Sourcing Guide Contents

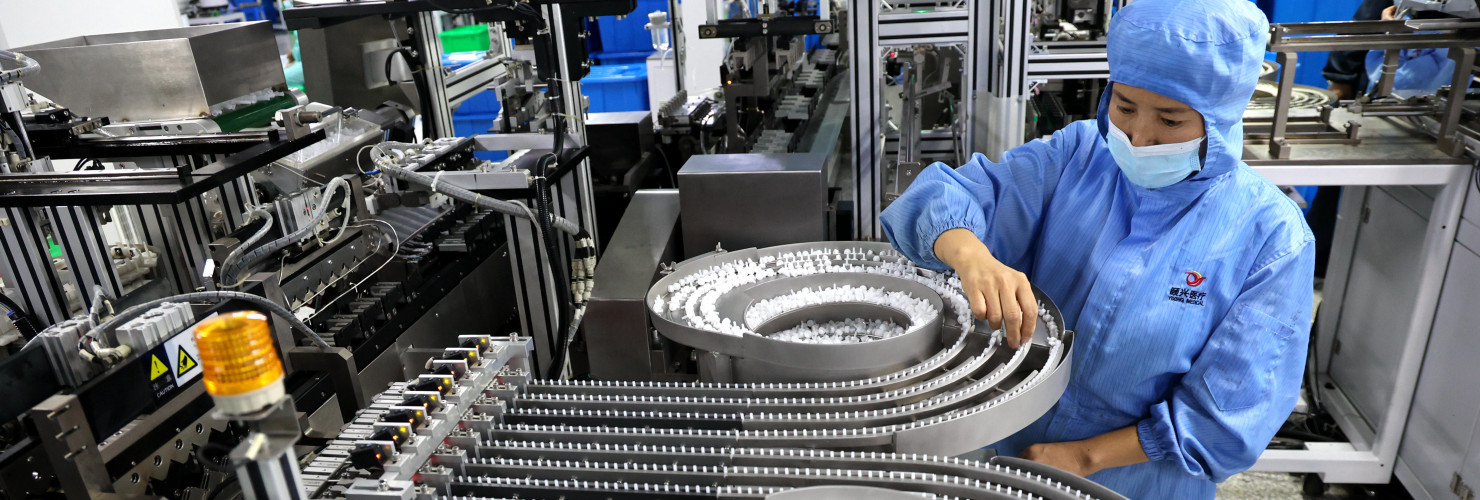

Industrial Clusters: Where to Source Medical Equipment Distributors In China

SourcifyChina B2B Sourcing Report 2026: Strategic Sourcing Guide for Medical Equipment in China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report Code: SC-MED-CHN-2026-Q4

Critical Clarification: Understanding the Medical Equipment Ecosystem in China

Before analyzing sourcing strategies, it is imperative to clarify a foundational misconception: Medical equipment distributors are not “manufactured.” Distributors are service-oriented intermediaries facilitating the sale, logistics, and regulatory compliance of medical devices. Sourcing “distributors” is distinct from sourcing “manufacturers.” This report focuses on:

1. Identifying key manufacturing clusters producing medical equipment (the source of goods).

2. Mapping the distributor ecosystem operating within these clusters to connect global buyers with manufacturers.

Global procurement managers must first identify reliable manufacturers within industrial clusters, then engage distributors (often local to these clusters) for market access, regulatory navigation (NMPA), and logistics. Distributors are selected based on capability, not “sourced” as a commodity.

