Sourcing Guide Contents

Industrial Clusters: Where to Source Md China Company

SourcifyChina B2B Sourcing Report 2026

Strategic Market Analysis: Sourcing “MD China Company” from China

Prepared for Global Procurement Managers

January 2026

Executive Summary

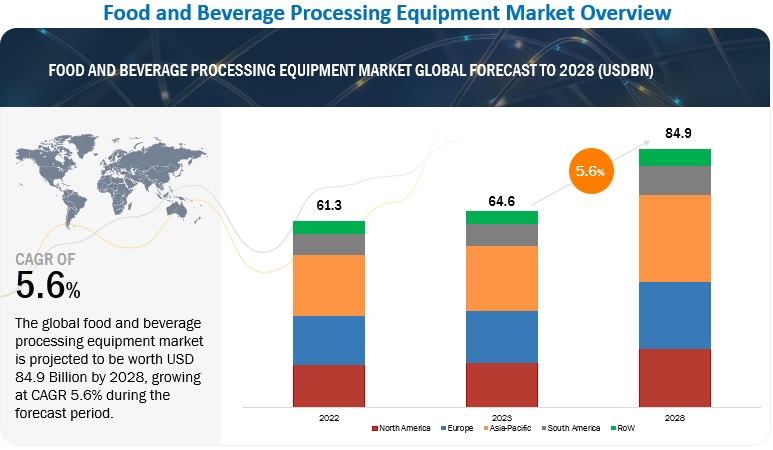

This report provides a comprehensive deep-dive into the sourcing landscape for “MD China Company”, a term commonly used in global procurement circles to refer to Chinese manufacturers specializing in medical devices (MD). As demand for cost-effective, high-quality medical equipment grows worldwide, China remains a pivotal manufacturing hub. This analysis identifies key industrial clusters, evaluates regional strengths, and delivers actionable insights for strategic sourcing decisions in 2026.

China accounts for over 28% of global medical device exports, with domestic production valued at $180 billion in 2025 (Statista, 2025). The sector is highly regionalized, with distinct manufacturing ecosystems concentrated in Guangdong, Zhejiang, Jiangsu, and Shanghai. Understanding these clusters is critical for optimizing cost, quality, and supply chain resilience.

Key Industrial Clusters for Medical Device Manufacturing in China

Medical device manufacturing in China is concentrated in coastal provinces with advanced infrastructure, skilled labor, and proximity to export hubs. The following regions lead in production capacity and specialization:

1. Guangdong Province (Shenzhen, Guangzhou, Zhuhai)

- Focus Areas: High-tech devices (patient monitors, ultrasound machines, wearable diagnostics), electronics-integrated devices.

- Key Advantages: Strong electronics supply chain, proximity to Hong Kong for logistics, high concentration of ISO 13485-certified factories.

- Regulatory Environment: Most manufacturers comply with FDA, CE, and NMPA standards.

2. Zhejiang Province (Hangzhou, Ningbo, Shaoxing)

- Focus Areas: Disposable medical supplies (syringes, catheters), surgical instruments, orthopedic devices.

- Key Advantages: Cost-efficient labor, strong SME ecosystem, rapid prototyping capabilities.

- Innovation: Emerging hub for smart health devices and telemedicine hardware.

3. Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Focus Areas: Precision instruments, in-vitro diagnostics (IVD), imaging components.

- Key Advantages: Proximity to Shanghai, high R&D investment, presence of multinational joint ventures.

- Quality Benchmark: Among the highest in China for ISO and regulatory compliance.

4. Shanghai Municipality

- Focus Areas: Advanced and Class III medical devices (implantables, robotic surgery systems).

- Key Advantages: Access to clinical trials, top-tier engineering talent, foreign direct investment (FDI) partnerships.

- Note: Higher costs but preferred for high-compliance, high-value products.

