The global medical scrubs market is undergoing significant expansion, driven by rising healthcare demand, heightened infection control protocols, and increased emphasis on professional medical attire. According to Grand View Research, the global scrubs market size was valued at USD 7.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2030. This growth trajectory presents a critical opportunity for manufacturers to innovate and differentiate through material selection. With performance attributes such as durability, moisture-wicking, antimicrobial protection, and comfort becoming key purchasing factors, the choice of fabric directly impacts product competitiveness. In response, leading scrubs manufacturers are increasingly evaluating advanced textile options—from polyester-cotton blends to cutting-edge synthetics—to balance cost, functionality, and sustainability. The following analysis identifies the top 10 materials shaping the future of scrubs manufacturing, informed by market trends and material performance data.

Top 10 Materials For Scrubs Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 BOSTON Scrubs Fabric Technology fabric details

Domain Est. 2023

Website: bostonscrub.com

Key Highlights: The fabric composition of our company’s Medical Industrial Laundry Uniforms is polyester-cotton blend,65% polyester, 35% cotton….

#2 Wholesale Medical Uniform Suppliers

Domain Est. 2001

Website: spectrumuniforms.com

Key Highlights: Spectrum is No.1 Unisex Wholesale Medical Uniform Suppliers and Vendors for organizations at affordable rates with High-Quality over three decades….

#3 Cintas: Uniforms

Domain Est. 1995

Website: cintas.com

Key Highlights: WE’LL OUTFIT YOUR TEAM AND YOUR BUSINESS · WE CAN HELP WITH YOUR WORK APPAREL, FACILITY SERVICES, FIRST AID AND SAFETY AND FIRE PROTECTION NEEDS · ABOUT US….

#4 UniFirst

Domain Est. 1995

Website: unifirst.com

Key Highlights: At UniFirst, we always deliver because you always deliver. We provide uniforms, workwear, safety clothing, PPE, first aid supplies, and facility services to ……

#5 Med Couture. Perfect fit jogger scrub pants, scrub tops, scrub jackets …

Domain Est. 2007

Website: medcouture.com

Key Highlights: We offer a selection of products that are unique in design, available in great colors and extended sizes from XS to 5X….

#6 Medical Scrubs and Nonwovens

Domain Est. 2008

Website: wptnonwovens.com

Key Highlights: Medical scrubs can help prevent and solve many problems–for more information, contact WPT Nonwovens!…

#7 Scrubd

Domain Est. 2021

Website: scrubd.co.za

Key Highlights: Polycotton fabric is a great combination material comprising of artificial polyester and the natural cotton fibers….

#8 LUUNA SCRUBS

Domain Est. 2021

Website: luunascrubs.com

Key Highlights: Our scrubs are crafted from recycled materials using a distinctive, refined fabric that reflects our commitment to offering quality and elevated scrubs. Fit & ……

#9 What materials make durable and highly functional scrubs?

Domain Est. 2024

Website: classico-global.com

Key Highlights: Polyester fabric is known for its durability and high functionality. It is widely used in sportswear due to its excellent elasticity and ease of movement. It ……

#10 Scrub Manufacturers – Low MOQ Custom

Domain Est. 2024

Website: bestexscrubs.com

Key Highlights: Bestex details the four core materials – Ultra Soft, Premium Stretch, Eco-Flex & Pro-Cool – engineered for durability, mobility, and all-day comfort. Request ……

Expert Sourcing Insights for Materials For Scrubs

Materials For Scrubs: 2026 Market Trends Analysis

Sustainable and Eco-Friendly Fabrics Driving Innovation

By 2026, sustainability will be a dominant force shaping the materials used in scrubs. Healthcare professionals and institutions are increasingly prioritizing environmentally responsible practices, leading to a surge in demand for scrubs made from organic cotton, recycled polyester, and plant-based fibers such as TENCEL™ (lyocell) and hemp. These materials offer biodegradability, lower carbon footprints, and reduced water consumption during production. Brands are responding by launching eco-conscious scrub lines certified by organizations like OEKO-TEX® and GOTS (Global Organic Textile Standard), reflecting a shift toward transparency and ethical sourcing.

Antimicrobial and Performance-Enhanced Textiles on the Rise

Healthcare-associated infections (HAIs) continue to drive innovation in functional fabric technologies. By 2026, antimicrobial-treated and inherently antimicrobial fabrics—such as those incorporating silver ion, copper oxide, or natural agents like chitosan—are expected to become standard in high-end scrub lines. These materials inhibit bacterial growth, reduce odor, and extend garment lifespan. Additionally, moisture-wicking, wrinkle-resistant, and fluid-repellent finishes are being integrated into scrub textiles to improve comfort and hygiene, especially in high-intensity clinical environments.

