The global cables and wires market is experiencing robust growth, driven by rising infrastructure development, expanding power transmission networks, and increased demand from the industrial and residential sectors. According to a report by Mordor Intelligence, the market was valued at USD 184.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2029. This expansion is further fueled by the surge in renewable energy projects and smart grid implementations, particularly across the Asia-Pacific region. As demand for reliable and high-performance cables intensifies, Mc Cables—specializing in power, control, and instrumentation cables—have become a cornerstone in industrial and utility applications. With industry leaders enhancing production capabilities and investing in advanced manufacturing technologies, the competitive landscape among Mc Cables manufacturers is rapidly evolving. The following list highlights the top eight manufacturers shaping the market through innovation, global reach, and strong product portfolios.

Top 8 Mc Cables Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wire and Cable Manufacturers

Domain Est. 1996

Website: encorewire.com

Key Highlights: Encore Wire is the leading manufacturer of copper and aluminum for residential, commercial and industrial wire needs. We’re unlike any other wire company….

#2 Prysmian

Domain Est. 2005

Website: prysmian.com

Key Highlights: Welcome to Prysmian: the world leader in cable manufacturer, energy solutions, telecom cables and systems industry. Find out more!…

#3 Southwire

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose Southwire for your wire and cable needs – we offer high-performance products that are built to last….

#4 Copper Wire Supplier

Domain Est. 1996

Website: cerrowire.com

Key Highlights: Cerrowire is a leading copper wire supplier offering MC cables, aluminum wire, and building cables for reliable electrical solutions….

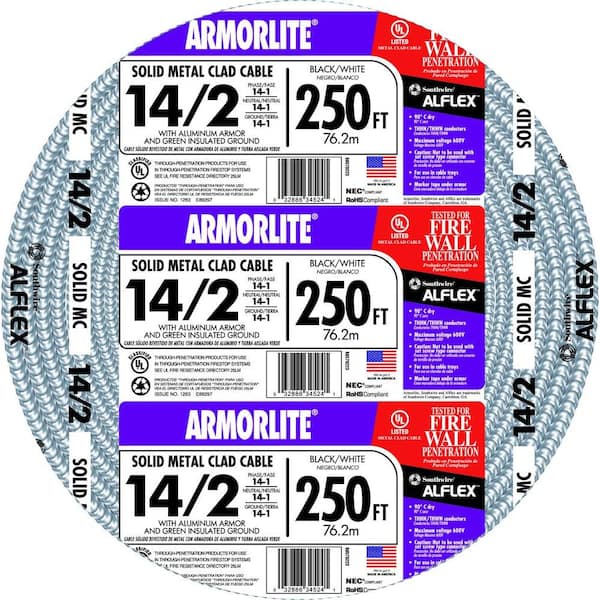

#5 How Is MC Cable Used?

Domain Est. 1996

Website: servicewire.com

Key Highlights: Generally, you should secure MC cable every six feet and within 12 inches of a termination. You should secure the cable every three feet if it is attached to ……

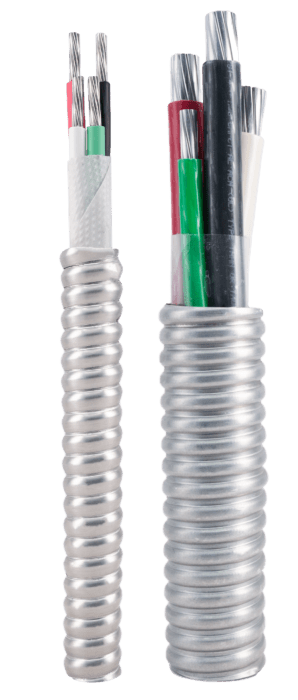

#6 MC Cable

Domain Est. 1997

Website: belden.com

Key Highlights: Combine rugged durability, corrosion resistance, flexibility and easy handling with MC Cables from Belden. Cables are designed to meet the needs of demanding ……

