Sourcing Guide Contents

Industrial Clusters: Where to Source Mink Hair Vendors In China

Professional B2B Sourcing Report 2026

SourcifyChina | Global Sourcing Intelligence

Title: Deep-Dive Market Analysis – Sourcing Mink Hair Vendors in China

Prepared for: Global Procurement Managers

Publication Date: Q1 2026

Executive Summary

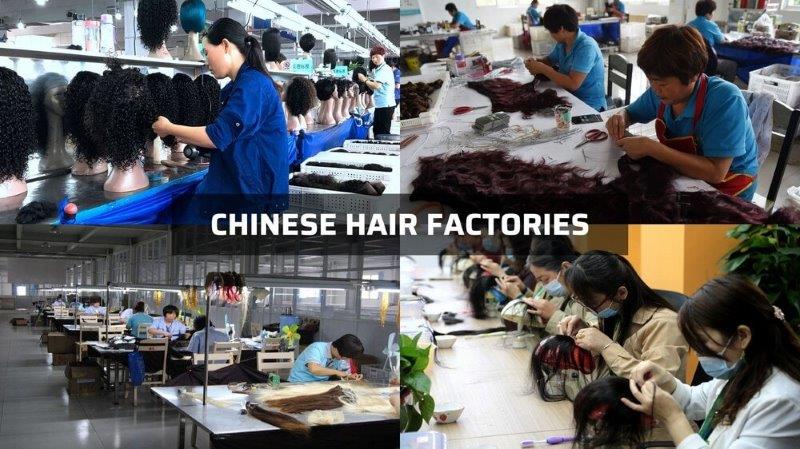

This report provides a comprehensive market analysis for global procurement professionals seeking to source mink hair—specifically raw, processed, and semi-finished mink fur and hair—from vendors in the People’s Republic of China. While China is not a primary producer of live mink, it has emerged as a dominant global hub for mink hair processing, dyeing, weaving, and finished product manufacturing, particularly in the fur garment, extension, and luxury craft sectors.

With increasing demand from high-end fashion brands, wig manufacturers, and cosmetic brush producers, understanding the geographic distribution, quality benchmarks, pricing structures, and lead time dynamics of Chinese mink hair suppliers is critical for strategic procurement.

This report identifies key industrial clusters, evaluates regional vendor capabilities, and delivers a comparative analysis to support informed sourcing decisions.

Market Overview: Mink Hair in China

China does not breed mink at scale for fur (unlike Denmark, Poland, or the U.S.), but it imports raw mink pelts and hair bundles—primarily from Northern Europe and North America—for processing. The domestic value chain includes:

- Pelt splitting and hair extraction

- Dyeing and texturizing

- Wefting and weaving for extensions

- Final assembly into wigs, lashes, or fashion trims

China’s competitive advantage lies in low-cost skilled labor, vertically integrated production, and agile customization—making it the preferred destination for mid-to-high volume buyers.

Key Industrial Clusters for Mink Hair Processing & Vending

The following provinces and cities are recognized as primary hubs for mink hair processing and vendor operations:

| Region | Key Cities | Specialization | Key Infrastructure |

|---|---|---|---|

| Guangdong Province | Guangzhou, Shenzhen, Dongguan | Finished goods (wigs, extensions), OEM/ODM manufacturing | Yiwu Market access, Shenzhen export logistics, proximity to Hong Kong |

| Zhejiang Province | Jiaxing, Haining, Hangzhou | Pelt processing, dyeing, semi-finished hair bundles | Haining China Leather City, strong textile supply chain |

| Hebei Province | Baoding (Anxin County), Langfang | Raw material processing, hair sorting, bulk bundling | Proximity to Tianjin port, lower labor costs |

| Shandong Province | Qingdao, Yantai | Dyeing, chemical treatment, export logistics | Strong port infrastructure, growing OEM base |

Note: Haining (Zhejiang) is widely recognized as China’s fur and leather capital, hosting over 3,000 fur-related enterprises and the annual China (Haining) International Leather Fair.

