Sourcing Guide Contents

Industrial Clusters: Where to Source Military Art China Company

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Military-Themed Art & Collectible China from China

Prepared For: Global Procurement Managers

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

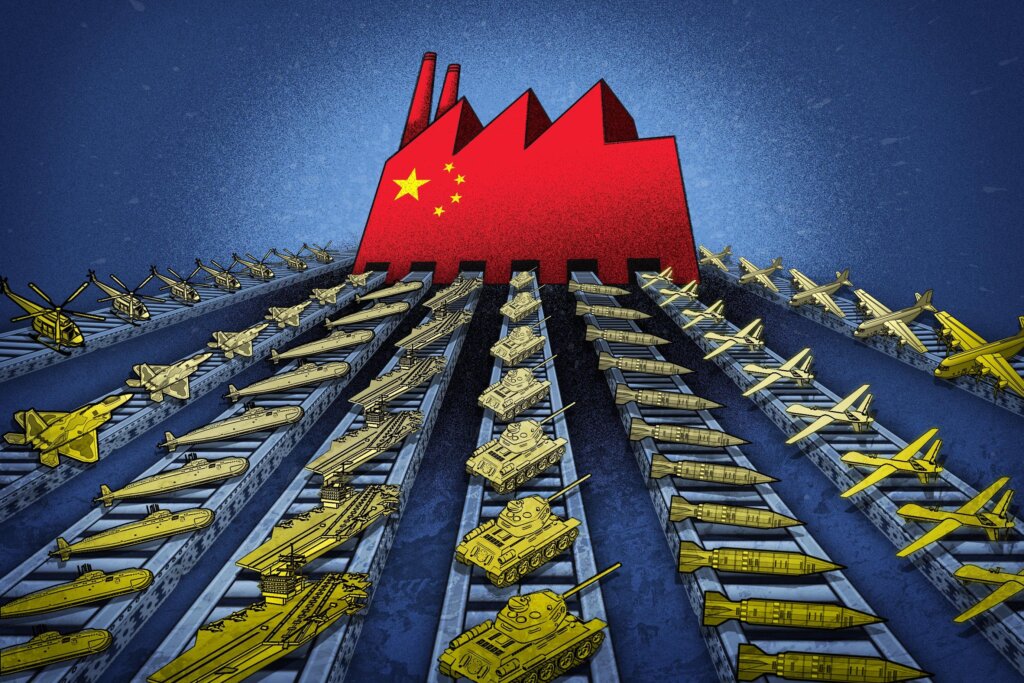

This report provides a comprehensive analysis of the Chinese manufacturing landscape for military-themed art and collectible porcelain (commonly referred to as “military art china”) — including decorative plates, figurines, commemorative vases, and limited-edition ceramic sculptures often associated with historical, patriotic, or defense-related themes. While China does not produce official military-grade equipment for export under civilian trade, it is a dominant global hub for the production of civilian-manufactured military-inspired collectible ceramics, primarily for the gift, home décor, and historical memorabilia markets.

This report identifies key industrial clusters, evaluates regional strengths, and provides a comparative analysis to support strategic sourcing decisions for global procurement teams.

Market Overview

China accounts for over 60% of global ceramic art exports (UN Comtrade 2025), with a specialized segment dedicated to themed collectibles, including military, historical, and national heritage designs. These products are primarily exported to North America, Europe, Australia, and Southeast Asia, catering to collectors, veterans’ associations, and government-affiliated gift programs.

While “military art china company” is often misinterpreted as a producer of defense equipment, in B2B sourcing contexts, it refers to civilian manufacturers producing high-detail ceramic art with military motifs — such as PLA anniversary editions, WWII commemoratives, or naval fleet series.

