Introduction: Navigating the Global Market for best eighties outfits

The resurgence of eighties fashion on the global stage has unlocked fresh commercial opportunities for savvy B2B buyers across continents. As bold colors, structured silhouettes, and iconic styles from the 1980s drive consumer demand from Lagos to Buenos Aires, and Madrid to Riyadh, procuring the best eighties outfits is no longer a niche move—it’s a strategic investment. Whether for retail expansion, event-driven merchandising, or themed hospitality, capitalizing on this trend requires both historical awareness and an ability to identify high-quality, market-ready products.

Why is understanding the best eighties outfits vital for B2B buyers today? The continued influence of ‘80s aesthetics—seen on runways, in music, and across digital culture—means enterprises must stay ahead of global style cycles. Buyers who source authentic and on-trend eighties collections can differentiate their offerings, meet evolving local tastes, and boost margins through premium or customized lines. For markets throughout Africa, South America, the Middle East, and Europe, this translates to attracting new demographics, responding to cultural nostalgia, and leveraging the visual power of the eighties in branding and retail experience.

This comprehensive guide equips international buyers with actionable knowledge to navigate the dynamic world of eighties-inspired apparel. Inside, you’ll find:

- Overview of key eighties outfit types and iconic fashion elements

- Analysis of essential materials, fabric trends, and quality markers

- Insights into manufacturing processes, quality control standards, and compliance

- Guidance on selecting trusted suppliers and negotiating terms

- Realistic breakdowns of costs, pricing models, and market margins

- Exploration of current global demand and regional market nuances

- Clear answers to frequently asked sourcing questions

Every section is designed to empower your procurement teams—helping you make confident, data-driven sourcing decisions that match your market’s style appetite and commercial priorities. Prepare to unlock new growth by mastering the art of eighties fashion sourcing.

Understanding best eighties outfits Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Power Suits | Structured shoulders, tailored fit, bold colors, wide lapels | Corporate events, themed conferences, film/costume rentals | Highly iconic, versatile; requires quality tailoring; higher production costs |

| Bodysuits & Underwear-As-Outerwear | Sleek silhouettes, often lace or shiny fabrics, layered styling | Fashion retail, music/entertainment, clubwear | High trend appeal; may face cultural constraints in conservative markets |

| Sequined & Metallic Outfits | All-over sequins, metallic fabrics, bold glamour | Partywear wholesale, performance costumes, event suppliers | Eye-catching & premium; may have storage/care challenges |

| Statement Accessories | Chunky jewelry, large earrings, bold belts | Fashion stores, promotional gifting, costume add-ons | Low unit cost, easy to bundle; trend-driven inventory risks |

| Oversized Outwear (Blazers & Coats) | Exaggerated fits, checks/plaids, padded shoulders | Seasonal retail, fashion chains, branded uniform suppliers | Trans-seasonal, unisex options; may require bulkier logistics |

Power Suits

Power suits are arguably the most emblematic of 1980s fashion, defined by strong, structured shoulders, sharp tailoring, and confident color palettes. Key for events replicating eighties aesthetics or as fashion-forward uniforms, they signal authority and retro sophistication. For B2B buyers, investing in quality fabrics and construction is essential, as the suits need both on-trend design and professional durability. They are particularly suited to corporate clients, event planners, and media productions seeking authenticity.

Bodysuits & Underwear-As-Outerwear

This type leverages the daring eighties fashion trend of visible bodysuits, often styled with high-waisted pants or skirts. They feature materials such as lycra, lace, and shiny synthetics, offering sleek lines ideal for both clubwear and retail collections. While demand is strong in youthful and entertainment-driven markets, buyers should assess local cultural and regulatory norms, especially for regions with specific modesty requirements. Licensing or collaboration with contemporary artists can expand appeal.

