Sourcing Guide Contents

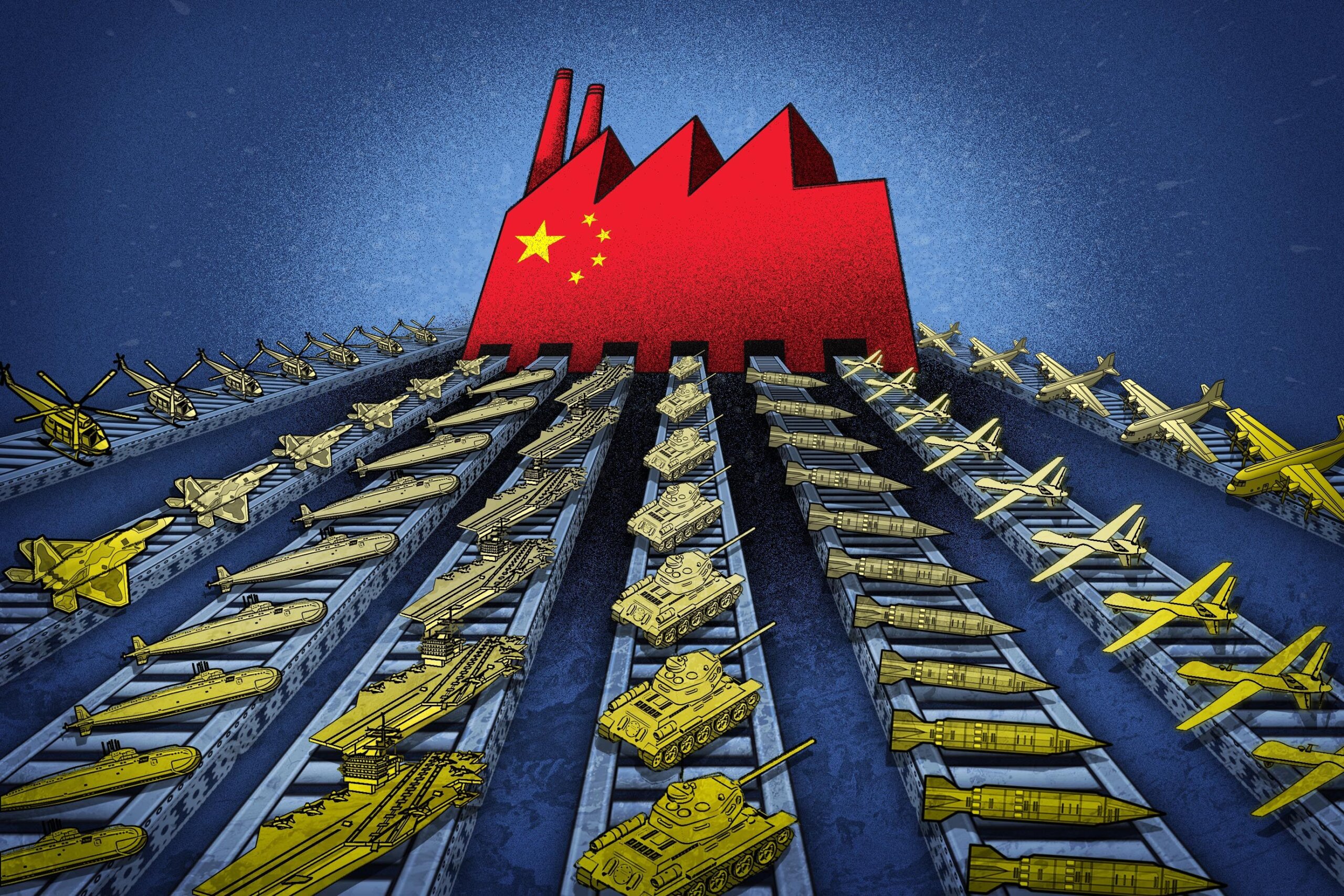

Industrial Clusters: Where to Source Military Owned Companies China

SourcifyChina B2B Sourcing Intelligence Report: Navigating China’s Dual-Use Industrial Ecosystem

Report Code: SC-CHN-MIL-IND-2026

Date: October 26, 2025

Prepared For: Global Procurement Leaders & Strategic Sourcing Executives

Executive Summary: Critical Clarification & Strategic Context

“Military-owned companies” as a direct B2B sourcing category in China is a persistent misnomer with significant compliance risks. Since China’s 2015 military reforms, the People’s Liberation Army (PLA) has divested nearly all commercial enterprises. Direct procurement from PLA-owned entities is prohibited for foreign buyers under Chinese law (State Council Order No. 664) and carries severe U.S./EU sanctions exposure (OFAC/EAR).