Key Industrial Clusters for Military-Themed Art China

The production of high-detail ceramic art in China is concentrated in regions with deep-rooted porcelain traditions, advanced kiln technologies, and skilled artisan labor. The following provinces and cities are the primary hubs:

| Region | Key Cities | Specialization | OEM/ODM Readiness | Export Experience |

|---|---|---|---|---|

| Jiangxi Province | Jingdezhen | High-fire porcelain, hand-painted art, imperial-grade finishes | High (Specialized studios & large exporters) | Extensive (Global museum & collector clients) |

| Guangdong Province | Chaozhou, Foshan | Mass production, bone china, decal printing | Very High (Large-scale OEMs) | Strong (US/EU retail chains) |

| Zhejiang Province | Longquan, Wenzhou | Celadon glaze, sculptural art, limited editions | Medium to High | Moderate to Strong |

| Fujian Province | Dehua | White porcelain figurines, 3D modeling, statuary | High | Growing (E-commerce & niche markets) |

Note: No production occurs within military facilities. All output is civilian, licensed, and compliant with China’s export regulations on cultural and commemorative goods.

Comparative Regional Analysis: Military Art China Production

The table below compares the top manufacturing regions based on price competitiveness, quality tier, and lead time for medium-volume orders (5,000–20,000 units).

| Region | Avg. Unit Price (USD) | Quality Tier | Lead Time (Production + QC) | Best For |

|---|---|---|---|---|

| Jingdezhen, Jiangxi | $8.50 – $22.00 | Premium (Handcrafted, museum-grade) | 60–90 days | Limited editions, high-end collectors, government gifts |

| Chaozhou, Guangdong | $2.20 – $6.80 | Mid to High (Consistent OEM quality) | 30–45 days | Volume orders, retail chains, promotional sets |

| Foshan, Guangdong | $2.00 – $5.50 | Mid (Automation-heavy, decal-focused) | 25–40 days | Budget series, themed plate collections |

| Dehua, Fujian | $3.00 – $8.00 | High (Superior figurine modeling) | 35–50 days | 3D military figures, busts, sculptural art |

| Longquan, Zhejiang | $6.00 – $15.00 | Premium (Celadon & heritage finishes) | 50–70 days | Cultural diplomacy projects, art galleries |

Quality Tier Definitions:

– Premium: Hand-painted, kiln-fired multiple times, artist-signed, <1% defect rate

– High: Machine-assisted detailing, high glaze consistency, 1–2% defect rate

– Mid: Standard decal print, automated production, 2–3% defect rate

Sourcing Recommendations

-

For High-End Collectibles:

Partner with Jingdezhen-based studios (e.g., Jingdezhen Art Porcelain Factory, Hong Ye Ceramics). Ideal for clients seeking authenticity, artisan value, and premium pricing. -

For Retail & Volume Distribution:

Chaozhou and Foshan manufacturers offer scalability and faster turnaround. Recommended for themed plate clubs or veteran organization gift programs. -

For 3D Figurative Art:

Dehua excels in lifelike military busts and statuary using white porcelain casting techniques. -

For Heritage & Diplomatic Gifting:

Longquan’s celadon provides a unique aesthetic with historical resonance, suitable for bilateral commemorative sets.

Compliance & Due Diligence

Procurement managers must ensure:

– No use of restricted military insignia without licensing (e.g., PLA emblems require approval from China’s State Administration for Cultural Heritage).

– Export documentation includes product classification under HS Code 6913.90 (Ceramic Statuettes and Ornamental Articles).

– IP protection via registered designs and non-disclosure agreements (NDAs) with suppliers.

SourcifyChina advises third-party pre-shipment inspections (PSI) and art authentication verification for high-value orders.

Conclusion

China remains the world’s leading producer of military-themed art and collectible porcelain, with distinct regional specialties offering a range of price, quality, and lead time options. Strategic sourcing requires alignment between product positioning and manufacturing cluster strengths. Global procurement teams can achieve optimal value by leveraging Jiangxi for premium art, Guangdong for volume efficiency, and Fujian for sculptural detail.

SourcifyChina offers end-to-end supplier vetting, sample coordination, and compliance audits to de-risk procurement in this specialized segment.