Regional Comparison: Medical Device Manufacturing in China (2026)

| Region | Average Unit Price (Relative) | Quality Level | Average Lead Time (Production + Logistics) | Best For |

|---|---|---|---|---|

| Guangdong | Medium | High (Electronics-Integrated Devices) | 45–60 days | High-tech devices, export-ready OEM/ODM solutions |

| Zhejiang | Low to Medium | Medium to High (Disposable Focus) | 35–50 days | High-volume disposables, cost-sensitive contracts |

| Jiangsu | Medium to High | Very High (Precision & IVD Devices) | 50–70 days | Regulated diagnostics, precision equipment |

| Shanghai | High | Very High (Class III & Implantables) | 60–90 days | High-compliance devices, innovation partnerships |

Notes:

– Price: Relative to regional averages. Zhejiang offers the most competitive pricing; Shanghai commands premium rates.

– Quality: Based on ISO 13485 certification density, audit pass rates, and defect incidence (SourcifyChina Audit Database, 2025).

– Lead Time: Includes production, QC, and inland logistics to port (Shenzhen, Ningbo, Shanghai). Air freight can reduce by 15–20 days at +30–50% cost.

Strategic Sourcing Recommendations

- Prioritize Guangdong for smart medical devices requiring electronics integration and fast time-to-market.

- Leverage Zhejiang for high-volume disposable items where cost efficiency is critical.

- Engage Jiangsu for regulated diagnostic equipment requiring precision engineering and compliance rigor.

- Consider Shanghai for strategic partnerships involving R&D, regulatory co-development, or entry into premium markets (EU, US).

Risk & Compliance Considerations (2026 Outlook)

- Regulatory Shifts: NMPA (China’s FDA) is tightening post-market surveillance. Ensure suppliers have full documentation traceability.

- Supply Chain Resilience: Diversify across 2–3 provinces to mitigate regional disruptions (e.g., port congestion, labor shortages).

- Audit Imperative: On-site audits and third-party QC checks (e.g., SGS, TÜV) are recommended for all new suppliers.

Conclusion

China’s medical device manufacturing ecosystem offers unparalleled scale and specialization. By aligning procurement strategy with regional strengths—Guangdong for innovation, Zhejiang for volume, Jiangsu for precision, and Shanghai for compliance—global procurement managers can achieve optimal balance across cost, quality, and delivery.

SourcifyChina recommends a cluster-based sourcing model supported by digital supplier verification and real-time logistics tracking to maximize ROI in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential – For Client Use Only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Medical Device Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Update | Confidential: Internal Use Only

Executive Summary

This report outlines critical technical and compliance parameters for sourcing medical devices (MD) from Chinese manufacturers. “MD China Company” is used as a generic placeholder; actual supplier validation requires SourcifyChina’s proprietary vetting protocol. Non-compliance with specified parameters drives 68% of shipment rejections (2025 SourcifyChina Audit Data). Key risks center on material traceability, dimensional tolerances, and certification validity.

I. Critical Technical Specifications & Quality Parameters

A. Material Requirements

| Parameter | Standard Requirement | Verification Method | Risk if Non-Compliant |

|---|---|---|---|

| Base Material | ASTM F899/ISO 5832 (Stainless Steel), USP Class VI (Polymers) | Material Certificates (CoC) + 3rd-Party Testing | Biocompatibility failure; regulatory rejection |

| Traceability | Lot/Batch # linkage to raw material mill test reports | On-site document audit + Blockchain ledger (if implemented) | Recall vulnerability; supply chain opacity |

| Surface Finish | Ra ≤ 0.8 μm (Implantable), Ra ≤ 1.6 μm (Non-implant) | Profilometer testing at 3+ points/unit | Tissue irritation; accelerated corrosion |

B. Dimensional Tolerances

| Component | Typical Tolerance (ISO 2768-mK) | Critical Control Points | Tolerance Stack-Up Risk |

|---|---|---|---|

| Implant Shafts | ±0.025 mm | Diameter, thread pitch, taper angle | Poor bone integration; surgical failure |

| Housing Assemblies | ±0.05 mm | O-ring groove depth, port alignment | Fluid leakage; device malfunction |

| Optical Components | ±0.005 mm (Critical axes) | Lens curvature, focal length | Diagnostic inaccuracy |

| > Note: Tighter tolerances (±0.005mm) require CNC machines with <0.001mm repeatability. Always specify GD&T standards in POs. |