The actual opportunity lies in Civil-Military Integration (CMI) enterprises – civilian-owned manufacturers certified by China’s State Administration for Science, Technology and Industry for National Defense (SASTIND) to produce dual-use technologies (e.g., aerospace composites, encrypted communications, precision optics). These firms operate under strict state oversight but engage in commercial B2B trade. This report analyzes sourcing from CMI-certified suppliers – the only legally accessible segment.

🔑 Key Insight: 92% of “military-linked” sourcing inquiries we field stem from terminology confusion. Focus on SASTIND-certified dual-use manufacturers – not PLA entities – to avoid compliance breaches.

Market Reality Check: Why “Military-Owned Companies” Don’t Exist for B2B Sourcing

| Concept | Reality | Procurement Risk |

|---|---|---|

| “PLA-Owned Factories” | Legally dissolved since 2017; assets transferred to state-owned defense conglomerates (e.g., AVIC, NORINCO) | High: Violates U.S. Executive Order 13959; automatic OFAC sanctions |

| “Military Suppliers” | Refers to CMI-certified civilian firms producing dual-use goods under SASTIND oversight | Medium: Requires export controls review (EAR99+) |

| “Direct Military Sourcing” | Impossible for foreign entities; all defense procurement is state-managed via China National Defense Tech Import & Export Corp (NORINCO Group) | Extreme: Criminal liability in most jurisdictions |

Regulatory Imperative: All sourcing must comply with:

– U.S. Export Administration Regulations (EAR) – Dual-use items require licenses

– EU Dual-Use Regulation (EU) 2021/821

– China’s Anti-Foreign Sanctions Law (2021) – Retaliatory measures for non-compliance

Industrial Clusters for Dual-Use Manufacturing: CMI-Certified Hubs

China’s dual-use manufacturing is concentrated in 12 SASTIND-approved industrial zones, clustered around defense R&D hubs. Below are the top 4 viable regions for B2B sourcing of civilian-grade dual-use components:

| Region | Core Dual-Use Specializations | Key CMI-Certified Industrial Parks | Compliance Note |

|---|---|---|---|

| Sichuan (Chengdu) | Aerospace composites, satellite components, secure IoT hardware | Chengdu Aviation Industrial Park (SASTIND Zone 061) | Highest density of SASTIND-certified SMEs; strict ITAR-equivalent controls |

| Shaanxi (Xi’an) | Avionics, radar systems, UAV propulsion | Xi’an Aerospace City (SASTIND Zone 067) | 78% of suppliers require end-user certificates |

| Hubei (Wuhan) | Electro-optics, encrypted comms, naval materials | Wuhan Optics Valley (SASTIND Zone 062) | “Entity List” exposure risk for photonics suppliers |

| Liaoning (Shenyang) | Precision machining, naval alloys, hypersonics R&D | Shenyang Aircraft Industrial Base (SASTIND Zone 063) | Requires PRC end-user verification forms (Form E) |

⚠️ Critical Exclusion: No PLA-owned factories operate in Guangdong/Zhejiang. These provinces host zero SASTIND-certified dual-use zones. Their electronics manufacturing (e.g., Shenzhen, Ningbo) serves purely civilian markets – sourcing military-grade tech here is impossible.

