The packaging manufacturing sector in the Midlands has experienced steady growth, driven by rising demand from food and beverage, pharmaceutical, and e-commerce industries. According to Grand View Research, the global packaging market size was valued at USD 915.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. Regional data from Mordor Intelligence highlights that the UK packaging market is projected to grow at a CAGR of approximately 3.8% during the same period, with the Midlands emerging as a key hub due to its strategic location, skilled workforce, and robust manufacturing infrastructure. Fueled by sustainability mandates and innovations in materials, Midlands-based packaging corporations are increasingly adopting eco-friendly practices and automation technologies to remain competitive. This growth trajectory underscores the importance of identifying the top-performing manufacturers in the region—organizations that combine scale, innovation, and environmental responsibility. Here are the top six packaging corporations shaping the Midlands’ industrial landscape.

Top 6 Midlands Packaging Corp Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Midlands Packaging Corporation

Domain Est. 2019

Website: corrugatedboxcompanies.com

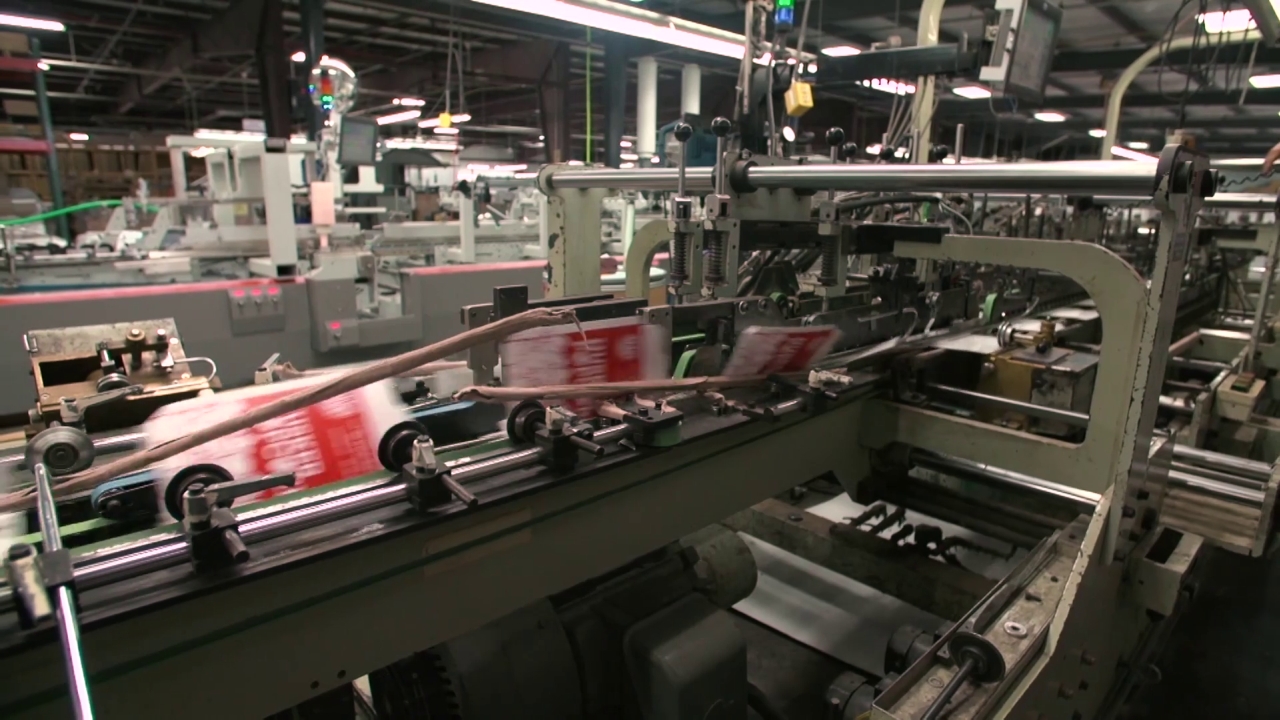

Key Highlights: Midlands Packaging Corporation is a leading provider of high-quality corrugated box products and comprehensive packaging solutions….

