The global jigsaw blade market is experiencing steady growth, driven by rising demand across construction, metalworking, and DIY sectors. According to Grand View Research, the global saw blades market was valued at USD 4.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030, fueled by advancements in blade materials and increased industrial automation. Metal-cutting jigsaw blades, in particular, are witnessing heightened adoption due to their precision and efficiency in cutting ferrous and non-ferrous metals. As demand grows, manufacturers are investing in carbide-tipped technologies, hardened steel alloys, and innovative tooth geometries to enhance durability and cutting performance. In this competitive landscape, a select group of manufacturers have emerged as leaders, setting industry benchmarks in quality, innovation, and global reach. Here, we spotlight the top 7 metal jigsaw blade manufacturers shaping the future of cutting tools.

Top 7 Metal Jigsaw Blade Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 3″ & 4″ Jig Saw Blades

Domain Est. 1998

Website: bodico.com

Key Highlights: Durable, high performance bi-metal jig saw blades outlast all other types of carbon and high speed steel blades. These shatterproof blades can be used in wood, ……

#2 Jigsaw Blades

Domain Est. 2017

Website: cutwithlenox.com

Key Highlights: LENOX® has continued to lead the way, redefining performance in the jigsaw blade category with Power Arc® and Power Blast® technology….

#3

Domain Est. 1997

Website: mkmorse.com

Key Highlights: Morse provides cutting solutions that transform ideas into reality by providing blades that last longer, cut smoother, and do every conceivable cutting job….

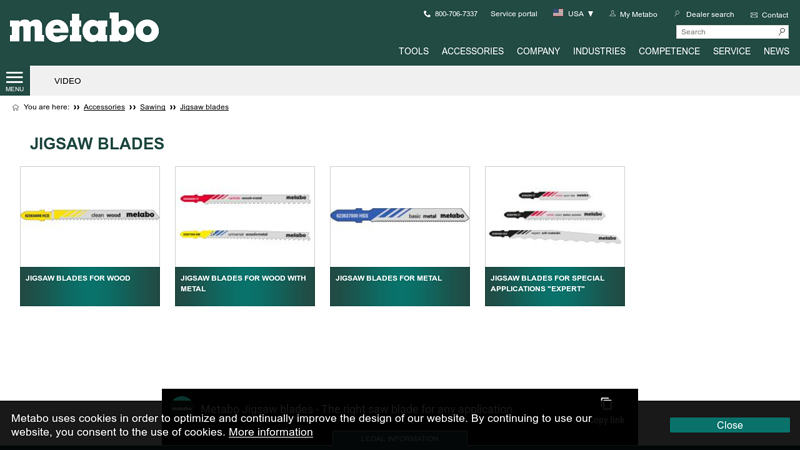

#4 Jigsaw blades

Domain Est. 1997

Website: metabo.com

Key Highlights: Jigsaw blades from Metabo – High-quality, reliable and long-lasting. Learn about professional power tools from Metabo now….

#5 Jigsaw blades for professionals by WILPU

Domain Est. 1998

Website: wilpu.com

Key Highlights: WILPU is offering a wide range of jigsaw blades for metals, woods, plastics and special materials of all types and dimensions….

#6 Jigsaw Blades

Domain Est. 2002

Website: irwintools.com

Key Highlights: IRWIN Linear Edge jigsaw blades feature precision ground teeth for fast smooth cutting hard and soft wood, plastics, laminate particle board, plywood….

#7 Jigsaw Blades

Domain Est. 2004

Website: diablotools.com

Key Highlights: Made from the highest quality carbide, bi-metal, high speed steel, high carbon steel, and diamond grit, Diablo’s jig saw blades are simply the best blades in ……

Expert Sourcing Insights for Metal Jigsaw Blade

H2: 2026 Market Trends for Metal Jigsaw Blades

The global market for metal jigsaw blades is poised for steady growth and transformation by 2026, driven by advancements in material science, rising industrial automation, and increased demand in metalworking sectors. This analysis explores key trends shaping the metal jigsaw blade market over the coming years.

