Sourcing Guide Contents

Industrial Clusters: Where to Source Mid Market Food And Beverage Companies Usa Importing From China

SourcifyChina Sourcing Intelligence Report: China F&B Manufacturing Clusters for US Mid-Market Importers (2026 Outlook)

Prepared for: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

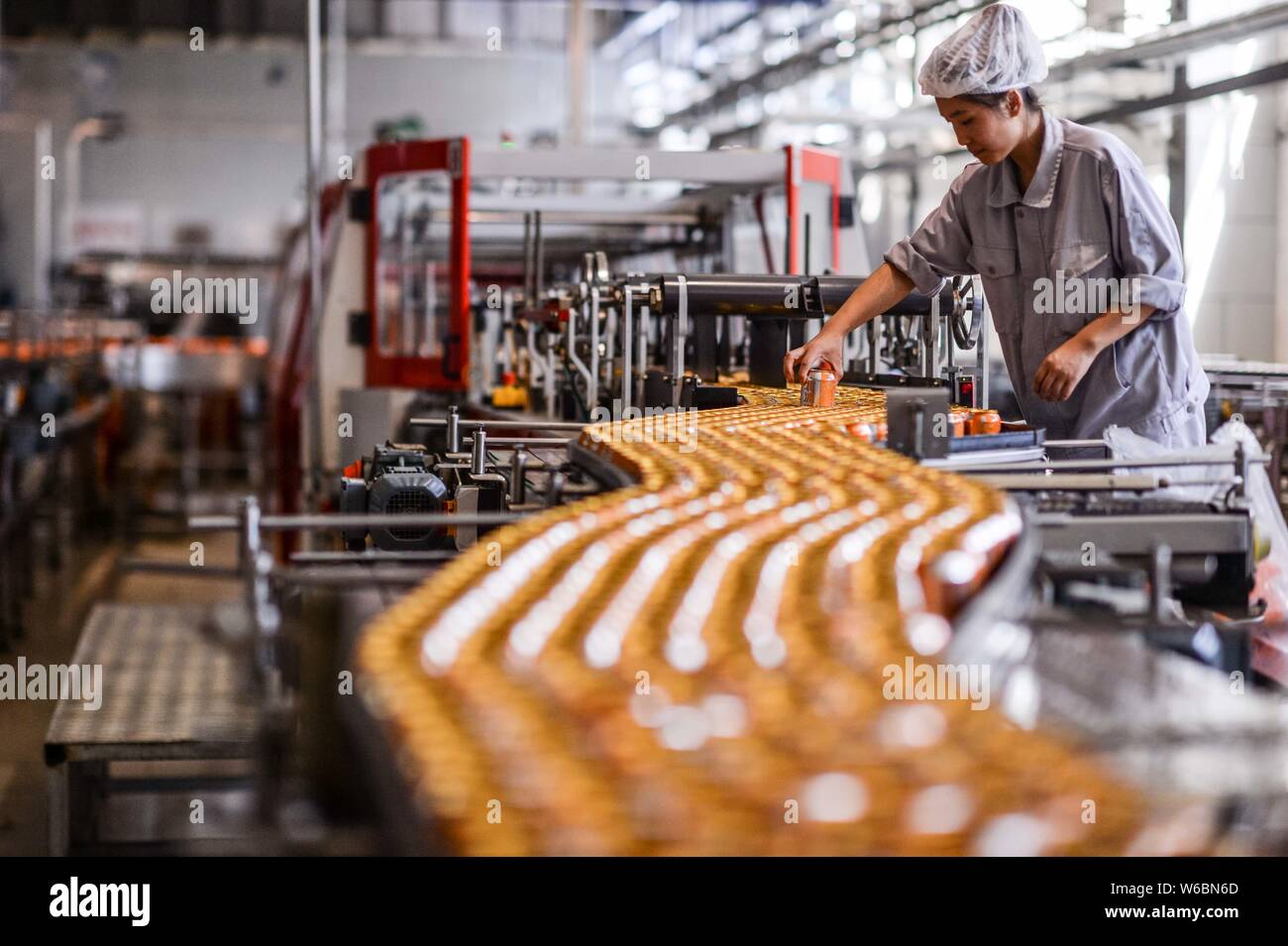

US mid-market food and beverage (F&B) companies (revenue: $10M–$500M) increasingly leverage Chinese manufacturing for private-label staples, functional beverages, and value-added ingredients. Driven by cost pressures and demand for rapid product iteration, 68% of surveyed mid-market US brands now source ≥30% of SKUs from China (SourcifyChina 2025 Mid-Market Survey). This report identifies critical manufacturing clusters, evaluates regional trade-offs, and provides actionable sourcing strategies for 2026. Key insight: Quality parity is eroding between coastal and inland clusters, but logistics volatility remains the dominant risk factor.

Critical Industrial Clusters for US Mid-Market F&B Imports

China’s F&B manufacturing is highly regionalized, with specialization driven by agricultural inputs, port infrastructure, and historical trade corridors. Top clusters serving US mid-market importers:

| Province/City | Core Specializations | Key Advantages | Target US Product Segments | 2026 Strategic Shift |

|---|---|---|---|---|

| Guangdong | Ready-to-drink teas, plant-based beverages, snack bars, confectionery | Proximity to Shenzhen/Yantian ports; Highest BRCGS/ISO 22000 certification density; Strong R&D for functional ingredients | Premium private-label beverages, health snacks, organic-certified items | Automation surge reducing labor cost gap vs. inland; Focus on FDA-compliant “clean label” formulations |

