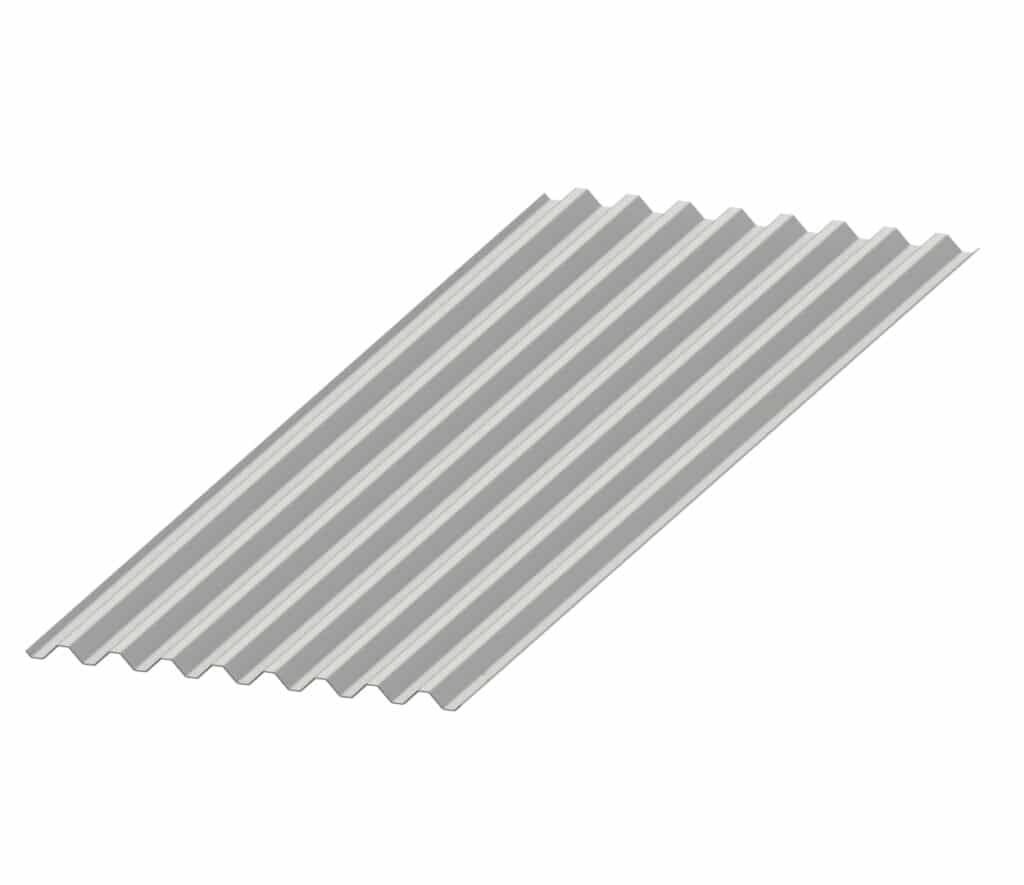

The global metal floor decking market is experiencing robust growth, driven by increasing demand for durable, cost-effective, and fire-resistant flooring solutions in commercial, industrial, and residential construction. According to Grand View Research, the global structural steel market size—which includes metal floor decking—was valued at USD 125.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by rapid urbanization, infrastructure development, and the rising adoption of prefabricated building systems. Mordor Intelligence further projects that the metal floor decking segment will benefit from the construction industry’s shift toward sustainable and lightweight materials, particularly in North America and the Asia Pacific. As demand intensifies, a select group of manufacturers are leading innovation, scalability, and product performance. Below are the top 10 metal floor decking manufacturers shaping the future of modern construction.

Top 10 Metal Floor Decking Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Metal Deck Supplier & Manufacturer CSM Products & Solutions

Domain Est. 2002

Website: metaldecking.com

Key Highlights: We use structural grade steel coil, and our deck is manufactured per ANSI Standards. Our products include metal roof deck, composite floor deck, and form deck….

#2 Structural Steel Roof and Floor Deck by ASC Steel Deck

Domain Est. 2002

Website: ascsd.com

Key Highlights: ASC Steel Deck is a leading steel deck manufacturer offering a full line of light gage structural roof deck and floor deck products….

