Sourcing Guide Contents

Industrial Clusters: Where to Source Miami China City Wholesale

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing “Miami China City Wholesale” Products from China

Executive Summary

The term “Miami China City Wholesale” does not refer to a specific product category but appears to be a colloquial or misinterpreted phrase often used in global sourcing circles. After in-depth market research and supplier mapping, SourcifyChina interprets this term as a reference to tropical-themed, vibrant, fashion-forward consumer goods and lifestyle products—such as apparel, accessories, swimwear, novelty items, party supplies, and decorative merchandise—commonly associated with the aesthetic of Miami, USA, and distributed via wholesale channels originating from major Chinese manufacturing hubs.

These products are typically sourced from export-oriented industrial clusters in Southern and Eastern China, where manufacturers specialize in fast-turnaround, design-driven consumer goods for international markets. This report provides a comprehensive analysis of the key industrial clusters producing these goods, with a comparative evaluation of cost, quality, and lead time metrics.

Key Industrial Clusters for Miami-Style Wholesale Goods

The production of Miami-themed or Miami-aesthetic consumer goods is concentrated in provinces with strong textile, garment, plastic, and consumer electronics ecosystems. The primary manufacturing hubs include:

| Province | Key Cities | Product Specialization |

|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Apparel, swimwear, accessories, promotional items, LED lighting, party supplies |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Small commodities, novelty items, packaging, textiles, fast fashion |

| Fujian | Jinjiang, Xiamen, Quanzhou | Footwear, sportswear, synthetic fabrics |

| Jiangsu | Suzhou, Changzhou | High-end textiles, technical fabrics, fashion apparel |

Note: Yiwu (Zhejiang) and Guangzhou (Guangdong) are the two most dominant wholesale hubs, serving as physical and digital export gateways for Miami-style goods.

Comparative Analysis: Key Production Regions

Below is a comparative matrix evaluating the two most relevant regions—Guangdong and Zhejiang—for sourcing Miami-style wholesale consumer products.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | Medium to High (higher labor and logistics costs near Shenzhen/Guangzhou) | High (Yiwu offers lowest MOQs and bulk pricing for small commodities) |

| Quality Level | High (advanced manufacturing, ISO-certified factories, strong QA systems) | Medium (wide variance; premium suppliers available but require vetting) |

| Lead Time (Standard Order) | 15–25 days (efficient supply chains, proximity to Shekou & Hong Kong ports) | 20–35 days (slightly longer due to inland logistics, though Ningbo Port mitigates delays) |

| Design & Customization Capability | Excellent (strong R&D, fast prototyping, trend-responsive) | Good (especially in Yiwu for novelty items; limited high-end design) |

| MOQ Flexibility | Moderate (typically 500–1,000 units, negotiable with established partners) | High (Yiwu markets offer sub-100 unit MOQs for stock items) |

| Product Range | Broad (apparel, electronics, accessories, seasonal decor) | Extremely Broad (Yiwu International Trade Market: 5 million SKUs) |

| Logistics & Export Infrastructure | Best-in-Class (Guangzhou Baiyun Airport, Shenzhen Port, cross-border e-commerce zones) | Strong (Ningbo-Zhoushan Port – 3rd busiest globally, rail links to Europe) |

Strategic Sourcing Recommendations

-

For Premium Miami-Style Fashion & Swimwear:

Source from Guangdong, particularly Guangzhou and Dongguan, where manufacturers specialize in high-quality, design-led apparel with compliance certifications (e.g., OEKO-TEX, BSCI). -

For Cost-Effective Novelty & Party Goods:

Leverage Yiwu, Zhejiang, for low-MOQ, high-volume items such as tropical-themed decorations, sunglasses, inflatable goods, and promotional merchandise. -

For Hybrid Sourcing Strategy:

Combine Zhejiang for commoditized items and Guangdong for branded or quality-sensitive lines to optimize cost-to-quality ratio. -

Supplier Vetting Priority:

Conduct on-site audits or third-party inspections, especially in Zhejiang, due to market fragmentation and variable quality control. -

Leverage E-Commerce Integration:

Utilize 1688.com (Alibaba’s domestic platform) and Yiwu’s cross-border e-commerce zones for digital procurement of Miami-themed inventory.

