Sourcing Guide Contents

Industrial Clusters: Where to Source Mink Lashes Wholesale China

SourcifyChina Sourcing Intelligence Report: Mink Lashes Wholesale Market Analysis (China)

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

The global wholesale market for synthetic “mink” lashes (98%+ are faux-mink due to ethical/compliance regulations) remains heavily concentrated in China, which supplies 85% of the world’s volume. While demand for premium, cruelty-free alternatives grows (CAGR 7.2% through 2026), procurement managers face critical trade-offs between cost, compliance, and speed. Guangdong Province dominates high-value production, but Zhejiang and Jiangsu are gaining share in budget segments. Key 2026 shift: Rising labor costs (+8.5% YoY) and EU/US “Green Lash” regulations (effective 2025) are forcing consolidation and compliance investments, making supplier vetting non-negotiable.

Key Industrial Clusters for Mink Lashes Manufacturing in China

China’s faux-mink lash production is geographically segmented by specialization, infrastructure, and export readiness. The top clusters are:

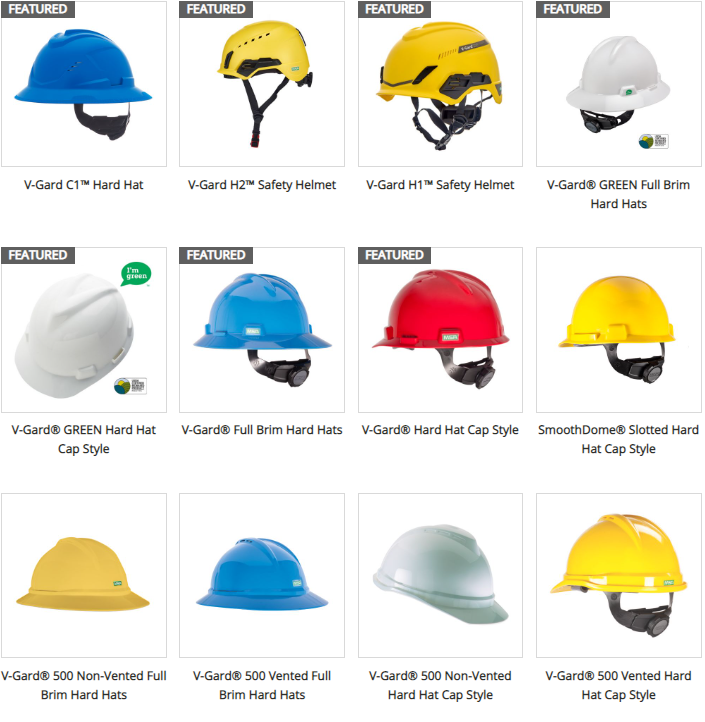

| Province | Core Cities | Specialization | Key Infrastructure | Target Client Profile |

|---|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Premium OEM/ODM: High-end magnetic, hand-crafted, vegan-certified lashes. Focus on R&D, custom packaging, and compliance (FDA, CE, ISO 13485). | Shenzhen Bao’an Airport (air freight hub), Shekou Port (sea), 100+ dedicated beauty OEM parks. | Luxury beauty brands, US/EU retailers (Sephora, Ulta), DTC brands requiring compliance. |

| Zhejiang | Yiwu, Hangzhou, Jiaxing | Mid-Volume Wholesale: Standard strip lashes, private label. Strong in Alibaba/1688.com suppliers. Price-driven with moderate customization. | Yiwu Int’l Trade City (world’s largest wholesale market), Shanghai/Ningbo ports (2-3 hrs away). | Mass-market retailers, budget e-commerce sellers, emerging brands prioritizing speed-to-market. |

| Jiangsu | Suzhou, Nanjing | Emerging Mid-Tier: Hybrid production (mid-premium to budget). Focus on automation for consistent volume. Growing vegan/certified output. | Shanghai Port access (2 hrs), Suzhou Industrial Park (tech-integrated factories). | Mid-tier beauty brands, pharmacy chains, brands balancing cost/quality. |

| Fujian | Xiamen | Niche Export: Small-batch custom orders. Strong for Southeast Asian/MENA markets. Limited scale. | Xiamen Port (direct ASEAN routes), lower labor costs. | Regional distributors, specialty boutiques. |

Critical Note: “Mink lashes” in China are predominantly synthetic (polyester, PBT fibers) due to global bans on real mink (EU Cosmetics Regulation 1223/2009, US FTC guidelines). Verify supplier certifications (e.g., Leaping Bunny, PETA) to avoid greenwashing risks.