#3 Steel Deck Institute

Domain Est. 1995 | Founded: 1939

Website: sdi.org

Key Highlights: Since 1939, the Steel Deck Institute has provided uniform industry standards for the design, manufacture, and field usage of steel deck products….

#4 Verco Decking

Domain Est. 1997

Website: vercodeck.com

Key Highlights: Explore Verco Decking’s steel roof and floor deck solutions engineered for strength, adaptability, and top-tier performance in construction projects….

#5 Vulcraft Deck

Domain Est. 1997

Website: vulcraft.com

Key Highlights: Explore Vulcraft’s steel roof deck, composite floor deck, & non-composite floor deck solutions. Strong, sustainable, & available in a variety of depths ……

#6 Nucor Steel Decking

Domain Est. 1997

Website: nucor.com

Key Highlights: Nucor’s Vulcraft/Verco Group offers a complete range of steel roof and floor deck through 10 strategically located manufacturing facilities….

#7 Metal Decking For Concrete

Domain Est. 1998

Website: metaldeck.com

Key Highlights: Large inventory of metal decking for concrete. Same day pick up or delivery in Arizona, California, and Texas. Delivery throughout the USA at MetalDeck.com….

#8 A.C.T. Metal Deck Supply

Domain Est. 1999

Website: metaldecksupply.com

Key Highlights: We stock all the metal deck and metal deck accessories you need in all types, gauges and finishes, as well as project management for any job size….

#9 Cordeck Metal Decking

Domain Est. 1999

Website: cordeck.com

Key Highlights: Cordeck’s lines include Roof Deck, Floor Deck, and Form Deck. Our products are corrosion resistant, featuring galvanized, galvanized pre-painted, cold-rolled, ……

#10 O’Donnell Metal Deck

Domain Est. 2016 | Founded: 1996

Website: odonnellmetaldeck.com

Key Highlights: Since 1996, O’Donnell Metal Deck has become one of the nation’s leading metal floor and roof deck suppliers. Metal roof deck, composite and form decking….

Expert Sourcing Insights for Metal Floor Decking

2026 Market Trends for Metal Floor Decking

The metal floor decking market is poised for continued evolution in 2026, driven by shifting construction dynamics, sustainability imperatives, and technological advancements. Here are the key trends expected to shape the industry:

Accelerated Adoption of Sustainable and Low-Carbon Solutions

Environmental regulations and green building standards (like LEED, BREEAM, and evolving ESG mandates) will intensify demand for low-carbon construction materials. In 2026, metal floor decking manufacturers will increasingly focus on using recycled steel content, optimizing production energy use, and offering Environmental Product Declarations (EPDs). Specifiers will favor decking systems that contribute to whole-life carbon reduction, including design for disassembly and recyclability at end-of-life.

Integration with Offsite and Modular Construction

The global push for faster, more efficient building methods will boost the use of metal floor decking within prefabricated and modular construction. By 2026, decking will be engineered for seamless integration into preassembled floor cassettes or wall panels, enabling rapid on-site installation. This trend will drive demand for standardized profiles and connection details compatible with offsite production workflows.