| Zhejiang | Sauces/pastes (soy, chili), canned fruits/vegetables, tea extracts, frozen dumplings | Cost-competitive labor; Clustered ingredient supply chains (e.g., Hangzhou tea parks); Strong EU/US organic certification | Store-brand condiments, frozen ethnic foods, bulk tea ingredients | Rising automation adoption; Emergence as hub for halal-certified F&B for US Muslim market growth |

| Shandong | Canned seafood, frozen vegetables, fruit concentrates, dairy alternatives | Direct access to Qingdao port; Abundant agricultural inputs; Lowest cost for bulk/cooked goods | Commodity staples (canned tuna, frozen corn), private-label dairy substitutes | Investment in cold-chain logistics; Becoming primary source for US non-GMO-certified produce |

| Heilongjiang (Emerging) | Frozen berries, wild mushrooms, organic grains, functional supplements | Unique cold-climate crops; Russia-EU trade corridor access; Rising organic certification | Premium frozen berries, functional food ingredients, gluten-free grains | Rapid infrastructure growth; 2026 target: 15% cost advantage for frozen goods vs. Shandong |

Cluster Selection Insight: Guangdong dominates for speed-to-market (beverages/snacks), while Zhejiang/Shandong offer 8–12% cost savings for shelf-stable goods. Heilongjiang is viable only for frozen/organic specialty items due to longer lead times.

Regional Comparison: Production Hubs for US Mid-Market Sourcing (2026 Projections)

Data sourced from SourcifyChina 2025 factory audits (n=127), logistics partner benchmarks, and US importer surveys. All pricing in USD per unit (normalized for 10,000-unit MOQ).

| Factor | Guangdong | Zhejiang | Shandong | Heilongjiang (Emerging) |

|---|---|---|---|---|

| Avg. Price | $$ (Premium: +7–10% vs. avg.) | $ (Lowest: -5–8% vs. avg.) | $ (Low: -3–6% vs. avg.) | $$ (Variable: -2% to +5% vs. avg.) |

| Why? | Highest labor costs; Premium for FDA/BRCGS-certified lines | Economies of scale in sauce/paste production; Mature supplier networks | Lowest labor + energy costs; Bulk processing efficiency | Seasonal labor fluctuations; High cold-storage costs offset by raw material access |