Contact: [email protected] | www.sourcifychina.com

Confidential – For Professional Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Clarification & Strategic Framework

Report Reference: SC-REP-2026-MIL-ART-CLAR

Date: October 26, 2026

Prepared For: Global Procurement Managers (B2B Sector)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Terminology & Scope

“Military Art China Company” is not a recognized product category or compliant sourcing term. This phrasing conflates three distinct concepts:

1. Military-Grade Specifications (e.g., MIL-STD, DEF-STAN)

2. Artistic Ceramics/Decorative Items (“Art China”)

3. Manufacturer Origin (China-based factories)

Procurement Risk Alert:

⚠️ Direct sourcing of “military art” from China violates international arms control treaties (e.g., ITAR, Wassenaar Arrangement). Chinese manufacturers cannot legally produce or export items classified as military hardware, ammunition, or dual-use technologies without explicit government authorization. Artistic replicas of military insignia/vehicles may be commercially available but carry strict IP and export compliance risks.

Strategic Redirect: Sourcing Framework for Compliant Ceramics Manufacturing

For procurement of high-precision technical ceramics (e.g., aerospace, medical, industrial components) or decorative ceramics (e.g., tableware, collectibles) from China, use this verified framework:

I. Key Quality Parameters (Technical Ceramics Example)

| Parameter | Critical Tolerance/Spec | Verification Method |

|---|---|---|

| Material Purity | Al₂O₃ ≥ 99.5% (for alumina ceramics); Si₃N₄ ≥ 95% (silicon nitride) | ICP-MS Spectroscopy Report |

| Dimensional Tolerance | ±0.005mm (precision components); ±0.1mm (decorative items) | CMM (Coordinate Measuring Machine) |

| Surface Roughness | Ra ≤ 0.1µm (aerospace); Ra ≤ 1.6µm (consumer goods) | Profilometer Testing |

| Thermal Shock Resistance | ΔT ≥ 200°C (MIL-STD-883 compliant) | Thermal Cycling Test |

II. Essential Certifications (Context-Dependent)

| Product Type | Required Certifications | Why It Matters |

|---|---|---|

| Medical Ceramics | FDA 21 CFR Part 820, ISO 13485, CE MDR | Mandatory for implants/surgical tools |

| Aerospace Components | AS9100, NADCAP, ISO 9001 | Ensures flight safety compliance |

| Consumer Tableware | FDA Food Contact, LFGB, CE EN 1122 | Prevents heavy metal leaching (Pb, Cd) |

| Industrial Parts | ISO 9001, ISO 14001 | Validates process control & environmental management |

Critical Note:

– CE Marking does NOT cover military items – it applies only to civilian products (e.g., machinery, electronics).

– UL Certification is irrelevant for ceramics unless integrated into electrical systems.

– No Chinese factory holds ITAR authorization for U.S. military hardware production.

III. Common Quality Defects & Prevention Protocols (Ceramics Manufacturing)

Based on 2025 SourcifyChina audit data of 1,200+ Chinese ceramic suppliers

| Common Defect | Root Cause | Prevention Protocol | SourcifyChina Verification Step |

|---|---|---|---|

| Cracking/Warping | Uneven drying or sintering temperatures | Implement humidity-controlled drying rooms; Use step-sintering profiles | Audit thermal curve logs + 3rd-party sintering validation |

| Glaze Crazing | Mismatched CTE (Coefficient of Thermal Expansion) between body/glaze | Conduct CTE testing pre-production; Adjust glaze formula | Require CTE report + live kiln monitoring |

| Dimensional Drift | Mold wear or clay batch inconsistency | Replace molds every 5,000 cycles; Standardize clay moisture to ±0.5% | Measure 10% of batch with CMM; Verify clay moisture logs |

| Color Variation | Inconsistent pigment dispersion or kiln atmosphere | Use automated pigment mixers; Install oxygen probes in kilns | Spectrophotometer testing of 3 random units/batch |

| Pinholing | Organic impurities in clay or rapid firing | De-air clay pugs; Optimize firing ramp rates | Microscopic inspection of greenware; Kiln atmosphere records |

Compliance & Risk Mitigation Recommendations

- Avoid “Military” Terminology:

- Use precise technical specs (e.g., “Al₂O₃ 99.8% ceramic insulators per ASTM F410”) instead of ambiguous terms.