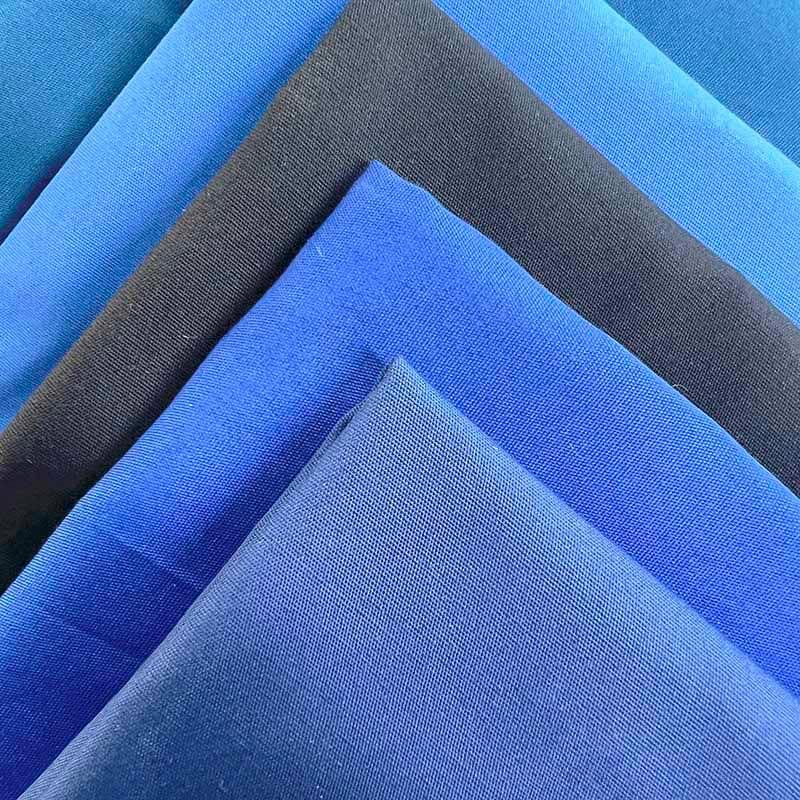

Growth in Blended and Technical Fabric Combinations

The market is moving toward hybrid fabrics that combine the best properties of natural and synthetic fibers. Polyester-cotton blends remain popular for durability and comfort, but advanced blends incorporating spandex for stretch, modal for softness, and recycled fibers for sustainability are gaining traction. These technical blends enhance mobility, fit, and longevity—critical factors for healthcare workers who wear scrubs for extended shifts. Innovations in knitting and weaving techniques are also enabling lighter, more breathable fabrics without sacrificing strength.

Consumer Demand for Comfort and Aesthetic Appeal

As scrubs evolve from purely functional workwear to fashion-forward uniforms, material choices are increasingly influenced by comfort and style. Soft-touch finishes, four-way stretch fabrics, and premium hand-feels are becoming key differentiators in the competitive scrub market. The rise of direct-to-consumer (DTC) brands and customization options is pushing manufacturers to use higher-quality materials that support diverse fits, colors, and patterns while maintaining professional standards.

Regional Shifts and Supply Chain Optimization

Asia-Pacific, particularly China and India, remains a major hub for textile production, but geopolitical factors and supply chain resilience concerns are prompting brands to diversify sourcing. By 2026, nearshoring and regional manufacturing are expected to grow, especially in North America and Europe, to reduce lead times and improve sustainability. This shift is encouraging innovation in local textile production and adoption of circular economy models, including fabric recycling programs and closed-loop manufacturing.

Conclusion

The 2026 market for materials used in scrubs is characterized by a convergence of sustainability, performance, and aesthetics. Driven by healthcare worker preferences, institutional procurement policies, and environmental regulations, manufacturers are investing in next-generation textiles that balance functionality with ecological responsibility. As the line between medical apparel and lifestyle wear blurs, materials innovation will remain a critical competitive advantage in the global scrub market.

Common Pitfalls Sourcing Materials for Scrubs

When sourcing materials for scrubs—especially in regulated industries like healthcare, pharmaceuticals, or cosmetics—organizations must navigate several critical challenges related to quality and intellectual property (IP). Overlooking these pitfalls can result in product failures, regulatory non-compliance, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inconsistent Material Specifications

A frequent issue is receiving raw materials that vary in composition, texture, or performance due to poorly defined or inconsistently enforced specifications. Without clear, standardized criteria (e.g., fiber content, breathability, antimicrobial properties), batches may differ significantly, compromising scrub durability and safety.

Lack of Supplier Qualification and Audits

Relying on unverified suppliers increases the risk of substandard materials. Many organizations fail to conduct proper due diligence, such as on-site audits, quality management system reviews (e.g., ISO 13485), or testing of sample batches before full-scale procurement.

Inadequate Testing and Certification

Materials used in scrubs—especially those labeled as antimicrobial, fluid-resistant, or hypoallergenic—must meet specific performance standards (e.g., ASTM, AAMI). Sourcing without requiring third-party testing or compliance certifications can lead to false claims and regulatory penalties.

Supply Chain Transparency Gaps

Complex supply chains may obscure the origin of raw materials. This lack of traceability makes it difficult to verify ethical sourcing, sustainability claims, or contamination risks (e.g., banned dyes or allergens), especially when sourcing from multiple international vendors.