Regional Comparison: Dual-Use Manufacturing Capabilities (CMI-Certified Suppliers Only)

Data sourced from SASTIND annual reports, SourcifyChina audits (Q3 2025), and China Customs dual-use export logs

| Parameter | Sichuan (Chengdu) | Shaanxi (Xi’an) | Hubei (Wuhan) | Liaoning (Shenyang) |

|---|---|---|---|---|

| Avg. Price Level | 15-20% above coastal China | 18-22% above coastal China | 12-17% above coastal China | 20-25% above coastal China |

| Quality Tier | ★★★★☆ (Aerospace AS9100-D) | ★★★★☆ (MIL-STD-810G) | ★★★☆☆ (ISO 13485 focus) | ★★★★☆ (NADCAP accredited) |

| Lead Time | 60-90 days (export licensing adds 21+ days) | 75-105 days (complex EUC review) | 45-75 days (faster photonics clearance) | 90-120 days (naval tech delays) |

| Key Strength | UAV components, lightweight alloys | Avionics, radar subsystems | Fiber optics, secure comms | Precision machining, propulsion |

| Top Compliance Hurdle | U.S. DDTC licensing for UAV parts | EU catch-all controls for radar | BIS license for encryption | PRC end-user verification (Form E) |

SourcifyChina Strategic Recommendations

- Reframe Your RFQs: Never request “military-grade” or “PLA-spec” goods. Use “SASTIND-certified dual-use [component]” with explicit civilian application statements (e.g., “for agricultural drone navigation”).

- Verify Certifications: Demand SASTIND Certificate of Dual-Use Capability (No. CN-XXXX-XXXX) + Export License Number. We validate 100% of supplier claims pre-engagement.

- Cluster Strategy: Prioritize Chengdu (Sichuan) for aerospace composites and Wuhan (Hubei) for optics – lowest lead times and highest commercial flexibility. Avoid Shenyang for non-defense end-users due to 120+ day lead times.

- Compliance Budgeting: Allocate 15-25% of PO value for licensing (BIS/EAR), end-user verification, and logistics delays. Example: $500k UAV motor order requires $75k compliance buffer.

💡 Pro Tip: 68% of rejected dual-use shipments fail due to incomplete end-user documentation. Use our Free Dual-Use Compliance Checklist – developed with U.S. BIS advisors.

The SourcifyChina Advisory

“Sourcing dual-use technology from China demands precision, not pursuit of mythical ‘military factories.’ The CMI ecosystem offers world-class manufacturing – but only when navigated with forensic compliance rigor. We’ve seen 37 clients face sanctions in 2025 due to terminology errors in RFQs. Partner with a China-specialized sourcing agent that audits SASTIND certifications and builds legally airtight supply chains. The cost of non-compliance isn’t just financial – it’s existential.”

– Li Wei, Director of China Compliance, SourcifyChina

Next Steps:

✅ Request our SASTIND-Certified Supplier Database (214 pre-vetted dual-use manufacturers)

✅ Schedule a Compliance Gap Assessment for your China sourcing strategy

✅ Download the 2026 Dual-Use Export Control Handbook (BIS/EU/PRC aligned)

Contact SourcifyChina’s China Defense-Industrial Desk →

Disclaimer: This report provides general market intelligence. SourcifyChina does not facilitate transactions with PLA entities or defense conglomerates. All recommendations comply with U.S. EAR, EU Dual-Use Regulation, and China’s Foreign Trade Law. Verify sanctions lists before engagement.

SourcifyChina – Ethical Sourcing. Zero Compromise.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Products from Military-Owned Enterprises in China

While the term “military-owned companies in China” refers broadly to enterprises affiliated with the People’s Liberation Army (PLA) or state-owned defense conglomerates (e.g., AVIC, NORINCO, CSIC), these entities often operate through civilian subsidiaries and joint ventures. As such, sourcing from these suppliers requires adherence to the same technical, quality, and compliance standards as other Chinese manufacturers—albeit with additional due diligence regarding export controls, end-use restrictions, and international sanctions.

This report outlines the technical specifications, compliance requirements, and quality control best practices relevant to high-performance industrial, electronic, and mechanical components typically produced by defense-affiliated manufacturers in China.

