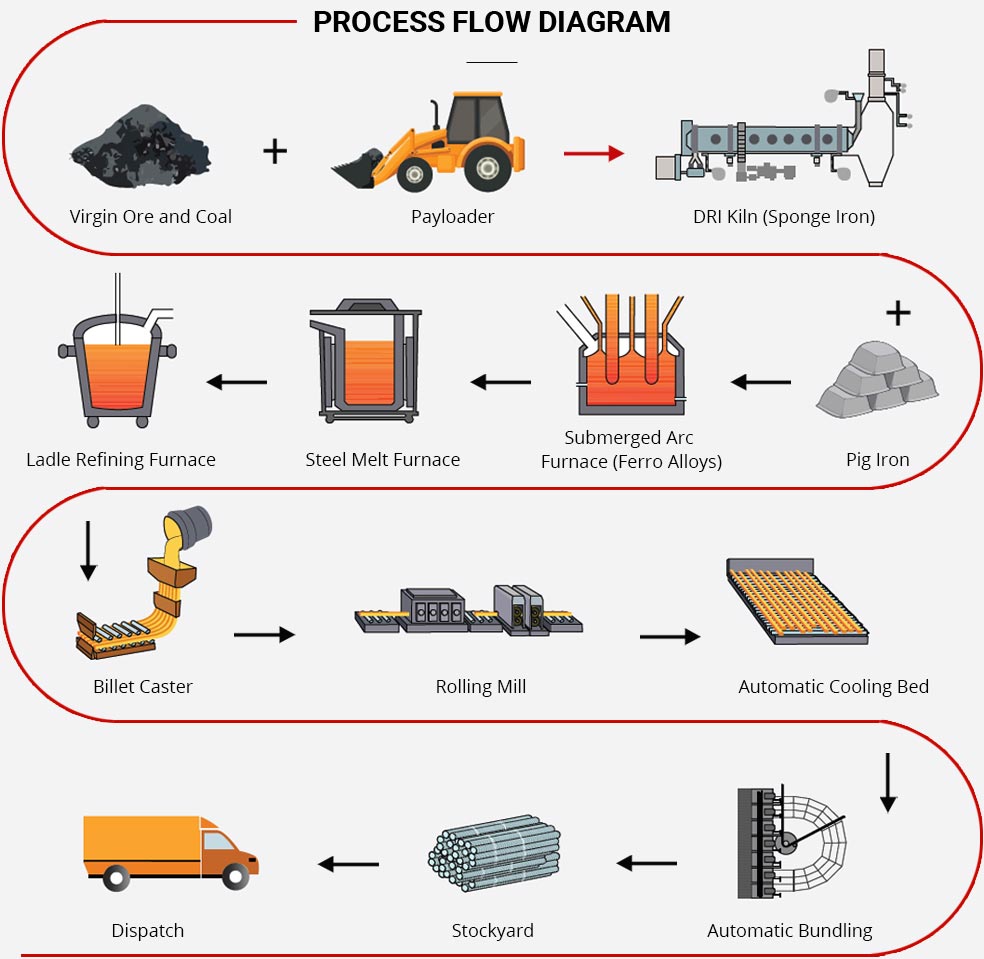

The global metal bar manufacturing industry is experiencing steady expansion, driven by rising demand across construction, automotive, and industrial machinery sectors. According to Mordor Intelligence, the metal market is projected to grow at a CAGR of approximately 5.8% from 2024 to 2029, fueled by infrastructure development and increased metal consumption in emerging economies. Steel bars, in particular, remain foundational in building and manufacturing, with reinforced bars (rebar) accounting for a significant share of structural applications. Additionally, Grand View Research valued the global steel market at USD 1.4 trillion in 2023 and anticipates continued growth through 2030, underpinned by advancements in material quality and sustainable production methods. As demand surges, manufacturers are scaling innovation in alloy composition, corrosion resistance, and production efficiency. In this competitive landscape, the following nine metal bar manufacturers stand out for their market presence, production capabilities, and technological leadership.

