The global metal molding industry is experiencing robust expansion, driven by rising demand across automotive, aerospace, industrial machinery, and consumer goods sectors. According to Grand View Research, the global metal casting market was valued at USD 137.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by advancements in casting technologies, increasing emphasis on lightweight and high-strength components, and the ongoing modernization of manufacturing infrastructure—particularly in Asia Pacific and North America. As industries prioritize precision, durability, and cost-efficiency, the role of leading metal molder manufacturers has become increasingly critical. These companies are not only scaling production capacity but also investing heavily in automation, sustainable practices, and advanced alloys to meet evolving regulatory and performance standards. In this competitive landscape, the following ten manufacturers stand out for their technological innovation, global footprint, and consistent delivery of high-quality metal components.

Top 10 Metal Molder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Precision Die Casting Solutions

Domain Est. 1995

Website: dynacast.com

Key Highlights: Dynacast transforms ideas into high-precision metal components. Leveraging innovative technology, unmatched engineering expertise, and the most precise die ……

#2 Liquidmetal

Domain Est. 1996

Website: liquidmetal.com

Key Highlights: Liquidmetal Technologies Inc. is a contract manufacturer that uses a patented injection molding process to produce amorphous metal components….

#3 NN, Inc.

Domain Est. 2001

Website: nninc.com

Key Highlights: NN, Inc. is a precision component manufacturer with extensive experience in machining, stamping, and precious metal plating….

#4 INDO

Domain Est. 2009

Website: indo-mim.com

Key Highlights: INDO-MIM Limited is a globally recognized manufacturer of Precision Engineering Components using Metal Injection Molding (“MIM”) technology….

#5 DME

Domain Est. 1999

Website: dme.net

Key Highlights: The premier global supplier of Mold Bases, Mold Components, Molding Supplies, Hot Runner & Controllers and Mold Technology with locations, operations, ……

#6 Smith Metal Products: MIM Part Production

Domain Est. 2000

Website: smithmetals.com

Key Highlights: Welcome to Smith Metal Products, a leader in metal injection molding (MIM) manufacturing with over 25 years of experience….

#7 Precision Metal Injection Molding Foundry

Domain Est. 2002

Website: optimim.com

Key Highlights: Explore OptiMIM’s metal injection molding foundry, delivering complex, high-precision metal parts with consistency, speed, and quality….

#8 SyBridge Technologies

Domain Est. 2003

Website: sybridge.com

Key Highlights: Drive product success with SyBridge’s precision injection molds. Full-lifecycle tooling partnership, 50+ years of expertise, global support….

#9 PSM Industries

Domain Est. 2006

Website: psmindustries.com

Key Highlights: PSM Industries offers sintered solutions in the metal fabrication business. Contact us for high quality metal parts by metal injection molding!…

#10 Cast Rite Metal Co.

Domain Est. 2007

Website: castritemetal.com

Key Highlights: If you are searching for a high quality aluminum sand casting foundry, look no further than Cast Rite Metal (CRM)….

Expert Sourcing Insights for Metal Molder

H2 2026 Market Trends for Metal Molders

The metal molding industry in the second half of 2026 is expected to navigate a complex landscape shaped by technological acceleration, shifting demand patterns, and persistent cost pressures. While challenges remain, strategic opportunities are emerging for agile and innovative foundries.

1. Advanced Manufacturing & Automation Acceleration (H2 2026):

* AI-Driven Process Optimization: Widespread adoption of AI for predictive maintenance, real-time process control (e.g., optimizing melt chemistry, cooling rates), and defect prediction is becoming standard for competitive foundries, significantly improving yield and reducing scrap.

* Integrated Digital Twins: H2 sees deeper implementation of digital twins, linking design (CAD/CAM/CAE), process simulation, and real-time shop floor data. This enables faster prototyping, reduced trial-and-error runs, and enhanced quality assurance for complex castings.

* Robotics & Cobots: Increased deployment of collaborative robots (cobots) for tasks like core handling, degating, fettling, and inspection is improving worker safety, consistency, and productivity, mitigating labor shortages.

* Additive Manufacturing Integration: Metal 3D printing (Binder Jetting, DED) is increasingly used alongside traditional molding for rapid tooling (cores, molds), complex internal geometries, and low-volume/high-mix production, blurring traditional boundaries.

2. Demand Shifts: Electrification, Energy & Sustainability (H2 2026):

* EV & Hybrids Remain Key (But Evolving): Demand for lightweight, high-integrity aluminum castings (e.g., structural battery trays, motor housings, suspension components) remains strong, driven by continued EV adoption. However, competition from alternative designs (e.g., large stampings) intensifies, pushing molder innovation.