Sequined & Metallic Outfits

These glamorous outfits dominate partywear and stage costumes, crafted from sequins, metallics, and lamé. Their visual impact commands attention for events, dance troupes, and specialty retailers. For B2B procurement, ensure suppliers meet quality standards for sequin attachment and colorfastness, as well as manageable care instructions. Supply chain considerations include careful packing and climate-controlled shipping to preserve sparkle and avoid distortion.

Statement Accessories

Chunky necklaces, oversized earrings, and dramatic belts were eighties staples and remain cost-effective ways to channel the era’s style. Accessories are easily integrated into multiproduct fashion ranges or stand-alone POS displays, making them an agile, low-risk inventory option. B2B buyers can leverage accessories for value-added bundles or promotional campaigns. The primary challenge lies in quickly shifting trends; close monitoring of market preferences ensures continued relevance.

Oversized Outerwear (Blazers & Coats)

Featuring plaid prints and exaggerated silhouettes, oversized blazers and coats cater to a wide demographic and transcend seasonality. They are ideal for both menswear and womenswear markets, and their looser cuts allow for easier fitting and lower return rates. B2B distributors should prioritize sourcing robust, easy-care fabrics and consider demand for both lightweight and winter-weight variations. Bulkier items, however, may necessitate efficient warehousing and distribution systems.

Key Industrial Applications of best eighties outfits

| Industry/Sector | Specific Application of best eighties outfits | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Event Management & Entertainment | Themed events, concerts, retro festivals, and film/tv production | Captivates attendees, enhances event authenticity, attracts larger audiences | Authenticity of design, durability, availability of wide size range, supplier reliability |

| Retail (Fashion & Apparel) | Seasonal retro collections and pop-up promotions | Drives sales through nostalgia trend, differentiates store offering | Trend adaptation, quality finishing, supply flexibility, regional style adaptation |

| Advertising & Marketing | Branded campaigns, influencer activations, photo/video shoots | Amplifies brand recall, increases campaign engagement, connects with diverse demographics | Customization options, fast production/lead times, compliance with branding requirements |

| Tourism & Hospitality | Staff uniforms for themed restaurants, hotels, cruise lines | Creates immersive guest experiences, boosts social media exposure, enhances brand positioning | Ease of maintenance, comfort, adherence to local workplace standards |

| Performing Arts & Cultural Institutions | Costume design for theatre, museums, exhibitions | Preserves cultural heritage, supports storytelling, increases visitor engagement | Historical accuracy, availability of custom sizing, collaboration with costume designers |

Event Management & Entertainment

Best eighties outfits are essential for creating impactful, memorable experiences at concerts, themed parties, music festivals, and film or television productions that tap into the vibrant aesthetics of the decade. These garments instantly set a tone, immerse attendees or viewers in nostalgia, and can be tailored for specific eras within the 1980s. For B2B buyers in diverse regions, reliable access to authentic-looking, robust costumes in size-inclusive ranges and prompt delivery is critical to avoid last-minute shortfalls before high-profile events.

Retail (Fashion & Apparel)

Retailers worldwide leverage the eighties trend to revitalize seasonal collections, deploy retro pop-up shops, or run limited-time campaigns that resonate with both Gen X and younger buyers fascinated by retro culture. For boutiques and department stores in Europe, Africa, South America, and the Middle East, key requirements include adaptable sizing, consistent quality, regionally sensitive adaptations, and the flexibility to scale orders as trends surge. Supplier agility and on-trend product development are especially valuable.

Advertising & Marketing

Bringing eighties-inspired fashion into branded campaigns, influencer activations, or high-impact photo and video content enables brands to tap into nostalgia and capture cross-generational engagement. Outfits must be customizable with branded elements or colorways and produced swiftly to meet dynamic campaign schedules. Marketing agencies in Argentina or the UAE, for example, will benefit from suppliers skilled in rapid prototyping, strong communication, and the ability to meet international branding standards.

