The global microfilm reader scanner market is experiencing steady resurgence, driven by increasing demand for digitization of archival records in government, healthcare, and academic institutions. According to a recent report by Mordor Intelligence, the document scanning equipment market—of which microfilm reader scanners are a critical component—is projected to grow at a CAGR of 5.8% from 2023 to 2028. This growth is fueled by the urgent need to preserve deteriorating microfilm archives and transition to searchable, cloud-based digital formats. As organizations prioritize long-term data accessibility and compliance, the role of advanced microfilm digitization solutions has become more pronounced. In this evolving landscape, a select group of manufacturers has emerged as leaders, combining optical precision, software intelligence, and scalable throughput to meet diverse archival needs. Below are the top 9 microfilm reader scanner manufacturers shaping the future of analog-to-digital preservation.

Top 9 Microfilm Reader Scanner Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ScanPro All

Domain Est. 1996

Website: image-1.com

Key Highlights: All current ScanPro models can ship from the factory as an All-In-One conversion scanner for both microfilm and microfiche….

#2 About Digital Check

Domain Est. 1996

Website: digitalcheck.com

Key Highlights: Digital Check Corp. is the world’s largest manufacturer of desktop check scanners, as well as the parent company of multiple other enterprises….

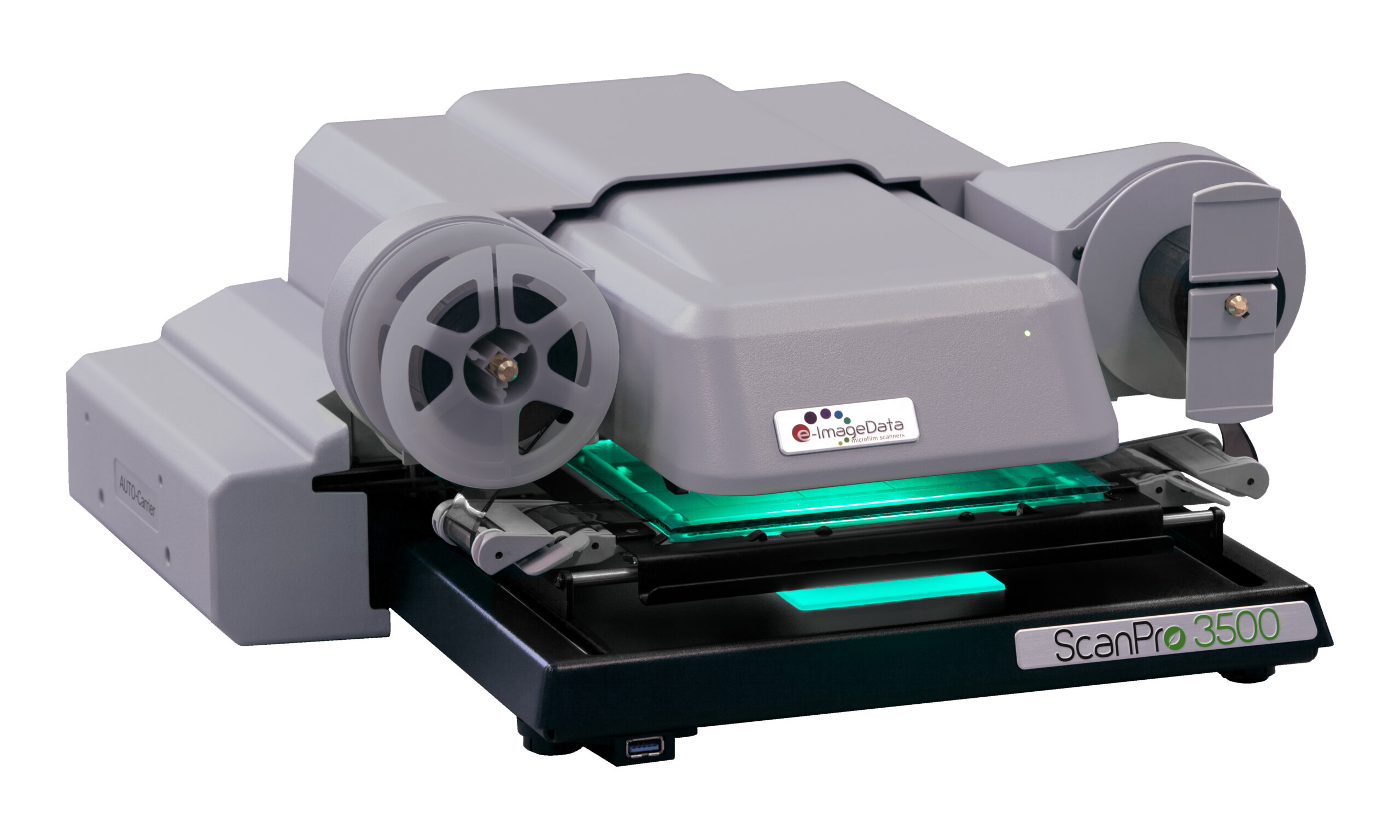

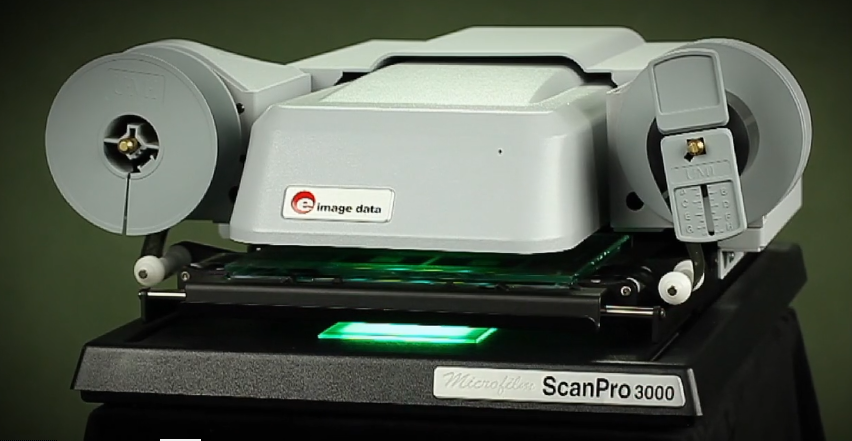

#3 e-ImageData

Domain Est. 2003

Website: e-imagedata.com

Key Highlights: e-ImageData manufactures high-quality microfilm, microfiche, aperture card, and film scanning equipment while using cutting edge technology….

#4 NMS Imaging

Domain Est. 1996

Website: nmsimaging.com

