The global bed frame market is experiencing steady expansion, driven by rising demand for durable, aesthetically appealing furniture and increasing residential construction activities. According to Grand View Research, the global bedroom furniture market size was valued at USD 67.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. Metal and wood bed frames, in particular, remain top choices among consumers due to their blend of strength, sustainability, and timeless design. With wood offering warmth and natural elegance, and metal providing industrial durability and modern flair, hybrid and standalone designs combining these materials are gaining traction in both residential and hospitality sectors. This growing preference is further bolstered by e-commerce penetration and customizable furniture options. As the market evolves, a select group of manufacturers has emerged as leaders in innovation, craftsmanship, and scalability—setting the benchmark in quality and design. Here are the top 10 metal and wood bed frame manufacturers shaping the industry today.

Top 10 Metal And Wood Bed Frame Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Flexsteel

Domain Est. 1996

Website: flexsteel.com

Key Highlights: Discover exceptional craftsmanship and style with Flexsteel, your premier manufacturer for high-quality furniture. Explore our extensive range of living ……

#2 hollywood bed frame

Domain Est. 1997

Website: hollywoodbed.com

Key Highlights: A full service manufacturer of quality bedding support products, including bed frames, bed bases, portable beds, center supports, bed rails, daybed hardware ……

#3 Lee Industries

Domain Est. 1997

Website: leeindustries.com

Key Highlights: SLEEPERS · OTTOMANS & BENCHES · CHAISES · BEDS · OUTDOOR · DINING · BAR & COUNTER STOOLS · MCALPINE HOME · THROW PILLOWS ……

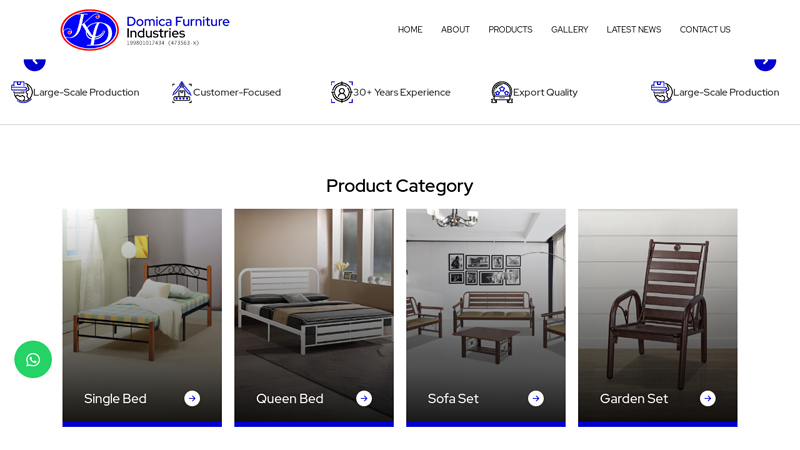

#4 Metal Bed Frame Manufacturer Kedah, Furniture Supplier Malaysia …

Domain Est. 1998

Website: domica.com

Key Highlights: Based in Kedah, Malaysia, Domica Furniture Industries Sdn Bhd has 30+ years’ expertise in metal bed frame manufacturing, exporting quality products worldwide ……

#5 Sturdy & Reliable Bed Frames

Domain Est. 2000

Website: americanbeddingmfg.com

Key Highlights: American Bedding’s metal and wooden bed frames offer a sturdy and durable sleeping solution for institutions such as colleges, camps, and military housing….

#6 Our Company

Domain Est. 2008

Website: knickerbockerbedframe.com

Key Highlights: Knickerbocker is America’s premier manufacturer of stylish and attractive heavy duty bed frames and bedding support systems….

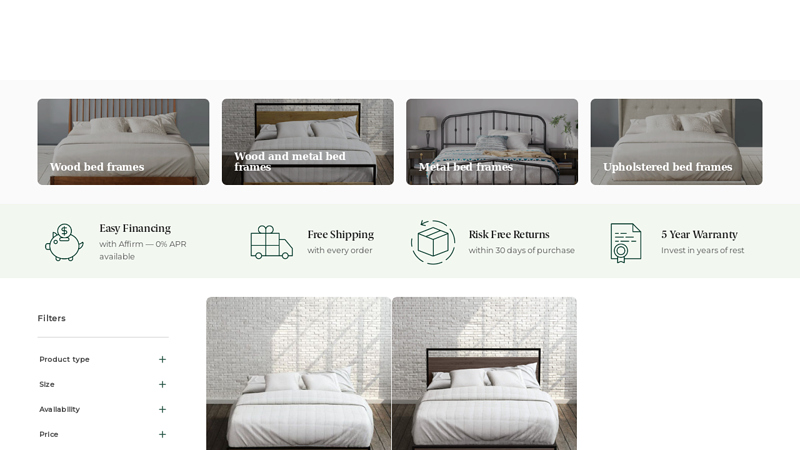

#7 Wood and metal bed frames

Domain Est. 2000

Website: zinus.com

Key Highlights: Free delivery · Free 100-day returnsDiscover the ultimate blend of style and durability with our wood and metal bed frames. Modern, unique, and versatile – perfect for your bedroo…

