The global micro LED display market is experiencing accelerated growth, driven by rising demand for high-brightness, energy-efficient, and ultra-high-resolution displays across consumer electronics, automotive, and commercial sectors. According to Mordor Intelligence, the micro LED market was valued at USD 1.27 billion in 2023 and is projected to grow at a CAGR of over 68.5% from 2024 to 2029, reaching an estimated USD 46.8 billion by the end of the forecast period. This explosive expansion is fueled by advancements in mass transfer technology, decreasing production costs, and increasing adoption in premium televisions, augmented reality (AR) devices, and transparent displays. As the technology transitions from R&D to commercialization, a select group of manufacturers are leading innovation, scaling production capabilities, and shaping the future of next-generation display solutions. Below are the top 10 micro LED screen manufacturers at the forefront of this transformation.

Top 10 Micro Led Screen Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Micro LED

Domain Est. 1998

Website: auo.com

Key Highlights: AUO’s micro LED utilizes technology to mass transfer millions of micro LEDs onto LTPS backplates to produce display modules that are industry-leading solutions….

#2

Domain Est. 1998 | Founded: 2000

Website: emagin.com

Key Highlights: Founded in 2000, we are the leading manufacturer of active-matrix Organic LED (AM-OLED) Microdisplays on Silicon….

#3 Aledia Creates MicroLED Technologies for the Displays of Tomorrow

Domain Est. 2002

Website: aledia.com

Key Highlights: Our microLED technology based on 3D and silicon nanowires opens the way to multi-functional, intelligent, interactive and transparent displays….

#4 Absen

Domain Est. 2003

Website: absen.com

Key Highlights: Absen is the world’s leading LED display products and service supplier. Absen’s products are exported to more than 140 countries and regions in America, ……

#5 VueReal – Micro-LED technology

Domain Est. 2015

Website: vuereal.com

Key Highlights: VueReal is not just advancing display technology; we’re creating a new blueprint for the future of micro semiconductor device fabrication….