Key Highlights: Specializing in Microfilm, Book and Large Format Scanners and Conversion Services as well as Records Management, Business Automation and Workflow Solutions….

#5 SunRise Imaging Inc, MicroFilm Scanner, Roll Film, Microfiche …

Domain Est. 1997

Website: sunriseimaging.com

Key Highlights: Sunrise Imaging is the international market leader in microfilm scanners, microfiche, rollfilm and aperture scanners. Our digitizing systems are used by ……

#6 Microfilm Scanner

Domain Est. 1998

Website: bscsolutions.com

Key Highlights: BSC offers cost-effective solutions for scanning your microfilm, microfiche, and aperture cards in high-quality digital images….

#7 ST Imaging

Domain Est. 1999

Website: stimaging.com

Key Highlights: The world’s premier digital microfilm reader. Browse and capture digital images directly from microfilm. Edit and share digital copies!…

#8 ScanPro Scanners

Domain Est. 1999

Website: worldmicrographics.com

Key Highlights: World Micrographics is a leading supplier of Microfilm Scanners, Microfiche Readers, Kodak Microfilm Processor parts, Microfilm Supplies, and Microfilm ……

#9 Microfilm Scanners and Products

Domain Est. 2005

Website: thecrowleycompany.com

Key Highlights: The Crowley Company manufactures and resells microfilm scanners and products for the digitization of all types of microform — microfilm, microfiche and aperture ……

Expert Sourcing Insights for Microfilm Reader Scanner

H2: 2026 Market Trends for Microfilm Reader Scanners

The global market for microfilm reader scanners is expected to undergo notable shifts by 2026, driven by evolving archival needs, technological advancements, and the ongoing digital transformation in libraries, government institutions, and private archives. While the overall demand for microfilm technology continues to decline due to the prevalence of digital document storage, niche applications and preservation mandates are sustaining a steady, albeit specialized, market.

