The micro combined heat and power (micro-CHP) market is experiencing steady growth, driven by rising energy costs, increasing demand for decentralized energy systems, and supportive government regulations promoting energy efficiency. According to a report by Mordor Intelligence, the global micro-CHP market was valued at USD 1.85 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2029. This expansion is fueled by technological advancements in fuel cell and internal combustion engine-based systems, along with growing adoption in residential and small commercial sectors across Europe, North America, and Japan. As sustainability and energy resilience become strategic priorities, manufacturers are innovating to deliver compact, efficient, and intelligent micro-CHP solutions. In this evolving landscape, nine key players have emerged as leaders, setting benchmarks in performance, reliability, and market reach.

Top 9 Micro Chp Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

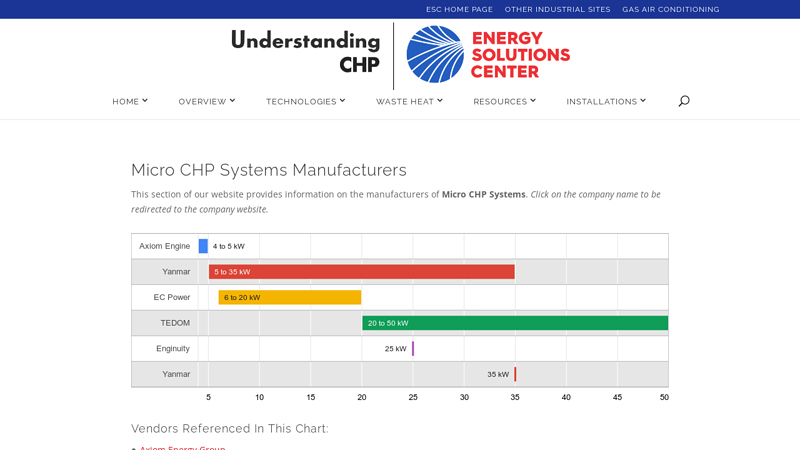

#1 Micro CHP Manufacturers

Domain Est. 2012

Website: understandingchp.com

Key Highlights: This section of our website provides information on the manufacturers of Micro CHP Systems. Click on the company name to be redirected to the company website….

#2 Capstone Green Energy Holdings, Inc. (CGEH)

Domain Est. 2021

Website: capstonegreenenergy.com

Key Highlights: Our microturbines deliver reliable, high-quality power when and where the grid can’t—while reducing costs, lowering emissions, and operating on a wide range of ……

#3 BLUEGEN

Website: bluegen.eu

Key Highlights: The micro-cogenerator BLUEGEN extracts hydrogen from natural gas and converts it directly into electricity and heat, using fuel cell technology. BLUEGEN ……

#4 Cogeneration Systems|Energy Systems

Domain Est. 1996

Website: yanmar.com

Key Highlights: Yanmar offers a wide range of cogeneration systems that provide excellent solutions for the efficient generation of electrical power and hot water….

#5 Combined Heat and Power (CHP) and District Energy

Domain Est. 1999

Website: energy.gov

Key Highlights: CHP, district energy systems, and microgrids improve energy efficiency, reduce carbon emissions, facilitate integration of renewable energy sources, lower ……

#6 2G Energy. Modular CHP cogeneration systems

Domain Est. 2015

Website: 2g-energy.com

Key Highlights: 2G provides a wide range of highly efficient, low emission cogeneration systems. 2G’s systems operate to generate electricity and heat at the point of use….

#7 EcoPrime Micro CHP System

Domain Est. 2020

Website: axiom-energy.com

Key Highlights: EcoPrime is a 4.4kW microCHP system powered by natual gas or propane that simultaneously generates electricity and utilizes waste heat on-site….

#8 micro chp

Website: microchap.info

Key Highlights: Micro CHP (micro Combined Heat & Power) is the simultaneous production of heat and electricity in individual homes. Effectively the micro CHP unit replaces ……

#9 micro CHP products

Website: micro-chp.com

Key Highlights: This section is intended for those who are considering the purchase of a micro CHP system, either for their own home or for clients….

