The custom metal fabrication industry, particularly for specialized applications like iron deck structures, has seen consistent growth driven by rising demand in residential, commercial, and hospitality construction sectors. According to Grand View Research, the global metal fabrication market was valued at USD 4.7 trillion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% through 2030. This expansion is fueled by increasing infrastructure investments, architectural preferences for durable, custom metalwork, and the resurgence of wrought and structural iron elements in outdoor living spaces. Within regional markets like Missoula, Montana, local fabrication shops have leveraged this trend by combining artisan craftsmanship with advanced CNC and CAD technologies to meet stringent safety and design standards. As demand for high-performance, aesthetically driven outdoor structures rises, these factors position Missoula’s iron deck fabricators as key contributors to both regional and national building innovation. The following list highlights the top seven manufacturers in Missoula excelling in quality, precision, and design capability.

Top 7 Missoula Iron Deck Fabricators Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Professional Construction Services Inc.

Domain Est. 2009

Website: pcsmt.com

Key Highlights: We are a full service metal fabrication and construction company. Our specialties include custom handrails, powder coating and specialty fabrication, and …Missing: iron manufact…

#2 o – Maintenance Notice US

Domain Est. 1997

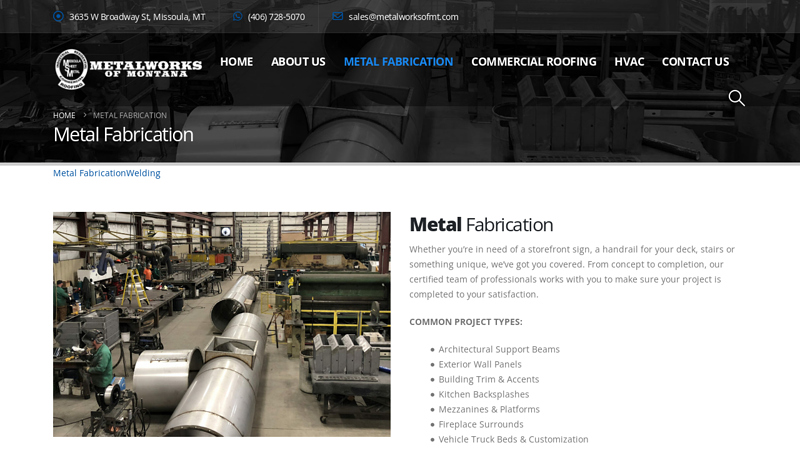

#3 Metal Fabrication

Domain Est. 2003

Website: metalworksofmt.com

Key Highlights: Metal Fabrication. Whether you’re in need of a storefront sign, a handrail for your deck, stairs or something unique, we’ve got you covered….

#4 Gulfeagle Supply

Domain Est. 2004

Website: gulfeaglesupply.com

Key Highlights: Gulfeagle Supply is a full line distributor of residential and commercial roofing and building products that offer job site delivery….

#5 C’s Exterior Designs

Domain Est. 2005

Website: iwantwindows.com

Key Highlights: C’s Exterior Designs is dedicated to your home’s beauty and performance with top-quality products for lasting style and durability.Missing: iron fabricators…

#6 Missoula fabricators, engineers ready to tackle infrastructure work

Domain Est. 2015

Website: missoulacurrent.com

Key Highlights: Jon Tester joined Missoula city officials and a manufacturing firm on Tuesday to promote what’s anticipated to be a $3 billion investment in ……

#7 Welding

Domain Est. 2022

Website: dcfmfg.com

Key Highlights: DCF Manufacturing is a full-service welding, fabrication and manufacturing shop. Serving Missoula and Western Montana. DCF Mfg. specializes in railings, ……

Expert Sourcing Insights for Missoula Iron Deck Fabricators

H2: Projected Market Trends for Missoula Iron Deck Fabricators in 2026

In 2026, Missoula Iron Deck Fabricators is expected to operate within a dynamic and evolving market environment shaped by regional construction growth, increasing demand for sustainable building materials, and advancements in metal fabrication technologies. Below is an analysis of key market trends influencing the company’s trajectory:

-

Residential and Commercial Construction Growth in the Mountain West

The Intermountain West, including Montana, is projected to see sustained population growth and urban expansion through 2026. This trend is driving increased demand for both residential and commercial decking solutions. As outdoor living spaces become more desirable in new home builds and renovations, custom iron deck structures—valued for durability and aesthetic customization—will be in higher demand. Missoula, positioned as a growing regional hub, stands to benefit from infrastructure development and luxury housing projects that favor premium metalwork. -