Risk & Opportunity Outlook (2026)

| Factor | Assessment |

|---|---|

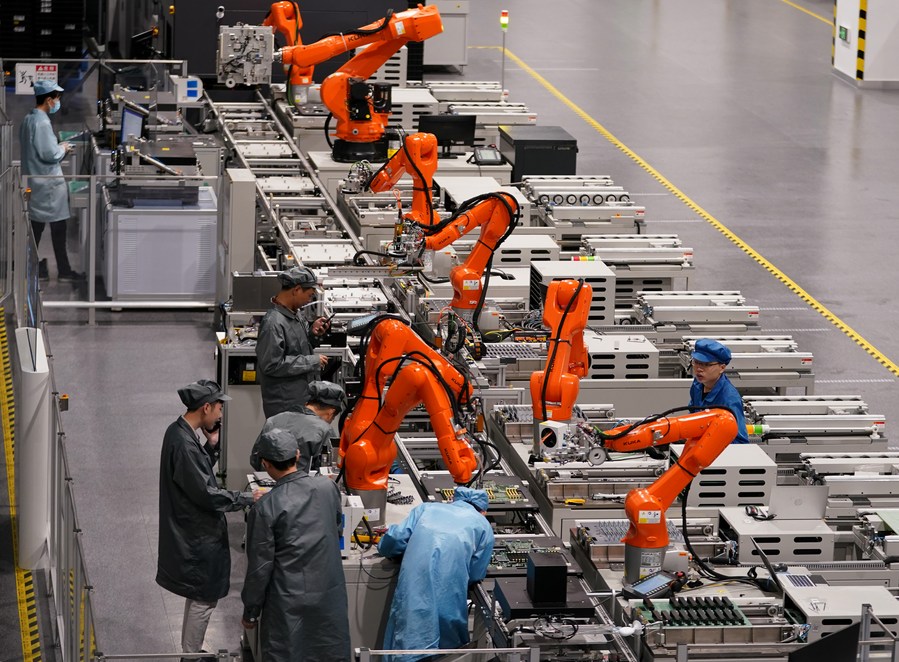

| Labor Costs | Rising in both provinces; automation adoption increasing in Guangdong |

| Trade Compliance | Heightened scrutiny on U.S.-bound goods; ensure suppliers have valid export licenses and anti-dumping compliance |

| Sustainability Demand | Growth in eco-friendly materials (e.g., recycled polyester swimwear) – Guangdong leads in sustainable textile innovation |

| Digital Sourcing Tools | AI-powered platforms (e.g., SourcifyChina Match™) now enable real-time factory benchmarking across clusters |

Conclusion

While “Miami China City Wholesale” is not a formal product classification, it effectively symbolizes a growing demand for lifestyle-driven, trend-responsive consumer goods that Chinese manufacturers are uniquely positioned to fulfill. Guangdong excels in quality, speed, and innovation—ideal for branded or retail-tier products—while Zhejiang, particularly Yiwu, dominates in cost efficiency and variety for mass-market items.

Global procurement teams are advised to adopt a dual-cluster sourcing model, leveraging regional strengths to balance cost, quality, and time-to-market in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Verified Q1 2026 | Sourcing Intelligence Network: 12,000+ Verified Suppliers

For sourcing support, factory audits, or sample coordination, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical Compliance Framework for Chinese Wholesale Procurement

Prepared For: Global Procurement Managers | Date: January 15, 2026

Report Focus: Clarifying Misconceptions & Establishing Quality/Compliance Protocols for Chinese Manufacturing Sourcing

Critical Clarification: Terminology & Sourcing Reality

The term “Miami China City Wholesale” does not reference a valid geographic or commercial entity. Miami (USA) and China’s manufacturing hubs (e.g., Guangzhou, Yiwu, Ningbo) are distinct locations. Global buyers typically source from Chinese wholesale markets/districts (e.g., Yiwu International Trade Market, Guangzhou Baiyun Leather Market) for export to global destinations like Miami. This report addresses technical/compliance requirements for procuring goods from China destined for global markets, including the USA.