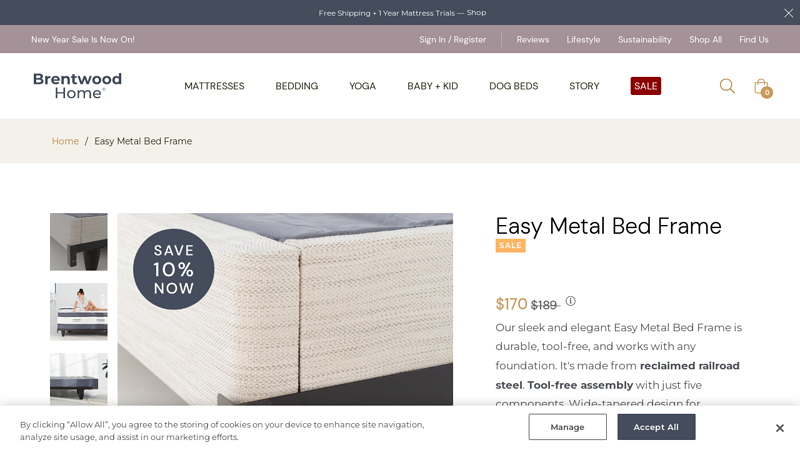

#8 Easy Metal Bed Frame Sale

Domain Est. 2014

Website: brentwoodhome.com

Key Highlights: In stock Rating 5.0 (27) Our sleek and elegant Easy Metal Bed Frame is durable, tool-free, and works with any foundation. It’s made from reclaimed railroad steel….

#9 Ironwood Bed Frames

Domain Est. 2015

Website: ironwoodbedframesandmattress.com

Key Highlights: Constructed of sturdy spruce wood and engineered to be assembled in your room or area of choice. Covered in the fabric of your choice and style you prefer….

#10 Custom Metal Bed Frames

Domain Est. 2016

Expert Sourcing Insights for Metal And Wood Bed Frame

H2: 2026 Market Trends for Metal and Wood Bed Frames

The global market for metal and wood bed frames is poised for significant transformation by 2026, driven by evolving consumer preferences, sustainability concerns, technological innovations, and shifts in global supply chains. This analysis explores key trends expected to shape the industry in the coming years.

1. Rising Demand for Sustainable and Eco-Friendly Materials

Environmental consciousness is increasingly influencing furniture purchasing decisions. Consumers are favoring wood bed frames made from sustainably sourced hardwoods like solid oak, maple, and bamboo, often certified by organizations such as FSC (Forest Stewardship Council). Similarly, metal bed frames are seeing a shift toward recycled steel and aluminum to reduce carbon footprints. By 2026, brands emphasizing eco-certifications and transparent sourcing are expected to gain substantial market share.

2. Growth of Hybrid Metal-Wood Designs

A growing trend is the fusion of metal and wood in bed frame construction, combining the durability of metal with the aesthetic warmth of wood. These hybrid designs cater to modern minimalist, industrial, and Scandinavian interior styles. Manufacturers are investing in innovative joinery techniques and modular designs, allowing for easier assembly and customization. This trend is expected to appeal to urban millennials and Gen Z consumers who value both style and functionality.

3. E-Commerce and Direct-to-Consumer (DTC) Expansion

Online retail continues to dominate furniture sales, with more consumers purchasing bed frames through e-commerce platforms and DTC brands. Companies like Floyd, Burrow, and Avocado are leading the charge with flat-pack designs, augmented reality (AR) visualization tools, and fast shipping options. By 2026, seamless online experiences—coupled with strong return policies and customer reviews—will be critical for market success.

4. Smart Bed Frame Integration

Although still niche, the integration of smart technology into bed frames—such as adjustable bases, built-in USB charging, under-bed lighting, and motion sensors—is gaining traction. While primarily associated with upholstered or high-tech models, metal frames are especially conducive to such integrations due to their structural strength. As smart home ecosystems expand, metal and hybrid frames may increasingly incorporate IoT-enabled features by 2026.