-

Rising Demand in Industrial and DIY Sectors

By 2026, both industrial manufacturing and the do-it-yourself (DIY) segment are expected to fuel demand for high-performance metal jigsaw blades. Growth in infrastructure development, automotive production, and HVAC installations will drive professional use, while home renovation trends and accessible power tools will boost consumer adoption. Dual-purpose blades capable of cutting various metals—such as steel, aluminum, and copper—will gain popularity for their versatility. -

Technological Advancements in Blade Materials

Innovation in blade materials, including bi-metal (high-speed steel and carbon steel composites) and carbide-tipped variants, will enhance durability, heat resistance, and cutting precision. By 2026, manufacturers are expected to introduce nano-coated and laser-hardened blades that reduce friction and extend service life. These advancements will cater to high-intensity industrial applications, particularly in aerospace and precision engineering. -

Expansion of E-Commerce and Direct-to-Consumer Sales

The distribution landscape for metal jigsaw blades is shifting toward online channels. E-commerce platforms, including Amazon, Alibaba, and specialized tool retailers, will dominate sales by offering competitive pricing, detailed product specifications, and customer reviews. Brands investing in digital marketing and subscription-based blade replacement services are likely to capture greater market share. -

Sustainability and Circular Economy Initiatives

Environmental considerations will influence product development and packaging. By 2026, leading manufacturers may adopt recyclable packaging and promote blade recycling programs. Additionally, longer-lasting blades that reduce waste and energy consumption during production and use will align with corporate sustainability goals and regulatory pressures in Europe and North America. -

Regional Market Dynamics

Asia-Pacific, particularly China and India, will emerge as high-growth regions due to rapid industrialization and urbanization. North America and Europe will maintain strong demand, supported by advanced manufacturing and renovation activities. Localized production hubs and partnerships with tool OEMs will help global players adapt to regional standards and preferences. -

Integration with Smart Tools and IoT

As smart power tools gain traction, metal jigsaw blades may be designed to work optimally with connected devices that monitor blade wear, temperature, and cutting speed. While the blades themselves may not be “smart,” compatibility with intelligent tool systems will become a differentiating factor by 2026, especially in professional and automated fabrication environments.

Conclusion

The metal jigsaw blade market in 2026 will be characterized by innovation, digitalization, and sustainability. Manufacturers that invest in advanced materials, expand online presence, and respond to regional and environmental demands will be best positioned to capitalize on evolving industry needs. As metal fabrication becomes more precise and efficient, the role of high-quality jigsaw blades will remain critical across multiple sectors.

Common Pitfalls When Sourcing Metal Jigsaw Blades (Quality and Intellectual Property)

Sourcing metal jigsaw blades can present several challenges, particularly concerning quality consistency and intellectual property (IP) risks. Being aware of these pitfalls helps ensure reliable performance and legal compliance.

Inconsistent Material Quality and Hardness

One of the most frequent issues is variability in the base material and heat treatment of the blades. Low-cost suppliers may use substandard steel alloys or inconsistent tempering processes, resulting in blades that dull quickly, break under stress, or fail to cut cleanly. This inconsistency can lead to increased downtime and higher long-term costs due to frequent replacements.

Poor Tooth Design and Manufacturing Tolerances

The effectiveness of a jigsaw blade heavily depends on precise tooth geometry and alignment. Poorly manufactured blades often suffer from irregular tooth pitch, incorrect rake angles, or uneven set (tooth offset). These flaws reduce cutting efficiency, cause excessive vibration, and can damage the workpiece or the tool itself.

Inadequate Coating or Surface Treatments

Many high-performance jigsaw blades feature coatings such as titanium nitride (TiN) or other proprietary treatments to enhance durability and reduce friction. Sourcing from unreliable suppliers may result in blades with ineffective or improperly applied coatings that wear off prematurely, negating any performance benefits.

Misrepresentation of Blade Specifications

Some suppliers may exaggerate or mislabel blade specifications, such as cutting capacity, compatible materials (e.g., claiming suitability for stainless steel when not tested), or longevity. This misrepresentation can lead to tool failure, safety hazards, and project delays.

Intellectual Property Infringement Risks

Copying patented blade designs, tooth patterns, or branding from established manufacturers is a common but serious IP pitfall. Sourcing generic or counterfeit blades that mimic protected innovations—such as specific tooth geometries or laser-cut patterns—can expose your business to legal action, product seizures, or reputational damage.

Lack of Traceability and Certifications

Reputable applications, especially in industrial or professional settings, require blades with documented quality control and material traceability. Many low-cost suppliers lack proper certifications (e.g., ISO standards) or batch tracking, making it difficult to ensure compliance or investigate failures.

Supply Chain Reliability and Scalability Issues

Choosing suppliers based solely on price often leads to unreliable lead times and limited scalability. Inconsistent production capacity or poor logistics can disrupt operations, especially when demand fluctuates or urgent reorders are needed.

By addressing these pitfalls through thorough supplier vetting, quality audits, and IP due diligence, businesses can secure reliable, high-performing metal jigsaw blades while minimizing legal and operational risks.

