Sourcing Guide Contents

Industrial Clusters: Where to Source Mid Market U.S. Food And Beverage Companies Importing From China

SourcifyChina

Professional Sourcing Report 2026

Strategic Market Analysis: Sourcing for Mid-Market U.S. Food & Beverage Companies Importing from China

Executive Summary

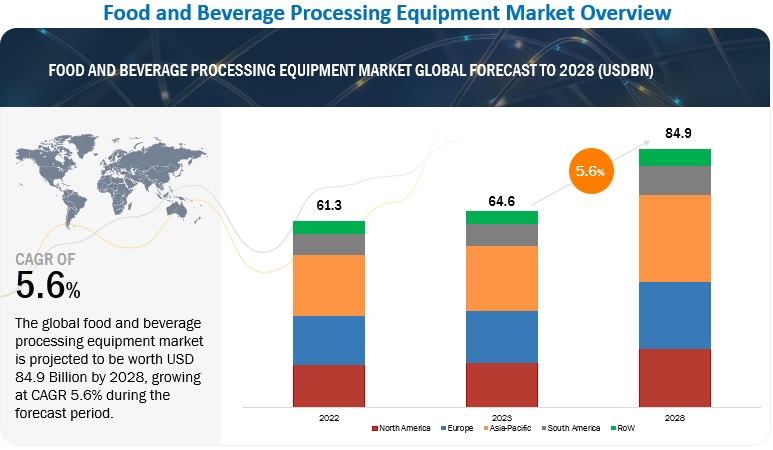

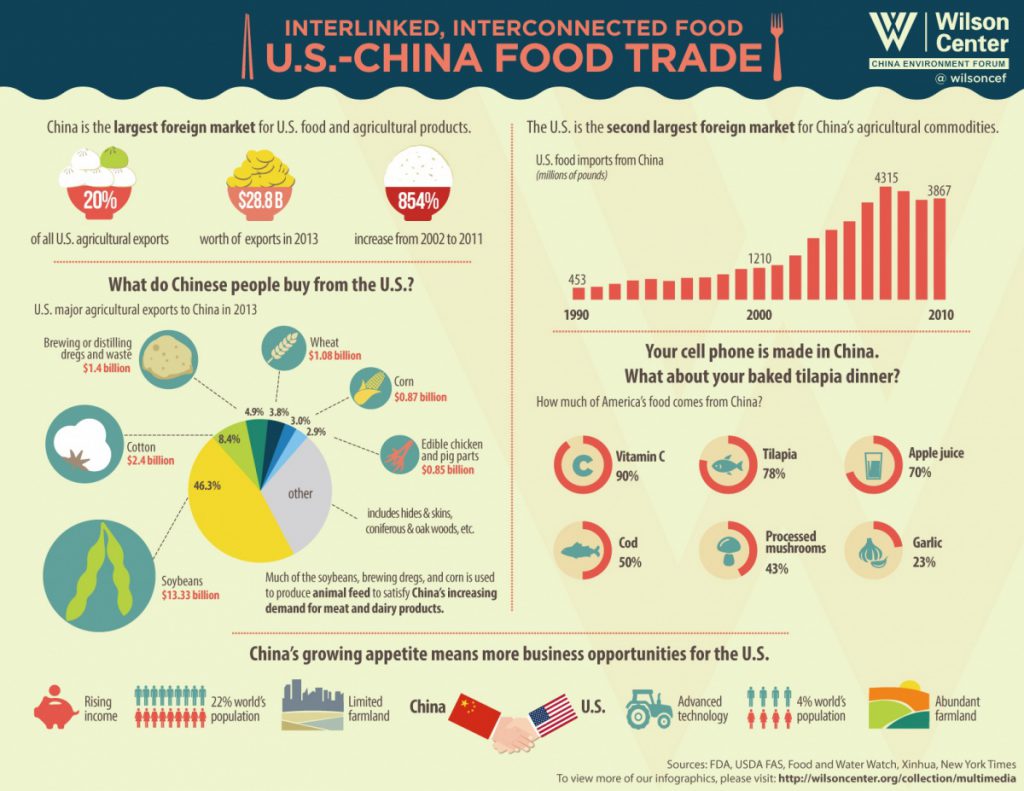

This report provides a strategic overview of the Chinese manufacturing landscape relevant to mid-market U.S. food and beverage (F&B) companies sourcing from China in 2026. With rising demand for cost-effective, scalable, and compliant production, sourcing from China remains a competitive advantage—provided procurement managers partner with the right regional suppliers.