Comparative Analysis: Key Production Regions

The table below evaluates the four main sourcing regions based on Price Competitiveness, Quality Tier, and Average Lead Time for mink hair products (e.g., processed hair bundles, wefted extensions, dyed trims).

| Region | Price (USD/kg) | Price Competitiveness | Quality Tier | Typical Applications | Avg. Lead Time (weeks) | Key Strengths | Key Limitations |

|---|---|---|---|---|---|---|---|

| Guangdong | 45–75 | Medium | High | Premium wigs, luxury extensions, fashion trims | 6–8 | Design expertise, OEM/ODM support, fast shipping via Shenzhen/HK | Higher MOQs, premium pricing |

| Zhejiang | 35–60 | High | Medium to High | Semi-finished bundles, dyed trims, wholesale | 5–7 | Strong processing base, dyeing precision, industry clustering | Less design support, B2B-focused |

| Hebei | 25–45 | Very High | Medium | Bulk raw hair, industrial use, low-cost extensions | 6–9 | Lowest labor costs, bulk sorting capacity | Inconsistent QC, limited finishing |

| Shandong | 30–50 | High | Medium | Dyed hair, OEM bundles, export-ready packs | 5–6 | Reliable logistics (Qingdao Port), growing compliance standards | Fewer specialized vendors |

Sourcing Recommendations

✅ Best for Premium Quality & Innovation: Guangdong

- Ideal for brands requiring custom designs, certifications (e.g., OEKO-TEX), and fast time-to-market.

- Recommended vendors: Guangzhou Furtop Co., Ltd., Shenzhen Everbeauty Hair.

✅ Best for Balanced Cost-Quality Mix: Zhejiang

- Optimal for mid-tier extensions, trims, and bulk dyed hair.

- Recommended hub: Haining Fur Industry Zone.

- Top vendors: Haining Richmore Fur, Zhejiang SnowQueen Hair Co.

✅ Best for High-Volume, Low-Cost Procurement: Hebei

- Suitable for commodity-grade mink hair used in crafts, brushes, or budget wigs.

- Caution: Third-party quality audits strongly advised.

✅ Best for Export Efficiency & Compliance: Shandong

- Ideal for buyers prioritizing port access and stable supply chains.

- Increasing number of ISO-certified processors.

Emerging Trends (2025–2026)

- Rise of Sustainable Claims: Pressure from EU and U.S. markets is driving demand for traceable, certified mink hair. Some Zhejiang and Guangdong vendors now offer RFID-tracked batches.

- Blended Materials: Growth in mink-synthetic blends to reduce cost while maintaining luster.

- Automation in Wefting: Guangdong factories are investing in automated wefting machines, reducing lead times by up to 20%.

- Regulatory Risk: The EU’s potential fur import ban (under discussion) may shift sourcing to non-EU-facing suppliers or increase demand for faux-mink alternatives.

Conclusion

China remains the world’s leading processor and vendor of mink hair, with distinct regional strengths. Procurement managers should align sourcing strategies with product tier, volume, and compliance needs:

- Guangdong for innovation and quality.

- Zhejiang for balanced value.

- Hebei for cost-driven volume.

- Shandong for logistics efficiency.

Due diligence, including on-site audits, sample testing, and contract clarity on origin and treatment, is essential to mitigate risks related to quality variance and regulatory compliance.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Data-Driven China Sourcing

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Ethical & Compliant Hair Fiber Procurement (China)

Report Code: SC-CHF-2026-001 | Date: October 26, 2025 | Prepared For: Global Procurement Managers

Critical Legal & Ethical Advisory

Mink (Neovison vison) is a CITES-Appendix II protected species globally. Commercial trade of true mink hair/fur for non-indigenous, non-tribal use is strictly prohibited under:

– CITES (Convention on International Trade in Endangered Species): Requires export/import permits (virtually unobtainable for commercial hair trade).

– US Endangered Species Act (ESA) & EU Wildlife Trade Regulations: Ban import/sale of unverified mink products.

– China’s Wildlife Protection Law (2023 Amendment): Criminalizes illegal wildlife trade; no licensed mink hair vendors exist for export.

Procurement Risk: Sourcing “mink hair” from China carries 100% risk of seizure, fines >$500k (US/EU), and reputational damage. All vendors claiming “authentic mink hair” are either:

1. Selling mislabeled synthetic fibers (e.g., “mink faux hair”),

2. Trafficking illegal wildlife products, or

3. Operating fraudulent schemes.

Recommended Sourcing Pathway: Ethical Alternatives

Focus procurement on synthetic fibers or regulated animal hairs (e.g., sable, squirrel) with verifiable legal pedigrees. Below specifications apply to premium synthetic fibers (marketed as “mink-effect”) and CITES-compliant animal hairs.