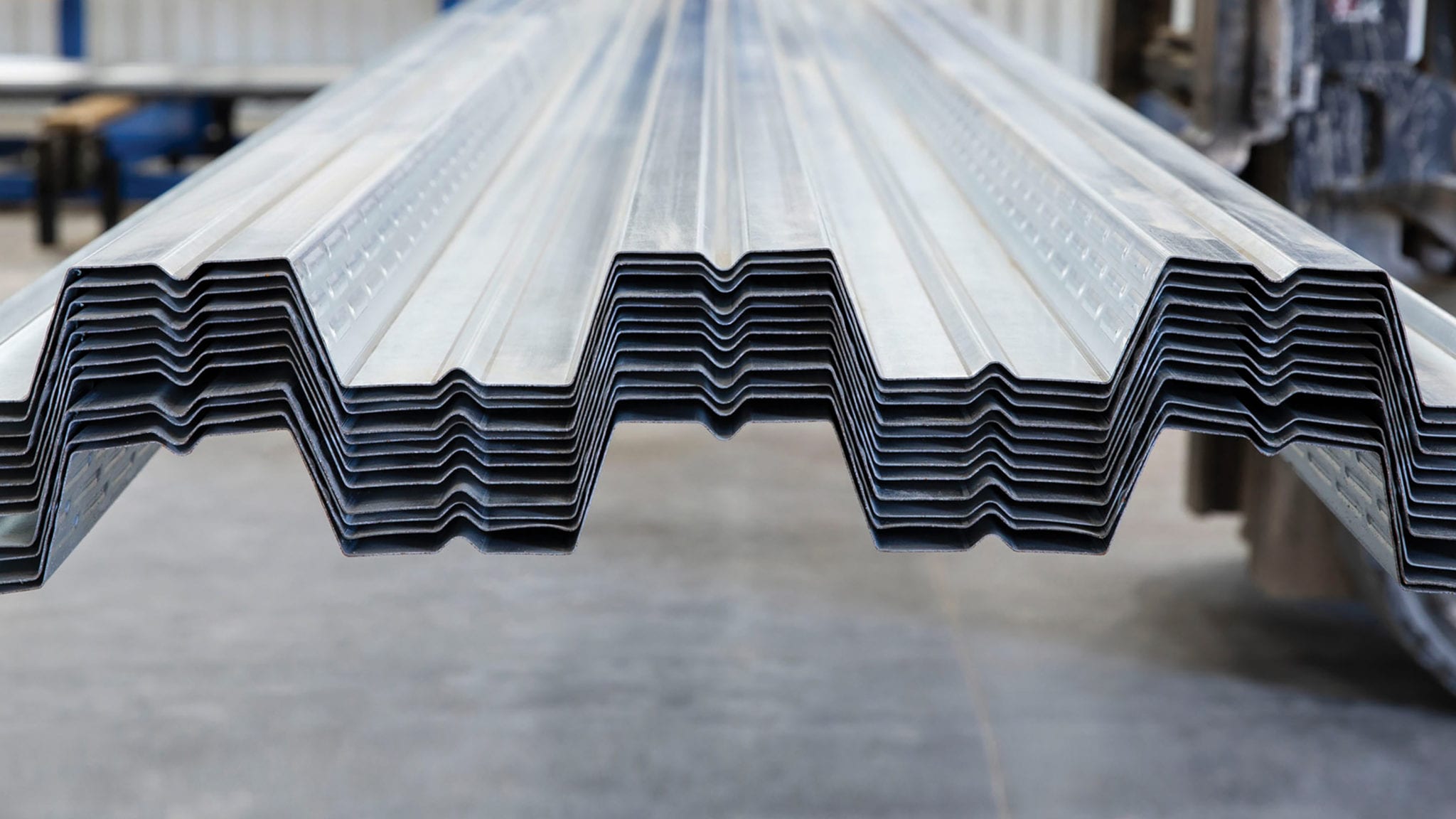

Technological Advancements in Coatings and Corrosion Resistance

To extend service life and reduce maintenance, especially in challenging environments (e.g., coastal or high-humidity regions), advanced corrosion-resistant coatings will become standard. Innovations such as higher-grade galvanization (e.g., G60, G90), metallic alloy coatings (e.g., Galvalume), and enhanced organic topcoats will be widely adopted. Digital tools like BIM-compatible product libraries and performance simulation software will also streamline design and specification.

Growth in Composite and Acoustically Optimized Decking

Demand for structural efficiency and noise control will drive the adoption of composite metal decking that works integrally with concrete slabs for enhanced load capacity. Additionally, 2026 will see increased use of acoustically rated decking systems—featuring embossments and profiles designed to dampen sound transmission—particularly in multi-family residential, education, and healthcare projects.

Regional Expansion and Infrastructure-Led Demand

Emerging economies in Asia-Pacific, Latin America, and parts of Africa will experience strong growth in commercial and industrial construction, fueling metal decking demand. Simultaneously, public infrastructure investments—especially in transportation hubs, warehouses, and mixed-use developments—will support market expansion in North America and Europe, where labor efficiency and speed of construction remain critical.

