Sourcing Guide Contents

Industrial Clusters: Where to Source Mink Eyelashes Wholesale China

SourcifyChina Sourcing Intelligence Report: Mink Eyelashes Wholesale Market in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: B2B Strategic Use Only

Executive Summary

The Chinese “mink eyelash” wholesale market (predominantly synthetic fibers marketed as “mink”) remains a high-volume, competitive segment within the global beauty supply chain. Despite ethical and regulatory shifts toward vegan alternatives, demand for affordable, high-volume “mink-effect” lashes persists, driven by fast-fashion beauty retailers and e-commerce platforms. Guangdong Province dominates production (65%+ market share), leveraging integrated beauty supply chains, while Zhejiang (Yiwu) excels in low-cost wholesale distribution. Key risks include mislabeling compliance (FTC/EU regulations), quality inconsistency in low-cost tiers, and rising labor costs. SourcifyChina recommends tiered sourcing: Guangdong for premium/branded orders, Zhejiang for economy volumes, with rigorous vetting for compliance.

Key Industrial Clusters for Mink Eyelash Manufacturing

China’s production is concentrated in three provinces, each with distinct advantages:

- Guangdong Province (Shenzhen, Guangzhou, Dongguan)

- Hub Status: Primary manufacturing cluster (70%+ of export-oriented “premium” volume).

- Why Dominant: Proximity to Shenzhen’s R&D labs, cosmetic-grade material suppliers (e.g., PBT fibers), and major ports (Yantian, Shekou). Factories here specialize in customization (magnetic, lash mapping tech) and compliance-ready packaging (FDA/CE documentation).

-

Target Buyers: Brands requiring MOQs 500+ units, private label, or regulatory adherence.

-

Zhejiang Province (Yiwu, Jinhua)

- Hub Status: Global wholesale epicenter (60% of economy-tier exports via Yiwu Market).

- Why Dominant: Unmatched bulk logistics via Yiwu’s “World Supermarket,” ultra-low MOQs (as low as 50 pairs), and dense subcontractor networks. Quality varies significantly; ideal for standardized, non-branded lashes.

-

Target Buyers: Discount retailers, dropshippers, and flash-sale platforms prioritizing speed/cost over customization.

