The rubber products manufacturing industry in Michigan continues to play a pivotal role in the U.S. industrial supply chain, particularly within the automotive, aerospace, and heavy equipment sectors. According to Grand View Research, the global rubber products market was valued at USD 330.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This sustained demand is echoed in regional manufacturing hubs like Michigan, where legacy automotive OEMs and Tier-1 suppliers drive consistent need for high-performance rubber components such as seals, gaskets, hoses, and vibration dampeners. Mordor Intelligence further highlights a steady resurgence in domestic manufacturing and supply chain localization, contributing to increased production activity and investment in U.S.-based rubber fabrication. In this evolving landscape, Michigan remains home to a concentrated cluster of specialized rubber manufacturers known for engineering precision, material innovation, and adherence to ISO and IATF quality standards. The following list identifies the top five rubber products manufacturers in Michigan, selected based on production capacity, industry certifications, client portfolios, and market presence.

Top 5 Michigan Rubber Products Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Cadillac Industrial Park

Domain Est. 2001

Website: cadillac-mi.net

Key Highlights: Michigan Rubber Products Website. Michigan Rubber Products is a manufacturer of rubber and plastic products, primarily for the automotive industry. 925 ……

#2 Inspection: 1146675.015

Domain Est. 1997

Website: osha.gov

Key Highlights: Site Address: Zhongding Usa Cadillac, Inc. Dba Michigan Rubber Products 1600 Holman Cadillac, MI 49601. Mailing Address: 1600 Holman, Cadillac, MI 49601….

#3 Southern Michigan Rubber, INC.

Domain Est. 1999

Website: smrubber.com

Key Highlights: Southern Michigan Rubber. Rubber parts, gaskets, belts, seals, vibration dampeners, bumpers and many more parts that make the world go-around….

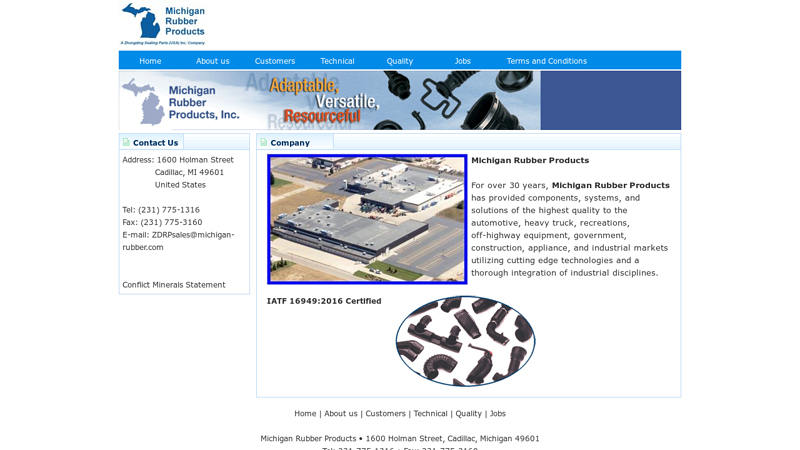

#4 Michigan Rubber Products

Domain Est. 1999

Website: michigan-rubber.com

Key Highlights: For over 30 years, Michigan Rubber Products has provided components, systems, and solutions of the highest quality to the automotive, heavy truck, recreations, ……

#5 Production Rubber Products (Paw Paw, Van Buren County)

Domain Est. 2001

Website: michigan.gov

Key Highlights: Production Rubber Products (PRP), located at 153 Commercial Street in Paw Paw, is a former rubber product manufacturing facility which operated from the ……

Expert Sourcing Insights for Michigan Rubber Products

H2: Market Trends for Michigan Rubber Products in 2026

As the global manufacturing and industrial sectors evolve, Michigan Rubber Products (MRP), a company specializing in custom rubber molding and sealing solutions, is poised to encounter a dynamic set of market trends in 2026. These trends are shaped by technological advancements, shifting industry demands, sustainability imperatives, and regional economic conditions. Below is an analysis of key trends expected to impact MRP in 2026.

1. Increased Demand from Automotive and Electric Vehicle (EV) Sectors

Michigan’s historical ties to the automotive industry continue to influence rubber product demand. In 2026, the transition toward electric vehicles will accelerate, increasing the need for high-performance rubber components such as seals, gaskets, and vibration dampeners designed to withstand unique thermal and electrical conditions in EVs. MRP can expect growing demand for custom rubber solutions tailored to battery enclosures, powertrain systems, and charging infrastructure, positioning the company as a critical supplier in the evolving mobility ecosystem.

