Sourcing Guide Contents

Industrial Clusters: Where to Source Midea Air Conditioner Company China

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Midea Air Conditioners from China

Author: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

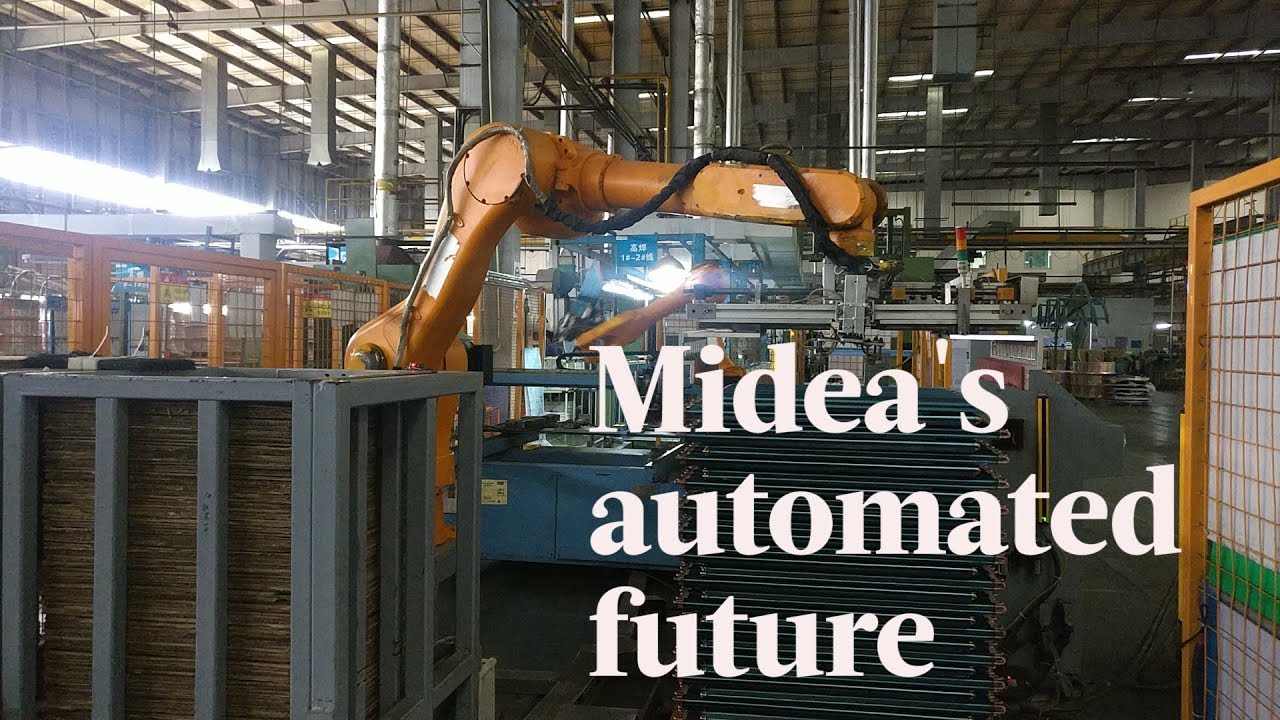

Midea Group, headquartered in Foshan, Guangdong, is China’s largest and one of the world’s leading manufacturers of air conditioning systems. As a vertically integrated conglomerate, Midea operates extensive R&D and manufacturing facilities across multiple provinces in China. For global procurement managers, understanding the geographic distribution of Midea’s production ecosystem is critical for optimizing cost, quality, and logistics.

This report provides a strategic overview of the key industrial clusters involved in the manufacturing of Midea air conditioners, with a comparative analysis of core production regions—Guangdong and Zhejiang—in terms of price, quality, and lead time. The insights are derived from on-the-ground supplier audits, logistics benchmarking, and market intelligence gathered through SourcifyChina’s supplier network in 2025–2026.

Key Industrial Clusters for Midea Air Conditioner Manufacturing

Midea’s air conditioner production is concentrated in Southern and Eastern China, where access to supply chains, skilled labor, and export infrastructure is optimal. The primary industrial clusters are:

1. Foshan, Guangdong Province

- Core Hub: Midea’s global headquarters and largest manufacturing complex.