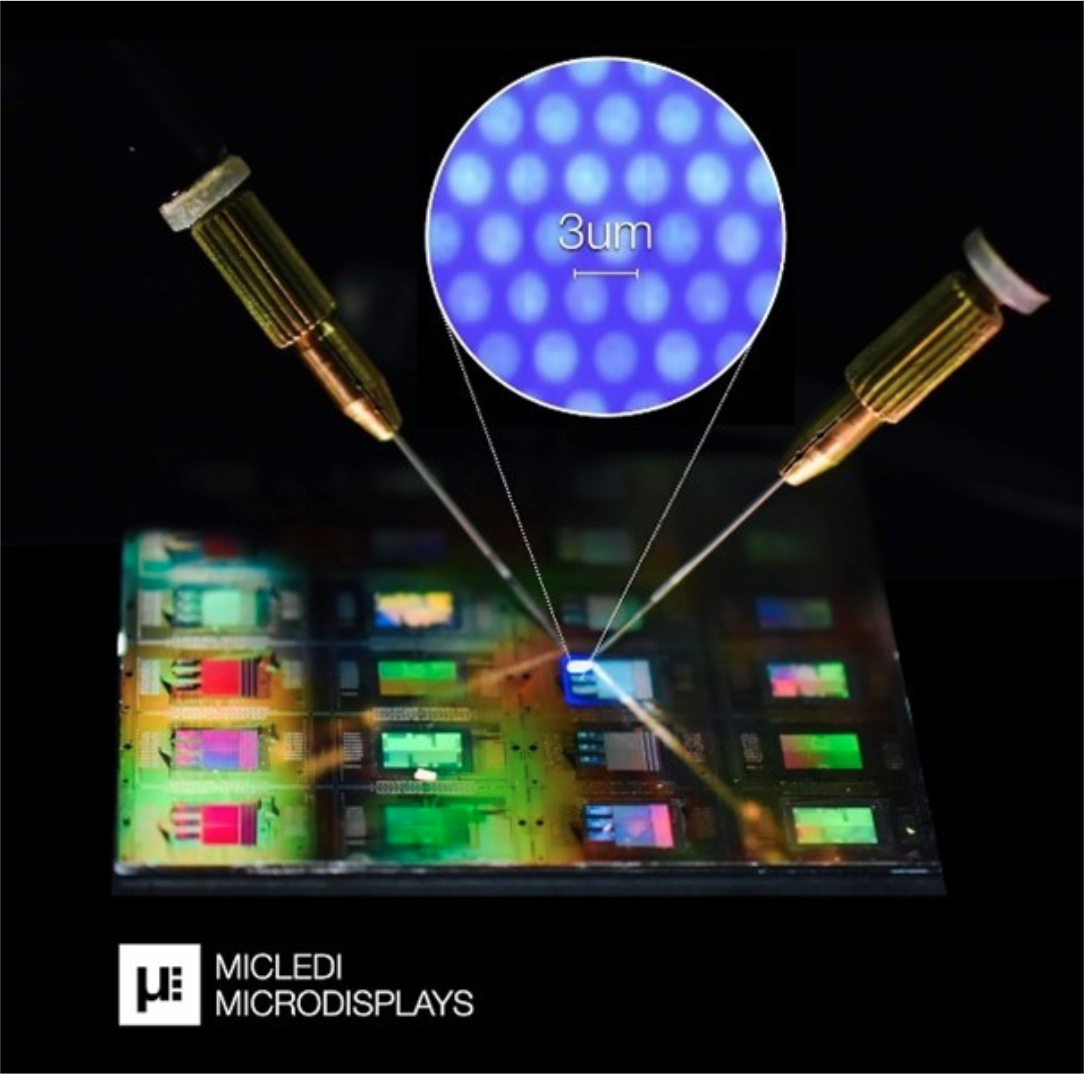

#6 Micledi Microdisplays

Domain Est. 2018

Website: micledi.com

Key Highlights: Micledi Microdisplays, a leader in MicroLED technology, revolutionizes AR and immersive displays with high-performance, energy-efficient solutions….

#7 Samsung’s The Wall

Domain Est. 1994

Website: samsung.com

Key Highlights: Explore Samsung’s The Wall, next generation microLED displays delivering a revolutionary viewing experience with pure black, true color and epic clarity….

#8 Sundiode

Domain Est. 2006

Website: sundiode.com

Key Highlights: Fully stacked RGB microLED subpixels are fabricated entirely on a single wafer, with each subpixel of a pixel independently controlled for full-color emission….

#9 MicroLED-Info

Domain Est. 2016 | Founded: 2017

Website: microled-info.com

Key Highlights: MicroLED-Info, established in 2017, is the world’s leading microLED industry portal – offering a range of services to the microLED industry….

#10

Domain Est. 2007

Website: microoled.net

Key Highlights: Taking near-eye display designs to the next level · Our solutions improve microdisplay technology to solve issues that are the most important to our customer….

