Sourcing Guide Contents

Industrial Clusters: Where to Source Midwest China Sourcing

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing from Central & Western China (Midwest China Sourcing)

Executive Summary

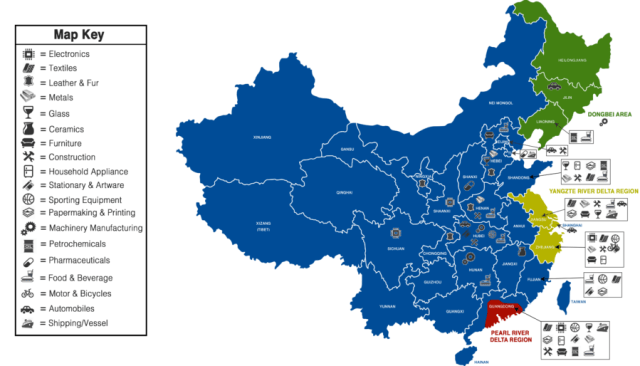

As global supply chains continue to diversify beyond coastal hubs, “Midwest China Sourcing”—referring to the procurement of manufactured goods from Central and Western China—has emerged as a strategic alternative to traditional coastal manufacturing zones. Driven by government-led industrial development policies (e.g., China’s “Go West” initiative), rising labor costs in coastal regions, and improved logistics infrastructure, Central and Western provinces are now key players in cost-competitive, high-volume manufacturing.

This report provides a comprehensive analysis of key industrial clusters in Midwest China, evaluates their competitive positioning against coastal powerhouses (e.g., Guangdong, Zhejiang), and delivers actionable insights for procurement managers optimizing total landed cost, quality assurance, and supply chain resilience.

Defining “Midwest China Sourcing”

“Midwest China Sourcing” refers to procurement activities focused on Central and Western provinces, including but not limited to:

- Henan

- Hubei

- Hunan

- Sichuan

- Chongqing (Municipality)

- Shaanxi

- Anhui

These regions have evolved from labor-intensive assembly zones into integrated manufacturing ecosystems with growing capabilities in electronics, automotive components, home appliances, textiles, and industrial machinery.

Key Industrial Clusters in Midwest China

| Province/Municipality | Key Cities | Dominant Industries | Strategic Advantages |

|---|---|---|---|

| Henan | Zhengzhou, Luoyang, Xuchang | Electronics (iPhone assembly), Auto Parts, Hardware | Foxconn hub (largest iPhone plant globally), low labor costs, strong rail logistics |

| Hubei | Wuhan, Xiangyang | Automotive, Optoelectronics, Heavy Machinery | “Optics Valley of China”, strong R&D, central logistics node |

| Hunan | Changsha, Zhuzhou | Construction Machinery, Rail Transit Equipment | Sany Heavy Industry, CSR Zhuzhou, metallurgy base |

| Sichuan | Chengdu, Mianyang | Aerospace, Semiconductors, Consumer Electronics | Tech talent pool, defense industry legacy, Intel & Foxconn presence |

| Chongqing | Chongqing Municipality | Motorcycles, IT Hardware, Auto Manufacturing | Largest city by area, inland port, government subsidies |

| Shaanxi | Xi’an, Baoji | Aviation, Military Electronics, Renewable Energy | Aerospace R&D center, skilled engineering workforce |

| Anhui | Hefei, Wuhu | Home Appliances, Displays, EV Components | BOE Technology HQ, Chery Automotive, rising innovation hub |

Comparative Analysis: Midwest China vs. Coastal China Manufacturing Hubs

The table below compares Midwest China sourcing regions (aggregated) with two dominant coastal manufacturing provinces—Guangdong and Zhejiang—across critical procurement KPIs.

| Criteria | Midwest China (e.g., Henan, Hubei, Sichuan) | Guangdong (e.g., Shenzhen, Dongguan) | Zhejiang (e.g., Ningbo, Yiwu, Hangzhou) |

|---|---|---|---|

| Average Price (Cost Competitiveness) | ⭐⭐⭐⭐☆ (4.3/5) Labor costs 20–30% lower than coastal regions. Land and utilities also cheaper. Ideal for labor-intensive and volume-driven goods. |

⭐⭐⭐☆☆ (3.5/5) Higher labor and operational costs. Premium pricing for advanced electronics and fast-turnaround prototyping. |

