The global metal flooring market is experiencing strong momentum, driven by rising demand for durable, fire-resistant, and low-maintenance flooring solutions across commercial, industrial, and institutional sectors. According to Grand View Research, the global metal flooring market was valued at USD 3.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing infrastructure investments, stringent building safety regulations, and the expanding use of raised access flooring systems in data centers and smart buildings. Mordor Intelligence also highlights accelerated demand in North America and Asia-Pacific, citing digitalization and industrial modernization as key contributors. As the market expands, innovation in materials and sustainability practices is reshaping competitive dynamics. In this evolving landscape, the following nine manufacturers have emerged as leaders, combining technological expertise, global reach, and a strong track record of performance in metal flooring solutions.

Top 9 Metal Floors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 O’Neal Steel: Metal Service Center

Domain Est. 1996

Website: onealsteel.com

Key Highlights: O’Neal Steel supplies aluminum, carbon & alloy steel, stainless, hot rolled, and cold-finished products nationwide. Get a quote now!…

#2 High Performance Flooring

Domain Est. 1998

Website: industrial.sherwin-williams.com

Key Highlights: Sherwin-Williams High Performance Flooring offers durable, seamless resinous systems for commercial and industrial applications. Get in touch with us today!…

#3 Armstrong World Industries

Domain Est. 1995

Website: armstrong.com

Key Highlights: Armstrong World Industries is a leader in the design, innovation and manufacture of ceiling and wall system solutions, transforming how people design, ……

#4 Steel Deck Institute

Domain Est. 1995 | Founded: 1939

Website: sdi.org

Key Highlights: Since 1939, the Steel Deck Institute has provided uniform industry standards for the design, manufacture, and field usage of steel deck products….

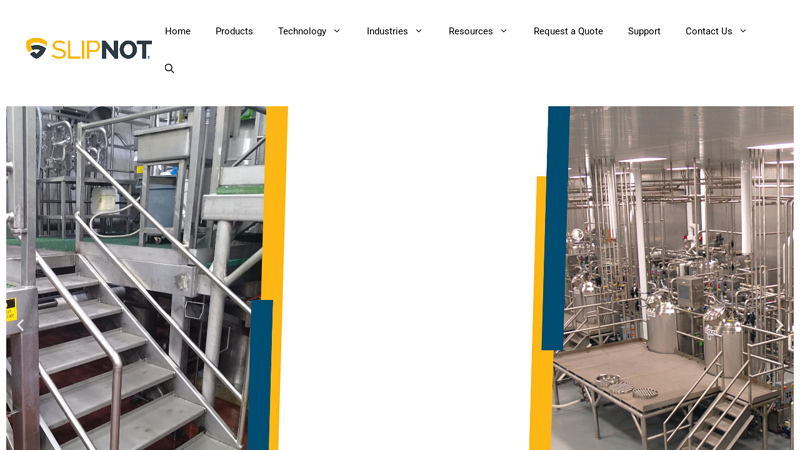

#5 SLIPNOT Metal Safety Flooring

Domain Est. 1996

Website: slipnot.com

Key Highlights: SLIPNOT provides specialized metal safety flooring products and surface technologies for walkways, stairs, ladders and more where you live, work, and play….