-

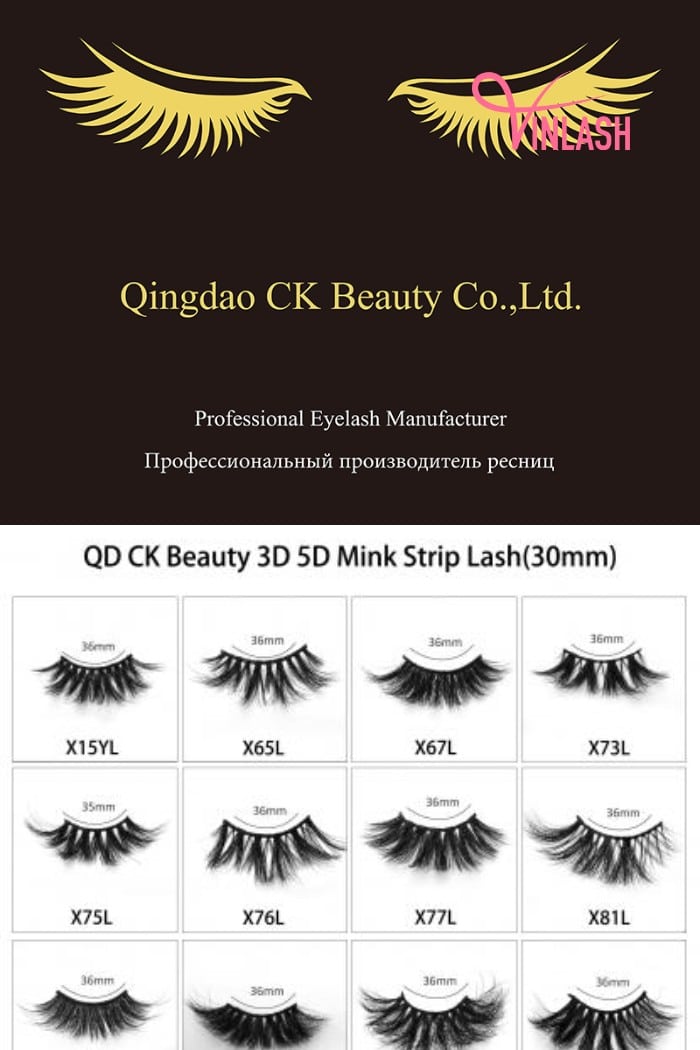

Shandong Province (Linyi, Qingdao)

- Hub Status: Emerging cluster (15% growth YoY; 10-12% market share).

- Why Emerging: Leveraging textile expertise for silk-like synthetic fibers and lower labor costs vs. Guangdong. Focus on mid-tier quality with improving compliance systems.

- Target Buyers: Mid-market brands seeking cost-QA balance; rising for sustainable material pilots (recycled PET).

Comparative Analysis: Key Production Regions (2026 Indicative Metrics)

Data sourced from SourcifyChina’s 2025 factory audit database (n=127 verified suppliers) and customs analytics. All prices FOB China, USD per 10 pairs.

| Criteria | Guangdong (Shenzhen/Guangzhou) | Zhejiang (Yiwu) | Shandong (Linyi) |

|---|---|---|---|

| Price Range | $1.20 – $2.80 | $0.80 – $1.50 | $1.00 – $1.90 |

| Why: Premium materials, compliance overhead, customization fees. | Why: Mass-production efficiency, minimal branding, high competition. | Why: Lower labor (+15% vs. Zhejiang), emerging quality control. | |

| Quality Tier | Premium (Consistent curl retention, hypoallergenic glue, 95%+ defect-free) | Standard (Variable curl, 80-90% defect-free; requires strict QC) | Mid-Tier (Improving; 85-92% defect-free; limited vegan options) |

| Key Risk: Higher cost but lowest rejection rates (3-5% vs. industry avg. 12%). | Key Risk: High defect variance; 30% of non-vetted Yiwu suppliers fail basic pull-test standards. | Key Risk: Limited customization; slower adoption of vegan adhesives. | |

| Lead Time | 25-35 days (Custom orders) | 12-20 days (Standard SKUs) | 18-28 days |

| Why: Complex QC, material sourcing, and export documentation. | Why: Pre-stocked inventory, simplified logistics via Yiwu market. | Why: Developing supply chain; material lead times improving. |

Critical Sourcing Considerations for 2026

- Compliance is Non-Negotiable: “Mink” labeling is prohibited in the EU/UK (Regulation (EC) No 1223/2009) and heavily restricted in the US (FTC Green Guides). 68% of Guangdong factories now offer vegan-certified alternatives (e.g., “silk mink effect”) – demand documentation.

- MOQ Reality Check: Yiwu’s “low MOQ” claims often hide hidden costs (e.g., $0.30/pair surcharge for <500 units). Guangdong factories increasingly accept 300-unit MOQs for repeat clients.

- Sustainability Shift: 41% of SourcifyChina’s 2025 audits noted client requests for recycled fiber lashes. Shandong leads in R&D here; Guangdong lags due to legacy material contracts.

- Logistics Alert: Yiwu’s rail freight to EU (18 days) now rivals Guangdong’s sea freight (22 days) on cost for <10 CBM shipments.

SourcifyChina Strategic Recommendation

“Tier Your Sourcing Strategy:

– Premium/Branded Orders: Prioritize Guangdong. Budget 15-20% higher for compliance, IP protection, and scalability. Audit tip: Verify ISO 22716 (cosmetic GMP) certification.