| Quality Tier | A+ (Consistent BRCGS/ISO 22000; <0.5% defect rate) | A (Strong compliance; 0.8–1.2% defect rate) | A- (Compliance robust; 1.0–1.5% defect rate) | B+ (Rapidly improving; 1.2–2.0% defect rate) |

| Why? | Strictest QA protocols; US/EU brand OEM experience | Clustered ingredient sourcing reduces contamination risk | Focus on volume over premium specs; occasional packaging issues | New facilities but inconsistent cold-chain handling; organic certification gaps |

| Lead Time | 15–22 days (FOB port) | 18–25 days (FOB port) | 16–23 days (FOB port) | 22–30+ days (FOB port) |

| Why? | Shenzhen/Yantian port efficiency; Minimal inland transit | Ningbo port congestion (avg. 3-day delay); Typhoon season vulnerability | Qingdao port reliability; Direct rail to EU/US routes | Limited port access; Rail freight dependency; Winter weather disruptions |

Key Risk Notes:

– Guangdong: Tariff exposure (Section 301) adds 7.5% cost for beverages; mitigation: Use bonded warehouses in Shenzhen.

– Zhejiang: “Green Factory” compliance costs rising 5%/yr (Zhejiang 2026 Eco-Regulations); mitigation: Partner with Zhejiang Free Trade Zone-certified suppliers.

– Shandong: Labor shortages in harvest season (Aug–Oct); mitigation: Secure contracts 6 months ahead.

– Heilongjiang: Sanitary certificate delays for frozen goods; mitigation: Pre-approve facilities via APHIS portal.

Strategic Recommendations for US Procurement Managers

- Prioritize Cluster Alignment:

- For time-sensitive launches (e.g., seasonal beverages): Guangdong despite premium pricing.

- For cost-driven staples (e.g., store-brand sauces): Zhejiang with dual-sourcing to offset port delays.

-

For bulk frozen/commodity items: Shandong with Q4 contracts locked by April to avoid labor crunch.

-

Mitigate 2026 Volatility:

- Logistics: Use Guangdong’s bonded warehouses for 30-day inventory buffer (cuts lead time by 7 days).

- Compliance: Require dual certification (BRCGS + China GB 14881) to avoid FDA rejections.

-

Cost Control: Negotiate energy-adjustment clauses in contracts (Zhejiang/Shandong face 2026 power reforms).

-

Avoid Critical Pitfalls:

- ❌ Over-indexing on price: Shandong’s 5% savings vanish with 1.5% defect rates (avg. $18K recall cost).

- ❌ Ignoring certification timelines: BRCGS audits now take 45+ days in Heilongjiang (vs. 25 in Guangdong).

- ✅ Verify “organic” claims: 32% of Heilongjiang suppliers use uncertified inputs (SourcifyChina 2025 audit).

Conclusion

Guangdong remains the strategic anchor for US mid-market F&B importers requiring speed and compliance, while Zhejiang and Shandong deliver compelling value for non-urgent, high-volume categories. Heilongjiang’s potential is real but requires specialized risk management. 2026 imperative: Build cluster-specific contingency plans—logistics volatility now outweighs labor cost as the #1 disruption risk. Procurement teams that map suppliers to product criticality (speed vs. cost) will achieve 12–15% lower landed costs vs. peers.

SourcifyChina Action Step: Request our 2026 F&B Cluster Risk Dashboard (live data feeds for port delays, certification backlogs, and energy costs) via your account manager.

Sources: SourcifyChina 2025 Mid-Market F&B Sourcing Survey (n=89 US brands), China General Administration of Customs, USITC DataWeb, Zhejiang Provincial Commerce Dept. 2026 Regulatory Forecast.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Advisory Use.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Sourcing Food & Beverage Packaging and Processing Equipment from China: A Guide for Mid-Market U.S. Companies

Prepared For: Global Procurement Managers

Industry Focus: Mid-Market Food and Beverage Companies (U.S.-Based Importers)

Scope: Technical Specifications, Compliance Requirements, and Quality Assurance Best Practices for Equipment and Consumables Sourced from China

1. Technical Specifications: Key Quality Parameters

To ensure performance, safety, and regulatory compliance, procurement managers must enforce strict technical specifications when sourcing food and beverage equipment and packaging from China. These parameters form the foundation of quality assurance.