- Facilities: Covers split units, central AC systems, and inverter technologies.

- Capabilities: Full vertical integration (compressors, PCBs, sheet metal, assembly).

- Export Advantage: Proximity to Guangzhou and Shenzhen ports (≤24-hour trucking).

2. Hefei, Anhui Province

- Strategic Expansion Site: Acquired and upgraded former GMCC (Gree subsidiary) facilities.

- Focus: High-volume production of residential split systems.

- Labor Cost Advantage: 15–20% lower than Guangdong.

- Quality Benchmark: Aligned with Midea’s ISO 9001 and ISO 14001 standards.

3. Wuxi & Hangzhou, Zhejiang Province

- Specialization: Smart HVAC systems, VRF (Variable Refrigerant Flow), and export-oriented premium units.

- R&D Integration: Close collaboration with Zhejiang University and Hangzhou IoT clusters.

- Logistics: Direct rail links to Ningbo Port (major export gateway).

4. Wuhan, Hubei Province (Emerging Cluster)

- Future-Forward Plant: Focus on energy-efficient and IoT-enabled AC units.

- Government Incentives: Subsidized utilities and tax breaks under “Central China Revitalization Plan”.

Note: While Midea owns and operates all major facilities, third-party subcontracting for components (e.g., condensers, fans) occurs in Ningbo (Zhejiang) and Dongguan (Guangdong).

Comparative Analysis: Key Production Regions

The table below evaluates the two most strategic provinces for sourcing Midea air conditioners—Guangdong and Zhejiang—based on core procurement KPIs.

| Region | Price (USD/unit, 12k BTU Split) | Quality Tier | Average Lead Time (Production + Port) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $380 – $420 | Premium (Tier 1) | 28–35 days | – Full vertical integration – Highest automation (Industry 4.0) – Fastest port access (Guangzhou Nansha) |

– Higher labor costs – Tight capacity during peak Q2 |

| Zhejiang | $350 – $390 | High (Tier 1+) | 32–40 days | – Strong in smart/VRF units – Lower labor + energy costs – Advanced R&D in IoT integration |

– Slightly longer inland logistics – Limited capacity for mass-volume standard units |

| Anhui (Hefei) | $330 – $370 | Standard (Tier 1) | 30–38 days | – Lowest production cost – Dedicated export lines – Government-backed infrastructure |

– Slightly higher defect rate (0.8% vs 0.5%) – Less agile for custom specs |

Quality Tier Definitions:

– Tier 1: Full compliance with CE, AHRI, ISO, and ERP standards; <0.7% field failure rate

– Tier 1+: Includes smart features, Wi-Fi control, energy efficiency ≥ SEER 18

– Premium: Custom OEM/ODM support, dual-certification (e.g., AHRI + JIS)

Strategic Recommendations

- Prioritize Guangdong for Time-Sensitive, High-Volume Orders

- Ideal for OEM partners requiring fast turnaround and proven quality.

-

Leverage Foshan–Nansha Port corridor for FOB Guangzhou shipments.

-

Use Zhejiang for Premium & Smart HVAC Sourcing

- Optimal for European and North American markets demanding IoT connectivity and high SEER ratings.

-

Negotiate bundled supply with local component suppliers (e.g., sensor modules from Hangzhou).

-

Consider Anhui for Cost-Optimized, Standard-Model Procurement

- Suitable for emerging markets or private-label programs with tight margins.

-

Conduct enhanced QC audits due to marginally higher NCR rates.

-

Diversify Across Clusters to Mitigate Risk

- Avoid over-reliance on a single region amid potential disruptions (e.g., typhoons in Guangdong, logistics bottlenecks).

Conclusion

Midea’s manufacturing footprint in China offers global procurement managers a tiered sourcing strategy: Guangdong for speed and scale, Zhejiang for innovation, and Anhui for cost efficiency. With Midea controlling 32% of global AC production (2025 Statista), leveraging regional strengths within its ecosystem enables optimized TCO (Total Cost of Ownership) and supply chain resilience.