Tourism & Hospitality

Hotels, themed restaurants, and cruise lines increasingly use eighties attire for staff uniforms and special events to differentiate guest experiences and encourage organic social media promotion. Outfits must be stylish yet practical—easy to clean, comfortable for extended wear, and compliant with relevant local labor norms. B2B buyers in regions with warm climates, such as the Middle East or parts of Africa, must also consider breathable materials and lighter adaptations of the classic looks.

Performing Arts & Cultural Institutions

Museums, theatres, and cultural venues rely on era-appropriate costumes to support exhibitions, stage productions, or educational programs about the 1980s. Authenticity in design and period-accurate materials boost visitor immersion and educational value. Institutions across Spain or Brazil often require bespoke sizing and close collaboration with designers, making supplier experience with custom work and responsiveness to institutional timelines and curation requirements imperative.

Related Video: USES OF ROBOTS | Robotics in Daily Life

Strategic Material Selection Guide for best eighties outfits

Selecting Optimal Materials for Iconic Eighties Outfits: A B2B Analysis

Success in sourcing and manufacturing eighties-inspired apparel depends heavily on material choice. International buyers, especially from Africa, South America, the Middle East, and Europe, must assess not only style authenticity and cost but also climate suitability, regulatory standards, and durability for shipment and end use. This section analyzes four key materials that dominated 1980s fashion, providing actionable insights for effective procurement and supply chain decisions.

1. Polyester

Key Properties:

Polyester was foundational to 1980s fashion, prized for its high strength, wrinkle resistance, and colorfastness. It resists stretching and shrinking, dries quickly, and maintains shape after repeated laundering.

Pros:

– Highly durable and abrasion-resistant

– Easy to care for, machine washable

– Retains vibrant colors, ideal for bold designs

Cons:

– Limited breathability, which can be uncomfortable in hot climates

– Can pill and accumulate static

– Oil-based: not biodegradable

Impact on Application:

Polyester is optimal for iconic pieces like power suits with sharp shoulders, tracksuits, and statement dresses. It’s compatible with neon dyes and sequins.

International B2B Considerations:

Buyers in hot, humid regions (e.g., Brazil, Nigeria) should consider blends for breathability. Meets global standards like ASTM D276, EN ISO 1833. Commonly available, but ethical sourcing (e.g., OEKO-TEX® certification) is increasingly important in European markets.

2. Cotton

Key Properties:

Cotton offers natural breathability, high water absorption, and is soft to wear. It’s hypoallergenic and withstands repeated washing.

Pros:

– Excellent temperature regulation, ideal for warm and variable climates

– Versatile for layering (turtlenecks, oversized shirts, acid-wash jeans)

– Biodegradable and favored in sustainability-focused markets

Cons:

– Prone to wrinkling and shrinking

– Can fade, especially with bright 80s colors

– Lower tensile strength than synthetics

Impact on Application:

Best for comfortable, casual retro wear: T-shirts, blouses, denim. Suitable for “street style” layering and checked outerwear.

International B2B Considerations:

Critical in Africa and Argentina’s summer markets. Compliance with standards like GOTS, BCI preferred for ethical sourcing—demand high in Europe, Spain, and the Middle East for “green” textiles.

3. Leather (Natural and Faux)

Key Properties:

Leather delivers strength, abrasion resistance, and a distinctive look, vital for jackets and statement belts. Faux (PU) leather mimics these properties but is lighter and often more cost-efficient.

Pros:

– Iconic, high perceived value (biker jackets, corset belts)

– Long-lasting if treated properly

– Water and wind resistant (for natural leather)

Cons:

– Heat retention unsuitable for tropical climates

– Higher initial cost, especially for genuine leather

– Regulatory restrictions on animal products and VOC emissions (in PU manufacturing)

Impact on Application:

Essential for outerwear, belts, statement accessories. Faux leather increasingly used for price and vegan compliance.

International B2B Considerations:

Middle Eastern and Latin American markets may favor lighter faux leathers for climate. EU REACH and EN 15987 standards regulate chemicals in both types. Sensitivities around animal products and sustainability should be weighed regionally.

