The global welding equipment market, which encompasses key components such as Miller parts, is experiencing steady expansion driven by increasing demand from industrial manufacturing, energy, and construction sectors. According to Grand View Research, the global welding equipment market was valued at USD 24.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This growth trajectory underscores the rising need for reliable, high-performance welding components, particularly from leading brands like Miller Electric. As manufacturers strive for greater efficiency and precision in metal fabrication, the demand for authentic and high-quality Miller parts—ranging from torches and liners to power sources and control boards—has intensified. This growing reliance has elevated the importance of specialized suppliers capable of delivering genuine components with consistent performance. In this context, we examine the top six manufacturers recognized for producing or distributing critical Miller parts, analyzing their market presence, product reliability, and role in supporting industrial welding operations worldwide.

Top 6 Miller Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OEM & Vintage Miller Welder Replacement Parts

Domain Est. 2007

Website: vpartsinc.com

Key Highlights: We provide vintage Miller Welder parts straight from the original manufacturer so that you never have to worry about the quality or compatibility of the ……

#2 Miller Ingenuity

Domain Est. 2013

Website: milleringenuity.com

Key Highlights: Miller Ingenuity is a global manufacturer and supplier of railroad parts and high-technology rail safety systems and services. For over 75 years, the company ……

#3 Miller Industries

Domain Est. 1997

Website: millerind.com

Key Highlights: Manufacturer and world leader in towing and recovery equipment with brands Century, Vulcan, Chevron, and Holmes. Products range from light, medium, ……

#4 Welder Service Parts

Domain Est. 2017

Website: millerserviceparts.com

Key Highlights: Free delivery over $85 30-day returnsYour #1 source for Miller Welder parts on the internet our OEM parts are LESS then anyones….

#5 Welding Equipment – Machines and Gear

Domain Est. 1996

Website: millerwelds.com

Key Highlights: Shop our complete selection of welding equipment, including welders, plasma cutters, oxy-fuel outfits, training solutions and welding automation systems….

#6 Parts & Miscellaneous

Domain Est. 2003

Website: miller-mfg.com

Key Highlights: Free delivery 30-day returnsFind replacement parts and miscellaneous products for all Miller Manufacturing brands – Little Giant, Double-Tuf, API, HOT-SHOT, ……

Expert Sourcing Insights for Miller Parts

H2: 2026 Market Trends Analysis for Miller Parts

As Miller Parts looks toward 2026, several key market trends are expected to shape the industrial components and aftermarket parts sector. These trends reflect broader shifts in technology, sustainability, supply chain dynamics, and customer expectations. Understanding these forces is critical for Miller Parts to maintain competitiveness, drive innovation, and capture growth opportunities.

-

Increased Demand for Sustainable and Eco-Friendly Components

Environmental regulations and corporate sustainability goals are pushing industries toward greener operations. By 2026, Miller Parts can expect heightened demand for energy-efficient, recyclable, and low-emission parts. Customers—especially in manufacturing, construction, and transportation—are prioritizing suppliers with strong environmental, social, and governance (ESG) practices. Miller Parts should consider expanding product lines with eco-certified materials and promoting lifecycle assessments to appeal to environmentally conscious clients. -

Digitalization and Smart Parts Integration

The Industrial Internet of Things (IIoT) is transforming how mechanical components are monitored and maintained. By 2026, “smart parts” embedded with sensors for predictive maintenance, real-time performance tracking, and remote diagnostics are expected to gain market traction. Miller Parts can capitalize on this trend by developing or partnering on sensor-integrated components, offering data-driven after-sales services, and enhancing digital customer platforms for part tracking and inventory management. -

Resilient and Regionalized Supply Chains

Global supply chain disruptions have prompted a shift toward regionalization and nearshoring. In 2026, Miller Parts is likely to benefit from a growing preference for localized sourcing to reduce lead times and mitigate geopolitical risks. Investing in regional manufacturing hubs or strengthening relationships with domestic suppliers could improve delivery reliability and responsiveness. Additionally, leveraging digital supply chain tools—such as AI-driven demand forecasting and blockchain for traceability—will be essential for operational agility. -