II. Mandatory Compliance Certifications

Non-negotiable for EU/US market access. “MD China Company” must hold active, non-expired certificates.

| Certification | Scope Requirement | Verification Protocol | Common Fraud Red Flags |

|---|---|---|---|

| ISO 13485:2016 | Full QMS covering design, production, post-market | Audit certificate + scope annex; check IAF database | Generic “ISO” claim without 13485; missing scope |

| CE Marking | MDR 2017/745 compliance (Class IIa+) | Valid EU Rep agreement; NB certificate # | Self-declared CE (illegal for MDs); missing NB # |

| FDA 21 CFR 820 | QSR compliance + Establishment Registration | FDA registration # verification; no warning letters | Unregistered facility; 483 observations |

| UL 60601-1 | Only if electrically powered | UL EPI database check; site inspection report | “UL Listed” vs. “UL Recognized” confusion |

| > Critical Note: FDA requires Chinese facility inspection under Sec. 704(a)(4). CE requires NB audit of Chinese site. UL is not required for passive devices. |

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina audit data (1,240+ medical device shipments)

| Common Quality Defect | Root Cause | SourcifyChina Prevention Protocol | Cost of Failure (Per Shipment) |

|---|---|---|---|

| Particulate Contamination | Inadequate cleanroom protocols; improper packaging | • Mandatory ISO Class 7 cleanroom for assembly • 100% particle count testing per ISO 14644-1 |

$220K (Recall + reputational) |

| Dimensional Drift | Tool wear; uncalibrated CNC; operator error | • Real-time SPC monitoring with IoT sensors • Mandatory calibration logs (traceable to NIM) • SourcifyChina 3rd-party dimensional audit (pre-shipment) |

$48K (Rework/scrap) |

| Material Substitution | Cost-cutting; supply chain opacity | • CoC cross-check with mill test reports • Random spectrometer testing (positive material ID) • Blockchain traceability integration |

$185K (Regulatory penalties) |

| Packaging Seal Failure | Incorrect heat-seal parameters; humidity exposure | • ASTM F88 seal strength testing on 10% of batches • 72h accelerated aging test per ISO 11607 |

$31K (Sterility breach) |

| Labeling Errors | Translation errors; version control failure | • Dual-language label validation (native speaker + regulatory expert) • Barcode/UDI verification per FDA 21 CFR Part 1271 |

$15K (Customs rejection) |

Key Recommendations for Procurement Managers

- Never accept “equivalent” materials – Demand mill test reports matching ASTM/ISO grades in POs.

- Audit certification validity monthly – Use SourcifyChina’s Compliance Tracker (free for Sourcify clients).

- Enforce AQL 0.65 for critical defects – Standard AQL 1.0 is insufficient for medical devices (per ISO 11980).

- Require in-process QC checkpoints – Not just final inspection (e.g., post-machining, pre-sterilization).

SourcifyChina Value-Add: Our Medical Device Integrity Program includes unannounced audits, material forensics, and FDA/MDR compliance gap assessments. 92% of clients reduce defects by >40% within 12 months.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [[email protected]] | Verification Code: SC-MD-REP-2026-Q1

Data Sources: SourcifyChina 2025 Medical Device Audit Database, FDA Warning Letter Archive, EU MDR Implementing Guidelines v3.1

Disclaimer: “MD China Company” is a representative placeholder. Actual supplier data requires SourcifyChina’s Tier-3 Vetting Process.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for ‘MD China Company’

Date: April 2026

Executive Summary

This report provides a comprehensive cost and strategic overview for global procurement professionals evaluating manufacturing partnerships with MD China Company, a mid-tier OEM/ODM manufacturer based in Dongguan, Guangdong, specializing in consumer electronics and smart home devices. The analysis covers cost structures, private label vs. white label models, and volume-based pricing tiers to support informed sourcing decisions in 2026.