Logistics & Compliance Guide for Metal Jigsaw Blades

Product Classification & HS Code

Metal jigsaw blades are typically classified under the Harmonized System (HS) code 8208.10, which covers interchangeable tools for hand tools, whether or not power-operated, of base metal, not elsewhere specified or included, for working in the hand, with cutting edges. However, verify the exact code with your local customs authority, as classifications can vary by country and blade composition (e.g., high-speed steel, carbide-tipped).

Packaging & Labeling Requirements

Ensure blades are securely packaged to prevent damage and injury during transit. Individual blades should be enclosed in protective sleeves or blister packs. Outer packaging must include:

– Product name and description

– Material composition (e.g., bi-metal, high-carbon steel)

– Country of origin

– Manufacturer or importer information

– Safety warnings (e.g., “Sharp Edges – Handle with Care”)

– Applicable barcode or SKU

Use tamper-evident packaging where required, especially for retail distribution.

International Shipping Regulations

Metal jigsaw blades are generally non-restricted items for international shipping. However, consider the following:

– Air Freight: Not classified as dangerous goods under IATA regulations, but sharp objects must be properly packaged to prevent injury to handlers.

– Sea Freight: Declare accurately on the bill of lading; no special handling typically required.

– Documentation: Include commercial invoice, packing list, and bill of lading/air waybill. Ensure declared value reflects actual transaction value.

Import & Export Compliance

- Export Controls: Most metal jigsaw blades are not subject to export restrictions (e.g., EAR99 under U.S. Export Administration Regulations). However, confirm if blades contain controlled materials or are intended for military applications.

- Import Duties & Taxes: Research tariff rates and VAT/GST requirements in the destination country. Duty rates vary (e.g., 2–6% in the EU, 0–4% in the U.S., depending on trade agreements).

- Certificates of Origin: May be required to claim preferential tariff treatment under trade agreements (e.g., USMCA, EU trade pacts).

Safety & Regulatory Standards

Compliance with regional safety standards is essential:

– CE Marking (EU): Required under the Machinery Directive or General Product Safety Directive. Blades themselves may not require CE, but ensure they meet EN standards for performance and safety (e.g., EN 300 for hand tools).

– REACH & RoHS (EU): Confirm that blade materials do not contain restricted substances above threshold levels (e.g., lead, cadmium, certain phthalates).

– OSHA & ANSI (USA): While no specific standard governs blades, ensure packaging includes appropriate safety warnings aligned with ANSI Z535 for hazard communication.

Environmental & Disposal Compliance

- Waste Disposal: Metal blades are recyclable. Provide end-user guidance on proper disposal through metal recycling channels.

- WEEE (EU): Not typically applicable to consumable tools like blades, but verify based on product integration with power tools.

- Eco-design: Consider recyclability and material efficiency in product design to meet sustainability goals.

Carrier & Handling Guidelines

- Use rigid outer containers to avoid crushing.

- Label packages as “Fragile” and “Sharp Objects Inside.”

- Avoid overpacking to prevent shifting during transit.

- For bulk shipments, use pallets secured with stretch wrap and corner boards.

Country-Specific Considerations

- United States: FDA does not regulate blades, but ensure compliance with CPSIA if marketed as consumer products.

- European Union: Full traceability and compliance with GPSD (General Product Safety Directive) required.

- Australia/NZ: Comply with AS/NZS standards for tool safety and labeling.

- Canada: Adhere to Canadian Consumer Product Safety Act (CCPSA) and proper French/English bilingual labeling.

Recordkeeping & Documentation

Maintain records for at least 5 years, including:

– Product specifications

– Safety data sheets (if applicable)

– Test reports for compliance

– Import/export declarations

– Certificates of conformity or origin

Ensure all documentation is accessible for audits by customs or regulatory bodies.

Summary

Proper logistics and compliance for metal jigsaw blades involve accurate classification, safe packaging, adherence to international shipping rules, and conformity with regional safety and environmental regulations. Proactive verification of local requirements in target markets minimizes delays and ensures smooth distribution.

In conclusion, sourcing metal jigsaw blades requires careful consideration of material quality, compatibility with tools and applications, supplier reliability, and cost-effectiveness. Selecting blades made from durable materials such as high-speed steel (HSS) or bi-metal ensures longevity and efficient performance when cutting various metals. It is essential to verify blade specifications—such as tooth count, shank type, and intended use—to match project requirements and equipment. Partnering with reputable suppliers who provide consistent quality, timely delivery, and technical support contributes to operational efficiency and reduced downtime. By balancing performance needs with budget constraints and prioritizing safety and durability, organizations can make informed sourcing decisions that enhance productivity and maintain high standards in metalworking applications.