#2 Midlands Packaging Corporation

Domain Est. 1987

Website: nemep.unl.edu

Key Highlights: Midlands Packaging Corporation produces folding cartons, corrugated cartons, and thermo-formed plastics….

#3 Midlands Packaging Corporation

Domain Est. 1996

Website: midlandspkg.com

Key Highlights: Midlands Packaging primarily produces folding cartons, corrugated containers, and thermoformed plastics. Our goal is to provide you with the service you deserve ……

#4 PCA’s History

Domain Est. 1999

Website: packagingcorp.com

Key Highlights: Packaging Corporation of America (PCA) is formed by the consolidation of the Central Fiber Products Company, the American Box Board Company and the Ohio ……

#5 Midlands Packaging Company

Domain Est. 2009

Website: leadiq.com

Key Highlights: Midlands Packaging Company’s official website is midlandspkg.com and has social profiles on LinkedIn. What is Midlands Packaging Company’s SIC code NAICS code?…

#6 Paper Clips Industry News

Domain Est. 1998

Website: midlandco.com

Key Highlights: Kimberly-Clark has announced that its manufacturing site in Koblenz, Germany has become the company’s first tissue manufacturing facility globally with a ……

Expert Sourcing Insights for Midlands Packaging Corp

H2: Market Trends Analysis for Midlands Packaging Corp. – 2026 Outlook

As Midlands Packaging Corp. prepares for 2026, a comprehensive analysis of emerging market trends reveals a dynamic and evolving landscape shaped by sustainability demands, technological innovation, shifting consumer behaviors, and supply chain transformation. This H2 assessment outlines key trends expected to influence the packaging industry and their strategic implications for the company.

1. Accelerated Shift Toward Sustainable Packaging

Environmental regulations and consumer preferences are driving a widespread demand for eco-friendly packaging. By 2026, the UK’s Extended Producer Responsibility (EPR) scheme and Plastic Packaging Tax will be fully operational, increasing pressure on companies to reduce plastic use and enhance recyclability. Midlands Packaging Corp. must prioritize investments in biodegradable, compostable, and recyclable materials—such as molded fiber, recycled paperboard, and plant-based polymers—to remain compliant and competitive. Brands across food & beverage, retail, and e-commerce are increasingly seeking packaging partners with verifiable sustainability credentials.

2. Growth of E-Commerce and Protective Packaging Demand

The e-commerce sector is projected to sustain growth, with online retail sales expected to account for over 30% of total UK retail by 2026. This trend increases demand for durable, lightweight, and right-sized packaging solutions that minimize damage during shipping while reducing material use. Midlands Packaging Corp. should expand its portfolio of engineered protective packaging, including corrugated cushioning and intelligent design solutions that optimize fill rates and reduce void space.

3. Adoption of Smart and Functional Packaging

Digital integration is transforming packaging into an interactive platform. Smart packaging technologies—such as QR codes, NFC tags, and time-temperature indicators—are gaining traction for brand engagement, authenticity verification, and supply chain transparency. Midlands Packaging Corp. has an opportunity to differentiate by offering value-added services, such as traceability solutions and consumer engagement tools, particularly for premium and perishable goods sectors.

4. Supply Chain Resilience and Regionalization

Post-pandemic disruptions and geopolitical uncertainty have prompted brands to reevaluate their supply chains. Nearshoring and regional sourcing are becoming strategic priorities. Midlands Packaging Corp. is well-positioned to leverage its UK-based manufacturing footprint to serve clients seeking localized, responsive, and lower-carbon supply chains. Investment in automation and digital inventory systems will enhance agility and reduce lead times, supporting just-in-time delivery models.