Supply Chain Resilience and Localization

Following recent global disruptions, manufacturers will prioritize supply chain localization and inventory optimization by 2026. Regional production hubs and strategic partnerships with steel suppliers will enhance material availability and reduce lead times, supporting just-in-time construction schedules.

Overall, the 2026 metal floor decking market will be defined by innovation in sustainability, performance, and construction efficiency, positioning metal decking as a core component of modern, resilient building systems.

Common Pitfalls When Sourcing Metal Floor Decking (Quality & Intellectual Property)

Sourcing metal floor decking involves navigating several critical challenges related to both product quality and intellectual property rights. Overlooking these pitfalls can lead to project delays, structural issues, legal disputes, and increased costs.

Inconsistent Material Quality and Manufacturing Standards

One of the most frequent issues is receiving metal floor decking that fails to meet specified material thickness, coating weight, or dimensional tolerances. Suppliers may substitute lower-grade steel or reduce galvanization levels to cut costs. Without rigorous quality control and third-party certification, variations in embossing patterns, flange heights, and edge profiles can compromise structural performance and composite action with concrete.

Lack of Certified Test Reports and Compliance Documentation

Many suppliers, particularly from less-regulated markets, provide incomplete or falsified mill test reports, load tables, or compliance certificates. Purchasers may unknowingly receive products that haven’t been tested to recognized standards (e.g., SDI, ASTM, or local building codes). This creates liability risks and can lead to rejection by site inspectors or engineers during project audits.

Counterfeit or Unauthorized Use of Proprietary Deck Profiles

Metal floor decking profiles are often protected by patents and intellectual property rights. A major risk is sourcing from suppliers who replicate patented emboss patterns, flute designs, or connection details without authorization. Using counterfeit decking may void performance warranties, expose the project to litigation, and undermine the structural integrity if the copycat design hasn’t been properly engineered.

Inadequate Traceability and Mill Certification

Without proper traceability—such as heat numbers, batch records, and certified mill documentation—it becomes difficult to verify the origin and composition of the steel. This lack of transparency not only affects quality assurance but can also violate procurement requirements on public or high-compliance projects where full material traceability is mandatory.

Misrepresentation of Load Capacity and Performance Data

Some suppliers provide inflated or generic load-span tables not validated by independent testing. These tables may not reflect actual performance under real-world conditions, leading to under-designed floor systems. Relying on unverified data risks structural failures, especially under dynamic or long-term loads.

Failure to Address Regional Building Code Requirements

Metal floor decking must comply with local building codes and seismic regulations. Sourcing generic products without verifying regional approvals can result in non-compliant installations. This is especially problematic in seismic zones where specific shear transfer and ductility requirements apply.

Supply Chain Vulnerabilities and Lead Time Risks

Depending on distant or single-source suppliers increases exposure to shipping delays, customs issues, and currency fluctuations. Unreliable delivery schedules can disrupt construction timelines, particularly when decking must coordinate with rebar placement and concrete pours.

Inadequate Corrosion Protection for Project Environment

Using standard galvanized coatings in corrosive environments (e.g., coastal or industrial areas) without specifying enhanced protection (like Galvalume or additional paint systems) can lead to premature degradation. Suppliers may not proactively recommend suitable coatings, resulting in long-term durability issues.

By recognizing these common pitfalls—especially those related to quality verification and IP compliance—procurement teams can implement stricter vetting processes, demand certified documentation, and partner with reputable, licensed manufacturers to ensure safe, compliant, and reliable metal floor decking supply.

Logistics & Compliance Guide for Metal Floor Decking

Metal floor decking is a critical component in structural steel construction, and its successful delivery and installation depend on meticulous logistics planning and strict adherence to compliance standards. This guide outlines key considerations for efficient transportation, handling, and regulatory compliance throughout the supply chain.