* Energy Transition Infrastructure Boom: Significant growth in demand for large, complex castings for wind turbine components (gearboxes, hubs, nacelles), hydrogen electrolyzers, and next-gen nuclear reactors. This favors foundries with large capacity and expertise in ferrous alloys (steel, ductile iron).

* Sustainability as a Core Competency: H2 2026 sees carbon footprint (Scope 1 & 2) as a critical customer requirement. Foundries investing in:

* Low-Carbon Energy: Increased use of renewable electricity and green hydrogen pilots for melting.

* Circular Economy: Advanced scrap sorting, closed-loop sand reclamation (>95% target), and partnerships for recycled metal sourcing.

* Process Efficiency: Optimized furnace operation, waste heat recovery, and reduced binder consumption are now table stakes for major contracts.

3. Supply Chain Resilience & Cost Management (H2 2026):

* Nearshoring/Reshoring Momentum: Geopolitical tensions and supply chain fragility continue to drive demand for regionalized production, particularly in North America and Europe. Foundries with strategic locations benefit.

* Raw Material Volatility: Prices for key alloys (aluminum, copper, nickel) remain susceptible to geopolitical events and energy costs. Foundries with strong supplier partnerships, hedging strategies, and material science expertise (e.g., designing for lower alloy content) gain an edge.

* Labor Challenges Persist: The skilled labor gap (molders, metallurgists, technicians) remains a critical constraint. Investment in training, automation, and improved working conditions is essential. Remote monitoring and expert support systems become more prevalent.

4. Materials & Process Innovation (H2 2026):

* High-Performance Alloys: Increased demand for castings using advanced aluminum alloys (e.g., high-silicon for wear resistance, heat-treatable high-strength grades) and specialized steels for extreme environments (e.g., hydrogen service).

* Process Refinement: Wider adoption of advanced techniques like Vacuum-Assisted High-Pressure Die Casting (V-HPDC) for thicker, more structural EV parts, and improved Low-Pressure Die Casting (LPDC) for complex aerospace components.

* In-Process Monitoring: Real-time monitoring of metal quality (e.g., hydrogen content, inclusions) and mold/core integrity using sensors and AI becomes more common, enabling proactive correction.

Key Challenges for H2 2026:

* High Capital Costs: Significant investment required for automation, digitalization, and decarbonization, pressuring margins, especially for SMEs.

* Talent Acquisition & Retention: Intense competition for skilled workers and engineers.

* Margin Pressure: Balancing rising energy, material, and technology investment costs with customer price expectations.

* Regulatory Compliance: Navigating increasingly stringent environmental regulations (emissions, waste, carbon reporting).

Strategic Imperatives for Metal Molders (H2 2026 Outlook):

* Embrace Digitalization: Invest in IIoT, AI, and data analytics to optimize operations and quality.

* Prioritize Sustainability: Develop and communicate a clear decarbonization roadmap; leverage it as a competitive differentiator.

* Focus on High-Value Niche Markets: Target growth sectors (Energy Transition, Aerospace, MedTech) with specialized capabilities and quality.

* Strengthen Supply Chains: Build resilient, regionalized networks and foster long-term partnerships.

* Invest in People: Develop talent pipelines and create attractive work environments.

Conclusion:

H2 2026 presents a pivotal period for the metal molding industry. Foundries that successfully leverage technology to enhance efficiency and quality, proactively address sustainability demands, strategically target growth markets, and build resilient operations will not only survive but thrive. The gap between traditional players and technologically advanced, sustainable foundries is expected to widen significantly by year-end. Adaptability and strategic investment are paramount.

Common Pitfalls in Sourcing Metal Molders: Quality and Intellectual Property Risks

Sourcing metal molders, especially from international suppliers, presents significant challenges related to both product quality and intellectual property (IP) protection. Overlooking these areas can lead to defective parts, production delays, legal disputes, and lost competitive advantage.

Quality-Related Pitfalls

Inconsistent Material Specifications

Suppliers may use substandard or incorrect alloys to cut costs, resulting in parts that fail to meet mechanical, thermal, or corrosion resistance requirements. Without strict material certification and verification processes, inconsistencies can compromise final product performance.

Poor Process Control and Lack of Documentation

Many molders lack robust quality management systems (e.g., ISO 9001), leading to inconsistent casting parameters, inadequate traceability, and undocumented process changes. This increases the risk of dimensional inaccuracies, porosity, and surface defects.