2. Emphasis on Sustainability and Recyclable Materials

Environmental regulations and corporate sustainability goals will drive demand for eco-friendly rubber materials. In 2026, MRP may face increasing pressure—and opportunity—to adopt bio-based elastomers, recycled rubber compounds, and low-emission manufacturing practices. Customers across industries, especially in automotive and consumer goods, will prioritize suppliers with strong environmental, social, and governance (ESG) credentials. MRP’s ability to innovate with sustainable materials and achieve certifications like ISO 14001 will enhance competitiveness.

3. Advanced Manufacturing and Automation Integration

The adoption of Industry 4.0 technologies—such as IoT-enabled monitoring, predictive maintenance, and automated molding processes—will be a key trend in 2026. For MRP, investing in smart manufacturing systems can improve precision, reduce waste, and increase production scalability. Automation will also help mitigate labor shortages and rising operational costs, ensuring consistent quality and faster turnaround times for custom orders.

4. Supply Chain Resilience and Nearshoring

Ongoing global supply chain disruptions have prompted U.S. manufacturers to prioritize domestic sourcing. In 2026, MRP is likely to benefit from the nearshoring trend, as automotive and industrial clients seek reliable, local suppliers to reduce logistics risks. Strengthening partnerships within the Midwest manufacturing corridor and leveraging Michigan’s skilled workforce will position MRP as a preferred regional supplier.

5. Growth in Industrial and Medical Applications

Beyond automotive, demand for rubber components in industrial equipment, fluid handling systems, and medical devices will rise in 2026. The medical sector, in particular, requires precision-molded rubber parts that meet stringent FDA and biocompatibility standards. Expanding into higher-margin markets like healthcare can diversify MRP’s revenue streams and provide insulation against cyclical downturns in traditional sectors.

6. Workforce Development and Talent Acquisition

As manufacturing becomes more technologically advanced, the demand for skilled workers in engineering, materials science, and automation will grow. MRP may need to collaborate with local community colleges and vocational programs to develop a talent pipeline. Initiatives in workforce training and upskilling will be critical to maintaining innovation and operational excellence.

Conclusion

In 2026, Michigan Rubber Products will operate in a market defined by technological innovation, sustainability demands, and shifting industrial priorities. By embracing automation, expanding into high-growth sectors, and adopting sustainable practices, MRP can strengthen its market position and capitalize on emerging opportunities. Strategic investments in R&D, supply chain resilience, and workforce development will be essential to long-term success in a competitive and evolving landscape.

Common Pitfalls in Sourcing Michigan Rubber Products (Quality, IP)

Sourcing rubber products from Michigan—or suppliers based in the region—can offer access to high-quality manufacturing and engineering expertise. However, businesses often encounter several recurring challenges related to quality assurance and intellectual property (IP) protection. Being aware of these pitfalls can help mitigate risks and ensure a successful supplier relationship.

Quality Control Inconsistencies

One of the primary concerns when sourcing rubber components is inconsistent product quality. Even reputable Michigan-based manufacturers may experience variability due to differences in raw material sourcing, production processes, or lack of standardized testing protocols. Without strict quality control measures—such as ISO certifications, batch testing, or on-site audits—buyers risk receiving parts that fail to meet technical specifications, leading to downstream failures in end-use applications.

Lack of Traceability and Documentation

Many suppliers fail to provide comprehensive material certifications, lot traceability, or process validation records. This absence of documentation makes it difficult to verify compliance with industry standards (e.g., FDA, NSF, or aerospace specifications) and complicates root cause analysis in the event of a product failure. Buyers should ensure suppliers maintain full documentation throughout the supply chain.

Intellectual Property Exposure

Rubber product designs—especially custom-molded components—often involve proprietary formulations, tooling designs, or engineering innovations. A common pitfall is inadequate protection of IP through legal agreements. Without a clearly defined non-disclosure agreement (NDA) or work-for-hire contract, suppliers may retain rights to molds, material compounds, or design data, potentially leading to unauthorized replication or use with competing clients.