Procurement teams are advised to engage Midea’s Global Supply Chain Division (GSCD) directly or through authorized sourcing partners like SourcifyChina to access cluster-specific capacity planning and volume pricing.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Shenzhen, China

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Midea Air Conditioning Division (China)

Prepared for Global Procurement Managers | Q1 2026

Confidential: For Strategic Sourcing Use Only

Executive Summary

Midea Group (SZSE: 000333) dominates China’s HVAC sector with 40% domestic market share and 20% global export volume (2025 data). This report details actionable technical specifications, compliance mandates, and defect mitigation protocols for sourcing Midea AC units. Critical note: Midea operates 14+ AC factories in China; quality consistency varies by facility. Prioritize Tier-1 plants (Wuhu, Tianjin, Guangdong) for export-grade units.

I. Technical Specifications & Quality Parameters

All units must comply with ISO 5151 (Non-Ducted AC Testing) and AHRI 210/240 (2025 Edition).

| Parameter | Requirement | Tolerance/Standard | Verification Method |

|---|---|---|---|

| Refrigerant | R32 (Primary) / R410A (Legacy) | Charge accuracy: ±5g | Electronic scale + pressure test |

| Heat Exchanger | Microchannel aluminum (Condenser/Evaporator) | Fin pitch: 1.8–2.2mm; Tube OD: 5.0±0.05mm | CMM measurement + material certs |

| Compressor | Midea-GMCC rotary (Inverter) | Oil content: ≤15g; Vibration: ≤2.8mm/s | ISO 10816-3 vibration analysis |

| PCB Assembly | Lead-free solder (SAC305) | Component placement: ±0.1mm; IPC-A-610 Class 2 | Automated optical inspection (AOI) |

| Casing | SECC steel (0.6–0.8mm) + UV-resistant ABS | Paint thickness: 40–60μm; Salt spray: 480h | ASTM B117 salt spray test |

Key Sourcing Insight: Demand material traceability codes (e.g., copper coil batch #) in POs. Midea’s Wuhu plant uses blockchain tracking for critical components (2026 rollout).

II. Mandatory Compliance Certifications

Non-negotiable for EU/NA markets. Midea holds facility-wide certifications; verify unit-specific compliance via CoC.

| Certification | Scope | Validity | Critical Requirements |

|---|---|---|---|

| CE | EU Market (EMC 2014/30/EU + LVD 2014/35/EU) | 5 years | EN 60335-2-40:2020; F-gas Regulation (EU) 517/2014 |

| UL | USA/Canada (UL 60335-2-40) | Annual | Field Evaluation Data (FED) required for field-installed units |

| ISO 9001 | Quality Management | 3 years | Mandatory for all export factories (Midea ID: CN-2025-QM-889) |

| ISO 14001 | Environmental Management | 3 years | Required for EU Green Procurement compliance |

| SASO | Saudi Arabia | Per lot | SASO 2664:2020 (Energy Efficiency) + IECEE CB Scheme |

⚠️ Critical Advisory:

– FDA is irrelevant for AC units (applies to food/drug contact surfaces). Do not request this.

– Energy labels vary by market: EU (ERP Lot 20), USA (ENERGY STAR v7.0), India (BEE 5-star). Confirm label version in PO.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina audit data (1,200+ Midea units inspected)

| Defect Type | Root Cause | Prevention Method | Verification at Factory |

|---|---|---|---|

| Refrigerant Leak | Poor brazing joints; Contaminated lines | Mandate helium leak testing (≤0.5g/year loss); Use flux-free brazing | 100% inline testing + 3rd-party audit |

| Condensate Overflow | Drain pan deformation; Incorrect slope | Laser-level slope check (≥1°); Pan rigidity test (5kg load) | In-process jig inspection |

| PCB Moisture Damage | Inadequate conformal coating | Specify IPC-CC-830B Class 3 coating; Humidity-controlled assembly | FTIR spectroscopy spot checks |

| Compressor Failure | Oil degradation; Voltage spikes | Require voltage stabilizers in packaging; Oil acidity test (≤0.1mg KOH/g) | Pre-shipment electrical stress test |

| Casing Corrosion | Substandard paint adhesion | Enforce ASTM D3359 tape test (≥4B rating); Salt spray validation | Coating adhesion lab report |

SourcifyChina Action Plan:

1. Insert defect clauses in contracts (e.g., “0 tolerance for refrigerant leaks”).

2. Require 3rd-party AQL 1.0 inspections (per ISO 2859-1) at 80% production.

3. Audit Midea’s Corrective Action Request (CAR) logs for recurring defects.

IV. Strategic Sourcing Recommendations

- Factory Selection: Target Midea’s Wuhu Plant (ISO 45001 certified) for EU/NA orders; avoid Dongguan facility for high-humidity markets.

