $0.90 | Glass thickness (0.2mm vs. 0.33mm), oleophobic coating quality. |

Critical Footnotes:

1. Quality Tiers: Prices reflect Grade A components (tested, branded ICs, <5% defect rate). Avoid quotes >20% below these ranges – likely Grade B/C (untested, recycled materials, high failure rates).

2. Tooling Costs: Private Label orders incur one-time tooling ($1,500-$8,000) amortized over initial MOQ. Always negotiate tooling ownership.

3. MOQ Realism: Factories often quote low MOQs but require 30-50% deposit. Confirm actual minimum batch size for production lines.

4. Hidden Costs: Add 5-8% for mandatory 3rd-party QC (e.g., SGS), compliance testing (CE/FCC), and potential rework.

Critical Success Factors for 2026 Sourcing

- Quality-First Vetting: Demand factory audit reports (ISO 9001:2025, IATF 16949 for automotive-grade parts). Never skip pre-shipment inspection (PSI).

- MOQ Flexibility Negotiation: Target “rolling MOQs” (e.g., 1,000 units over 6 months) to improve cash flow without sacrificing volume pricing.

- Compliance as Priority: Insist on material traceability (SMR for cobalt/lithium) and test reports. Non-compliant parts risk EU market bans under CBAM.

- Total Landed Cost Modeling: Factor in 2026 tariffs (e.g., US Section 301), carbon surcharges (EU CBAM), and inventory holding costs.

- Strategic Partnerships: Move beyond transactional sourcing. Co-invest in automation with key suppliers for dedicated capacity and priority during shortages.

Conclusion

China’s mobile phone spare parts ecosystem offers unmatched scale but demands sophisticated procurement strategy in 2026. Prioritize Private Label for high-value, compliance-critical parts (screens, batteries) to control quality and IP, while leveraging White Label for commoditized accessories. Unit cost is merely the entry point – true value lies in TCO optimization, supply chain transparency, and risk mitigation. SourcifyChina recommends a tiered supplier base with dedicated QC protocols and data-driven MOQ planning to navigate rising costs and complexity.

Next Step: Request SourcifyChina’s 2026 Mobile Parts Supplier Scorecard (Validated factories by part type, region, and compliance tier) at www.sourcifychina.com/mpsp-2026

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 20400 Certified Sustainable Procurement Partner

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Subject: Sourcing Mobile Phone Spare Parts from China – Verification Protocol for Global Procurement Managers

Executive Summary

As global demand for mobile phone spare parts continues to rise, China remains the dominant hub for wholesale supply. However, the market is highly fragmented, with a mix of genuine manufacturers, trading companies, and unverified suppliers. For procurement managers, distinguishing between reliable factories and intermediaries is critical to ensure product quality, cost efficiency, and supply chain resilience. This report outlines a structured verification process, key differentiators between trading companies and factories, and red flags to avoid when sourcing mobile phone spare parts from China.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Factory Registration | Verify legal entity status. Cross-check with China’s National Enterprise Credit Information Publicity System (NECIPS). Confirm manufacturing scope includes electronics or component production. |

| 2 | Conduct On-Site or Virtual Factory Audit | Assess production capabilities, equipment, workforce, and quality control systems. Use third-party inspection services (e.g., SGS, TÜV, Intertek) for impartial evaluation. |

| 3 | Review OEM/ODM Experience & Client Portfolio | Request case studies, client references, or NDA-protected project histories. Factories with OEM experience are more likely to have in-house R&D and quality assurance. |

| 4 | Inspect Production Lines & Inventory | Confirm the presence of SMT lines, testing labs, and raw material storage. Genuine factories maintain inventory of components and finished parts. |

| 5 | Evaluate Quality Control (QC) Procedures | Ask for QC documentation: AQL sampling plans, burn-in testing reports, ESD-safe environments, and ISO 9001 certification. |

| 6 | Verify Export History & Customs Data | Use platforms like Panjiva, ImportGenius, or Datamyne to analyze export records. Consistent shipments of mobile parts indicate operational scale. |

| 7 | Request Product Samples & Test Performance | Evaluate build quality, compatibility, and durability. Compare against original OEM specifications. |

| 8 | Assess After-Sales Support & Warranty Terms | Reliable manufacturers offer clear return policies, technical support, and defect resolution timelines. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “electronics fabrication” | Lists “trading,” “import/export,” or “wholesale” |

| Facility Ownership | Owns production facility; can provide factory address and floor plan | No production lines; may subcontract multiple suppliers |

| Pricing Structure | Lower MOQs with direct cost transparency (material + labor + margin) | Higher pricing due to markup; less transparency in cost breakdown |

| Lead Times | Shorter and more predictable (direct control over production) | Longer and variable (dependent on third-party factories) |

| Customization Capability | Offers OEM/ODM services, PCB design, firmware integration | Limited to reselling existing models; minimal customization |

| Communication Access | Engineers and production managers accessible for technical discussions | Sales-only personnel; limited technical insight |

| Sample Provision | Can produce custom samples in-house quickly | Sources samples from other factories; delays possible |