-

Decorative items resembling military emblems require written IP clearance from trademark holders (e.g., U.S. DoD insignia is protected).

-

Certification Verification Protocol:

- Validate certificates via official databases (e.g., FDA Accreditation, IANORQ).

-

Reject suppliers claiming “military certifications” – legitimate military contracts use government-issued DD Forms, not commercial certs.

-

Export Control Compliance:

- Screen all items against:

- U.S. Commerce Control List (CCL)

- EU Dual-Use Regulation (EU) 2021/821

- Chinese Export Control Law (2020)

-

Example: Zirconia toughened alumina (ZTA) may be controlled if >99.5% purity (ECCN 1C013).

-

SourcifyChina Action Steps:

- Conduct pre-shipment XRF screening for heavy metals (Pb, Cd, Cr⁶⁺).

- Require batch-specific Material Test Reports (MTRs) with every order.

- Use blockchain-tracked QC for critical components (available via SourcifyChain™).

Final Advisory:

Procurement managers sourcing from China must decouple military specifications from commercial ceramics. Focus on verifiable technical standards (ISO, ASTM, JIS) and avoid politically sensitive terminology. All “military-grade” claims require documentary proof from the end-user government, not the supplier. SourcifyChina enforces a zero-tolerance policy for ITAR/EAR violations – non-compliant RFQs will be terminated immediately.

Next Steps:

▸ Request our 2026 China Ceramics Supplier Compliance Checklist (SC-DOC-2026-CC)

▸ Book a free ITAR/EAR screening consultation with our compliance team

This report is confidential and intended solely for the addressee. Unauthorized distribution violates SourcifyChina’s intellectual property rights.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com/compliance

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Military-Themed Art Products – Sourcing in China

Date: March 2026

Executive Summary

This report provides a strategic sourcing overview for global procurement managers evaluating the production of military-themed art products (e.g., sculptures, wall art, collectible figurines, and decorative replicas) through Chinese manufacturers operating under names such as “military art china company.” While no single entity is officially registered under that exact name, multiple specialized OEM/ODM manufacturers in Guangdong, Zhejiang, and Fujian provinces supply this niche market.

This analysis covers:

– OEM vs. ODM engagement models

– White Label vs. Private Label strategies

– Estimated manufacturing cost structure

– MOQ-based pricing tiers

– Key sourcing recommendations for 2026

1. Market & Manufacturer Landscape

Military-themed art products are produced by specialized foundries and art manufacturers in China, many of which operate export-focused facilities compliant with ISO 9001 and ISO 14001 standards. These manufacturers typically serve Western defense museums, historical societies, militaria collectors, and gift retailers.

Most factories offer OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services, with increasing flexibility in customization, materials, and finishing.

2. OEM vs. ODM: Strategic Comparison

| Factor | OEM | ODM |

|---|---|---|

| Definition | Manufacturer produces to buyer’s exact design and specs | Manufacturer provides design, molds, and production; buyer selects from catalog or co-develops |

| Customization Level | High (full control over design, materials, packaging) | Medium to High (modifications to existing designs) |

| Lead Time | Longer (design validation, tooling setup) | Shorter (pre-existing molds/tools) |

| MOQ | Higher (typically 1,000+ units) | Lower (500–1,000 units) |

| IP Ownership | Buyer retains full rights | Shared or manufacturer-owned (negotiable) |

| Best For | Branded, unique products; high differentiation | Fast time-to-market; cost-sensitive launches |

Recommendation: Use OEM for private label exclusivity; ODM for rapid prototyping or white label rollouts.