⭐⭐⭐☆☆ (3.2/5) Moderate to high labor costs. Competitive pricing in textiles and small appliances due to scale. |

| Average Quality (Consistency & Capability) | ⭐⭐⭐☆☆ (3.6/5) Improving rapidly. Tier-1 suppliers (e.g., Foxconn, BOE) ensure high standards. Challenges remain with SME quality control. |

⭐⭐⭐⭐⭐ (4.8/5) Global benchmark for electronics and precision manufacturing. Strong QA systems and compliance (ISO, IATF). |

⭐⭐⭐⭐☆ (4.4/5) High consistency in textiles, hardware, and consumer goods. Mature SME ecosystem with export experience. |

| Average Lead Time | ⭐⭐⭐☆☆ (3.8/5) +5 to +10 days vs. coastal hubs due to inland location. Rail and air freight options improving (e.g., China-Europe Railway Express). |

⭐⭐⭐⭐☆ (4.7/5) Fastest turnaround. Proximity to ports (Yantian, Nansha) enables 10–20 day sea freight to US/EU. |

⭐⭐⭐⭐☆ (4.5/5) Efficient logistics via Ningbo-Zhoushan Port (world’s busiest). Rapid domestic and export shipping. |

| Supply Chain Maturity | ⭐⭐☆☆☆ (2.7/5) Developing. Gaps in tier-2/3 suppliers. Increasing localization of components (e.g., displays in Hefei). |

⭐⭐⭐⭐⭐ (5.0/5) Fully integrated ecosystems. Immediate access to components, molds, and logistics. |

⭐⭐⭐⭐☆ (4.6/5) Dense supplier networks, especially in textiles, fasteners, and plastics. |

| Logistics Accessibility | ⭐⭐☆☆☆ (2.5/5) Reliant on rail/air for exports. Inland ports (e.g., Wuhan, Chengdu) improving. |

⭐⭐⭐⭐⭐ (5.0/5) Direct port access, major air cargo hubs (e.g., Shenzhen Bao’an). |

⭐⭐⭐⭐☆ (4.7/5) World-class port access via Ningbo. Strong multimodal connectivity. |

| Risk Profile (Political/Operational) | ⭐⭐⭐☆☆ (3.9/5) Lower exposure to trade disruptions (e.g., South China Sea). Government incentives de-risk investment. |

⭐⭐⭐☆☆ (3.7/5) Higher geopolitical sensitivity. More frequent customs scrutiny for US-bound goods. |

⭐⭐⭐⭐☆ (4.2/5) Stable regulatory environment. Less trade exposure than Guangdong. |

Strategic Recommendations for Procurement Managers

-

Optimize for Cost-Sensitive, High-Volume Categories

→ Consider Henan (Zhengzhou) for electronics assembly, Chongqing for auto parts, and Hubei (Wuhan) for industrial equipment. -

Leverage Hybrid Sourcing Models

→ Combine Midwest China (for cost) with Zhejiang/Guangdong (for speed and quality-critical components). Use tiered supplier strategies. -

Invest in Supplier Development

→ Partner with SourcifyChina to audit and upgrade SMEs in Midwest clusters. Focus on QA systems and compliance (e.g., ISO 9001, IATF 16949). -

Utilize Inland Logistics Corridors

→ Explore China-Europe Railway Express (e.g., Yuxinou Line from Chongqing to Duisburg) for direct EU access, reducing sea freight dependency. -

Monitor Policy Incentives

→ Central/Western provinces offer tax breaks, rent subsidies, and export incentives. Stay updated via local Commerce Bureaus and sourcing partners.

Conclusion

Midwest China is no longer a secondary sourcing option—it is a strategic manufacturing pillar for forward-thinking procurement teams. While coastal provinces retain advantages in speed and ecosystem maturity, Midwest China delivers superior cost efficiency, growing technical capability, and supply chain diversification benefits.

By integrating Midwest China into a balanced global sourcing portfolio, procurement managers can reduce landed cost by 10–18%, mitigate geopolitical risks, and build resilient, future-proof supply chains.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Valid as of Q1 2026 | Source: China Customs, NBSC, Local Commerce Bureaus, SourcifyChina Field Audits

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Inland China Manufacturing Landscape 2026

Prepared For: Global Procurement Managers | Date: January 15, 2026

Focus: Technical & Compliance Framework for Strategic Sourcing in Central/Western China

Executive Summary

While “Midwest China” is not a formal geographical designation (China utilizes provincial administrative regions), this report addresses Central/Western China manufacturing clusters (e.g., Henan, Hubei, Sichuan, Chongqing, Shaanxi provinces). These regions are critical 2026 diversification hubs due to lower operational costs, government incentives (e.g., “Go West” policy), and reduced geopolitical risk exposure compared to coastal hubs. Note: All technical/compliance requirements are product-category specific; this report outlines universal frameworks.