4. Nylon

Key Properties:

Nylon is lightweight, strong, smooth, and moisture-wicking. It offers good elasticity and is easy to dye.

Pros:

– Resists mildew and moisture, suitable for rain jackets, track suits

– Retains shape and color

– Dries quickly, highly packable for export

Cons:

– Can yellow under UV light

– Moderate environmental concerns (microplastics, non-biodegradable)

– Lower heat and flame resistance

Impact on Application:

Perfect for sporty looks, windbreakers, and shiny party dresses that defined the late 80s.

International B2B Considerations:

Preferred for lightweight, export-friendly goods to Africa and South America. Compliance with ASTM D6775 for apparel durability is advisable. Growing scrutiny in Europe over environmental impact—recycled nylon blends in demand.

Summary Markdown Table: Material Assessment for Eighties-Inspired Apparel

| Material | Typical Use Case for best eighties outfits | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyester | Power suits, tracksuits, sequined dresses | Durable, vibrant color retention | Limited breathability, oil-based non-biodegradable | Low–Medium |

| Cotton | Acid-wash jeans, turtlenecks, oversized shirts | Breathable, comfortable, sustainable | Prone to wrinkling/shrinking, can fade | Medium |

| Leather (Natural/Faux) | Biker jackets, corset belts, accessories | Iconic style, abrasion resistance | High cost (genuine), unsuitable for hot climates, regulatory issues | Medium–High (varies by type) |

| Nylon | Windbreakers, sporty and shiny dresses | Lightweight, moisture-resistant | UV degradation, environmental concerns | Low–Medium |

This material analysis equips B2B buyers to confidently specify, source, and market authentic eighties-style apparel across diverse international contexts, balancing regional climate, end-user expectations, cost constraints, and compliance requirements.

In-depth Look: Manufacturing Processes and Quality Assurance for best eighties outfits

Overview of Manufacturing Stages for Eighties-Inspired Apparel

The production of best-selling eighties outfits adheres to a structured manufacturing process, combining classic garment techniques with modern textile innovations. B2B buyers seeking to source at scale should understand each stage, from selection of statement fabrics and trims to the critical assembly and finishing steps that influence both quality and appeal. Below is a breakdown of the main stages and techniques deployed in the current market:

1. Material Selection and Preparation

- Fabric Sourcing: The eighties boasted distinctive materials—bold synthetics (nylon, polyester), denim, sequined fabrics, neon lycra, and oversized knits. Reputable suppliers source from mills compliant with international chemical safety regulations such as REACH/OSHA, verifying fiber content and colorfastness before integration into production.

- Quality Grading and Pre-treatment: Swatches are tested for tensile strength, shrinkage, dye retention, and resistance to pilling—particularly important for vibrant and embellished items. Core fabrics (e.g., for structured blazers or bodysuits) may undergo pre-shrinking or anti-wrinkle treatments to maintain garment shape and finish.

- Trims and Accessories: Statement elements like shoulder pads, bold zippers, chunky jewelry accents, and metallic belts require quality verification with each incoming batch to ensure durability and regulatory compliance (such as restricted substances in Europe or Argentina).

2. Pattern Cutting and Fabric Shaping

- Pattern Development: Faithful reproduction of iconic ’80s silhouettes (e.g., oversized blazers, power shoulders, high-waisted jeans) begins with CAD patterning to ensure consistency at scale. Precision is required to accommodate exaggerated dimensions without compromising fit.

- Cutting Techniques: Both manual and automated cutting are used, depending on production volume and fabric type. Laser cutting may be deployed for intricate details like sequined appliqués, ensuring clean edges and minimal waste.

3. Assembly and Construction

- Sewing Operations: Specialized machines stitch complex assemblies, such as attaching structured shoulders or sequined overlays. Double-needle and chain-stitching techniques are commonly applied to enhance seam durability—critical for garments designed for regular laundering or active use, like bodysuits.