Intellectual Property (IP)-Related Pitfalls

Unintentional IP Infringement

Using fabric patterns, patented textile technologies, or branded performance features (e.g., moisture-wicking, odor control) without proper licensing can result in infringement claims. For example, adopting a fabric weave or antimicrobial treatment covered by a patent may expose the buyer to litigation.

Failure to Protect Own IP in Contracts

When co-developing materials or custom fabrics with suppliers, companies often neglect to clarify IP ownership in contracts. This oversight can result in losing rights to proprietary designs, formulations, or innovations developed during the sourcing process.

Reverse Engineering and Design Copying

In regions with weak IP enforcement, suppliers may reverse engineer custom materials or share designs with competitors. Without robust non-disclosure agreements (NDAs) and IP clauses, sensitive product information is vulnerable to misuse.

Ambiguous Licensing Agreements

When sourcing patented or trademarked materials (e.g., branded fibers like Coolmax® or TENCEL™), unclear licensing terms can lead to unauthorized use, particularly in volume production or secondary markets. Always verify the scope and territorial rights of any license.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Establish detailed material specifications and quality control protocols.

– Qualify and regularly audit suppliers.

– Require compliance with relevant industry standards and certifications.

– Conduct IP due diligence and secure proper licenses.

– Include clear IP clauses and confidentiality terms in supplier contracts.

– Maintain full traceability through the supply chain.

By proactively addressing quality and IP concerns, companies can ensure reliable, compliant, and legally sound sourcing of materials for scrubs.

Logistics & Compliance Guide for Materials for Scrubs

Sourcing and Supplier Compliance

Ensure all raw materials (e.g., cotton, polyester, spandex) are sourced from suppliers who comply with environmental, labor, and safety regulations. Verify supplier certifications such as OEKO-TEX® Standard 100, GOTS (Global Organic Textile Standard), or bluesign® to confirm materials are free from harmful substances and produced sustainably.

Material Transportation and Handling

Use climate-controlled and secure transportation methods to prevent contamination or damage during transit. Clearly label all shipments with content descriptions, handling instructions (e.g., “Keep Dry,” “Fragile”), and compliance markings. Maintain a documented chain of custody for high-risk or regulated materials.

Regulatory Compliance

Adhere to regional and international regulations including:

– REACH (EU): Ensure no restricted substances are present in fabric dyes or finishes.

– Proposition 65 (California): Disclose any chemicals known to cause cancer or reproductive harm.

– FDA Guidelines (if applicable): Follow guidelines if scrubs are intended for medical use and marketed as protective.

– Customs and Tariff Classifications: Accurately classify textile materials under the HTS (Harmonized Tariff Schedule) for import/export.

Quality Assurance and Testing

Implement routine quality checks for fabric weight, shrinkage, colorfastness, and tensile strength. Conduct third-party lab testing to verify compliance with industry standards for medical apparel, especially if scrubs are labeled as antimicrobial or fluid-resistant.

Packaging and Labeling Requirements

Package materials to prevent contamination and moisture exposure. Final scrub products must include permanent labels listing fiber content, care instructions, country of origin, and compliance certifications. Use standardized labeling formats per FTC (U.S.) or EU Textile Regulation.

Storage and Inventory Management

Store materials in dry, well-ventilated facilities away from direct sunlight and chemicals. Implement a FIFO (First In, First Out) inventory system to minimize degradation. Monitor storage conditions regularly to ensure compliance with material safety data sheets (MSDS/SDS).

Sustainability and Waste Management

Follow environmental regulations for waste disposal of fabric offcuts and dye residuals. Partner with certified recyclers and document waste streams to meet ESG (Environmental, Social, Governance) reporting requirements. Explore closed-loop recycling programs for post-industrial textile waste.

Documentation and Recordkeeping

Maintain comprehensive records of supplier audits, material safety data sheets (SDS), test reports, customs documentation, and compliance certifications. Retain records for a minimum of five years to support traceability and regulatory audits.

Training and Internal Audits

Train logistics and procurement teams on compliance protocols and conduct regular internal audits to ensure adherence to all regulatory and company-specific standards. Update procedures in response to regulatory changes or audit findings.

Conclusion: Sourcing Materials for Scrubs

Sourcing high-quality materials for scrubs is a critical step in ensuring comfort, durability, and functionality for healthcare professionals. The ideal fabric should balance breathability, softness, and resistance to frequent washing and wear. Common choices such as cotton-polyester blends, spun polyester, and antimicrobial-treated fabrics each offer distinct advantages depending on the end user’s needs. Sustainable and ethical sourcing practices are also increasingly important, with demand rising for eco-friendly textiles and transparent supply chains. Ultimately, selecting the right materials involves evaluating performance, cost, environmental impact, and user comfort to deliver scrubs that meet both practical and professional standards. A well-informed sourcing strategy not only enhances product quality but also supports brand reputation and long-term success in the healthcare apparel market.