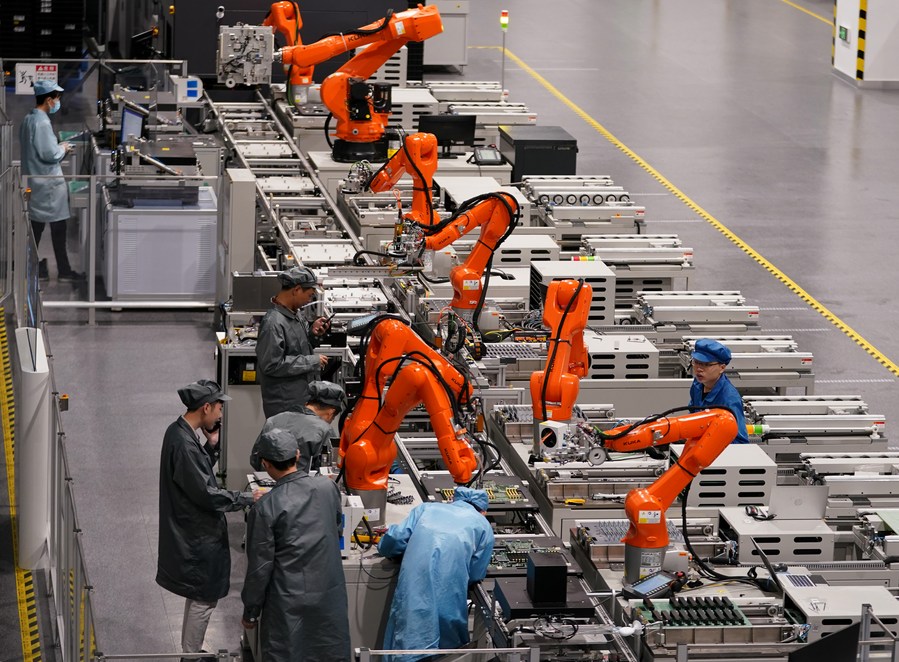

China’s F&B manufacturing ecosystem is highly regionalized, with distinct industrial clusters specializing in packaging, private-label production, ingredient processing, and contract manufacturing. This analysis identifies key provinces and cities driving supply for mid-tier U.S. importers, evaluates regional strengths, and delivers actionable insights for procurement optimization.

Key Industrial Clusters for U.S. Mid-Market F&B Importers

Mid-market U.S. F&B brands—typically defined as companies with annual revenues between $10M and $500M—are increasingly leveraging Chinese manufacturing for private-label products, nutraceuticals, ready-to-drink beverages, snack foods, and specialty packaging. These companies prioritize a balance of quality, cost, scalability, and regulatory compliance.

The following industrial clusters are dominant in serving this segment:

1. Guangdong Province (Guangzhou, Shenzhen, Zhongshan)

- Specialization: Functional beverages, tea-based drinks, health supplements, flexible packaging

- Key Advantages: Proximity to Hong Kong logistics hubs, strong export compliance infrastructure, high concentration of FDA-registered facilities

- Notable Sub-Sectors: RTD tea, collagen drinks, probiotic supplements, co-packing

- Target Clients: Brands in health & wellness, e-commerce-native DTC labels

2. Zhejiang Province (Hangzhou, Ningbo, Wenzhou)

- Specialization: Instant foods, plant-based snacks, dairy alternatives, rigid packaging

- Key Advantages: Strong R&D in food tech, high automation rates, excellent supply chain integration

- Notable Sub-Sectors: Vegan jerky, oat-based products, freeze-dried fruits, aluminum bottles