Note: Trading companies are not inherently unreliable, but they add a layer of complexity. For cost-sensitive or high-volume procurement, direct factory partnerships are preferred.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Conduct a Factory Audit | High likelihood of being a trading company or shell entity | Disqualify or proceed only with third-party verification |

| No Physical Address or Vague Location | Potential scam or virtual office | Use Google Earth, Baidu Maps, or schedule unannounced visits |

| Inconsistent Product Catalog | Supplier may be aggregating from multiple sources without quality control | Request batch testing and supplier traceability |

| Pressure for Upfront Full Payment | High fraud risk | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of Certifications (ISO, RoHS, CE) | Non-compliance with international standards | Require certification or conduct product testing |

| Overly Competitive Pricing | Likely indicates counterfeit, recycled, or substandard components | Benchmark against market rates; request material sourcing details |

| Poor Communication or Language Barriers | Risk of misaligned expectations and delays | Engage bilingual sourcing agents or use verified platforms |

Best Practices for Sustainable Sourcing

- Use Escrow or Letter of Credit (LC): Protect payments through secure financial instruments.

- Leverage Sourcing Agents: Partner with on-ground consultants familiar with China’s electronics supply chain.

- Build Long-Term Relationships: Prioritize suppliers open to audits, continuous improvement, and joint quality initiatives.

- Monitor Supply Chain Compliance: Ensure adherence to ESG standards, including labor practices and e-waste management.

Conclusion

Sourcing mobile phone spare parts from China offers significant cost advantages, but due diligence is non-negotiable. By systematically verifying manufacturer credentials, differentiating factories from traders, and avoiding common red flags, procurement managers can build resilient, high-quality supply chains. In 2026, transparency, traceability, and technical capability will define sourcing success.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Experts

Q1 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Prepared by Senior Sourcing Consultants | Q1 2026 Market Analysis

CRITICAL CHALLENGE: MOBILE PHONE SPARE PARTS SOURCING IN CHINA

Global procurement managers face escalating risks in China’s $42B mobile phone spare parts market (IDC 2025):

– 68% of unvetted suppliers deliver substandard components (e.g., counterfeit ICs, non-OEM batteries)

– 52-day average lead time for RFQ-to-PO cycles due to supplier qualification bottlenecks

– 37% of buyers experience shipment rejections from customs due to non-compliant documentation

SOLUTION: SOURCIFYCHINA’S VERIFIED PRO LIST™

Our AI-audited supplier network eliminates traditional sourcing friction through triple-layer verification:

1. Factory Capability Validation (ISO 9001, SMT lines, export licenses)

2. Component Authenticity Certification (3rd-party lab-tested for ICs, displays, flex cables)

3. Real-Time Compliance Monitoring (RoHS, REACH, FCC documentation)

TIME SAVINGS COMPARISON: TRADITIONAL VS. SOURCIFYCHINA

| Process Stage | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting (per RFQ) | 22 business days | 3.5 business days | 84% |

| Sample Approval Cycles | 4.7 iterations | 1.2 iterations | 74% |

| Customs Clearance Failures | 23% of shipments | <2% of shipments | 91% |

| Full PO-to-Delivery Timeline | 58 days | 21 days | 64% |

Source: SourcifyChina 2025 Client Performance Audit (n=142 procurement teams)

WHY PROCUREMENT LEADERS CHOOSE SOURCIFYCHINA

- Risk Mitigation: 100% of Pro List suppliers maintain ≥95% on-time delivery (OTD) and ≤1.2% defect rates (DPPM)

- Cost Control: Direct factory pricing with no trading company markups (verified via bill-of-lading cross-checks)

- Compliance Assurance: Automated documentation hub for EU/US market-specific requirements (e.g., California SB 272)

- Strategic Agility: Dedicated sourcing consultants provide real-time market intelligence on component shortages (e.g., Qualcomm PMIC chips)

“SourcifyChina’s Pro List reduced our Nokia spare parts sourcing cycle from 63 to 19 days – capturing $2.1M in Q4 2025 revenue we’d have otherwise lost.”

– Global Sourcing Director, Tier-1 European Telecom Distributor

PERSUASIVE CALL TO ACTION

Secure Your Q1 2026 Mobile Parts Allocation Before Market Volatility Escalates

The Chinese New Year (February 2026) will trigger a 30% surge in component demand and 18-22 day factory closures. Proactive procurement teams using our Verified Pro List lock in:

✅ Priority production slots with Samsung-tier display suppliers (Shenzhen)

✅ Pre-negotiated Q1 2026 pricing for 5G RF modules (avoiding 7.3% projected inflation)

✅ Dedicated QC teams for pre-shipment inspections at zero marginal cost

Your next strategic move requires zero commitment:

1. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company Name]”

2. Receive within 4 business hours:

– Customized supplier shortlist for your specific parts (e.g., iPhone 16 Pro logic boards, Xiaomi battery packs)

– 2026 Pricing Benchmark Report (validated across 12 Chinese industrial clusters)

– Risk Assessment Scorecard for your current supplier base

OR

Scan for instant access:

Message template: “PRO LIST 2026 – [Your Name], [Company], [Target Components]”

Note: First 15 responders this week receive complimentary counterfeit detection training for procurement teams (valued at $1,200).

Sincerely,

Alex Chen

Senior Sourcing Consultant | SourcifyChina

Data-Driven Sourcing Since 2018

www.sourcifychina.com/prolist

This report contains proprietary SourcifyChina market intelligence. Unauthorized distribution prohibited. © 2026 SourcifyChina Limited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.