Expert Sourcing Insights for Micro Led Screen

H2: 2026 Market Trends for Micro LED Screens

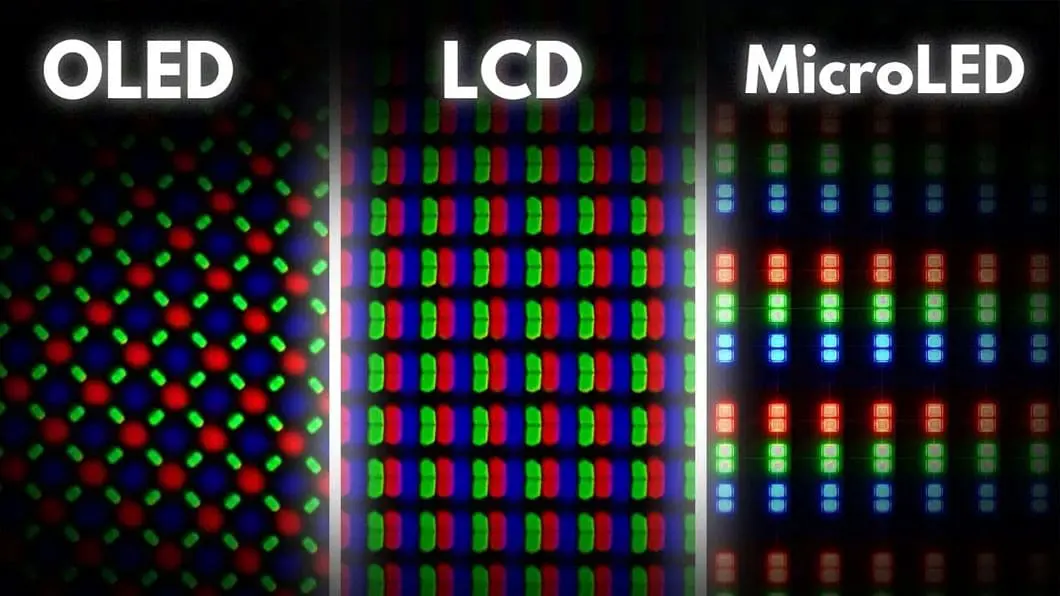

As the display technology landscape evolves rapidly, Micro LED screens are poised to become a transformative force by 2026. Characterized by self-emissive, microscopic LEDs offering superior brightness, contrast, longevity, and energy efficiency, Micro LED is transitioning from niche innovation toward broader commercial adoption. The following analysis outlines key market trends expected to shape the Micro LED screen industry in 2026.

1. Accelerated Commercialization Across Key Segments

By 2026, Micro LED will move beyond prototype stages into scalable production, particularly in high-value markets. Large-format displays for control rooms, retail environments, and luxury home theaters will see significant growth. Major electronics manufacturers like Samsung, LG, and Sony are expected to expand their Micro LED TV offerings, reducing prices modestly while improving yield rates. Additionally, commercial signage and outdoor advertising will increasingly adopt Micro LED due to its durability and visibility under direct sunlight.

