The global market for precision fasteners and high-performance aerospace components—key categories under MIL-PRF-87257 specifications—has seen steady expansion, driven by increasing defense spending and advancements in aviation technology. According to Grand View Research, the global aerospace fasteners market size was valued at USD 5.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by rising aircraft production, especially in commercial and military sectors, and stringent regulatory requirements for reliability and performance in extreme environments—conditions that MIL-PRF-87257-compliant components are specifically engineered to meet. As demand for certified, traceable, and high-strength fastening solutions increases, identifying reliable manufacturers becomes critical for primes and subcontractors alike. Below are the top 9 manufacturers recognized for their compliance, production capability, and technical expertise in producing MIL-PRF-87257-specified parts.

Top 9 Mil Prf 87257 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

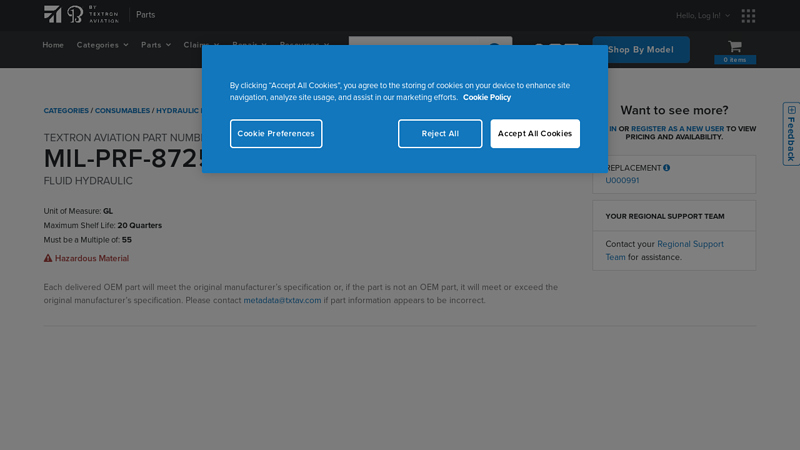

#1 MIL-PRF-87257

Domain Est. 2014

Website: ww2.txtav.com

Key Highlights: TEXTRON AVIATION PART NUMBER MIL-PRF-87257 FLUID HYDRAULIC Hazardous Material NOTES Each delivered OEM part will meet the original manufacturer’s specification….

#2 [PDF] mil

Domain Est. 2004

Website: petroleumservicecompany.com

Key Highlights: Page 2. Radco Industries, Inc. | 700 Kingsland Drive, Batavia, IL 60510 | 630-232-7966 | www.radcoind.com. MIL-PRF-87257C RADCOLUBE® FR257. PROPERTY. Acid ……

#3 AeroShell Fluid 31

Domain Est. 1989

Website: shell.com

Key Highlights: Synthetic hydrocarbon hydraulic fluid with enhanced fire resistance, high flash point, and temperature stability. MIL-PRF-83282D….

#4 Shop Talk: Change in Hydraulic Fluid

Domain Est. 1997

Website: onboardsystems.com

Key Highlights: MIL-PRF-87257 has been validated for operation to -65°F (-53.9°C) and is also suitable as a drop-in replacement for both MIL-PRF-5606 and MIL-H-83282. Since ……

#5 Military Lubricants

Domain Est. 1998

Website: radcoind.com

Key Highlights: (MIL-PRF-87257F) Synthetic, fire resistant hydraulic fluid consisting of synthetic hydrocarbon base oils and additives. Safe for use in low temperature ……

#6 MIL

Domain Est. 1999

#7 Castrol Brayco Micronic 881 MIL

Domain Est. 1999

#8 RADCOLUBE® FR257 Red MIL

Domain Est. 2003

Website: acilubes.com

Key Highlights: In stock $5 deliveryRADCOLUBE FR257 Red is a specialized fire-resistant synthetic low-temperature hydraulic fluid meticulously formulated to meet the MIL-PRF-87257C specification….