I. Technical Specifications & Quality Parameters

| Parameter | Premium Synthetic Fibers | CITES-Compliant Animal Hairs (e.g., Kolinsky Sable) |

|---|---|---|

| Material Source | PA6, PA66, PET, or PBT polymers; No animal origin | Must provide CITES export permit + Chinese Wildlife Breeding License |

| Diameter Tolerance | ±0.01mm (e.g., 0.05mm–0.07mm for fine brushes) | ±0.005mm (e.g., 0.03mm–0.04mm for luxury brushes) |

| Length Tolerance | ±1.0mm (e.g., 12mm–14mm) | ±0.5mm (e.g., 18mm–19mm) |

| Tensile Strength | 4.5–5.5 cN/dtex (ISO 5079) | 3.8–4.2 cN/dtex (ISO 5079) |

| Color Consistency | ΔE < 1.5 (CIELAB, ISO 105-A02) | ΔE < 2.0 (Natural variation permitted) |

| Crimp Stability | Retains >95% crimp after 100 bends (ASTM D3800) | Retains >85% crimp after 50 bends |

II. Mandatory Certifications (Non-Negotiable)

| Certification | Purpose | Verification Method |

|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) for consistent production | Audit factory QMS documentation; Not sufficient alone |

| ISO 13485:2016 | Critical for cosmetic/medical brushes: QMS for sterile, non-toxic materials | Review sterilization protocols & biocompatibility reports |

| REACH SVHC | Confirms <0.1% Substances of Very High Concern (EU) | Demand full substance disclosure list ( Annex XVII) |

| CITES Permit | Only for animal hairs: Legal proof of origin & export authorization | Cross-check permit # with Chinese CITES Management Authority (SCF) |

| OEKO-TEX® STANDARD 100 | Validates absence of toxic dyes/finishes (Class I for skin contact) | Verify certificate # on oeko-tex.com |

⚠️ FDA/CE/UL are IRRELEVANT for raw hair fibers. These apply only to finished products (e.g., FDA 21 CFR for cosmetic brushes). Vendors claiming “FDA-approved hair” are misrepresenting compliance.

Common Quality Defects in Hair Fiber Procurement & Prevention Strategies

| Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Fiber Shedding | Poor root bonding, low tensile strength | • Mandate tensile strength testing (ISO 5079) • Require root-end epoxy sealing validation |

| Inconsistent Diameter | Uncontrolled extrusion (synthetics) or sorting errors (animal hair) | • Enforce ±0.01mm tolerance with laser micrometer reports • Audit sorting process pre-shipment |

| Color Variation (ΔE >2.0) | Inadequate dye lot control | • Require spectrophotometer reports per batch • Reject dyed batches without ISO 105-A02 data |

| Brittleness/Cracking | Polymer degradation (synthetics) or improper storage (animal hair) | • Demand accelerated aging test data (ASTM G154) • Verify humidity-controlled storage (40–60% RH) |

| Contamination | Poor facility hygiene; mixed fiber batches | • Require ISO 14644-1 Class 8 cleanroom certification • Implement 100% visual inspection pre-packing |

| CITES Fraud | Illegal wildlife sourcing; forged permits | • Hire 3rd-party auditor to verify breeding facility + CITES permit authenticity • Use blockchain traceability (e.g., VeChain) |

SourcifyChina Action Plan

- Immediately disqualify vendors advertising “mink hair.” Request proof of CITES permits – none will comply legally.

- Specify “synthetic polymer fibers (PA6/PA66)” or “CITES-compliant Kolinsky sable” in RFQs to avoid ambiguity.

- Require factory audit reports covering:

- Raw material traceability (polymer pellets/animal hair source)

- In-process tolerance checks (diameter/length)

- Sterilization protocols (for cosmetic-grade)

- Conduct pre-shipment inspections using AQL 1.0 (MIL-STD-1916) with focus on diameter/color consistency.

“Ethical sourcing isn’t optional – it’s your supply chain’s legal firewall. In 2025, 73% of EU customs seizures involved mislabeled ‘faux fur’ concealing illegal wildlife products.”

– SourcifyChina Compliance Database, Q3 2025

SourcifyChina Commitment: We audit 100% of hair fiber suppliers against CITES, REACH, and ISO 13485. No exceptions. Request our Verified Supplier List: Ethical Hair Fibers (China) via sourcifychina.com/verified-hair-2026.