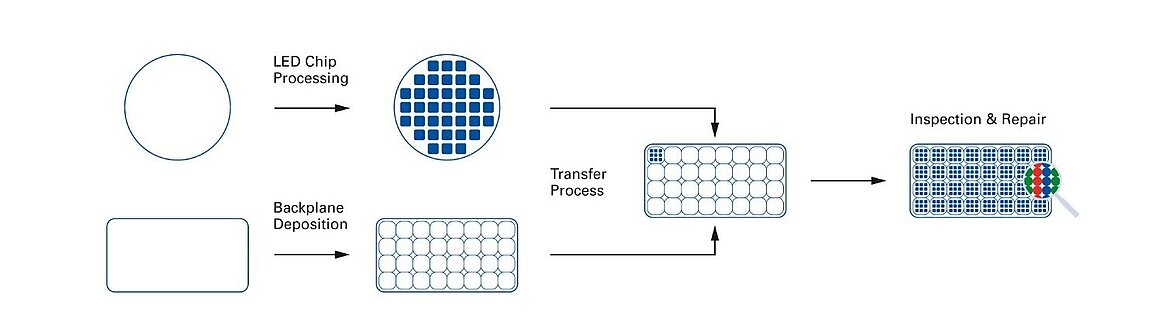

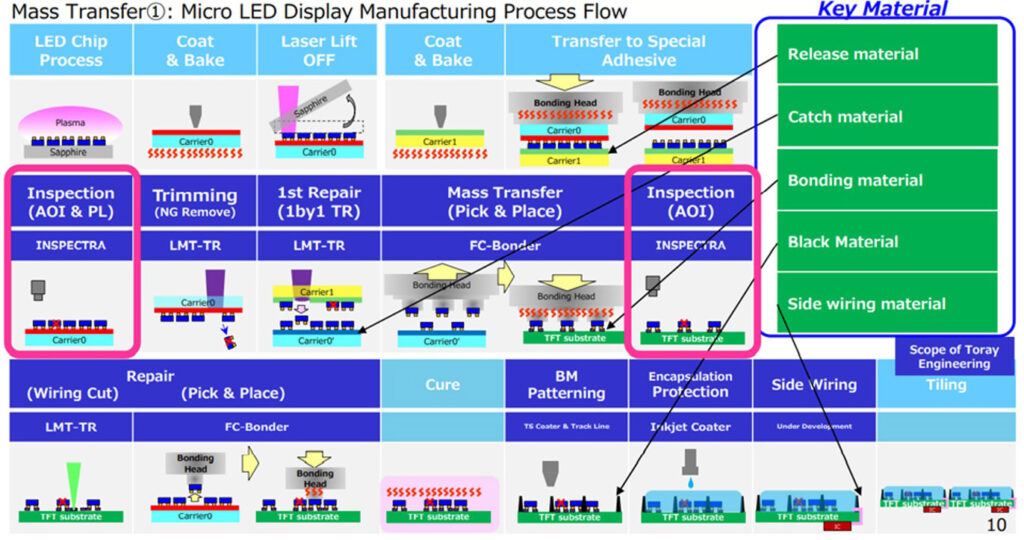

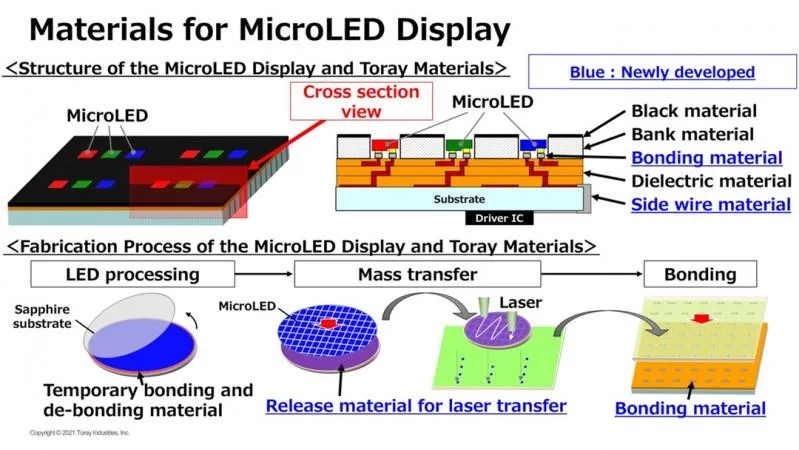

2. Advancements in Mass Transfer and Yield Optimization

One of the primary barriers to Micro LED adoption—high manufacturing costs due to complex mass transfer processes—will see meaningful improvements by 2026. Innovations in laser-based transfer, self-assembly techniques, and heterogeneous integration will enhance pick-and-place efficiency and reduce pixel defect rates. Yield improvements are expected to lower production costs by 30–40% compared to 2023 levels, making Micro LED more competitive with OLED and high-end LCDs.

3. Expansion into Emerging Applications

Beyond TVs and signage, 2026 will witness Micro LED penetration into new domains. Automotive applications, such as transparent dashboards, augmented reality (AR) head-up displays (HUDs), and adaptive headlights, will leverage Micro LED’s high brightness and compact form factor. Furthermore, the technology will gain traction in wearable devices and AR/VR headsets, where its high pixel density and low power consumption are critical.

4. Strategic Partnerships and Supply Chain Maturation

The ecosystem will mature through vertical integration and strategic alliances. Chipmakers (e.g., Apple, which has invested heavily in Micro LED R&D), display manufacturers, and equipment suppliers will collaborate to standardize processes and scale production. Foundry services specializing in Micro LED epitaxy and wafer processing will emerge, reducing entry barriers for smaller players and fostering innovation.

5. Regional Growth Dynamics

Asia-Pacific, particularly China, Taiwan, and South Korea, will remain the epicenter of Micro LED development and manufacturing. Chinese firms such as BOE, TCL CSOT, and Leyard are projected to lead in cost-effective production, targeting both domestic and global markets. Meanwhile, North America and Europe will focus on high-end applications in enterprise, automotive, and premium consumer electronics, supported by government funding for next-gen display R&D.

6. Competitive Pressure and Price Erosion

As production scales, Micro LED prices—especially for large-screen TVs—will begin a gradual decline. Although still premium compared to OLED, average selling prices (ASPs) for 80–110” models are expected to drop below $15,000 by 2026, opening access to affluent mainstream consumers. This price trajectory will pressure OLED manufacturers to innovate or diversify, potentially accelerating convergence with QD-OLED and other hybrid technologies.

7. Sustainability and Energy Efficiency as Market Drivers

With global emphasis on energy-efficient technologies, Micro LED’s low power consumption and absence of organic materials (unlike OLED) will appeal to eco-conscious consumers and ESG-focused enterprises. Its long operational lifespan (>100,000 hours) reduces e-waste, further enhancing its sustainability profile—a key differentiator in regulated markets.