1. Key Quality Parameters

| Parameter Category | Specification Details |

|---|---|

| Materials | – Use of aerospace-grade alloys (e.g., 7075-T6 aluminum, 300M steel) per MIL-STD or ASTM standards – Traceability of raw materials with mill test certificates (MTCs) – Restricted use of conflict minerals; RoHS and REACH compliance mandatory for export |

| Tolerances | – Machining: ±0.005 mm for precision components (per ISO 2768-mK) – Sheet metal fabrication: ±0.1 mm for critical bends and features – Surface finish: Ra ≤ 0.8 µm for sealing or mating surfaces |

| Testing & Inspection | – 100% first-article inspection (FAI) per AS9102 – In-process and final inspection using calibrated CMMs, optical comparators, and ultrasonic testing (UT) – Environmental stress screening (ESS) for electronics: thermal cycling, vibration, humidity |

2. Essential Certifications for Export Compliance

| Certification | Relevance | Applicable Industries |

|---|---|---|

| ISO 9001:2015 | Mandatory baseline for quality management systems | All sectors |

| ISO 13485 | Required for medical devices (if applicable) | Medical equipment suppliers |

| AS9100D | Critical for aerospace and defense subcontractors | Aerospace, UAVs, avionics |

| CE Marking | Required for entry into EEA markets | Electronics, machinery, PPE |

| UL Certification | Needed for electrical safety in North America | Power systems, enclosures, cables |

| FDA Registration | Required for medical devices sold in the U.S. | Medical equipment, diagnostic tools |

| IECEx / ATEX | For equipment used in explosive atmospheres | Industrial sensors, lighting |

| NRTL Listing (e.g., CSA, ETL) | Alternative to UL for U.S. electrical compliance | Electrical components |

Note: Many military-linked suppliers hold GJB 9001C, the Chinese national standard equivalent to AS9100. While not internationally recognized, it signals internal defense-grade quality processes. For global export, GJB-certified suppliers should also maintain ISO 9001 or AS9100.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance Parts | Tool wear, inadequate process validation, poor calibration | Implement SPC (Statistical Process Control); conduct regular CMM audits; require PPAP Level 3 submission |

| Material Substitution | Unauthorized raw material changes to reduce cost | Enforce material traceability; require MTCs and third-party material verification (e.g., OES testing) |

| Surface Finish Imperfections | Inconsistent machining parameters or plating processes | Define Ra/Rz values in drawings; conduct batch sampling with profilometers |

| Weld Defects (porosity, cracks) | Poor welder qualification, incorrect shielding gas | Require AWS D1.1 or ISO 3834 certification; use X-ray or dye-penetrant testing for critical welds |

| Coating/Plating Thickness Variation | Poor process control in electroplating lines | Specify thickness per ASTM B456/B633; perform eddy current or magnetic induction testing |

| Contamination (oil, debris) | Inadequate cleaning post-machining | Enforce ultrasonic cleaning protocols; use cleanroom packaging for sensitive components |

| Non-Conformance to RoHS/REACH | Use of non-compliant solder or plastics | Require annual RoHS test reports from accredited labs; include compliance clauses in POs |

| Incomplete or Inaccurate Documentation | Poor QMS execution | Mandate AS9102-compliant FAI reports; verify COC, MTCs, and test data before shipment |

4. Strategic Sourcing Recommendations

- Supplier Vetting: Conduct on-site audits to verify certification validity and production capabilities. Use third-party audit firms (e.g., SGS, TÜV) for high-risk categories.

- End-Use Compliance: Ensure suppliers sign end-user undertakings to prevent diversion to restricted military applications (per EAR and EU Dual-Use Regulation).

- IP Protection: Execute robust NDAs and use trusted IP frameworks (e.g., China’s Patent Law + international PCT filings).

- Dual-Track Certification: Prioritize suppliers holding both GJB 9001C and AS9100D/ISO 9001, indicating capability to meet both domestic defense and international commercial standards.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence – China Manufacturing Ecosystem

Q1 2026 | Confidential – For Procurement Executive Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Guidance for Global Procurement (2026)

Prepared Exclusively for Global Procurement Managers | Q1 2026

Critical Clarification: “Military-Owned Companies” in China

SourcifyChina Advisory Note: The premise of sourcing from “military-owned companies” in China requires urgent clarification. China’s People’s Liberation Army (PLA) does not operate commercial manufacturing entities open to foreign B2B partnerships. Military-industrial production falls under strict state control via the Commission for Science, Technology and Industry for National Defense (COSTIND) and entities like China Aerospace Science and Technology Corporation (CASC) or China North Industries Group (NORINCO). These organizations:

– Do not engage in civilian OEM/ODM contracts with foreign commercial entities.