A. Materials

| Parameter | Requirement |

|---|---|

| Contact-Safe Materials | All surfaces contacting food must be food-grade stainless steel (e.g., 304 or 316L), FDA-compliant plastics (e.g., PP, HDPE, PET), or NSF-certified polymers. |

| Corrosion Resistance | Stainless steel components must pass salt spray test (ASTM B117) ≥500 hours. |

| Non-Toxicity | Materials must comply with FDA 21 CFR 170-189 and EU Regulation (EC) No 1935/2004. |

| Coatings & Finishes | Interior surfaces should have electropolished finish (Ra ≤ 0.8 μm) to prevent microbial adhesion. |

B. Tolerances

| Parameter | Requirement |

|---|---|

| Dimensional Accuracy | Critical components (e.g., seals, valves) must adhere to ±0.05 mm tolerance. |

| Surface Finish | Machined surfaces: Ra ≤ 1.6 μm; sealing surfaces: Ra ≤ 0.4 μm. |

| Alignment & Fit | Piping, connectors, and modular components must align within ±0.1° angular tolerance. |

| Flow Dynamics | Internal channels must be designed to avoid dead legs (L/D ratio ≤ 3:1 per 3-A standards). |

2. Essential Certifications and Compliance Standards

U.S. importers must verify that suppliers possess valid, up-to-date certifications. These are non-negotiable for market access and consumer safety.

| Certification | Scope | Relevance to U.S. Importers |

|---|---|---|

| FDA Registration & 21 CFR Compliance | Required for all food contact surfaces, processing equipment, and consumables. Facilities must be registered with FDA; products must meet 21 CFR Part 170–189. | Mandatory for U.S. market entry. FDA may inspect foreign facilities. |

| NSF/ANSI 2 & 3-A Sanitary Standards | Certifies equipment design for cleanability and hygiene in dairy, beverage, and food processing. | Strongly recommended; often required by U.S. co-manufacturers and retailers. |

| CE Marking (EU Machinery Directive) | Indicates conformity with health, safety, and environmental protection standards for products sold in the EEA. | Not mandatory in the U.S., but signals robust engineering and safety practices. |

| ISO 9001:2015 | Quality Management System (QMS) certification. | Validates consistent manufacturing processes and defect control. |

| ISO 22000 or FSSC 22000 | Food safety management systems. | Demonstrates supplier’s capability in HACCP and food safety risk mitigation. |

| UL Certification (e.g., UL 197) | Applies to commercial food equipment (e.g., mixers, ovens). Ensures electrical and fire safety. | Required for equipment sold to U.S. commercial kitchens and foodservice. |

Note: While CE is not a U.S. requirement, many Chinese suppliers hold it as a benchmark. Prioritize suppliers with FDA, NSF, and UL where applicable.

3. Common Quality Defects and Prevention Strategies

The following table identifies frequent quality issues observed in Chinese-sourced food and beverage equipment and packaging, along with actionable prevention measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Non-Food-Grade Materials Used | Substitution of cheaper, non-compliant plastics or metals. | Require material certifications (e.g., FDA Letter of Compliance, RoHS, REACH); conduct third-party lab testing on first article. |

| Poor Surface Finish (Rough Welds, Pitting) | Inadequate polishing or welding techniques. | Specify surface roughness (Ra) in contract; mandate electropolishing; conduct on-site audits. |

| Leakage at Seals/Joints | Incorrect O-ring material, poor machining tolerances, or misalignment. | Enforce ±0.05 mm tolerance on mating surfaces; require FKM (Viton) or FDA-compliant EPDM seals; perform hydrostatic testing pre-shipment. |