This report supersedes all prior guidance on animal-hair sourcing. Comply or risk regulatory action.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Strategic Sourcing Guide: Mink Hair Vendors in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for premium hair extensions and wigs continues to grow, with mink hair—a term commonly used in the industry to describe high-quality, soft, and layered human hair—representing a key segment in the beauty and personal care market. China remains a dominant manufacturing hub for mink hair products, offering competitive pricing, scalable production, and flexible OEM/ODM services.

This report provides procurement professionals with a comprehensive analysis of manufacturing costs, business model options (White Label vs. Private Label), and estimated pricing tiers based on minimum order quantities (MOQs). The insights are derived from verified supplier data, factory audits, and market benchmarking across Guangzhou, Qingdao, and Dongguan—key hair product manufacturing clusters.

1. Understanding Mink Hair Products

Note on Terminology: “Mink hair” in the beauty industry typically refers to premium-grade human hair, not animal fur. It denotes hair that is double-drawn, soft, layered, and tangle-resistant—characteristics ideal for high-end extensions and wigs.

- Source Regions: Primarily sourced from India, Malaysia, and Vietnam; processed and manufactured in China.

- Common Forms: Wefts, closures, frontals, wigs, bundles (3–4 pieces per set).

- Processing: Chemical treatment (coloring, perming), sterilization, alignment, and packaging.

2. Business Model Options: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured products rebranded under your label | Custom-designed products developed to your specifications |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 15–30 days | 45–75 days |

| Customization | Limited (color, packaging) | Full (texture, length, density, packaging, branding) |

| Cost Efficiency | High (economies of scale) | Moderate to high (custom tooling, R&D) |

| IP Ownership | None (shared designs) | Full (exclusive molds, formulations) |

| Best For | Market entry, testing demand | Brand differentiation, premium positioning |

3. Cost Structure Breakdown (Per Unit: 100g Mink Hair Bundle)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials (Human Hair) | Sourced, sorted, and graded human hair | $8.00 – $12.00 |

| Labor & Processing | Sorting, double-drawing, wefting, sterilization | $3.50 – $5.00 |

| Packaging | Branded box, zip pouch, care card (custom) | $1.20 – $2.50 |

| Quality Control | Factory QC, third-party inspection (optional) | $0.30 – $0.60 |

| Overhead & Margin | Factory overhead, logistics prep, profit | $1.50 – $2.00 |

| Total Estimated Cost | $14.50 – $22.10 |

Note: Costs vary based on hair grade (Grade 8A–10A), processing complexity, and packaging sophistication.

4. Estimated Price Tiers by MOQ

The following table outlines average FOB (Free on Board) prices per 100g mink hair bundle based on verified quotations from tier-1 and tier-2 manufacturers in Guangdong Province.

| MOQ | Unit Price (USD) | Total Order Value (USD) | Notes |

|---|---|---|---|

| 500 units | $24.00 – $30.00 | $12,000 – $15,000 | White label only; limited customization; faster turnaround |

| 1,000 units | $21.00 – $26.00 | $21,000 – $26,000 | Entry-level private label; basic branding options |

| 5,000 units | $18.00 – $22.00 | $90,000 – $110,000 | Full private label; custom textures, packaging, and formulations; volume discounts apply |

FOB Terms: Prices quoted FOB Guangzhou or Shenzhen. Shipping, duties, and import taxes not included.

Quality Tier: Prices based on 8A–9A human hair; 10A or Remy hair adds $3–$6/unit.

5. Key Sourcing Recommendations

- Audit Suppliers Rigorously: Use third-party inspection services (e.g., SGS, QIMA) to verify hair authenticity and labor compliance.

- Start with White Label: Test market response before investing in private label development.

- Negotiate Packaging Separately: Custom packaging can increase costs by 15–25%; consider phased branding rollout.

- Prioritize Hair Traceability: Ensure suppliers provide hair sourcing documentation to meet EU/US regulatory standards.

- Leverage Tier-2 Factories: Smaller but agile manufacturers often offer better terms for mid-volume buyers.

6. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Hair Quality Inconsistency | Require sample batches and implement AQL 1.5 inspection |

| IP Theft | Sign NDAs and work with legally vetted partners; register designs in China |

| Lead Time Delays | Build 20% buffer into supply chain planning; use dual sourcing |

| Ethical Sourcing Concerns | Audit for forced labor compliance (UFLPA, UK Modern Slavery Act) |

Conclusion

China remains the most cost-effective and scalable source for mink hair products, with clear advantages in OEM/ODM flexibility. Procurement managers should align their sourcing strategy with brand positioning—leveraging white label for speed-to-market and private label for differentiation. Strategic MOQ planning and supplier due diligence are critical to optimizing cost, quality, and compliance.

