The global military vehicle parts manufacturing market is experiencing robust growth, driven by rising defense expenditures, modernization of armed forces, and increased demand for armored and tactical vehicles. According to a 2023 report by Mordor Intelligence, the military vehicle market is projected to grow at a CAGR of over 4.5% from 2023 to 2028, with a significant portion of this expansion attributed to advancements in vehicle subsystems and component technologies. This growth is further supported by geopolitical tensions and the need for enhanced battlefield mobility and survivability. As modern militaries prioritize upgrading legacy fleets and integrating next-generation platforms, the demand for high-performance, reliable components—from armor systems and powertrains to electronic warfare suites—has surged. In this evolving landscape, a select group of manufacturers has emerged as leaders in innovation, quality, and global supply chain reach. Below are the top 10 military vehicle parts manufacturers shaping the future of defense mobility.

Top 10 Military Vehicle Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

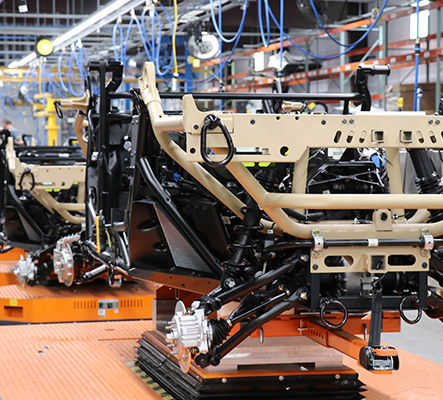

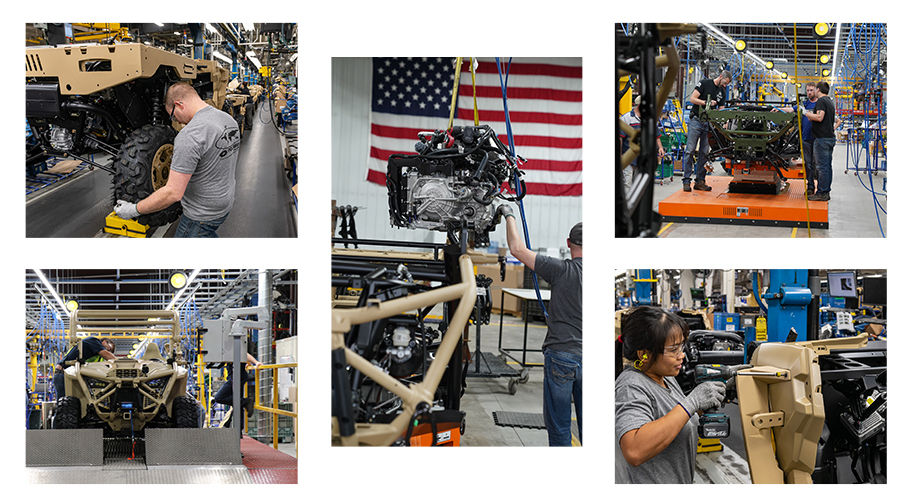

#1 AM General

Domain Est. 1997

Website: amgeneral.com

Key Highlights: AM General is an automotive manufacturer that builds military & commercial vehicles including the Humvee, tactical vehicles, enhanced tactical kits, ……

#2 Boyce Equipment, Utah, Military Surplus

Domain Est. 1997

Website: boyceequipment.com

Key Highlights: Boyce Equipment & Parts Co., Inc. out of Ogden, Utah is the leader in Military Trucks & Parts. We are a Dealer in in the field of Military Trucks, Truck Parts,…

#3 Oshkosh Defense

Domain Est. 2008

Website: oshkoshdefense.com

Key Highlights: Oshkosh Defense is a global leader in military technology, design and production. We build the world’s leading JLTV, MATV, and military trucks—trusted ……

#4 WWII MILITARY VEHICLE PARTS

Domain Est. 1998

Website: mvspares.com

Key Highlights: MV Spares is a manufacturing company, which reproduces rare parts for WWII Jeeps and WWII Harley Davidson motorcycles….

#5 International Parts Supply

Domain Est. 1999

Website: ipscorpusa.com

Key Highlights: Manufacturing, Distribution, Upgrades, Parts, Maintenance and Components for US Military Tracked Vehicles….

#6 Excalibur Army

Domain Est. 2001

Website: excaliburarmy.cz

Key Highlights: EXCALIBUR ARMY, a leading Czech company in the field of military vehicles, weapons and equipment….

#7 Mack Defense » Tactical Logistical Commercial & Specialty Military …

Domain Est. 2009

Website: mackdefense.com

Key Highlights: Mack Defense specializes in robust military trucks and advanced defense vehicles, engineered to withstand rigorous conditions and fulfill diverse defense ……

#8 Horstman Group: High

Domain Est. 2015

Website: horstmangroup.com

Key Highlights: Horstman Design, Develop, Deliver & Support High-Performance Military Vehicle Suspension Systems Worldwide for the Life of the Vehicle….

