The global metal stamping market is experiencing robust growth, driven by rising demand across automotive, aerospace, consumer electronics, and industrial equipment sectors. According to Grand View Research, the market was valued at USD 315.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. This expansion is fueled by increasing adoption of lightweight, high-strength stamped components in electric vehicles and advanced manufacturing technologies. Mordor Intelligence further highlights that innovations in progressive die stamping, precision tooling, and automation are enhancing production efficiency and part accuracy, reinforcing the competitive edge of leading manufacturers. As industries prioritize cost-effective, high-volume production with strict quality standards, the role of top-tier metal stamping companies becomes increasingly critical. The following list identifies the leading metal stamping process manufacturers shaping the industry through scale, technological investment, and global supply chain integration.

Top 10 Metal Stamping Process Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Trans

Domain Est. 1997

Website: transmatic.com

Key Highlights: Based out of our Holland, MI, headquarters, our global metal stamping manufacturer serves a range of industries from automotive to HVAC….

#2 High Precision & Volume Metal Stamping

Domain Est. 1999

Website: wiegel.com

Key Highlights: We are a high precision, high volume metal stamper that manufacturers have partnered with for 80 years, from automotive to appliance. Contact us today!…

#3 BTD Manufacturing

Domain Est. 1997

Website: btdmfg.com

Key Highlights: Your reliable and innovative partner for custom metal fabrication, welding, tool & die, CNC, EDM and more from locations in MN, IL and GA….

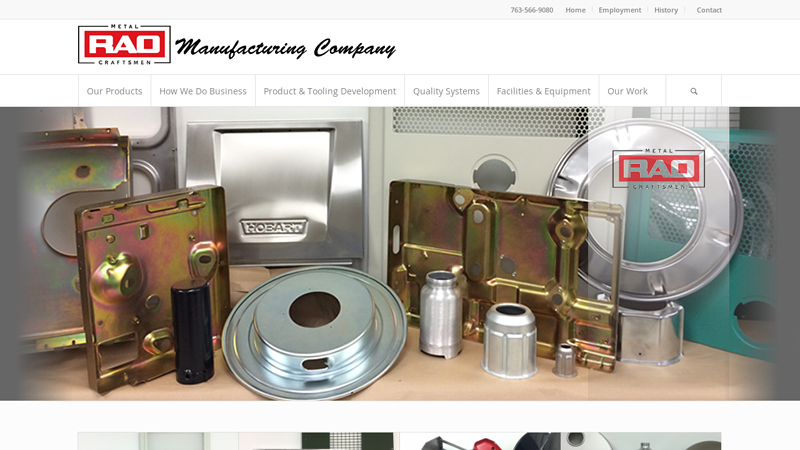

#4 RAO

Domain Est. 1997

Website: raomfg.com

Key Highlights: RAO specializes in Deep Drawn Metal Stampings, Drawn Tank Heads, Precision Sheet Metal Stampings, Precision Sheet Metal Fabrications, and Welded Assemblies….

#5 Wisconsin-Based Deep Draw Metal Stamping –

Domain Est. 1998

Website: atacosteel.com

Key Highlights: ATACO Steel Products excels in deep draw metal stamping and custom metal fabrication, providing precision-engineered solutions to the metals industry….

#6 G&M Manufacturing Corp

Domain Est. 1999

Website: gandm.com

Key Highlights: Discover precision custom metal stamping services at G&M Manufacturing. We specialize in high-quality, tailored metal parts for various industries….

#7 Kapco Metal Stamping

Domain Est. 1999

Website: kapcoinc.com

Key Highlights: Kapco Metal Stamping is committed to high-quality contract manufacturing with a dedicated and skilled team driven by our customers’ success….

#8 Metal Stamping Companies

Domain Est. 2001

Website: metalstamper.net

Key Highlights: We are the metal stampings experts. We have over 30 years of experience creating customized solutions for our customers in a wide variety of industries….

#9 Frontier Metal Stamping

Domain Est. 2003

Website: frontiermetal.com

Key Highlights: Frontier Metal Stamping provides cost-effective custom metal stampings and components for a variety of industries and applications….