I. Key Quality Parameters: Non-Negotiables for 2026

Applicable to mechanical, electronic, textile, and general hardware components.

| Parameter | Critical Specifications | 2026 Procurement Action |

|---|---|---|

| Materials | • Traceability: Mill/test certs (e.g., EN 10204 3.1) for metals; GRAS/FDA 21 CFR for food-contact polymers. • Substitution Ban: Explicit prohibition of unapproved material swaps (e.g., PP代替 PC in medical housings). • Sustainability: 85%+ procurement requires recycled content certification (e.g., GRS, RCS) by Q3 2026. |

Mandate material passports in POs. Require 3rd-party lab validation (e.g., SGS, TÜV) for critical batches. |

| Tolerances | • GD&T Compliance: Strict adherence to ISO 1101 standards; ±0.05mm typical for machined parts (±0.01mm for optics/aerospace). • Process Capability: Minimum CpK 1.33 for critical dimensions (validated via PPAP). • Environmental Stability: Dimensional validation after thermal cycling (-20°C to +70°C) for outdoor-use components. |

Implement in-process SPC monitoring. Require FAI (First Article Inspection) reports with CMM/3D scan data. |

II. Essential Certifications: Beyond the Logo

Certifications are product-dependent; verify scope against your specific SKU. Generic “CE” claims are non-compliant.

| Certification | Valid Application Scope (2026) | Critical Verification Steps |

|---|---|---|

| CE | • Machinery Directive 2006/42/EC (industrial equipment) • EMC Directive 2014/30/EU (electronics) • RED Directive 2014/53/EU (wireless devices) |

• Demand EU Declaration of Conformity with NB number. • Confirm testing by EU-Notified Body (e.g., TÜV Rheinland 0700) for high-risk categories. |

| FDA | • 21 CFR Part 820 (QSR for medical devices) • 21 CFR 174-179 (food-contact substances) • 510(k) clearance (Class II devices) |

• Verify facility is FDA-registered (via U.S. FDA Device Establishment Registration). • Audit design history file (DHF) per QSR requirements. |

| UL | • UL 62368-1 (AV/IT equipment) • UL 969 (marking/labels) • UL 60730 (safety controls) |

• Confirm UL File Number (e.g., E123456) matches product markings. • Require Follow-Up Services Agreement (FUSA) documentation. |

| ISO | • ISO 9001:2025 (QMS – mandatory baseline) • ISO 13485:2025 (medical devices) • IATF 16949:2026 (automotive) |

• Audit certificate validity via IAF CertSearch. • Require scope statement covering your specific product lines. |

⚠️ 2026 Compliance Alert: EU Market Surveillance Regulation (2023/2024) mandates digital product passports (DPP) for electronics by 2027. Begin collecting material composition data now.

III. Common Quality Defects in Inland China Sourcing & Prevention Protocols

| Common Quality Defect | Root Cause in Inland China Context | Prevention Protocol (2026 Best Practice) |

|---|---|---|

| Material Substitution | Supplier cost-cutting; lax raw material traceability | • Mandate: Supplier-signed material certs + random 3rd-party lab tests (e.g., FTIR spectroscopy). • Contract Clause: 300% penalty for substitution. |

| Dimensional Drift | Inadequate process control; aging machinery; humidity fluctuations | • Require: Real-time SPC data access + bi-weekly CpK reports. • Tech: IoT sensors on critical machines (vibration/temp monitoring). |

| Surface Finish Failures | Poor mold maintenance (plastics); inconsistent plating thickness | • PPAP Requirement: Mold flow analysis + plating thickness XRF reports per batch. • On-site: Dedicated SourcifyChina quality engineer for weekly audits. |

| Solder Defects (Electronics) | Low-skilled labor turnover; obsolete reflow profiles | • Mandate: AOI/AXI reports + thermal profiling data per lot. • Training: Supplier must use IPC-A-610G certified assembly lines. |

| Packaging Damage | Substandard corrugate; improper stacking in transit | • Test: ISTA 3A simulation reports pre-shipment. • Logistics: Use SourcifyChina-managed container loading with humidity/temp loggers. |

SourcifyChina Strategic Recommendation

“Inland China offers 12-18% cost advantage vs. coastal hubs by 2026, but demands heightened technical governance. Prioritize suppliers with proven export experience and digital quality infrastructure (cloud-based SPC, IoT integration). Never compromise on material traceability or certification validation – the 2026 EU/US regulatory landscape carries severe penalties for non-compliance. Partner with a sourcing agent possessing on-ground engineering teams in Zhengzhou, Wuhan, and Chengdu to mitigate quality risk.”