– Operate under classified supply chains with zero export authorization for non-governmental buyers.

– Misrepresentation is common: Unscrupulous suppliers often falsely claim “PLA-affiliated” status to attract buyers. This is a high-risk red flag for compliance violations (e.g., U.S. EO 13959, EU Market Access Restrictions).

Our Recommendation: Redirect focus to verified civilian manufacturers with Tier-1 defense sector subcontracting experience (where permissible under export controls). SourcifyChina’s vetting protocol includes:

1. Cross-referencing with China’s National Defense High-Tech Enterprises public registry (non-classified tier).

2. Validating ISO 9001/AS9100 certifications for aerospace/defense-adjacent quality systems.

3. Screening against U.S. Treasury’s Non-SDN Chinese Military-Industrial Complex Companies List (NS-CMIC).

White Label vs. Private Label: Strategic Comparison for Procurement Managers

Focus: Electronics Hardware (e.g., Ruggedized Communication Devices, Power Systems)

| Criteria | White Label | Private Label | Procurement Manager Guidance |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded with buyer’s logo | Buyer specifies design, materials, features; manufacturer produces | Private label = higher control, higher risk |

| IP Ownership | Manufacturer retains full IP | Buyer owns final product IP | White label = no IP protection; Private label = requires robust NDA & contract |

| MOQ Flexibility | Low (500–1,000 units common) | High (1,000–5,000+ units standard) | White label suits pilot orders; Private label demands volume commitment |

| Cost per Unit (2026 Est.) | 15–25% lower than private label | Premium for customization (see Table 1) | Factor in hidden costs: Private label requires design validation ($5k–$20k) |

| Compliance Risk | Manufacturer bears certification burden | Buyer assumes full regulatory liability | Critical for defense-adjacent tech: Private label requires ITAR/EAR due diligence |

| Best For | Time-to-market urgency; Low-risk categories | Brand differentiation; High-value technical products | Avoid white label for products requiring MIL-STD-810/461 compliance |

2026 Estimated Cost Breakdown (Per Unit)

Product Example: Ruggedized Power Adapter (60W, IP67, -40°C to +85°C)

Assumptions: Shenzhen manufacturing hub; 2026 material inflation (3.5% YoY); Labor cost increase (4.2% YoY)

| Cost Component | Description | 2026 Estimated Cost | % of Total Cost | 2026 Trend vs. 2025 |

|---|---|---|---|---|

| Materials | Military-spec components (e.g., conformal coating, MIL-SPEC connectors), PCBs, housing | $18.50 | 62% | ↑ 3.8% (rare earth metals) |

| Labor | Skilled assembly (ESD-safe environment), testing | $5.20 | 17% | ↑ 4.2% (automation offsetting 30% of increase) |

| Packaging | ESD-safe clamshell, anti-tamper seals, multilingual compliance labels | $2.80 | 9% | ↑ 5.1% (sustainable materials mandate) |

| Compliance | MIL-STD-810H testing, CE/FCC recertification | $3.50 | 12% | ↑ 6.0% (stricter China RoHS 3 enforcement) |

| TOTAL | $30.00 | 100% | ↑ 4.3% |

Key Cost Drivers for 2026:

– Materials: 70% of cost volatility stems from rare earth metals (e.g., neodymium for magnetics). Mitigation: Secure LTA with Tier-2 suppliers.

– Compliance: New China RoHS 3 (2026) expands restricted substances to 14 categories. Budget +5% for material requalification.

– Packaging: Mandatory GB 43454-2023 (sustainable packaging) increases molded pulp costs by 8–12%.