5. Regulatory and Material Cost Volatility

Raw material prices—particularly for paper, recycled content, and resins—are expected to remain volatile due to global supply constraints and energy costs. Simultaneously, evolving regulations on labeling, recyclability, and carbon reporting will require operational transparency. Midlands Packaging Corp. should strengthen supplier partnerships, explore closed-loop material systems, and adopt digital tools for lifecycle assessment and compliance reporting.

6. Customization and Brand Differentiation

As competition intensifies, brands are using packaging as a key differentiator. Demand for customized, high-quality print finishes and innovative structural designs is rising. Midlands Packaging Corp. can capitalize on this by enhancing its digital printing capabilities and offering end-to-end design services that support brand storytelling and shelf impact.

Strategic Recommendations for Midlands Packaging Corp.:

– Lead with Sustainability: Certify products under recognized standards (e.g., FSC, ISO 14001) and launch a “Green Portfolio” line.

– Invest in Technology: Upgrade production lines with automation and integrate IoT for predictive maintenance and real-time monitoring.

– Expand Service Offerings: Develop smart packaging solutions and lifecycle analytics for clients.

– Strengthen Regional Advantage: Market Midlands’ UK manufacturing base as a sustainable, resilient alternative to offshore sourcing.

– Foster Innovation Partnerships: Collaborate with material science firms and academic institutions to pilot next-gen packaging formats.

In conclusion, 2026 presents both challenges and opportunities for Midlands Packaging Corp. By aligning with H2 trends—sustainability, digitalization, resilience, and customization—the company can strengthen its market position as a forward-thinking, customer-centric packaging leader in the Midlands and beyond.

Common Pitfalls When Sourcing from Midlands Packaging Corp (Quality, IP)

Sourcing from Midlands Packaging Corp—like any third-party supplier—can present several challenges, particularly in the areas of product quality and intellectual property (IP) protection. Being aware of common pitfalls can help businesses mitigate risks and ensure a reliable, compliant supply chain.

Quality Control Issues

One of the primary concerns when sourcing packaging materials is maintaining consistent product quality. Midlands Packaging Corp may deliver variable output due to factors such as machinery calibration, raw material sourcing, or workforce training. Key quality pitfalls include:

- Inconsistent Material Standards: Variations in thickness, durability, or chemical resistance of packaging materials can compromise product safety and shelf life.

- Lack of Real-Time Monitoring: Without on-site audits or third-party inspections, defects may go unnoticed until after shipment.

- Non-Compliance with Industry Regulations: Packaging for food, pharmaceuticals, or cosmetics must meet strict regulatory standards (e.g., FDA, ISO). Failure to verify certifications can lead to legal and reputational risks.

Intellectual Property Risks

When working with external manufacturers like Midlands Packaging Corp, protecting proprietary designs, branding, and innovations is critical. Common IP-related pitfalls include:

- Unprotected Design Specifications: Sharing detailed packaging designs without non-disclosure agreements (NDAs) or IP clauses in contracts may lead to unauthorized replication or resale.

- Reverse Engineering by Suppliers: A vendor with access to unique packaging molds or materials might reverse-engineer and supply similar products to competitors.

- Weak Contractual Safeguards: Absence of clear IP ownership clauses in sourcing agreements can result in disputes over design rights, especially for custom packaging solutions.

Mitigation Strategies

To avoid these pitfalls, companies should:

– Conduct regular quality audits and request material test reports.

– Require certifications relevant to your industry.

– Implement strong legal agreements, including NDAs and explicit IP ownership terms.

– Limit access to sensitive design information on a need-to-know basis.

Proactive due diligence and clear contractual frameworks are essential to ensuring both quality consistency and IP security when sourcing from Midlands Packaging Corp.

Logistics & Compliance Guide for Midlands Packaging Corp.