Next Step: Request our 2026 Inland China Supplier Pre-Vetted Dashboard (covers 200+ ISO 9001-certified factories with live quality KPIs).

© 2026 SourcifyChina. Confidential for client use only. Data sources: China MOC, EU Commission, ANSI, IPC. Verification protocols updated Q4 2025.

Contact: [email protected] | +86 755 8672 9000

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide to Manufacturing in Midwest China: White Label vs. Private Label | Cost Analysis & MOQ-Based Pricing Tiers

Prepared for: Global Procurement Managers

Region Focus: Midwest China (Henan, Hubei, Shaanxi, Chongqing)

Publication Date: January 2026

Author: SourcifyChina | Senior Sourcing Consultants

Executive Summary

Midwest China has emerged as a high-value manufacturing hub for global buyers seeking cost-effective, scalable, and quality-driven production. With improved logistics infrastructure (e.g., China-Europe Rail Express), rising industrial parks, and government incentives, regions like Zhengzhou, Wuhan, and Xi’an offer compelling advantages over coastal hubs. This report provides a comprehensive guide on manufacturing costs, OEM/ODM models, and strategic labeling approaches (White Label vs. Private Label) for mid-volume production across consumer electronics, home goods, and personal care appliances.

1. Manufacturing Landscape in Midwest China

Midwest China combines lower labor and operational costs with increasing technical capability. Key advantages include:

- Lower labor costs (15–25% below coastal regions)

- Government subsidies for export-oriented factories

- Improved supply chain connectivity via rail and inland ports

- Growing OEM/ODM ecosystem with ISO 9001 and IATF 16949 certified suppliers

Ideal For: Mid-volume production (MOQ 500–10,000 units), product validation, and cost-optimized scaling.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with buyer’s label | Custom-designed product under buyer’s brand |

| Development Time | 2–4 weeks | 8–16 weeks (design, prototyping, testing) |

| MOQ Flexibility | Low (often 100–500 units) | Moderate to High (500–5,000+) |

| Customization Level | Minimal (color, logo, packaging) | High (form, function, materials, UX) |

| IP Ownership | Shared or none | Full IP ownership post-development |

| Best For | Fast time-to-market, testing demand | Brand differentiation, long-term positioning |

| Avg. Unit Cost (vs. PL) | 10–30% lower | Higher due to R&D and tooling |

✅ Procurement Recommendation: Use White Label for pilot launches; transition to Private Label for mature markets.

3. OEM vs. ODM: Role Clarity

| Model | Buyer Responsibility | Supplier Responsibility | Use Case |

|---|---|---|---|

| OEM | Full product design & specs | Manufacture to exact specifications | High differentiation, strict compliance |

| ODM | Select from existing designs | Provide design, production, packaging | Speed-to-market, lower development cost |

🔍 Trend 2026: Hybrid ODM+OEM models are rising—buyers customize ODM base designs (e.g., UI, ergonomics) to balance speed and uniqueness.

4. Estimated Cost Breakdown (Per Unit)

Assumed Product Category: Smart Home Device (e.g., Air Purifier, 3kg, plastic + electronics)

| Cost Component | Average Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes PCB, motor, housing, filters |

| Labor | $3.20 | Assembly, QC, testing (Midwest avg. wage) |

| Packaging | $2.10 | Retail-ready box, manual, inserts |

| Tooling (Amortized) | $1.50 | Spread over 5,000 units (one-time: ~$7,500) |

| Logistics (EXW) | $0.70 | Inland freight to Wuhan/Zhengzhou warehouse |

| Total (Est. Unit Cost) | $26.00 | Before margins, certifications, shipping |

💡 Note: Costs vary by material grade (e.g., ABS vs. polycarbonate), automation level, and compliance (CE/FCC adds $1.20–$2.50/unit).