Aftermarket Growth and Servitization

The aftermarket for industrial parts is expanding as businesses seek cost-effective maintenance and extended equipment lifecycles. By 2026, customers will increasingly value service bundles over standalone parts. Miller Parts should explore servitization models—offering maintenance contracts, performance guarantees, or parts-as-a-service—to deepen customer relationships and create recurring revenue streams. -

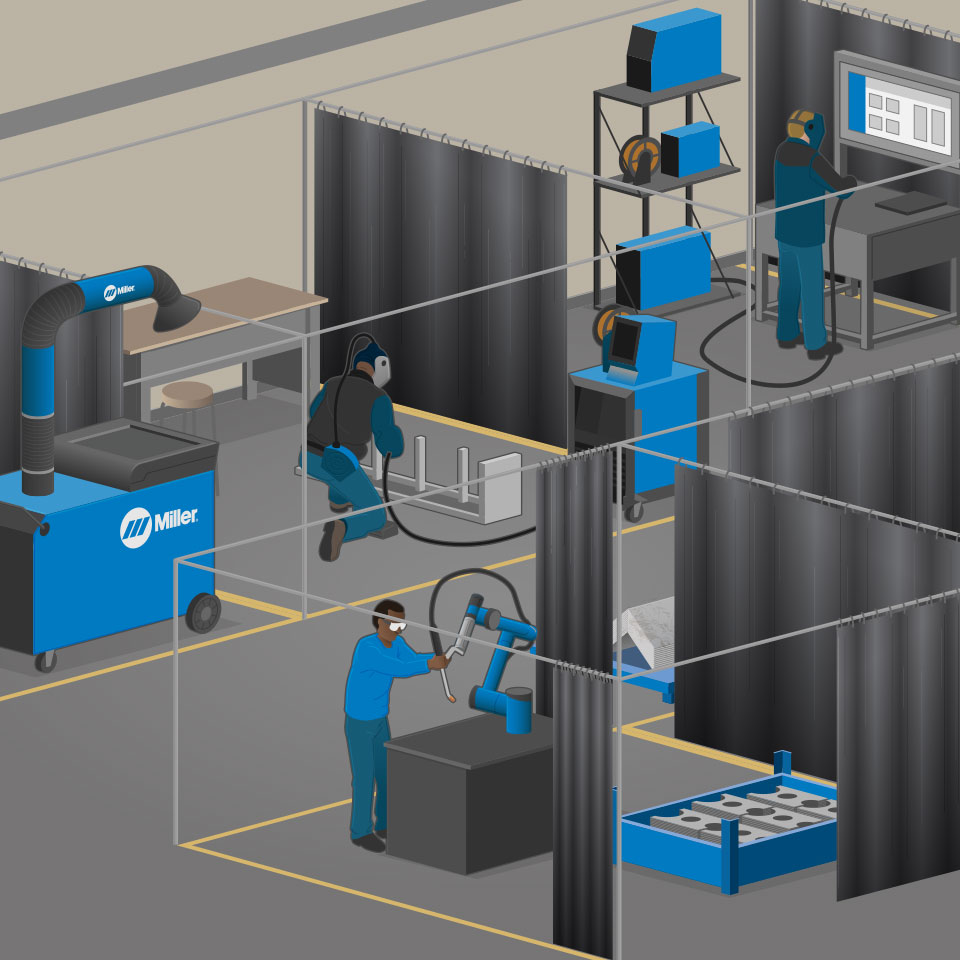

Labor Shortages and Automation Adoption

Skilled labor shortages in industrial sectors are accelerating the adoption of automation and robotics. This shift increases demand for precision components compatible with automated systems. Miller Parts can target industries embracing automation by developing high-tolerance, durable parts designed for robotic integration and minimal maintenance. -

Customization and On-Demand Manufacturing

Advancements in 3D printing and digital manufacturing are enabling faster, cost-effective customization. By 2026, industrial clients will expect tailored solutions with shorter lead times. Miller Parts should explore additive manufacturing capabilities or strategic partnerships to offer bespoke parts without compromising scalability.