-

Continued Niche Demand in Archival and Government Sectors

By 2026, microfilm reader scanners will remain in use primarily within government archives, legal repositories, and national libraries where long-term data preservation regulations require physically stable, non-digital backups. Institutions bound by compliance standards—such as the U.S. National Archives or land record offices—will continue to rely on microfilm as a tamper-proof, durable medium, supporting sustained demand for compatible reader scanners. -

Integration with Digital Conversion Workflows

A key trend shaping the 2026 market is the integration of microfilm reader scanners into digitization pipelines. Organizations are increasingly investing in high-speed scanners that can convert microfilm records into searchable digital formats (e.g., PDF/A, TIFF). This transition is driving demand for hybrid systems that combine traditional microfilm reading with OCR (Optical Character Recognition) and cloud-based document management integration. -

Declining Production and Rising Retrofit Solutions

As original equipment manufacturers reduce production of new microfilm scanners due to shrinking markets, the 2026 landscape will likely see a growing aftermarket for refurbished units and retrofit kits. Upgrades such as enhanced optics, USB connectivity, and software compatibility with modern operating systems will become common, extending the life of legacy hardware. -

Geographic Market Shifts

While North America and Western Europe continue to phase out microfilm systems, emerging markets in Asia, Latin America, and parts of Africa may see modest growth in microfilm scanner adoption. This is particularly true in regions where digitization is still in early stages and microfilm offers a cost-effective interim solution for preserving historical records. -

Sustainability and Obsolescence Concerns

By 2026, concerns over the obsolescence of microfilm technology and the environmental cost of maintaining analog systems will influence purchasing decisions. However, the longevity of existing microfilm collections—some dating back to the mid-20th century—will necessitate continued support for reader scanners, prompting service providers to focus on maintenance, training, and data migration services. -

Consolidation Among Suppliers

The microfilm reader scanner market is expected to consolidate further by 2026, with fewer manufacturers and an increased role for specialized distributors and third-party service providers. This could lead to higher prices for new units but also create opportunities for innovative startups offering AI-powered scanning solutions or cloud-based microfilm access platforms.

In summary, the 2026 microfilm reader scanner market will be characterized by contraction in mainstream use, sustained demand in regulated sectors, and a strong emphasis on digitization and legacy system support. While not a growth market in the traditional sense, it will remain relevant for institutions prioritizing archival integrity and long-term data preservation.

Common Pitfalls When Sourcing a Microfilm Reader Scanner (Quality and Intellectual Property)

Sourcing a microfilm reader scanner involves more than just comparing prices and specifications. Two critical areas where organizations often encounter issues are product quality and intellectual property (IP) concerns. Overlooking these aspects can lead to operational inefficiencies, legal complications, and long-term costs. Below are common pitfalls in both categories.

Quality-Related Pitfalls

1. Choosing Low-Resolution Scanners

One of the most frequent mistakes is selecting a microfilm reader scanner with inadequate resolution. Low-resolution models fail to capture fine details, especially on older or degraded microfilm, resulting in unreadable digital copies. This undermines the purpose of digitization and may necessitate re-scanning with better equipment.

2. Poor Build Quality and Reliability

Some budget-friendly scanners are constructed with subpar materials and components, leading to frequent mechanical failures or misalignment. This not only disrupts workflow but also increases maintenance and downtime, ultimately affecting project timelines.

3. Inadequate Software Integration

Even high-quality hardware can underperform if paired with poorly designed or outdated software. Lack of compatibility with modern operating systems, absence of OCR (Optical Character Recognition), or limited file export options (e.g., only TIFF without PDF or searchable formats) can severely limit usability.

4. Insufficient Customer Support and Service

Vendors offering low-cost scanners may lack robust technical support or local service centers. When issues arise, slow response times or unavailability of spare parts can halt digitization efforts, especially in mission-critical environments like archives or legal departments.

Intellectual Property (IP) Pitfalls

1. Unauthorized Use of Proprietary Technology

Some low-cost or offshore manufacturers may incorporate patented technologies—such as specific imaging algorithms or mechanical designs—without proper licensing. Purchasing such equipment can inadvertently expose the buyer to legal risk, especially if the vendor is later found to infringe on IP rights.

2. Lack of Warranty on IP Compliance

Many vendors do not explicitly warrant that their products do not infringe on third-party intellectual property. Without such assurances, organizations may face liability if a patent holder takes legal action, even if the buyer was unaware of the infringement.

3. Closed-Source Software and Vendor Lock-In

Some microfilm scanners come with proprietary, closed-source software that restricts access to image data or limits integration with other systems. This creates dependency on the vendor for updates, support, or data migration, potentially leading to increased long-term costs and reduced flexibility.

4. Data Ownership and Usage Rights

In certain cases, especially with cloud-based scanning systems or managed services, terms of service may include clauses that grant the vendor usage rights to digitized content. Organizations must carefully review licensing agreements to ensure they retain full ownership and control over their digitized archives.