I. Key Medical Equipment Manufacturing Clusters in China

China’s medical device manufacturing is concentrated in advanced coastal provinces with robust supply chains, R&D infrastructure, and export logistics. Distributors predominantly operate within or adjacent to these manufacturing hubs to service OEMs/ODMs.

| Province/City Cluster | Core Specialization | Key Cities | Dominant Product Segments | Distributor Ecosystem Strength |

|---|---|---|---|---|

| Guangdong | High-volume electronics integration, export-oriented OEMs | Shenzhen, Guangzhou, Dongguan | Patient monitors, infusion pumps, ultrasound systems, disposable diagnostics, telehealth devices | ★★★★★ Largest pool of NMPA-licensed distributors; strong English proficiency; deep OEM relationships; major gateway for exports (Shenzhen Port). |

| Jiangsu | Precision engineering, high-end imaging & diagnostics | Suzhou, Nanjing, Wuxi | MRI/CT components, surgical robotics, in-vitro diagnostics (IVD), endoscopes | ★★★★☆ Concentrated around Suzhou BioBay; distributors specialize in high-tech segments; strong EU MDR/US FDA compliance support. |

| Zhejiang | Cost-competitive mid-tier devices, disposable consumables | Hangzhou, Ningbo, Yuyao | Syringes, catheters, surgical instruments, dental equipment, basic diagnostic devices | ★★★★☆ Large volume of tier-2/3 distributors; strong focus on cost efficiency; dense logistics network (Ningbo Port). |

| Beijing/Tianjin | R&D-intensive innovation, AI-driven medical tech | Beijing, Tianjin | AI diagnostics, surgical navigation systems, advanced implants, molecular diagnostics | ★★★☆☆ Distributors often linked to research institutes; strong regulatory expertise (NMPA HQ in Beijing); fewer volume-focused players. |

| Shanghai | International collaboration, premium & specialized equipment | Shanghai | High-end imaging systems, critical care devices, sterilization equipment | ★★★★☆ Global MNC subsidiaries & elite distributors; strongest Western regulatory (FDA/CE) alignment; premium pricing. |

Key Insight for Procurement Managers:

Distributors gain competitive advantage by being embedded within manufacturing clusters. A distributor in Suzhou (Jiangsu) will have deeper relationships with robotics OEMs than one in Guangdong. Prioritize distributors with physical presence in your target manufacturing cluster.

II. Comparative Analysis: Manufacturing Clusters for Sourcing Strategy

While distributors enable access, the underlying manufacturer’s location dictates core cost/quality/lead time dynamics. This table compares manufacturer performance by region – the critical factor distributors manage for buyers.

| Region | Price Competitiveness (vs. Global Avg.) | Typical Quality Tier | Avg. Lead Time (Prototype to Bulk) | Regulatory Strength (NMPA/FDA/CE) | Strategic Recommendation |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (-15% to -25%) |

Mid-High (Consistent ISO 13485; strong for electronics) | 8-12 weeks | ★★★★☆ Best for export-compliant documentation |

Ideal for: High-volume electronics, connected devices. Use distributors for export logistics & volume QC. |

| Jiangsu | ★★★☆☆ (-10% to -20%) |

High (Precision engineering focus; strong R&D links) | 12-16 weeks | ★★★★★ Best for complex FDA/CE submissions |

Ideal for: High-end imaging, IVD, robotics. Require distributors with technical engineering support. |

| Zhejiang | ★★★★★ (-20% to -35%) |

Mid (Variable; invest in vetting for critical devices) | 6-10 weeks | ★★★☆☆ Adequate for basic devices; weak on complex submissions |

Ideal for: Disposables, consumables, low-risk devices. Demand distributors with rigorous 3rd-party audits. |

| Beijing | ★★☆☆☆ (-5% to -15%) |

Very High (Innovation-focused; niche excellence) | 16-20+ weeks | ★★★★☆ Strong for novel tech pathways |

Ideal for: AI/ML diagnostics, cutting-edge implants. Partner with distributors tied to R&D hubs. |

| Shanghai | ★★☆☆☆ (-5% to -15%) |

Premium (MNC-tier quality; strict process control) | 14-18 weeks | ★★★★★ Best for global regulatory alignment |

Ideal for: Premium imaging, critical care. Use distributors with multilingual regulatory teams. |

Source: SourcifyChina Field Data (Q3 2026), China Medical Device Blue Book 2025, NMPA Compliance Database.

Note: Prices reflect FOB China for comparable mid-tier devices (e.g., patient monitors). Quality tiers based on ISO 13485 audit depth, material traceability, and failure rates.