#9 MIL

Domain Est. 2005

Website: pilotjohn.com

Key Highlights: 4-day delivery 30-day returnsMIL-PRF-87257 hydraulic fluid is a specification established by the U.S. military for fire-resistant hydraulic fluid used in aircraft hydraulic systems…

Expert Sourcing Insights for Mil Prf 87257

H2: 2026 Market Trends Analysis for MIL-PRF-87257

MIL-PRF-87257 is a U.S. military performance specification that covers high-performance, electrically conductive, anti-static, and EMI/RFI shielding gaskets used in military and aerospace applications. These gaskets are essential for ensuring electromagnetic interference (EMI) shielding, environmental sealing, and grounding continuity in harsh operational environments. As we approach 2026, several key market trends are shaping the demand, development, and application of components compliant with MIL-PRF-87257.

-

Increased Defense and Aerospace Modernization Programs

Governments worldwide, particularly the U.S., are investing heavily in modernizing military platforms—including aircraft, ground vehicles, and naval systems. Programs such as the F-35 upgrade cycle, Next Generation Air Dominance (NGAD), and hypersonic weapons development are driving demand for MIL-PRF-87257-compliant gaskets. These systems require advanced EMI shielding to support integrated electronic warfare (EW), communication, and sensor systems, increasing reliance on high-reliability shielding solutions. -

Growth in Electromagnetic Compatibility (EMC) Requirements

As battlefield electronics become more complex and densely packed, ensuring electromagnetic compatibility (EMC) is critical. MIL-PRF-87257 gaskets offer consistent shielding effectiveness across a broad frequency spectrum. With the proliferation of electronic systems in unmanned platforms and command-and-control networks, compliance with stringent EMC standards is expected to boost demand for certified gasket solutions. -

Expansion of the Defense Supply Chain and Dual-Use Technologies

The line between military and commercial aerospace technology is blurring. Commercial satellite constellations, space exploration initiatives (e.g., Artemis program), and high-altitude platforms often adopt MIL-PRF-87257 components due to their reliability. This dual-use trend expands the market beyond traditional defense contractors into private space and aviation sectors, creating new growth avenues by 2026. -

Material Innovation and Performance Enhancements

Ongoing R&D is focused on improving the durability, conductivity, and environmental resistance of gasket materials—especially for extreme conditions (e.g., high temperatures, salt fog, vibration). Silicone-based elastomers with embedded conductive particles (e.g., silver, nickel, or aluminum-coated substrates) are seeing performance upgrades. By 2026, expect wider adoption of hybrid and nano-engineered composites that meet or exceed MIL-PRF-87257 specifications while offering longer service life and lower lifecycle costs. -

Supply Chain Resilience and Domestic Sourcing Initiatives

Geopolitical tensions and supply chain disruptions have prompted the U.S. Department of Defense (DoD) to emphasize domestic manufacturing. Section 809 recommendations and the Defense Production Act are encouraging onshoring of critical components. Companies producing MIL-PRF-87257 gaskets in the U.S. are likely to benefit from increased procurement priority, creating opportunities for domestic suppliers and reshoring investments. -

Sustainability and Regulatory Pressures

Environmental regulations are influencing material selection. The phase-out of hazardous substances (e.g., hexavalent chromium) under directives like the EU’s REACH and DoD’s Green Procurement Program is pushing manufacturers to develop compliant conductive coatings and substrates. By 2026, expect a shift toward eco-friendly conductive fillers and recyclable elastomer bases without compromising performance. -

Digital Engineering and Predictive Maintenance Integration

The integration of digital twins and predictive maintenance systems in military platforms is increasing the need for reliable sealing and shielding. MIL-PRF-87257 gaskets that support long-term signal integrity are crucial for maintaining sensor accuracy and data fidelity. As platforms become more connected, demand for high-performance, durable gaskets will rise to support system uptime and mission readiness.

Conclusion

By 2026, the market for MIL-PRF-87257-compliant gaskets will be shaped by rising defense spending, technological complexity in electronic systems, and supply chain localization. Growth will be driven by innovation in materials, broader adoption in commercial aerospace, and tightening EMC requirements. Manufacturers who invest in scalable, compliant, and sustainable production will be well-positioned to capture market share in this niche but critical segment of the defense electronics supply chain.

