The mini truck segment has emerged as a critical component of urban logistics and last-mile delivery, driven by increasing demand for fuel-efficient, maneuverable, and cost-effective commercial vehicles. According to a 2023 report by Mordor Intelligence, the global mini truck market was valued at USD 17.43 billion and is projected to grow at a CAGR of 6.8% from 2023 to 2028. This growth is fueled by rising e-commerce activities, government support for small businesses, and stricter emission norms pushing fleets toward cleaner, compact alternatives. In parallel, Grand View Research notes expanding adoption in Asia-Pacific—particularly in India and Southeast Asia—where infrastructure constraints and high population density favor smaller freight vehicles. As demand surges, manufacturers are responding with innovations in electric drivetrains, payload capacity, and durability tailored to informal and rural economies. Against this backdrop, we spotlight the top 10 mini truck manufacturers leading the charge in technology, market reach, and volume production.

Top 10 Mini Truk Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mitsubishi Fuso Truck and Bus Corporation

Domain Est. 2002

Website: mitsubishi-fuso.com

Key Highlights: Headquartered in Kawasaki, Japan, Mitsubishi Fuso Truck and Bus Corp. (MFTBC) manufactures trucks, buses and industrial engines for over 170 markets around ……

#2 FOTON

Domain Est. 2003

Website: fotonmotor.com

Key Highlights: Aiming to make breakthroughs in science and technology, produce energy-saving, environmentally friendly and intelligently interconnected automobile products….

#3 KEYTON MOTOR

Domain Est. 2020

Website: keytonauto.com

Key Highlights: China professional manufacturers & suppliers, combined with rich experience in production mini pickup, electric vehicle, SUV. Top quality, great selection ……

#4 Mack Trucks

Domain Est. 1995

Website: macktrucks.com

Key Highlights: Mack creates durable, purpose-built trucks like the Mack Anthem® and Pioneer™, offering advanced uptime and driving progress for tough jobs worldwide….

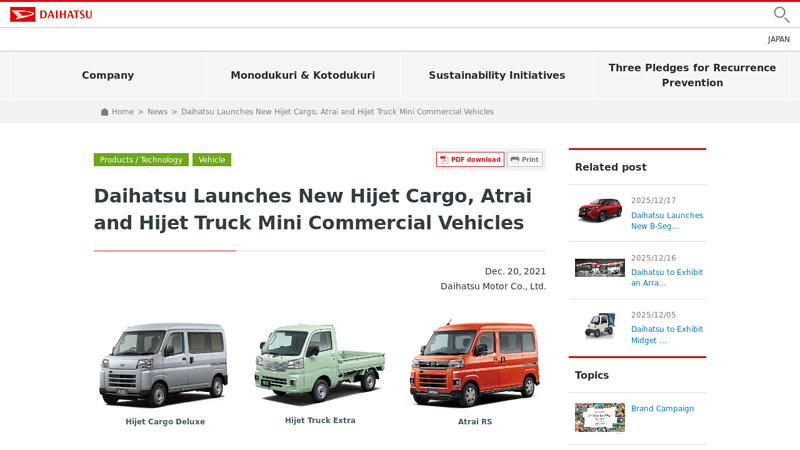

#5 Daihatsu Launches New Hijet Cargo, Atrai and Hijet Truck Mini …

Domain Est. 1997

Website: daihatsu.com

Key Highlights: Daihatsu announced that it has fully redesigned the Hijet Cargo and Atrai mini commercial vehicles, along with the special-purpose vehicles and welfare ……

#6 Minitrucks.Net

Domain Est. 2000

Website: minitrucks.net

Key Highlights: Providing everything you need to know about mini trucks. We sell trucks and parts, as well as offer information on Japanese mini trucks. Customer Support….

