The global milling balls market is experiencing robust growth, driven by increasing demand from industries such as mining, cement, ceramics, and chemicals. According to Grand View Research, the global grinding media market—of which milling balls are a key component—was valued at USD 8.4 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2030. This growth is fueled by rising mineral processing activities, expanding metal exploration projects, and the need for efficient size-reduction solutions in industrial manufacturing. Mordor Intelligence also highlights a steady CAGR of approximately 5% over the forecast period, underscoring the critical role of high-performance milling media in optimizing grinding efficiency and reducing operational downtime. As demand continues to rise, manufacturers are focusing on innovation in materials—such as high-carbon steel, forged steel, and ceramic compounds—to enhance wear resistance and energy efficiency. In this evolving landscape, identifying the top milling balls manufacturers becomes essential for industries seeking reliable, scalable, and technologically advanced grinding solutions.

Top 10 Milling Balls Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Economy Ball Mill/JSB Industrial Solutions Inc.

Domain Est. 2011

Website: economyballmill.com

Key Highlights: We manufacture ball mills for industrial materials processing and customize them for your needs. Learn more about our custom ball mills today….

#2 BSMPL: Grinding Media Balls & Hi

Domain Est. 2013

Website: bluestarmalleable.com

Key Highlights: Leading manufacturer and exporter of high chrome and low chrome grinding media balls – BSMPL, liners, and diaphragms for ball mills and industrial use….

#3 RETSCH

Domain Est. 1997

Website: retsch.com

Key Highlights: Retsch is the leading manufacturer of laboratory mills, jaw crushers and sieving equipment. With more than 100 years of experience, Retsch develops innovative ……

#4 Milling Media Manufacturer

Domain Est. 1998

Website: foxindustries.com

Key Highlights: FOX Industries: A global Milling Media Manufacturer offering premium steel balls, ceramic beads, and glass beads for superior milling performance….

#5 Sino Grinding

Domain Est. 2010

Website: sinogrinding.com

Key Highlights: Sino Grinding International is the premier designer and manufacturer of grinding media for mining companies around the world….

#6 FRITSCH Sample Preparation and Particle Sizing

Domain Est. 2014

Website: fritsch-international.com

Key Highlights: FRITSCH is a manufacturer of application-oriented laboratory instruments for Sample Preparation and Particle Sizing in industry and research laboratories….

#7 Shandong Shengye Grinding Ball Co.Ltd

Domain Est. 2015

Website: en.shengyegrindingball.com

Key Highlights: It is a professional factory in China specializing in the production of forged, hot rolled grinding steel balls and alloy wear resistant steel rods for ball ……

#8 Grinding Ball

Domain Est. 1998

Website: www2.gerdau.com

Key Highlights: Gerdau Grinding Ball products are produced in a facility designed specifically to manufacture high carbon, forged steel for application in the mineral ……

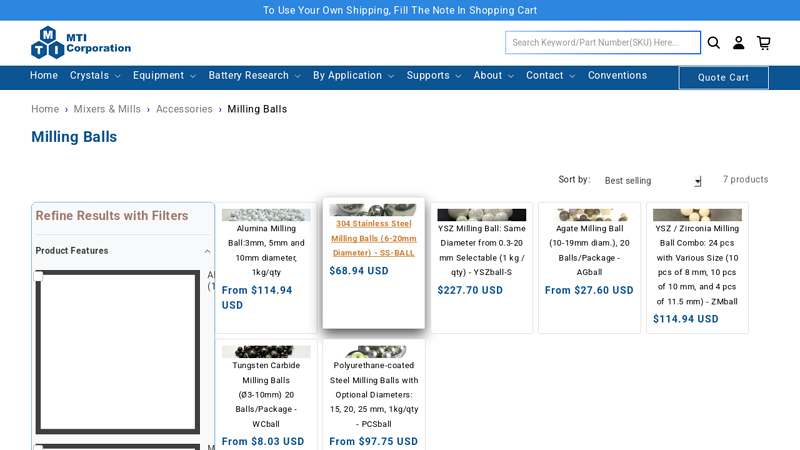

#9 Milling Balls

Domain Est. 2002

Website: mtixtl.com

Key Highlights: YSZ / Zirconia Milling Ball Combo: 24 pcs with Various Size (10 pcs of 8 mm, 10 pcs of 10 mm, and 4 pcs of 11.5 mm) – ZMball…

#10 Grinding Balls

Domain Est. 2007

Website: preciballusa.com

Key Highlights: Used for processing various minerals such as silica, graphite, and coal, these cast or forged balls are stocked in varying materials and diameters….

Expert Sourcing Insights for Milling Balls

H2: Projected 2026 Market Trends for Milling Balls

The global milling balls market is poised for steady growth by 2026, driven by increasing demand across mining, cement, and advanced materials manufacturing sectors. Several key trends are expected to shape the industry landscape in the coming years.