#9 Black Dog Customs

Domain Est. 2016

Website: blackdogcustoms.com

Key Highlights: Free delivery over $599To anyone looking to purchase parts or do business with Black Dog Customs, I recommend doing business with them, and you will soon realize these guys are her…

#10 GM Defense: Driving the Future of Military Mobility

Domain Est. 2017

Website: gmdefensellc.com

Key Highlights: Today, GM Defense is continuing a legacy of over 100 years of designing, validating and manufacturing vehicles and equipment in support of military and ……

Expert Sourcing Insights for Military Vehicle Parts

H2: 2026 Market Trends for Military Vehicle Parts

The global military vehicle parts market is anticipated to undergo significant transformation by 2026, driven by evolving defense strategies, technological advancements, and geopolitical dynamics. Key trends shaping the market include increased modernization of armed forces, rising demand for armored and tactical vehicles, integration of advanced materials and smart technologies, and a growing emphasis on vehicle survivability and mobility.

-

Modernization Programs Driving Demand

Many nations are prioritizing the upgrade of legacy military vehicle fleets to enhance operational effectiveness. Defense spending increases—particularly in the U.S., China, India, and several European countries—are fueling investments in next-generation combat vehicles and their components. This trend is creating robust demand for advanced engines, transmissions, suspension systems, and armor solutions. -

Adoption of Lightweight and Composite Materials

A major trend is the shift toward lightweight, high-strength materials such as composites, aluminum alloys, and advanced ceramics. These materials improve fuel efficiency, payload capacity, and protection levels without increasing vehicle weight. Suppliers specializing in composite armor and modular protection kits are expected to see strong growth. -

Integration of Electrification and Hybrid Technologies

The defense sector is exploring hybrid-electric and fully electric propulsion systems to reduce thermal signatures, lower logistics burdens, and support silent mobility operations. This shift is driving demand for specialized electric drivetrains, power electronics, and battery management systems tailored for military environments. -

Growth in C4ISR and Digital Integration

Military vehicles are increasingly becoming nodes in networked battlefield systems. As a result, components related to communications, navigation, sensors, and electronic warfare (e.g., antennas, data buses, and ruggedized computing units) are seeing rising demand. The integration of AI-driven diagnostics and predictive maintenance systems is also enhancing vehicle readiness and reducing lifecycle costs. -

Focus on Survivability and Active Protection Systems (APS)

With asymmetric warfare and urban combat on the rise, there is heightened demand for parts that enhance crew protection. Active protection systems, mine-resistant undercarriages, and modular armor kits are becoming standard requirements. The market for blast-mitigating seats, advanced vision systems, and NBC (nuclear, biological, chemical) protection components is expanding accordingly. -

Regional Geopolitical Tensions and Defense Procurement

Escalating regional conflicts and territorial disputes are prompting countries to bolster their armored vehicle fleets. Eastern Europe, the Middle East, and the Indo-Pacific region are expected to be key growth areas. This geopolitical climate supports long-term demand for spare parts, repair services, and upgrade kits. -

Supply Chain Resilience and Localization

Global supply chain disruptions have prompted defense ministries to emphasize domestic production and supply chain security. Countries are incentivizing local manufacturing of critical vehicle components to reduce dependency on foreign suppliers, creating opportunities for regional OEMs and Tier-1 suppliers. -

Sustainability and Lifecycle Management

Military operators are focusing on sustainability through remanufacturing, recycling, and extended lifecycle management of vehicle parts. This trend is fostering growth in the aftermarket segment, including refurbished engines, transmissions, and tracked systems.

In summary, the 2026 military vehicle parts market is poised for sustained growth, shaped by technological innovation, strategic modernization, and global security challenges. Companies that invest in R&D, adapt to digital transformation, and align with defense procurement priorities will be best positioned to capitalize on emerging opportunities.

Common Pitfalls Sourcing Military Vehicle Parts (Quality, IP)

Poor Quality Control and Counterfeit Components

Sourcing military vehicle parts often exposes buyers to substandard or counterfeit components, especially when procuring through secondary or gray-market suppliers. These parts may lack proper metallurgical certifications, fail to meet MIL-SPEC standards, or be reverse-engineered without rigorous testing. Using such parts compromises vehicle reliability, endangers personnel, and can lead to mission failure. Always verify supplier credentials, demand full traceability documentation (e.g., Certificates of Conformance), and conduct independent quality inspections when possible.

Intellectual Property (IP) and Unauthorized Manufacturing Risks

Many military vehicle components are protected by strict intellectual property rights, including technical data packages (TDPs) and proprietary designs controlled under regulations like ITAR (International Traffic in Arms Regulations). Sourcing parts from unauthorized manufacturers or third-party vendors can lead to IP infringement, legal liability, and supply chain vulnerabilities. Unauthorized replication—even if functionally adequate—can result in compliance violations and jeopardize government contracts. Ensure suppliers are authorized licensees or approved sources listed in official technical manuals or government databases.