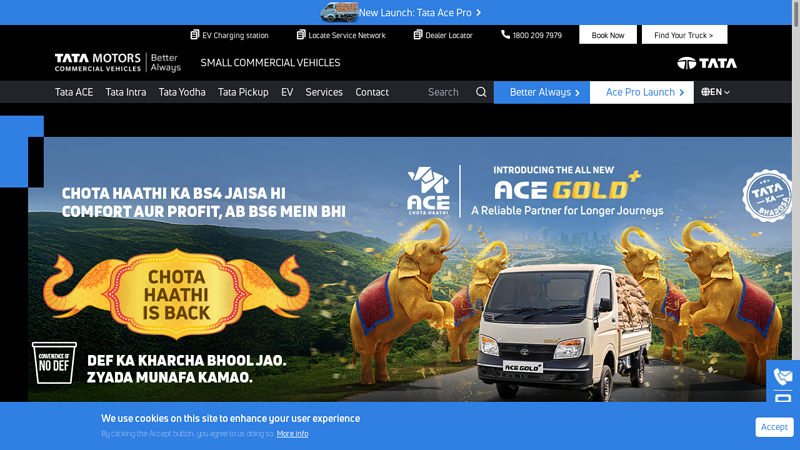

#7 Explore Tata Motors Small Trucks

Domain Est. 2002

Website: smalltrucks.tatamotors.com

Key Highlights: Discover Tata Motors’ small trucks designed for reliability, fuel efficiency, and high performance. Perfect for small businesses and urban transportation ……

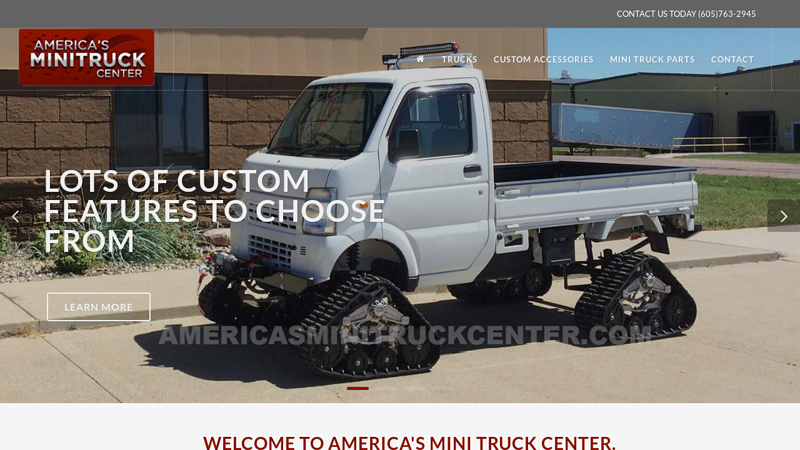

#8 America’s Mini Truck Center

Domain Est. 2007

Website: americasminitruckcenter.com

Key Highlights: WELCOME TO AMERICA’S MINI TRUCK CENTER. We are a direct importer, parts supplier, and accessory supplier for Japanese 4×4 mini trucks and Chinese mini trucks….

#9 Mini Truck Depot

Domain Est. 2021

Website: minitruckdepot.com

Key Highlights: Our nationwide network of mini truck expert dealers means there will always be someone near you to help you get the best model for your needs at the best price….

#10 TELO Trucks

Domain Est. 2023

Website: telotrucks.com

Key Highlights: TELO Trucks makes the world’s most efficient EV pickup for urban living and weekend adventuring. We redesigned the EV truck footprint and function from the ……

Expert Sourcing Insights for Mini Truk

H2 2026 Market Trends for Mini Trucks

The mini truck market in the second half of 2026 is poised for significant transformation, driven by technological advancements, evolving regulations, and shifting economic and consumer demands. Here’s a comprehensive analysis of the key trends shaping the industry:

1. Electrification Acceleration

- Market Shift to EVs: By H2 2026, battery-electric mini trucks will gain substantial market share, especially in urban delivery and last-mile logistics. Major manufacturers like Toyota, Nissan, and Mahindra are expected to launch updated electric models with improved range (80–120 km per charge) and faster charging.