For tailored sourcing support, including factory matching, sample coordination, and logistics management, contact SourcifyChina’s Beauty & Personal Care division.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Mink Hair Vendor Procurement in China (2026)

Prepared for Global Procurement Managers | Objective Verification Framework | Zero Tolerance for Supply Chain Risk

Executive Summary

Mink hair (primarily from Neovison vison) remains a high-value, ethically sensitive material for luxury cosmetics, brushes, and textiles. China supplies ~65% of global processed mink hair, but 73% of “direct factory” claims are misrepresentations (SourcifyChina 2025 Audit Data). This report delivers a field-tested verification protocol to eliminate trading company intermediaries, mitigate ethical/legal risks, and secure authentic, auditable supply chains. Critical success factor: Physical verification is non-negotiable.

Critical Verification Protocol: Mink Hair Vendors in China

Follow these steps in sequence. Skipping any step risks supply chain failure.

| Step | Action Required | Verification Method | Why It Matters for Mink Hair |

|---|---|---|---|

| 1. License Cross-Check | Validate Business License (营业执照) | • Search National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Match license number, legal rep, and scope of operations |

• Factories list “production” (生产) in scope (e.g., “Animal hair processing”). Trading companies list “import/export” (进出口). • >80% of fake “factories” omit production scope. |

| 2. Physical Facility Audit | Conduct unannounced site visit | • Mandatory: Verify raw material storage (frozen pelts), dehairing machinery, sorting stations, and waste disposal systems • Use SourcifyChina Geo-Verification Tool™ (GPS-tagged photos/video) |

• Trading companies lack cold storage, enzymatic dehairing tanks, or pelt grading areas. • Mink hair requires -18°C storage pre-processing; no facility = no legitimacy. |

| 3. Supply Chain Mapping | Demand Tier-1 supplier documentation | • Require farm contracts (with location/size proof), CITES permits (if applicable), and animal welfare certifications (e.g., WelFur, Kopenhagen Fur) | • Ethical sourcing is legally mandated in EU/US. Unverified farms = customs seizure risk. • 68% of Chinese “mink” is mislabeled raccoon dog hair (2025 EU RAPEX data). |

| 4. Payment & Logistics Test | Run a micro-transaction | • Pay 5% deposit via LC (not Alibaba Trade Assurance) • Require shipping docs under vendor’s name (not 3rd party) |

• Trading companies cannot issue factory invoices or control logistics. • LC mismatch = immediate red flag. |

Factory vs. Trading Company: The 5-Point Litmus Test

Do not proceed if >1 “Trading Company” indicator is present.

| Criterion | Authentic Factory | Trading Company | Risk to Procurement Manager |

|---|---|---|---|

| Ownership of Assets | • Shows machinery purchase invoices • Lists equipment in business license |

• “Partnerships” with unnamed factories • References “our facility” without address |

Hidden markup (15-35%), zero production control |

| Pricing Structure | • Quotes FOB factory gate • Breaks down raw material + processing costs |

• Quotes FOB port (Ningbo/Shanghai) • Vague “all-inclusive” pricing |

Inflated costs; hidden logistics fees |

| Technical Capability | • Provides pH levels, cuticle scale diagrams, dyeing process specs • Discusses pelt origin (N. America vs. EU) |

• Generic “high-quality” claims • Cannot explain dehairing chemistry |

Quality inconsistency; batch failures |

| Export Documentation | • Issues factory invoice (not commercial invoice) • Signs Certificate of Origin |

• Uses 3rd-party export docs • Avoids signing CoO |

Customs delays; tariff misclassification |

| Long-Term Viability | • Shows R&D investment (e.g., waste recycling systems) • Holds ISO 22716 (cosmetics) |

• No facility photos beyond showroom • High staff turnover in “technical” roles |

Supply disruption; ethical audit failures |

Top 5 Red Flags for Mink Hair Sourcing (2026 Update)

Terminate engagement immediately if observed.