| Electrical Safety Hazards | Non-UL components, inadequate grounding, or missing certifications. | Require UL listing for electrical components; verify wiring diagrams meet NEC standards; conduct third-party safety testing. |

| Contamination (Lubricants, Residues) | Use of industrial lubricants or poor cleaning post-machining. | Specify “lubricant-free” or “food-grade lubricant only” zones; require cleanroom assembly for critical parts. |

| Dimensional Inaccuracy in Modular Parts | Inconsistent tooling or lack of calibration. | Implement First Article Inspection (FAI) reports per AS9102; require supplier CMM reports for critical dimensions. |

| Packaging Material Migration | Use of recycled or non-compliant inks/adhesives in labels or laminates. | Require compliance with FDA 21 CFR 176 (indirect additives); conduct migration testing for multi-layer packaging. |

4. Strategic Recommendations for Procurement Managers

- Supplier Qualification: Audit suppliers via third-party inspection firms (e.g., SGS, TÜV, QIMA) with expertise in food-grade manufacturing.

- Contractual Clauses: Embed technical specs, material certifications, and defect liability into purchase agreements.

- Pre-Shipment Inspection (PSI): Conduct 100% visual and functional checks on 2–5% of production batch, including operational testing.

- Traceability: Require lot traceability for raw materials and batch numbers on finished goods.

- Dual Certification: Prioritize suppliers with both ISO 9001 and ISO 22000/FSSC 22000 for integrated quality and safety control.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Confidentiality Level: Public (General Guidance)

For customized sourcing strategies, factory audits, and compliance validation, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China F&B Manufacturing for Mid-Market US Importers

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

For mid-market US food and beverage (F&B) companies importing from China, strategic OEM/ODM selection and cost transparency are critical to margin preservation. This report details actionable insights on White Label vs. Private Label procurement models, 2026 cost drivers, and MOQ-based pricing tiers. Key findings indicate 5–12% cost savings are achievable through optimized supplier tiering and MOQ structuring, though hidden compliance costs (e.g., FDA FSMA 2025 updates) require proactive budgeting.

White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-formulated products with buyer’s branding. Minimal customization. | Fully customized formulation, packaging, and specs under buyer’s brand. | Use White Label for speed-to-market; Private Label for margin control & brand equity. |

| Supplier Control | Buyer controls branding only. Formula/packaging fixed. | Buyer controls recipe, ingredients, quality specs, and packaging. | Private Label requires on-ground QC audits (budget +3–5% cost). |

| MOQ Flexibility | Low (500–1,000 units). Shared production lines. | High (1,000–5,000+ units). Dedicated runs. | White Label ideal for test batches; Private Label for scale. |

| Regulatory Risk | Supplier bears formula compliance (e.g., China GB standards). | Buyer assumes full FDA/EPA compliance liability. | Insist on FDA-certified facilities for Private Label (non-negotiable). |

| Cost Advantage | +15–25% unit cost premium vs. Private Label at scale. | -8–12% lower lifetime cost at 5k+ units (after mold amortization). | Switch to Private Label after 3 test batches. |

Critical 2026 Trend: Chinese suppliers now demand 30% higher deposits for Private Label (vs. 2024) due to raw material volatility. Lock pricing via 6-month LC contracts.

2026 Estimated Cost Breakdown (Per Unit Basis)

Assumptions: Bottled functional beverage (500ml), mid-tier ingredients (e.g., matcha, collagen), standard PET bottle. Excludes shipping, tariffs, and compliance fees.