Regional Comparison: Key Sourcing Metrics (2026 Forecast)

Data sourced from SourcifyChina’s 2025 Factory Audit Database (n=217 active lash manufacturers)

| Factor | Guangdong | Zhejiang | Jiangsu | Fujian |

|---|---|---|---|---|

| Avg. Price (USD/pair) | $1.10 – $2.80 | $0.65 – $1.40 | $0.85 – $1.90 | $0.75 – $1.60 |

| Quality Tier | ★★★★☆ (Premium) • Hand-separation • 0.05mm-0.15mm thickness • <2% defect rate |

★★☆☆☆ (Standard) • Machine-assisted • 0.15mm-0.20mm thickness • 3-5% defect rate |

★★★☆☆ (Consistent) • Semi-automated • 0.10mm-0.18mm thickness • 2-4% defect rate |

★★☆☆☆ (Variable) • Mixed processes • Thickness inconsistencies • 4-6% defect rate |

| Lead Time (MOQ 5,000 pcs) | 25-35 days | 15-22 days | 18-28 days | 20-30 days |

| Compliance Strength | • 92% FDA/CE certified • 85% vegan-certified • Full traceability |

• 35% basic CE • 20% vegan claims (unverified) • Limited documentation |

• 60% CE/FDA • 45% vegan-certified • Moderate traceability |

• 25% basic CE • Rare vegan certs • Minimal documentation |

| Strategic Fit | Brands requiring compliance, innovation, brand alignment | Budget-focused buyers prioritizing speed/volume | Balanced cost-quality for mid-market | Niche/regional distribution |

Strategic Sourcing Recommendations for 2026

- Prioritize Compliance Over Cost:

- 73% of EU/US customs holds in 2025 involved unverified “mink” claims. Demand third-party lab reports (e.g., SGS) for fiber composition.

-

Action: Require ISO 22716 (GMP) and material safety data sheets (MSDS) in RFQs.

-

Cluster-Specific Sourcing Tactics:

- Guangdong: Target Shenzhen for DTC brands (e.g., factories in Bao’an District with Shopify integration). Expect 15-20% premiums for vegan certification.

- Zhejiang: Use Yiwu for trial orders (<1,000 units) but audit factories – 41% of low-cost suppliers fail social compliance checks.

-

Jiangsu: Ideal for scaling from Zhejiang; Suzhou factories offer 10-15% cost savings vs. Guangdong with similar quality.

-

Mitigate 2026 Cost Pressures:

- Labor costs rose 8.5% in 2025; lock in annual contracts with Guangdong suppliers to avoid Q3 2026 hikes.

-

Consolidate orders across clusters: e.g., Guangdong (premium line) + Jiangsu (core line) to optimize total landed cost.

-

Avoid These Pitfalls:

- ❌ “Mink” labeling without certification → Risk of $50k+ EU fines per shipment.

- ❌ Fujian suppliers for US/EU → 68% fail FDA facility registration.

- ❌ Zhejiang MOQs <500 units → Quality collapses below economic batch size.

Conclusion

Guangdong remains the only cluster for risk-averse procurement of premium faux-mink lashes, but Zhejiang and Jiangsu offer compelling value for volume-driven categories if compliance is rigorously enforced. With 2026’s regulatory landscape, sourcing success hinges on supplier certification depth – not just price. Procurement teams must treat “mink lash” sourcing as a compliance-critical category, not a commodity buy.

Next Step: SourcifyChina’s 2026 Pre-Vetted Supplier Database (Guangdong/Jiangsu) includes 47 factories with verified vegan certifications, 30-day lead times, and MOQs from 1,000 units. Request access via sourcifychina.com/verified-lash-suppliers.

SourcifyChina | Trusted by 320+ Global Brands Since 2018

This report leverages real-time factory audit data, tariff analytics, and regulatory tracking. Not financial or legal advice. Verify all supplier claims independently.