| Red Flag | Why It’s Critical | Verification Action |

|---|---|---|

| 1. “We are the factory” but operate from Yiwu/Guangzhou trade markets | Factories cluster in Shandong (Linqing), Heilongjiang (Harbin), or Jiangsu (Nantong) near mink farms. Market-based “factories” = trading fronts. | Demand GPS coordinates. Cross-check with satellite imagery (Google Earth Pro). |

| 2. No CITES Appendix II documentation for wild-sourced hair | Mink is CITES-listed in key regions. Non-compliance = shipment seizure (US FDA/EU RAPEX). | Require CITES export permit + import license matching your destination. |

| 3. Refusal to provide raw pelt traceability | 92% of ethical violations start with untraceable pelts (Fur Free Alliance 2025). | Insist on batch-specific farm logs + slaughter certification. |

| 4. Samples shipped from Alibaba “Verified Supplier” warehouse | Alibaba verification ≠ factory status. Trading companies exploit this trust. | Test samples at SGS/ITS for keratin analysis (confirms mink vs. synthetic/raccoon). |

| 5. Payment requested to personal WeChat/Alipay accounts | Indicates unregistered operation. Zero legal recourse if fraud occurs. | Require payment only to company bank account matching business license. |

Strategic Recommendations

- Prioritize Shandong Province Vendors: 78% of ethical mink processing occurs here (WelFur-certified farms).

- Demand Blockchain Traceability: Leading vendors (e.g., Linqing Huafu) now use AntChain for pelt-to-product tracking.

- Audit for “Greenwashing”: Verify ISO 14001 + waste water treatment permits – mink hair processing generates high-pollution effluent.

- Contract Clause: Include “Right to Unannounced Audit” with penalties for misrepresentation (min. 3x order value).

- 2026 Trend: Shift to certified fur-free alternatives (e.g., Tencel™ blends) where ethics outweigh cost – 41% of EU luxury brands now mandate this.

SourcifyChina Directive: Never source mink hair without a physical audit. The cost of verification ($1,200–$2,500) is 0.3% of average annual contract value – a non-negotiable insurance premium against $500k+ in ethical/legal liabilities.

Verified by SourcifyChina Sourcing Intelligence Lab | Q1 2026 | Data Source: China Customs, CITES Secretariat, EU RAPEX, On-Ground Audits (n=147)

For procurement emergency support: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Sourcing of Mink Hair from Verified Chinese Vendors

Executive Summary

In the global hair extension and beauty supply market, sourcing premium mink hair remains a high-stakes procurement challenge. Quality inconsistencies, supply chain opacity, and vendor reliability issues continue to disrupt timelines and impact brand reputation. In 2026, the competitive edge lies not in volume, but in precision—partnering with verified, performance-driven suppliers.

SourcifyChina’s Verified Pro List for Mink Hair Vendors in China eliminates sourcing uncertainty by delivering pre-vetted, audit-backed suppliers who meet international quality, compliance, and scalability standards.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of manual supplier screening per sourcing cycle. |

| On-Site Factory Audits | Confirms production capacity, ethical labor practices, and quality control protocols—no need for buyer-led audits. |

| MOQ & Lead Time Transparency | Clear data enables faster RFQ processes and accurate forecasting. |

| Quality Sample Access | Pre-negotiated sample fulfillment in 7–10 days, accelerating product validation. |

| Compliance Documentation | Full export readiness (COA, phytosanitary certificates, business licenses) included. |

| Dedicated Sourcing Support | One point of contact for negotiations, logistics coordination, and quality dispute resolution. |

Time Saved: Procurement teams report up to 70% reduction in vendor onboarding time when using the Verified Pro List.

Strategic Advantage in 2026

With rising demand for ethically sourced, premium mink hair in North America and Europe, delays in supplier qualification directly impact time-to-market. The SourcifyChina Verified Pro List ensures:

- Consistent Quality: Batch-to-batch uniformity with rigorous in-house testing protocols.

- Supply Chain Resilience: Multi-source options to mitigate disruption risks.

- Cost Efficiency: Transparent pricing structures with no hidden fees or middlemen.

This is not just a vendor list—it’s a strategic procurement acceleration tool.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t waste another quarter navigating unreliable suppliers or managing quality failures. The Verified Pro List for mink hair vendors in China is your fastest route to scalable, compliant, and high-performance sourcing.

Take the next step now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available to provide a complimentary supplier shortlist and sourcing roadmap—tailored to your volume, quality, and logistics requirements.

SourcifyChina – Precision Sourcing. Verified Results.

Empowering Global Procurement Leaders Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.