#10 Metal Stamping

Domain Est. 2019

Website: walkermanufacturing.com

Key Highlights: Our metal stamping service extends to include hardware insertion, ensuring components are shaped to perfection and ready for immediate use in assembly lines….

Expert Sourcing Insights for Metal Stamping Process

H2: Market Trends in the Metal Stamping Process for 2026

The metal stamping industry is poised for significant transformation by 2026, driven by technological innovation, evolving manufacturing demands, and global economic shifts. As a critical process in sectors such as automotive, aerospace, electronics, and medical devices, metal stamping is adapting to meet higher precision, efficiency, and sustainability standards. Below are the key market trends shaping the metal stamping process in 2026:

-

Increased Adoption of Automation and Smart Manufacturing

By 2026, automation will be deeply integrated into metal stamping operations. The rise of Industry 4.0 technologies—such as AI-driven predictive maintenance, real-time monitoring systems, and robotic press tending—is enhancing production accuracy and reducing downtime. Smart factories are leveraging IoT-enabled stamping presses to optimize workflows and improve traceability across the supply chain. -

Growth in Demand from Electric Vehicles (EVs)

The automotive sector remains the largest consumer of stamped metal components. With the global push toward electric mobility, demand is shifting toward lightweight, high-strength stamped parts for EV battery enclosures, motor housings, and structural components. This trend is driving innovation in advanced high-strength steel (AHSS) and aluminum stamping techniques. -

Sustainability and Green Manufacturing Initiatives

Environmental regulations and corporate sustainability goals are pushing metal stampers to adopt greener practices. In 2026, manufacturers are increasingly investing in energy-efficient presses, closed-loop recycling systems, and low-emission coating technologies. There is also a growing emphasis on reducing material waste through precision blanking and nesting software. -

Advancements in Materials and Hybrid Stamping

The use of composite materials and multi-material stamping is gaining traction. Hybrid stamping—combining metals with polymers or composites—is enabling lighter, stronger components, especially in aerospace and consumer electronics. Concurrently, advancements in material science are expanding the use of aluminum, magnesium, and ultra-high-strength steels in stamping applications. -

Rise of Nearshoring and Supply Chain Resilience

Geopolitical tensions and supply chain disruptions have prompted companies to reevaluate sourcing strategies. By 2026, there is a noticeable shift toward nearshoring and regionalization of metal stamping operations, particularly in North America and Europe. This trend supports faster turnaround times, reduced logistics costs, and greater control over quality. -

Customization and Low-Volume High-Mix Production

Driven by demand for personalized products and rapid prototyping, metal stamping is adapting to low-volume, high-mix production environments. Flexible stamping lines with quick die-change systems (e.g., SMED) and modular tooling are enabling manufacturers to respond swiftly to customized orders, particularly in medical and industrial equipment sectors. -

Digital Twin and Simulation Technologies

Digital twin technology is becoming mainstream in metal stamping by 2026. Manufacturers use virtual models to simulate the entire stamping process, from tool design to final part formation. This reduces trial-and-error, improves first-time quality, and accelerates time-to-market for new products. -

Consolidation and Strategic Partnerships

The competitive landscape is seeing increased consolidation among metal stamping firms. Larger players are acquiring niche specialists to expand capabilities in precision stamping, surface treatment, or specific end markets. Strategic partnerships with OEMs are also on the rise, emphasizing long-term collaboration and co-development.

In conclusion, the 2026 metal stamping market is characterized by technological sophistication, sustainability focus, and responsiveness to dynamic end-user demands. Companies that embrace digitalization, material innovation, and agile manufacturing will be best positioned to lead in this evolving landscape.

Common Pitfalls in Sourcing Metal Stamping Processes (Quality, IP)

Sourcing metal stamping services can offer cost-effective manufacturing solutions, but it comes with significant risks—particularly in quality consistency and intellectual property (IP) protection. Failing to address these pitfalls can lead to production delays, compromised product integrity, and legal exposure.