- Fleet Adoption: Logistics companies and e-commerce platforms are increasingly adopting electric mini trucks to comply with zero-emission zone regulations in cities across Europe, China, and India.

- Battery Cost Reduction: Continued decline in lithium-ion battery prices (projected 15–20% drop from 2023 levels) will make electric mini trucks more cost-competitive with internal combustion engine (ICE) variants.

2. Regulatory Pressure and Urban Mobility Policies

- Stricter Emission Norms: Governments in key markets (e.g., EU Euro 7 standards, India BS-VI Stage II, China CN6b) will push manufacturers to phase out high-emission ICE mini trucks.

- Urban Access Restrictions: Many megacities will expand low-emission or zero-emission zones, incentivizing businesses to switch to cleaner mini trucks.

- Incentives and Subsidies: National and municipal governments are expected to extend purchase incentives, tax breaks, and charging infrastructure support for commercial EVs, including mini trucks.

3. Growth in Last-Mile Delivery Demand

- E-Commerce Expansion: Sustained growth in online shopping, particularly in emerging markets like Southeast Asia, India, and Latin America, will drive demand for compact, maneuverable delivery vehicles.

- Micro-Fulfillment Centers: The proliferation of urban micro-fulfillment hubs will increase the need for mini trucks capable of frequent, short-distance trips with high payload efficiency.

- Autonomous Delivery Pilots: Several companies will launch pilot programs using autonomous or semi-autonomous electric mini trucks for scheduled urban deliveries.

4. Technological Integration and Connectivity

- Telematics and Fleet Management: Advanced telematics systems will become standard, enabling real-time tracking, predictive maintenance, route optimization, and driver behavior monitoring.

- IoT and Smart Features: Integration with IoT platforms allows remote diagnostics, cargo monitoring (e.g., temperature, security), and seamless integration with logistics software.

- Driver Assistance Systems: Wider adoption of ADAS (Advanced Driver Assistance Systems) such as lane departure warnings, automatic braking, and blind-spot detection, even in entry-level models.

5. Emerging Markets Driving Volume Growth

- Asia-Pacific Dominance: Countries like India, Indonesia, and the Philippines will remain the largest markets due to informal sector demand, affordable pricing, and infrastructure suited for compact vehicles.

- Africa and Latin America Expansion: Growing urbanization and SME logistics needs will boost mini truck sales, with manufacturers offering rugged, low-maintenance models tailored to local conditions.

- Localization of Production: To reduce costs and tariffs, OEMs are increasing local assembly and supply chain partnerships in developing regions.

6. Sustainability and Circular Economy Focus

- Recyclable Materials: Increased use of lightweight, recyclable materials in manufacturing to improve efficiency and reduce environmental impact.

- Battery Recycling Initiatives: Growth in second-life battery applications (e.g., energy storage) and recycling programs to address end-of-life concerns for EV mini trucks.

- Lifecycle Emissions Reporting: Companies will face growing pressure to disclose full lifecycle emissions, influencing procurement decisions.

7. Competitive Landscape and Market Consolidation

- New Entrants and Partnerships: Tech companies and EV startups may enter the segment via partnerships with traditional OEMs or through niche product launches.

- Platform Sharing: Automakers are expected to adopt shared EV platforms across vehicle segments, reducing development costs and accelerating time-to-market.

- Aftermarket and Service Expansion: OEMs and third parties will expand service networks, spare parts availability, and digital service platforms to support growing fleets.

Conclusion

By H2 2026, the mini truck market will be increasingly defined by electrification, digitalization, and sustainability. While ICE models will still hold significant share in price-sensitive and rural markets, the trajectory is clearly toward electric, connected, and efficient urban delivery solutions. Success will depend on manufacturers’ ability to innovate, adapt to regional regulations, and meet the evolving needs of logistics providers and small businesses in a rapidly urbanizing world.

