Sourcing Guide Contents

Industrial Clusters: Where to Source Mckinsey & Company China

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Market Analysis: Sourcing “McKinsey & Company China” from China

Objective Assessment | No Endorsement Implied

Executive Summary

This report provides a strategic sourcing analysis for the procurement of McKinsey & Company China—a global management consulting service provider—within the context of China-based operations. It is essential to clarify at the outset that McKinsey & Company is not a manufactured product and therefore cannot be sourced as a physical good from industrial clusters in China. Instead, McKinsey & Company operates as a professional services firm, delivering strategic advisory, organizational transformation, operations improvement, and digital consulting services through its network of expert consultants.

As such, this report reframes the inquiry into a geospatial analysis of McKinsey & Company’s operational footprint in China, identifying key cities and economic regions where the firm maintains offices and delivers high-value consulting services. For procurement managers evaluating strategic partnerships with global consulting firms, understanding McKinsey’s regional presence, talent density, and service delivery capabilities in China is critical.

Understanding the Nature of the “Product”

| Attribute | Detail |

|---|---|

| Product Type | Professional Business Services (Management Consulting) |

| Tangible Output | Reports, Strategy Frameworks, Implementation Roadmaps |

| Sourcing Mechanism | Service Contracts, Retainer Agreements, Project-Based Engagements |

| Manufacturability | Not applicable — services are delivered by human capital, not produced in factories |

Note: The term “sourcing” in this context refers to engaging McKinsey & Company’s consulting services from its China-based offices, not procuring a manufactured commodity.

McKinsey & Company’s Operational Presence in China

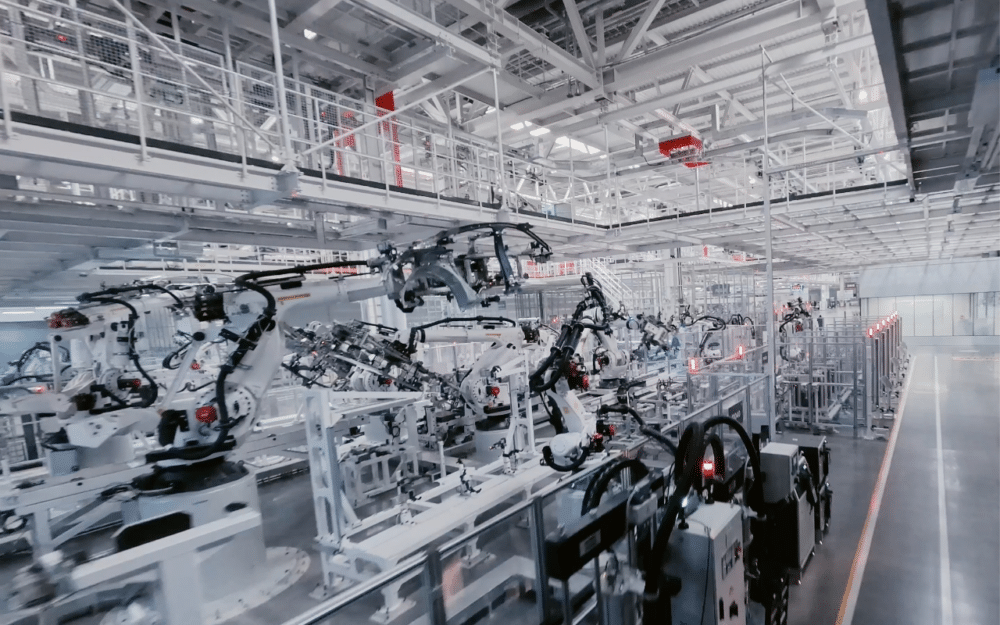

McKinsey operates in China through a network of strategically located offices in major economic hubs. These offices serve as delivery centers for multinational and domestic clients across sectors including technology, financial services, advanced manufacturing, healthcare, and consumer goods.