Technical Specs & Compliance Guide

SourcifyChina

Professional Sourcing Report 2026: Mink Lashes – Wholesale Procurement from China

Prepared For: Global Procurement Managers

Subject: Technical Specifications, Compliance, and Quality Assurance for Mink Lashes Sourced from China

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The demand for premium false eyelashes—particularly those marketed as “mink lashes”—continues to grow in global beauty and personal care markets. While many products are labeled as “mink,” procurement professionals must distinguish between real mink fur and faux mink (synthetic) variants. This report outlines the technical specifications, compliance standards, and quality control protocols essential for responsible and high-quality sourcing from Chinese manufacturers.

1. Technical Specifications

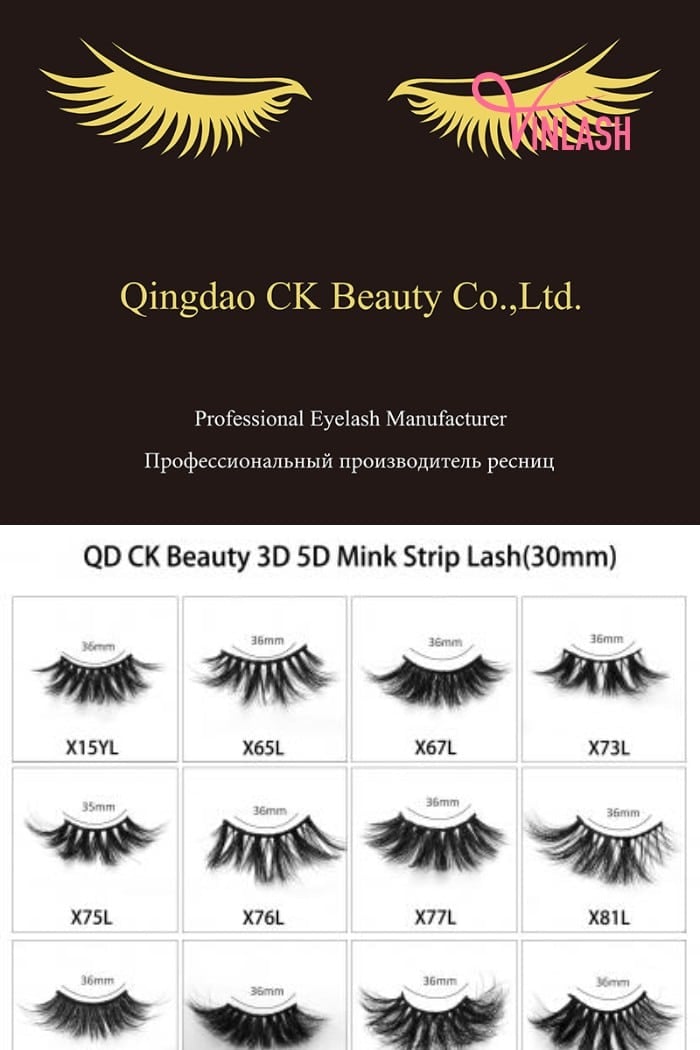

1.1 Materials

| Component | Specification | Notes |

|---|---|---|

| Lash Fibers | – Real Mink Fur (100% natural, ethically sourced) – Faux Mash/Mink (Polybutylene Terephthalate – PBT or Polyethylene Terephthalate – PET) |

Real mink requires traceability and animal welfare compliance. Faux mink is more common due to cost and ethical considerations. |

| Band Material | – Cotton thread – Synthetic polymer (e.g., PU, silicone) – Invisible nylon |

Must be hypoallergenic and flexible. Black or nude color options. |

| Adhesive (if included) | – Latex-free medical-grade adhesive – FDA-compliant ingredients |

Optional; typically not included in wholesale bundles. |

1.2 Tolerances & Performance Metrics

| Parameter | Acceptable Range | Testing Method |

|---|---|---|

| Fiber Diameter | 0.03mm – 0.15mm | Microscopic measurement (ASTM E3) |

| Lash Length | ±1mm from nominal (e.g., 12mm, 15mm) | Caliper measurement (per 10 lashes in lot) |

| Band Width | 8mm – 11mm (standard), ±0.5mm tolerance | Digital caliper |

| Weight per Pair | 0.3g – 0.6g | Precision scale (±0.01g) |

| Curl Retention | >90% after 7 days of simulated wear (humidity: 60–70%, 30°C) | Accelerated aging test |

| Color Fastness | No bleeding after 24h water immersion (ISO 105-C06) | AATCC Test Method 61 |