Top 9 Metal Bar Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

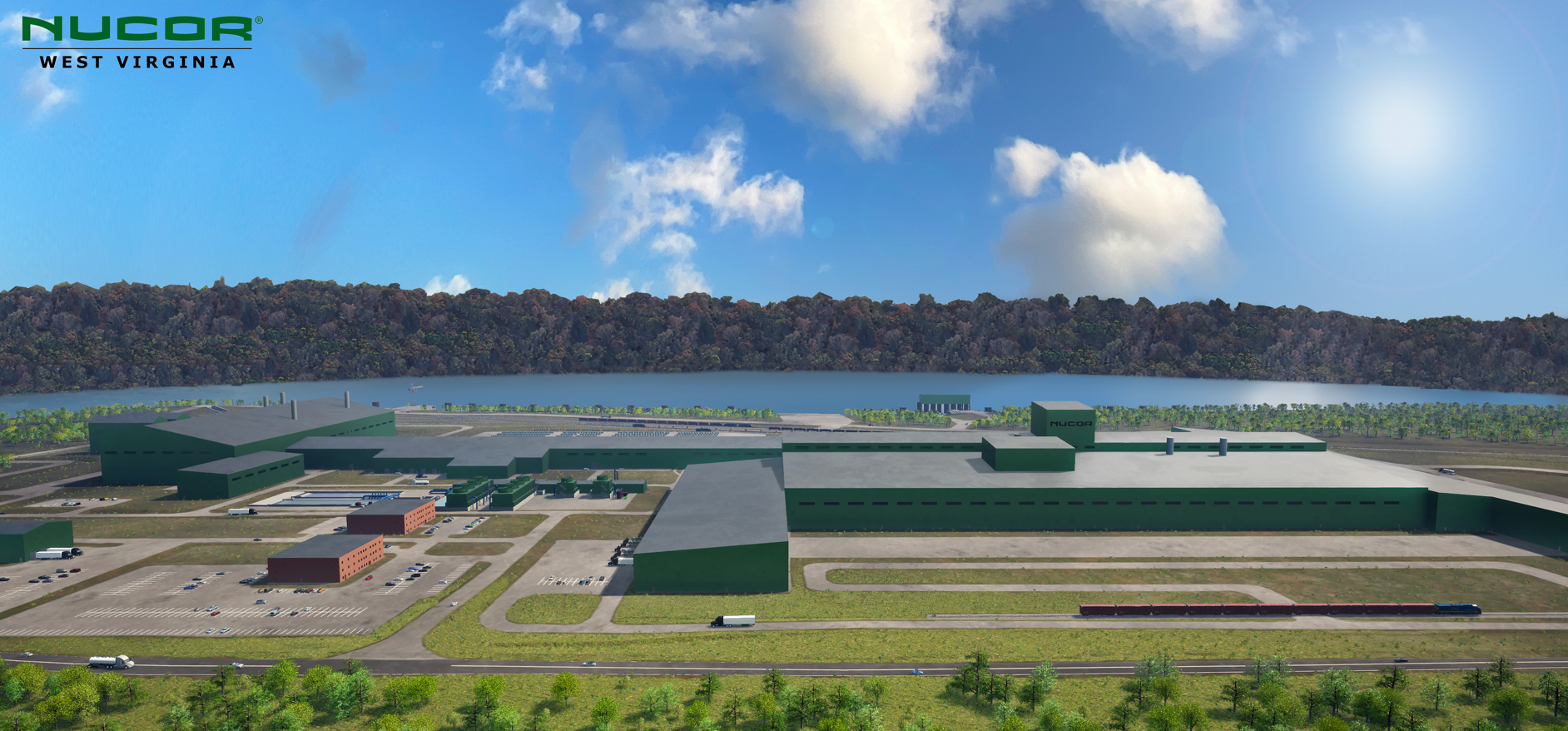

#1 Nucor

Domain Est. 1997

Website: nucor.com

Key Highlights: North America’s largest steel manufacturer and recycler. We are a team forged around a vision for leading our industry by providing unparalleled customer care….

#2 Steel Round, Square, & Rectangular Bar

Domain Est. 1997

Website: sss-steel.com

Key Highlights: Triple-S Steel offers an extensive selection of steel round, square, and rectangular bar to meet a variety of needs….