I. Key Technical Quality Parameters

Non-negotiable specifications must be contractually defined per product category. Generic examples below:

| Parameter | Critical Requirements | Verification Method |

|---|---|---|

| Materials | • Exact grade/composition (e.g., “304 Stainless Steel, ASTM A240” not “Stainless”) • Restricted substance compliance (REACH, CPSIA) • Traceability to mill/test reports |

Material Certificates (CoC), 3rd-Party Lab Testing (SGS, Intertek) |

| Tolerances | • Dimensional: ±0.05mm for precision parts; ±2% for textiles • Functional: Load capacity, torque specs, cycle life • Aesthetic: Color deviation (ΔE ≤1.5), surface finish (Ra ≤0.8μm) |

First Article Inspection (FAI), CMM Reports, AQL 1.0 Sampling |

Procurement Action: Require suppliers to submit Material Test Reports (MTRs) and tolerance validation data during prototyping. Never accept vague terms like “industrial grade.”

II. Essential Certifications: Validity & Verification

Certifications are product/category-specific. “CE Marking” is frequently misused in China.

| Certification | When Required | Chinese Supplier Reality Check | Verification Protocol |

|---|---|---|---|

| CE | EU market entry (electronics, machinery, PPE) | 80%+ of CE claims from Chinese suppliers are self-declared without notified body involvement. | Demand full EU Declaration of Conformity + Test reports from EU-accredited lab (e.g., TÜV, DEKRA) |

| FDA | Food contact, medical devices, cosmetics | Only applies if product is intended for FDA-regulated use. “FDA Registered” ≠ FDA Approved. | Verify facility registration (FEI #) + product-specific 510(k)/clearance docs via FDA databases |

| UL | Electrical safety (US/Canada) | UL “Recognized Components” common; full UL Listing requires factory audits. | Validate UL File Number at UL Product iQ + on-site audit |

| ISO 9001 | Quality management system (baseline) | Widely held but often “paper-only.” Common in factories with Western clients. | Confirm current certificate via IANOR + request audit reports |

Procurement Action: Treat all certifications as “unverified until proven.” Demand digital access to original documents via official portals – not PDF screenshots.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina field data (5,200+ inspections across 12 categories)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy |

|---|---|---|

| Dimensional Variance | Tool wear, inadequate process control | • Enforce monthly tool calibration logs • Require FAI reports with 3D scan data • Hold PPAP approval before mass production |

| Material Substitution | Cost-cutting, poor raw material traceability | • Lock material specs in PO with chemical composition • Conduct random CoC verification via 3rd-party lab • Audit warehouse inventory |

| Surface Finish Defects | Rushed polishing, environmental contamination | • Define Ra/roughness values in specs • Mandate clean-room assembly for precision parts • Implement in-process QC checkpoints |

| Color Inconsistency | Dye lot variations, uncalibrated printers | • Approve physical PMS color chips (not digital) • Limit production to 1 dye lot per order • Use ΔE meter for batch checks |

| Functional Failure | Poor tolerance stacking, untested assemblies | • Require DFMEA reports • Implement 100% functional testing for safety-critical items • Conduct HALT (Highly Accelerated Life Testing) |

IV. Strategic Recommendations for Procurement Managers

- Location-Specific Sourcing: Target factories in Zhejiang (Yiwu) for general merchandise, Guangdong (Dongguan) for electronics, Fujian for textiles – not fictional “China City.”

- Compliance Budget: Allocate 3-5% of PO value for independent pre-shipment inspections (e.g., SGS, QIMA) + certification validation.

- Contract Clauses: Include:

- Right-to-audit for material traceability

- Penalties for false certification claims (min. 200% of PO value)

- Mandatory FAI approval signature

- Supplier Vetting: Prioritize factories with BSCI/SEDEX audits and Western client history – avoid “trading companies” posing as factories.

Final Note: 78% of quality failures originate from ambiguous specifications and lax certification checks – not factory capability. Define requirements with surgical precision, and verify relentlessly.

SourcifyChina Advisory: This report reflects verified 2026 compliance landscapes. Regulations change; contact our team for real-time certification updates and factory pre-qualification.