Expert Sourcing Insights for Micro Chp

2026 Market Trends for Micro CHP: A Hydrogen (H₂) Perspective

The micro combined heat and power (micro-CHP) market in 2026 is undergoing a significant transformation, with hydrogen (H₂) emerging as a pivotal factor shaping its future trajectory. While traditional natural gas-fueled systems remain dominant, H₂ is rapidly transitioning from a niche prospect to a central driver of innovation, policy, and market expansion. Here’s an analysis of key trends through the lens of hydrogen:

1. Hydrogen-Ready Appliances: The New Standard

* Dominant Trend: The most significant development is the shift towards “hydrogen-ready” micro-CHP units. Manufacturers (e.g., Viessmann, Bosch, Vaillant) are increasingly designing and launching models based on existing natural gas technology but engineered to run on 100% H₂ with minimal modifications (primarily fuel injectors, seals, and software).

* Impact: This future-proofs installations for homeowners and building managers, reducing the long-term cost and disruption of transitioning to green energy. It signals strong market confidence in the hydrogen pathway and accelerates the potential for widespread H₂ adoption in the built environment by 2030+.

* 2026 Status: Hydrogen-ready models are moving beyond pilots into broader commercial availability, particularly in key European markets (UK, Germany, Netherlands) and Japan, driven by government incentives and utility programs.

2. Green Hydrogen Cost Reduction & Infrastructure Development

* Critical Enabler: The economic viability and environmental benefit of H₂-fueled micro-CHP hinge on the availability of green hydrogen (produced via electrolysis using renewable electricity). In 2026, significant investments are flowing into large-scale electrolyzer manufacturing and deployment.

* Impact: Costs for green H₂ are projected to decrease substantially by 2026 (though still above natural gas), driven by economies of scale, falling renewable electricity prices, and technological advancements. Parallel investments in H₂ pipeline repurposing (e.g., parts of the European gas grid) and local distribution networks are beginning to create the necessary infrastructure, albeit at an early stage.

* 2026 Status: Green H₂ costs remain a barrier for widespread direct consumer use in micro-CHP, but pilot projects blending H₂ into natural gas grids (up to 20%) are demonstrating technical feasibility and safety, building confidence for pure H₂ deployment later.

3. Policy & Regulation as Primary Drivers

* Accelerating Factor: Government policies are the strongest catalyst for H₂ integration in micro-CHP. Net-zero targets (EU, UK, Japan, South Korea) mandate decarbonization of heating. Specific regulations are emerging:

* Mandates: Potential future bans on new natural gas boiler installations (e.g., UK 2035 target) create a clear market pull for alternatives like H₂ micro-CHP.

* Subsidies & Incentives: Significant grants and subsidies (e.g., UK Boiler Upgrade Scheme, EU Innovation Fund, Japanese subsidies) are increasingly favoring or specifically targeting hydrogen-capable or hydrogen-fueled technologies.

* Carbon Pricing: Rising carbon prices make fossil-fuel-based micro-CHP less competitive, improving the relative economics of green H₂ systems over time.

* 2026 Status: Policy frameworks are actively being shaped, creating market certainty and de-risking investment for manufacturers and installers. The regulatory push is arguably the most powerful trend for H₂ adoption in micro-CHP.