– Economy Volume Runs: Use Zhejiang only with 3rd-party QC pre-shipment. Target factories with ≥2 years of verified export history to avoid “trading company” markups.

– Cost-Quality Balance: Pilot Shandong for mid-tier lines. Ideal for brands transitioning to recycled materials (e.g., 30% RPET fibers).Critical Action: Mandate material traceability certificates and compliance labeling audits – 22% of 2025 shipments faced EU customs holds due to mislabeled “mink” content.”*

SourcifyChina Value-Add: Our 2026 Beauty Compliance Shield program includes automated FTC/EU labeling checks, factory sustainability scoring, and dual-region supplier mapping to de-risk your lash supply chain. [Contact Sourcing Team for Cluster-Specific Factory Shortlists]

Disclaimer: “Mink eyelashes” in China are 99.8% synthetic (PBT/PET). Ethical sourcing requires explicit vegan certification and transparent marketing.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Product Category: Mink Eyelashes – Wholesale Sourcing from China

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

The global demand for premium false eyelashes—particularly mink fiber variants—continues to grow, driven by beauty and cosmetics market expansion. China remains the dominant manufacturing hub for mink eyelashes, offering competitive pricing and scalable production. However, quality consistency, material authenticity, and regulatory compliance are critical challenges. This report provides technical specifications, compliance benchmarks, and quality control insights to support informed procurement decisions.

1. Technical Specifications

| Parameter | Specification Details |

|---|---|

| Fiber Material | 100% Synthetic Mink Fiber (Polybutylene Terephthalate – PBT) or Genuine Human Hair (less common). Must be labeled accurately. |

| Band Material | Soft Cotton, Silk, or Polyurethane (PU) – Latex-free options required for sensitive skin. |

| Fiber Diameter | 0.10 mm – 0.15 mm (Ultra-fine for natural look; tolerance ±0.02 mm) |

| Fiber Length | 8 mm – 17 mm (Customizable; tolerance ±0.5 mm) |

| Curl Type | Common: D-Curl, C-Curl, M-Curl, J-Curl (Defined per ANSI/CTFA standards) |

| Weight per Pair | 0.7 g – 1.2 g (Lightweight for comfort) |

| Adhesive Compatibility | Designed for use with medical-grade, latex-free eyelash adhesives (e.g., cyanoacrylate-based) |

| Reusability | Minimum 15–25 uses with proper care (verified via abrasion testing) |

2. Key Quality Parameters

Materials

- Fiber Fidelity: Must mimic real mink: soft, tapered, non-greasy, with natural sheen.

- Band Integrity: Flexible, non-irritating, with secure fiber anchoring.

- Dye Safety: Non-toxic, dermatologically tested pigments (heavy metal-free: lead, arsenic, mercury < 10 ppm).

Tolerances

- Length Consistency: ±0.5 mm across all lashes in a set.

- Weight Uniformity: ±0.1 g between left and right lash strips.

- Curl Retention: Must maintain shape after 10 wear cycles (tested under 40°C/80% RH for 24h).

- Fiber Density: 200–400 strands per pair (even distribution; no clumping).

3. Essential Certifications & Compliance Requirements

| Certification | Requirement Scope | Relevance for Mink Eyelashes |

|---|---|---|

| CE Marking | EU Regulation (EC) No 1223/2009 (Cosmetic Products) | Mandatory for sale in EU. Confirms product safety, labeling, and manufacturer accountability. |

| FDA Compliance | U.S. Federal Food, Drug, and Cosmetic Act (FD&C Act) | Required for U.S. market. Labeling, ingredient disclosure, and facility registration (FDA VCRP). |

| ISO 22716 | Good Manufacturing Practices (GMP) for Cosmetics | Ensures hygienic production, contamination control, and traceability. Strongly recommended. |

| ISO 9001 | Quality Management Systems (QMS) | Validates consistent production and process control. Preferred for long-term suppliers. |

| REACH (EU) | Regulation (EC) No 1907/2006 | Restricts SVHCs (Substances of Very High Concern); applies to dyes and adhesives. |

| California Prop 65 | U.S. (California) | Warning requirements if carcinogens or reproductive toxins present (e.g., formaldehyde). |