Tooling Ownership Ambiguity

Tooling used in rubber molding is expensive and critical to product consistency. A frequent oversight is failing to clarify ownership of molds and tooling in the sourcing agreement. If the supplier retains ownership, the buyer may face challenges switching vendors or lose leverage in cost negotiations. Always specify in writing that tooling paid for by the buyer is their exclusive property.

Insufficient Supplier Vetting

Not all Michigan rubber manufacturers are equally capable. Some may lack the capacity for high-volume production, advanced testing capabilities, or expertise in specialty compounds (e.g., silicone, EPDM, or fluorocarbon). Conducting thorough due diligence—including site visits, customer references, and review of quality management systems—is essential to avoid partnering with an underqualified supplier.

Conclusion

To avoid these common pitfalls, buyers should establish clear quality requirements, secure IP rights through legal agreements, insist on full documentation, and conduct rigorous supplier validation. Proactive management of these factors ensures reliable supply, protects innovation, and supports long-term success in sourcing rubber products from Michigan manufacturers.

Logistics & Compliance Guide for Michigan Rubber Products

This guide outlines the essential logistics and compliance procedures for handling, transporting, and documenting rubber products manufactured and distributed by Michigan Rubber Products. Adherence to these standards ensures operational efficiency, regulatory compliance, and customer satisfaction.

Shipping & Transportation

All rubber products must be packaged securely to prevent damage during transit. Use moisture-resistant wrapping and sturdy pallets secured with stretch wrap or banding. Coordinate with certified carriers experienced in handling industrial goods. Shipments must comply with Department of Transportation (DOT) regulations, especially when transporting hazardous materials (e.g., certain chemical additives). Maintain accurate shipping logs, including carrier details, departure/arrival times, and tracking information.

Inventory Management

Implement a first-in, first-out (FIFO) inventory system to prevent product aging and material degradation. Conduct monthly cycle counts and annual physical inventories. Store rubber products in a climate-controlled environment (60–75°F, 50–60% humidity) away from direct sunlight, ozone sources, and chemical exposure to maintain material integrity.

Regulatory Compliance

Michigan Rubber Products must comply with all applicable federal, state, and local regulations. This includes:

- EPA Regulations: Adherence to environmental standards for rubber manufacturing, including emissions control and waste disposal.

- OSHA Standards: Ensuring safe handling, storage, and workplace practices for rubber compounds and byproducts.

- REACH & RoHS Compliance: For international shipments, verify that products meet EU regulations on restricted substances.

- Customs Documentation: For exports, provide accurate Harmonized System (HS) codes, commercial invoices, and certificates of origin.

Quality Assurance & Documentation

All shipments must include a Certificate of Conformance (CoC) verifying that products meet customer specifications and industry standards (e.g., ASTM, ISO). Retain batch records, test results, and inspection reports for a minimum of seven years. Non-conforming products must be quarantined and dispositioned per internal quality procedures.

Returns & Reverse Logistics

Establish a formal process for handling returned goods. Inspect all returns for damage, contamination, or shelf-life expiration. Document reason for return and update inventory and compliance records accordingly. Coordinate environmentally responsible disposal or recycling of non-reusable materials in accordance with Michigan Department of Environment, Great Lakes, and Energy (EGLE) guidelines.

Continuous Improvement

Review logistics and compliance performance quarterly through key metrics such as on-time delivery rate, damage claims, inventory accuracy, and audit findings. Implement corrective actions as needed and provide ongoing training to staff on updated regulations and best practices.

Conclusion: Sourcing Michigan Rubber Products

Sourcing rubber products from Michigan offers numerous advantages due to the state’s strong manufacturing heritage, skilled workforce, and proximity to key industrial sectors such as automotive, aerospace, and heavy machinery. Michigan is home to a diverse network of rubber manufacturers and suppliers that provide high-quality custom and standard rubber components, including seals, gaskets, tubing, and molded parts. These companies often adhere to strict quality standards and certifications, ensuring reliability and compliance with industry requirements.

Additionally, sourcing locally within Michigan reduces lead times, lowers transportation costs, and supports supply chain resilience through stronger vendor relationships and greater oversight. The emphasis on innovation and advanced manufacturing technologies in the region further enhances product quality and customization capabilities.

In conclusion, Michigan represents a strategic and reliable source for rubber products, combining industrial expertise, geographic advantage, and a commitment to quality. Businesses seeking durable, precision-engineered rubber components will find Michigan-based suppliers to be valuable partners in meeting their operational and supply chain goals.