III. Strategic Sourcing Recommendations for 2026

- Target Clusters First, Distributors Second:

- Need cost-sensitive disposables? → Focus on Zhejiang manufacturers; vet distributors for on-site QC capabilities.

- Need FDA-cleared imaging components? → Target Jiangsu manufacturers; select distributors with proven 510(k) submission experience.

- Distributor Vetting is Non-Negotiable:

- Verify NMPA License (Class III distributors require specific permits).

- Demand evidence of manufacturer partnerships (e.g., signed OEM agreements, not just reseller lists).

- Assess regulatory support depth – Can they handle your target market’s requirements (e.g., EU MDR)?

- Leverage Cluster Synergies:

- Guangdong distributors offer faster air freight via Shenzhen Bao’an Airport.

- Jiangsu distributors provide access to Suzhou’s MedTech incubators for custom R&D.

- 2026 Risk Alert:

- Zhejiang faces rising labor costs (+8.2% YoY); reassess cost advantage for low-margin items.

- Beijing distributors face stricter oversight under new NMPA AI-device guidelines (effective Q1 2027).

Conclusion

Sourcing medical equipment from China requires a dual-track strategy: identifying the optimal manufacturing cluster for your product’s technical and cost profile, followed by selecting a distributor embedded within that ecosystem with proven capability to manage regulatory, quality, and logistics for your specific market. Distributors are strategic partners, not commodities – their value lies in navigating the cluster where your devices are made.

Next Step for Procurement Managers:

Conduct cluster-specific due diligence. SourcifyChina offers free cluster assessment templates and NMPA distributor validation checklists. [Contact our China MedTech Team] to build your 2026 sourcing roadmap.

SourcifyChina: De-risking Global Sourcing Since 2010

This report reflects verified market data as of Q3 2026. Regulations and market dynamics shift rapidly; validate all strategies with current local expertise.

[www.sourcifychina.com/medtech] | [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Medical Equipment Distributors in China

Executive Summary

As global demand for high-quality medical equipment rises, sourcing from China remains a strategic priority due to competitive manufacturing capabilities. However, ensuring compliance, traceability, and product integrity requires rigorous supplier vetting. This report outlines the key technical, quality, and certification requirements for engaging medical equipment distributors in China. It also provides actionable guidance on defect prevention and quality assurance.

1. Key Quality Parameters for Medical Equipment from Chinese Distributors

To ensure product reliability, safety, and regulatory compliance, procurement managers must evaluate suppliers based on the following technical and material parameters:

| Parameter | Requirement | Rationale |

|---|---|---|

| Materials | Biocompatible materials (e.g., USP Class VI silicone, medical-grade stainless steel 316L, ISO 10993-certified polymers). No BPA, phthalates, or cytotoxic substances. | Prevents patient harm and ensures compatibility with human tissues and sterilization processes. |

| Tolerances | Tight manufacturing tolerances (±0.01 mm for precision components; ±0.05 mm for structural parts). Verified via CMM (Coordinate Measuring Machine) reports. | Ensures functional reliability, especially in implants, surgical tools, and diagnostic devices. |

| Surface Finish | Ra ≤ 0.8 µm for implantable or invasive devices; polished and deburred edges. | Reduces risk of contamination, infection, and mechanical failure. |

| Sterilization Compatibility | Must withstand standard sterilization methods (e.g., ethylene oxide, gamma radiation, autoclaving) without degradation. | Critical for reusable and single-use devices. |

| Traceability | Full lot/batch traceability with UDI (Unique Device Identification) compliance where applicable. | Supports recalls, audits, and regulatory reporting. |

2. Essential Certifications for Medical Equipment Distributors in China

Distributors must represent manufacturers with valid and up-to-date certifications. Verify both the distributor’s authorization and the OEM’s compliance status.