1. Rising Demand from the Mining and Mineral Processing Industries

The mining sector remains the largest consumer of milling balls, particularly in large-scale ore grinding operations. As global demand for base and precious metals continues to grow—fueled by urbanization, infrastructure development, and the energy transition—mining companies are investing in more efficient grinding technologies. This is expected to boost the demand for high-performance milling balls, especially forged and cast steel varieties known for durability and wear resistance.

2. Shift Toward High-Chrome and Composite Milling Balls

Technological advancements are pushing a transition from traditional low- and medium-carbon steel balls to high-chrome alloy and composite milling balls. These advanced variants offer superior hardness, corrosion resistance, and longer service life, reducing downtime and replacement costs. By 2026, high-chrome balls are projected to capture a growing market share, particularly in applications requiring fine grinding and where contamination must be minimized.

3. Emphasis on Sustainability and Energy Efficiency

With increasing regulatory pressure and corporate sustainability goals, manufacturers are focusing on energy-efficient grinding processes. Optimized milling ball size distribution, improved ball-to-powder ratios, and the use of precision-engineered balls contribute to reduced energy consumption in ball mills. Additionally, recyclability of steel-based milling balls supports circular economy initiatives, further enhancing their appeal.

4. Regional Market Dynamics

Asia-Pacific, particularly China and India, will remain dominant in both production and consumption of milling balls due to robust industrial activity and expanding mining operations. Latin America and Africa are also emerging as high-growth regions, supported by new mining projects and infrastructure investments. In contrast, mature markets in North America and Europe will focus on product innovation and premium-grade balls for specialized applications.

5. Supply Chain and Raw Material Volatility

Fluctuations in the prices of raw materials such as chromium, manganese, and iron ore may impact production costs. Manufacturers are anticipated to adopt strategic sourcing, vertical integration, and alternative alloy formulations to mitigate cost volatility and maintain margins.

6. Technological Integration and Customization

By 2026, digitalization and Industry 4.0 technologies are expected to influence milling ball manufacturing and usage. Predictive maintenance tools, wear monitoring systems, and customized ball solutions tailored to specific ore types and mill configurations will become more prevalent, enhancing operational efficiency.

In summary, the 2026 milling balls market will be characterized by technological innovation, regional expansion, and a strong push toward efficiency and sustainability. Companies that invest in R&D, sustainable practices, and customer-specific solutions are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls Sourcing Milling Balls (Quality, IP)

Sourcing milling balls—critical components in industries like mining, cement, and chemicals—can be fraught with challenges, especially concerning quality and intellectual property (IP). Overlooking these aspects can lead to operational inefficiencies, increased costs, and legal risks. Below are key pitfalls to avoid:

Inadequate Quality Control and Material Verification

One of the most frequent issues is receiving milling balls that do not meet the specified hardness, density, or chemical composition. Suppliers may cut corners by using substandard raw materials or inconsistent heat treatment processes, leading to premature wear, breakage, and contamination of the milled product. Without third-party material testing or clear quality certifications (e.g., ISO, ASTM), buyers risk operational downtime and higher replacement costs.

Misrepresentation of Performance Claims

Some suppliers exaggerate performance metrics such as wear resistance, service life, or impact strength. These inflated claims may be based on non-standardized testing or selective data. Buyers who rely solely on supplier brochures without conducting independent performance validation (e.g., pilot trials or lab testing) often discover too late that the balls underperform in real-world conditions.

Lack of Traceability and Certification

High-quality milling balls require traceable batches and material certifications (e.g., mill test reports). Without proper documentation, it becomes difficult to verify the origin of raw materials, ensure regulatory compliance (e.g., REACH, RoHS), or investigate failures. This lack of traceability also complicates warranty claims and liability assessments.

Intellectual Property (IP) Infringement Risks

Sourcing from manufacturers that replicate patented designs or proprietary alloy formulations exposes buyers to IP infringement risks. Even unintentional use of counterfeit or cloned products can result in legal action, supply chain disruptions, or reputational damage. It’s essential to verify that the supplier holds legitimate rights to their manufacturing processes and materials.

Overlooking Supplier IP Due Diligence

Many buyers focus solely on price and delivery timelines, neglecting to assess whether the supplier respects IP rights. Engaging with manufacturers that reverse-engineer or copy established brands may lead to supply instability if the original IP holder enforces legal action. Conducting IP due diligence—such as reviewing patents, trademarks, and manufacturing licenses—mitigates this risk.

Failure to Secure IP in Custom Designs

When working with suppliers on custom milling ball formulations or geometries, companies often fail to formalize IP ownership in contracts. Without clear agreements, the supplier may retain rights to the design, allowing them to sell identical products to competitors. Always ensure that development agreements explicitly assign IP rights to the buyer.

Avoiding these pitfalls requires rigorous supplier vetting, contractual safeguards, and independent quality verification. Prioritizing both material integrity and IP compliance ensures reliable performance and long-term legal security.