- Accessory Integration: Trims, belts, and statement elements are attached in dedicated lines, often requiring skilled labor for delicate operations (e.g., hand-setting grommets, oversewing sequins to prevent shedding).

4. Finishing and Detailing

- Pressing and Steaming: Finished garments are pressed to bring out signature eighties silhouettes; structured pieces are steamed with care to retain volume without warping synthetic fibers.

- Final Touches: Quality tags, care labels (multilingual for export), and packaging are applied. For B2B export, eco-compliant and regionally appropriate packaging is standard (adhering to, for example, EU packaging directives).

Key Quality Assurance Protocols in Eighties Outfit Manufacturing

Quality assurance (QA) is integral at every stage of production, combining global standards with fashion industry-specific measures to safeguard consistency and compliance. International B2B buyers must be familiar with QA checkpoints, compliance requirements, and effective verification strategies.

International Standards and Compliance

- ISO 9001 (Quality Management Systems): Most export-focused manufacturers operate ISO 9001-certified facilities. This ensures standardized processes, traceability, and ongoing improvement, reducing risk for buyers in regions such as Africa, South America, or the Middle East.

- CE Marking (Europe): If accessories or trims could fall under PPE (personal protective equipment) or electrical components (e.g., illuminated signage), CE marking is essential for EU-bound goods, especially Spain.

- REACH and Oeko-Tex: For goods exported to the EU, compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and Oeko-Tex Standard 100 is increasingly required—to guarantee the absence of harmful substances.

- Local Certification: Some countries (e.g., Argentina, Egypt, Saudi Arabia) may require additional national standards and mark of conformity for textile imports. Buyers should request supplier documentation on compliance.

Core Quality Control Points

Three main quality control (QC) checkpoints are critical:

-

Incoming Quality Control (IQC):

– Material Inspection: Verifies colorfastness, hand-feel, and physical durability of fabrics and trims before production. Non-compliant batches are quarantined and rejected.

– Certification Verification: Ensures all incoming materials comply with required international and buyer-driven certifications. -

In-Process Quality Control (IPQC):

– Assembly Monitoring: Supervisors inspect at key production intervals—checking seam strength, accuracy of major construction steps (e.g., shoulder reinforcement, zipper placement), and adherence to design specifications.

– Defect Capture: In-line checks for sewing flaws, misalignment, or surface defects. Immediate correction prevents batch-level failures. -

Final Quality Control (FQC):

– Performance Testing: Finished goods are spot-checked for size conformity, embellishment adherence, and defect-free assembly. For special finishes (e.g., metallic or sequin), rub and wash tests gauge durability.

– Packaging QC: Cross-verifies labeling accuracy and appropriate packaging for target markets, with special regard to language, regulatory information, and customs requirements.

Common Testing Methods Used

- Color Fastness Testing: Ensures dyes do not run or fade during wear or washing (ISO 105 recommended for most textiles).

- Tensile Strength & Seam Slippage: SGS and intertek-approved protocols test whether heavy embellishments or oversized features (shoulder pads, accessories) remain intact during use.

- Chemical Safety Screening: Confirms the absence of restricted substances, vital for European and South American buyers.

- Hand-Feel & Comfort Evaluation: User trials and simulated wear ensure comfort and correct sizing, accounting for regional preferences (some areas prefer looser or slimmer fits).

How International B2B Buyers Can Verify Supplier Quality

For Africa, South America, the Middle East, and European B2B importers, robust supplier QA verification is essential. The following strategies are highly effective:

- Supplier Audits: Conduct regular on-site audits—personally or via appointed agents such as SGS, Intertek, or Bureau Veritas—to assess plant hygiene, machinery conditions, process compliance, and worker training.

- Certification Diligence: Request up-to-date copies of ISO 9001, Oeko-Tex, CE, or other region-specific certifications before contracting. Validate details directly with the issuing authority if possible.