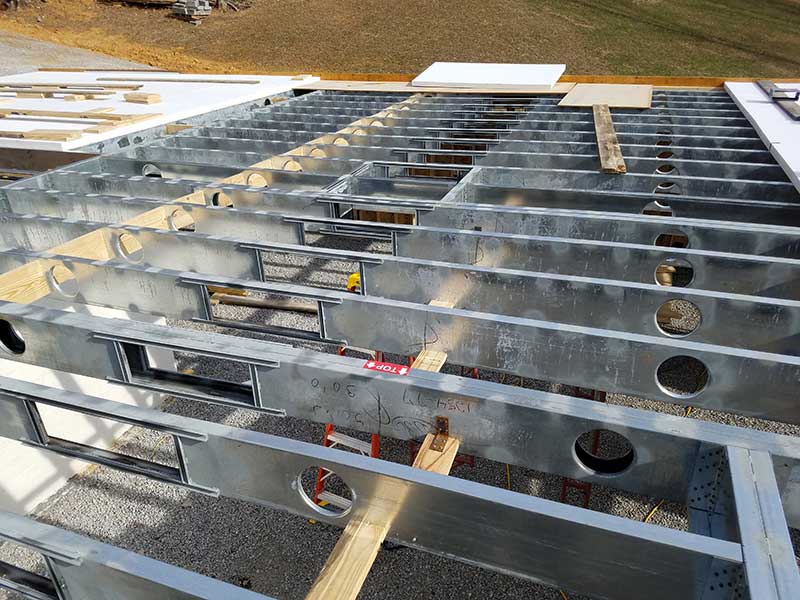

#6 Metwood

Domain Est. 1998

Website: metwood.com

Key Highlights: 6-day delivery 30-day returnsMetwood: Innovative cold-formed steel solutions for construction. Explore joist reinforcers, Ledger Brackets, ICF hangers, and more….

#7 Ryerson: Online Metals Supplier

Domain Est. 1998

Website: ryerson.com

Key Highlights: Ryerson is an online metal supplier, metal processor and distributor, offering more than 65000 varieties of stainless, aluminum, carbon and alloys in all ……

#8 Metal trims and transitions

Domain Est. 2003

Website: powerhold.com

Key Highlights: Metal trims and transitions · Bevel Caps (6) · Blank Clampdown for Tack Strip (1) · Carpet Tile To LVT (5) · Clampdown with Pins (18) · Coving Caps (4) · Flat Bar (8) ……

#9 ClarkDietrich Building Systems

Domain Est. 2011

Website: clarkdietrich.com

Key Highlights: From framing to finishing, from interior to exterior, from digital tools to engineering expertise, our leading products and services work as a system. A system ……

Expert Sourcing Insights for Metal Floors

H2 2026 Market Trends for Metal Floors

As we look toward the second half of 2026, the global metal flooring market is poised for continued evolution, driven by technological innovation, sustainability imperatives, and shifting demands across key end-use sectors. Here are the dominant trends shaping the H2 2026 landscape:

1. Accelerated Adoption of Sustainable and Recycled Materials:

Environmental regulations and corporate ESG (Environmental, Social, Governance) goals are pushing demand for eco-friendly flooring solutions. In H2 2026, expect a significant rise in metal floors made from high-recycled content steel and aluminum, particularly in commercial, industrial, and public infrastructure projects. Manufacturers are investing in closed-loop recycling systems and low-carbon production processes to meet green building certifications like LEED v5 and BREEAM, making sustainability a key differentiator.

2. Growth in Modular and Prefabricated Metal Flooring Systems:

Driven by the need for faster construction timelines and reduced on-site labor costs, modular metal flooring—especially steel grating and composite floor decks—is gaining traction. H2 2026 will see increased deployment in data centers, modular healthcare facilities, and industrial warehouses. These systems offer precision engineering, easy installation, and scalability, aligning with trends in off-site construction and industrial automation.

3. Smart Integration and IoT-Enabled Floors:

Metal floors are increasingly serving as platforms for smart building technologies. In H2 2026, we anticipate growth in metal flooring integrated with sensors for structural health monitoring, load distribution tracking, and environmental sensing (e.g., temperature, vibration). This trend is particularly strong in high-value industrial settings, logistics hubs, and smart factories where predictive maintenance and operational efficiency are critical.

4. Rising Demand in Data Centers and High-Tech Facilities:

The exponential growth of AI, cloud computing, and edge data centers is fueling demand for robust, conductive, and easily serviceable flooring. Raised access metal floors with anti-static properties and high load capacity are in high demand. H2 2026 will likely see innovations in thermal management integration (e.g., embedded cooling channels) and EMI shielding within metal floor panels to support next-gen server infrastructure.

5. Regional Infrastructure Investment Driving Growth:

Government-led infrastructure initiatives in North America (e.g., U.S. IIJA), Europe (Green Deal), and parts of Asia-Pacific (especially India and Southeast Asia) are boosting public and private construction. Metal flooring—valued for durability, fire resistance, and long lifecycle—is being specified more frequently in transportation hubs, government buildings, and industrial parks. This trend will gain momentum in H2 2026 as major projects move into the construction phase.