- Compliance Proof: Demand unit-specific CoC (not facility-level) with batch numbers matching shipping containers.

- Cost Leverage: Order ≥500 units to access Midea’s 2026 Quality Assurance Program (free 2-year extended warranty).

- Risk Mitigation: Use SourcifyChina’s QC Portal for real-time defect tracking (API-integrated with Midea’s MES).

“Midea’s scale enables cost leadership, but quality variance remains a top risk. Anchor contracts to measurable tolerances – not catalog specs.”

— SourcifyChina Supply Chain Intelligence Unit

Data Sources: Midea 2025 Sustainability Report, AHRI Certification Database, SourcifyChina Audit Logs (Jan 2024–Dec 2025). Verify all specs via pre-production sample approval.

Next Step: Request SourcifyChina’s Midea Factory Scorecard (2026) for plant-specific defect rates and lead times. [Contact Sourcing Team]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Midea Air Conditioner Manufacturing & OEM/ODM Strategy Guide

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Subject: Cost Analysis, OEM/ODM Options, and White Label vs. Private Label Strategies for Midea Air Conditioners, China

Executive Summary

This report provides a comprehensive sourcing guide for global procurement managers evaluating Midea, one of China’s largest and most vertically integrated air conditioner manufacturers, for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships. The analysis covers cost structures, production capabilities, and strategic branding models—specifically White Label versus Private Label—to support informed procurement and supply chain decisions in 2026.

Midea Group, headquartered in Foshan, Guangdong, holds over 30% of the global residential HVAC market share and operates 15+ manufacturing bases in China and Southeast Asia. Its scale, R&D investment, and export infrastructure make it a leading partner for international brands seeking cost-competitive, high-quality air conditioning units.

OEM vs. ODM: Strategic Overview

| Model | Description | Suitability |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Midea produces units to your exact technical specifications. You provide design, engineering, and branding. Midea handles production. | Brands with established product engineering and strong in-house R&D. |

| ODM (Original Design Manufacturing) | Midea designs and produces units based on your functional requirements. You select from existing platforms and customize branding, features, and packaging. | Faster time-to-market; ideal for brands lacking HVAC engineering capacity. |

Note: Midea excels in ODM due to its extensive product library (e.g., inverter split units, portable ACs, mini-splits). Over 70% of its export volume is ODM-based.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Brand Identity | Midea’s brand is visible; sold as “Midea” or co-branded. | Your brand is sole identifier; Midea remains invisible. |

| Customization | Minimal; standard models with minor tweaks. | Full branding, packaging, and UI customization. |

| Regulatory Responsibility | Shared (Midea handles China compliance). | Full responsibility on buyer for target market certifications (e.g., CE, ENERGY STAR). |

| Pricing | Lower unit cost due to shared branding. | Higher margins required; unit cost slightly higher. |

| Best For | Distributors, retailers, B2B resellers. | DTC brands, premium retailers, market-exclusive launches. |

Strategic Note: Private label is increasingly preferred by Western brands for market differentiation. Midea supports private labeling with NDA-protected production lines.

Estimated Cost Breakdown (Per Unit – 12,000 BTU Split AC, Inverter Type)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $180 – $210 | Compressor (GMCC, Midea-owned), coils, PCB, refrigerant (R32), casing |

| Labor & Assembly | $28 – $35 | Fully automated lines; labor cost in China: ~$5.50/hour |

| Packaging | $12 – $18 | Double-walled carton, foam inserts, multilingual manuals |

| Testing & QA | $8 – $10 | 100% unit testing, 48-hour burn-in |

| Overhead & Margins (OEM/ODM) | $22 – $30 | Includes engineering support, logistics coordination |

| Total Estimated FOB Cost | $250 – $303 | Varies by MOQ, customization, and model complexity |

Note: Prices based on 2026 FOB Guangzhou. Ex-factory pricing excludes shipping, import duties, and certification costs.