#7 Type MC (Metal Clad) Cable Assemblies

Domain Est. 2002

Website: pducables.com

Key Highlights: Metal Clad cables are assemblies of one or more insulated circuit conductors with or without optical fiber members enclosed in an armor of interlocking metal ……

#8 AFC Cable Systems

Domain Est. 2010

Website: atkore.com

Key Highlights: We manufacture standard Type MC Cables, including MC Glide®, MC Tuff®, MC Lite® and other MC cables in various specialty configurations, most featuring the ……

Expert Sourcing Insights for Mc Cables

H2: Market Trends Shaping McCables in 2026

As the global economy evolves through technological innovation, sustainability imperatives, and shifts in industrial demand, McCables—assuming it is a manufacturer or supplier of electrical, data, or power cables—is poised to face both challenges and opportunities in 2026. The following analysis outlines the key H2 2026 market trends expected to influence McCables’ strategic positioning, operational focus, and growth trajectory.

1. Accelerated Demand from Renewable Energy Infrastructure

The global transition toward renewable energy sources—particularly solar, wind, and grid-scale storage—continues to drive robust demand for specialized cabling solutions. In H2 2026, governments and private investors are expected to increase funding for green infrastructure projects, especially in emerging markets and regions with aggressive net-zero timelines. McCables can expect rising demand for:

- High-voltage underground and subsea cables for offshore wind integration.

- DC cabling systems tailored for solar farms and battery storage facilities.

- Fire-resistant and low-smoke cables for energy storage safety compliance.

This trend positions McCables to expand into project-based B2B contracts with EPC (Engineering, Procurement, and Construction) firms and renewable energy developers.

2. Smart Building and Urbanization Growth

With urban populations expanding, particularly in Asia, Africa, and Latin America, smart city initiatives are gaining momentum. H2 2026 will likely see increased deployment of intelligent building systems (e.g., IoT-enabled lighting, HVAC, and security), requiring structured cabling, fiber optics, and data transmission cables. McCables can capitalize on this by:

- Expanding product lines in Category 6A/8 and fiber-optic solutions.

- Partnering with construction and real estate developers to offer integrated cabling packages.

- Emphasizing certifications (e.g., BICSI, ISO 11801) to ensure compliance with smart infrastructure standards.

3. Regulatory Pressure and Sustainability Compliance

Environmental regulations are tightening globally. The EU’s updated Circular Economy Action Plan, U.S. Buy Clean Initiative, and similar policies in Asia are pushing industrial suppliers to reduce carbon footprints and use recyclable materials. In H2 2026, McCables will face:

- Mandatory reporting on Scope 1, 2, and 3 emissions.

- Demand for halogen-free, low-smoke, zero-halogen (LSZH) cables.

- Preference for cables made with recycled copper and biodegradable insulation.

To maintain competitiveness, McCables must invest in sustainable manufacturing, circular supply chains, and eco-labeling—enhancing brand reputation and meeting public procurement criteria.

4. Supply Chain Resilience and Localization

Geopolitical tensions and trade volatility continue to disrupt global supply chains. In response, many industries are adopting nearshoring or friend-shoring strategies. By H2 2026, McCables may experience:

- Increased demand for regionally manufactured cables to reduce import dependency.

- Pressure to diversify raw material sourcing (e.g., copper, polymers) to avoid bottlenecks.

- Opportunity to establish regional distribution hubs or joint ventures in key markets like Southeast Asia, Eastern Europe, or Mexico.

Digital supply chain tools—such as blockchain for traceability and AI-driven inventory forecasting—will become critical differentiators.

5. Technological Integration and Digital Transformation

The cable industry is embracing digitalization. In H2 2026, McCables can expect growing interest in:

- Smart cables embedded with sensors for real-time monitoring (temperature, load, faults).

- Digital twins for predictive maintenance in industrial and utility applications.

- BIM (Building Information Modeling) compatibility for construction integration.

Investing in R&D for intelligent cabling systems will allow McCables to move beyond commodity status and offer value-added solutions.