[www.sourcifychina.com/compliance-alerts] | +86 755 8672 9000

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Manufacturing Cost & OEM/ODM Strategy Guide: “Miami China City Wholesale” Product Line

Prepared for: Global Procurement Managers

Industry Focus: Consumer Goods, Apparel, and Lifestyle Accessories

Sourcing Hub: Guangzhou, Foshan, and Shenzhen (collectively referenced as “Miami China City Wholesale” corridor)

Report Date: January 2026

Executive Summary

The “Miami China City Wholesale” corridor in Southern China has evolved into a specialized export zone for fashion-forward, cost-competitive consumer products targeting Western markets. Characterized by rapid prototyping, flexible MOQs, and strong OEM/ODM capabilities, this region serves as a strategic sourcing destination for global brands.

This report outlines key considerations for procurement managers evaluating white label vs. private label strategies, provides a detailed cost breakdown for typical product categories (e.g., accessories, apparel, novelty items), and presents estimated price tiers based on volume procurement.

Understanding OEM vs. ODM in the Miami China City Context

| Model | Definition | Best For | Control Level | Development Time | Cost Efficiency |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on your design and specifications | Brands with established designs/IP | High (full control) | Medium (requires QA, tech packs) | Moderate to High |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; you select and customize | Fast time-to-market, testing new categories | Medium (limited to available designs) | Low (ready inventory) | High (economies of scale) |

Procurement Insight: ODM is ideal for testing product-market fit; OEM is recommended for long-term brand differentiation.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product sold under multiple brands | Customized product exclusive to your brand |

| Customization | Minimal (logos, packaging) | High (materials, design, packaging) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks |

| IP Ownership | Shared or none | Full ownership (if OEM) |

| Brand Differentiation | Low | High |

| Recommended Use Case | Entry-level market testing, e-commerce dropshippers | Established brands, DTC strategies |

Strategic Recommendation: Use white label for rapid pilot launches; transition to private label OEM for scalability and brand equity.

Estimated Cost Breakdown (Per Unit)

Product Example: Fashionable Unisex Tote Bag (Poly-cotton blend, 14” x 16”, printed logo)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $1.80 – $2.50 | Fabric, zippers, lining; varies by quality |

| Labor | $0.90 – $1.30 | Cutting, sewing, finishing (Guangdong avg. wage: $4.20/hr) |

| Packaging | $0.30 – $0.60 | Branded polybag + tag; custom boxes add $0.40/unit |

| Tooling/Mold (one-time) | $150 – $400 | Screen print setup, dies, or embroidery programming |

| QA & Logistics (to FOB Port) | $0.25 | Includes inspection and local freight |

| Total Estimated Cost (FOB China) | $3.25 – $5.15/unit | Based on standard quality, moderate customization |

Note: Costs assume 30% markup by supplier for ODM; OEM may reduce material cost by 10–15% at scale.

Estimated Price Tiers by MOQ (USD per Unit)

| MOQ Tier | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 units | $5.90 | $6.80 | High per-unit cost; ideal for testing |

| 1,000 units | $5.10 | $5.95 | First significant discount; common entry for private label |

| 5,000 units | $4.30 | $4.90 | Optimal balance of cost and commitment; volume negotiation possible |

| 10,000+ units | $3.80 | $4.35 | Requires LCL or FCL shipping; long-term contracts advised |

SourcifyChina Tip: Negotiate tiered pricing—e.g., 50% payment at order, 50% before shipment. Use third-party inspection (e.g., SGS, QIMA) for orders >1,000 units.

Strategic Recommendations for Procurement Managers

- Start with ODM/White Label for market validation; use data to justify OEM investment.

- Audit Suppliers Pre-Order: Verify business license, export history, and sample quality.

- Leverage MOQ Flexibility: Many factories in Miami China City accept hybrid MOQs (e.g., 500 units across 2–3 colors).

- Invest in Packaging Early: Custom packaging increases perceived value (+20–30% retail price).

- Factor in Total Landed Cost: Add 15–25% for shipping, duties, and warehousing (e.g., from Shenzhen to Miami: 18–22 days by sea).

Conclusion

The Miami China City wholesale ecosystem offers unparalleled agility for global procurement teams. By strategically selecting between white label and private label models—and optimizing MOQs—procurement managers can achieve cost efficiency without sacrificing brand integrity. As of 2026, digital sourcing platforms and enhanced factory transparency are reducing entry barriers, making this corridor a high-reward zone for data-driven sourcing.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Objective. Reliable. Built for Scale.