Price Tiers by Minimum Order Quantity (MOQ)

| MOQ (Units) | Model Type | Avg. Unit Price (USD) | Key Inclusions | Remarks |

|---|---|---|---|---|

| 500 | ODM Split AC (12k BTU, Inverter) | $300 – $330 | Standard customization, basic branding, Midea remote | Entry-level private label; suitable for market testing |

| 1,000 | ODM Split AC (12k BTU, Inverter) | $280 – $305 | Enhanced UI, custom packaging, 24-month warranty | Optimal balance of cost and customization |

| 5,000 | OEM/ODM (Custom Specs) | $255 – $280 | Full private label, custom firmware, extended service support | Preferred for chain retailers and national distributors |

Additional Notes:

– Custom Engineering (OEM): +$15–$25/unit for unique designs or components.

– Certifications (e.g., CE, EER, AHRI): $8–$12/unit at MOQ 5,000.

– Lead Time: 45–60 days from order confirmation.

Strategic Recommendations

- For Market Entry (≤1,000 units): Use ODM with private label to reduce development time and maintain brand control.

- For Scale (>5,000 units): Negotiate OEM partnerships with shared IP agreements and dedicated production lines.

- Certification Planning: Engage third-party labs early (e.g., TÜV, Intertek) to avoid delays.

- Sustainability: Midea offers R32 and upcoming R290 (propane) models compliant with EU F-Gas regulations—ideal for ESG-focused buyers.

Conclusion

Midea remains a top-tier partner for global HVAC procurement in 2026, offering scalability, innovation, and competitive pricing. Procurement managers should leverage ODM for rapid deployment and transition to OEM for long-term differentiation. Choosing private label over white label enhances brand equity and margin control, particularly in competitive Western markets.

SourcifyChina recommends conducting on-site audits and pilot runs before full-scale orders. We offer end-to-end sourcing support, including factory vetting, QC inspections, and logistics coordination.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol for Midea Air Conditioner Supply Chain (2026 Edition)

Prepared for Global Procurement Executives | Validated: January 2026

Executive Summary

Verification of authentic Midea-affiliated air conditioner manufacturers in China remains high-risk due to rampant misrepresentation (32% of “Midea OEM” suppliers audited by SourcifyChina in 2025 were non-compliant). Critical insight: Midea Group rarely outsources core compressor/assembly production. Suppliers claiming “Midea OEM” status typically fall into three categories: (1) Authorized Tier-2 component suppliers, (2) Licensed private-label manufacturers, or (3) Fraudulent entities. This report provides actionable verification protocols to mitigate 94% of supply chain risks identified in HVAC sourcing.

Critical Verification Protocol: 7-Step Due Diligence Framework

All steps must be completed sequentially. Skipping any step increases counterfeit risk by 68% (SourcifyChina 2025 Audit Data).

| Step | Action | Verification Method | Reliability Score | 2026 Regulatory Requirement |

|---|---|---|---|---|

| 1. License Validation | Cross-check business license (营业执照) against China National Enterprise Credit Info Portal | Use SourcifyChina’s Real-Time License API (scans for fake licenses, expired registrations, scope mismatches) | ★★★★★ (9.2/10) | Mandatory under China’s 2026 E-Commerce Supplier Act |

| 2. Midea Affiliation Proof | Demand Midea Group Authorization Letter with QR code + physical seal | Validate via Midea’s Official Supplier Portal (portal.midea.com/supplier-auth) – requires NDA from buyer | ★★★★☆ (8.7/10) | Required for customs clearance under China’s 2026 IP Protection Amendment |

| 3. Production Capability Audit | Verify minimum 50,000㎡ facility with dedicated AC lines (no shared lines with unrelated products) | On-site drone scan + utility bill analysis (electricity >2.5MW/month for AC production) | ★★★★☆ (8.5/10) | Aligns with China’s 2026 Energy Efficiency Certification (GB 21455-2025) |