Conclusion:

To thrive in the 2026 market landscape, Miller Parts must embrace sustainability, digital innovation, and customer-centric service models. Strategic investments in smart technologies, supply chain resilience, and aftermarket services will position the company as a forward-thinking leader in the industrial parts sector. Proactive adaptation to these trends will ensure long-term growth and competitive advantage.

Common Pitfalls Sourcing Miller Parts: Quality and Intellectual Property Risks

When sourcing Miller parts—whether for equipment maintenance, manufacturing, or resale—businesses often encounter significant challenges related to part quality and intellectual property (IP) compliance. Falling into these pitfalls can lead to equipment failure, safety hazards, legal liabilities, and reputational damage.

1. Compromised Part Quality from Unauthorized Suppliers

One of the most prevalent risks is purchasing counterfeit or substandard Miller parts from unauthorized distributors or unverified online marketplaces. These parts may appear identical to genuine components but are often made with inferior materials and manufacturing processes.

- Performance & Safety Risks: Non-genuine parts may fail prematurely under stress, leading to equipment downtime, increased maintenance costs, or even safety incidents—especially critical in industries like welding, construction, or HVAC.

- Lack of Testing & Certification: Authentic Miller parts undergo rigorous testing to meet industry standards. Counterfeit versions often bypass these protocols, compromising reliability and compliance.

- Voided Warranties: Using non-OEM parts can void warranties on Miller equipment, leaving businesses responsible for repair costs.

2. Intellectual Property Infringement

Miller Electric, like many OEMs, holds strong intellectual property rights, including trademarks, patents, and design protections on its parts and branding. Sourcing from unauthorized or third-party manufacturers can lead to unintentional IP violations.

- Trademark Violations: Selling or using parts that bear the Miller name or logo without authorization constitutes trademark infringement. Even resellers may face legal action if they distribute counterfeit-labeled parts.

- Patent Infringement: Some Miller parts are protected by utility or design patents. Replicas that mimic patented features—even if functionally similar—can expose buyers and sellers to litigation.

- Gray Market Risks: Parts sourced through unofficial channels (gray market) may be genuine but sold outside authorized distribution networks, potentially violating distribution agreements and IP terms.

3. Misrepresentation and Lack of Traceability

Unreliable suppliers may misrepresent parts as “compatible” or “OEM-equivalent” while providing no verifiable documentation or traceability.

- Inadequate Documentation: Lack of certificates of conformance, material test reports, or traceable batch numbers makes it difficult to verify authenticity or comply with regulatory audits.

- Ambiguous Labeling: Terms like “Miller-style” or “fits Miller models” can blur the line between imitation and infringement, increasing legal exposure.

4. Supply Chain Vulnerabilities

Relying on offshore or unveted suppliers increases the risk of receiving non-compliant parts. Complex global supply chains can obscure the origin and authenticity of components.

- Counterfeit Proliferation: Certain regions are known for producing and exporting counterfeit industrial parts. Without due diligence, businesses may inadvertently source from these networks.

- Limited Recourse: Disputes with international suppliers over quality or IP issues can be difficult and costly to resolve.

Mitigation Strategies

To avoid these pitfalls:

– Source exclusively through authorized Miller distributors.

– Verify supplier credentials and request authenticity documentation.

– Conduct periodic audits of parts and supply chains.

– Consult legal counsel when dealing with third-party or “compatible” parts to assess IP risks.

By proactively addressing quality and IP concerns, businesses can ensure operational reliability and legal compliance when sourcing Miller parts.

Logistics & Compliance Guide for Miller Parts

This guide outlines the essential logistics and compliance procedures for handling, transporting, and documenting Miller Parts to ensure operational efficiency, regulatory adherence, and customer satisfaction.