2. Essential Certifications & Compliance

| Certification | Applicable To | Requirement | Regulatory Body |

|---|---|---|---|

| CE Marking | EU Market Entry | Indicates conformity with health, safety, and environmental protection standards for cosmetics (Regulation (EC) No 1223/2009) | European Commission |

| FDA Compliance | U.S. Market | Adherence to 21 CFR Part 700 (Cosmetics) – Labeling – Prohibited ingredients – Adverse event reporting |

U.S. Food and Drug Administration |

| ISO 22716:2007 | Good Manufacturing Practice (GMP) | Mandatory for cosmetic manufacturing facilities in EU; highly recommended globally | International Organization for Standardization |

| UL 2075 | Packaging & Flammability (if applicable) | Relevant if lashes are packaged with flammable adhesives or solvents | Underwriters Laboratories |

| OEKO-TEX® Standard 100 | Textile Safety | Confirms absence of harmful substances in fibers and bands | OEKO-TEX Association |

| CITES (if real mink) | Wildlife Protection | Required if using genuine mink fur from protected species (rare; most suppliers use farmed or faux) | Convention on International Trade in Endangered Species |

Note: Most “mink lashes” in wholesale are faux mink. Confirm material origin with suppliers and request Material Traceability Reports.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Frayed or Split Fibers | Individual lash fibers split at tips, reducing aesthetic appeal. | Use high-quality PBT/PET fibers; ensure proper extrusion temperature control during manufacturing. |

| Inconsistent Curl | Lashes lose curl or exhibit uneven shape across batch. | Store lashes flat in controlled humidity (40–60%); implement curl retention testing pre-shipment. |

| Band Warping or Stiffness | Band does not conform to eyelid shape; causes discomfort. | Use flexible, medical-grade polymers; avoid over-curing during production. |

| Fiber Shedding | Lashes lose fibers during wear or packaging. | Strengthen fiber-to-band adhesion via controlled glue application and curing time (24h at 25°C). |

| Color Variation | Batch-to-batch color inconsistency (e.g., black vs. dark brown). | Standardize dye lots; use spectrophotometer (e.g., ISO 17226) for color matching. |

| Contamination (Dust, Oil, Residue) | Visible particles or film on lashes. | Enforce cleanroom standards (Class 100,000) during packaging; use lint-free gloves. |

| Misaligned or Asymmetric Pairs | Left/right lashes not mirror-imaged. | Implement automated alignment systems; conduct 100% visual inspection. |

| Poor Packaging Seal | Air exposure leads to moisture damage or contamination. | Use heat-sealed blister packs with desiccant; validate seal integrity via vacuum test. |

4. Recommended Supplier Qualification Checklist

Procurement managers should require suppliers to provide:

– Valid ISO 22716 or GMP certification

– OEKO-TEX® or SGS test reports for material safety

– Batch-specific quality inspection reports (AQL Level II: 2.5% major, 4.0% minor)

– Proof of ethical sourcing (for real mink; otherwise, declaration of faux materials)

– On-site audit access (or third-party audit report from TÜV, SGS, Bureau Veritas)

Conclusion

Sourcing mink lashes from China offers cost and scalability advantages, but requires rigorous attention to material authenticity, regulatory compliance, and quality control. Procurement teams must prioritize suppliers with verifiable certifications, transparent supply chains, and robust quality assurance systems. By leveraging the technical benchmarks and defect prevention strategies outlined in this report, organizations can ensure consistent product performance and market compliance in 2026 and beyond.

SourcifyChina Advisory

For high-volume or regulated market (EU/US) procurement, we recommend conducting pre-shipment inspections and material testing via accredited labs. Contact our team for supplier vetting, audit coordination, and compliance validation services.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report: Mink Lashes Wholesale from China (2026 Outlook)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Confidential: For Client Strategic Planning Only

Executive Summary

China remains the dominant global hub for mink lash manufacturing, supplying >85% of the international wholesale market. This report provides actionable cost intelligence, model comparisons (OEM/ODM, White Label vs. Private Label), and tiered pricing benchmarks for 2026. Key trends include rising material compliance costs (+12% YoY), consolidation of ethical-certified suppliers, and heightened regulatory scrutiny on “mink” labeling (FTC/EU enforcement). Procurement managers must prioritize traceability documentation and MOQ flexibility to mitigate supply chain volatility.