Quality-Related Pitfalls

Inadequate Supplier Qualification

One of the most common mistakes is selecting a stamping supplier based solely on cost or lead time without thoroughly vetting their capabilities, certifications (e.g., ISO 9001), equipment condition, or quality control processes. This can result in dimensional inaccuracies, material defects, and non-compliance with specifications.

Lack of Clear Quality Specifications

Vague or incomplete technical documentation—such as missing tolerances, material grades, surface finish requirements, or inspection criteria—leads to inconsistent output. Suppliers may interpret drawings differently, causing parts to fail in assembly or performance.

Insufficient Process Validation and PPAP Compliance

Skipping or inadequately executing Production Part Approval Process (PPAP) documentation increases the risk of undetected process flaws. Without proper First Article Inspection (FAI), capability studies (Cp/Cpk), and control plans, long-term quality issues may go unnoticed until mass production.

Poor Communication and Change Management

Unapproved design or process changes by the supplier—often made to reduce costs or expedite delivery—can compromise part functionality and reliability. Without a formal change notification and approval process, these alterations go undetected.

Inconsistent Incoming and In-Process Inspections

Relying solely on final inspection without robust in-process checks (e.g., SPC, gaging, visual audits) allows defects to accumulate. Suppliers with weak inspection protocols may pass non-conforming parts, especially in high-volume runs.

Intellectual Property-Related Pitfalls

Unprotected Design and Tooling Ownership

Failure to formally establish ownership of dies, molds, CAD files, and process know-how in the contract can result in the supplier claiming rights to tooling or reusing designs for competitors. This is especially risky with overseas suppliers.

Weak or Absent NDAs and IP Clauses

Using generic or poorly drafted Non-Disclosure Agreements (NDAs) without specific clauses covering reverse engineering, data security, and post-contract obligations increases the risk of IP leakage or unauthorized replication.

Lack of Control Over Digital Assets

Sharing CAD models, tool paths, and process parameters without encryption, access controls, or usage restrictions exposes sensitive design information. Suppliers may retain or misuse digital files beyond the scope of the agreement.

Geopolitical and Legal Jurisdiction Risks

Sourcing from regions with weak IP enforcement increases vulnerability to design theft and counterfeit production. Legal remedies may be difficult or impractical to enforce across borders.

Tooling Stored at Supplier Facilities Without Oversight

When stamping dies remain at the supplier’s site without clear access rights or audit provisions, it becomes difficult to verify exclusive usage or prevent unauthorized production runs.

Mitigation Strategies

To avoid these pitfalls, establish a structured sourcing strategy that includes: rigorous supplier audits, detailed technical specifications, formal PPAP processes, strong legal contracts with explicit IP ownership terms, encrypted data sharing protocols, and regular on-site quality audits. Proactive management of both quality and IP safeguards ensures reliable supply and protects innovation.

Logistics & Compliance Guide for Metal Stamping Process

Overview of Metal Stamping

Metal stamping is a manufacturing process that uses dies and stamping presses to transform flat metal sheets into specific shapes. It is widely used in automotive, aerospace, electronics, and industrial equipment sectors. Efficient logistics and strict compliance measures are essential to ensure product quality, safety, and regulatory adherence throughout the supply chain.

Regulatory Compliance Requirements

Compliance with international, national, and industry-specific regulations is critical in metal stamping operations. Key standards include:

– ISO 9001: Quality management systems for consistent product quality.

– ISO 14001: Environmental management to minimize waste and emissions.

– OSHA Standards (USA): Workplace safety, especially regarding machinery guarding and hazardous materials.

– REACH & RoHS (EU): Restrictions on hazardous substances in materials and finished goods.

– ITAR/EAR (if applicable): For defense-related components, ensuring proper export controls.

Regular audits and documentation are required to maintain compliance.

Material Sourcing and Traceability

Raw material selection and traceability are key to compliance and quality assurance.

– Source metals (steel, aluminum, copper alloys) from certified suppliers adhering to ASTM, SAE, or EN standards.