Conclusion

In 2026, the Micro LED screen market will transition from early adoption to accelerated growth, driven by manufacturing breakthroughs, expanding applications, and strategic industry alignment. While challenges in cost and yield persist, ongoing innovation will solidify Micro LED’s position as the premium display technology of choice for high-performance visual experiences across consumer, commercial, and industrial sectors.

Common Pitfalls When Sourcing Micro LED Screens (Quality, IP)

Sourcing Micro LED screens presents unique challenges, particularly concerning quality assurance and intellectual property (IP) risks. Falling into these pitfalls can lead to product failures, legal disputes, and reputational damage. Below are key issues to watch for:

Quality Inconsistencies and Defects

Micro LED technology is highly complex, involving the placement of millions of microscopic LEDs onto a backplane with extreme precision. A common pitfall is inconsistent brightness, color uniformity, or dead pixels due to errors in mass transfer and calibration processes. Many suppliers, especially newer entrants, may lack the mature manufacturing processes needed for high yield rates, leading to visible defects in final displays. Buyers must verify quality through rigorous testing protocols and on-site factory audits.

Lack of Standardized Testing and Specifications

Unlike more mature display technologies (e.g., OLED or LCD), the Micro LED industry lacks universally accepted performance standards. Suppliers may use proprietary metrics or inflated specifications (e.g., brightness, contrast, lifespan), making comparisons difficult. This opacity can mislead buyers into selecting subpar products. Always insist on third-party validation and standardized testing reports before procurement.

Supply Chain Immaturity and Scalability Issues

Micro LED production requires specialized equipment and materials, many of which are still in development or controlled by a few key players. Relying on a supplier without a proven, scalable supply chain increases the risk of delays, cost overruns, and inconsistent batch quality. Evaluate the supplier’s ecosystem—including chip suppliers, driver IC partners, and testing infrastructure—before committing.

Intellectual Property (IP) Infringement Risks

Micro LED technology is heavily patented, with core IP held by companies in the U.S., South Korea, Taiwan, and Japan. Sourcing from manufacturers who do not properly license essential technologies—such as mass transfer techniques, bonding methods, or defect repair processes—can expose buyers to legal liability. Conduct thorough IP due diligence, including freedom-to-operate (FTO) analyses, and require suppliers to provide proof of licensing agreements.

Misrepresentation of Technology Maturity

Some suppliers may claim to offer “Micro LED” screens while actually delivering hybrid solutions (e.g., Mini LED with quantum dots) or prototypes not suitable for commercial deployment. This misrepresentation can lead to integration issues and performance shortfalls. Clearly define technical expectations and request demonstrable proof of true Micro LED architecture, such as pixel pitch below 100µm and individual LED control.

Insufficient Support and Warranty Coverage

Due to the nascent state of the technology, some suppliers offer limited technical support, repair options, or warranty terms. Given the high cost of Micro LED screens, inadequate after-sales support can result in significant downtime and repair expenses. Ensure service level agreements (SLAs), repair turnaround times, and warranty conditions are contractually defined upfront.

Avoiding these pitfalls requires due diligence, technical expertise, and strong contractual safeguards. Partnering with reputable suppliers, validating claims independently, and securing IP clearance are essential steps in successful Micro LED sourcing.

Logistics & Compliance Guide for Micro LED Screens

Micro LED screens represent a cutting-edge display technology with unique handling, shipping, and regulatory requirements. This guide outlines the essential logistics and compliance considerations for manufacturers, distributors, and importers to ensure safe transportation and adherence to international standards.

Product Classification and HS Code

Micro LED screens are typically classified under the Harmonized System (HS) for international trade. The most common HS code is 8528.59.00, which covers “Monitors and projectors, not incorporating television reception apparatus, color, combining a flat panel display.” However, classification may vary based on screen size, resolution, and intended use. It is critical to consult the specific country’s tariff schedule or engage a customs broker for accurate classification to avoid delays and incorrect duty assessments.

Packaging and Handling Requirements

Due to their fragile nature and sensitive components, Micro LED screens require specialized packaging:

– Use anti-static, shock-absorbent materials such as foam inserts and corrugated cardboard.

