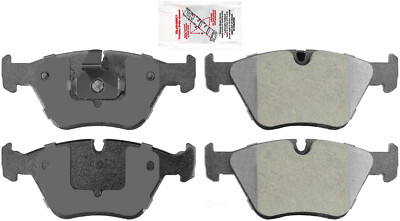

The global brake pad market is experiencing steady growth, driven by increasing vehicle production, rising demand for automotive safety components, and stringent government regulations on vehicle emissions and braking performance. According to Grand View Research, the global brake pad market was valued at USD 25.6 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. A critical yet often overlooked component in brake pad assemblies is the metal clip—small hardware pieces that ensure proper fit, reduce noise, and enhance braking efficiency. As vehicle OEMs and aftermarket suppliers prioritize performance and durability, demand for high-quality metal clips has risen in parallel. This growing reliance underscores the importance of leading manufacturers specializing in precision-engineered clips for brake systems. Based on production scale, innovation, global reach, and industry reputation, the following nine companies have emerged as key players in the metal clips for brake pads segment.

Top 9 Metal Clips On Brake Pads Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 AmeriBRAKES

Domain Est. 2013

Website: momentumusainc.com

Key Highlights: Brake Pads. Features & Benefits: Abutment Hardware Included. Always replace abutment clips for best brake system results. Resonant Dampening Shim Technology….

#2 Baer Brakes 6S/XTR Caliper Brake Pad Anti

Domain Est. 1996

Website: baer.com

Key Highlights: In stock Free deliveryStainless Steel Brake Pad Anti-Rattle Clip for all Baer 6S calipers and Baer XTR Caliper When Using Bolt In Bridge. Designed to Hold Pressure on Brake Pads….

#3 7 Brake Hardware Items, Including Abutment Clips, Shims

Domain Est. 1996

Website: tirereview.com

Key Highlights: Abutment clips reside on the caliper bracket lands on most vehicles. They create a uniform surface for the pads to make contact with….

#4 Braking

Domain Est. 1997

Website: febi.com

Key Highlights: Certain brake pads also come supplied with anti-rattle clips or springs that minimise ‘play’ between the pads and caliper to further dampen vibrations. For ……

#5 DP Brakes

Domain Est. 1998

Website: dp-brakes.com

Key Highlights: At DP Brakes, we manufacture quality sintered metal brake pads for replacements and performance upgrades for every riding application, including racing, sport, ……

#6 Engineering Essentials

Domain Est. 2001

Website: ferodo.com

Key Highlights: Ferodo’s expertise in making high-quality brake pads, has led us to supply a broad range of high-quality brake-related products….

#7

Domain Est. 2002

Website: akebonobrakes.com

Key Highlights: Akebono manufactures ceramic brake pads in three distinct brands, each specifically formulated for domestic and Asian, European, or performance vehicles….

#8 OE

Domain Est. 2006

Website: duralastparts.com

Key Highlights: Get brake parts as strong as your work ethic. Pads, rotors, ABS brake supplies, and more. Learn more about stocking your shop with Duralast brake equipment….

#9 QuietGlide Brake Clips

Domain Est. 2013

Website: carlsonqualitybrakeparts.com

Key Highlights: Carlson manufactures QuietGlide brake pad abutment clips with precision. The clips are made of stainless steel for overall corrosion-free performance….

Expert Sourcing Insights for Metal Clips On Brake Pads

H2: Market Trends for Metal Clips on Brake Pads in 2026

The global market for metal clips on brake pads is expected to experience steady growth and transformation by 2026, driven by evolving automotive technologies, regulatory standards, and shifts in manufacturing practices. These small yet critical components—used to secure brake pads within calipers, reduce noise, and ensure proper alignment—play a vital role in brake system performance and safety. The following analysis outlines key trends shaping the demand and development of metal clips on brake pads in the 2026 market landscape.

-

Increasing Demand for Quiet and Efficient Braking Systems

As vehicle manufacturers prioritize NVH (Noise, Vibration, and Harshness) reduction, the demand for high-performance metal clips that dampen squealing and rattling noises is rising. By 2026, OEMs and aftermarket suppliers are increasingly integrating precision-engineered metal clips with anti-vibration coatings or dual-layer designs to enhance acoustic comfort, especially in electric and hybrid vehicles where engine noise is minimal and brake noise is more noticeable. -

Growth in Electric Vehicle (EV) Production

The rapid expansion of the EV market is influencing brake system design. While regenerative braking reduces wear on friction components, occasional high-stress braking still necessitates reliable pad retention. Metal clips are being redesigned for lighter weight and corrosion resistance to meet the unique requirements of EVs. By 2026, demand for aluminum- or stainless steel-based clips with anti-corrosion treatments is projected to grow, particularly in premium and long-range EV models. -

Stringent Safety and Emission Regulations

Global regulations, such as those from Euro NCAP, NHTSA, and UNECE, continue to emphasize vehicle safety and durability. These standards indirectly boost the demand for robust brake hardware, including metal clips that prevent pad misalignment and ensure consistent brake performance. In 2026, compliance with ISO and IATF quality management systems will be a key differentiator for clip manufacturers, driving innovation in material quality and manufacturing consistency. -

Shift Toward Lightweight and Durable Materials

To support fuel efficiency and reduce emissions, automakers are focusing on lightweighting. Metal clips are being optimized using high-tensile steel alloys and composite-metal hybrids that maintain strength while reducing weight. By 2026, advanced surface treatments such as zinc-nickel plating and black oxide coatings will be standard to enhance corrosion resistance without adding mass. -