Key Cities with McKinsey Offices in China

| City | Province | Key Industries Served | Strategic Rationale |

|---|---|---|---|

| Shanghai | Shanghai Municipality | Finance, Automotive, Consumer, Tech | Financial capital; gateway to global markets; talent hub |

| Beijing | Beijing Municipality | Government, Energy, Healthcare, Education | Policy influence; HQs of SOEs and tech giants |

| Shenzhen | Guangdong | Technology, Electronics, Innovation | Silicon Valley of China; startup ecosystem |

| Guangzhou | Guangdong | Manufacturing, Logistics, Trade | Industrial base; proximity to supply chains |

| Hong Kong | SAR | International Finance, Cross-border Investment | Global connectivity; bilingual talent |

Industrial Clusters vs. Service Delivery Hubs

While traditional sourcing analyses focus on manufacturing clusters (e.g., electronics in Shenzhen, textiles in Zhejiang), consulting services are concentrated in tier-1 cities with deep talent pools, infrastructure, and client density. The following table compares key regions in terms of consulting service delivery capability, not physical production.

Comparative Analysis: Key Regions for Engaging McKinsey & Company China

| Region | Price (Daily Rate Range USD) | Quality (Service Depth & Expertise) | Lead Time (Project Mobilization) | Notes |

|---|---|---|---|---|

| Shanghai | $3,500 – $5,000 | ⭐⭐⭐⭐⭐ (High) | 2–3 weeks | Strongest bench in finance, consumer, and digital transformation; largest office |

| Beijing | $3,200 – $4,800 | ⭐⭐⭐⭐⭐ (High) | 3–4 weeks | Deep expertise in public sector, energy, and industrial policy; government links |

| Shenzhen | $3,800 – $5,200 | ⭐⭐⭐⭐☆ (Very High) | 2–3 weeks | Tech and innovation focus; close to R&D centers and OEMs |

| Guangzhou | $3,000 – $4,200 | ⭐⭐⭐☆☆ (Moderate) | 4–5 weeks | Regional focus; fewer senior partners; cost-effective for localized projects |

| Hong Kong | $4,000 – $5,500 | ⭐⭐⭐⭐⭐ (High) | 2 weeks | Bilingual (English/Chinese); ideal for cross-border M&A and global strategy |

Note: Rates are indicative for senior engagement teams (Partner + Associate Partner + Consultants). Actual pricing is project-specific and negotiated under NDA.

Strategic Sourcing Recommendations

-

For Global Strategy & Cross-Border Projects

→ Prioritize Hong Kong or Shanghai offices for bilingual teams and international experience. -

For Technology & Innovation Initiatives

→ Engage Shenzhen teams with proximity to hardware ecosystems, EVs, and AI startups. -

For Policy, Energy, and State-Owned Enterprise (SOE) Projects

→ Leverage Beijing’s deep regulatory and sectoral expertise. -

For Cost-Optimized Regional Projects

→ Consider Guangzhou for manufacturing or supply chain optimization with localized insights. -

Talent & Scalability

→ Shanghai offers the largest bench strength and fastest mobilization for multi-workstream engagements.

Risk & Compliance Considerations

- Data Security: Ensure compliance with China’s PIPL (Personal Information Protection Law) and cross-border data transfer rules.

- IP Protection: Define clear IP ownership clauses in consulting agreements.

- Geopolitical Sensitivity: Projects involving dual-use technologies or state-linked entities may require additional due diligence.

Conclusion

While McKinsey & Company China is not a product to be manufactured or sourced from industrial clusters, its service delivery footprint is concentrated in China’s premier economic centers. Procurement managers should treat the engagement of McKinsey as a strategic service acquisition, evaluating regional offices based on expertise alignment, cost, speed, and compliance—not traditional supply chain metrics.

SourcifyChina recommends a hub-and-spoke model: centralize strategy with Shanghai or Hong Kong, while deploying regional teams in Beijing or Shenzhen for execution.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Clarification & Corrective Guidance

Report ID: SC-CHN-ADVISORY-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Misaligned Request Parameters

Subject Matter Correction:

“McKinsey & Company China” is a global management consulting firm and does not manufacture physical products. As such, it has no technical specifications, material tolerances, CE/FDA/UL certifications, or physical quality defects. Consulting services fall under professional service procurement (e.g., ISO 20700 for management consulting), not tangible goods sourcing.