5. Regional Market Diversification

North America and Europe remain dominant markets, but Asia-Pacific (particularly China, India, and Southeast Asia) is expected to experience rapid growth due to urbanization, rising disposable incomes, and expanding e-commerce infrastructure. Localized designs that cater to regional sleeping habits (e.g., low-profile frames in Japan or larger sizes in the U.S.) will be crucial for global brands.

6. Supply Chain Resilience and Local Manufacturing

Ongoing geopolitical tensions and post-pandemic supply chain disruptions have prompted manufacturers to reshore or nearshore production. By 2026, increased investment in local manufacturing—especially in North America and Europe—is expected to reduce lead times and enhance responsiveness to market demands. This shift also supports sustainability goals by reducing transportation emissions.

7. Customization and Personalization

Consumers are increasingly seeking personalized furniture that reflects their style and space requirements. Customizable options—such as choice of wood finish, metal color, size, and storage integration—are becoming standard offerings. Digital configurators on brand websites allow users to design their ideal bed frame, enhancing engagement and reducing returns.

Conclusion

By 2026, the metal and wood bed frame market will be shaped by sustainability, innovation, digital transformation, and regional adaptation. Companies that embrace eco-conscious materials, hybrid designs, e-commerce agility, and customer-centric customization will be best positioned to thrive in an increasingly competitive landscape.

Common Pitfalls When Sourcing Metal and Wood Bed Frames (Quality, Intellectual Property)

Sourcing metal and wood bed frames from manufacturers—especially overseas—can be cost-effective, but it comes with several risks related to quality control and intellectual property (IP) protection. Being aware of these pitfalls can help buyers avoid costly mistakes and protect their business interests.

Poor Material Quality and Substitutions

One of the most frequent issues is receiving bed frames made with inferior materials than specified. Suppliers may substitute lower-grade wood (such as particleboard instead of solid hardwood) or thinner-gauge metal to reduce costs. These substitutions compromise durability, safety, and aesthetics. Without clear specifications and on-site inspections, it’s easy to overlook material discrepancies until after shipment.

Inconsistent Craftsmanship and Finish

Even when the correct materials are used, inconsistent welding, uneven wood staining, or poor joinery can degrade product quality. Small manufacturers may lack standardized production processes, leading to variability between batches. This inconsistency harms brand reputation and increases return rates.

Lack of Structural Integrity Testing

Many sourced bed frames have not undergone rigorous load or stress testing. Without proper engineering validation, frames may fail under normal use, posing safety risks and potential liability. Buyers often assume compliance with safety standards, but verification through third-party testing is essential.

Inadequate or Missing Certifications

Reputable wood and metal furniture should meet specific safety and environmental standards (e.g., CARB for wood, ASTM for structural safety). Suppliers may claim compliance without valid certification. Sourcing without verifying documentation can lead to customs delays, recalls, or legal issues in target markets.

Intellectual Property Infringement Risks

Designs for bed frames—especially unique combinations of metal and wood—can be protected under design patents or copyrights. Sourcing from manufacturers who copy branded or patented designs exposes buyers to IP litigation. Even unintentional infringement can result in seized shipments or lawsuits.

Unprotected Design Disclosure

When sharing custom designs with suppliers for production, there is a risk of design theft. Without non-disclosure agreements (NDAs) or IP assignment clauses in contracts, manufacturers may sell the design to competitors or produce knock-offs independently.

Limited Recourse in Case of Disputes

International sourcing often means limited legal recourse if quality issues or IP violations occur. Jurisdictional challenges, language barriers, and lack of enforceable contracts make it difficult to hold suppliers accountable, especially in regions with weak IP enforcement.

Conclusion

To mitigate these risks, buyers should conduct thorough due diligence, require material certifications, perform pre-shipment inspections, and secure legal protections for their designs. Partnering with reputable suppliers and using third-party quality auditors can significantly reduce the likelihood of encountering these common pitfalls.

Logistics & Compliance Guide for Metal and Wood Bed Frames

Product Classification and Harmonized System (HS) Codes

Identify the correct HS code for accurate customs clearance and tariff assessment. Metal and wood bed frames typically fall under:

– HS Code 9403.20: For wooden bed frames

– HS Code 9403.50: For metal bed frames

Confirm with local customs authorities, as sub-classifications may vary by country and material composition.