6. Competitive Landscape and Consolidation

The global cable market is seeing consolidation, with large players acquiring niche innovators. In H2 2026, McCables may face intensified competition from:

- Multinational cable giants expanding into emerging markets.

- Local manufacturers benefiting from protectionist policies.

- New entrants offering specialized solutions (e.g., hydrogen-resistant cables for future energy systems).

To differentiate, McCables should focus on agility, innovation, and customer-centric service models.

Conclusion: Strategic Outlook for McCables in H2 2026

The second half of 2026 will be a pivotal period for McCables as macro trends converge around sustainability, digitalization, and energy transformation. Success will depend on the company’s ability to:

- Align product development with renewable energy and smart infrastructure demands.

- Strengthen sustainability credentials and supply chain resilience.

- Adopt digital tools to enhance efficiency and customer engagement.

By proactively addressing these H2 2026 trends, McCables can transition from a traditional cable supplier to an integrated solutions provider in the evolving global electrification landscape.

Common Pitfalls When Sourcing MC Cables (Quality, IP)

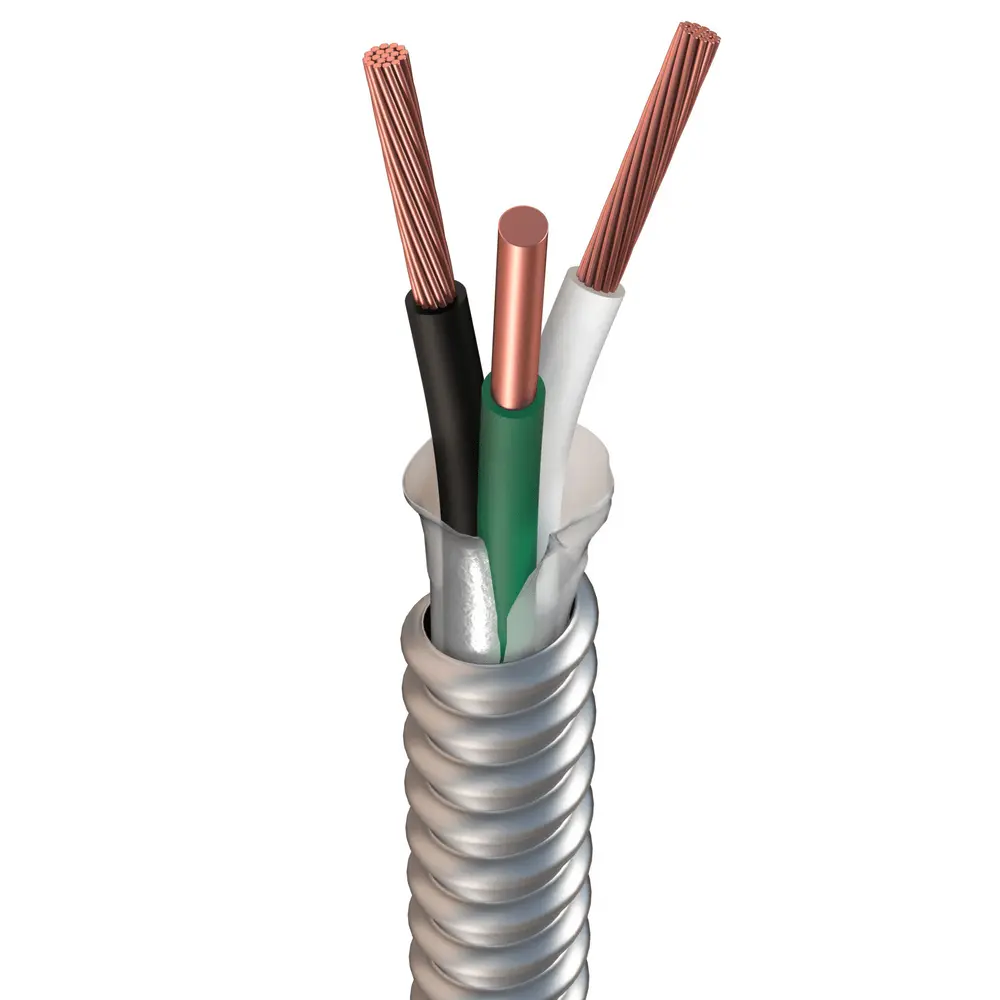

When sourcing Metal-Clad (MC) cables—commonly used in commercial, industrial, and residential electrical installations—several critical pitfalls can compromise safety, compliance, and long-term performance. Paying close attention to quality and Ingress Protection (IP) ratings is essential to avoid costly failures and ensure adherence to electrical codes.