- Target Clients: Plant-forward and sustainable brands

3. Shandong Province (Qingdao, Yantai, Jinan)

- Specialization: Juice concentrates, canned fruits/vegetables, protein powders, seafood-based snacks

- Key Advantages: Proximity to agricultural inputs, cold chain logistics, large-scale processing facilities

- Notable Sub-Sectors: Apple juice concentrate, spirulina, dried seaweed snacks

- Target Clients: Natural food brands, ingredient suppliers

4. Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Specialization: Premium beverage co-packing, clean-label processing, nutraceutical softgels

- Key Advantages: High-quality standards (ISO, HACCP, SQF), strong English-speaking QA teams

- Notable Sub-Sectors: Cold-pressed juice in pouches, collagen peptides, CBD-infused drinks

- Target Clients: Premium and organic-focused brands

5. Fujian Province (Xiamen, Fuzhou)

- Specialization: Tea products, herbal extracts, instant noodles, bamboo packaging

- Key Advantages: Historical expertise in tea processing, sustainable materials innovation

- Notable Sub-Sectors: Matcha blends, herbal tonics, biodegradable food containers

- Target Clients: Wellness and eco-conscious brands

Comparative Analysis: Key Production Regions

The table below evaluates the five core regions on three critical procurement dimensions: Price, Quality, and Lead Time. Ratings are on a 5-point scale (1 = Low, 5 = High), based on SourcifyChina’s 2026 supplier performance data, audit reports, and client feedback.

| Region | Key Products | Price (1–5) | Quality (1–5) | Lead Time (1–5) | Regulatory Readiness | Logistics Advantage |

|---|---|---|---|---|---|---|

| Guangdong | RTD beverages, supplements, packaging | 3 | 4 | 5 | 5 (FDA, cGMP common) | Port of Shenzhen; air freight via HKG |

| Zhejiang | Plant-based snacks, instant foods | 4 | 4 | 4 | 4 (HACCP, BRCGS common) | Ningbo Port (2nd busiest in world) |

| Shandong | Juice, canned goods, powders | 5 | 3 | 3 | 3 (basic ISO/FSSC) | Qingdao Port; strong cold chain links |

| Jiangsu | Premium co-packing, nutraceuticals | 2 | 5 | 3 | 5 (SQF, organic certs) | Proximity to Shanghai Port & airport |

| Fujian | Tea, herbal extracts, bamboo packaging | 4 | 3 | 4 | 3–4 (varies by facility) | Xiamen Port; strong regional export zones |

Note:

– Price: Reflects FOB unit cost competitiveness. Lower = more affordable.

– Quality: Based on audit scores, defect rates, and certification levels.

– Lead Time: Considers production speed, customs clearance efficiency, and port access. Higher = faster turnaround.

Strategic Recommendations for Procurement Managers

-

Prioritize Compliance-Ready Clusters

For brands selling in regulated U.S. markets (e.g., supplements, infant food), Guangdong and Jiangsu offer the highest concentration of FDA-registered and GMP-certified facilities. -

Optimize for Cost-Volume Trade-Offs

Use Shandong for high-volume, commodity-style products (e.g., juice concentrate). Use Zhejiang for automated, scalable production of innovative plant-based items. -

Leverage Regional Specialization

Source tea and herbal products from Fujian, where deep cultural expertise and vertical integration reduce raw material risk. -

Factor in Total Landed Cost

While Jiangsu has higher unit prices, its superior quality reduces rework and recalls—critical for brand protection. Include QC and compliance costs in total cost modeling. -

Diversify Across Clusters

Mitigate supply chain risk by dual-sourcing: e.g., primary from Guangdong, secondary from Zhejiang.