Packaging and Transportation Requirements

Ensure bed frames are securely packaged to prevent damage during transit:

– Use edge protectors, corner guards, and shrink-wrapping for metal frames.

– Wooden frames should be wrapped in protective film and palletized.

– Use sturdy corrugated cardboard or wooden crates for export shipments.

– Securely fasten components to prevent shifting during transport.

Weight, Dimensions, and Load Capacity

Adhere to standard freight and handling limits:

– Clearly label each unit with gross weight and dimensions (L x W x H).

– Ensure packaging supports stacking without collapse (max stack height: typically 5–6 layers).

– Confirm load capacity meets safety standards (e.g., ASTM F1561 or EN 1725).

Import/Export Documentation

Prepare and maintain the following for international shipments:

– Commercial invoice

– Packing list

– Bill of lading (B/L) or air waybill (AWB)

– Certificate of origin

– Import/export licenses (if required by destination country)

Regulatory Compliance

Meet safety and environmental standards in target markets:

– United States: Comply with CPSC regulations under ASTM F1561 (residential bed rails and frames).

– European Union: Conform to EN 1725 (furniture – beds and mattresses – safety requirements and test methods).

– Canada: Follow Health Canada’s requirements under the Furniture Improvement Regulations.

– Chemical Compliance: Ensure wood components meet CARB Phase 2 (U.S.) or REACH (EU) for formaldehyde emissions.

– FSC or PEFC Certification: Required if marketing wood as sustainably sourced.

Labeling and Marking

Include mandatory labels on product or packaging:

– Country of origin (e.g., “Made in Vietnam”)

– Manufacturer/importer name and address

– Model number and batch/lot number

– Weight capacity rating

– Care and assembly instructions

– Safety warnings (e.g., “Do not jump on bed”)

Customs Duties and Tariffs

Research applicable duties based on destination:

– Duties vary by country and material (e.g., wood may attract higher tariffs or anti-dumping measures).

– Leverage Free Trade Agreements (e.g., USMCA, ASEAN) where applicable to reduce tariffs.

– Monitor changes in trade policies affecting steel, aluminum, or timber products.

Environmental and Sustainability Regulations

Address eco-compliance for wood and metal sourcing:

– Prohibit use of endangered wood species (CITES-listed).

– Comply with EU Timber Regulation (EUTR) requiring due diligence for imported wood.

– Recyclability: Label metal components as recyclable; provide disassembly instructions.

Transportation Mode Selection

Choose appropriate freight method based on volume and urgency:

– Ocean Freight: Best for large container loads (FCL/LCL); cost-effective for bulk shipments.

– Air Freight: Suitable for urgent, low-volume orders; higher cost.

– Ground Transport: Ideal for regional distribution (e.g., cross-border within North America or EU).

Warehousing and Inventory Management

Optimize storage conditions:

– Store in dry, climate-controlled environments to prevent warping (wood) or rust (metal).

– Use racking systems designed for long, bulky items.

– Implement FIFO (First In, First Out) to manage stock rotation.

Product Recalls and Liability

Establish a recall protocol in case of non-compliance or safety issues:

– Maintain traceability via batch/lot numbers.

– Register with national product safety authorities (e.g., CPSC, RAPEX).

– Carry product liability insurance covering defects and injuries.

Final Inspection and Quality Control

Conduct pre-shipment inspections to ensure compliance:

– Verify structural integrity, finish quality, and correct labeling.

– Test for compliance with strength and stability standards.

– Use third-party inspectors (e.g., SGS, Intertek) for high-volume exports.

By following this guide, manufacturers, importers, and distributors can ensure smooth logistics operations and full regulatory compliance for metal and wood bed frames across global markets.

In conclusion, sourcing a bed frame made from metal or wood involves evaluating several factors including durability, aesthetics, cost, sustainability, and maintenance. Metal bed frames offer strength, longevity, and a modern or industrial look, making them ideal for high-use environments or minimalist designs. They are often lighter and more resistant to pests, though they may be prone to noise or rust over time. On the other hand, wooden bed frames provide warmth, timeless appeal, and sturdiness, with the added benefit of being eco-friendly when sourced from sustainable forests. They tend to be heavier and may require more maintenance, but offer greater design versatility.

The choice between metal and wood ultimately depends on personal preference, bedroom style, budget, and environmental considerations. Sourcing from reputable suppliers who prioritize quality materials and ethical production practices ensures longevity and value for money. Whether opting for the sleek resilience of metal or the natural elegance of wood, a well-chosen bed frame serves as both a functional foundation and a key design element in the bedroom.