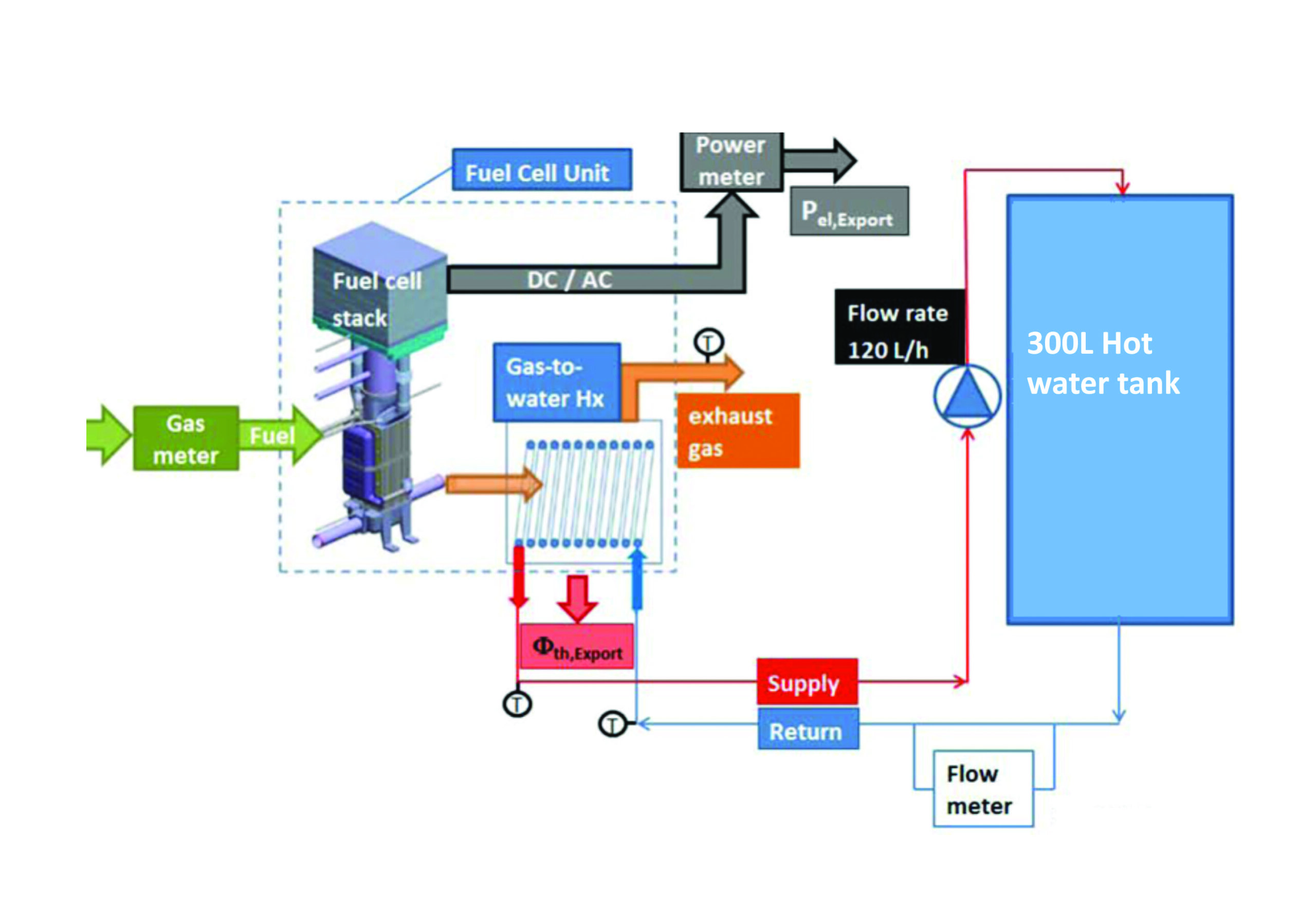

4. Technology Evolution: Fuel Cells Lead, ICE Adapts

* Fuel Cell Micro-CHP (SOFC/PEMFC): Solid Oxide Fuel Cells (SOFC) are particularly well-suited for H₂ due to their high efficiency and fuel flexibility. Leading players (e.g., Bosch, Viessmann with SOFCpower, Ceres) are heavily investing in H₂-optimized SOFC systems, targeting higher electrical efficiencies (>60%) and lower emissions. Proton Exchange Membrane Fuel Cells (PEMFC) are also being adapted for H₂ use.

* Internal Combustion Engine (ICE) Micro-CHP: While less efficient than fuel cells, ICE technology is robust and lower cost. Manufacturers are adapting existing ICE designs for H₂ combustion, leveraging the hydrogen-ready appliance trend. Efficiency and NOx emissions remain key R&D challenges for H₂-ICE.