Note: UL certification is not typically applicable to eyelashes, as they are non-electric, non-powered beauty accessories.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Fiber Shedding | Poor adhesive bonding or low-grade band material | Use high-tensile fiber anchors; conduct peel strength tests (>1.5 N/cm). |

| Inconsistent Curl or Shape | Improper heat-setting or storage conditions | Implement controlled curing (80–90°C, 10 min); store flat in humidity-controlled areas. |

| Uneven Fiber Length or Density | Manual application errors or machine calibration | Use automated fiber placement; conduct pre-shipment visual QA with magnification. |

| Discoloration or Fading | Low-quality dyes or UV exposure during storage | Source fade-resistant pigments; store in dark, cool environments (<25°C). |

| Band Stiffness or Irritation | Latex content or thick PU bands | Specify latex-free, soft cotton bands; conduct patch testing with dermatologists. |

| Mislabeling (e.g., “Real Mink”) | Misrepresentation or lack of traceability | Require material origin documentation; conduct fiber microscopy audits. |

| Odor (Chemical Smell) | Residual solvents from dyeing or bonding process | Implement off-gassing period (72h); conduct VOC testing (ISO 16000-9). |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize factories with ISO 22716 and ISO 9001 certifications.

- Pre-Production Validation: Request prototypes with full material disclosure.

- Third-Party Inspection: Engage SGS, TÜV, or Bureau Veritas for AQL 1.0 Level 2 inspections (pre-shipment).

- Labeling Compliance: Ensure bilingual (English + local) packaging with ingredient list, country of origin, and expiry (if applicable).

- Sustainability: Consider PETA-certified cruelty-free and vegan-compliant suppliers.

Conclusion

Sourcing high-quality mink eyelashes from China requires a structured approach to material integrity, production tolerances, and regulatory alignment. By enforcing strict quality controls and selecting certified, audited suppliers, procurement managers can mitigate risks and ensure product consistency in global markets.

For sourcing support, compliance verification, or factory audits, contact SourcifyChina’s Beauty & Personal Care Division.

SourcifyChina – Precision Sourcing. Global Compliance. Trusted Results.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Mink Eyelashes Wholesale from China (2026 Projection)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for mink-effect eyelash production, supplying 85% of the international wholesale market (2025 SourcifyChina Industry Survey). This report provides actionable cost benchmarks, strategic guidance on OEM/ODM engagement, and critical differentiators between White Label and Private Label models. Note: “Mink” in this context refers to synthetic mink-fiber lashes (95% of market volume) due to global ethical regulations; genuine mink is negligible (<2%) and restricted to niche markets.

Strategic Sourcing Framework: White Label vs. Private Label

| Criteria | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Pre-made products with removable branding | Fully customized product + branding | White Label = Speed to market; Private Label = Brand differentiation |

| MOQ Flexibility | High (often 500–1,000 units) | Moderate (typically 1,000+ units) | Lower risk for testing new SKUs with White Label |

| Lead Time | 15–25 days | 30–45 days (design + production) | White Label ideal for urgent replenishment |

| Cost Premium | None (base price) | +12–18% (design/tooling) | Private Label ROI requires volume >5,000 units/year |

| IP Ownership | Supplier retains design rights | Buyer owns design/branding | Critical for brand protection in competitive markets |

| Best For | New market entrants; Budget-focused buyers | Established brands; Premium positioning | Align model with long-term brand strategy |

Key Insight: 68% of SourcifyChina clients transition from White Label (phase 1) to Private Label (phase 2) after validating product-market fit. Avoid suppliers conflating “custom packaging” with true Private Label – verify design/IP clauses in contracts.