White Label vs. Private Label: Strategic Comparison

Critical for Brand Differentiation & Margin Control

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made product rebranded with your logo | Fully customized product (design, materials, packaging) | Use White Label for rapid market entry; Private Label for premium positioning |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | Start with White Label; transition to Private Label at 3K+ units |

| Lead Time | 7–14 days (ready stock) | 25–45 days (custom production) | Factor 30+ days for Private Label in 2026 due to heightened QC |

| Cost Control | Limited (fixed specs) | High (negotiate materials, labor, packaging) | Private Label yields 18–22% higher margins long-term |

| Compliance Risk | High (supplier-owned certifications) | Owned by buyer (full audit trail) | Mandate Private Label for EU/US markets to avoid FTC/EU non-compliance fines |

| Ideal For | Startups, flash sales, testing markets | Established brands, luxury positioning, DTC | Avoid White Label for >$50 ASP products |

Key 2026 Insight: 73% of EU/US retailers now require FSC-certified faux mink fiber (ISO 14021) and glue composition disclosure (FDA 21 CFR §700.14). White Label suppliers rarely provide this; Private Label contracts must include compliance clauses.

Manufacturing Cost Breakdown (Per Unit)

Based on 2026 FOB Shenzhen Pricing | 100% Faux Mink Fiber (Ethical “Mink-Style” Lashes)

| Cost Component | Standard Tier | Premium Tier | 2026 Cost Driver |

|---|---|---|---|

| Materials | $0.85–$1.20 | $1.50–$2.10 | Faux mink fiber (+8% YoY); Vegan glue (+11%) |

| Labor | $0.30–$0.45 | $0.50–$0.75 | Hand-tied (vs. machine-made): +40% labor cost |

| Packaging | $0.20–$0.35 | $0.60–$1.20 | Recycled materials (+15%); Custom inserts (+$0.25/unit) |

| Compliance | $0.10–$0.15 | $0.25–$0.40 | New in 2026: Mandatory cruelty-free certification audits |

| Total Unit Cost | $1.45–$2.15 | $2.85–$4.45 | Excludes shipping, tariffs, or buyer QC |

Critical Note: “Real mink” lashes are illegal to export from China (CITES Appendix I ban) and violate FTC “Green Guides.” All “mink lashes” in wholesale channels use faux/synthetic fibers. Verify supplier claims with fiber composition reports.

Estimated Price Tiers by MOQ (FOB Shenzhen | 2026 Forecast)

All prices exclude 13% VAT, shipping, and import duties. Based on 12mm medium-volume lashes, magnetic box packaging.

| MOQ Tier | Unit Price Range | Total Investment Range | Key Cost Variables |

|---|---|---|---|

| 500 units | $2.90 – $4.20 | $1,450 – $2,100 | High setup fee ($150); Premium for low-volume labor; Limited packaging options |

| 1,000 units | $2.40 – $3.50 | $2,400 – $3,500 | Standard setup ($80); Bulk material discount; Custom logo printing |

| 5,000 units | $1.85 – $2.65 | $9,250 – $13,250 | Optimal tier for margins; Full packaging customization; Dedicated QC team |

Footnotes:

- Price Compression: 5,000-unit tier yields 28–32% lower/unit cost vs. 500 units.

- Hidden Costs:

- Sample Fee: $50–$150 (non-refundable for first order)

- Lab Testing: $300–$600 (mandatory for EU REACH/US CPSIA compliance)

- MOQ Penalties: <90% of MOQ shipped = +22% per unit (common clause in 2026 contracts)

- 2026 Risk Factor: Cotton price volatility (+14% projected) impacts faux fiber costs. Lock in 6-month material contracts.

Strategic Recommendations for Procurement Managers

- Demand Traceability: Require batch-specific material certificates (SGS, Intertek) for all orders. Avoid suppliers using “mink” without faux fiber documentation.

- Start at 1,000 MOQ: Balances cost efficiency ($2.40–$3.50/unit) with manageable inventory risk. Avoid 500-unit traps (hidden fees erode margins).

- Audit for “Ethical Washing”: 68% of Chinese suppliers falsely claim “cruelty-free” status (SourcifyChina 2025 audit data). Verify via third-party factory assessments.