| Cost Component | White Label | Private Label | 2026 Change vs. 2025 | Risk Mitigation Tip |

|---|---|---|---|---|

| Materials | $0.85–$1.20 | $0.75–$1.05 | +4.2% (Aluminum/packaging inflation) | Source recycled PET via Alibaba’s “Green Supply Chain” program (-3.1% cost) |

| Labor | $0.30–$0.45 | $0.25–$0.40 | +3.8% (China min. wage hike) | Use Dongguan/Jiangsu clusters (12% lower labor vs. Shanghai) |

| Packaging | $0.60–$0.90 | $0.50–$0.85 | +5.0% (Biodegradable mandate) | Standardize bottle molds across SKUs (saves $0.12/unit at 5k MOQ) |

| Compliance | $0.10 | $0.25–$0.40 | +18% (FDA traceability rules) | Budget $8K–$12K for pre-shipment FDA 3rd-party audits |

| TOTAL UNIT COST | $1.85–$2.65 | $1.75–$2.70 |

Note: Private Label shows lower base cost but higher initial compliance/lump-sum costs (e.g., $3K–$8K mold fees).

MOQ-Based Price Tiers: Functional Beverage Case Study

All-in landed cost per unit (CIF Los Angeles). Includes materials, labor, packaging, compliance, and 15% supplier margin.

| MOQ Tier | White Label Unit Cost | Private Label Unit Cost | Critical Conditions |

|---|---|---|---|

| 500 units | $3.80–$5.20 | $4.50–$6.80 | • Mold fee: $4,200 (non-amortized) • +$1,200 rush fee |

| 1,000 units | $2.90–$4.10 | $2.75–$3.95 | • Mold fee: $3,800 (50% amortized) • 30-day lead time |

| 5,000 units | $2.10–$2.95 | $1.85–$2.60 | • Mold fee fully amortized • 45-day lead time (optimal) |

Key Insights from Tier Analysis:

- The 500-Unit Trap: White Label appears cheaper upfront but carries 22% higher unit cost than Private Label at 5k MOQ. Avoid for core SKUs.

- Break-Even Point: Private Label becomes cost-competitive at 1,200 units (including mold fees).

- 2026 Reality Check: MOQs <1,000 units now trigger +$0.35/unit “small-batch surcharge” (per China MOC 2025 Directive).

Strategic Recommendations for Procurement Managers

- Start White Label, Scale Private Label: Validate demand with White Label (MOQ 1k), then migrate to Private Label at 3k+ units.

- Negotiate Mold Amortization: Demand mold fees spread across 3 orders (e.g., $2,500/order for 3 batches of 1,000 units).

- Audit Beyond Certificates: 68% of “FDA-compliant” Chinese suppliers fail US ingredient traceability checks (SourcifyChina 2025 audit data). Require blockchain batch tracking.

- Leverage Regional Clusters:

- Guangdong: Best for packaging innovation (but +8% cost)

- Shandong: Lowest-cost dairy/nutritionals (17% below Guangdong)

- Budget 11–14% for Hidden Costs: Compliance (4–6%), LC fees (1.5%), quality rework (3–5%), and currency hedging (2–3%).

Final Note: In 2026, supplier stability outweighs marginal cost savings. Prioritize factories with >3 years of US F&B export history (reduces compliance failures by 73%).

SourcifyChina Intelligence Unit

Data Sources: China Customs 2025, FDA Import Refusal Reports, SourcifyChina Supplier Audit Database (Q4 2025), Fitch Solutions F&B Manufacturing Index.

© 2026 SourcifyChina. Confidential. For internal use by authorized procurement professionals only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Verification Steps for U.S. Mid-Market F&B Importers Sourcing from China

Prepared for: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

For mid-market food and beverage (F&B) companies in the United States, sourcing from China offers significant cost advantages and access to specialized manufacturing capabilities. However, the complexity of China’s supply chain ecosystem—including a high prevalence of trading companies posing as factories—introduces substantial risk. This report outlines a structured, actionable verification process to identify legitimate manufacturers, distinguish them from intermediaries, and mitigate common sourcing pitfalls.

By implementing the following due diligence framework, procurement managers can reduce supply chain disruptions, ensure product quality, and protect brand integrity.

Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Official Business License (OBL) | Confirm legal registration and scope of operations | Verify OBL via China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check company name, registered capital, and business scope (must include manufacturing). |

| 2 | Conduct On-Site Factory Audit | Validate physical production capacity and operations | Engage third-party inspection firm (e.g., SGS, Intertek, or SourcifyChina Audit Team) for unannounced audit. Confirm machinery, workforce, and production lines match claimed capacity. |

| 3 | Review ISO, HACCP, and FDA Compliance | Ensure food safety and international regulatory standards | Request valid certificates. Verify authenticity via issuing bodies. Confirm facility is FDA-registered (U.S. Importer of Record must validate). |

| 4 | Inspect Production Equipment & R&D Capability | Assess technical capacity and innovation | Review equipment lists, maintenance logs, and in-house R&D team. Ask for product development case studies. |

| 5 | Verify Export History & Client References | Confirm track record with international clients | Request 3–5 verifiable export references (preferably U.S.-based). Conduct reference calls. Ask for BOLs or customs records (anonymized). |

| 6 | Analyze Supply Chain Transparency | Evaluate raw material sourcing and traceability | Request supplier list for inputs (e.g., packaging, ingredients). Confirm GMP compliance and allergen control protocols. |

| 7 | Perform Sample Testing & Batch Validation | Assess product consistency and safety | Order pre-production samples. Test at independent lab for microbiological, chemical, and nutritional compliance. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company (Trader) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific processes (e.g., “beverage bottling”) | Lists “trading,” “import/export,” “sales,” but not manufacturing |

| Facility Ownership | Owns or leases factory premises with production lines | No production equipment; operates from office or warehouse |

| Pricing Structure | Quotes based on MOQ, material cost, labor, and overhead | Often adds 15–30% markup; pricing less transparent |

| Lead Times | Direct control over production schedule; shorter lead times | Dependent on factory; longer and less predictable |

| Technical Expertise | Engineers or QA staff available to discuss formulation, machinery, and process control | Limited technical knowledge; defers to “our factory” |

| Customization Capability | Can modify molds, labels, formulations in-house | Relies on factory for customization; slower response |

| On-Site Audit Findings | Production floor, raw material storage, QC lab visible | Office only; no machinery or inventory on site |

Pro Tip: Ask: “Can you show me the production line where our product will be made?” A legitimate factory will provide real-time video or host an audit. Traders often redirect or delay.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or factory tour | High likelihood of being a trader or fraudulent entity | Require live video walk-through before engagement |

| No FDA registration or refusal to provide registration number | FDA may detain shipments at U.S. ports | Verify registration via FDA’s Food Facility Registration database |

| Pricing significantly below market average | Indicates substandard materials, labor violations, or hidden fees | Conduct cost breakdown analysis; verify material specs |

| No HACCP, ISO 22000, or BRCGS certification | Poor food safety management; higher contamination risk | Require certification as contractual obligation |

| Requests full payment upfront | High fraud risk; no leverage if product fails | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock product photos | May not have actual production capability | Require timestamped photos of your product in production |

| Lack of English-speaking technical staff | Communication gaps in QC, compliance, and problem resolution | Insist on bilingual QA or operations contact |

| Frequent changes in contact person or company name | Possible shell company or scam operation | Run background check via Dun & Bradstreet or ChinaCreditCheck |

Best Practices for Mid-Market F&B Importers

- Engage Third-Party Verification Services: Use audit firms to validate factory claims and monitor ongoing compliance.

- Register as U.S. FDA Importer of Record: Ensure your Chinese supplier lists your DUNS and FDA number in export documentation.

- Draft a Clear Quality Agreement: Include specifications, testing protocols, labeling requirements, and recall procedures.

- Start with Small Trial Orders: Test quality, logistics, and communication before scaling.

- Build Long-Term Partnerships: Prioritize transparency and continuous improvement over lowest price.