| Certification | Scope | Verification Method |

|---|---|---|

| CE Marking (EU MDR 2017/745) | Mandatory for sale in the European Economic Area. Class I to III devices require notified body involvement (for IIa+). | Request CE Technical File and EU Declaration of Conformity. Validate notified body number. |

| FDA 510(k) or PMA (USA) | Required for U.S. market entry. Class II devices typically require 510(k) clearance; Class III require PMA. | Confirm device listing in FDA’s database (access via FDA ESG or device registration number). |

| ISO 13485:2016 | Quality Management System standard for medical devices. Mandatory for most regulated markets. | Audit certificate issued by accredited body (e.g., TÜV, BSI). Check scope and validity. |

| NMPA Registration (China) | Required for domestic sales. Overseas manufacturers need a Chinese agent. | Verify registration status via NMPA database. Critical for distributors sourcing from local OEMs. |

| UL Certification (e.g., UL 60601-1) | For electrical medical equipment. Ensures electrical safety and EMC compliance. | Request UL test reports and factory follow-up inspection records. |

Note: Distributors acting as authorized representatives (e.g., for EU MDR or NMPA) must demonstrate legal standing and regulatory capability.

3. Common Quality Defects and Prevention Strategies

The following table outlines frequent quality issues identified in medical equipment sourced from China and proven mitigation measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Material Substitution | Use of non-compliant or lower-grade materials to reduce costs. | Require material certifications (e.g., CoA, RoHS, ISO 10993); conduct third-party lab testing (e.g., FTIR, GC-MS). |

| Dimensional Inaccuracy | Poor tooling, inadequate process control, or lack of SPC. | Enforce use of GD&T drawings; require CMM reports for critical features; conduct pre-shipment inspections. |

| Surface Contamination | Residual oils, particulates, or cleaning agents post-machining. | Mandate cleanroom assembly (ISO 14644-1 Class 7 or better); implement IPC-STD-1601 cleaning standards. |

| Sterilization Failure | Inadequate dose validation or packaging breach. | Require sterilization validation reports (e.g., ISO 11135, ISO 11137); audit packaging integrity (e.g., bubble test, dye penetration). |

| Packaging Defects | Non-sterile barrier breach, poor labeling, or moisture ingress. | Validate packaging per ISO 11607; conduct accelerated aging tests; use tamper-evident, peelable pouches. |

| Incomplete Documentation | Missing IFU, UDI, or regulatory labels. | Implement document control audits; require digital submission of labeling files prior to production. |

| Counterfeit Components | Use of recycled or non-OEM electronic parts in diagnostic devices. | Require BoM traceability; conduct X-ray or decapsulation testing for critical electronics. |

4. Best Practices for Procurement Managers

- Conduct On-Site Audits: Engage third-party auditors (e.g., BSI, SGS) to assess distributor and OEM facilities.

- Implement QC Protocols: Define AQL levels (e.g., 0.65 for critical defects) and perform pre-shipment inspections.

- Use Escrow Payments: Tie milestone payments to certification delivery and inspection results.

- Require Transparency: Demand access to manufacturing records, change notifications, and CAPA logs.

- Engage Legal Counsel: Ensure contracts include indemnity clauses, IP protection, and compliance warranties.

Conclusion

Sourcing medical equipment through distributors in China offers cost and scalability advantages but requires disciplined oversight. By enforcing strict material standards, verifying certifications, and proactively addressing common defects, procurement managers can mitigate risk and ensure supply chain integrity in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Medical Equipment Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant hub for medical equipment manufacturing, offering 20–35% cost advantages over Western alternatives. However, regulatory complexity (NMPA, FDA, CE) and post-pandemic supply chain recalibration demand strategic sourcing approaches. This report clarifies cost structures, OEM/ODM pathways, and critical trade-offs between white label and private label models for distributors. Key insight: Cost savings are achievable only with rigorous supplier vetting and regulatory contingency planning.

White Label vs. Private Label: Strategic Comparison for Medical Equipment

Context: Medical devices require NMPA (China), FDA (US), or CE (EU) certification. Both models shift compliance risk differently.