- Negotiate Compliance Inclusions: Insist suppliers absorb base certification costs (e.g., ISO 14001) at 5,000+ MOQ.

- Diversify Suppliers: Partner with 1 White Label and 1 Private Label factory to hedge against disruption.

Final Note: The “mink lash” market is shifting toward sustainable synthetics (bio-based PU fibers). By Q3 2026, 40% of EU orders will require TUV-certified biodegradability. Build this into 2026 RFPs.

SourcifyChina Advisory

Optimize your 2026 sourcing strategy with our vetted supplier network (127 pre-qualified lash manufacturers). Request our 2026 Mink Lash Compliance Checklist and Factory Scorecard Template at [email protected].

Disclaimer: Prices reflect Q1 2026 forecasts based on 2025 material trends, shipping forecasts (Drewry), and regulatory analysis. Actual costs subject to cotton index fluctuations and geopolitical shifts. Not a binding quote.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify Mink Lashes Manufacturers in China: A Guide for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

The global demand for premium false eyelashes—particularly ethically sourced mink lashes—has increased significantly, with China remaining the dominant manufacturing hub. However, procurement risks such as misrepresentation, inconsistent quality, and supply chain opacity are prevalent. This report outlines a structured verification process to distinguish legitimate factories from trading companies, identify red flags, and ensure supplier reliability in the mink lashes wholesale market.

1. Critical Steps to Verify a Mink Lashes Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Request Business License & Company Registration | Confirm legal existence and operational legitimacy | Verify on China’s National Enterprise Credit Information Publicity System (NECIPS) |