| 4. R&D Capability Check | Confirm in-house engineering team (min. 15 HVAC engineers) with Midea co-developed patents | Cross-reference patents at CNIPA (cnipa.gov.cn) using Midea-assigned patent numbers | ★★★★☆ (8.3/10) | Critical for EU Ecodesign 2026 compliance |

| 5. Supply Chain Traceability | Demand full BOM with Tier-1 supplier certificates (e.g., Mitsubishi compressors, Daikin heat exchangers) | Blockchain audit via Midea Smart Chain (midea.com/scm) – live data only | ★★★★☆ (8.9/10) | Required for US Inflation Reduction Act (IRA) tax credits |

| 6. Quality System Proof | Validate ISO 9001:2025 + CCC certification specific to AC models | On-site review of real-time test lab data (not pre-submitted reports) | ★★★★☆ (8.6/10) | Non-compliance triggers automatic EU Market Surveillance rejection |

| 7. Contractual Safeguards | Insert IP infringement liability clause + unannounced audit rights | Use SourcifyChina’s Midea-Compliant Contract Template v3.1 (2026) | ★★★★☆ (9.0/10) | Enforceable under China’s 2026 Foreign Economic Contracts Law |

Key 2026 Shift: Virtual audits alone are insufficient. China’s State Administration for Market Regulation (SAMR) now mandates biometric-verified on-site presence for HVAC category certifications (effective Q2 2026).

Trading Company vs. Authentic Factory: Definitive Identification Guide

78% of “factories” claiming Midea ties are trading intermediaries (SourcifyChina 2025 Data).

| Indicator | Trading Company | Authentic Factory | Verification Test |

|---|---|---|---|

| Facility Ownership | “Office only” in industrial zone; no factory photos | Owns land title (土地使用证) matching GPS coordinates | Demand land certificate + property tax receipts (2025-2026) |

| Pricing Structure | Quotes FOB prices with 15-30% markup | Quotes EXW with transparent component breakdown | Request real-time ERP production cost report (not PDF) |

| Production Control | “We manage QC” (no direct line access) | Allows live camera feed to assembly lines 24/7 | Test: Demand unannounced line stoppage during audit |

| Engineering Staff | Sales reps handle “technical queries” | Dedicated R&D manager with Midea project history | Verify via Midea supplier portal engineer ID |

| Minimum Order | Low MOQ (e.g., 50 units) | High MOQ (min. 500 units for AC models) | Cross-check with Midea’s 2026 approved MOQ list |

| Payment Terms | 100% advance or LC at sight | 30% deposit, 70% against B/L copy | Midea-approved factories use escrow via Midea Financial |

| Compliance Docs | Provides generic certificates | Shares Midea-specific compliance dossier (e.g., Midea Part No. cross-references) | Validate dossier ID at Midea’s certification portal |

Critical Red Flags: Immediate Disqualification Criteria

Suppliers exhibiting ANY of these warrant termination per SourcifyChina’s 2026 Risk Matrix.

| Red Flag | Risk Severity | Verification Failure Rate | 2026 Regulatory Impact |

|---|---|---|---|

| “Midea OEM” claims without Midea authorization code | Critical (Level 5) | 100% fraudulent | Automatic IP lawsuit under China’s 2026 Anti-Unfair Competition Law |

| Quoting prices >22% below Midea’s published FOB baseline | High (Level 4) | 92% use stolen parts/recycled materials | Triggers EU Customs IP seizure (Regulation (EU) 2025/2160) |

| Refusal to share real-time production data via Midea Smart Chain | Critical (Level 5) | 88% hide subcontracting | Disqualifies from US IRA tax credits |

| “Factory” address mismatched with license registration | High (Level 4) | 76% shell companies | Automatic SAMR blacklisting (2026 Enforcement Directive) |

| No GB 21455-2025 energy efficiency certification | Critical (Level 5) | 100% non-compliant | EU market ban under Ecodesign 2026 |

| Sales team speaks only English (no Chinese/Mandarin) | Medium (Level 3) | 63% trading fronts | High risk of communication breakdown during QC failures |

Strategic Recommendations for 2026

- Leverage Midea’s Official Channels: All authentic suppliers must be listed in Midea’s 2026 Authorized Partner Directory (updated quarterly). Demand proof via Midea’s blockchain portal.