Logistics & Compliance Guide for Milling Balls

Overview

Milling balls are essential components in industrial grinding and milling processes, commonly used in mining, pharmaceuticals, ceramics, and materials science. Due to their material composition (e.g., steel, tungsten carbide, zirconia, ceramic) and potential regulatory implications, proper logistics and compliance measures are critical for safe, legal, and efficient transportation and handling.

Classification and HS Codes

Proper product classification ensures compliance with international trade regulations. Milling balls are typically categorized under the following Harmonized System (HS) codes:

– 8209.00: Parts for tools of headings 8202 to 8208 (e.g., steel or tungsten carbide grinding media)

– 6909.12 or 6909.19: Ceramic goods for laboratory, chemical, or industrial use (e.g., zirconia or alumina balls)

– 7326.20: Other articles of steel (when applicable)

Note: Final HS code should be confirmed based on material, size, and intended use, in consultation with customs authorities or a trade compliance expert.

Export Controls and Restrictions

Certain milling balls may be subject to export control regulations, particularly if made from dual-use materials:

– Wassenaar Arrangement: Tungsten carbide and other hard metals may be listed due to potential use in military or aerospace applications.

– EAR (Export Administration Regulations): Check Commerce Control List (CCL) for items requiring a license based on destination and end-use.

– ITAR (International Traffic in Arms Regulations): Generally not applicable unless integrated into defense-related systems.

Recommendation: Conduct an end-use assessment and screen customer/partner names against denied parties lists (e.g., U.S. BIS, EU Consolidated List).

Packaging and Handling Requirements

- Material Compatibility: Use non-reactive, moisture-resistant packaging (e.g., sealed plastic bags inside sturdy cardboard or steel drums) to prevent corrosion.

- Cushioning: Prevent movement during transit to avoid surface damage or contamination.

- Labeling: Clearly mark contents, weight, material type (e.g., “Zirconia Milling Media”), manufacturer, and any hazard symbols if applicable.

- UN Certification: Not typically required unless classified as hazardous, but robust packaging is essential for international freight.

Transportation and Shipping

- Mode of Transport: Suitable for air, sea, and ground freight. Air freight requires adherence to IATA packaging standards; sea freight should follow IMDG Code guidelines if containerized.

- Weight and Density: Milling balls are dense; ensure packaging and pallets can support the load. Use proper weight distribution to avoid damage.

- Documentation: Include commercial invoice, packing list, certificate of origin, and material safety data sheet (MSDS/SDS) if requested.

Safety Data Sheets (SDS) and Hazard Communication

- While most milling balls are non-hazardous in solid form, SDS should be available for:

- Metal dust generation during use (respiratory hazard)

- Material-specific risks (e.g., cobalt in tungsten carbide)

- Disposal guidelines (potential heavy metal content)

- SDS must comply with GHS (Globally Harmonized System) standards when shipped internationally.

Import Regulations by Region

- United States: CBP requires accurate HTSUS code, entry documentation, and possible import duties. Check for Section 301 tariffs on Chinese-origin steel products.

- European Union: Comply with REACH and RoHS directives; declare substances of very high concern (SVHC) if applicable.

- China: May require CCC certification for certain industrial components; verify with local customs.

- Other Regions: Confirm local industrial goods or metal import requirements (e.g., INMETRO in Brazil, KC in South Korea).

Environmental and Disposal Compliance

- Used milling balls may contain contaminated materials or trace metals.

- Follow local hazardous waste regulations (e.g., RCRA in the U.S.) for disposal or recycling.

- Encourage customers to recycle spent media through certified metal reclamation facilities.

Recordkeeping and Audits

- Maintain records of export licenses, customer certifications, SDS, and shipping documents for a minimum of 5 years (or per local regulation).

- Conduct periodic compliance audits to ensure adherence to evolving trade laws.

Best Practices Summary

- Classify accurately using correct HS codes

- Screen all international transactions for export control risks

- Package securely to prevent damage and contamination

- Provide up-to-date SDS and product documentation

- Stay informed on regional import/export updates

- Train staff on compliance protocols and reporting procedures

Disclaimer: This guide provides general information and does not constitute legal or regulatory advice. Consult with qualified trade compliance professionals for case-specific guidance.

Conclusion for Sourcing Milling Balls

In conclusion, sourcing high-quality milling balls is a critical factor in ensuring efficient and effective grinding, milling, and material processing operations. The selection process must consider material composition (such as steel, stainless steel, ceramic, or tungsten carbide), size, hardness, density, wear resistance, and compatibility with the processed material. Evaluating reliable suppliers based on their manufacturing standards, consistency in product quality, cost-effectiveness, and technical support is essential to maintaining operational performance and reducing downtime.

Moreover, long-term cost efficiency should be prioritized over initial price savings, as high-performance milling balls contribute to reduced contamination, longer service life, and improved process outcomes. By conducting thorough market research, requesting samples, and establishing partnerships with reputable manufacturers or distributors, organizations can optimize their milling processes, enhance productivity, and achieve superior end-product quality. Ultimately, a strategic sourcing approach to milling balls supports sustainability, reliability, and competitiveness in industrial operations.