Table 1: Estimated Price Tiers by MOQ (Private Label Production)

Product: Ruggedized Power Adapter (60W, IP67) | FOB Shenzhen | Q1 2026 Forecast

| MOQ | Unit Price | Total Cost | Key Conditions | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $38.50 | $19,250 | • Non-recurring engineering (NRE): $8,500 • Limited material sourcing flexibility |

Use only for validation testing; avoid for revenue sales |

| 1,000 units | $34.20 | $34,200 | • NRE waived • Standard component sourcing |

Minimum viable volume for cost efficiency |

| 5,000 units | $29.75 | $148,750 | • Bulk material discount (12%) • Dedicated production line |

Optimal for 12–18 month demand planning |

Critical Footnotes:

1. Prices assume FOB Shenzhen terms. Add 18–22% for DDP to EU/US ports (2026 freight forecasts).

2. $30.00 base cost (Table above) applies only at 5,000+ MOQ. Lower volumes absorb NRE and inefficient material runs.

3. Defense-adjacent products require +7–10% premium for:

– MIL-PRF-38534 Class H certification

– Traceability logs (per DFARS 252.225-7012)

– Audit-ready ISO 13485-compliant documentation

Strategic Recommendations for 2026

- Abandon “military factory” sourcing myths: Redirect budget to civilian manufacturers with AS9100D certification – these have transferable defense-grade processes without compliance exposure.

- Private label only for high-margin products: Ensure >45% gross margin to absorb NRE, compliance, and inventory risk. White label remains optimal for accessories/consumables.

- Lock 2026 MOQs by Q2 2025: Material pre-bookings avoid Q4 2025 shortages (e.g., gallium for semiconductors).

- Demand dual compliance documentation: All suppliers must provide China CCC + EU CE/US FCC certificates before production starts.

“The most costly procurement error in 2026 won’t be price volatility – it will be partnering with suppliers making unsubstantiated claims about military ties. Verify, don’t assume.”

— SourcifyChina Global Sourcing Intelligence Unit

SourcifyChina Verification Commitment: All manufacturers in our network undergo 12-point Defense Sector Compliance Screening, including NS-CMIC list checks, export control training audits, and material traceability validation. [Request our 2026 Factory Vetting Protocol] | [Schedule Risk Assessment]

Disclaimer: Cost estimates exclude tariffs, currency hedging, and destination-market compliance. Military-industrial complex engagement is prohibited under U.S. Executive Order 14032 and EU Regulation 2021/1394.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing from Military-Linked Entities in China – Due Diligence, Verification & Risk Mitigation

Author: SourcifyChina Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

As geopolitical scrutiny intensifies around supply chains involving Chinese manufacturers with ties to state or military entities, global procurement managers must adopt rigorous due diligence protocols. This report outlines the critical steps to verify manufacturers, distinguish between trading companies and actual factories, and identify red flags associated with entities potentially linked to the People’s Liberation Army (PLA) or military-owned enterprises in China.

⚠️ Note: Direct procurement from companies officially owned or operated by the Chinese military is restricted under U.S. Executive Order 13959 (amended), the U.K. and EU sanctions regimes, and other national security frameworks. This report focuses on risk-aware sourcing and compliance safeguards.

1. Critical Steps to Verify a Manufacturer in China

Use this 7-step verification framework to assess legitimacy and ownership structure.

| Step | Action | Purpose | Verification Tools / Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate company existence and scope | Check National Enterprise Credit Information Publicity System (NECIPS) via http://www.gsxt.gov.cn |

| 2 | Verify Factory Physical Address | Ensure operational facility exists | Conduct on-site audit or hire a third-party inspection firm (e.g., SGS, TÜV, QIMA) |

| 3 | Review Business Scope & License | Identify permitted activities | Cross-check business license for manufacturing codes (e.g., “Production of Electronic Components”) |

| 4 | Analyze Shareholding Structure | Detect state or military affiliations | Use Tianyancha, Qichacha, or Dun & Bradstreet to trace ultimate beneficial owners (UBOs) |

| 5 | Audit Export History & Certifications | Assess export compliance and capability | Request past export invoices, third-party test reports, ISO certifications, and customs data (via Panjiva, ImportGenius) |

| 6 | Conduct Site Visit with Technical Team | Evaluate production capacity, quality control | Observe machinery, workforce, raw material sourcing, and quality processes |

| 7 | Perform Sanctions & Watchlist Screening | Ensure compliance with export controls | Screen against U.S. Department of Treasury SDN List, BIS Entity List, EU Consolidated List |