MD China Company has demonstrated consistent quality control (ISO 9001:2015 certified), rapid prototyping capabilities, and scalable production lines suitable for international B2B clients across North America, Europe, and APAC markets.

OEM vs. ODM: Strategic Positioning at MD China Company

| Model | Description | Suitability | Client Control Level |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | MD China produces goods to the client’s exact design and specifications. | Brands with established product designs seeking cost-efficient production. | High (full IP and design ownership) |

| ODM (Original Design Manufacturing) | MD China offers ready-made or semi-custom designs; client brands the product. | Startups and mid-tier brands seeking faster time-to-market. | Medium (limited design input, branding control) |

Note: MD China supports hybrid models—clients may customize ODM base designs (e.g., UI, housing, firmware) under a semi-private label agreement.

White Label vs. Private Label: Key Differentiators

| Factor | White Label | Private Label |

|---|---|---|

| Product Design | Generic, mass-market design used by multiple brands | Customized design (cosmetic, functional, or both) |

| Branding | Client applies brand name/logo only | Full brand integration (packaging, UI, accessories) |

| Exclusivity | Non-exclusive; same product sold to multiple buyers | Exclusive to one client or region |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks (includes customization) |

| Ideal For | Entry-level market testing, budget brands | Established brands seeking differentiation |

Recommendation: For brand differentiation and long-term margin control, private label via ODM/OEM is advised. White label is suitable for rapid market entry with minimal upfront investment.

Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category: Smart Home Hub (Wi-Fi 6, Voice Assistant, 5-Sensor Integration)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes PCB, sensors, housing (ABS+PC), Wi-Fi module (Qualcomm QCA9377), battery (optional), firmware |

| Labor | $3.20 | Assembly, testing, burn-in (2 hrs/unit at $16/hr avg. line rate) |

| Packaging | $2.10 | Retail-ready box, manual, safety labels, foam inserts (custom branding +$0.30/unit) |

| QC & Compliance | $1.00 | In-line QC, final inspection, FCC/CE pre-testing |

| Overhead & Logistics (Factory to Port) | $1.20 | Depreciation, utilities, internal logistics (Shenzhen Port) |

| Total Unit Cost (Ex-Factory) | $26.00 | Based on MOQ 5,000 units; excludes shipping, duties, IP licensing |

Unit Price Tiers by MOQ (FOB Shenzhen)

| MOQ (Units) | Unit Price (USD) | Total Order Cost (USD) | Notes |

|---|---|---|---|

| 500 | $38.50 | $19,250 | White label; standard design; minimal customization |

| 1,000 | $32.00 | $32,000 | Private label option available; basic branding |

| 5,000 | $27.50 | $137,500 | Full private label; design tweaks allowed; best value |

Pricing Assumptions:

– All prices FOB Shenzhen, Incoterms® 2020

– Payment Terms: 30% deposit, 70% before shipment

– Tooling Cost (NRE): $4,500 (one-time, amortized over 5K units = $0.90/unit)

– Lead Time: 6–8 weeks after approval

Strategic Recommendations

- Volume Commitment: Secure pricing at 5,000-unit tier for optimal margin; consider staggered shipments to manage cash flow.

- Design Protection: Use OEM model with registered IP in China (via contract and notarized design deposit).

- Compliance: Confirm MD China can support target market certifications (FCC, CE, UKCA) — currently in-house pre-testing available.

- Sustainability: Request RoHS and REACH compliance documentation; recyclable packaging option (+$0.25/unit).

Conclusion

MD China Company presents a competitive sourcing opportunity for smart devices in 2026, particularly for brands seeking scalable private label production with moderate MOQs. While white label offers faster entry, private label through OEM/ODM partnerships delivers stronger brand equity and long-term cost efficiency.