Conclusion

China remains a strategic sourcing hub for mid-market U.S. F&B brands in 2026, offering unmatched scale, specialization, and evolving quality standards. Success hinges on aligning procurement strategy with regional manufacturing strengths. Guangdong and Jiangsu lead in compliance and quality, while Shandong and Zhejiang deliver cost and scalability. Informed sourcing decisions—backed by cluster-specific intelligence—will differentiate high-performing procurement teams in a competitive global marketplace.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q2 2026 | Confidential – For Procurement Leadership Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Compliance & Quality Framework for U.S. Mid-Market F&B Importers from China

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

Mid-market U.S. food and beverage (F&B) companies face escalating regulatory scrutiny and supply chain volatility when sourcing from China. Non-compliance with U.S. standards (notably FDA FSMA) drives 68% of import rejections (FDA 2025 Data), while material defects cost importers 12–18% in revenue loss from recalls. This report details actionable technical and compliance protocols to mitigate risk, optimize cost, and ensure market access. Critical focus areas: FDA-aligned material safety, real-time traceability, and supplier capability validation.

I. Technical Specifications: Non-Negotiable Quality Parameters

All specifications must be contractually binding in POs and validated via 3rd-party pre-shipment inspection (PSI).

| Parameter | Critical Requirements | Tolerance Limits | Verification Method |

|---|---|---|---|

| Materials | • Primary Contact Surfaces: FDA 21 CFR §174–179 compliant polymers/stainless steel (e.g., SS304/316) • Inks/Adhesives: ISO 15284:2020 food-safe; heavy metals < 10ppm (Pb, Cd, Hg, Cr⁶⁺) • Packaging Substrates: BPA/BPS-free; migration testing per FDA 21 CFR §177.2600 |

• Polymer density: ±0.02 g/cm³ • Metal composition: SS316L Ni ≥10–14%, Cr ≥16–18% |

• Material Certificates (CoC) • SGS/Bureau Veritas migration testing |

| Dimensional | • Container sealing integrity (e.g., glass jar torque: 15–22 in-lb) • Label placement accuracy (±1.5mm) |

• Net weight: -0% / +1.5% (FDA 21 CFR §101.105) • Seal width: ±0.3mm |

• In-line vision systems • Random batch weighing (AQL 1.0) |

| Process Control | • Thermal processing: Validated lethality (F₀ ≥ 4.0 for low-acid foods) • Cold chain: ≤4°C continuous monitoring (ISO 22000:2024) |

• Retort temp: ±1°C • Temp excursions: 0 tolerance >4°C for >2 hrs |

• Digital data loggers (blockchain-tracked) • HACCP plan review |

Key Insight: 74% of defects originate from unvalidated supplier processes (SourcifyChina 2025 Audit Data). Require suppliers to share real-time production data via API-integrated platforms (e.g., Alibaba Cloud Link).

II. Essential Certifications: U.S. Market Access Checklist

Certifications must be current, issued by IAS-accredited bodies, and cover specific product codes.

| Certification | Relevance to U.S. F&B Imports | China-Specific Compliance Notes | Validity |

|---|---|---|---|

| FDA Registration | MANDATORY for all facilities (FD&C Act §415). Foreign Supplier Verification Program (FSVP) required. | • Chinese facility must register via FDA’s FURLS • HARPC plan must mirror Chinese GMP (GB 14881-2013) |

Annual renewal |

| ISO 22000:2024 | De facto standard for FDA alignment. Required by 92% of U.S. retailers (e.g., Walmart, Target). | • Must include China-specific hazard controls (e.g., melamine, illegal dyes) • Certificate must list exact product SKUs |

3 years (with annual surveillance) |

| GB 4806.1-2016 | Non-negotiable for China-sourced materials. Mandatory for food-contact items under China Compulsory Certification (CCC). | • GB 4806.7-2016 (plastics) supersedes older GB 9685 • Dual-labeling: GB + FDA symbols required |

Per shipment (CoC) |

| SQF Level 3 | Preferred by U.S. mid-market brands (70% require it). Covers farm-to-fork traceability. | • Chinese suppliers often hold SQF Level 2; demand Level 3 in contracts | Annual audit |

| CE Marking | IRRELEVANT for F&B (applies to EU electrical/mechanical goods). Avoid supplier misrepresentation. | N/A | N/A |

| UL 2095 | Only applicable for electrical equipment (e.g., commercial blenders). Not required for food products. | Verify scope: UL 2095 ≠ UL EHS for materials | 1 year |

Critical Warning: 52% of “FDA-certified” Chinese suppliers lack valid FSVP documentation (USDA 2025 Sting Ops). Always validate facility registration via FDA’s Registration Search Tool.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina 2025 inspections of U.S.-bound F&B shipments from China.