- Third-Party Pre-Shipment Inspections: Employ neutral inspectors to sample random batches before dispatch. These checks typically include physical testing, measurements, packaging verification, and accessory durability tests.

- Production Reports: Reliable suppliers furnish detailed QA/QC records by batch—including defects found, corrective actions, and results from in-line and final inspections.

- Transparent Communication: Maintain continuous dialogue with the supplier’s quality manager, including video walkthroughs or real-time QC reporting in regions where travel is impractical.

- Post-Shipment QA: For higher-risk or first-time suppliers, arrange for incoming checks in your local facility before distribution.

Regional Quality and Compliance Considerations

- Africa: Importers should look for suppliers experienced in handling local climate requirements—e.g., colorfastness under intense sun for North Africa, durable trims suitable for both urban and rural customers.

- South America (e.g., Argentina): Compliance with Mercosur labeling, language requirements (Spanish/Portuguese), and local safety directives is crucial. Demand traceable documentation for all materials.

- Middle East: Modesty and comfort vary in importance; oversee color, cut, and accessory choices for cultural sensitivity. Verify that suppliers understand local regulations related to textiles and consumer safety.

- Europe (e.g., Spain): Strict chemical, labeling, and eco-compliance (especially under EU Green Deal) define market entry. Prioritize suppliers with proven, up-to-date regulatory know-how—including circular economy practices gaining traction.

Actionable Recommendations for B2B Buyers

- Perform due diligence on certifications, QA documentation, and compliance with both your own and destination market regulations.

- Schedule regular audits and third-party inspections, especially ahead of major shipments.

- Insist on clear, multi-lingual product labeling and compliant packaging to prevent customs delays.

- Invest in long-term supplier relationships, favoring partners that demonstrate transparency and adapt their QC processes to meet evolving international standards.

- Collaborate on fashion-specific QA checklists to address unique challenges of eighties-inspired garments—such as oversized construction, bold coloration, and statement embellishments.

By mastering manufacturing and quality assurance intricacies specific to eighties apparel, international B2B buyers can confidently build standout product lines adapted to global tastes, regulatory frameworks, and consumer expectations.

Related Video: Amazing Garment Manufacturing Process from Fabric to Finished Product Inside the Factory

Comprehensive Cost and Pricing Analysis for best eighties outfits Sourcing

Understanding the Key Cost Drivers in Eighties Outfits Sourcing

When planning to source the best eighties outfits on the international B2B market, a clear understanding of the full cost structure is essential for budget control and competitive pricing. Vintage-inspired apparel carries certain unique cost drivers due to its styling, materials, and production methods. Below is an actionable breakdown of the main components impacting total costs, as well as critical pricing influencers and strategies to maximize cost efficiency for global buyers.

Breakdown of Cost Components

- Materials: Fabrics (denim, synthetic blends, sequins, neon synthetics, tulle) make up 25-45% of the total garment cost. Eighties fashion often requires specialty materials—like power shoulder pads, bold prints, and metallics—which are more expensive or require sourcing from specialized suppliers.

- Labor: Assembly and embellishment add significant value, especially when hand-applied details (like ruffles, sequins, or custom tailoring) are required. Labor costs vary by region; buyers will find distinct price points across Asia, Turkey, and Eastern Europe.

- Manufacturing Overhead: Includes factory operational expenses, depreciation on equipment (notably for unique silhouettes), and compliance with workplace standards—a key consideration for established brands seeking global certifications.

- Tooling and Sampling: Eighties-inspired items with unique shapes or prints may require custom die-cutting, molds, or fabric printing screens, increasing upfront development costs.

- Quality Control (QC): Rigorous QC is demanded for intricate styling and durability, from colorfastness to seam strength, with potential third-party testing for larger orders.

- Logistics and Freight: Voluminous items (e.g., puffed jackets or shoulder-padded blazers) can result in higher volumetric shipping costs. Air vs. sea freight decisions also heavily impact total landed cost, especially for African, South American, and Middle Eastern destinations.