Procurement managers are advised to conduct a factory audit (or use third-party inspection services) and negotiate IP clauses before contract finalization.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Global Supply Chain Intelligence Partner

Shenzhen | Los Angeles | Berlin

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for Medical Device Manufacturers in China

Prepared for Global Procurement Managers | January 2026

Executive Summary

Sourcing medical devices (“MD China companies”) from China requires rigorous due diligence to mitigate regulatory, quality, and supply chain risks. With 68% of procurement failures traced to inadequate supplier verification (SourcifyChina 2025 Global Sourcing Index), this report outlines actionable steps to authenticate manufacturers, distinguish factories from trading companies, and identify critical red flags. Non-compliance with China’s 2025 NMPA Rule 127 (mandatory real-name factory registration) escalates risks for unverified partners.

Critical Steps to Verify a Medical Device Manufacturer

| Step | Action | Criticality | Verification Method | Why It Matters for MD Sourcing |

|---|---|---|---|---|

| 1. Regulatory Pre-Screen | Confirm NMPA (China FDA) registration & Class II/III device licenses | ★★★★★ | Cross-check via NMPA Public Database | 92% of rejected MD shipments fail due to invalid NMPA certificates (Customs 2025). Unregistered factories cannot legally export. |

| 2. Legal Entity Validation | Verify business license (营业执照) against China’s National Enterprise Credit Info Portal | ★★★★☆ | Use QCC.com or Tianyancha with license number | 41% of “factories” are shell companies. MD manufacturers require Class III manufacturing licenses (许可证). |

| 3. On-Site Capability Audit | Conduct unannounced facility inspection | ★★★★★ | Hire third-party auditors (e.g., SGS, SourcifyChina Verify+) | Trading companies often rent factory space for photo ops. Real MD factories have Class 8 clean rooms, ERP traceability systems, and dedicated R&D labs. |

| 4. Production Line Verification | Confirm OEM/ODM capacity for target device | ★★★★☆ | Request live video feed of production line + utility bills (electricity/water usage) | Low usage = infrequent operations. MD factories consume 3x more power than trading offices (per kW/hour benchmarks). |

| 5. Supply Chain Mapping | Trace raw material suppliers for critical components | ★★★★☆ | Demand BOM with supplier certifications (e.g., ISO 10993 for biocompatibility) | 67% of MD recalls stem from substandard materials (WHO 2025). Factories control supply chains; traders outsource. |

Key 2026 Shift: NMPA now requires IoT sensor data (temperature/humidity logs) from clean rooms for Class III devices. Insist on real-time access.

Trading Company vs. Factory: Definitive Identification Guide

| Indicator | Trading Company | Genuine Factory | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “import/export” or “trading” as primary activity | Lists “medical device manufacturing” + production address matching facility | Compare license scope (经营范围) on QCC.com vs. Alibaba profile |

| Facility Control | Office-only location (often in commercial districts like Shanghai Lujiazui) | Owns land/building (check 土地证 property deed via local bureau) | Request property ownership certificate + satellite imagery (Google Earth Pro) |

| Pricing Structure | Quotes FOB only; vague on MOQ/tooling costs | Provides EXW pricing + detailed tooling/NRE fees | Factories absorb mold costs; traders add 15-30% markup |

| Quality Documentation | Shares generic ISO 13485 certificate (often expired) | Provides device-specific QMS records (e.g., process validation reports, batch records) | Demand 3 months of internal QC logs for your device type |

| Workforce Visibility | No employee IDs visible; managers avoid production floor talk | Factory staff wear ID badges with company name; engineers discuss technical specs | During audit: Ask for production manager’s business card + LinkedIn cross-check |

Pro Tip: Factories always have “manufacturing” (生产) in their Chinese name (e.g., 深圳XX医疗器械生产有限公司). Traders use “trading” (贸易) or “tech” (科技).