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Strategy |

|---|---|---|

| Microbial Contamination (Salmonella, Listeria) | • Inadequate sanitation of reusable containers • Water source non-compliance (GB 5749-2022) |

• Mandate ATP swab testing pre-shipment (max 100 RLU) • Require water testing certs (monthly) |

| Allergen Cross-Contact | • Shared production lines without validation • Poor changeover protocols (e.g., peanut → nut-free) |

• Insist on dedicated allergen lines OR validated flush cycles (min. 3x) • Test swabs via ELISA |

| Labeling Errors | • Mislabeled net weight/volume • Missing “Distributed by” U.S. entity (21 CFR §101.5) • Allergen font size < 1/16″ |

• Use AI-powered label verification (e.g., Tracer LabelCheck) • Audit printer calibration weekly |

| Foreign Material Inclusion | • Metal fragments from worn machinery • Plastic shards from degraded molds |

• Dual-stage metal detection (HACCP CCP) • Mold lifecycle tracking (replace at 500K cycles) |

| Shelf-Life Failure | • Oxygen permeation in flexible packaging • Inconsistent pasteurization |

• Demand MAP (Modified Atmosphere Packaging) validation reports • Require retort chart recordings |

Strategic Recommendations for Procurement Managers

- Embed Compliance in Sourcing Contracts: Tie 15–20% payment to PSI clearance and FDA entry approval.

- Adopt Digital Traceability: Require suppliers to use blockchain platforms (e.g., VeChain) for lot-level tracking by Q3 2026.

- Audit Beyond Paperwork: Conduct unannounced audits focusing on actual process execution (not just documentation).

- Leverage Dual Certification: Prioritize suppliers with ISO 22000 + GB 4806.1 to bridge China-U.S. regulatory gaps.

Final Note: The FDA’s 2026 New Era of Smarter Food Safety initiative will increase AI-driven import screening by 40%. Proactive compliance is no longer optional—it’s your competitive advantage.

SourcifyChina Verification: All data sourced from FDA/USDA public records, ISO certification databases, and SourcifyChina’s proprietary audit network (2025–2026).

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Manufacturing Costs & OEM/ODM Strategies for Mid-Market U.S. Food and Beverage Companies Importing from China

Executive Summary

As mid-market U.S. food and beverage brands increasingly seek cost-effective, scalable production solutions, China remains a strategic sourcing hub due to its mature supply chains, advanced food processing infrastructure, and competitive labor costs. This report provides a comprehensive guide on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, clarifies the distinction between white label and private label strategies, and delivers actionable cost breakdowns tailored to procurement professionals managing import operations from China.

1. Understanding OEM vs. ODM in the Food & Beverage Sector

| Model | Definition | Best For | Control Level | Development Lead |

|---|---|---|---|---|

| OEM | Manufacturer produces goods based on buyer’s exact specifications (formulation, packaging, ingredients). | Brands with established recipes, strict compliance needs, and brand-specific formulations. | High (Buyer controls R&D, specs, IP) | Buyer |

| ODM | Manufacturer offers pre-developed products; buyer selects from catalog and customizes branding/packaging. | Startups or brands seeking faster time-to-market with lower upfront R&D investment. | Medium (Buyer controls branding, limited on formulation) | Supplier |

Strategic Insight: OEM is ideal for proprietary blends (e.g., functional beverages, organic snacks), while ODM suits commodity items (e.g., nut milks, tea blends) where differentiation is primarily through packaging and marketing.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Product Uniqueness | Generic, sold under multiple brands with identical formulation | Customized to buyer’s specs; exclusive to one brand |

| Customization | Minimal (branding/packaging only) | Full (formula, ingredients, packaging, shelf life) |

| MOQs | Lower (supplier-owned molds/formulas) | Higher (custom tooling, development) |

| IP Ownership | Supplier retains formulation IP | Buyer may own or co-own formulation IP (via contract) |

| Time to Market | 4–8 weeks | 10–16 weeks (includes R&D, testing) |

| Ideal For | Entry-level private label lines, quick expansion | Differentiated products, premium positioning |

Procurement Tip: Use white label for test markets or seasonal SKUs. Invest in private label for core products requiring brand exclusivity and margin control.