* 2026 Status: H₂-fueled fuel cell micro-CHP is leading in terms of efficiency and emissions performance, while H₂-ICE offers a potentially faster, lower-cost transition path for the existing appliance base. Both technologies are actively being commercialized.

5. Market Expansion Beyond Residential

* Beyond Homes: While residential applications are the primary focus for hydrogen-ready appliances, 2026 sees growing interest in H₂ micro-CHP for commercial buildings (offices, hotels, schools) and district heating networks. The higher energy demands and centralized nature make them attractive early adopters, especially where green H₂ supply might be more feasible initially.

* 2026 Status: Commercial and institutional pilot projects using H₂ micro-CHP are increasing, demonstrating scalability and integration potential.

6. Integration with Energy Systems & Electrification

* Smart Grid & Storage: H₂ micro-CHP systems are increasingly designed as smart, grid-interactive components. They can:

* Provide valuable grid balancing services by adjusting electricity output based on grid signals.

* Act as a form of energy storage when H₂ is produced via electrolysis during periods of excess renewable generation (Power-to-Gas-to-Power), though this is less efficient than pure storage.

* Competition/Complementarity: H₂ micro-CHP competes with heat pumps but offers a potential solution for buildings difficult or expensive to decarbonize via full electrification (e.g., older buildings, high-heat-demand applications). It’s increasingly seen as a complementary technology within a diversified low-carbon heating strategy.

Conclusion for 2026:

The 2026 micro-CHP market is defined by strategic preparation for a hydrogen future. While pure green H₂ fueling is still limited by cost and infrastructure, the trend is undeniable. Hydrogen-ready appliances are becoming the new baseline, driven by aggressive policy mandates and long-term decarbonization goals. Significant investments in green H₂ production and infrastructure are laying the groundwork. Fuel cell technology is advancing rapidly for H₂, while ICE adaptations provide a transitional path. Policy remains the dominant force, creating market pull. By 2026, the micro-CHP sector is not just adapting to H₂; it is actively positioning itself as a crucial enabler of the hydrogen economy in the built environment, ready to scale rapidly once green H₂ becomes more accessible and cost-competitive. The focus is on building the technological and regulatory foundation for a major shift post-2026.

Common Pitfalls in Sourcing Micro CHP: Quality and Intellectual Property Concerns

When sourcing micro combined heat and power (micro CHP) systems, organizations often encounter significant challenges related to quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to performance issues, legal disputes, and financial losses.

Quality-Related Pitfalls

-

Inconsistent Product Performance

Micro CHP units from different suppliers may vary widely in efficiency, reliability, and emissions. Sourcing from manufacturers without proven field performance data or third-party certifications (e.g., UL, CE, or CEN standards) increases the risk of underperforming systems. -

Lack of Standardization

The absence of universal technical standards for micro CHP components can result in compatibility issues with existing energy infrastructure, leading to integration delays and higher installation costs. -

Insufficient Testing and Validation

Some suppliers may provide limited real-world testing data. Without access to long-term durability and load-following performance records, buyers may unknowingly select systems prone to frequent maintenance or early failure. -

Poor After-Sales Support and Service Networks

Even high-quality units can underperform if the supplier lacks a robust service network. Downtime due to delayed repairs or unavailability of spare parts diminishes return on investment.

Intellectual Property-Related Pitfalls

-

Unclear IP Ownership in Custom Integrations

When tailoring micro CHP systems for specific applications, modifications may involve proprietary software or design elements. Failure to define IP ownership in contracts can lead to disputes over usage rights or resale limitations. -

Risk of IP Infringement

Sourcing from low-cost suppliers, especially in regions with weak IP enforcement, increases the risk of inadvertently acquiring systems that infringe on patented technologies. This exposes the buyer to legal liability and potential product recalls. -

Limited Access to Firmware and Control Algorithms

Many micro CHP systems rely on proprietary control software to optimize efficiency. Suppliers may restrict access to source code or update protocols, limiting the buyer’s ability to maintain, troubleshoot, or integrate with other smart energy systems. -

Inadequate Licensing Agreements

Without clear licensing terms for embedded software or patented components, organizations may face unexpected fees or restrictions on system deployment, especially in multi-site or cross-border operations.