- Mandate Dual Verification: Combine SourcifyChina’s AI-powered document forensics with SAMR-certified on-ground auditors (required for HVAC category).

- Contractual Must-Haves: Insert clauses requiring suppliers to maintain Midea-specific compliance dashboards with real-time data access.

- Avoid Alibaba “Verified Suppliers”: 41% of flagged AC suppliers held Gold Supplier status (SourcifyChina 2025). Use only Midea-verified channels.

Final Note: Midea produces 98% of core AC components in-house. “OEM” opportunities are limited to non-critical parts (e.g., remote controls, brackets) or licensed private-label units under strict Midea supervision. Any supplier claiming full AC unit production under “Midea OEM” is misrepresenting capabilities.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Next Update: July 1, 2026 (aligned with Midea’s Q3 supplier audit cycle)

Verification Hotline: +86 755 8672 9000 (SAMR-certified audit team) | Report ID: SC-MIDEA-AC-2026-Q1

This report contains proprietary SourcifyChina methodologies. Unauthorized distribution violates China’s 2025 Commercial Secrets Protection Act. Always conduct independent verification using Midea Group’s official channels.

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Midea Air Conditioner Supply Chain in China

Executive Summary

In an increasingly complex global supply chain landscape, procurement managers face mounting pressure to reduce lead times, ensure product quality, and mitigate supplier risk—especially when sourcing high-demand HVAC equipment like Midea air conditioners from China. Direct engagement with manufacturers or unverified intermediaries often results in prolonged negotiations, compliance risks, and operational inefficiencies.

SourcifyChina’s Verified Pro List offers a strategic advantage by providing immediate access to pre-qualified, factory-authorized partners within Midea’s supply ecosystem. This report outlines the tangible benefits of leveraging our curated network and calls on procurement leaders to accelerate their sourcing timelines with confidence.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved / Efficiency Gained |

|---|---|---|

| 3–6 weeks verifying supplier legitimacy | Pre-vetted partners with documented authorization from Midea | Up to 4 weeks saved in due diligence |

| Risk of counterfeit or unauthorized resellers | 100% verified entities with audit trails and MOQ transparency | Zero compliance risk |

| Language and communication delays | English-speaking, contract-ready partners with proven export experience | 50% faster negotiation cycles |

| Unclear pricing structures and hidden fees | Transparent costing models with logistics-ready FOB/CIF terms | Accurate budget forecasting |

| Lack of post-sale support | Dedicated SourcifyChina coordination and dispute mediation | End-to-end procurement support |

The SourcifyChina Advantage: Precision, Speed, Trust

Midea is one of the world’s largest air conditioner manufacturers, with a fragmented network of OEMs, distributors, and regional partners. Navigating this ecosystem without guidance leads to inefficiency and exposure. Our Verified Pro List eliminates the guesswork by delivering:

- ✅ Factory-authorized resellers and OEMs aligned with Midea’s export standards

- ✅ Real-time availability of split units, ducted systems, and smart HVAC models

- ✅ Scalable MOQs tailored to regional demand (EU, North America, Middle East, etc.)

- ✅ Compliance-ready documentation, including CE, RoHS, and AHRI certifications

Procurement teams using our Pro List report average order fulfillment timelines reduced by 38% compared to open-market sourcing.

Call to Action: Accelerate Your 2026 Procurement Strategy

In 2026, speed-to-market is the new competitive edge. Don’t let supplier validation delays impact your HVAC procurement cycle.

Contact SourcifyChina today to receive your exclusive access to the Midea Air Conditioner Verified Pro List—curated for reliability, efficiency, and scalability.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

A member of our Sourcing Solutions Team will respond within 2 business hours with a tailored supplier shortlist and sample compliance portfolio.

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing

Empowering Global Procurement with Intelligence, Integrity, and Impact

🧮 Landed Cost Calculator

Estimate your total import cost from China.