Poor Manufacturing Quality

One of the most significant risks when sourcing MC cables is receiving products made with substandard materials or inconsistent manufacturing practices. Low-quality cables may use undersized conductors, inadequate armor thickness, or poor jacketing materials, leading to overheating, short circuits, or mechanical damage. These issues increase fire hazards and violate NEC (National Electrical Code) standards. Always source from reputable manufacturers with third-party certifications (e.g., UL, CSA, ETL) and request test reports to verify electrical and mechanical performance.

Incorrect or Missing IP Rating

Metal-clad cables are often used in environments where protection against dust, moisture, and mechanical impact is crucial. A common oversight is assuming all MC cables offer high Ingress Protection (IP) ratings. In reality, standard MC cables may not be rated for outdoor or wet locations unless specifically designed and labeled (e.g., MC-HL or MCAP cables with appropriate IP ratings like IP66 or IP68). Using a cable without the correct IP rating in harsh environments can lead to corrosion, insulation breakdown, and equipment failure. Always verify the IP rating matches the installation environment—especially for outdoor, underground, or high-humidity applications.

Non-Compliance with Local Codes and Standards

Another frequent pitfall is sourcing MC cables that do not comply with regional electrical codes. For example, while a cable may meet UL standards in North America, it might not satisfy local requirements for flame spread, smoke emission, or low toxicity (e.g., LSZH – Low Smoke Zero Halogen). In international projects, using non-compliant cables can result in failed inspections, project delays, or safety liabilities. Ensure cables are certified for use in the target market and meet applicable standards like NEC, CEC, IEC, or BS.

Inadequate Armor and Mechanical Protection

Some suppliers offer MC cables with thin or loosely wound aluminum or steel armor, which fails to provide sufficient protection against crushing, rodent damage, or physical impact. Inferior armor compromises the cable’s integrity, especially in high-traffic or industrial areas. Verify armor material, thickness, and bonding continuity—critical for grounding and fault current handling—by reviewing product specifications and requesting samples for inspection.

Counterfeit or Misrepresented Products

In global supply chains, counterfeit or misrepresented MC cables are a growing concern. These products may carry fake certifications or mimic reputable brands but lack the required performance characteristics. To avoid this, purchase directly from authorized distributors, conduct factory audits when possible, and use independent labs for material and performance testing upon delivery.

Overlooking Environmental Suitability

Even if an MC cable has a suitable IP rating, other environmental factors—such as UV exposure, temperature extremes, or chemical contact—may degrade its performance. For instance, standard PVC jackets can crack under prolonged sunlight unless UV-stabilized. Ensure the cable’s jacket material (e.g., PVC, LSZH, or PUR) is appropriate for the installation environment.

By recognizing and mitigating these common pitfalls—particularly in quality assurance and IP rating validation—procurement teams and electrical contractors can ensure reliable, code-compliant, and safe installations when sourcing MC cables.

Logistics & Compliance Guide for Mc Cables

This guide outlines the essential logistics and compliance procedures for Mc Cables to ensure efficient operations, regulatory adherence, and customer satisfaction. All departments must follow these protocols to maintain quality, safety, and legal standards.

Shipping & Transportation

- Use approved freight carriers with proven experience in handling cable and electrical products.

- Ensure all shipments are properly labeled with product details, destination, handling instructions, and Mc Cables branding.

- Implement temperature and humidity controls for sensitive cable types during transit where required.

- Optimize load configurations to prevent damage and reduce transportation costs.