Common Pitfalls When Sourcing MIL-PRF-87257 (Quality and IP)

Sourcing products to MIL-PRF-87257, the U.S. military performance specification for high-reliability, high-performance electronic connectors used in harsh environments, presents unique challenges related to quality assurance and intellectual property (IP). Failing to address these pitfalls can lead to supply chain disruptions, non-compliance, and legal risk.

Inadequate Qualification and Certification Verification

A primary quality pitfall is assuming supplier claims without rigorous validation. MIL-PRF-87257 requires connectors to be qualified under the Qualified Products List (QPL) program. Sourcing from non-QPL-listed manufacturers, or accepting products without valid QPL certificates (such as QML or QPL certificates from DSCC), risks receiving non-compliant parts that fail in critical applications. Always verify current QPL status through official sources like the Defense Logistics Information Service (DLIS) and demand up-to-date certification documentation.

Compromised Material and Process Control

MIL-PRF-87257 mandates strict control over materials (e.g., specific alloys, plating thicknesses like gold over nickel) and manufacturing processes (e.g., precision machining, controlled brazing, hermetic sealing). Sourcing from suppliers with inconsistent process controls or substandard material traceability introduces defects such as plating voids, seal leaks, or mechanical weakness. Ensuring suppliers implement and document full lot traceability and adhere to approved process specifications is essential to avoid field failures.

Counterfeit and Unauthorized Re-marking Risks

The high value and long lifecycle of MIL-PRF-87257 connectors make them targets for counterfeiting. Unauthorized re-marking of commercial-grade or used connectors as “MIL-SPEC” is a common issue. These counterfeit parts often fail environmental and electrical testing. Sourcing through authorized distribution channels, conducting independent authentication (e.g., X-ray, decapsulation), and requiring full chain-of-custody documentation are critical IP and quality safeguards.

Failure to Protect Proprietary Design IP

Many MIL-PRF-87257 connectors incorporate proprietary designs or tooling developed by original manufacturers. Sourcing from unauthorized “clones” or second-source suppliers without proper licensing infringes on intellectual property rights and may result in designs that deviate from the performance envelope. Always confirm that suppliers have legitimate rights to produce the specified connector series and avoid vendors offering “equivalent” parts without documented compliance and IP clearance.

Insufficient Testing and Lot Acceptance Procedures

MIL-PRF-87257 includes rigorous testing requirements such as mechanical strength, electrical continuity, temperature cycling, and hermeticity (fine and gross leak tests). A common pitfall is accepting parts without witnessing or reviewing full lot acceptance test data (LAT). Suppliers may perform reduced testing or skip destructive tests altogether. Require comprehensive test reports conforming to the specification and consider third-party verification for high-risk procurements.

Lack of Long-Term Supply Chain Stability

MIL-PRF-87257 connectors are often used in systems with decades-long service lives. Relying on suppliers without proven obsolescence management or lifecycle support plans can lead to future sourcing failures. Evaluate suppliers not only on current capability but also on their commitment to long-term production, documentation retention, and notification of changes—all aspects tied to both quality continuity and IP stewardship.

Logistics & Compliance Guide for MIL-PRF-87257

Purpose and Scope

MIL-PRF-87257 is a U.S. military performance specification that defines the requirements for high-performance, high-density polyethylene (HDPE) pipe and fittings used in tactical fuel distribution systems. This guide outlines the logistics considerations and compliance requirements necessary to ensure that all materials, procurement, and field use adhere to this specification.

Applicable Products

This specification covers HDPE pipe in nominal diameters from 2 inches to 12 inches and includes associated fusion-fitted joints and mechanical fittings. These components are designed for rapid deployment in temporary fuel lines used in military operations, including aviation fuel (JP-8, JP-5) and diesel fuel (DF-2).