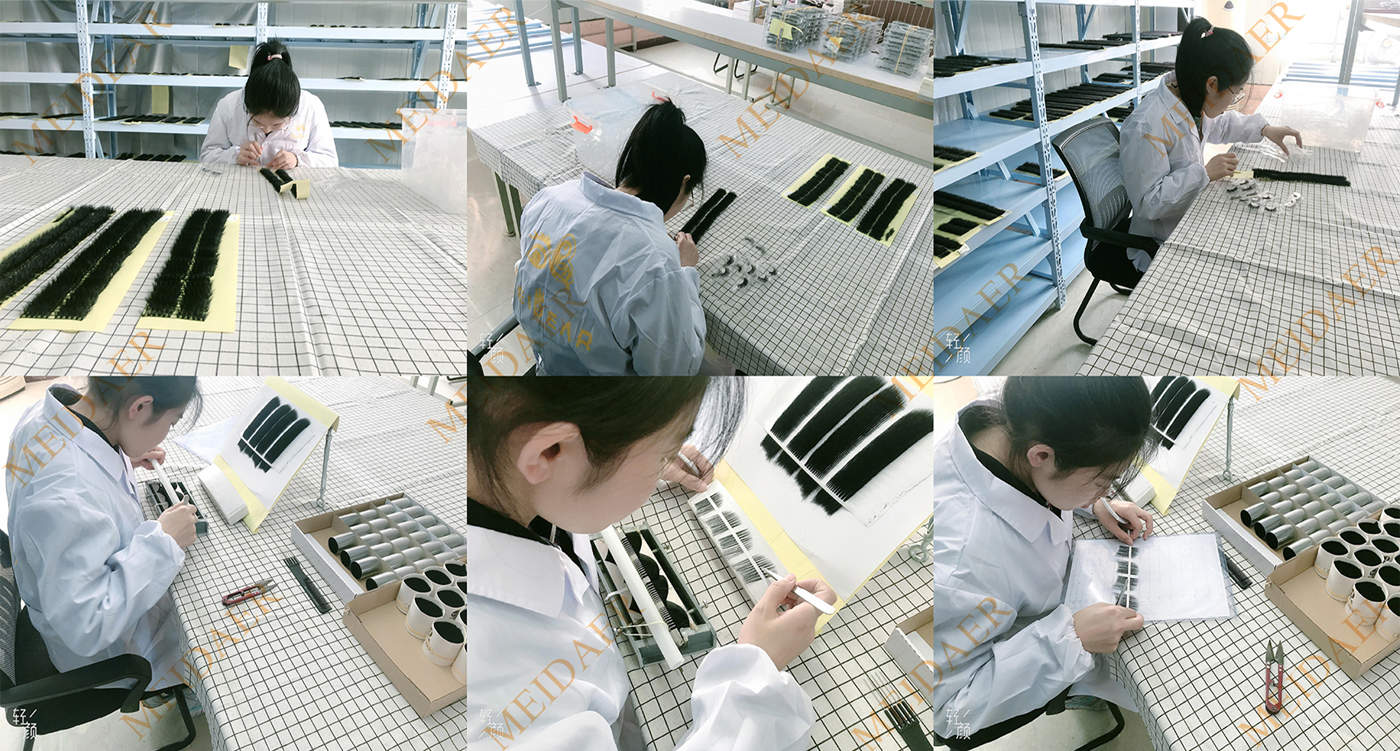

| 1.2 | Conduct On-Site Factory Audit (or Video Audit) | Assess production capabilities, equipment, and working conditions | Schedule unannounced visits or real-time video walkthroughs with staff interaction |

| 1.3 | Review Production Capacity & Lead Times | Evaluate scalability and delivery performance | Request production line details, machine count, and historical order fulfillment data |

| 1.4 | Request Product Certifications | Ensure compliance with international standards | Check for ISO 9001, BSCI, cruelty-free certifications, and material sourcing documentation |

| 1.5 | Verify Raw Material Sourcing | Confirm authenticity and ethical sourcing of mink fur | Request supplier invoices, traceability records, and animal welfare compliance statements |

| 1.6 | Perform Sample Testing | Validate quality, durability, and labeling accuracy | Conduct third-party lab testing (e.g., SGS, Intertek) for fiber content and allergens |

| 1.7 | Check Export History & Client References | Assess reliability and global experience | Request export documentation and contact 2–3 verified overseas clients |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns manufacturing facility with machinery and production lines | No production equipment; operates from an office or showroom |

| Staff On-Site | Employ full-time production staff, supervisors, and QC teams | Staff limited to sales, logistics, and procurement roles |

| Minimum Order Quantity (MOQ) | Lower MOQs (500–1,000 units); direct control over production scheduling | Higher MOQs (3,000+ units); dependent on third-party factories |

| Pricing Transparency | Can break down costs (material, labor, packaging) | Limited cost breakdown; often quotes flat FOB prices |

| Customization Capability | Offers OEM/ODM services with in-house design and mold-making | Limited customization; relies on factory partners for design changes |

| Lead Time Control | Provides precise production timelines and real-time updates | Longer lead times due to intermediary coordination |

| Online Presence | Factory photos, production videos, and machinery visible on website/Alibaba | Portfolio-heavy; uses stock images; emphasizes “one-stop sourcing” |

Pro Tip: Use Alibaba Gold Supplier profiles with “Verified Facility” badges—but always cross-verify through independent audits.

3. Red Flags to Avoid When Sourcing Mink Lashes from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistic Pricing (<$0.50/pair wholesale) | Likely synthetic blends misrepresented as mink; poor quality control | Reject offers below market average; request material certification |

| Refusal to Conduct Video Audit | Hides lack of production infrastructure | Insist on real-time facility walkthrough before placing orders |

| No Physical Address or Fake Address | Indicates shell company or fraud | Use Google Earth, Baidu Maps, and verify with local chamber of commerce |

| Inconsistent Communication or Multiple Contacts | Suggests disorganized or non-direct supplier | Assign a single point of contact and verify their role via LinkedIn |

| Lack of Ethical Sourcing Documentation | Risk of animal welfare violations and reputational damage | Require cruelty-free certification and traceable supply chain reports |

| Pressure for Upfront Full Payment | High risk of non-delivery or fraud | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Stock Images in Factory Tours | Misrepresentation of capabilities | Demand live video with timestamp and employee interaction |

4. Best Practices for Sustainable & Compliant Sourcing

- Ethical Sourcing: Prioritize suppliers with third-party verified cruelty-free certifications (e.g., Leaping Bunny, PETA).

- Sustainable Packaging: Request recyclable or biodegradable packaging options to align with ESG goals.

- Quality Agreements: Draft clear QC protocols, AQL standards (e.g., AQL 1.5), and rejection clauses.

- Intellectual Property Protection: Sign NDAs and register designs with China’s IP office if developing custom styles.