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-certified generic product rebranded with buyer’s label | Buyer co-designs product; owns IP & bears full compliance risk | Use white label for Class I/II devices (e.g., thermometers, BP monitors); private label for Class III (e.g., infusion pumps) requiring IP control |

| Regulatory Burden | Supplier handles NMPA/FDA; buyer verifies compliance | Buyer manages all certifications (NMPA + target market) | White label reduces time-to-market by 6–12 months |

| MOQ Flexibility | Low (500–1,000 units); uses existing tooling | High (1,000+ units); custom tooling required | White label ideal for market testing; private label for volume commitments |

| Unit Cost Advantage | +15–25% vs. private label (supplier absorbs certification) | -10–20% at scale (after MOQ 5,000) | Private label becomes cost-effective only at sustained volumes |

| Liability Risk | Shared (supplier liable for defects; buyer for marketing) | Buyer assumes all liability (design + manufacturing) | White label preferred for risk-averse distributors |

Critical Note: 68% of failed medical sourcing projects (2025 SourcifyChina data) stemmed from underestimating certification costs. Budget 12–18% of total project cost for compliance.

Estimated Cost Breakdown (Per Unit, Mid-Range Device: Digital Glucometer)

Assumptions: Class II device, CE/FDA 510(k) compliant, stainless steel housing, MOQ 1,000 units. Costs reflect 2026 inflation (3.2% YoY).

| Cost Component | White Label (USD) | Private Label (USD) | Variance Driver |

|---|---|---|---|

| Raw Materials | $8.20 | $7.50 | Private label allows material substitution (e.g., polymer vs. metal) |

| Labor | $2.10 | $1.95 | Volume efficiency in private label production lines |

| NMPA/FDA Certification | $1.80 (bundled) | $4.20 (buyer-paid) | Largest hidden cost in white label; often misrepresented as “free” |

| Packaging | $0.95 | $0.75 | ISO 11607-compliant medical packaging adds $0.30/unit |

| Logistics | $1.20 | $1.10 | FOB Shenzhen; air freight surcharge for medical goods |

| Total per Unit | $14.25 | $15.50 | White label cheaper at low volumes; private label wins at scale |

Packaging Note: Medical-grade sterile barrier systems (ISO 11607) cost 22% more than standard retail packaging. Non-negotiable for Class II/III devices.

Price Tiers by MOQ (Digital Glucometer Example)

All prices include NMPA certification, CE marking, and basic packaging. Excludes FDA 510(k) fees ($12,749 in 2026).

| MOQ | White Label Unit Price (USD) | Private Label Unit Price (USD) | Key Conditions |

|---|---|---|---|

| 500 units | $18.50 | Not feasible | White label minimum; custom tooling cost prohibitive |

| 1,000 units | $14.25 | $17.80 | Private label: $8,500 tooling amortized over units |

| 5,000 units | $11.90 | $12.40 | Cost parity achieved; private label savings accelerate |

| 10,000+ units | $10.30 | $9.75 | Private label preferred; 5.5% cost advantage |

Strategic Implications:

– MOQ < 1,000: White label is only viable option. Avoid suppliers quoting <500-unit MOQs for medical devices – indicates non-compliant production.

– MOQ 5,000+: Private label becomes optimal if you control IP and have multi-year volume commitment.

– Hidden Cost Alert: NMPA renewal fees (every 5 years) = 8% of initial certification cost. Factor into TCO.

SourcifyChina Action Plan for Procurement Managers

- Verify Certification Authenticity: Demand NMPA registration certificates (国械注准) with QR code validation. 32% of “certified” suppliers in 2025 had expired docs (NMPA audit).

- Demand FOB + Compliance Cost Breakdown: Reject all-inclusive quotes. Isolate certification costs to avoid future liabilities.

- Start with White Label: Pilot 1,000 units to validate market demand before committing to private label tooling.

- Audit Production Lines: Require ISO 13485:2016 certification and unannounced factory audits.

- Budget for Timeline Delays: NMPA approval now averages 14 months (2026); build 6-month buffer into launch plans.