#3 Industrial Supplier of Steel Bar, Rod, & Wire

Domain Est. 1999

Website: kingsteelcorp.com

Key Highlights: King Steel is a world-wide full service steel supplier with over 100 years of experience in the bar, rod, and wire industries. Contact us today!…

#4 Premium Metals & Plastics Distributor

Domain Est. 1996

Website: alro.com

Key Highlights: Your one-stop-shop for premium metals and plastics, offering a vast inventory of in-stock products and processing service options with next day delivery….

#5 Eaton Steel Bar Company

Domain Est. 1996 | Founded: 1953

Website: eatonsteel.com

Key Highlights: Eaton Steel Bar Company is the industry leader in hot rolled & cold drawn bars, and are the premier steel supply chain specialists since 1953….

#6 EMJ

Domain Est. 1996 | Founded: 1921

Website: emjmetals.com

Key Highlights: EMJ is a leading supplier of steel and aluminum bar, tubing and plate since 1921. More About Us. Making a Material Difference®. © 2026 Earle M. Jorgensen ……

#7 Steel Bar, Rod, & Wire Supplier

Domain Est. 1997

Website: twmetals.com

Key Highlights: For the very best in steel bar, wire and rod products, turn to TW Metals. We have the processing, pricing and quality you are looking for. Call now!…

#8 Steel Dynamics

Domain Est. 1999

Website: lpg.steeldynamics.com

Key Highlights: Long Products Steel supplies beams and shapes, rail, engineered special bar-quality steel, cold finished steel, merchant bar products, and specialty steel….

#9 Ternium, a steel manufacturing company

Domain Est. 2005

Website: us.ternium.com

Key Highlights: Need steel for Metal Building. At Ternium we manufacture high-quality products to supply housing and infrastructure works. Used in the roofs of houses and ……

Expert Sourcing Insights for Metal Bar

H2: Market Trends for Metal Bars in 2026

As we approach 2026, the global metal bar market is undergoing significant transformation, driven by technological innovation, shifting industrial demand, sustainability imperatives, and evolving supply chain dynamics. Below is an analysis of key trends shaping the metal bar sector in 2026, with a focus on materials such as steel, aluminum, titanium, and specialty alloys.

1. Increased Demand from Construction and Infrastructure

Governments worldwide are investing heavily in infrastructure modernization and green building projects under post-pandemic recovery and climate resilience initiatives. In 2026, metal bars—especially rebar and structural steel—are seeing sustained demand in large-scale infrastructure developments across emerging markets (e.g., India, Southeast Asia, and Africa) and developed economies (e.g., U.S. Infrastructure Bill projects and EU Green Deal programs). High-strength, corrosion-resistant steel bars are particularly favored for durability and lifecycle cost savings.

2. Growth in Automotive and Aerospace Sectors

The automotive industry’s transition to electric vehicles (EVs) is influencing demand for lightweight metal bars, especially aluminum and high-strength steel alloys. In 2026, manufacturers are using advanced metal bars in EV chassis and battery enclosures to reduce vehicle weight and improve efficiency. Similarly, aerospace demand for titanium and nickel-based alloy bars is rising due to increased production of fuel-efficient and next-gen aircraft.