- Margins: Supplier margins vary (10-35%) based on volume, buyer relationship, exclusivity, and payment terms.

Price Influencers for International Buyers

- Order Volume and Minimum Order Quantities (MOQs): Large volumes reduce unit costs due to scale, but each supplier has unique MOQ thresholds, especially for niche eighties fabrics or trims. Buyers from emerging markets (e.g., Argentina, Nigeria) might face higher MOQs or surcharges.

- Specifications and Customization: Requests for authentic retro fabrics, vintage washes, unique colorways, or custom branding add material and labor costs. Licenses for famous designs (e.g., pop-culture prints) will entail additional royalties.

- Raw Material Fluctuations: Prices for synthetics and metals used in chunky jewelry or accessories are subject to commodity market swings.

- Quality Requirements and Certifications: International buyers, especially those importing to the EU or GCC, should consider costs associated with compliance (OEKO-TEX, REACH, ISO), which can add 3-8% to base price but are often non-negotiable for regulatory entry.

- Supplier Location and Experience: Well-established suppliers with export experience may charge premium rates but provide reliable lead times and better after-sales support.

- Incoterms: The choice between EXW, FOB, CIF, or DDP impacts the buyer’s responsibility for inland freight, export duties, insurance, and final delivery. DDP can benefit new importers but includes higher supplier markups.

Actionable Tips for International B2B Buyers

- Leverage Scale and Aggregation: Use consolidated orders or partner with other buyers from your region to reach MOQs and reduce per-unit costs.

- Request Detailed Quotes: Always require a breakdown (materials, labor, QC, logistics, margin) in supplier quotations. This enhances negotiation leverage.

- Total Cost of Ownership: Factor in all costs—including import duties, insurance, local compliance testing, and warehousing—not just unit price. Shipping, customs, and last-mile costs can vary 15-30% between regions.

- Negotiate Payment Terms: Seek extended payment windows (e.g., 60-day terms) to improve cash flow, or discounts for upfront payment, depending on supplier reliability and your credit profile.

- Beware of Hidden Costs in Customization: Authentic eighties looks may involve high sampling costs and longer lead times. Clarify up front to avoid surprises.

- Certifications and Compliance: For buyers selling in regulated markets (notably the EU), verify necessary product certifications early and budget for associated fees and lab testing.

- Seasonal Buying Considerations: Place orders well ahead of seasons or eighties revival events to avoid rush fees and inflated logistics costs.

Disclaimer: All prices and markups cited are indicative and will fluctuate based on supplier location, order specifics, international freight markets, and evolving compliance requirements. Buyers should always conduct supplier audits and request sample runs prior to high-volume commitments.

By understanding these nuances and cost drivers, international buyers across Africa, South America, the Middle East, and Europe can confidently secure the best value while managing sourcing risks and regulatory challenges.

Spotlight on Potential best eighties outfits Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘best eighties outfits’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

20 Popular 80s Clothing Brands We Loved (illumeably.net)

With a curated selection of the most iconic 1980s clothing labels, this supplier aggregates vintage-inspired collections representing the height of eighties trends. The range spans denim authorities like Guess—with their acid-wash jeans and triangle-logo jackets—to Calvin Klein’s minimalism and Lacoste’s renowned preppy polos. Specialized in brand-specific nostalgia, they offer licensed styles as well as retro reinterpretations, appealing to both apparel retailers and lifestyle boutiques targeting a new generation of consumers hungry for authentic eighties aesthetics. Their portfolio supports broad market needs—from rugged denim and practical basics to statement pieces reminiscent of pop culture’s golden era. Though detailed certifications or manufacturing standards are not widely disclosed, their proven dedication to legacy brands and trend-led collections makes them a resource for B2B buyers seeking popular retro apparel with international resonance.