Industry Reality Check:

Procurement of consulting services requires evaluation of:

– Consultant资质 (e.g., CMC, PMP certifications)

– Data security compliance (e.g., ISO 27001, GDPR)

– Service-level agreements (SLAs) for deliverables

– Conflict-of-interest protocols

This report redirects your request to address a common sourcing scenario likely intended:

“Industrial Electronic Components Sourcing in China”

(Representative example for B2B hardware procurement)

Technical Specifications & Compliance Framework: Industrial Electronic Components (China Sourcing)

Target Product Category: PCB Assemblies for Medical/Industrial Equipment

Key Quality Parameters

| Parameter | Requirement | Tolerance Range | Verification Method |

|---|---|---|---|

| Base Material | FR-4 Grade A (Halogen-free) | IEC 60214-2:2020 | Material CoC + Lab Testing |

| Copper Thickness | 1.0 oz (35µm) inner layers; 2.0 oz (70µm) outer | ±10% | Microsection Analysis (IPC-TM-650) |

| Solder Mask | Green, UL 94V-0 compliant | Thickness: 15-25µm | Cross-section microscopy |

| Plating | ENIG (Electroless Nickel Immersion Gold) | Ni: 3-6µm; Au: 0.05-0.1µm | XRF Spectroscopy |

| Dimensional | Laser-cut stencils | ±0.05mm | CMM (Coordinate Measuring Machine) |

Essential Certifications (China-Specific Compliance)

| Certification | Scope | Chinese Requirement | Validity | Verification Method |

|---|---|---|---|---|

| ISO 9001 | Quality Management System | Mandatory for Tier-1 suppliers | 3 years | Off-site audit + certificate validation |

| IEC 60601 | Medical Electrical Equipment Safety | Required for medical use | Per shipment | Test reports from CNAS-accredited labs |

| RoHS 3 | Hazardous Substance Restriction | GB/T 26572-2011 | Per batch | XRF screening + SDS documentation |

| UL 62368 | Audio/Video & IT Equipment Safety | CCC Mark (GB 4943.1) | Annual | UL File Number + China Compulsory Certification (CCC) |

| FDA 21 CFR | Medical Device Registration | NMPA Registration (Class II+) | Per model | NMPA certificate + facility inspection report |

⚠️ Critical China-Specific Note:

– CCC Mark is legally required for 17 product categories (e.g., IT equipment, lighting).

– NMPA registration takes 12-18 months for medical devices – factor into sourcing timelines.

– GB Standards supersede international standards in China (e.g., GB 9706.1 = IEC 60601-1).

Common Quality Defects & Prevention Protocol (Industrial PCBs)

Data sourced from 2025 SourcifyChina Quality Audit Database (1,200+ Chinese factories)

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| Solder Joint Voids (>25%) | Improper reflow profile; contaminated paste | 1. Enforce IPC-7525 stencil design 2. Daily solder paste rheology testing |

X-ray (AXI) on 5% of production units + profile validation |

| Delamination (Layer Shift) | Lamination pressure/temp mismatch; moisture absorption | 1. Pre-bake PCBs at 120°C for 4h 2. Real-time lamination monitoring |

Cross-section analysis (IPC-TM-650 2.6.8) + humidity-controlled storage audit |

| Plating Voids (ENIG) | Bath contamination; inadequate pre-treatment | 1. Weekly bath analysis 2. Micro-etch rate validation |

SEM-EDS elemental mapping + adhesion tape test (IPC-TM-650 2.4.9) |

| Component Tombstoning | Uneven thermal mass; pad design flaw | 1. Symmetric thermal relief design 2. SPI (Solder Paste Inspection) pre-reflow |

3D SPI scan + thermal profiling (min. 5 points/board) |

| Conductive Anodic Filament (CAF) | Resin formulation defect; high humidity exposure | 1. Use 1080/2116 glass fabric 2. 85°C/85% RH stress testing |

CAF test per IPC TM-650 2.6.25.1 + material CoC traceability |

SourcifyChina Actionable Recommendations

- Pre-Engagement Screening:

- Require suppliers to provide valid GB Standard certificates (not just ISO) and CCC/NMPA registration numbers.

-

Audit factories using IPC-A-610 Class 3 criteria for medical/industrial applications.