Conclusion

To avoid these pitfalls, organizations should prioritize reputable suppliers, conduct thorough due diligence on product specifications and software capabilities, and review legal terms related to intellectual property and data rights. Investing time upfront in vetting microfilm reader scanners can prevent costly problems down the line and ensure a reliable, compliant digitization process.

Logistics & Compliance Guide for Microfilm Reader Scanner

Overview

This guide outlines the logistics and compliance considerations for the transportation, handling, installation, and operation of a Microfilm Reader Scanner. Adherence to these guidelines ensures product integrity, regulatory compliance, and user safety.

Product Specifications

- Dimensions: Vary by model (e.g., 50 cm W × 40 cm D × 35 cm H)

- Weight: Typically 15–25 kg

- Power Requirements: 100–240 V AC, 50/60 Hz, 1.5 A

- Data Interface: USB 2.0/3.0, Ethernet (optional)

- Operating Environment: 10°C to 35°C, 20% to 80% non-condensing humidity

Packaging & Handling

- Packaging: Unit must be shipped in original manufacturer packaging with anti-static wrap and shock-absorbing materials.

- Labeling: Outer box must display:

- Fragile and This Side Up indicators

- Serial number and model

- Regulatory compliance marks (CE, FCC, RoHS)

- Handling: Use two-person lift for movement. Avoid tilting beyond 15 degrees during transport.

Shipping & Transportation

- Domestic/International: Complies with IATA/IMDG regulations for electronic equipment. No hazardous materials.

- Carrier Requirements: Use carriers experienced in handling precision electronics. Include tracking and insurance.

- Documentation: Provide commercial invoice, packing list, and certificate of compliance (CE/FCC) for cross-border shipments.

Import/Export Compliance

- HS Code: 8471.90 (Other machines for the reproduction of documents)

- Export Controls: Verify if equipment contains encryption technology (check country-specific regulations such as U.S. EAR).

- Duties & Taxes: Importer responsible for local customs clearance, VAT, and tariffs. Consult local authorities for exemptions (e.g., educational or archival use).

Installation Requirements

- Site Preparation:

- Stable, level surface with adequate ventilation

- Proximity to grounded power outlet and network access (if applicable)

- No exposure to direct sunlight or magnetic fields

- Electrical Compliance: Ensure grounding per local electrical codes (e.g., NEC in USA, IEC in EU). Use surge protector.

Regulatory Certifications

- FCC (USA): Complies with Part 15 Class B for electromagnetic interference.

- CE Marking (EU): Meets EMC Directive 2014/30/EU, RoHS 2011/65/EU, and Low Voltage Directive 2014/35/EU.

- Other Regions: Check local requirements (e.g., KC Mark for South Korea, RCM for Australia/NZ).

Data Security & Privacy

- Scanning Operations: If digitizing sensitive records (e.g., medical, legal), ensure compliance with:

- GDPR (EU)

- HIPAA (USA, if applicable)

- Local data protection laws

- Data Storage: Use encrypted storage devices; disable auto-upload unless secured.

Maintenance & Disposal

- Routine Maintenance: Clean optics with approved microfiber cloth; avoid liquids.

- End-of-Life Disposal: Recycle per WEEE Directive (EU) or local e-waste regulations. Do not dispose in general waste.

- Battery (if applicable): Remove and recycle separately under battery-specific guidelines.

Training & Documentation

- Provide user manual in local language.

- Train operators on safe handling, emergency shutdown, and compliance protocols.

Support & Warranty

- Warranty Period: Typically 1–3 years, parts and labor.

- Support Contact: Manufacturer or authorized service provider for technical and compliance inquiries.

Revision History

- Version 1.0: Initial release

- Last Updated: [Insert Date]

Ensure all personnel involved in logistics, installation, and operation review this guide and adhere to applicable regulations.

Conclusion:

After a thorough evaluation of available options, it is recommended to proceed with the acquisition of a reliable, high-resolution microfilm reader scanner that meets the organization’s archival, accessibility, and long-term preservation needs. The selected equipment should offer compatibility with various microfilm formats (including 16mm, 35mm, and aperture cards), intuitive user operation, digital export capabilities, and integration potential with existing document management systems.

Investing in a modern microfilm reader scanner not only ensures the efficient digitization of historical and critical records but also enhances data security, reduces physical storage demands, and improves access for staff and stakeholders. Additionally, features such as image enhancement, OCR functionality, and cloud connectivity provide added value for future-proofing information retrieval.

Ultimately, sourcing the right microfilm scanning solution supports compliance, continuity, and operational efficiency—making it a strategic step in the digital transformation of archival resources.