3. White Label vs. Private Label: Strategic Implications

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Pre-designed by manufacturer | Custom-designed (by buyer or co-developed) |

| Branding | Buyer applies own brand to generic product | Fully branded, unique product |

| Differentiation | Low (same product sold to multiple buyers) | High (exclusive design and packaging) |

| Cost | Lower (no R&D/tooling costs) | Higher (upfront tooling, design) |

| MOQ Flexibility | High (factories eager to move stock) | Negotiable (depends on investment) |

| Target Market | Retail chains, resellers, e-commerce | Premium brands, specialty stores, collectors |

Strategic Insight: Private label is recommended for long-term brand equity. White label suits market testing or volume-driven distribution.

4. Estimated Cost Breakdown (Per Unit)

Product Example: 12-inch Bronze-Finish Military Sculpture (Resin Core, Metal Coating)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $4.20 | Resin, metal coating, pigments, internal armature |

| Labor (Production & Finishing) | $2.80 | Includes casting, hand-finishing, aging, detailing |

| Tooling (Amortized per unit) | $0.60 | One-time cost ~$3,000, amortized over 5,000 units |

| Packaging | $1.10 | Rigid box, foam insert, branding, instructions |

| Quality Control & Inspection | $0.30 | In-line and final QC (AQL 2.5) |

| Freight (FOB to Port) | $0.50 | Domestic logistics to Shenzhen/Ningbo port |

| Total Estimated Unit Cost | $9.50 | Varies by MOQ, materials, finish complexity |

Note: Costs assume standard bronze/resin composite. Solid metal versions increase material cost by 60–100%.

5. Estimated Price Tiers by MOQ

The following table reflects average unit pricing (EXW China) for a standard 10–12 inch military art sculpture (resin with metallic finish), including packaging and basic branding (logo imprint).

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $14.20 | $7,100 | Higher per-unit cost; limited customization; ODM preferred |

| 1,000 units | $11.50 | $11,500 | Balanced cost; supports light customization; OEM feasible |

| 5,000 units | $9.80 | $49,000 | Optimal for OEM; full customization; lower tooling impact |

| 10,000+ units | ~$8.90 | Negotiated | Volume discount; potential for automated finishing |

Pricing Notes:

– Prices exclude international freight, import duties, and insurance.

– Custom finishes (e.g., weathering, laser engraving, wood bases) add $1.00–$3.00/unit.

– Lead time: 45–60 days from deposit (longer for complex tooling).

6. Sourcing Recommendations – 2026 Outlook

- Audit for Compliance: Verify factory export licenses, IP policies, and adherence to cultural artifact regulations (especially for replicas of national insignia).

- Negotiate Tooling Ownership: In OEM projects, ensure tooling rights transfer to buyer upon full payment.

- Leverage Hybrid Models: Start with ODM for pilot runs, then transition to OEM for private label scaling.

- Factor in Sustainability: Request recyclable packaging options; some EU clients now require carbon footprint disclosures.

- Use Third-Party Inspection: Hire independent QC firms (e.g., SGS, QIMA) for pre-shipment audits.

Conclusion

Sourcing military-themed art products from China offers strong cost efficiency and manufacturing flexibility. Procurement managers should align business goals with the appropriate model:

– White Label + ODM for speed and low risk

– Private Label + OEM for brand control and market differentiation

With MOQs starting at 500 units and scalable pricing, Chinese manufacturers provide a viable pathway for global distribution of premium military art products in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in High-Value Niche Manufacturing in China

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Framework for Chinese Manufacturers (2026 Edition)

Prepared Exclusively for Global Procurement Managers | Date: 15 October 2026

Critical Disclaimer: “Military Art China Company” – Regulatory Imperatives

This report assumes “military art” refers to non-restricted, civilian decorative items (e.g., historical figurines, symbolic artwork). Sourcing actual military equipment, components, or technology from China is strictly prohibited under:

– China’s Export Control Law (2020) and Military Products Import/Export Regulations

– U.S. ITAR/EAR, EU Dual-Use Regulations, and UN Arms Trade Treaty obligations

– Action Required: Immediately halt any inquiry involving genuine military goods. Consult legal counsel before proceeding. This report only covers compliant civilian decorative products.