Expansion of the Aftermarket Sector

The growing vehicle parc, especially in emerging markets like India, Southeast Asia, and Latin America, is fueling demand in the brake aftermarket. Consumers and repair shops are increasingly aware of the importance of genuine or high-quality replacement hardware. Metal clip kits bundled with brake pads are becoming common, offering improved installation efficiency and safety. This trend is expected to drive revenue growth for aftermarket suppliers by 2026. -

Automation and Precision Manufacturing

The adoption of automated production lines and robotic assembly in brake pad manufacturing is pushing clip designs toward greater standardization and tighter tolerances. In 2026, suppliers are expected to leverage AI-driven quality control and real-time monitoring to ensure clip consistency, reducing failure rates and enhancing overall brake system reliability. -

Regional Market Dynamics

Asia-Pacific will remain the dominant market for metal clips on brake pads due to high automotive production volumes in China, Japan, and India. Meanwhile, North America and Europe will see steady demand driven by vehicle safety regulations and the rise of premium EVs. Localized production and supply chain resilience will be key strategic focuses for manufacturers by 2026.

In conclusion, the 2026 market for metal clips on brake pads is characterized by innovation in materials, design, and manufacturing processes, with strong growth drivers in electrification, noise reduction, and regulatory compliance. As a critical yet often overlooked component, metal clips are gaining recognition for their role in enhancing brake safety and performance, positioning the segment for sustained relevance in the evolving automotive ecosystem.

Common Pitfalls When Sourcing Metal Clips for Brake Pads: Quality and Intellectual Property Risks

Logistics & Compliance Guide for Metal Clips on Brake Pads

Overview of Metal Clips on Brake Pads

Metal clips on brake pads are essential components in automotive braking systems, serving to reduce noise, ensure proper pad alignment, and enhance brake performance. Due to their mechanical function and placement within safety-critical systems, these parts are subject to strict logistics handling and regulatory compliance requirements across international markets.

Classification and Harmonized System (HS) Codes

Accurate product classification is vital for customs clearance and tariff assessment. Metal clips for brake pads are typically classified under the following HS codes:

– 8708.39.00: “Parts and accessories of braking systems for motor vehicles” (common in the U.S. HTS).

– 8708.39.80: Specific subcategory for non-electronic brake components in some jurisdictions.

Classification may vary by country; consult local customs authorities or a trade compliance expert for precise coding.

Regulatory Compliance Requirements

Metal clips must comply with regional and international automotive safety standards:

– North America: Compliance with FMVSS (Federal Motor Vehicle Safety Standards), particularly FMVSS 105 and 135, may be indirectly required through the overall brake assembly certification.

– European Union: Must meet ECE R90 standards for replacement brake components. CE marking may be required if sold as part of a certified brake kit.

– China (CCC): Brake system parts may require China Compulsory Certification depending on end-use classification.

– RoHS & REACH: Metal clips must comply with restrictions on hazardous substances (e.g., lead, cadmium) under EU directives.

Packaging and Handling Guidelines

To prevent damage and ensure traceability:

– Use anti-corrosion packaging (e.g., VCI paper or coated containers) for ferrous metal clips.

– Employ secure, stackable containers to prevent deformation during transit.

– Label packages with part numbers, batch/lot numbers, and handling symbols (e.g., “Fragile,” “Do Not Stack”).

– Include compliance documentation (e.g., RoHS/REACH declarations, material certifications) with each shipment.

Transportation and Logistics Considerations

- Mode of Transport: Suitable for air, sea, or ground freight. Air freight recommended for urgent OEM supply chains.

- Weight and Volume: Typically lightweight; optimize palletization for container or truckload efficiency.

- Hazardous Materials: Generally non-hazardous, but verify coating treatments (e.g., zinc plating) for chemical transport restrictions.

- Storage Conditions: Store in dry, temperature-controlled environments to prevent rust or degradation.

Import/Export Documentation

Ensure all shipments include:

– Commercial invoice with HS code, country of origin, and value.

– Packing list detailing quantities, weights, and dimensions.

– Certificate of Origin (preferably Form A for GSP eligibility).

– Material test reports or compliance certificates (e.g., ISO 9001, PPAP documentation for OEMs).

– SDS (Safety Data Sheet) if coatings contain regulated substances.

Quality and Traceability Standards

- Implement batch traceability systems (e.g., barcode or QR codes) to support recalls or audits.

- Comply with ISO/TS 16949 or IATF 16949 for automotive production processes.

- Maintain records of raw material sourcing and production controls for regulatory inspections.

End-of-Life and Environmental Compliance

- Metal clips are typically recyclable; support WEEE or ELV (End-of-Life Vehicles) directives in applicable regions.

- Provide recycling guidance to distributors and end users as part of corporate sustainability programs.

Conclusion

Proper logistics and compliance management for metal clips on brake pads ensures regulatory adherence, minimizes supply chain disruptions, and supports automotive safety standards. Regular audits, up-to-date documentation, and collaboration with certified logistics partners are essential for global distribution success.

In conclusion, sourcing metal clips for brake pads requires careful consideration of several key factors to ensure optimal braking performance, safety, and longevity. Original equipment manufacturer (OEM) specifications should be prioritized to guarantee compatibility and adherence to quality standards. Suppliers must be evaluated based not only on cost but also on their reputation for consistency, material quality, and compliance with industry regulations such as ISO or IATF certifications.

Using high-quality metal clips helps maintain proper pad positioning, reduces noise and vibration, prevents premature wear, and enhances overall brake system reliability. While aftermarket alternatives may offer cost savings, compromising on clip quality can lead to increased maintenance, safety risks, and higher long-term costs.

Therefore, a strategic sourcing approach—balancing cost, quality, reliability, and supplier credibility—is essential. Establishing strong relationships with reputable suppliers, conducting regular quality audits, and staying informed about material and design advancements will ensure the consistent supply of high-performance metal clips, ultimately contributing to safer and more efficient braking systems.