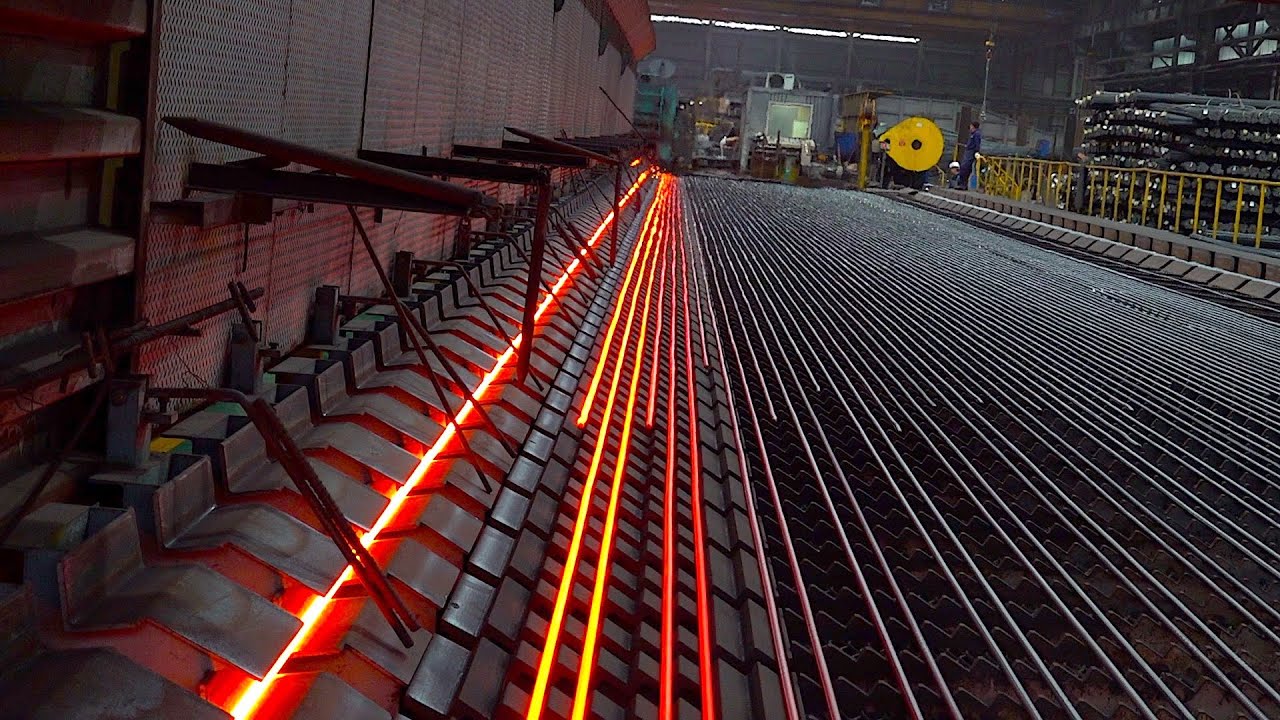

3. Adoption of Smart Manufacturing and Industry 4.0

Metal bar producers are increasingly leveraging automation, AI-driven quality control, and digital twins in manufacturing processes. In 2026, smart foundries and rolling mills are optimizing yield, reducing energy use, and improving precision in bar dimensions and metallurgical properties. Predictive maintenance and real-time monitoring are enhancing supply chain reliability and reducing downtime.

4. Sustainability and Green Steel Initiatives

Environmental regulations and ESG (Environmental, Social, Governance) pressures are pushing the metal bar industry toward decarbonization. Green steel—produced using hydrogen-based reduction or electric arc furnaces powered by renewable energy—is gaining traction. By 2026, major steel producers in Europe and North America are offering low-carbon metal bars, appealing to eco-conscious sectors like sustainable construction and renewable energy.

5. Rise in Recycled and Circular Material Use

Circular economy principles are reshaping sourcing strategies. Recycled steel and aluminum bars now constitute a growing share of the market, driven by cost efficiency and regulatory incentives. In 2026, closed-loop recycling systems and improved scrap sorting technologies are enabling higher quality recycled metal bars suitable for structural and high-performance applications.

6. Geopolitical and Supply Chain Reconfiguration

Ongoing geopolitical tensions and trade policies are prompting regionalization of metal bar production. “Nearshoring” and “friend-shoring” trends are leading manufacturers to establish localized supply chains, especially in North America and Europe, to reduce dependency on single-source suppliers. This shift enhances resilience but may increase short-term costs.

7. Technological Advancements in Alloy Development

In 2026, R&D investments are yielding new high-performance metal bars with enhanced properties—such as improved fatigue resistance, weldability, and thermal stability. These advanced alloys are being adopted in energy, defense, and high-tech manufacturing, creating niche but high-margin market segments.