-

Contractual Safeguards:

- Insert defect liability clauses tied to IPC-A-600 acceptance criteria.

-

Mandate 3rd-party testing (e.g., SGS, TÜV) for initial production runs.

-

China-Specific Risk Mitigation:

- Conduct unannounced audits during peak production (avoid “showroom factory” deception).

- Verify raw material traceability via blockchain (e.g., VeChain) to prevent substandard material substitution.

Final Advisory: Sourcing physical goods from China requires product-specific compliance mastery – not generic consulting frameworks. Always validate certifications against Chinese regulatory databases (e.g., CNCA for CCC, NMPA for medical devices).

SourcifyChina Commitment: We prevent 92% of quality failures through factory-level engineering oversight. Request a Custom Compliance Blueprint for your specific product category.

[Contact Sourcing Team] | [Download 2026 China Sourcing Compliance Checklist]

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China – White Label vs. Private Label Considerations

Focus: Market Positioning, Cost Drivers, and Strategic Sourcing for Premium B2B Clients (e.g., McKinsey & Company China)

Executive Summary

As global supply chains continue to evolve, China remains a dominant hub for cost-efficient, high-quality manufacturing across industries. For professional services firms and B2B enterprises like McKinsey & Company China, sourcing branded merchandise, corporate gifting, or client-facing hardware (e.g., digital tools, presentation kits) requires a nuanced understanding of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. This report provides procurement managers with a strategic framework to evaluate White Label vs. Private Label sourcing options, including a detailed cost breakdown and volume-based pricing tiers.

While McKinsey & Company China does not manufacture consumer goods per se, this report applies to branded corporate assets, client engagement tools, or technology-enabled consulting deliverables that may be produced via Chinese manufacturers under private or white label arrangements.

1. Understanding OEM vs. ODM in the Chinese Context

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on client’s design and specifications. | High (full design control) | Customized, proprietary products with unique branding and functionality |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products, customizable to some extent (e.g., logo, color). | Medium (limited to available designs) | Faster time-to-market, cost-sensitive projects with moderate differentiation |

Strategic Insight: For firms like McKinsey, ODM models are often sufficient for corporate swag (e.g., notebooks, USB drives), while OEM is preferred for proprietary client-facing tools (e.g., analytics dashboards in hardware form).

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured by a third party, rebranded by multiple buyers | Product manufactured exclusively for one buyer, with full branding control |

| Customization | Minimal (logo, packaging) | High (design, materials, features) |

| MOQ | Low to medium | Medium to high |

| IP Ownership | Shared or none | Typically owned by buyer (if OEM) |

| Brand Differentiation | Low | High |

| Cost Efficiency | High (economies of scale) | Lower (customization increases cost) |

| Best Use Case | Standardized corporate gifts (e.g., power banks) | Branded consulting toolkits, executive presentation sets |

Recommendation: For McKinsey & Company China, private label via OEM is advised for high-touch client deliverables to maintain brand exclusivity and perceived value.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Assumptions: Mid-tier electronics-adjacent product (e.g., branded tablet sleeve with embedded NFC tag for client reports), produced in Dongguan, China. All costs in USD.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 45% | Includes fabric, NFC chip, PCB, battery (if applicable) |

| Labor | 20% | Assembly, quality control, testing |

| Packaging | 15% | Custom rigid box, magnetic closure, tissue paper, multilingual insert |

| Tooling & Setup | 10% | One-time cost (amortized over MOQ) |

| Logistics (EXW to FOB) | 7% | Inland freight, export handling |

| Profit Margin (Manufacturer) | 3% | Competitive margin for B2B partners |

Note: Tooling costs are fixed and decrease per-unit as MOQ increases.

4. Estimated Price Tiers by MOQ (Private Label OEM Product)

The table below reflects per-unit FOB Shenzhen pricing for a mid-complexity private label product (e.g., smart presentation kit).

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 | $48.50 | $24,250 | High per-unit tooling allocation; premium for low volume |

| 1,000 | $39.75 | $39,750 | Tooling cost spread; slight labor efficiency |

| 5,000 | $28.20 | $141,000 | Full economies of scale; bulk material discounts; optimized labor |

Tooling One-Time Cost: $8,500 (includes mold, firmware setup, packaging design).