Insufficient Testing and Inspection Capabilities

Some suppliers perform only basic visual inspections and lack access to non-destructive testing (NDT) methods like X-ray, ultrasonic, or magnetic particle inspection. This can allow internal defects—such as voids or inclusions—to go undetected until failure in the field.

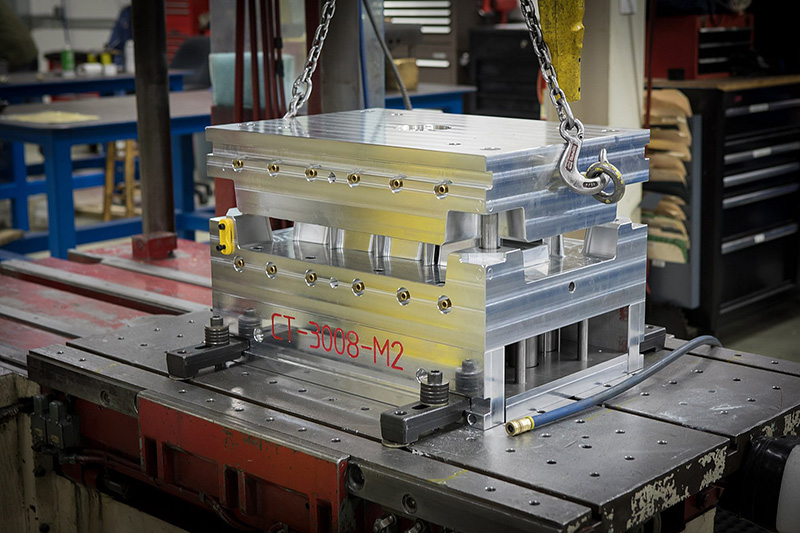

Tooling Wear and Maintenance Neglect

Mold tooling degrades over time, affecting part consistency. Suppliers may delay maintenance or reuse worn molds to save costs, leading to dimensional drift and increased scrap rates over production runs.

Intellectual Property-Related Pitfalls

Weak or Unenforceable IP Agreements

Contracts may lack clear clauses on IP ownership, confidentiality, and usage rights. In some jurisdictions, even signed NDAs offer limited legal recourse, leaving designs vulnerable to unauthorized use or replication.

Unauthorized Subcontracting

Suppliers may subcontract work to third-party foundries without approval, increasing the risk of IP exposure. These subcontractors often operate with minimal oversight and may have poor security practices.

Digital File Exposure During Design Transfer

Sharing CAD models, tooling designs, or process specifications exposes sensitive IP. Without secure data transfer protocols and access controls, digital blueprints can be copied or leaked.

Reverse Engineering and Market Competition

A molder with access to your product design could reverse engineer it to produce competing parts or sell them to your competitors, especially in regions with lax IP enforcement.

Mitigating these risks requires thorough supplier vetting, on-site audits, strong contractual protections, and ongoing quality monitoring. Engaging legal counsel familiar with international IP law and investing in secure collaboration platforms are essential steps in safeguarding both quality and proprietary information.

Logistics & Compliance Guide for Metal Molders

Overview of Metal Molding Industry Logistics

The metal molding industry involves complex logistical operations due to the nature of raw materials, finished products, and regulatory requirements. Efficient logistics and strict compliance are essential to ensure timely delivery, maintain product quality, and meet environmental, safety, and legal standards. This guide outlines key logistics considerations and compliance obligations specific to metal molders.

Raw Material Procurement and Handling

Metal molders rely heavily on raw materials such as ferrous and non-ferrous metals (e.g., iron, aluminum, copper), alloys, and refractory materials. Effective procurement strategies include establishing long-term contracts with reliable suppliers, managing inventory through just-in-time (JIT) systems to reduce holding costs, and ensuring quality control upon receipt. Materials must be stored properly to prevent contamination, moisture damage, and oxidation—especially critical for scrap metal and molten metal feedstocks.

In-Plant Material Flow and Production Logistics

Optimizing internal logistics enhances efficiency and reduces waste. Foundries must streamline the flow of materials from receiving to melting, molding, casting, finishing, and shipping. Automated handling systems (e.g., conveyors, robotic arms) can improve throughput and safety. Thermal management is critical; molten metal handling requires specialized equipment and strict protocols to avoid accidents. Work-in-process (WIP) tracking systems ensure traceability and support lean manufacturing principles.

Finished Product Packaging and Storage

Casted metal parts vary in size, weight, and fragility, necessitating customized packaging solutions. Common methods include wooden crates, steel racks, and protective coatings to prevent corrosion. Proper labeling with part numbers, batch codes, and handling instructions ensures accuracy and safety. Finished goods should be stored in dry, organized areas with weight-appropriate racking to prevent deformation or damage.