Logistics & Compliance Guide for Military Vehicle Parts

Overview and Importance

Military vehicle parts logistics and compliance involve the management, transportation, storage, and regulatory adherence required for components used in defense and military applications. Given the sensitive nature and strategic importance of these parts, strict protocols must be followed to ensure operational readiness, security, traceability, and compliance with national and international regulations.

Regulatory Compliance Framework

All logistics operations involving military vehicle parts must comply with a range of legal and regulatory standards, including:

– International Traffic in Arms Regulations (ITAR) – U.S. regulations controlling the export and import of defense-related articles and services listed on the U.S. Munitions List (USML).

– Export Administration Regulations (EAR) – Governs dual-use items that have both civilian and military applications.

– Defense Federal Acquisition Regulation Supplement (DFARS) – Specifies requirements for contractors providing goods and services to the U.S. Department of Defense.

– National and Host Nation Regulations – Vary by country; require compliance with local defense trade controls, customs, and import/export laws.

– NATO Supply Classification Codes (NSN System) – Ensures standardized identification and tracking of military parts across allied forces.

Classification and Documentation

Proper classification of military vehicle parts is essential for compliance:

– Assign correct National Stock Numbers (NSNs) for standardized identification.

– Determine ECCN (Export Control Classification Number) or ITAR category for export control purposes.

– Maintain accurate Technical Data Packages (TDPs) and Bill of Materials (BOMs).

– Ensure all shipments are accompanied by required documentation, including:

– Commercial invoices

– Packing lists

– Export licenses (when required)

– End-User Certificates (EUCs)

– Certificates of Conformance (CoC)

Transportation and Shipment

Military vehicle parts often require specialized handling due to size, weight, sensitivity, or security classification:

– Utilize certified freight forwarders experienced in defense logistics and ITAR compliance.

– Employ secure, tamper-evident packaging and tracking systems (e.g., GPS-enabled containers).

– Choose transport modes (air, sea, ground) based on urgency, cost, and security requirements.

– For international shipments, coordinate with Customs brokers familiar with military cargo and defense trade laws.

– Maintain chain of custody logs for high-value or classified components.

Storage and Inventory Management

Secure and compliant storage is critical:

– Use ITAR-compliant warehouses with restricted access, surveillance, and physical security measures.

– Implement an Inventory Management System (IMS) capable of tracking lot numbers, serial numbers, shelf life, and location.

– Conduct regular audits and cycle counts to ensure accuracy and detect discrepancies.

– Store hazardous or sensitive materials (e.g., batteries, pyrotechnics) in accordance with safety regulations (OSHA, NFPA, etc.).

Security and Access Control

Given the sensitive nature of military components:

– Enforce personnel vetting (e.g., security clearances, background checks) for all staff handling parts.

– Apply Need-to-Know principles and role-based access controls in both physical and digital systems.

– Encrypt and protect technical data and logistics records in accordance with DFARS cybersecurity requirements (e.g., NIST SP 800-171).

– Report any security breaches or unauthorized access immediately to the appropriate authorities (e.g., DDTC for ITAR violations).

Maintenance, Repair, and Return Logistics (MRO)

MRO processes must align with compliance and operational standards:

– Track maintenance history and component lifecycle using digital maintenance logs.

– Follow OEM and military technical manuals for repairs and overhauls.

– Ensure return shipments of repaired parts comply with export controls, especially when cross-border.

– Manage obsolescence and shelf life proactively to prevent use of outdated or degraded components.

Training and Compliance Culture

Sustained compliance requires ongoing education:

– Provide regular training on ITAR, EAR, DFARS, and internal logistics procedures.

– Conduct compliance audits and risk assessments annually or as required.

– Appoint a Compliance Officer responsible for monitoring adherence and managing export licenses.

– Foster a culture of accountability and continuous improvement in logistics operations.

Conclusion

Effective logistics and compliance for military vehicle parts require meticulous attention to regulatory requirements, security protocols, and operational efficiency. By integrating robust systems, trained personnel, and strict adherence to international and national standards, organizations can ensure the integrity, availability, and lawful handling of critical defense components.

In conclusion, sourcing military vehicle parts requires a strategic, well-regulated approach that balances operational readiness with compliance, cost-efficiency, and supply chain resilience. Given the specialized nature of these components, procurement must prioritize certified suppliers, adherence to strict quality and security standards, and traceability throughout the supply chain. Leveraging both domestic manufacturing capabilities and trusted international partnerships can enhance availability while mitigating risks associated with obsolescence and geopolitical instability. Furthermore, adopting advanced logistics solutions, digital inventory management, and lifecycle planning ensures long-term sustainability and mission readiness. Effective sourcing of military vehicle parts is not merely a logistical task but a critical component of national defense strategy, demanding continuous evaluation, innovation, and collaboration across military, industrial, and governmental sectors.