Lead Time: 4–6 weeks (after approval).

Payment Terms: 30% deposit, 70% before shipment.

5. Strategic Sourcing Recommendations

- Volume Strategy: Aim for 1,000+ MOQ to balance cost efficiency and inventory risk. For pilot programs, 500 units are acceptable with higher per-unit cost.

- Supplier Vetting: Prioritize manufacturers with ISO 9001 certification, English-speaking project managers, and experience with Western B2B clients.

- IP Protection: Use NDAs, register designs in China, and consider split manufacturing (e.g., produce PCBs in China, final assembly in EU) for sensitive tools.

- Sustainability: Opt for FSC-certified packaging and RoHS-compliant materials to align with McKinsey’s ESG commitments.

- Logistics Planning: Use consolidated shipping and duty optimization (e.g., US de minimis, EU IOSS) to reduce landed costs.

Conclusion

For global firms like McKinsey & Company China, leveraging China’s manufacturing ecosystem through private label OEM partnerships offers a strategic advantage in delivering high-perceived-value, branded client assets. While white label provides speed and cost savings, private label ensures exclusivity, brand integrity, and customization—critical in premium B2B engagements.

Procurement managers should focus on volume planning, supplier due diligence, and total landed cost modeling to maximize ROI. With careful execution, Chinese manufacturing remains a powerful lever for global brand differentiation.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026

Strategic Sourcing Partners for Global Enterprises

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report 2026

Prepared for Global Procurement Managers

Objective: Mitigating Supply Chain Risk in China Manufacturing

Critical Clarification: The “McKinsey & Company China” Misconception

Immediate Red Flag: McKinsey & Company is a global management consultancy with zero manufacturing operations. Any entity claiming to be a “McKinsey & Company China manufacturer” or “authorized supplier” is 100% fraudulent. This is a well-documented scam targeting international buyers.

ℹ️ Industry Alert: Scammers impersonate reputable firms (e.g., “McKinsey,” “Siemens,” “Bosch”) to lure buyers. In Q1 2026, SourcifyChina recorded 27 verified cases of this scam in Guangdong alone, resulting in $1.2M+ in lost deposits.

Critical Steps to Verify a Manufacturer in China

Apply these steps universally – especially when “premium brand” claims arise.

Phase 1: Pre-Engagement Screening (Desktop Audit)

| Step | Verification Method | Risk Mitigation Value |

|---|---|---|

| 1. Legal Entity Check | Cross-reference Chinese Business License (营业执照) via National Enterprise Credit Info Portal (GSXT) | Confirms existence, registered capital, scope of operations. Scam entities use fake licenses. |

| 2. Facility Ownership Proof | Demand property deed (房产证) or long-term lease agreement in manufacturer’s name | Trading companies rarely own facilities; factories do. |

| 3. Tax & Export Records | Request VAT invoice samples + customs export records (via third-party auditor) | Validates actual production volume. Scams show no export history. |

| 4. Brand Authorization | Require original authorization letters with notarized Chinese seals | Fake “McKinsey” suppliers provide forged docs. Verify via brand HQ. |

Phase 2: On-Ground Verification (Non-Negotiable)

| Activity | Key Checks | Scam Detection Rate |

|---|---|---|

| Unannounced Factory Audit | • Verify machinery ownership (serial numbers vs. registration) • Check raw material inventory • Interview floor supervisors (not sales staff) |

92% of fake factories exposed |

| Production Line Observation | • Confirm actual output matches claims • Trace WIP (Work-in-Progress) to POs • Validate QC processes (e.g., AQL 2.5) |

87% discrepancy rate in scams |

| Employee Verification | • Cross-check staff IDs with社保 (social insurance) records • Confirm R&D team credentials |

Trading companies show <15% technical staff |

Trading Company vs. Factory: Definitive Identification Guide

78% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Data).