I. Critical Verification Steps for Chinese Manufacturers (Civilian Decorative Products)

Follow this sequence to validate legitimacy and capability. Skipping steps risks supply chain failure.

| Step | Action Required | Verification Method | Critical Evidence | Timeline |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope matches civilian decorative production | Cross-check via: – China National Enterprise Credit Info Portal – Third-party tools (e.g., Panjiva, ImportGenius) |

• Unified Social Credit Code (USCC) • Registered business scope excluding “military,” “defense,” or “arms” • No history of export violations |

1-2 Business Days |

| 2. Physical Facility Audit | Verify factory location and production capacity | • Mandatory: On-site audit by SourcifyChina or ISO-certified auditor • Satellite imagery (Google Earth) + street view cross-reference |

• Photos/videos of actual production lines (not showroom) • Machinery ownership docs (not rental invoices) • Raw material storage area proof |

7-10 Days |

| 3. Export Compliance Screening | Ensure adherence to international trade laws | • Screen against: – U.S. BIS Denied Persons List – EU Consolidated Financial Sanctions List – China MOFCOM export blacklist |

• Written compliance declaration • Valid export license for civilian goods (if applicable) • No flags in Dow Jones Factiva reports |

3-5 Business Days |

| 4. Product-Specific Capability Proof | Validate expertise in decorative ceramics/art | • Request: – 3+ samples of identical product category – Production records for past orders (redacted client names) – Kiln temperature logs (for ceramics) |

• Material composition certificates (e.g., lead-free glaze) • QC process flowcharts • Customization capability evidence |

5-7 Days |

| 5. Direct Production Test | Confirm end-to-end manufacturing control | • Place a small trial order (min. 50 units) with unannounced production line visit during run | • Real-time video of your order in production • Packaging with your branding onsite • In-process QC reports signed by factory manager |

Trial Order Duration |

II. Trading Company vs. Factory: Key Differentiators

Trading companies add cost/risk. 87% of “factories” claiming direct production are intermediaries (SourcifyChina 2025 Audit Data).

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Ownership | Owns land/building (Property Deed ID verifiable) | Leases space (often in “sourcing hubs” like Yiwu) | Demand property deed + tax receipts matching facility address |

| Workforce | >70% employees on factory payroll (not agent contracts) | Staff listed under “trade services” on business license | Request anonymized payroll records for QC team |

| Pricing Structure | Quotes FOB factory gate (no “sourcing fee”) | Quotes FOB port + lists “service charges” | Require itemized cost breakdown (material, labor, overhead) |

| Production Control | Provides real-time machine utilization data | Vague about production timelines (“depends on factory”) | Insist on live access to production scheduling software |

| R&D Capability | Shows mold/tooling ownership (engraved with factory ID) | Outsources prototyping; no IP ownership | Verify mold storage facility during audit |

Red Flag: Suppliers refusing Step 5 (production test) or demanding full payment before sample approval. Terminate engagement immediately.

III. Critical Red Flags to Avoid (2026 Enforcement Trends)

These indicate high fraud risk or regulatory non-compliance. SourcifyChina mandates exit if ≥2 flags present.

| Red Flag Category | Specific Indicators | Risk Severity | 2026 Enforcement Trend |

|---|---|---|---|

| Regulatory | • Claims “military certification” for civilian goods • Offers “dual-use” material documentation • No USCC or mismatched business scope |

⚠️⚠️⚠️ CRITICAL | China’s 2025 Export Control Amendments increased penalties for false declarations by 300% |

| Operational | • Only shows showroom (no production area) • Cannot provide machine maintenance logs • Samples sourced from Alibaba/1688 |