Material Requirements

All HDPE pipe and fittings must be manufactured from materials that meet the physical, chemical, and performance properties outlined in MIL-PRF-87257. This includes:

– Minimum required hydrostatic design stress (HDS) of 1,000 psi

– Resistance to environmental stress cracking (ESCR) per ASTM D1693

– UV stabilization for outdoor exposure

– Compatibility with military-grade fuels and extreme environmental conditions

Certification and Testing

Suppliers must provide certification that the HDPE pipe and fittings comply with MIL-PRF-87257. Required testing includes:

– Hydrostatic pressure testing

– Slow crack growth resistance (e.g., PENT test)

– Dimensions and tolerances verification

– Marking and traceability per specification

Third-party testing by an accredited laboratory may be required for initial qualification and periodic surveillance.

Marking and Traceability

Each length of pipe and each fitting must be permanently marked with:

– Manufacturer’s name or trademark

– MIL-PRF-87257 designation

– Size and wall thickness (SDR)

– Material designation (e.g., PE4710)

– Lot or batch number

– Date of manufacture

This ensures full traceability throughout the supply chain and during field use.

Packaging and Handling

- Pipes must be coiled or bundled as specified, protected from UV degradation and physical damage.

- Fittings should be packed in sealed containers to prevent contamination.

- All packaging must include documentation verifying compliance with MIL-PRF-87257.

- Handling procedures must prevent kinking, gouging, or exposure to contaminants.

Storage Conditions

- Store in shaded, dry areas away from direct sunlight, hydrocarbons, and extreme temperatures.

- Avoid contact with oxidizing agents or solvents.

- Maximum recommended storage duration: 2 years unless manufacturer specifies otherwise.

- Rotate stock using FIFO (First In, First Out) to prevent aging.

Transportation Logistics

- Secure loads to prevent shifting or abrasion during transit.

- Use clean vehicles free of fuel residues or debris.

- Protect materials from weather during loading, transit, and unloading.

- Comply with Department of Defense (DoD) transportation regulations (e.g., MIL-STD-1660 for unit loads).

Field Deployment and Installation

- Only trained personnel should perform fusion joining (butt, socket, or electrofusion).

- Follow manufacturer procedures and MIL-PRF-87257 installation guidelines.

- Inspect all joints and connections prior to pressurization.

- Conduct leak testing at 1.5 times operating pressure before operational use.

Quality Assurance and Surveillance

- Procurement contracts must require full compliance with MIL-PRF-87257.

- Government representatives may conduct audits, inspections, and sampling.

- Non-conforming products must be rejected, quarantined, and reported.

- Maintain records of compliance, test reports, and field performance.

Regulatory and Compliance Oversight

- Compliance is enforced by the Defense Logistics Agency (DLA) and applicable military service branches.

- Products may be listed on the Qualified Products List (QPL) for MIL-PRF-87257.

- Use of non-compliant materials may result in contract penalties or operational failure.

Conclusion

Adherence to MIL-PRF-87257 ensures reliable, safe, and interoperable fuel distribution systems in military operations. Effective logistics management and strict compliance throughout the lifecycle—from manufacturing to deployment—are essential to mission success and personnel safety.

Conclusion for Sourcing MIL-PRF-87257

Sourcing materials, components, or services in accordance with MIL-PRF-87257 requires strict adherence to the U.S. Department of Defense (DoD) performance specification, which outlines rigorous quality, performance, and testing standards for high-reliability electrical connectors used in demanding military and aerospace environments. Successfully sourcing compliant products involves verifying manufacturer qualifications, ensuring traceability of materials, and confirming certification to the latest revision of the specification.

It is essential to engage with trusted, authorized suppliers or manufacturers listed on the Qualified Products List (QPL) or via the Defense Logistics Agency (DLA) databases to ensure authenticity and compliance. Additionally, attention to proper documentation, including Certificate of Conformance (CoC) and test reports, is critical to meet inspection and audit requirements.

In conclusion, sourcing MIL-PRF-87257-compliant components demands diligence, technical expertise, and reliance on verified supply chains. Prioritizing compliance not only ensures operational reliability and safety in critical systems but also supports regulatory and contractual obligations within defense and aerospace programs.

![[PDF] mil](https://www.fobsourcify.com/wp-content/uploads/2026/01/pdf-mil-693.jpg)