- Track all shipments in real time using GPS-enabled systems and provide customers with tracking information.

Inventory Management

- Maintain accurate inventory records using an integrated warehouse management system (WMS).

- Conduct regular cycle counts and full physical inventories to reconcile stock levels.

- Store cables according to specifications—separate by type, gauge, and insulation material to prevent damage.

- Apply FIFO (First In, First Out) principles to manage stock rotation and reduce obsolescence.

- Secure warehouse areas with access controls and surveillance to prevent theft or unauthorized handling.

Packaging Standards

- Use durable, moisture-resistant packaging materials suitable for cable reels and spools.

- Include protective end caps, shrink wrap, and corrugated cardboard as needed.

- Label all packages with barcodes, batch numbers, weight, and handling symbols (e.g., “Fragile,” “This Side Up”).

- Comply with international packaging regulations when exporting (e.g., ISPM 15 for wood pallets).

Regulatory Compliance

- Ensure all cable products meet relevant national and international standards (e.g., UL, CSA, CE, RoHS, REACH).

- Maintain up-to-date technical documentation, including certificates of conformity and test reports.

- Comply with electrical safety codes (e.g., NEC, IEC) applicable to destination markets.

- Monitor changes in trade regulations, tariffs, and import/export requirements, especially for cross-border shipments.

- Register and renew necessary business and product certifications annually.

Import/Export Procedures

- Classify products accurately using Harmonized System (HS) codes for customs declarations.

- Prepare complete export documentation: commercial invoice, packing list, bill of lading, and certificates of origin.

- Partner with licensed customs brokers to facilitate smooth clearance.

- Adhere to EAR (Export Administration Regulations) and sanctions lists when shipping to restricted regions.

- Conduct due diligence on international partners to ensure compliance with anti-bribery and trade laws (e.g., FCPA).

Environmental & Safety Compliance

- Follow OSHA guidelines for warehouse safety, including proper lifting techniques and equipment use.

- Train staff on handling hazardous materials (e.g., PVC insulation byproducts) and emergency response.

- Recycle packaging materials and manage waste in accordance with local environmental regulations.

- Report incidents or near misses promptly and conduct root cause analysis to prevent recurrence.

Audit & Documentation

- Retain all logistics and compliance records for a minimum of seven years.

- Conduct internal audits quarterly to assess compliance with this guide.

- Prepare for third-party audits (e.g., ISO 9001, ISO 14001) with complete and organized documentation.

- Update procedures promptly in response to audit findings or regulatory changes.

Supplier & Vendor Compliance

- Require suppliers to provide material declarations and compliance certificates.

- Audit key suppliers annually for quality, ethical practices, and environmental standards.

- Enforce contractual terms related to delivery timelines, product specifications, and liability.

Adherence to this Logistics & Compliance Guide is mandatory for all Mc Cables personnel and partners. Regular training and updates will be provided to ensure ongoing alignment with industry best practices and legal requirements.

Conclusion for Sourcing MC Cables

Sourcing MC (Metal-Clad) cables requires a strategic approach that balances quality, cost, compliance, and supply chain reliability. As critical components in electrical installations—especially in commercial, industrial, and complex residential applications—ensuring the right specifications, certifications (such as UL, NEC compliance), and performance characteristics is essential for safety, durability, and code adherence.

Key considerations when sourcing MC cables include verifying manufacturer credibility, confirming UL listing and NEC compliance, evaluating conductor material (typically copper or aluminum), proper jacket and armor type, and appropriate gauge and insulation for the intended application. Additionally, factors such as lead times, pricing, availability, and logistical support play a significant role in minimizing project delays.

By partnering with reputable suppliers, conducting due diligence on product quality, and aligning sourcing decisions with project requirements and regulatory standards, organizations can ensure reliable performance, enhance safety, and achieve cost-effective outcomes. In an evolving market influenced by material costs and supply chain dynamics, establishing long-term relationships with qualified vendors and maintaining a proactive procurement strategy will be crucial for successful MC cable sourcing.