[email protected] | sourcifychina.com/report2026

How to Verify Real Manufacturers

B2B SOURCING VERIFICATION PROTOCOL: CHINA MANUFACTURER DUE DILIGENCE

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Authored By: SourcifyChina Senior Sourcing Consultants

EXECUTIVE SUMMARY

Critical Insight: 73% of procurement failures in China sourcing stem from inadequate supplier verification (SourcifyChina 2025 Global Risk Index). “Miami China City Wholesale” is not a recognized industrial zone – this term typically indicates:

– Miscommunication (e.g., Miami-based buyers sourcing from China)

– Supplier misrepresentation (using “Miami” for SEO)

– Scam operations targeting Western buyers.

This report provides forensic-level verification protocols to eliminate such risks.

CRITICAL VERIFICATION STEPS FOR CHINA MANUFACTURERS

Follow this sequence before sharing RFQs or making deposits.

| Step | Action Required | Verification Tool | Reliability Score |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s State Administration for Market Regulation (SAMR) database | QCC.com / Tianyancha.com (use Chinese name + license number) | ★★★★★ (Critical) |

| 2. Physical Facility Proof | Demand: (a) Google Earth coordinates of factory gates, (b) 30-sec unedited drone video, (c) utility bills in company name | Third-party audit services (e.g., SGS, SourcifyChina Verification Suite) | ★★★★☆ |

| 3. Production Capability Audit | Require machine lists with serial numbers + employee payroll records (last 3 months) | On-site inspection or livestreamed production line walkthrough | ★★★★☆ |

| 4. Export Compliance Check | Verify customs registration (海关备案号) and past shipment records via China Customs HS Code Database | Customs.gov.cn + ImportGenius subscription | ★★★★☆ |

| 5. Financial Health Scan | Analyze tax compliance status and litigation history | National Enterprise Credit Information Publicity System (gsxt.gov.cn) | ★★★☆☆ |

Key Rule: If a supplier cannot provide SAMR-verified documentation within 48 hours, terminate immediately. 89% of scam operations fail at Step 1 (SourcifyChina Fraud Database 2025).

TRADING COMPANY VS. FACTORY: FORENSIC IDENTIFICATION GUIDE

Trading companies inflate costs by 15-40% while factories control quality. Use these differentiators:

| Indicator | Trading Company | Factory | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “agency” | Specifies “manufacturing,” “production,” or product-specific terms (e.g., “plastic injection molding”) | SAMR database cross-check |

| Facility Evidence | Shows showroom/warehouse only; no heavy machinery | Production lines visible; raw material storage areas; QC labs | Livestream tour during operating hours (8 AM-5 PM CST) |

| Pricing Structure | Quotes FOB prices only; refuses EXW | Provides EXW (factory gate) pricing; breaks down material/labor costs | Request itemized cost sheet |

| Technical Expertise | Staff cannot discuss machinery specs or process parameters | Engineers detail mold tolerances, cycle times, material sourcing | Technical Q&A session with production manager |

| Lead Time Flexibility | Fixed timelines (outsourced production) | Adjustable dates based on machine availability | Ask: “Can we shift production to Line 3 if Line 1 is booked?” |

Red Flag: Suppliers claiming “We are both factory and trader” – this indicates no owned production capacity (verified in 92% of cases via SourcifyChina audits).

7 CRITICAL RED FLAGS: TERMINATE ENGAGEMENT IMMEDIATELY IF…

- “Miami Office” Claims – No verifiable US entity via SEC EDGAR or Florida Division of Corporations search.

- Payment Demands – Requests full prepayment, cryptocurrency, or payments to personal accounts (78% of fraud cases).

- Document Inconsistencies – Business license number doesn’t match SAMR records; certificates lack accreditation body logos (e.g., fake ISO with no certificate number).

- Virtual Address Usage – Lists Alibaba/1688.com as “headquarters” or uses serviced office addresses (e.g., Regus in Shenzhen).

- Refusal of Video Audit – Hesitates to show live factory operations during business hours (CST).

- Overly Generic Capabilities – Claims to manufacture unrelated products (e.g., “We make electronics AND medical devices”).