6. Technological Advancements in Coatings and Finishes:

To enhance corrosion resistance, slip resistance, and aesthetics, advanced coatings such as nano-ceramic, powder-coated polymers, and zinc-aluminum alloys are becoming standard. In H2 2026, expect wider adoption of antimicrobial and self-cleaning metal floor finishes, particularly in healthcare, food processing, and cleanroom environments.

7. Supply Chain Resilience and Localization:

Ongoing geopolitical tensions and logistics volatility are prompting manufacturers to regionalize supply chains. In H2 2026, we’ll see more nearshoring of metal floor production, especially in North America and Europe, to reduce lead times and mitigate risks. This shift supports faster project delivery and reduces carbon footprint from transportation.

Conclusion:

H2 2026 marks a pivotal phase for the metal flooring industry, where sustainability, digital integration, and infrastructure modernization converge. Companies that innovate in eco-design, modular systems, and smart functionality will lead the market. With strong tailwinds from construction, technology, and policy, metal floors are transitioning from mere structural components to intelligent, sustainable building assets.

Common Pitfalls Sourcing Metal Floors (Quality, IP)

Sourcing metal flooring systems—such as raised access floors, grating, or structural metal decking—can present significant challenges, particularly concerning quality assurance and intellectual property (IP) protection. Falling into common traps can result in substandard installations, safety risks, legal disputes, and project delays. Below are key pitfalls to avoid:

Poor Quality Control and Material Verification

One of the most frequent issues in sourcing metal floors is inadequate quality control. Suppliers, especially those from low-cost regions, may use inferior materials or fail to adhere to technical specifications. This includes using substandard steel grades, incorrect coating thicknesses (e.g., insufficient galvanization), or inconsistent welding practices. Without third-party inspections or material test reports (MTRs), buyers risk receiving products that compromise structural integrity, fire resistance, or load-bearing capacity.

Lack of Compliance with International Standards

Metal flooring systems must meet specific standards such as ISO, EN, ASTM, or local building codes. A common pitfall is assuming compliance based on supplier claims without verified certification. For example, raised access floors should comply with standards like EN 12825 for load classification, while fire ratings must be validated through accredited testing. Failure to verify compliance can lead to rejected shipments, rework, or liability in case of failure.

Inadequate Due Diligence on Suppliers

Sourcing from unknown or unverified manufacturers increases the risk of receiving counterfeit or reverse-engineered products. Some suppliers may falsely claim partnerships with reputable brands or present forged certifications. Conducting thorough due diligence—including site audits, reference checks, and validation of business licenses—is essential to ensure authenticity and reliability.

Intellectual Property Infringement

Metal floor designs, especially innovative panel configurations, locking mechanisms, or integrated cable management systems, are often protected by patents, design rights, or trade secrets. Sourcing from suppliers who replicate proprietary designs without authorization exposes the buyer to IP infringement claims. This is particularly risky when working with generic manufacturers who copy patented systems. Always verify that the product does not violate existing IP rights, and request IP indemnity clauses in contracts.

Insufficient Documentation and Traceability

High-quality metal flooring requires complete documentation, including CAD drawings, installation manuals, test reports, and traceable material certifications. A common oversight is accepting products without full documentation, which complicates quality validation, installation, and compliance audits. Lack of traceability also hampers accountability in case of defects or recalls.

Overlooking Long-Term Support and Warranty

Some suppliers offer attractive initial pricing but lack the infrastructure for after-sales support, spare parts, or warranty fulfillment. This becomes critical when replacements or maintenance are needed years after installation. Ensure warranty terms are clear, enforceable, and backed by a reliable supplier with a proven service history.

Currency, Logistics, and Lead Time Risks

Metal floors are heavy and bulky, leading to high shipping costs and logistical complexity. Delays due to port congestion, customs issues, or inaccurate lead time estimates can disrupt project schedules. Additionally, fluctuating raw material prices and currency exchange rates can impact final costs if not locked in early via firm contracts.