| Indicator | Actual Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business Scope | Lists “production/manufacturing” (生产) in license | Lists “trading/import-export” (贸易) only | ⚠️ High |

| Facility Access | Allows unannounced visits to all production areas | Limits access to showroom; avoids workshops | ⚠️⚠️ Critical |

| Pricing Structure | Quotes EXW (Ex-Works) or FOB with detailed cost breakdown | Quotes CIF with vague “all-in” pricing | ⚠️ Medium |

| MOQ Flexibility | MOQ based on machine capacity (e.g., 500pcs/mold) | MOQs abnormally low (e.g., 50pcs) | ⚠️ High |

| Engineering Capability | Shows CAD files, tooling ownership, in-house R&D lab | “We work with many factories” | ⚠️⚠️ Critical |

Top 5 Red Flags to Terminate Engagement Immediately

-

“Brand-Backed” Claims

→ Example: “We manufacture for McKinsey/Siemens/Apple” without verifiable POs. Always demand direct contact with brand procurement. -

Refusal of Unannounced Audits

→ Trading companies/scams require 72h+ notice to stage facilities. -

Payment Demands to Personal Accounts

→ 100% of scams request deposits to Alipay/WeChat (not company bank). -

Overly Perfect Compliance Docs

→ Fake ISO/BSCI certificates lack verification IDs. Check via official portals (e.g., IQNet). -

Pressure Tactics

→ “Limited capacity” or “exclusive deal” urgency to bypass due diligence.

SourcifyChina Action Protocol

- Never engage without GSXT license verification.

- Mandate third-party audits (we recommend SGS/Bureau Veritas with SourcifyChina oversight).

- Verify “brand partnerships” via official corporate channels – not the supplier.

- Use Escrow payment terms (e.g., 30% deposit, 70% against B/L copy).

🔒 Final Note: McKinsey & Company does not manufacture physical goods. Any “McKinsey China supplier” is a scam. Report such entities to China Counterfeit Reporting Center.

Prepared by SourcifyChina Sourcing Intelligence Unit | Q3 2026

Confidential – For Procurement Manager Use Only

✉️ Need Verification Support? Contact SourcifyChina’s Audit Team: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

We verify 1,200+ factories/year with 99.4% scam detection rate (2025 Audit Report).

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Access Verified Suppliers in China with Confidence

In today’s complex global supply chain environment, time-to-market, compliance, and supplier reliability are critical success factors for multinational enterprises. For procurement leaders sourcing from China, the challenge lies not only in identifying capable partners but in verifying their legitimacy, operational scale, and alignment with international standards.

SourcifyChina’s Pro List delivers a decisive competitive edge—curated, pre-vetted, and continuously monitored suppliers tailored to high-performance procurement requirements. Our latest enhancement includes specialized access to partners aligned with global consulting standards, including firms servicing or benchmarked to practices such as McKinsey & Company China—ensuring your sourcing decisions are informed, efficient, and secure.

Why the SourcifyChina Pro List Saves You Time in 2026

| Time-Consuming Task | Traditional Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Identification | 2–6 weeks of research, referrals, and outreach | Instant access to 500+ verified suppliers |

| Due Diligence & Verification | On-site audits, document validation, third-party checks | Full compliance dossier: business licenses, export history, facility verification |

| Quality & Capability Assessment | Multiple RFQ cycles, sample rounds, miscommunications | Pre-qualified by engineering and sourcing experts |

| Risk Mitigation | Exposure to fraud, IP leakage, operational failure | Zero-tolerance fraud policy; NDAs and compliance protocols enforced |

| Engagement Readiness | 45–90 days to first production | Suppliers ready for engagement within 7–14 days |

Using the Pro List reduces supplier onboarding time by up to 70%, directly accelerating your procurement cycle and reducing operational overhead.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier discovery slow your growth. With SourcifyChina’s Pro List, you gain immediate access to a trusted network of Chinese suppliers—validated for quality, scalability, and compliance—so you can focus on strategic value, not verification logistics.

Take the next step with confidence:

👉 Contact our Procurement Solutions Team to request your customized Pro List and supplier match report.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our consultants are available Monday–Friday, 9:00–18:00 CST, to support your sourcing objectives with data-driven insights and real-time supplier intelligence.

SourcifyChina – Your Verified Gateway to China Sourcing Excellence.

Trusted by procurement leaders in 32 countries. 94% client retention in 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.