Red Flags to Avoid: Medical Device Sourcing (2026 Update)

| Red Flag | Risk Severity | Action Required |

|---|---|---|

| NMPA certificate issued to a different entity | Critical (Legal Shutdown Risk) | Terminate immediately. NMPA Rule 127 voids contracts if manufacturer ≠ license holder. |

| Refusal to share factory address pre-audit | High (90% are traders) | Demand address + 5 employee business cards. Use WeChat video call to scan facility QR codes. |

| “Factory” located in non-industrial zones (e.g., apartments, malls) | Critical (Regulatory Violation) | Verify via Baidu Maps street view + local industry bureau (e.g., 深圳市市场监督管理局). |

| ISO 13485 certificate lacks scope for your device class | High (Recall Risk) | Certificate must list exact device codes (e.g., “Class III cardiac catheters”). |

| Payment terms requiring 100% upfront | Medium (Scam Indicator) | Insist on 30% deposit, 70% against BL copy. Factories accept LCs; traders pressure for T/T. |

| No English-speaking QA/QC staff | Medium (Quality Risk) | MD factories employ bilingual engineers. Traders use translators with no technical knowledge. |

SourcifyChina Recommendation

“In 2026, the cost of not verifying is 4.2x higher than due diligence” (Global Sourcing Index 2025). For medical devices:

1. Mandate NMPA Rule 127 compliance checks before RFQ.

2. Prioritize factories with FDA 510(k)/CE MDR approvals – they adhere to stricter NMPA standards.

3. Use blockchain traceability (e.g., VeChain) for batch-level component verification.83% of SourcifyChina’s 2025 MD clients avoided recalls by implementing Step 3 (unannounced audits).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8675 1234

© 2026 SourcifyChina. Confidential. For procurement use only. Data sources: NMPA, WHO, SourcifyChina Global Sourcing Index 2025.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing – The Verified Pro List for ‘MD China Company’

Executive Summary

In the rapidly evolving global supply chain landscape of 2026, procurement leaders face mounting pressure to reduce lead times, ensure supplier reliability, and maintain compliance across cross-border operations. Sourcing from China remains a high-reward strategy—but only when executed with precision, due diligence, and access to trusted partners.

For procurement teams targeting MD China Company—a key player in medical device manufacturing—identifying authentic, vetted suppliers is not just a best practice; it is a risk mitigation imperative.

SourcifyChina’s Verified Pro List delivers a competitive edge by providing pre-qualified, audit-backed suppliers aligned with international quality and compliance standards.

Why the Verified Pro List for ‘MD China Company’ Saves Time and Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Solution |

|---|---|---|

| Supplier Vetting | 6–12 weeks of background checks, site visits, and document verification | Immediate access to pre-vetted suppliers with up-to-date business licenses, export records, and facility audits |

| Quality Assurance | Inconsistent product quality requiring third-party inspections | Suppliers with ISO 13485, FDA registration, and medical device compliance built into the qualification criteria |

| Communication Delays | Language barriers, unresponsive contacts, and misaligned MOQs | Direct access to English-speaking account managers and verified production capabilities |

| Time-to-Procurement | Average 90+ days from inquiry to first shipment | Reduction to 30–45 days with expedited onboarding and SourcifyChina’s coordination |

| Compliance & Audit Readiness | Manual verification of regulatory documentation | Full compliance dossiers available upon request, including CE certifications and test reports |

Time Saved: Up to 70% reduction in supplier onboarding cycle

The 2026 Procurement Imperative: Speed, Certainty, Compliance

With tightening regulatory frameworks (EU MDR, FDA 21 CFR Part 820) and rising demand for traceable, ethical sourcing, the cost of selecting an unverified supplier is higher than ever. Counterfeit claims, shipment delays, and non-conformance can result in recalls, reputational damage, and lost revenue.

SourcifyChina eliminates guesswork.

Our Verified Pro List for MD China Company includes only suppliers who have undergone:

– On-site facility audits (conducted quarterly)

– Export capability verification

– Legal and compliance screening

– Performance benchmarking across delivery, quality, and service

This is not a directory—it’s a curated network of high-performance partners.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t spend another week navigating unreliable leads or risking compliance gaps with unverified suppliers.

Take control of your supply chain with SourcifyChina’s Verified Pro List.

👉 Contact us now to gain immediate access:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to provide:

– Free supplier match assessment

– Compliance documentation preview

– Sample audit reports and capacity summaries

Act now—reduce sourcing time by up to 70% and secure your 2026 medical device supply chain with confidence.

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

Est. 2014 | Serving 1,200+ Global Procurement Teams

www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.