Common Pitfalls When Sourcing Mini Trucks (Quality, Intellectual Property)

Sourcing mini trucks—especially from low-cost manufacturing regions—can offer significant cost advantages, but it also comes with notable risks, particularly concerning product quality and intellectual property (IP) protection. Understanding and mitigating these pitfalls is crucial for long-term success.

Poor Build Quality and Durability

One of the most frequent issues encountered when sourcing mini trucks is substandard build quality. Many manufacturers cut corners to meet low price points, resulting in vehicles with:

- Thin or low-grade metal frames prone to rust or deformation

- Inadequate welding and assembly practices

- Inferior suspension, braking, and steering components

- Shorter engine lifespan due to poor materials and design

This compromises safety, increases maintenance costs, and damages brand reputation.

Inconsistent Quality Control

Suppliers may pass initial inspections but fail to maintain consistent quality over time. Without rigorous on-site quality assurance processes, batches can vary significantly. Issues include:

- Non-uniform paint finishes and cosmetic defects

- Mismatched or incorrectly installed parts

- Incomplete or missing components in shipments

Relying solely on third-party inspections without ongoing monitoring increases the risk of receiving defective units.

Non-Compliance with Safety and Emissions Standards

Mini trucks sourced from certain regions may not meet international safety, emissions, or regulatory standards (e.g., EPA, Euro norms, or local transport authority requirements). Importing non-compliant vehicles can lead to:

- Customs delays or shipment rejections

- Legal liability in end markets

- Costly retrofits or recalls

Always verify that the supplier can provide certified test reports and documentation proving compliance.

Intellectual Property (IP) Infringement Risks

Many low-cost mini trucks are reverse-engineered copies of established models from brands like Mitsubishi, Suzuki, or Isuzu. Sourcing such vehicles exposes buyers to significant IP risks:

- Potential legal action from original equipment manufacturers (OEMs) for trademark or design patent violations

- Seizure of goods by customs authorities under IP enforcement programs

- Reputational damage associated with selling counterfeit or imitation products

Always conduct due diligence on the supplier’s design origins and request proof of legitimate IP rights or licensing.

Lack of After-Sales Support and Spare Parts

Mini trucks from obscure manufacturers often lack reliable after-sales infrastructure. Pitfalls include:

- No warranty enforcement or limited service networks

- Difficulty sourcing genuine spare parts

- Poor technical documentation and training materials

This diminishes customer satisfaction and increases long-term ownership costs.

Hidden Costs from Re-Work and Warranty Claims

Initial pricing may appear attractive, but hidden costs can quickly accumulate due to:

- On-site rework or refurbishment of defective units

- High warranty claim rates

- Logistics and handling costs for returns or repairs

Factor in total cost of ownership, not just unit price, when evaluating suppliers.

Mitigation Strategies

To avoid these pitfalls:

- Conduct thorough factory audits and request production history

- Require sample testing under real-world conditions

- Insist on compliance certifications and third-party lab reports

- Use legal agreements that protect IP and define quality standards

- Work with suppliers who invest in R&D and have legitimate designs

By proactively addressing quality and IP concerns, businesses can reduce risks and build a sustainable mini truck sourcing strategy.

Logistics & Compliance Guide for Mini Truk

Mini Truks—also known as three-wheeled cargo vehicles, tuk-tuks, or auto rickshaws—are increasingly popular for last-mile delivery and urban logistics due to their cost-efficiency, maneuverability, and low fuel consumption. However, operating Mini Truks within formal logistics chains requires attention to regulatory, safety, and operational compliance. This guide outlines key considerations for legal and efficient Mini Truk operations.

Vehicle Classification and Registration

Ensure each Mini Truk is properly classified under local transportation regulations. Most jurisdictions categorize Mini Truks as light commercial vehicles or three-wheeled motor vehicles. Operators must:

- Register the vehicle with the national or regional transport authority.