– Maintain material certifications (e.g., Mill Test Reports) for each batch.

– Implement a traceability system using batch/lot numbers to track materials from receipt through production and shipment.

– Conduct incoming material inspections for composition, thickness, and surface quality.

Production Process Controls

Effective in-process controls ensure consistency and adherence to specifications:

– Validate stamping dies and tooling through first article inspection (FAI) per AS9102 or PPAP requirements.

– Monitor press parameters (tonnage, speed, stroke) and perform regular maintenance.

– Implement Statistical Process Control (SPC) to detect deviations in critical dimensions.

– Conduct in-process inspections using calibrated gauges and coordinate measuring machines (CMM).

Waste Management and Environmental Compliance

Metal stamping generates scrap, lubricants, and metal fines requiring proper handling.

– Segregate recyclable scrap (e.g., steel, aluminum) and partner with licensed recycling facilities.

– Manage stamping fluids (oils, coolants) per EPA or local regulations; prevent soil/water contamination.

– Treat or dispose of hazardous waste (e.g., sludge, used solvents) through certified waste handlers.

– Maintain records of waste disposal and pollution control measures for regulatory reporting.

Packaging and Shipping Logistics

Proper packaging ensures components arrive undamaged and meet customer requirements:

– Use protective packaging (VCI paper, desiccants, edge protectors) to prevent corrosion and physical damage.

– Label packages with part numbers, quantities, batch/lot numbers, and handling instructions.

– Comply with carrier and customer-specific shipping standards (e.g., ISTA, MIL-STD).

– Optimize container loading for freight efficiency while ensuring load stability.

Documentation and Recordkeeping

Accurate documentation supports compliance and traceability:

– Maintain production records, inspection reports, non-conformance reports (NCRs), and corrective actions.

– Provide customers with Certificates of Conformance (CoC) and material test reports.

– Store digital records securely with backup systems; retain documents per regulatory requirements (typically 5–10 years).

– Use ERP or MES systems to automate data capture and reporting.

Import/Export Compliance

For international operations, adhere to customs and trade regulations:

– Classify stamped parts correctly under the Harmonized System (HS) code.

– Prepare accurate commercial invoices, packing lists, and certificates of origin.

– Comply with export controls (e.g., EAR, ITAR) if components are used in restricted applications.

– Monitor changes in trade agreements, tariffs, or sanctions affecting material or finished goods movement.

Continuous Improvement and Audits

Ongoing evaluation ensures long-term compliance and efficiency:

– Conduct internal audits of logistics and compliance procedures semi-annually.

– Engage in supplier performance reviews and third-party certifications.

– Use customer feedback and non-conformance data to drive corrective and preventive actions (CAPA).

– Stay updated on evolving regulations and industry best practices through training and association memberships.

Conclusion

A robust logistics and compliance framework is essential for successful metal stamping operations. By integrating regulatory adherence, traceability, environmental responsibility, and efficient supply chain management, manufacturers can ensure quality, reduce risk, and maintain customer trust in competitive global markets.

Conclusion for Sourcing Metal Stamping Process:

Sourcing the metal stamping process requires a strategic approach that balances cost, quality, lead time, and supplier reliability. After thorough evaluation, it is evident that selecting the right manufacturing partner is critical to ensuring consistent product quality, scalability, and long-term operational efficiency. Key factors such as tooling capabilities, material expertise, production capacity, engineering support, and compliance with industry standards (e.g., ISO, IATF) should heavily influence sourcing decisions.

Nearshoring or offshoring options each present unique advantages—whether it’s reduced labor costs overseas or shorter lead times and better communication with regional suppliers. However, risks related to supply chain disruptions, quality control, and intellectual property must be carefully managed through robust supplier vetting, clear contracts, and ongoing performance monitoring.

In conclusion, a successful metal stamping sourcing strategy integrates comprehensive supplier assessment, long-term partnership development, and continuous process improvement. By aligning sourcing decisions with overall business goals, companies can achieve cost-effective, high-quality metal stamping solutions that support innovation and competitive advantage in the marketplace.