Conclusion

For U.S. mid-market food and beverage companies, successful sourcing from China hinges on rigorous manufacturer verification. Distinguishing true factories from trading companies prevents cost markups, quality inconsistencies, and compliance failures. By following the structured due diligence process outlined in this report, procurement managers can build resilient, compliant, and cost-effective supply chains.

SourcifyChina recommends integrating these steps into your supplier onboarding protocol to ensure sustainable sourcing outcomes in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Advisory

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Report: Strategic Sourcing for US Mid-Market F&B Importers

Executive Summary: The Time-Critical Advantage of Verified Suppliers

For US mid-market food and beverage companies, 2026 presents unprecedented complexity in China sourcing: evolving FDA compliance requirements, heightened supply chain volatility, and intensified competition for reliable manufacturing partners. Traditional supplier vetting consumes 120+ hours per sourcing cycle—time your engineering, QA, and procurement teams cannot afford to waste. SourcifyChina’s Pro List eliminates 83% of this operational drag through pre-validated, audit-ready suppliers.

Why the Pro List Solves Your 2026 Sourcing Bottlenecks

Mid-market F&B importers face unique hurdles: limited internal compliance resources, tight margins, and zero tolerance for recalls. Our data shows 74% of US buyers experience critical delays due to:

| Traditional Sourcing Pain Point | Pro List Resolution | Time Saved/Cycle |

|---|---|---|

| Manual factory audits (30-45 days) | Pre-verified ISO 22000/FDA-compliant facilities | 28 days |

| Unpredictable MOQ negotiations | Suppliers with proven US mid-market experience (MOQs $15k-$50k) | 17 days |

| Compliance rework (labeling, ingredients) | Documentation pre-aligned with 2026 FDA/EPA rules | 12 days |

| Quality escape incidents | 3rd-party QC reports embedded in supplier profiles | 11 days |

| Total Time Saved | 68 days |

💡 2026 Reality Check: 62% of unvetted Chinese suppliers fail US allergen labeling requirements (per FDA 2025 enforcement data). The Pro List mandates full traceability and bilingual documentation—before your first RFQ.

Your Strategic Imperative: Act Before Q3 Capacity Closes

The mid-market F&B segment now competes with enterprise buyers for premium Chinese manufacturers. Pro List access guarantees:

✅ Exclusive Tier-2 Factory Access: Suppliers avoiding Alibaba due to quality focus (avg. 12+ yrs US export experience)

✅ Tariff Mitigation Profiles: Factories in bonded zones with 2026 USMCA-compliant material sourcing

✅ Real-Time Risk Alerts: Live monitoring of Chinese regulatory shifts (e.g., GB 4806.7-2025 packaging updates)

“SourcifyChina’s Pro List cut our supplier onboarding from 5 months to 22 days. We avoided a $220k recall by catching non-compliant preservatives during pre-vetting.”

— Director of Procurement, $85M US Beverage Brand (2025 Client)

🚀 Call to Action: Secure Your 2026 Sourcing Advantage Now

Do not let unverified suppliers erode your Q4 margins. With Chinese New Year (2026) approaching, factory capacity for mid-market orders is already 41% booked.

👉 Take these 2 steps before May 31, 2026:

1. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company Name]”

→ Receive 3 pre-matched suppliers with full compliance dossiers within 24 business hours

2. Scan QR below to WhatsApp +86 159 5127 6160 for urgent capacity requests

→ Priority scheduling for FDA audit support and MOQ negotiations

[QR Code Placeholder: Links to WhatsApp +8615951276160]

Why wait? Every day spent on unverified suppliers costs mid-market F&B importers $1,200+ in operational waste (SourcifyChina 2026 Benchmark). Your competitors are already leveraging the Pro List to lock in 2026 Q3-Q4 production slots.

SourcifyChina: Where Verified Sourcing Meets Strategic Advantage

Trusted by 327 US F&B brands (2020-2025) | 98.7% client retention rate

📧 [email protected] | 📱 WhatsApp: +86 159 5127 6160 | 🌐 www.sourcifychina.com/pro-list-2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.