- Obtain a valid commercial license plate if used for business purposes.

- Maintain up-to-date registration documents and display them visibly.

- Verify that the vehicle meets emissions and safety standards applicable to its class.

Driver Licensing and Training

Drivers must hold appropriate licenses based on vehicle weight and engine capacity:

- Obtain a valid driver’s license with authorization for three-wheeled or light motor vehicles.

- Complete safety and cargo handling training, including load securing and defensive driving.

- Maintain a clean driving record and undergo periodic refresher training.

- Ensure all drivers carry valid identification and license copies during operation.

Road Safety and Vehicle Maintenance

Regular maintenance and adherence to safety standards are critical:

- Conduct pre-trip inspections (brakes, lights, tires, horn).

- Follow manufacturer-recommended service schedules.

- Equip each Mini Truk with essential safety gear: fire extinguisher, first aid kit, reflective triangles, and seat belts (if available).

- Prohibit overloading; adhere to manufacturer-specified payload limits.

- Install rearview mirrors, turn signals, and proper lighting for night operations.

Cargo Handling and Load Compliance

Improper loading can lead to accidents and regulatory penalties:

- Secure cargo with straps, nets, or enclosed containers to prevent shifting.

- Distribute weight evenly to maintain vehicle stability.

- Do not exceed the maximum gross vehicle weight rating (GVWR).

- Avoid transporting hazardous materials unless specifically permitted and equipped.

- Use clearly labeled, weather-resistant cargo bodies for professional service.

Regulatory and Environmental Compliance

Stay aligned with local, regional, and national regulations:

- Comply with urban access restrictions (e.g., low-emission zones, no-entry hours).

- Obtain necessary permits for commercial operations in city centers.

- Follow noise and emissions standards—especially important for electric or CNG-powered models.

- Keep records of emissions tests, maintenance logs, and inspections.

Insurance Requirements

Proper insurance protects against financial liability:

- Carry mandatory third-party liability insurance.

- Consider comprehensive coverage including cargo, personal injury, and vehicle damage.

- Verify that insurance policies cover commercial use and delivery operations.

- Maintain up-to-date insurance documents in each vehicle.

Digital Tracking and Fleet Management

Enhance efficiency and compliance with technology:

- Install GPS tracking systems to monitor routes, delivery times, and driver behavior.

- Use fleet management software for scheduling, maintenance alerts, and compliance reporting.

- Maintain digital logs of trips, fuel usage, and service history.

Local Permits and Zoning Laws

Check municipal bylaws before operating:

- Obtain business licenses for logistics or delivery services.

- Secure route-specific permissions if delivering in restricted zones (e.g., markets, hospitals, schools).

- Comply with parking regulations for loading/unloading.

Conclusion

Mini Truks offer a sustainable and agile solution for urban logistics, but success depends on strict adherence to compliance and safety standards. By ensuring proper registration, training, maintenance, and documentation, operators can build a reliable and legally compliant delivery network. Regular audits and ongoing staff training will further enhance operational efficiency and regulatory alignment.

Conclusion for Sourcing Mini Trucks

In conclusion, sourcing mini trucks presents a strategic opportunity for businesses requiring cost-effective, fuel-efficient, and maneuverable transportation solutions, particularly in urban environments or for last-mile delivery operations. When evaluating suppliers and models, key considerations such as load capacity, fuel efficiency, maintenance costs, regulatory compliance, and after-sales support must be carefully assessed. Exploring both domestic manufacturers and international suppliers—especially from regions like Asia known for robust mini truck production—can offer competitive pricing and a range of customizable options.

Ultimately, successful sourcing involves conducting thorough due diligence, building relationships with reliable vendors, and aligning vehicle specifications with operational needs. By prioritizing quality, reliability, and total cost of ownership, organizations can leverage mini trucks to enhance logistics efficiency and scalability while maintaining economic and environmental sustainability.