– Ensure screens are sealed in moisture-resistant bags to prevent condensation during transit.

– Clearly label packages with “Fragile,” “This Side Up,” and “Do Not Stack” indicators.

– Include desiccants to control humidity in sealed packaging, especially for long sea voyages.

Transportation Modes and Considerations

Choose the appropriate transport method based on urgency, cost, and destination:

– Air Freight: Recommended for high-value or time-sensitive shipments. Provides faster delivery and reduced handling risks.

– Sea Freight: Cost-effective for bulk shipments but involves longer transit times. Use climate-controlled containers to protect against temperature and humidity fluctuations.

– Ground Transport: Essential for last-mile delivery; ensure vehicles are equipped with suspension systems to minimize vibration and shocks.

Monitor environmental conditions (temperature, humidity, and pressure) throughout transit to prevent damage to sensitive electronic components.

Import/Export Documentation

Ensure all required documentation is accurate and complete:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin

– Import/Export License (if required by jurisdiction)

– Technical Datasheets and Product Specifications

Incomplete or incorrect documentation is a leading cause of customs delays.

Regulatory Compliance

Micro LED screens must comply with various regional and international standards:

– RoHS (EU): Restriction of Hazardous Substances in electrical equipment. Ensure screens are free of lead, mercury, cadmium, and other restricted materials.

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals. Declare substances of very high concern (SVHCs).

– CE Marking (EU): Mandatory for products sold in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

– FCC (USA): Federal Communications Commission certification for electromagnetic interference (EMI) and radio frequency (RF) compliance.

– Energy Star (USA/Canada): Energy efficiency certification for displays, where applicable.

– KC Mark (South Korea): Required for electronic devices sold in South Korea.

– PSE (Japan): Product Safety Electrical Appliance & Material for electrical safety compliance.

Environmental and Safety Standards

- Comply with WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions, ensuring proper end-of-life recycling plans.

- Adhere to IEC 62368-1, the international safety standard for audio/video, information, and communication technology equipment.

- Screens should meet IP (Ingress Protection) ratings if marketed for outdoor or harsh environments.

Labeling and Language Requirements

- Include multilingual labeling where required by destination countries, especially for safety warnings and compliance marks.

- Ensure all labels (including barcodes and serial numbers) are durable and clearly visible.

Risk Management and Insurance

- Secure comprehensive cargo insurance covering damage, theft, and environmental hazards during transit.

- Perform regular audits of logistics partners to ensure compliance with handling protocols.

- Implement tracking systems for real-time monitoring of shipments.

Final Inspection and Quality Control

Conduct pre-shipment inspections to verify:

– Screen functionality and absence of dead pixels.

– Integrity of packaging and labeling.

– Compliance with customer and regulatory specifications.

By following this guide, stakeholders in the Micro LED screen supply chain can mitigate risks, ensure regulatory compliance, and deliver high-quality products efficiently across global markets. Regular updates to logistics practices and compliance standards are recommended to adapt to evolving regulations and technological advancements.

Conclusion for Sourcing Micro LED Screens

Sourcing Micro LED screens represents a forward-looking investment in display technology, offering superior brightness, contrast, energy efficiency, and longevity compared to traditional LCD and OLED solutions. As the technology matures and production scales, costs are gradually decreasing, making Micro LED more accessible for high-end commercial, industrial, and premium consumer applications.

When sourcing Micro LED screens, it is essential to evaluate suppliers based on technical expertise, manufacturing capabilities, yield rates, and track record in delivering reliable products. Key considerations include resolution requirements, pixel pitch, module uniformity, scalability, and after-sales support. Additionally, forming strategic partnerships with leading manufacturers or authorized distributors can ensure access to cutting-edge technology and technical assistance.

While challenges around cost and supply chain maturity remain, the long-term benefits of Micro LED—such as seamless tiling for large-format displays and exceptional performance in bright environments—make it a compelling choice for applications in control rooms, digital signage, luxury retail, and high-end home theaters.

In conclusion, stakeholders should adopt a phased approach: start with pilot deployments, engage early with trusted suppliers, and stay informed on industry developments. As the ecosystem evolves, proactive sourcing strategies will position organizations to leverage Micro LED’s full potential and gain a competitive edge in visual performance and innovation.