Transportation and Distribution

Metal molders must select transportation modes based on product specifications and customer requirements. Heavy or bulky castings often require flatbed trucks or rail freight, while smaller, high-value components may be shipped via LTL (Less Than Truckload) or express carriers. International shipments may involve containerized ocean freight or air freight for urgent orders. Key considerations include load securing, temperature exposure, transit time, and carrier reliability. Partnering with specialized industrial freight providers familiar with metal shipments is recommended.

Regulatory Compliance: Environmental Standards

Metal molding operations are subject to stringent environmental regulations due to emissions, waste generation, and energy use. Key compliance areas include:

- Air Quality: Foundries must control particulate matter, volatile organic compounds (VOCs), and hazardous air pollutants (HAPs) from melting and molding processes. Compliance with EPA standards (e.g., NESHAP for Iron and Steel Foundries) often requires air filtration systems and regular emissions monitoring.

- Wastewater Management: Effluent from cooling systems and cleaning operations must be treated to meet local and federal discharge limits.

- Hazardous Waste Handling: Spent sand, sludge, and used refractories may be classified as hazardous waste. Proper storage, labeling, and disposal via licensed facilities are mandatory under RCRA (Resource Conservation and Recovery Act).

Regulatory Compliance: Occupational Health and Safety

Worker safety is paramount in high-temperature, high-noise environments. Compliance with OSHA regulations includes:

- Personal Protective Equipment (PPE): Heat-resistant clothing, face shields, gloves, and hearing protection.

- Hazard Communication (HazCom): Clear labeling and Safety Data Sheets (SDS) for all chemicals and molten materials.

- Machine Safeguarding: Guards on moving parts and emergency stop systems.

- Confined Space and Hot Work Permits: Required for maintenance in furnaces or other hazardous areas.

- Training Programs: Regular safety training on fire response, lockout/tagout (LOTO), and emergency procedures.

Regulatory Compliance: Transportation and Shipping Regulations

Shipping metal castings involves adherence to transportation safety standards:

- DOT Regulations: Proper classification, packaging, and labeling of materials, especially if transporting hazardous substances (e.g., molten metal, certain coatings).

- International Compliance: For exports, adherence to IMDG (maritime), IATA (air), or ADR (road) regulations may apply. Customs documentation, including HS codes and certificates of origin, must be accurate.

- Weight and Dimension Compliance: Over-dimensional loads require special permits and routing.

Quality Standards and Industry Certifications

Meeting quality standards enhances customer trust and market access. Relevant certifications include:

- ISO 9001: Quality management systems.

- IATF 16949: For automotive suppliers, ensuring consistent quality in cast components.

- AS9100: For aerospace casting applications.

- NADCAP: Special processes such as heat treatment and non-destructive testing.

Regular internal audits, supplier qualification, and traceability systems (e.g., lot tracking) support compliance with these standards.

Recordkeeping and Documentation

Accurate recordkeeping is essential for regulatory audits and process improvement. Required documentation includes:

- Material test reports (MTRs)

- Production batch logs

- Inspection and quality test results

- Environmental monitoring data

- Safety training records

- Shipping and customs documents

Digital systems (e.g., ERP, MES) improve data accuracy and accessibility.

Continuous Improvement and Risk Management

Metal molders should conduct regular logistics and compliance audits to identify inefficiencies and risks. Implementing corrective actions and staying updated on regulatory changes ensures long-term sustainability. Utilizing key performance indicators (KPIs) such as on-time delivery rate, defect rate, and emissions levels helps measure progress.

Conclusion

Effective logistics and rigorous compliance are critical for the success and sustainability of metal molding operations. By integrating best practices in material handling, transportation, environmental stewardship, and worker safety, metal molders can enhance operational efficiency, reduce legal risks, and maintain a strong reputation in competitive markets.

Conclusion for Sourcing a Metal Molder

In conclusion, sourcing a reliable metal molder is a critical step in ensuring the quality, consistency, and cost-effectiveness of metal components for your manufacturing needs. A thorough evaluation of potential suppliers—considering factors such as technical capabilities, material expertise, production capacity, quality certifications, lead times, and cost—will help identify a partner aligned with your operational and strategic goals. Emphasizing strong communication, clear specifications, and ongoing performance monitoring further enhances the success of the partnership. By selecting a competent and dependable metal molder, businesses can improve product integrity, reduce production risks, and maintain a competitive edge in the market.