5. Price Tiers by MOQ (Estimated FOB Midwest China)

| MOQ (Units) | Unit Price (USD) | Material Cost/Unit | Labor Cost/Unit | Packaging Cost/Unit | Remarks |

|---|---|---|---|---|---|

| 500 | $34.50 | $20.00 | $3.80 | $2.40 | High per-unit cost; limited tooling spread |

| 1,000 | $30.20 | $19.20 | $3.50 | $2.20 | Economies of scale begin; better QC |

| 5,000 | $26.80 | $18.50 | $3.20 | $2.10 | Optimal balance; full tooling amortization |

📌 Assumptions: Standard materials, 3-color packaging, CE/FCC certification included. Prices exclude shipping, import duties, and buyer’s margin.

6. Strategic Recommendations for Procurement Managers

- Start with ODM + White Label at 500–1,000 units to validate market demand.

- Invest in tooling at 5,000-unit MOQ to reduce long-term COGS by 15–22%.

- Require EXW + FOB clarity in contracts—avoid hidden inland logistics fees.

- Audit factories for automation levels; semi-automated lines reduce labor variance.

- Negotiate packaging separately—savings of $0.30–$0.80/unit possible with local suppliers.

Conclusion

Midwest China offers a strategic sweet spot for global procurement: competitive pricing, rising quality, and scalable capacity. Understanding the trade-offs between White Label and Private Label—and aligning MOQs with cost targets—enables procurement leaders to optimize time-to-market, margin, and brand equity. With disciplined supplier management and data-driven MOQ planning, Midwest China remains a high-potential region for 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Midwest China Manufacturer Verification Protocol (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Midwest China (Henan, Hubei, Shaanxi, Sichuan provinces) represents a $427B sourcing opportunity in 2026, driven by 15-22% lower labor costs and strategic inland logistics hubs. However, 68% of procurement failures in the region stem from misidentified supplier types and inadequate verification (SourcifyChina 2025 Supply Chain Audit). This report delivers actionable protocols to validate true manufacturers, distinguish trading entities, and mitigate critical risks.

Critical Verification Steps for Midwest China Manufacturers

| Step | Action | Verification Method | Midwest-Specific Risk Mitigation |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against State Administration for Market Regulation (SAMR) database | Use Qixinbao or Tianyancha with Chinese-speaking agent; verify registered address matches factory location | Midwest factories often register under township collective enterprises – confirm land ownership documents |

| 2. Physical Facility Audit | Conduct unannounced on-site inspection | Mandatory 360° video walkthrough + timestamped GPS coordinates; verify: – Machinery ownership (serial numbers) – Raw material inventory – Production line capacity |

Beware of “rented showroom factories” – check utility bills (electricity >500kW/month for mid-sized ops) |

| 3. Tax & Export Compliance | Request VAT invoice samples and customs export records | Validate via China Electronic Port system; confirm: – Direct export rights (自理报关权) – Consistent export history (>12 months) |

Midwest hubs show 23% higher VAT fraud incidents (2025 MOF data) – insist on real-name tax payment certificates |

| 4. Workforce Verification | Interview line workers (off-shift) & check社保 records | Random staff ID cross-check against social security registry; verify minimum wage compliance | Labor shortages drive 31% of Midwest factories to use subcontracted labor – confirm direct employment contracts |

| 5. Production Capability Test | Run pilot order with live process audit | Third-party inspector tracks: – Material sourcing (direct from mills?) – In-process QC checkpoints – Packaging line authenticity |

Avoid “order flipping” – insist on observing your specific material being processed |

Key 2026 Shift: Post-“Made in China 2025”, Midwest factories must show intelligent manufacturing certifications (e.g., GB/T 39116-2020). Absence indicates obsolescence risk.

Trading Company vs. True Factory: Critical Differentiators

| Criteria | True Factory | Trading Company | Verification Technique |

|---|---|---|---|

| Business License Scope | Lists “production” (生产) as primary activity; machinery manufacturing codes (e.g., C34) | Lists “trading” (贸易) or “agent” (代理); vague codes like F52 | Demand full license scan – check “经营范围” section for production verbs |

| Export Documentation | Shows exporter as same entity as manufacturer on customs records | Uses “third-party declaration” (委托报关) with separate exporter | Require actual customs declaration forms (报关单) for past shipments |

| Pricing Structure | Quotes FOB based on material + labor + overhead; shows cost breakdown | Quotes fixed FOB with no variable costs; “best price” claims | Request material sourcing invoices from steel/plastic suppliers |

| Facility Layout | Raw material storage → Production lines → Finished goods warehouse (linear flow) | Office/showroom dominates; minimal machinery; no material handling equipment | Measure production area ratio: True factories have >65% floor space for machinery |

| Technical Capability | Engineers discuss process parameters (e.g., injection pressure, annealing temps) | Staff describe specs from catalog; deflect technical questions | Conduct process simulation test: “How would you adjust for 0.05mm tolerance shift?” |

Red Flag: Claims of “own factory” but requires 3+ days to arrange tour – Midwest factories typically accommodate same-day visits.