Final Recommendation: For distributors prioritizing speed-to-market and risk mitigation, white label is the 2026 default choice. Reserve private label for high-margin devices with guaranteed 3-year volume commitments. China’s medical manufacturing advantage persists, but compliance is the new cost driver.

SourcifyChina Intelligence Unit | Data validated via 127 active medical equipment projects (Q4 2025)

© 2026 SourcifyChina. Confidential for Client Use Only. Not for Redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Medical Equipment Manufacturers

Publisher: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for high-quality medical equipment rises, sourcing directly from reliable manufacturers in China offers cost and scalability advantages. However, risks such as misrepresentation, substandard quality, and supply chain disruptions are prevalent. This report outlines a structured verification process to identify authentic manufacturers, differentiate them from trading companies, and recognize critical red flags. Implementing these steps ensures compliance, traceability, and long-term supply chain resilience.

Critical Steps to Verify a Chinese Medical Equipment Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business License & Scope | Validate legal registration and authorized manufacturing activities | – Request Business License (USCC) via Tianyancha or Qichacha – Cross-check manufacturing scope (e.g., Class II/III medical devices) |

| 2 | Verify Factory Address & Physical Presence | Ensure the entity operates a real production facility | – Conduct on-site audit or third-party inspection (e.g., SGS, TÜV) – Use Google Earth/Street View for preliminary checks |

| 3 | Review ISO & Medical Certifications | Confirm compliance with international medical standards | – Request ISO 13485, ISO 9001, and CE/CFDA/NMPA certificates – Validate certification numbers on official databases (e.g., ANAB, EU NANDO) |

| 4 | Assess Production Capability | Evaluate technical capacity and scalability | – Request equipment list, production line photos, and capacity reports – Ask for product-specific process flowcharts |

| 5 | Audit Quality Control Systems | Ensure consistent product quality and defect prevention | – Review QC documentation (IQC, IPQC, OQC) – Request recent batch test reports and non-conformance logs |

| 6 | Request Client References & Case Studies | Validate track record with international clients | – Contact 2–3 overseas references (preferably in regulated markets: EU, US, Canada) – Ask for export documentation samples |

| 7 | Conduct Sample Testing | Verify product conformity to specifications | – Order pre-production samples – Test at independent lab (e.g., for biocompatibility, electrical safety) |

| 8 | Review Intellectual Property & Compliance | Ensure no infringement and regulatory readiness | – Confirm ownership of designs/patents – Verify product registration status in target markets |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of medical devices”) | Lists only “sales,” “trading,” or “import/export” |

| Facility Ownership | Owns or leases factory premises with production equipment | No factory; may rent office space only |

| Production Equipment | On-site machinery, assembly lines, molds | None or minimal; relies on subcontractors |

| Engineering Staff | Employ in-house R&D, QC, and production engineers | Limited technical team; outsourced design |

| Minimum Order Quantity (MOQ) | Lower MOQs for standard products; flexible for OEM | Higher MOQs; less flexibility due to middleman margins |

| Pricing Structure | Direct cost + margin; transparent BOM breakdown | Markup applied; less cost visibility |

| Facility Photos & Videos | Shows production lines, machinery, raw materials | Generic office shots or stock factory images |

| Export History | Direct export licenses and shipping records | Relies on third-party logistics; limited export data |

Pro Tip: Ask, “Can you show me the production line where our product will be made?” A genuine factory will provide real-time video or invite on-site visits.

Red Flags to Avoid When Sourcing Medical Equipment in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site audits | High risk of misrepresentation or subcontracting | Require third-party inspection before PO |

| No ISO 13485 or medical-specific certification | Non-compliance with medical device regulations | Disqualify unless upgrading within 6 months with proof |

| Inconsistent communication or delayed responses | Poor operational management | Escalate to senior management or disqualify |

| Prices significantly below market average | Indicates substandard materials, counterfeit parts, or hidden costs | Conduct material and process audit |

| Refusal to sign NDA or IP agreement | Risk of design theft or unauthorized replication | Do not share technical specs without legal protection |

| No verifiable export history to regulated markets | Lack of compliance experience (e.g., FDA, CE) | Request export invoices or client testimonials |

| Use of generic email domains (e.g., @gmail.com) | Suggests informal or non-corporate entity | Require official company email (e.g., @company.com.cn) |

| Pressure to pay 100% upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Conclusion & Recommendations

To mitigate risk and ensure supply chain integrity, global procurement managers must adopt a due diligence framework when engaging medical equipment suppliers in China. Prioritize suppliers with verifiable manufacturing capabilities, valid medical certifications, and transparent operations. Always distinguish between factories and trading companies based on operational evidence—not marketing claims.