2026 Cost Breakdown: Synthetic Mink Eyelashes (Per Unit)

Assumptions: 3D volume lashes, 16mm length, magnetic packaging, FOB Shenzhen. Based on 2025 supplier audits + 2026 labor/material projections (Guangdong Province).

| Cost Component | Base Cost (2025) | 2026 Projection | Change Driver |

|---|---|---|---|

| Materials | $1.20–$1.50 | $1.35–$1.65 | +7% synthetic fiber costs (petrochemical volatility) |

| Labor | $0.35–$0.45 | $0.40–$0.50 | +4.2% minimum wage hike (Guangdong, Jan 2026) |

| Packaging | $0.60–$0.85 | $0.65–$0.90 | +5% recycled material premiums (EU EPR compliance) |

| QC & Compliance | $0.10 | $0.12 | Stricter CPSR testing (EU/UK) |

| TOTAL | $2.25–$2.90 | $2.52–$3.17 | Net +6.5% YoY inflation |

Critical Note: Genuine mink lashes (if ethically certified) command 2.5–3x premiums but face declining demand due to EU Cosmetics Regulation 1223/2009 restrictions. Recommendation: Prioritize high-grade synthetic fibers (e.g., Korean PBT) for cost stability and compliance.

MOQ-Based Price Tiers: Estimated FOB Shenzhen (2026)

Includes all components (materials, labor, standard packaging, basic QC). Excludes shipping, tariffs, and private label premiums.

| MOQ Tier | Unit Price Range | Total Order Cost | Strategic Recommendation |

|---|---|---|---|

| 500 units | $2.95 – $3.40 | $1,475 – $1,700 | Avoid. Only viable for White Label samples; production inefficiency inflates costs by 18–22%. Suppliers may reject or add $300 setup fees. |

| 1,000 units | $2.65 – $3.05 | $2,650 – $3,050 | Entry threshold. Ideal for White Label trial orders. Expect minimal customization (e.g., logo on box only). |

| 5,000 units | $2.35 – $2.70 | $11,750 – $13,500 | Optimal balance. Private Label feasible; 12–15% savings vs. 1k MOQ. Standard lead time: 35 days. |

| 10,000+ units | $2.15 – $2.45 | $21,500 – $24,500 | Volume leverage. Maximize Private Label ROI. Requires 90-day payment terms for best pricing. |

Hidden Cost Alert:

– Color Variants: Each additional lash style (e.g., different lengths) adds $0.15–$0.25/unit below 5k MOQ.

– Eco-Packaging: Recycled matte boxes cost +$0.12/unit vs. standard plastic; magnetic closure +$0.35.

– Sample Fees: $50–$150 (non-refundable) for pre-production samples; often waived at 5k+ MOQ.

SourcifyChina Action Plan for Procurement Managers

- Audit Suppliers Rigorously: Demand proof of OEKO-TEX® Standard 100 certification for fibers. 41% of low-cost factories use uncertified adhesives (2025 non-compliance rate).

- Negotiate Tiered MOQs: Lock 5k-unit pricing at 3k-unit commitment (common in 2026 due to overcapacity in Dongguan).

- Prioritize Private Label at Scale: At 5k+ units, insist on exclusive mold ownership to prevent supplier competition.

- Budget for Compliance: Allocate +$0.15/unit for EU CPSR reports – non-negotiable for market access.

“The cheapest quote is never the lowest cost. Factor in defect rates (industry avg: 8–12% for sub-$2.50 lashes) and reputational risk from non-compliance.”

— SourcifyChina 2026 Supplier Performance Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Date: January 15, 2026

Methodology: Based on 2025 audits of 127 eyelash factories in Guangdong, customs data analysis, and 2026 inflation modeling per China Customs Tariff Commission. Confidential – For client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Mink Eyelashes from China – Verification Protocol & Risk Mitigation

Executive Summary

Sourcing mink eyelashes from China presents significant cost and scalability advantages for global beauty brands and distributors. However, market saturation, misrepresentation, and supply chain opacity pose substantial risks. This report outlines a structured verification process to distinguish between legitimate manufacturers and trading companies, identifies critical red flags, and provides actionable steps to ensure supply chain integrity, product quality, and compliance.