Transportation Planning

Proper transportation ensures metal floor decking arrives at the jobsite undamaged and ready for installation. Key factors include:

- Load Configuration: Decking is typically shipped in bundles secured with strapping or banding. Bundles must be arranged to prevent shifting during transit. Overhang should comply with local transportation regulations (usually no more than 4 feet beyond the rear of the trailer).

- Trailer Selection: Flatbed trailers are most common. Lowboy trailers may be required for taller loads or bridge clearances. Ensure trailers are clean and free of debris to prevent surface damage.

- Weather Protection: Use waterproof tarps or shrink-wrapping to protect decking from moisture, especially during extended transit or storage. Condensation under tarps should be minimized with proper ventilation.

- Route Planning: Account for bridge weight limits, overhead clearances, and road restrictions, particularly in urban areas or remote job sites.

Handling & On-Site Storage

Safe and correct handling preserves material integrity and ensures worker safety:

- Unloading Procedures: Use forklifts with wide, padded forks or lifting beams designed for metal decking. Never drag bundles across surfaces. Lift from the bottom to avoid deformation.

- Storage Conditions: Store bundles on level, elevated supports (e.g., lumber skids) to prevent ground moisture absorption. Keep decking covered and off the ground, ideally under a canopy or temporary shelter.

- Stacking Limits: Do not stack bundles more than two high unless engineered supports are used. Excessive stacking can cause bottom layers to deform.

- Site Security: Secure storage areas to prevent theft or unauthorized handling. Clearly label materials by project phase or location.

Regulatory & Safety Compliance

Adherence to industry and governmental standards is mandatory:

- OSHA Requirements: Follow OSHA 29 CFR 1926 for construction safety, including fall protection during installation, proper lifting techniques, and hazard communication (e.g., sharp edges).

- Building Codes: Ensure decking design and installation comply with local building codes and standards such as IBC (International Building Code) and AISC (American Institute of Steel Construction) guidelines.

- Material Certifications: Retain mill test reports (MTRs) and certifications confirming compliance with ASTM standards (e.g., ASTM A653 for galvanized steel, ASTM A792 for metallic-coated sheet steel).

- Environmental Regulations: Manage scrap metal responsibly in accordance with EPA and local waste disposal regulations. Recycle whenever possible.

Quality Assurance & Documentation

Maintain traceability and accountability from supplier to installation:

- Inspection upon Delivery: Check for visible damage, corrosion, or deformation. Verify quantities and specifications against purchase orders and shop drawings.

- Traceability: Keep batch numbers, heat numbers, and delivery documentation on file for audit and compliance purposes.

- Installation Compliance: Confirm that installers follow manufacturer-recommended fastening patterns, seam overlaps, and field cutting procedures.

Coordination with Stakeholders

Effective communication ensures smooth logistics flow:

- Supplier Coordination: Align delivery schedules with project timelines. Confirm packaging, labeling, and delivery windows in advance.

- General Contractor Integration: Coordinate crane schedules, laydown areas, and access routes with site management.

- Subcontractor Alignment: Ensure erectors and concrete crews are aware of decking delivery and installation sequences to avoid delays.

By following this guide, project teams can ensure that metal floor decking is delivered safely, stored properly, and installed in compliance with all applicable standards, supporting structural integrity and project efficiency.

Conclusion for Sourcing Metal Floor Decking

Sourcing metal floor decking requires a strategic approach that balances quality, cost, lead times, and supplier reliability. After evaluating various suppliers, material specifications, and market conditions, it is evident that selecting the right provider involves more than just competitive pricing. Factors such as compliance with industry standards (e.g., ASTM, AISC), material gauge and profile suitability for structural requirements, production capacity, and logistical efficiency play critical roles in ensuring project success.

Establishing partnerships with reputable manufacturers or distributors who offer technical support, consistent quality control, and just-in-time delivery can significantly reduce project risks and delays. Additionally, considering sustainable sourcing options and recycled content may support broader environmental and corporate responsibility goals.

In conclusion, a well-informed sourcing strategy for metal floor decking—grounded in thorough due diligence, clear specifications, and strong supplier relationships—ensures structural integrity, cost efficiency, and timely project execution. Continuous evaluation and performance monitoring of suppliers will further enhance long-term value and reliability in future construction endeavors.