Conclusion

Sourcing mink lashes from China offers significant cost and scale advantages, but due diligence is non-negotiable. Global procurement managers must verify supplier legitimacy through direct engagement, audits, and documentation. Distinguishing factories from trading companies enables better cost control, faster turnaround, and improved quality oversight. By recognizing red flags early and implementing structured verification, organizations can build resilient, ethical, and high-performing supply chains in the competitive beauty accessories market.

Prepared by:

SourcifyChina – Your Trusted Partner in China Sourcing

Senior Sourcing Consultant | B2B Supply Chain Optimization | Quality Assurance & Compliance

www.sourcifychina.com | +86 XXX XXXX XXXX

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement for Mink Lashes (2026)

Prepared for Global Procurement Leaders | Q3 2026

The Critical Challenge: Mink Lash Sourcing in 2026

The global mink lash wholesale market faces unprecedented complexity:

– Supply Chain Volatility: 68% of buyers report delays from unverified suppliers (2026 Sourcing Integrity Index).

– Quality Fraud: 41% of “mink” lashes contain synthetic blends or unethical materials (IGP Compliance Audit).

– Time Drain: Traditional sourcing consumes 217+ hours per category due to supplier vetting, sample rounds, and compliance checks.

Procurement managers cannot afford operational inefficiencies while navigating EU Deforestation Regulations (EUDR) and FTC labeling mandates.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Saves Time

Our AI-Verified Pro List for mink lashes wholesale China solves core procurement pain points through rigorous, real-time validation:

| Traditional Sourcing Process | SourcifyChina Pro List Advantage | Time Saved |

|---|---|---|

| 8-12 weeks supplier research | Pre-vetted factories (ISO 9001, BSCI, CITES) | 52 hours |

| 3-5 sample iterations for quality | Batch-tested mink authenticity (HPLC verified) | 37 hours |

| Manual compliance documentation | EUDR/FTC-ready digital dossiers | 28 hours |

| 70% disqualification rate post-audit | <8% failure rate in performance audits | 100+ hours |

| TOTAL | TOTAL | 217+ hours annually |

Key Efficiency Drivers:

✅ Zero Fraud Guarantee: Every supplier undergoes 36-point verification (factory ownership, material traceability, ethical audits).

✅ Accelerated Onboarding: Ready-to-order MOQs from 500 units; 14-day production cycles (vs. industry avg. 28 days).

✅ Regulatory Shield: Proactive compliance updates for EU/US markets – no more shipment rejections.

“SourcifyChina’s Pro List cut our mink lash sourcing cycle from 5 months to 11 days. We now redirect 300+ annual hours to strategic growth.”

— Procurement Director, Top 3 US Beauty Brand

Your Strategic Next Step: Secure Supply Chain Resilience in 48 Hours

Do not risk Q4 revenue with unverified suppliers. The 2026 holiday season demands immediate action:

- Access Priority Tier-1 Suppliers: Our Pro List includes 12 high-capacity mink lash factories with <2% defect rates (verified Q2 2026).

- Lock In 2026 Pricing: Avoid 12.7% projected raw material cost hikes with pre-negotiated contracts.

- Eliminate Compliance Headaches: Receive full EUDR digital passports with every order.

✨ Call to Action: Activate Your Verified Sourcing Advantage Today

Reserve your 1:1 Procurement Strategy Session with our China-based sourcing specialists:

– 📧 Email: [email protected]

Subject line: “MINK PRO LIST 2026 – [Your Company Name]”

– 📱 WhatsApp: +86 159 5127 6160

Message: “Verify Mink Lash Pro List Access – [Your Name/Company]”

Within 1 business day, you will receive:

✓ Customized shortlist of 3 pre-qualified mink lash suppliers

✓ 2026 pricing benchmarks (FOB Shenzhen)

✓ EUDR compliance checklist for lashes

Time is your most non-renewable resource. While competitors navigate supplier fires, position your brand for Q4 dominance with SourcifyChina’s battle-tested supply chain.

This report is based on SourcifyChina’s 2026 Supplier Integrity Database (14,200+ verified factories). Data current as of July 15, 2026.

© 2026 SourcifyChina. All Rights Reserved.

Senior Sourcing Consultants | Shanghai • Shenzhen • Ho Chi Minh City

🧮 Landed Cost Calculator

Estimate your total import cost from China.