8. Price Volatility and Raw Material Constraints

Despite progress, the metal bar market remains sensitive to fluctuations in iron ore, coking coal, and lithium (for specialty alloys). In 2026, supply constraints and energy costs continue to cause price volatility. Producers are responding with long-term hedging strategies and vertical integration to secure raw material supplies.

Conclusion:

The 2026 metal bar market is characterized by a dual focus on innovation and sustainability. While traditional sectors like construction remain key drivers, emerging applications in clean technology and advanced manufacturing are reshaping demand patterns. Companies that embrace digital transformation, low-carbon production, and circular practices are best positioned to lead in this dynamic landscape.

Common Pitfalls When Sourcing Metal Bar (Quality, Intellectual Property)

Sourcing metal bars—especially for critical applications in aerospace, automotive, or medical industries—requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to production delays, safety risks, legal disputes, and reputational damage. Below are common pitfalls to avoid:

Poor Quality Control and Non-Compliance

One of the most frequent issues is receiving metal bars that do not meet specified standards (e.g., ASTM, ASME, ISO). Suppliers may provide substandard alloys, incorrect heat treatments, or inaccurate certifications. This can result in part failures, regulatory non-compliance, and costly rework.

Inadequate Material Traceability

Failing to ensure full traceability—from raw material origin to final test reports (e.g., mill test certificates, MTCs)—can compromise quality assurance. Without proper documentation, it becomes difficult to verify compliance or conduct root cause analysis in case of failure.

Counterfeit or Misrepresented Materials

Unreliable suppliers may pass off inferior or recycled metals as high-grade alloys. This is especially common with specialty metals like titanium or high-nickel alloys. Counterfeit materials often lack required mechanical properties and can lead to catastrophic failures.

Lack of Independent Testing

Relying solely on supplier-provided certifications without third-party verification (e.g., Positive Material Identification – PMI, mechanical testing) increases the risk of accepting non-conforming material. Independent testing should be standard practice for critical applications.

Ignoring Supply Chain Transparency

Sourcing through multiple intermediaries can obscure the true origin of the metal. This lack of transparency increases exposure to unethical practices, conflict materials, or IP-infringing products, particularly in regions with weak regulatory oversight.

Overlooking Intellectual Property Rights

Some high-performance metal alloys are protected by patents or proprietary compositions (e.g., Inconel®, Hastelloy®). Sourcing equivalent or “copy” alloys without proper licensing may infringe on IP rights, leading to legal action, import bans, or supply chain disruptions.

Misuse of Trademarked Alloy Names

Suppliers may falsely label materials using registered trademarked names (e.g., claiming a bar is “Inconel 718” without authorization). This not only violates IP law but also misleads buyers about the material’s performance and origin.

Insufficient Supplier Vetting

Failing to audit suppliers’ quality management systems (e.g., ISO 9001, AS9100), production capabilities, and compliance history can result in inconsistent quality and IP risks. Due diligence is essential, especially when sourcing from new or low-cost regions.

Poor Contractual Protections

Contracts that lack clear specifications, warranties, liability clauses, or IP indemnification expose buyers to financial and legal risk. Ensure contracts explicitly define material standards, certification requirements, and ownership of IP related to custom alloys or processing.

Failure to Monitor Regulatory Changes

Alloy compositions and sourcing regulations (e.g., REACH, ITAR, conflict minerals) evolve. Not staying updated can lead to unintentional non-compliance, especially when sourcing globally.

Avoiding these pitfalls requires a proactive sourcing strategy that combines technical rigor, legal awareness, and supply chain diligence. Establishing long-term relationships with certified, transparent suppliers—and verifying both quality and IP legitimacy—is key to mitigating risk.

Logistics & Compliance Guide for Metal Bars

Overview

This guide outlines the key logistics and compliance considerations for the transportation, storage, and regulatory handling of metal bars, including steel, aluminum, copper, and other ferrous and non-ferrous metals. Proper planning ensures safety, regulatory adherence, cost efficiency, and on-time delivery.

Classification and Product Specifications

Metal bars are typically classified by material type (e.g., carbon steel, stainless steel, aluminum), dimensions (length, diameter, cross-section), grade, and finish. Accurate classification is essential for compliance with international trade standards, safety regulations, and shipping requirements.