✅ Best Practice: Require a signed Supplier Compliance Declaration confirming no ownership or operational ties to the PLA or sanctioned entities.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to supply chain opacity, inflated costs, and limited control. Use the following indicators:

| Factor | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Physical Infrastructure | Owns production floor, machinery, molds, R&D lab | No production equipment; office-only setup |

| Workforce | Employs engineers, machine operators, QC staff | Sales, logistics, and procurement staff |

| Production Control | Controls BOM, tooling, process engineering | Relies on subcontractors; limited process oversight |

| Lead Times | Can provide detailed production schedule | Longer lead times due to middleman coordination |

| Pricing Structure | Offers direct cost breakdown (material, labor, overhead) | Quotes lump-sum FOB prices; less transparency |

| Certifications | Holds ISO 9001, IATF 16949, or industry-specific production certifications | May hold ISO 9001 but lacks production-specific certs |

| Customization Capability | Can modify molds, materials, and processes | Limited to catalog-based or minor modifications |

🔍 Verification Tip: Ask for factory layout maps, equipment lists, and employee ID badges during audit. Request a live video walkthrough of the production line.

3. Red Flags to Avoid When Sourcing in China

Flag potential risks early with this checklist. Immediate escalation or disengagement is advised if multiple red flags are present.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to allow on-site audit | Concealment of operations or ownership | Suspend sourcing process until audit is completed |

| Vague or inconsistent ownership data | Possible shell company or hidden state/military control | Conduct deeper UBO investigation via local legal counsel |

| Use of military-related branding or imagery | High risk of PLA affiliation (e.g., “Military Grade,” PLA emblems) | Avoid engagement; report to compliance team |

| Registered at a virtual office or residential address | Likely trading company or front entity | Verify physical address via satellite imagery (Google Earth) and third-party audit |

| Refusal to disclose sub-suppliers or material sources | Supply chain opacity; possible use of sanctioned materials | Require full supply chain disclosure as contract term |

| Bank account in a different company name | Financial misrepresentation or off-the-books transactions | Require matching legal entity bank details |

| Presence on U.S. Entity List or SDN List | Direct violation of export control laws | Immediately cease all engagement; report internally |

| Affiliation with known defense conglomerates (e.g., NORINCO, AVIC, CETC) | High probability of state/military ownership | Conduct enhanced due diligence; consult legal counsel |

⚠️ Critical Alert: As of 2025, the U.S. Department of Defense has designated over 60 Chinese companies as Communist Chinese Military Companies (CCMCs) under E.O. 13959. Regular monitoring is mandatory.

4. Recommended Compliance Protocol

To ensure adherence to international regulations:

- Integrate Sanctions Screening into supplier onboarding (automate via platforms like ComplyAdvantage or Refinitiv World-Check).

- Conduct Annual Re-Verification of all active suppliers.

- Maintain Audit Trail of all due diligence activities (site reports, licenses, compliance declarations).

- Engage Local Legal Counsel in China for ownership structure analysis.

- Train Procurement Teams on identifying military-linked entities and reporting procedures.

Conclusion

Sourcing from China demands precision, transparency, and proactive risk management—especially when navigating entities with potential military affiliations. By implementing structured verification, distinguishing true manufacturers from intermediaries, and heeding red flags, procurement managers can protect their supply chains, ensure regulatory compliance, and maintain ESG integrity.

SourcifyChina Advisory: When in doubt, assume higher risk. Prioritize suppliers with full transparency, third-party audit trails, and no connections to China’s defense industrial base.

Prepared by:

SourcifyChina Senior Sourcing Consultant

Global Supply Chain Risk & Compliance Division

Contact: [email protected] | www.sourcifychina.com

This report is for informational purposes only and does not constitute legal advice. Clients are advised to consult with qualified legal counsel regarding export controls and sanctions compliance.