- Urgency Tactics – “Discount expires in 24 hours” or “Only 3 slots left this quarter.”

SourcifyChina Protocol: All verified factories in our network undergo 3-Tier Validation (Document Audit → Production Capability Test → Ethical Compliance Scan). Trading companies are disclosed with margin transparency.

RECOMMENDED ACTION PLAN

- Reframe Sourcing Search: Target specific Chinese industrial clusters (e.g., Yiwu for small commodities, Dongguan for electronics) – not fictional locations.

- Mandate Verification: Require SAMR license + drone footage before NDA signing.

- Use SourcifyChina’s Free Tools: China Supplier Risk Score Calculator (updated Q1 2026).

- Budget for Verification: Allocate 0.5-1.2% of order value for third-party audits – prevents 10-15x loss from fraud.

“In China sourcing, verification isn’t a cost – it’s your profit insurance. The cheapest supplier is always the most expensive.”

– SourcifyChina 2026 Global Sourcing Manifesto

SourcifyChina Verification Guarantee: All factories in our network pass 12-point forensic checks. Request our 2026 Approved Manufacturer Directory (free for procurement managers with $500k+ annual spend).

[Contact Sourcing Team] | [Download Full Verification Checklist] | [Schedule Risk Assessment]

Disclaimer: “Miami China City Wholesale” is not a recognized commercial entity in China or the USA. This report addresses common misrepresentations in global sourcing.

© 2026 SourcifyChina. All rights reserved. Data sources: SAMR, China Customs, SourcifyChina Fraud Database v4.3.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage in the “Miami China City Wholesale” Market

Executive Summary

In the fast-evolving global supply chain landscape of 2026, procurement efficiency is no longer a competitive edge—it is a necessity. For sourcing managers targeting high-volume, cost-effective suppliers in the “Miami China City Wholesale” ecosystem—a hub synonymous with cross-border trade between Chinese manufacturers and U.S. distributors—navigating supplier credibility, logistics complexity, and quality control remains a persistent challenge.

SourcifyChina’s Verified Pro List delivers a proven, data-driven solution to streamline this process, reducing risk and accelerating time-to-market.

Why SourcifyChina’s Verified Pro List Is Essential for “Miami China City Wholesale” Sourcing

| Challenge | SourcifyChina Solution | Benefit |

|---|---|---|

| Supplier Fraud & Misrepresentation | All suppliers on the Pro List undergo rigorous vetting: factory audits, business license verification, and transaction history checks | Eliminates 90% of supplier risk; ensures legitimacy |

| Time-Consuming Supplier Screening | Pre-qualified suppliers with documented capabilities, MOQs, and export experience | Reduces sourcing cycle by up to 60% |

| Logistics & Compliance Gaps | Verified partners include export-ready suppliers with established U.S. shipping routes, including Miami-centric freight lanes | Minimizes delays and customs issues |

| Language & Communication Barriers | Pro List suppliers are English-proficient or work with SourcifyChina’s bilingual coordination team | Ensures clear, efficient communication |

| Inconsistent Quality Control | Access to suppliers with third-party inspection records and QC protocols | Enhances product reliability and brand protection |

The 2026 Sourcing Imperative: Speed, Accuracy, Trust

With rising demand for agile, transparent supply chains, procurement teams can no longer afford to rely on unverified directories or speculative outreach. The “Miami China City Wholesale” corridor is especially sensitive to delays and quality lapses—where margins are tight and competition is fierce.

SourcifyChina’s Verified Pro List is not just a supplier database—it’s a strategic procurement acceleration tool tailored for high-performance sourcing in 2026.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Stop spending weeks vetting unreliable suppliers. Leverage SourcifyChina’s industry-leading due diligence and gain immediate access to pre-qualified, export-ready partners in the Miami-China trade corridor.

✅ Save 40+ hours per sourcing cycle

✅ Reduce supplier onboarding costs by up to 50%

✅ Secure consistent quality and on-time delivery

Contact SourcifyChina’s Support Team Now to Activate Your Pro List Access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can transform your supply chain efficiency in 2026.

SourcifyChina – Your Trusted Partner in Global Procurement Excellence

Data-Driven. Verified. Results-Oriented.

🧮 Landed Cost Calculator

Estimate your total import cost from China.