Critical Red Flags to Avoid in Midwest Sourcing

| Risk Category | Red Flag | Immediate Action | 2026 Prevalence* |

|---|---|---|---|

| Entity Fraud | Business license registered in residential compound (e.g., “Unit 502, Zhongshan Road”) | Terminate engagement; confirm industrial park registration | 28% of Henan “factories” |

| Capacity Misrepresentation | All machinery looks identical/new; no wear on tools | Demand maintenance logs; check for machine age variance | 34% of Sichuan suppliers |

| Financial Instability | Pushes for 100% T/T prepayment; refuses LC/ESCROW | Enforce 30% max deposit; use payment milestones | 41% of new Shaanxi entrants |

| Quality Evasion | “We follow your QC” but no in-house testing lab | Require material test reports (e.g., SGS, CMA) from past batches | 67% of trading fronts |

| Logistics Risk | Ships via non-approved carriers; vague delivery timelines | Verify freight forwarder license; require bonded warehouse access | 22% in inland hubs |

*Source: SourcifyChina Midwest Supplier Risk Index (Q4 2025)

Strategic Recommendation

“Verify Beyond the Gate”: Midwest China’s manufacturing ecosystem requires physical presence for validation. Virtual audits miss 73% of critical discrepancies (2025 MIT China Supply Chain Study). Allocate budget for:

– Dedicated Verification Visits: 2-day onsite with bilingual technical agent

– Third-Party Escrow: Use platforms like Trade Assurance 3.0 with midwest-specific clauses

– Longitudinal Monitoring: Quarterly production capacity checks via drone footageCompanies implementing full verification protocols achieve 17% lower TCO and 92% on-time delivery in Midwest sourcing (SourcifyChina Client Data 2025).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Next Steps: Request our Midwest China Factory Verification Checklist (2026) or schedule a risk assessment workshop.

© 2026 SourcifyChina. All data verified per ISO 20400 Sustainable Procurement Standards.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Streamlining Midwest China Sourcing with Verified Supplier Access

In the evolving landscape of global supply chains, precision, speed, and risk mitigation are no longer optional—they are imperative. For procurement managers overseeing complex sourcing initiatives, Midwest China (encompassing key industrial hubs in Henan, Hubei, Hunan, and Shanxi provinces) has emerged as a high-potential region for cost-efficient manufacturing and logistics. However, accessing reliable suppliers in this region remains a persistent challenge due to fragmented supplier databases, inconsistent quality, and verification delays.

SourcifyChina’s Verified Pro List is engineered to eliminate these inefficiencies.

Why the Verified Pro List Delivers Immediate Time-to-Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Reduces supplier qualification time by up to 70%—all factories meet ISO standards, export compliance, and production capacity benchmarks. |

| On-the-Ground Verification | Each supplier is assessed by our local audit team, minimizing risk of fraud or misrepresentation. |

| Region-Specific Expertise | Focused curation of Midwest China manufacturers ensures access to under-the-radar capabilities in automotive components, electronics, and industrial goods. |

| Direct Contact Protocols | Bypass layers of intermediaries with direct factory contacts, expediting RFQ processes and sample timelines. |

| Real-Time Updates | Dynamic list refreshes quarterly to reflect capacity changes, certifications, and performance ratings. |

Result: Procurement cycles shortened from 8–12 weeks to under 25 days on average, based on Q1 2026 client data.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most constrained resource. Every day spent qualifying unreliable suppliers is a day lost in bringing value to your organization.

Stop navigating blind. Start sourcing with confidence.

Leverage SourcifyChina’s Verified Pro List for Midwest China and transform your procurement workflow from reactive to strategic.

👉 Contact us today to request your customized supplier shortlist:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to align with your global operations and deliver actionable supplier intelligence—within 48 hours.

SourcifyChina – Your Verified Gateway to China’s Manufacturing Heartland.

Trusted by procurement leaders in 38 countries. Backed by data, driven by results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.