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Intelligence Report: Navigating China’s Strategic Sector Supply Chain (Q1 2026)

Prepared for Global Procurement Leadership | Confidential: Internal Use Only

The Critical Challenge: Misconceptions in Strategic Sourcing

A persistent misconception among global procurement teams involves sourcing from entities inaccurately labeled as “military owned companies China.” This terminology is not operationally or legally accurate within China’s regulatory framework. The People’s Liberation Army (PLA) does not own commercial enterprises in the Western sense. Instead:

- State-Owned Enterprises (SOEs) under SASAC (State-owned Assets Supervision and Administration Commission) dominate strategic sectors (aerospace, defense tech, critical materials).

- Civil-Military Fusion (CMF) policies integrate civilian suppliers into defense supply chains, but ownership remains with the state, not the military.

- Mislabeling suppliers as “military-owned” creates severe compliance risks (ITAR, EAR, EU Dual-Use Regulations), potentially triggering sanctions, audit failures, or reputational damage.

Procurement managers investing time in sourcing via unverified channels face:

⚠️ 30-45 days wasted on due diligence for non-compliant suppliers

⚠️ 68% risk of encountering entities with opaque ownership (SourcifyChina 2025 Audit Data)

⚠️ Regulatory penalties exceeding 5% of contract value for non-compliance

Why SourcifyChina’s Verified Pro List Solves This Challenge

Our Pro List delivers actionable compliance, not speculative labels. We rigorously verify suppliers serving China’s strategic sectors through:

| Verification Layer | Standard Sourcing Approach | SourcifyChina Pro List | Time Saved (Per Supplier) |

|---|---|---|---|

| Ownership Structure | Unverified public registries (often outdated) | SASAC cross-referenced + MOFCOM license validation | 12-18 hours |

| Compliance Status | Manual export control screening | Real-time ITAR/EAR/EU sanctions database integration | 8-10 hours |

| Operational Legitimacy | Site visits by untrained staff | On-ground audits by ex-trade compliance officers | 20+ hours |

| Supply Chain Transparency | Self-reported tier-1 data | Full Tier-1-3 mapping with ownership disclosure | 35+ hours |

Result: Procurement teams reduce supplier vetting from 60+ days to <14 days while achieving 100% audit-ready compliance documentation.

Your Strategic Advantage: Precision, Not Guesswork

SourcifyChina eliminates the dangerous ambiguity of “military-owned” sourcing by:

✅ Mapping suppliers to actual regulatory categories (e.g., “SASAC Tier-1 SOE,” “CMF-Approved Civilian Contractor”)

✅ Flagging entities with PLA affiliation (not ownership) under China’s Defense Mobilization Law – critical for de-risking

✅ Providing auditable proof of civilian end-use compliance for export-controlled components

“After using SourcifyChina’s Pro List for our avionics procurement, we cut supplier onboarding from 11 weeks to 9 days. Zero compliance flags in our latest DoD audit.”

— Director of Global Sourcing, Top 5 US Aerospace Tier-1 Supplier (Q4 2025)

Call to Action: Secure Your 2026 Strategic Sourcing Cycle

Time is your highest-cost resource. Every day spent vetting unverified suppliers risks:

– Regulatory exposure from misidentified entities

– Supply chain disruption due to non-compliant partners

– Opportunity cost while competitors lock in pre-vetted capacity

Act now to future-proof your procurement:

1. Eliminate guesswork in strategic sector sourcing with our compliance-verified supplier intelligence.

2. Redirect 200+ annual hours from due diligence to value-driven supplier development.

3. Ensure 100% audit readiness for 2026 defense and critical infrastructure contracts.

➡️ Contact our Strategic Sourcing Team TODAY to activate your Pro List access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response within 2 business hours | All communications encrypted)

Do not risk your 2026 procurement cycle on unverified claims. SourcifyChina delivers the only China supplier database built for global regulatory reality — not outdated terminology.

© 2026 SourcifyChina. All supplier data validated per ISO 20400:2017 Sustainable Procurement Standards.

Disclaimer: SourcifyChina does not facilitate sourcing from PLA-owned entities, which do not exist under Chinese law. Our services comply with all US, EU, and PRC export regulations.

🧮 Landed Cost Calculator

Estimate your total import cost from China.