This guide outlines the essential logistics and compliance protocols for Midlands Packaging Corp. to ensure efficient operations, regulatory adherence, and customer satisfaction. All departments must follow these standards to maintain safety, legality, and operational excellence.

Transportation & Distribution

Midlands Packaging Corp. utilizes a combination of third-party carriers and dedicated fleet vehicles to deliver packaging materials and finished products. All shipments must be scheduled through the Logistics Management System (LMS), ensuring accurate tracking and documentation. Packaging must meet DOT and carrier-specific requirements for weight, labeling, and secure loading. Temperature-sensitive materials require validated cold chain protocols, with real-time monitoring during transit.

Regulatory Compliance

Compliance with national and international regulations is mandatory. All packaging materials must conform to FDA, USDA, and EU food contact material standards where applicable. SDS (Safety Data Sheets) must be maintained for all chemical components used in production. Export shipments require adherence to IATA, IMDG, and customs regulations, including accurate HS codes and export documentation. Regular audits will be conducted to ensure alignment with REACH, RoHS, and other environmental directives.

Warehouse Operations

Warehousing must comply with OSHA safety standards and internal 5S methodology. Inventory is managed via barcode scanning and WMS (Warehouse Management System) to ensure FIFO (First In, First Out) rotation and accurate stock levels. Hazardous materials must be stored in designated, ventilated areas with spill containment measures. Fire suppression systems and emergency exits must be inspected monthly.

Packaging Standards & Labeling

All packaging must meet customer specifications and industry standards for durability, recyclability, and labeling clarity. Labels must include product ID, batch number, manufacturing date, expiry (if applicable), handling instructions, and compliance marks (e.g., recyclable symbol, FSC certification). Dual-language labeling is required for cross-border shipments into bilingual regions.

Import/Export Documentation

The Trade Compliance Team is responsible for preparing and verifying export documentation, including commercial invoices, packing lists, certificates of origin, and export licenses when required. All imports must be cleared through customs using accurate tariff classifications and valuation. Records must be retained for a minimum of five years in compliance with CBP and HMRC regulations.

Sustainability & Environmental Compliance

Midlands Packaging Corp. is committed to reducing environmental impact. All facilities must comply with local waste disposal regulations and report hazardous waste shipments via EPA Form 8700-22. Recycling programs are mandatory, and packaging design must prioritize reduced material use and recyclability. Annual carbon footprint assessments will guide logistics routing and fleet optimization initiatives.

Training & Reporting

All logistics and operations staff must complete annual training on safety, compliance, and system usage. Incident reports, delivery discrepancies, and compliance deviations must be logged in the company’s ERP system within 24 hours. The Compliance Officer will review reports monthly and recommend corrective actions as needed.

Continuous Improvement

Midlands Packaging Corp. will conduct bi-annual logistics reviews to assess KPIs such as on-time delivery rate, damage claims, and customs clearance times. Feedback from customers and carriers will inform process enhancements. Compliance updates will be communicated company-wide via the internal portal to ensure timely adaptation to regulatory changes.

Conclusion: Sourcing from Midlands Packaging Corp.

After a thorough evaluation of Midlands Packaging Corp. as a potential supplier, it is evident that the company presents a strong and reliable option for packaging needs. Their established reputation for quality manufacturing, compliance with industry standards, and experience across diverse packaging solutions positions them as a competitive partner. Midlands Packaging Corp. demonstrates operational stability, consistent production capacity, and a commitment to sustainable practices—factors that align well with our strategic sourcing objectives.

Additionally, their location in the Midlands region offers logistical advantages, including favorable transportation access and potential cost efficiencies. While pricing remains competitive, the value-added services such as design support, on-time delivery, and responsive customer service further strengthen their appeal.

In conclusion, sourcing from Midlands Packaging Corp. represents a viable and advantageous partnership opportunity. We recommend proceeding with a pilot order to validate performance and scalability before entering into a long-term agreement, ensuring seamless integration into our supply chain.