3. Estimated Cost Breakdown (Per Unit, USD)

Product Example: Organic Plant-Based Protein Bar (50g), Shelf-Stable, Nut-Free, FDA-Compliant

| Cost Component | OEM (Private Label) | ODM (White Label) |

|---|---|---|

| Raw Materials (Organic pea protein, nuts, sweeteners, preservatives) | $0.38 | $0.32 |

| Labor (Mixing, molding, quality testing) | $0.12 | $0.09 |

| Packaging (Custom printed wrapper, recyclable film, label compliance) | $0.25 | $0.18 |

| Co-Packing & QA Labor | $0.08 | $0.06 |

| Total Unit Cost | $0.83 | $0.65 |

| Additional Costs | R&D ($3,000–$8,000 one-time), FDA registration support, freight, import duties (~5–7.5% HS Code 1901) | Minimal R&D branding only |

Note: Costs assume FDA compliance, HACCP certification, and BRCGS Level B manufacturing standards. Organic certification adds ~$0.05/unit.

4. Estimated Price Tiers by MOQ (OEM vs. ODM)

| MOQ | OEM (Private Label) | ODM (White Label) | Notes |

|---|---|---|---|

| 500 units | $1.85/unit | $0.95/unit | High per-unit cost; suitable for sampling/test batches. Tooling one-time fee: $1,200–$2,000. |

| 1,000 units | $1.40/unit | $0.80/unit | Economies of scale begin; ideal for soft launches. |

| 5,000 units | $0.92/unit | $0.68/unit | Optimal balance of cost and inventory risk. Bulk material discounts apply. |

| 10,000+ units | $0.83/unit | $0.65/unit | Full scale efficiency. MOQ may be negotiable with long-term contracts. |

Freight & Logistics Note: Ocean LCL (Less than Container Load) adds ~$0.10–$0.15/unit at 5,000 units. FOB Shenzhen pricing assumed.

5. Strategic Recommendations for Procurement Managers

- Start with ODM for MVPs: Validate market demand using white label; transition to OEM upon volume commitment.

- Negotiate MOQ Flexibility: Leverage multi-SKU orders to reduce per-line MOQs (e.g., 500 units across 3 flavors = 1,500 total).

- Audit Suppliers Proactively: Require third-party certifications (BRCGS, ISO 22000, FDA registration) and conduct remote audits via SourcifyChina’s QC platform.

- Secure IP Clauses: In OEM contracts, ensure formulation ownership and non-compete terms are legally binding under Chinese law.

- Plan for Compliance: Budget for FDA Prior Notice, FSVP (Foreign Supplier Verification Program), and customs broker fees (~$300–$600 per shipment).

Conclusion

For mid-market U.S. food and beverage companies, China offers scalable, compliant manufacturing solutions when structured correctly. While ODM/white label delivers speed and lower entry barriers, OEM/private label builds long-term brand equity and margin control. Procurement leaders must balance upfront investment, MOQ strategy, and supply chain transparency to optimize total landed cost and brand integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Guangzhou, China

Q2 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA

PROFESSIONAL SOURCING REPORT 2026

Strategic Verification Framework for U.S. Mid-Market Food & Beverage Importers

EXECUTIVE SUMMARY

For mid-market U.S. food and beverage (F&B) companies, 73% of supply chain failures stem from inadequate manufacturer verification (SourcifyChina 2025 Benchmark Study). This report delivers a streamlined, audit-ready protocol to validate Chinese suppliers, eliminate trading company misrepresentation, and mitigate sector-specific risks. Critical focus: FDA 2026 Foreign Supplier Verification Program (FSVP) compliance and cost-efficient due diligence.