Mitigation Strategies

To avoid these pitfalls, buyers should conduct thorough due diligence, prioritize suppliers with verifiable performance data and strong IP compliance, and ensure contracts explicitly address quality benchmarks, service level agreements, and IP rights. Engaging independent technical consultants and legal experts during procurement can further reduce exposure to risk.

Logistics & Compliance Guide for Micro CHP Systems Using Hydrogen (H₂)

Micro Combined Heat and Power (Micro CHP) systems utilizing hydrogen (H₂) as a fuel source represent a sustainable and efficient energy solution for residential, commercial, and small-scale industrial applications. These systems simultaneously generate electricity and usable heat, significantly improving energy efficiency and reducing greenhouse gas emissions. However, deploying H₂-powered Micro CHP units involves careful logistical planning and strict compliance with regulatory standards.

This guide outlines key considerations in the logistics and compliance aspects of hydrogen-fueled Micro CHP systems.

H2 Supply & Storage Logistics

1. Hydrogen Sourcing

- On-Site Production (Electrolysis): Utilize renewable-powered electrolyzers to produce hydrogen locally, minimizing transportation needs and ensuring a green H₂ supply.

- Off-Site Delivery: For locations without on-site generation, hydrogen can be delivered via tube trailers or liquid hydrogen tankers. Ensure compatibility with local infrastructure.

- Blended Gas (H₂-natural gas mix): In regions where pure hydrogen distribution is limited, systems may operate on hydrogen blends (e.g., up to 20% H₂ in natural gas). Confirm equipment compatibility.

2. Storage Requirements

- Compressed Hydrogen (CGH₂): Most common for Micro CHP applications. Store in high-pressure tanks (typically 350–700 bar).

- Use approved ASME, ISO, or EU-PED certified pressure vessels.

- Install storage in well-ventilated, fire-rated enclosures away from ignition sources.

- Material Compatibility: Ensure all storage and piping materials are hydrogen-compatible (e.g., stainless steel, specific polymers) to prevent embrittlement.

- Capacity Planning: Size storage to meet peak demand and account for supply lead times.

3. Refueling & Replenishment

- Establish regular delivery schedules with certified hydrogen suppliers.

- Automate monitoring systems to track H₂ levels and trigger refill alerts.

- For on-site electrolysis, ensure sufficient water supply and grid or renewable power availability.

Transportation & Handling

1. Regulatory Compliance

- DOT (USA): Comply with 49 CFR regulations for the transportation of compressed hydrogen, including proper labeling, tank certification, and driver training.

- ADR (Europe): Adhere to European Agreement concerning the International Carriage of Dangerous Goods by Road, particularly Class 2.1 (flammable gases).

- ISO Standards: Use ISO 11119 (composite cylinders) and ISO 16111 (transportable gas storage devices).

2. Safety Protocols

- Use certified transport containers with pressure relief devices.

- Conduct leak checks before and after transport.

- Train personnel in H₂ safety, including emergency shutdown procedures.

Installation & Site Logistics

1. Site Assessment

- Evaluate ventilation, fire separation distances, and seismic stability.

- Confirm compliance with local building codes and zoning laws.

- Ensure proximity to emergency exits and firefighting systems.

2. Equipment Installation

- Install Micro CHP units on stable, non-combustible foundations.

- Use hydrogen-rated valves, fittings, and sensors throughout the system.

- Implement automatic shutoff valves and hydrogen leak detectors (H₂ sensors) with alarms.

3. Ventilation & Containment

- Provide natural or mechanical ventilation to prevent H₂ accumulation (H₂ is lighter than air but highly flammable at 4–75% concentration in air).

- Install explosion relief panels if housed indoors.