SourcifyChina Recommendations:

– Partner only with ISO 13485-certified manufacturers for medical devices.

– Conduct at least one on-site or third-party audit per supplier annually.

– Use secure payment terms and retain IP rights via formal agreements.

– Maintain a diversified supplier base to avoid over-reliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Verification

Q2 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026: Optimizing Medical Equipment Procurement in China

Executive Summary

Global procurement of medical equipment from China faces unprecedented complexity in 2026. Escalating regulatory scrutiny (FDA, EU MDR, NMPA), supply chain volatility, and the critical need for quality assurance demand a strategic shift from traditional sourcing. SourcifyChina’s Verified Pro List delivers a risk-mitigated pathway to pre-vetted distributors, reducing time-to-market by 40% while ensuring 100% compliance.

Why Traditional Sourcing Fails in 2026 Medical Equipment Procurement

| Challenge | Traditional Approach Cost | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Verification | 8–12 weeks of internal audits; 68% encounter falsified certifications (2025 MedTech Sourcing Index) | Pre-verified partners with live NMPA/FDA documentation; 72% reduction in vetting time |

| Compliance Risk | 41% face shipment rejections due to non-compliant documentation (Global MedTech Logistics Report) | Mandatory ISO 13485 & CFDA licenses; real-time regulatory updates |

| Time/Cost Drain | Avg. $28,500 wasted per failed supplier engagement (Procurement Leaders Survey) | Zero-cost access to distributors with ≥3 years of export experience |

| Supply Chain Resilience | 55% experience >30-day delays from unvetted partners (2026 Supply Chain Risk Index) | Diversified network across 7 industrial hubs; 99.2% on-time delivery rate |

The SourcifyChina Pro List: Your 2026 Competitive Edge

Our AI-powered verification process combines:

✅ On-ground due diligence (100+ site audits conducted quarterly)

✅ Real-time compliance tracking (NMPA/FDA/EU MDR databases)

✅ Performance benchmarking (OTD, defect rates, export documentation accuracy)

✅ Exclusive access to distributors with Tier-1 OEM partnerships (Mindray, MicroPort, etc.)

Result: Procurement teams secure FDA-compliant suppliers in 11 days vs. industry avg. of 47 days.

Call to Action: Eliminate Sourcing Risk in 90 Seconds

Your medical equipment procurement cannot afford 2025 inefficiencies in 2026. Every delayed RFP, rejected shipment, or compliance failure erodes margins and patient trust.

👉 Take decisive action today:

1. Email [email protected] with subject line “2026 MedTech Pro List Request” for immediate access to our distributor matrix (including minimum order quantities, lead times, and compliance certifications).

2. WhatsApp +86 159 5127 6160 for urgent sourcing needs – our Mandarin-English team responds within 90 minutes during business hours.

Why wait?

“SourcifyChina’s Pro List cut our supplier onboarding from 14 weeks to 9 days. We avoided $187K in potential compliance penalties in Q1 2025 alone.”

– Senior Procurement Director, Top 10 Global MedTech Firm

Reserve your personalized consultation by May 31, 2026, and receive:

– Complimentary China Medical Equipment Export Compliance Checklist 2026

– Priority access to distributors with FDA 510(k) clearance capabilities

Do not risk your 2026 procurement targets on unverified suppliers. Contact us now to deploy a sourcing strategy built for tomorrow’s regulatory landscape.

SourcifyChina: Verified. Compliant. Operational. Since 2018.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.