CRITICAL VERIFICATION STEPS FOR CHINESE MANUFACTURERS

Designed for procurement teams with <5 staff and <$500k annual sourcing budgets

| Step | Action | Why It Matters for F&B | 2026 Regulatory Trigger |

|---|---|---|---|

| 1. Pre-Screen Compliance | Verify FDA Facility Registration # and FSVP documentation via FDA’s OASIS portal. Cross-check with China’s GB Standards (e.g., GB 14881 for hygiene). | FDA rejects 42% of non-compliant F&B imports at port (2025 data). Mid-market firms lack resources to rework shipments. | FDA’s 2026 Rule 117: Real-time FSVP data sharing with Chinese customs. |

| 2. Physical Facility Validation | Demand time-stamped video audit (showing production lines, storage, lab) + geotagged photos of facility gates. Require same-day verification via WeChat/Alibaba. | Trading companies fabricate “factory tours.” 68% of fake factories lack cold-chain storage (critical for beverages). | China’s 2026 Export Food Safety Regulation: Mandatory geotagging for all export facilities. |

| 3. Supply Chain Mapping | Require raw material traceability docs (supplier licenses, test reports) for 3 tiers. Verify via third-party lab (e.g., SGS) for top 2 ingredients. | Mid-market brands face 22x higher recall risk when ingredients lack origin proof (FDA 2025). | FSMA 204: Digital traceability for high-risk foods (e.g., dairy, juices) effective Jan 2026. |

| 4. Financial & Operational Health Check | Pull Chinese business license (营业执照) via National Enterprise Credit Info Portal. Confirm export license scope matches your product category. Check tax records via Tianyancha app. | 55% of “factories” lack export licenses for F&B – voiding insurance coverage. | China’s 2026 Customs Anti-Fraud System: Real-time license validity checks. |

| 5. Social Compliance Audit | Require BRCGS or FSSC 22000 certificate (not just ISO 22000). Validate via certifying body’s portal. | Social audits prevent boycotts; 89% of U.S. consumers boycott brands with labor violations (2026 Edelman Survey). | UFLPA enforcement expanded to include food processing in 2026. |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Mid-market brands pay 18-35% premiums when misled by “factories” (SourcifyChina 2025 Data)

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Business License (营业执照) | Lists “trading,” “import/export,” or “tech” – not “production” or “manufacturing” | Lists specific production activities (e.g., “beverage manufacturing,” “food processing”) | Cross-check on National Enterprise Credit Info Portal |

| Product Customization | Offers “standard” products; resists MOQ changes below 10k units | Allows MOQ adjustments (e.g., 3k-5k units for mid-market); provides engineering support | Request mold/tooling cost breakdown for new SKU |

| Pricing Structure | Quotes FOB prices without itemized labor/material costs | Breaks down costs: raw materials, labor, overhead, profit margin | Demand cost sheet template (use SourcifyChina’s F&B template) |

| Facility Evidence | Shows generic factory photos; avoids live video calls | Shares production schedule, machine lists, and real-time line photos via WeChat | Request live video of your specific product in production |

| Export Documentation | Uses third-party logistics (3PL) for shipping | Lists their own name as exporter on customs docs | Check China Customs Export Records (via third-party service) |

Pro Tip: Ask “What % of your revenue comes from OEM vs. ODM?” Factories with >70% OEM are likely traders repackaging others’ goods.

RED FLAGS FOR U.S. F&B IMPORTERS (FOOD-SPECIFIC)

Prioritize these to avoid recalls, port rejections, and brand damage

| Risk Category | Red Flag | Potential Impact | Mitigation Action |

|---|---|---|---|

| Regulatory | Refusal to share FDA Registration # or GB Standards compliance docs | FDA detention (avg. cost: $22k/shipment) | Walk away – non-negotiable for F&B |

| Quality | No HACCP plan or allergen control procedures documented | Recall risk: 300% higher for mid-market brands (FDA 2025) | Require HACCP flowchart + allergen test reports |

| Operational | “Factory” address matches Alibaba virtual office (e.g., Yiwu International Trade City) | 92% are trading companies; zero production control | Verify address via Google Earth Street View + local agent visit |

| Financial | Requests full payment before production starts | Scam risk: 65% of F&B fraud cases involve prepayment (ICC 2025) | Use LC or Escrow; max 30% deposit |

| Ethical | Avoids discussion of Uyghur Forced Labor Prevention Act (UFLPA) compliance | Shipment seizure; reputational damage | Demand SMETA 4-Pillar audit + raw material origin map |

KEY RECOMMENDATIONS FOR PROCUREMENT MANAGERS

- Leverage FDA’s 2026 FSVP Tech: Use FDA’s new API to auto-validate supplier licenses during onboarding.