Packaging and Handling Requirements

Metal bars must be securely bundled, often using steel strapping or shrink-wrapping, to prevent shifting during transit. Wooden pallets or cradles are recommended for protection and ease of forklift handling. Corrosion-resistant coatings or VCI (Vapor Corrosion Inhibitor) paper may be used for moisture protection, especially for long-term storage or maritime transport.

Transportation Modes

Metal bars can be shipped via road, rail, sea, or air, depending on volume, destination, and urgency.

– Road/Rail: Ideal for domestic or regional shipments; requires proper load securing per FMCSA (U.S.) or ADR (Europe) regulations.

– Sea Freight: Common for international trade; bars are typically containerized or shipped as breakbulk cargo. Proper dunnage and lashing are critical to prevent damage and shifting.

– Air Freight: Rare due to high costs and weight; generally limited to high-value or urgent shipments.

Weight and Dimension Constraints

Metal bars are heavy and dense, so adherence to weight limits per axle, container, or aircraft is crucial. Overloading can lead to safety hazards and regulatory penalties. Proper calculation of total shipment weight and dimensional footprint ensures compliance with carrier and infrastructure regulations.

Regulatory Compliance

Ensure compliance with relevant national and international regulations:

– HS Codes (Harmonized System): Use correct codes (e.g., 7214 for alloy steel bars) for customs declarations.

– Export Controls: Some high-strength or specialty alloys may be subject to export restrictions (e.g., ITAR, EAR in the U.S.).

– REACH & RoHS (EU): Verify compliance for heavy metals and chemical content in certain alloys.

– Customs Documentation: Include commercial invoices, packing lists, certificates of origin, and material test reports (MTRs) as required.

Safety and Hazard Considerations

While most metal bars are non-hazardous, sharp edges pose physical injury risks. Proper labeling, handling procedures, and worker training are essential. If coated with oils or treated with chemicals, review SDS (Safety Data Sheets) for potential hazards.

Storage and Inventory Management

Store metal bars in dry, well-ventilated areas to prevent rust and degradation. Use racking systems to avoid deformation and ensure easy access. Implement FIFO (First In, First Out) practices to manage inventory and reduce material aging risks.

Environmental and Sustainability Practices

Recycling and scrap metal regulations may apply. Maintain documentation for scrap tracking and ensure environmentally responsible disposal of packaging and off-cuts. Consider carbon footprint reduction through optimized transport routing and modal shifts.

Documentation and Traceability

Maintain full traceability from production to delivery. Required documents include:

– Mill Test Certificates (e.g., EN 10204 3.1 or 3.2)

– Weight tickets and delivery notes

– Bill of Lading or Air Waybill

– Customs clearance records

Import/Export Clearance

Work with licensed customs brokers to ensure timely clearance. Be prepared for potential inspections, duties, and anti-dumping measures—particularly for steel products subject to trade remedies.

Insurance and Liability

Obtain appropriate cargo insurance covering damage, loss, or theft during transit. Clarify liability terms (e.g., Incoterms® 2020) with trading partners to define responsibilities for transport, risk transfer, and insurance obligations.

Conclusion

Effective logistics and compliance management for metal bars requires attention to detail in packaging, transport, documentation, and regulatory adherence. Proactive planning minimizes delays, reduces costs, and ensures safe, compliant delivery across global supply chains.

Conclusion for Sourcing Metal Bar:

In conclusion, the successful sourcing of metal bars requires a comprehensive approach that balances quality, cost, reliability, and sustainability. A thorough evaluation of suppliers—based on material certifications, production capabilities, lead times, and compliance with industry standards—is essential to ensure consistent product performance and supply chain stability. Additionally, considering factors such as geographic location, logistics, and long-term partnerships can enhance efficiency and reduce risks. By leveraging market analysis, supplier audits, and strategic procurement practices, businesses can secure high-quality metal bars that meet technical specifications while optimizing costs and supporting operational goals. Ultimately, effective sourcing contributes significantly to manufacturing excellence, project timelines, and overall competitiveness in the market.