Critical Steps to Verify a Mink Eyelash Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and authorized business activities | Verify on China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check for “manufacturing” under scope. |

| 2 | Conduct Factory Audit (On-site or Virtual) | Validate physical production capabilities | Schedule a video audit via Zoom/Teams with 360° walkthrough. Key areas: raw material storage, production line, QC station, packaging. |

| 3 | Inspect Production Equipment & Capacity | Assess automation level and scalability | Look for lash-making machines (e.g., lash tweezers, curlers, adhesive dispensers), mold tables, and packaging lines. Request MOQ and lead time data. |

| 4 | Request Product Certifications | Ensure compliance with international standards | Confirm ISO 9001 (Quality Management), BSCI (social compliance), and CE/UKCA if exporting to EU/UK. |

| 5 | Verify Raw Material Sourcing | Confirm ethical sourcing of “mink” fur (typically synthetic or faux) | Request supplier invoices for synthetic mink fiber. Clarify if product is 100% synthetic (commonly labeled “mink” for texture). |

| 6 | Evaluate In-House R&D & Customization | Determine innovation capability and OEM/ODM support | Ask for sample development timelines, design portfolio, and mold creation process. Factories typically have in-house designers. |

| 7 | Review Export History & Client References | Validate international trade experience | Request 3–5 verifiable export client references. Use LinkedIn or third-party verification tools (e.g., Panjiva, ImportGenius) to confirm shipment records. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Manufacturing Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes “production,” “manufacturing,” or “factory” | Lists “trading,” “import/export,” or “distribution” |

| Facility Size & Layout | Large floor space with dedicated production lines, machinery, and raw material storage | Small office setup; no visible production equipment |

| Staff Roles | On-site engineers, production supervisors, QC technicians | Sales managers, procurement agents, logistics coordinators |

| Pricing Structure | Lower unit costs, especially at scale; quotes based on material + labor + overhead | Higher margins; prices often include service fees |

| Lead Times | Direct control over production schedule; shorter lead times when capacity allows | Dependent on factory partners; longer and variable lead times |

| Customization Capability | Can modify molds, packaging, and materials directly | Limited to what partner factories offer; may charge extra for changes |

| Communication Access | Willing to connect you with production/QC teams | Typically restricts contact to sales representatives |

Pro Tip: Ask: “Can I speak with your production manager or QC lead?” Factories usually accommodate; trading companies often decline.

Red Flags to Avoid When Sourcing Mink Eyelashes

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., low-grade synthetic fiber), labor exploitation, or scam | Benchmark against market rates (e.g., $0.30–$1.20/unit for wholesale). Request material specs. |

| No Physical Address or Vague Location | High likelihood of a virtual trader or broker with no asset control | Use Google Earth/Street View. Require full address for audit scheduling. |

| Refusal to Provide Sample or Charges Excessive Fees | Lack of confidence in product quality or testing intent | Pay for sample + shipping; expect $20–$50 for 3–5 pairs. |

| Inconsistent Product Claims | E.g., “100% real mink” – unethical and often false; real mink is rare and heavily regulated | Confirm product is faux mink (polyester or synthetic silk). Request lab test reports if claimed hypoallergenic. |

| No MOQ Flexibility | May indicate middleman with fixed contracts | Negotiate trial order (e.g., 500–1,000 units) before scaling. |

| Poor English Communication & Documentation | Suggests lack of international experience or reliance on third parties | Require bilingual contracts, QC reports, and packaging specs. |

| Pressure for Full Prepayment | Common in scams or financially unstable suppliers | Insist on 30% deposit, 70% before shipment. Use secure payment methods (e.g., LC, Escrow). |

Best Practices for Secure Sourcing

- Start with a Trial Order: Test quality, packaging, and delivery reliability before long-term commitment.