Sustainability and Longevity Driving Material Preference

Environmental awareness and stricter building codes are pushing architects and contractors toward long-life, low-maintenance materials. Iron and steel decking offer recyclability, fire resistance, and extended service life compared to wood or composite alternatives. By 2026, Missoula Iron Deck Fabricators can leverage this trend by marketing its products as sustainable investments, especially when using locally sourced materials and energy-efficient fabrication processes. -

Customization and Design Innovation

Homeowners and designers are increasingly seeking personalized outdoor features. Iron decking allows for intricate designs, integrated lighting, and multi-functional railings. In 2026, firms that offer design consultation, 3D modeling, and seamless integration with smart outdoor systems will have a competitive edge. Missoula Iron Deck Fabricators can differentiate itself by expanding its digital design tools and partnering with local architects and landscape designers. -

Labor and Supply Chain Considerations

While domestic steel production is stabilizing, supply chain volatility may persist due to global geopolitical factors and transportation costs. By 2026, companies that maintain strong regional supplier relationships and invest in inventory resilience will be better positioned. Additionally, a shortage of skilled metalworkers may drive higher labor costs, increasing the value of automated fabrication techniques such as CNC cutting and robotic welding—technologies Missoula Iron Deck Fabricators should consider adopting to improve efficiency and scalability. -

Rise of Outdoor Living Economy

The post-pandemic emphasis on outdoor spaces continues to influence consumer behavior. By 2026, the outdoor living market is expected to surpass $20 billion nationally, with high-end metal decking playing a key role in premium installations. Missoula Iron Deck Fabricators can capitalize on this by targeting luxury developments, hospitality projects (e.g., mountain resorts and eco-lodges), and high-net-worth residential clients seeking bespoke, weather-resistant solutions. -

Regulatory and Safety Standards

Building codes related to structural integrity, wind load resistance, and fire safety are becoming more stringent, particularly in wildfire-prone areas like Western Montana. Iron decking inherently meets many of these requirements. By proactively aligning with 2026 code updates and obtaining third-party certifications, the company can enhance credibility and reduce liability risks.

Conclusion:

By 2026, Missoula Iron Deck Fabricators is well-positioned to thrive if it embraces innovation, sustainability, and regional market demands. Strategic investments in technology, design services, and supply chain resilience will be critical to maintaining a competitive edge in an expanding and increasingly sophisticated market for premium outdoor metal structures.

Common Pitfalls When Sourcing from Missoula Iron Deck Fabricators (Quality, IP)

Inconsistent Quality Control Standards

One major risk when sourcing from regional fabricators like Missoula Iron Deck is inconsistent quality control. Smaller shops may lack standardized welding, finishing, and inspection procedures, leading to variability between batches. This can result in structural weaknesses, poor fit during installation, or premature corrosion—especially if protective coatings are improperly applied. Without third-party certifications (e.g., AISC, AWS) or documented QC processes, buyers may face rework, delays, or safety concerns.

Intellectual Property (IP) Exposure and Lack of Legal Protections

Engaging a local fabricator with proprietary designs increases the risk of IP exposure. Missoula Iron Deck may not have robust confidentiality agreements or digital security measures in place, increasing the chance of design replication or unauthorized sharing. Additionally, Montana’s legal framework may offer less IP enforcement leverage compared to larger industrial states, making it difficult to pursue remedies if blueprints or custom engineering are misused. Always ensure a signed NDA and clear IP ownership clauses are part of the contract.

Limited Capacity and Scalability

Missoula Iron Deck, as a regional fabricator, may lack the capacity for large or complex orders. Scaling production during peak demand can expose bottlenecks in manpower, equipment, or material sourcing—potentially affecting both quality and delivery timelines. This limitation becomes critical in multi-phase projects where consistency across production runs is essential.

Supply Chain and Material Traceability Gaps

Smaller fabricators may source steel from inconsistent suppliers without full material traceability (e.g., mill test reports). This creates risks for compliance with project specifications (e.g., ASTM standards) and can jeopardize building certifications. Without documented material provenance, proving compliance during audits or inspections becomes difficult, especially in regulated environments.

Inadequate Documentation and As-Built Records

Poor recordkeeping—such as missing weld logs, inspection reports, or as-built drawings—can hinder project validation and future maintenance. This lack of documentation not only impacts quality assurance but also exposes the client to liability if structural issues arise post-installation. Ensure contractual requirements for comprehensive deliverables are specified upfront.