Regulatory Compliance

1. National & Local Codes

- USA: Follow NFPA 2 (Hydrogen Technologies Code), NFPA 55 (Compressed and Low-Temperature Gases), and local fire codes.

- EU: Comply with ATEX directives for equipment in explosive atmospheres and the Pressure Equipment Directive (PED) 2014/68/EU.

- UK: Adhere to the Health and Safety Executive (HSE) guidelines and the Gas Safety (Installation and Use) Regulations.

2. Permits & Approvals

- Obtain permits for H₂ storage, fuel systems, and electrical interconnection.

- Coordinate with utilities for grid-connection approval (if feeding excess electricity back).

- Submit safety documentation, including risk assessments and emergency plans.

3. Emissions & Environmental Standards

- Ensure zero or near-zero NOx and CO₂ emissions (dependent on combustion method—e.g., fuel cells vs. internal combustion).

- For fuel cell-based Micro CHP, emissions are primarily water vapor.

- Monitor and report environmental performance where required.

4. Worker Safety & Training

- Train personnel per OSHA (USA) or equivalent (e.g., COSHH in UK) standards.

- Conduct regular drills for H₂ leaks, fires, and system failures.

- Maintain Material Safety Data Sheets (MSDS/SDS) for hydrogen and system components.

Maintenance & Monitoring

1. Preventive Maintenance

- Schedule regular inspections of H₂ lines, seals, and pressure regulators.

- Replace hydrogen-exposed components according to manufacturer guidelines.

- Calibrate H₂ sensors quarterly.

2. Remote Monitoring

- Use IoT-enabled systems to monitor H₂ consumption, pressure, temperature, and system efficiency.

- Integrate alarms for leaks, pressure drops, or performance anomalies.

3. Record Keeping

- Maintain logs of inspections, repairs, H₂ deliveries, and safety incidents.

- Retain records for audit and regulatory compliance (typically 5+ years).

Emergency Preparedness

1. Emergency Shutdown (ESD)

- Install manual and automatic ESD systems that isolate H₂ supply and power during faults.

2. Leak Response

- Evacuate area and ventilate if a leak is detected.

- Use non-sparking tools and eliminate ignition sources.

- Do not attempt repairs under pressure.

3. Fire Suppression

- Use Class C (electrical) fire extinguishers.

- Avoid water jets on high-pressure H₂ fires; let controlled burn occur if safe.

Conclusion

Deploying Micro CHP systems powered by hydrogen offers a clean, efficient energy solution, but requires rigorous attention to logistics and compliance. From secure hydrogen supply and storage to adherence to international safety standards, every stage must prioritize safety, efficiency, and regulatory alignment. By following this guide, stakeholders can ensure safe, reliable, and compliant operation of H₂-based Micro CHP systems.

Conclusion for Sourcing Micro CHP (Combined Heat and Power) Systems

Sourcing micro-CHP systems requires a strategic and comprehensive approach that balances technical requirements, economic feasibility, regulatory compliance, and long-term sustainability goals. As decentralized energy solutions gain momentum, micro-CHP offers a compelling option for improving energy efficiency, reducing carbon emissions, and enhancing energy security—particularly in residential, commercial, and small industrial applications.

Key considerations in the sourcing process include evaluating technology types (such as fuel cells, internal combustion engines, or Stirling engines), fuel availability (natural gas, biogas, hydrogen-readiness), system reliability, maintenance needs, and integration with existing heating and electrical systems. Equally important is selecting reputable suppliers with proven track records, strong technical support, and warranty offerings.

Cost-benefit analysis should account not only for upfront investment but also for operational savings, potential incentives or subsidies, and payback periods. Life-cycle assessment ensures long-term value and alignment with environmental goals.

In conclusion, successful sourcing of micro-CHP systems hinges on thorough due diligence, stakeholder engagement, and a clear understanding of site-specific energy demands. When implemented effectively, micro-CHP can deliver resilient, efficient, and sustainable energy solutions that support both economic and environmental performance. As technology advances and markets evolve, ongoing evaluation and adaptability will remain crucial to maximizing the benefits of micro-CHP investments.