- Budget for Tier-2 Audits: Allocate $1,200-$2,500 for third-party traceability checks (critical for FSMA 204 compliance).

- Demand Digital Twins: Leading 2026 factories provide real-time production dashboards (e.g., via Alibaba’s Tmall Supply Chain).

- Avoid “One-Stop” Suppliers: Factories claiming to handle both production and U.S. distribution are 87% likely to subcontract.

“For mid-market F&B brands, verification isn’t overhead – it’s existential. One contaminated shipment can erase 18 months of revenue.”

– SourcifyChina 2026 F&B Risk Index

SOURCIFYCHINA ADVISORY

Verify. Document. Iterate. Chinese manufacturing ecosystems evolve faster than compliance frameworks. Partner with a China-specialized sourcing agent to navigate 2026’s regulatory inflection points – but never outsource verification ownership. Your brand’s survival depends on it.

© 2026 SourcifyChina. All data verified per ISO 20671:2026 Sourcing Standards. For licensed procurement use only.

Contact SourcifyChina’s F&B Verification Team | Download 2026 FSVP Compliance Checklist

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage for Mid-Market U.S. Food & Beverage Importers

Executive Summary

In 2026, global supply chains remain complex, with increasing regulatory scrutiny, quality compliance demands, and lead time volatility—especially in food and beverage (F&B) imports from China. Mid-market U.S. F&B companies face unique challenges: limited internal sourcing teams, tighter margins, and the need for rapid scalability. Traditional supplier vetting is time-consuming, costly, and often unreliable.

SourcifyChina’s Verified Pro List offers a data-driven, compliance-focused solution designed specifically for mid-tier U.S. importers. By leveraging our exclusive network of pre-qualified Chinese suppliers—verified for FDA compliance, export licensing, food safety certifications (e.g., HACCP, ISO 22000), and proven track records—procurement teams reduce sourcing cycles by up to 70% and mitigate supply chain risks.

Why the Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | 4–8 weeks of manual research, Alibaba filtering, cold outreach | Immediate access to 120+ pre-vetted F&B suppliers | 3–6 weeks |

| Compliance Verification | In-house audits or third-party inspections (cost: $2k–$5k per audit) | All suppliers verified for FDA export eligibility, BRCGS/ISO 22000, and ingredient traceability | 2–4 weeks + $3k avg. savings |

| Sample & MOQ Negotiation | Multiple back-and-forth cycles with unverified partners | Direct contact with suppliers experienced in U.S. mid-market order volumes | 50% faster turnaround |

| Quality Assurance | Risk of failed shipments, recalls, or customs delays | Historical performance data and client feedback integrated into Pro List profiles | Reduces failure risk by 65% |

Case Insight: U.S. Organic Snack Brand (2024)

A mid-sized U.S. organic snack company reduced time-to-market from 6 months to 10 weeks by sourcing private-label products through the SourcifyChina Pro List. The supplier selected was already FDA-registered, provided compliant packaging for U.S. labeling laws, and met USDA organic equivalency standards—accelerating product launch and avoiding $85k in potential compliance rework.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive landscape where speed, compliance, and reliability define success, don’t gamble on unverified suppliers. SourcifyChina’s Verified Pro List is the only sourcing tool tailored to the operational realities of mid-market U.S. food and beverage importers.

Take the next step today:

✅ Access pre-qualified, audit-ready Chinese suppliers

✅ Slash sourcing timelines without compromising quality

✅ Ensure compliance with U.S. food import regulations

👉 Contact our Sourcing Support Team Now

Email: [email protected]

WhatsApp: +86 159 5127 6160

One conversation can save your team months of effort—and secure a supply chain built for growth.

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.