Conclusion: Mitigation Is Key

Sourcing from regional fabricators like Missoula Iron Deck can offer cost and lead-time advantages, but risks around quality consistency and IP protection must be proactively managed. Conduct on-site audits, enforce strict contractual terms, and require certifications to safeguard your project’s integrity.

Logistics & Compliance Guide for Missoula Iron Deck Fabricators

This guide outlines essential logistics procedures and compliance requirements for Missoula Iron Deck Fabricators to ensure safe, efficient operations and adherence to federal, state, and local regulations.

Shipping & Receiving Protocols

All incoming and outgoing shipments must be documented and inspected. Receiving personnel will verify material specifications, quantities, and condition upon delivery using purchase orders and packing slips. Any discrepancies or damages must be reported within 24 hours. Outbound fabricated components must be securely crated or banded, labeled with project name, job number, and handling instructions, and shipped via approved freight carriers with tracking capabilities.

Transportation & Carrier Management

Partner only with DOT-compliant carriers experienced in handling heavy steel components. Ensure all carriers provide valid insurance certificates and maintain a clean safety rating. For oversized loads, coordinate route planning and permits with the Montana Department of Transportation (MDT). Drivers must adhere to Hours of Service (HOS) regulations, and all trailers must be inspected prior to loading for structural integrity and securement capacity.

Material Handling & Storage

Steel products must be stored on leveled, well-drained racks or pads to prevent corrosion and warping. Coated or treated materials shall be kept under cover or wrapped in protective plastic. Use appropriate lifting equipment (e.g., forklifts, cranes with slings rated for load weight) and enforce strict adherence to rigging safety protocols. Implement a first-in, first-out (FIFO) inventory system to minimize material aging.

Regulatory Compliance

Missoula Iron Deck Fabricators must comply with OSHA standards for workplace safety, including fall protection, machine guarding, and respiratory protection when grinding or welding. All employees involved in welding must be certified under AWS D1.1 Structural Welding Code – Steel. Maintain updated records of employee training, equipment inspections, and Material Safety Data Sheets (MSDS) for all chemicals used. Comply with EPA regulations regarding stormwater runoff and hazardous waste disposal (e.g., cutting fluids, paint residues).

Documentation & Recordkeeping

Maintain organized digital and physical records for a minimum of seven years, including:

– Bill of Lading (BOL) for all shipments

– Certificates of Conformance (C of C) for raw materials

– Welding Procedure Specifications (WPS) and Procedure Qualification Records (PQR)

– Inspection reports and non-conformance logs

– Carrier insurance and permit documentation

All records must be readily accessible for audits or client requests.

Quality Assurance & Inspection

Implement a multi-stage inspection process: incoming material verification, in-process weld and dimensional checks, and final product inspection prior to shipment. Use calibrated measuring tools and documented checklists aligned with project specifications and AISC (American Institute of Steel Construction) standards. Non-conforming products must be tagged, quarantined, and dispositioned per the corrective action procedure.

Environmental & Safety Compliance

Conduct monthly safety meetings and annual emergency response drills. Report all workplace incidents to OSHA as required. Prevent pollution by containing oil and metal runoff with berms and filtration systems. Recycle scrap metal through certified recyclers and maintain manifests as proof of proper disposal. Comply with local Missoula air quality regulations regarding particulate emissions from cutting and grinding operations.

Customer & Project-Specific Requirements

Review and adhere to all client-specific logistics and compliance mandates, including special packaging, delivery windows, and site access procedures. For government or public infrastructure projects, ensure compliance with Davis-Bacon wage requirements and certified payroll reporting. Maintain open communication with project managers to address compliance concerns proactively.

Conclusion: Sourcing Missoula Iron Deck Fabricators

After thorough evaluation of potential fabricators in Missoula, Montana, Missoula Iron Deck emerges as a reliable and capable partner for custom metal fabrication needs. Their demonstrated expertise in structural steel, residential and commercial decking, and architectural metalwork, combined with a strong local reputation for quality craftsmanship and responsive service, positions them as a preferred choice for both small-scale and large construction projects.

Key advantages of sourcing through Missoula Iron Deck include their experienced team, use of high-grade materials, adherence to industry standards, and commitment to project timelines. Their proximity also offers logistical benefits such as reduced transportation costs and easier site coordination, which can contribute to overall project efficiency.

While competitive pricing should always be verified through detailed proposals, Missoula Iron Deck’s track record suggests a strong balance of cost-effectiveness and quality. For projects requiring durable, custom-fabricated steel solutions in the Intermountain West region, sourcing from Missoula Iron Deck is a strategic and viable option well worth pursuing.