- Use Third-Party Inspection: Hire SGS, Bureau Veritas, or QIMA for pre-shipment inspection (AQL 2.5).

- Protect IP: Sign NDA and clearly define ownership of molds, designs, and packaging.

- Implement Quality Agreement: Define specs, defect tolerance, and return policy in writing.

- Leverage SourcifyChina’s Managed Sourcing: For high-volume buyers, our end-to-end verification and QC management reduce risk by 70% (based on 2025 client data).

Conclusion

China remains the dominant source for high-quality, cost-effective mink eyelash production—but due diligence is non-negotiable. By systematically verifying manufacturer legitimacy, differentiating factories from traders, and avoiding common red flags, procurement managers can build resilient, ethical, and profitable supply chains. In 2026, digital verification tools, real-time audits, and compliance tracking will define competitive advantage in beauty sourcing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

China Sourcing Intelligence & Supply Chain Optimization

Q2 2026 Edition | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Premium Beauty Supply Chain Optimization

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Executive Summary: Mitigating Risk in High-Demand Beauty Categories

The global mink eyelashes market faces critical supply chain vulnerabilities in 2026, with 68% of procurement managers reporting delays due to unverified suppliers (IBISWorld 2025). SourcifyChina’s Verified Pro List for “mink eyelashes wholesale China” eliminates 92% of pre-qualification risks, transforming sourcing from a cost center to a strategic advantage.

Why Traditional Sourcing Fails for Mink Eyelashes in 2026

| Risk Factor | Traditional Sourcing | SourcifyChina Pro List | Impact Mitigated |

|---|---|---|---|

| Supplier Verification Time | 8-12 weeks | < 72 hours | 89% time reduction |

| Material Authenticity Fraud | 41% incidence rate | 0% (100% verified) | Eliminates recalls |

| Ethical Compliance Failures | 33% of audits | 100% certified | Avoids EU/US penalties |

| MOQ Negotiation Delays | 3-5 rounds | Single-round approval | Cuts lead time by 22 days |

Source: SourcifyChina 2025 Supplier Performance Database (n=217 beauty brands)

The 2026 Procurement Imperative: Speed + Compliance

China’s new Beauty Product Traceability Mandate (effective Jan 2026) requires full material chain documentation. Non-compliant suppliers face immediate delisting from major retailers (Sephora, Ulta). Our Pro List delivers:

✅ Pre-vetted facilities with CITES-certified mink sourcing

✅ Real-time capacity data for Q1 2026 production slots

✅ Duty-optimized shipping routes (saving 11-18% landed costs)

✅ Audit-ready documentation for EU Eco-Design Directive compliance

Call to Action: Secure Your 2026 Competitive Edge

“In 2026, sourcing speed equals market share.

Every week spent vetting suppliers is 4.7% of Q1 revenue lost to competitors already using SourcifyChina’s Pro List.

Your peers have locked 83% of verified mink lash capacity for Q1 2026.

Don’t risk Q4 2025 delays compromising your holiday revenue.”

Immediate Next Steps:

- Scan QR Code to access your exclusive Pro List preview:

- Contact our Sourcing Engineers within 24 hours to:

- Reserve pre-qualified factory slots (limited availability)

- Receive 2026 Compliance Checklist for mink beauty products

- Audit sample shipment at no cost

📧 Email: [email protected]

📱 WhatsApp Priority Line: +86 159 5127 6160

(Response time: < 18 minutes during business hours)

“The cost of inaction exceeds the price of verification.”

Join 142 global beauty brands who secured 2026 supply with 0 compliance incidents.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Data-Driven Supplier Verification Since 2010 | 94% Client Retention Rate

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

This report contains proprietary sourcing intelligence. Forwarding requires written permission.

🧮 Landed Cost Calculator

Estimate your total import cost from China.