Avoiding these pitfalls requires a structured sourcing strategy that emphasizes supplier vetting, independent quality verification, legal compliance, and robust contractual terms—especially around IP rights and performance warranties.

Logistics & Compliance Guide for Metal Floors

Introduction

This guide outlines the essential logistics and compliance considerations for the transportation, handling, storage, and regulatory adherence related to metal floor products. Adhering to these standards ensures product integrity, worker safety, and legal compliance across the supply chain.

Product Specifications

Metal floors typically include structural steel flooring, grating, checker plates, or insulated metal floor panels used in construction, industrial platforms, and modular buildings. Key characteristics include weight, dimensions, load capacity, corrosion resistance, and fire ratings. Accurate documentation of material composition (e.g., galvanized steel, aluminum, stainless steel) is essential for compliance.

Packaging & Handling Requirements

Metal floors must be packaged to prevent deformation, corrosion, and surface damage during transit. Use edge protectors, wooden skids, and moisture-resistant wrapping. Label each unit with handling instructions (e.g., “Do Not Stack,” “Fragile Surface,” “This Side Up”). Use forklifts or cranes with appropriate lifting fixtures; never drag or drop materials.

Storage Guidelines

Store metal floors indoors or under cover in a dry, flat area to prevent moisture exposure and warping. Stack units evenly on level ground using spacers to allow airflow. Limit stack height to prevent bottom units from buckling. Implement a first-in, first-out (FIFO) system to manage inventory and reduce long-term exposure risks.

Transportation Standards

Use enclosed trucks or flatbeds with secure load restraints (e.g., ratchet straps, load locks) to prevent shifting. Comply with regional weight and dimension regulations (e.g., ADR in Europe, FMCSA in the U.S.). For international shipments, ensure cargo is secured per ISO container standards and IMDG Code if applicable. Maintain transport records including delivery notes and condition reports.

Regulatory Compliance

Metal floors must meet industry and regional standards, such as:

– Structural Safety: EN 10025 (EU), ASTM A36 (U.S.)

– Fire Resistance: ASTM E84, EN 13501-1

– Slip Resistance: ANSI A1264.2, BS 7976

– Environmental: REACH, RoHS (EU), TSCA (U.S.)

Provide Material Safety Data Sheets (MSDS/SDS) and product certifications upon request.

Import & Export Documentation

For cross-border shipments, prepare:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Origin

– Conformity assessment (e.g., CE, UKCA, or NRTL marks)

Ensure Harmonized System (HS) codes are accurate (e.g., 7308.90 for steel flooring structures) to avoid customs delays.

Environmental & Sustainability Practices

Recycle packaging materials and promote returnable skids where possible. Source materials from suppliers with environmental management systems (ISO 14001). Comply with waste disposal regulations (e.g., EPA in the U.S., WEEE Directive in the EU) for scrap metal and damaged units.

Incident Reporting & Corrective Actions

Establish procedures for reporting damaged goods, transportation incidents, or compliance breaches. Conduct root cause analysis and implement corrective actions promptly. Maintain logs for audits and continuous improvement.

Training & Accountability

Provide logistics and warehouse staff with training on safe handling, compliance standards, and emergency procedures. Assign compliance officers to monitor regulatory updates and ensure alignment across all operations.

Conclusion

Proper logistics and compliance management for metal floors minimizes risks, ensures product quality, and supports legal and environmental responsibilities. Regular audits and supplier collaboration are key to maintaining high standards across the supply chain.

In conclusion, sourcing metal floors requires a comprehensive evaluation of material quality, supplier reliability, cost-efficiency, and compliance with industry standards. Considerations such as durability, load capacity, fire resistance, and environmental conditions play a critical role in selecting the right metal flooring solution for industrial, commercial, or specialized applications. Building strong relationships with reputable suppliers, conducting thorough due diligence, and balancing upfront costs with long-term performance can ensure a successful procurement process. Ultimately, well-sourced metal floors contribute to structural integrity, safety, and operational efficiency, making them a valuable investment in any construction or renovation project.