Order Processing & Inventory Management

- Accurate Order Entry: Ensure all orders are entered promptly and verified for part number, quantity, and customer details.

- Inventory Accuracy: Conduct regular cycle counts and scheduled audits to maintain real-time inventory accuracy within the warehouse management system (WMS).

- Stock Rotation: Implement FEFO (First Expired, First Out) or FIFO (First In, First Out) practices for parts with shelf-life considerations.

- Storage Standards: Store parts according to manufacturer specifications, including temperature, humidity, and segregation requirements.

Packaging & Labeling Requirements

- Protective Packaging: Use industry-standard packaging materials to prevent damage during transit. Include cushioning, moisture barriers, and secure sealing.

- Labeling Compliance: Ensure all packages display:

- Miller Part number and description

- Quantity and batch/lot number (if applicable)

- Handling instructions (e.g., “Fragile,” “Do Not Stack”)

- Barcode/QR code for traceability

- Hazardous Materials: If applicable, comply with OSHA and DOT regulations for labeling and documentation of hazardous components.

Domestic & International Shipping

- Carrier Selection: Use approved freight carriers with experience in industrial parts logistics. Prioritize reliability, tracking capability, and delivery timelines.

- Shipping Documentation: Prepare accurate and complete shipping documents, including:

- Commercial Invoice

- Packing List

- Bill of Lading (BOL)

- Certificate of Origin (for international shipments)

- Customs Compliance: For international shipments, ensure Harmonized System (HS) codes are correctly assigned and all export controls (e.g., EAR/ITAR) are followed.

- Incoterms: Clearly define responsibilities using appropriate Incoterms (e.g., FOB, EXW, DDP) on all sales contracts.

Regulatory & Trade Compliance

- Export Controls: Verify that Miller Parts are not subject to export restrictions under U.S. Department of Commerce (BIS) or State Department regulations.

- Import Compliance: Ensure adherence to destination country import requirements, including duties, taxes, and product certifications.

- Record Retention: Maintain shipping, compliance, and transaction records for a minimum of five years as required by international trade laws.

- Sanctions Screening: Screen all customers and partners against OFAC and other global watchlists prior to shipment.

Returns & Reverse Logistics

- Return Authorization (RMA): Require a valid RMA number for all returns. Process RMAs within 24 hours of request.

- Inspection & Evaluation: Inspect returned parts for damage, misuse, or tampering before processing credit or replacement.

- Refurbishment & Disposal: Follow environmental regulations (e.g., EPA, WEEE) for parts that are to be refurbished or disposed of.

Quality & Traceability

- Lot Traceability: Maintain full traceability from supplier to end customer using lot numbers and digital logs.

- Non-Conformance Reporting: Document and report any logistics-related quality issues through the internal quality management system (QMS).

- Corrective Actions: Implement corrective and preventive actions (CAPA) for recurring logistics or compliance issues.

Training & Continuous Improvement

- Employee Training: Conduct regular training for logistics staff on compliance updates, safety protocols, and system usage.

- Audits & Assessments: Perform internal logistics audits annually and address findings promptly.

- Feedback Loop: Collect feedback from customers and carriers to improve packaging, delivery performance, and compliance accuracy.

Adherence to this guide ensures that Miller Parts are handled with the highest standards of logistics efficiency and regulatory compliance across the supply chain.

Conclusion for Sourcing Miller Parts

In conclusion, sourcing Miller parts requires a strategic approach that balances authenticity, cost, availability, and supplier reliability. Utilizing authorized distributors and certified dealers ensures genuine components, optimal equipment performance, and preservation of warranty coverage. While alternative sourcing options may offer short-term cost savings, they carry risks related to part quality and long-term durability. Establishing relationships with trusted suppliers, maintaining an inventory of critical spare parts, and leveraging digital procurement platforms can enhance efficiency and reduce downtime. Ultimately, a well-structured sourcing strategy for Miller parts supports operational continuity, extends equipment lifespan, and contributes to overall productivity and safety in industrial and construction environments.