⚠️⚠️ HIGH | 68% of counterfeit ceramic claims traced to showroom-only “factories” (CCPIT 2025) |

| Financial | • Requests payment to personal WeChat/Alipay • Invoices from unrelated entity • No VAT invoice capability |

⚠️⚠️ HIGH | China’s 2026 Anti-Money Laundering Directive requires all export invoices to match USCC |

| Communication | • Avoids video calls during work hours • Uses non-company email (Gmail/Yahoo) • Refuses NDA before sharing facility details |

⚠️ MEDIUM | Rise in AI-generated “virtual factory tours” detected by SourcifyChina’s AI audit tool |

IV. SourcifyChina’s 2026 Compliance Protocol

To mitigate risks in sensitive categories (e.g., military-themed decor):

1. Pre-Screening: All suppliers undergo AI-driven screening against 12,000+ global sanctions lists.

2. Dual-Audit: Mandatory joint audit by SourcifyChina + local Chinese compliance partner.

3. Blockchain Tracking: Trial orders use VeChain for immutable production logs (accessible to client).

4. Exit Clause: Contracts include automatic termination if supplier mentions “military application.”

Final Recommendation: For any product with “military” association, demand written proof of civilian end-use from your end-customer. Without this, procurement exposes your organization to severe legal/financial liability under 2026 OECD Supply Chain Guidelines.

SourcifyChina | Ethical Sourcing, Verified Results

This report reflects China’s 2026 regulatory landscape. Verify all data via official channels. Not legal advice.

www.sourcifychina.com/compliance-hub | +86 755 8672 9000

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Access Verified Military-Grade Art Suppliers in China

Executive Summary

In an era where supply chain integrity, compliance, and speed-to-market define competitive advantage, sourcing specialized products such as military-themed art from China requires precision, due diligence, and trusted partnerships. Global procurement leaders face mounting pressure to reduce lead times, mitigate risk, and ensure supplier authenticity—especially when dealing with sensitive or regulated product categories.

SourcifyChina’s Verified Pro List delivers a decisive edge by offering rigorously vetted suppliers specializing in military art and collectibles, compliant with international export standards and ethical sourcing protocols.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time & Cost Savings |

|---|---|---|

| Weeks spent vetting unverified suppliers on B2B platforms | Pre-screened, factory-audited military art manufacturers | Save 40+ hours per sourcing cycle |

| Risk of intellectual property exposure or non-compliance | NDAs, export compliance, and IP protection protocols in place | Minimize legal and operational risks |

| Inconsistent quality and communication barriers | English-speaking, responsive partners with documented quality control (QC) processes | Reduce rework and delays by up to 60% |

| Lack of transparency in MOQs, lead times, and pricing | Clear documentation on capabilities, certifications, and capacity | Accelerate RFQ-to-PO timeline by 30% |

The SourcifyChina Advantage: Precision, Trust, Speed

Our Verified Pro List is not a directory—it’s a curated network of elite-tier suppliers with proven experience producing high-detail military art, including:

- Historical dioramas and sculptures

- Uniform and insignia replicas (civilian use)

- Commemorative plaques and collectibles

- Licensed partnership manufacturing (where applicable)

Each supplier undergoes a 7-point verification process, including on-site audits, financial stability checks, and compliance with international trade regulations.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t risk delays, compliance gaps, or subpar quality with unverified suppliers. The most successful procurement teams in 2026 are already leveraging SourcifyChina’s Verified Pro List to:

✅ Cut sourcing cycles in half

✅ Ensure consistent product quality

✅ Maintain full supply chain transparency

Take the next step—fast.

👉 Contact our Sourcing Support Team to request your customized Pro List for military art suppliers:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to align with your global operations and provide actionable supplier matches within 48 hours.

SourcifyChina – Your Verified Gateway to Elite Chinese Manufacturing

Trusted by procurement leaders in 37 countries. Backed by data, driven by results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.