The 21 Best 80s Streetwear Brands [2025] (www.discobrands.co)

Combining retro aesthetics with modern production, The 21 Best 80s Streetwear Brands [2025] curates and supplies iconic eighties outfits for today’s fashion market. The company spotlights brands such as Levi’s, Tommy Hilfiger, Champion, and Guess, offering products characterized by bold colors, distinctive patterns, and enduring street style silhouettes. Their collection appeals to buyers seeking authentic retro appeal with contemporary quality standards, ideal for large-scale retail or boutique distribution.

Key Strengths for B2B Buyers

- Specialization: Focused on high-quality 80s-inspired streetwear, including denim, athleisure, and statement pieces popular with modern urban consumers.

- Broad Sourcing: Offers premium selections from globally recognized brands, supporting diverse inventories tailored to regional market preferences across Africa, South America, the Middle East, and Europe.

- Market Relevance: Tracks current streetwear trends and integrates them with nostalgic 80s influences, ensuring ongoing consumer demand.

- Support: Provides comprehensive information resources and trend analysis for buyers seeking strategic assortment planning.

Note: While detailed certifications and in-house manufacturing capabilities are not publicly disclosed, the company is highly regarded within the best eighties outfits sector for its curated brand portfolio and trend-driven approach.

The 21 Best 80s Clothing Brands (retailboss.co)

The 21 Best 80s Clothing Brands, featured on RetailBoss, offers a curated selection of manufacturers and suppliers specializing in iconic eighties-inspired apparel and accessories for the global wholesale market. Their portfolio emphasizes vibrant colors, bold silhouettes, and retro aesthetics that capture the essence of 1980s fashion trends—such as oversized blazers, statement accessories, and power dressing. While detailed manufacturing certifications are not publicly disclosed, their presence on a leading B2B fashion platform suggests adherence to industry standards and a network of international suppliers. This collective is well-suited for B2B buyers seeking trend-driven apparel for established or emerging markets, with a strong focus on adaptability to diverse consumer preferences in Africa, South America, the Middle East, and Europe. Unique selling points include comprehensive sourcing options and trend consultancy for retailers aiming to capture the ongoing demand for retro and nostalgia-driven fashion.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 20 Popular 80s Clothing Brands We Loved | Iconic, multi-brand retro 80s apparel supplier | illumeably.net |

| The 21 Best 80s Streetwear Brands [2025] | Curated iconic 80s streetwear brands. | www.discobrands.co |

| The 21 Best 80s Clothing Brands | Curated retro-fashion sourcing for global retailers | retailboss.co |

Essential Technical Properties and Trade Terminology for best eighties outfits

Key Technical Specifications for ‘Best Eighties Outfits’

Understanding and specifying the right technical attributes is crucial when sourcing 1980s-inspired fashion for wholesale or retail. These standards directly impact quality, compliance, consumer appeal, and supply chain efficiency—especially in international markets.

1. Fabric Composition and Grade

The material used is the foundation of any garment’s quality and performance. For ’80s outfits, popular authentic materials include cotton-blend jerseys (for bodysuits and t-shirts), polyester (for dresses and outerwear), spandex/elastane (for stretch fit), and sequined or metallic fabrics. Grade designations—such as “A-grade knit” or “OEKO-TEX certified”—indicate durability and compliance with safety or environmental standards, which are increasingly important for buyers in Europe and the Middle East.

2. Colorfastness and Dye Standards

Vivid, saturated hues were a hallmark of eighties fashion—think neon pinks, cobalt blues, and bold prints. For bulk buyers, colorfastness guarantees that garments retain their color during washing, shipping, and wear. Common indicators include ISO 105-C06 for wash fastness and AATCC 61 standards. Specifying these minimizes returns and brand complaints.

3. Garment Construction and Tolerance

Attention to construction—such as reinforced seams on blazers or Zig-Zag stitching on stretchwear—ensures the pieces withstand frequent use and laundering. Tolerances relate to permissible variances in size or fit; for example, a ±1cm discrepancy in shoulder width can affect fit, especially for iconic power jackets with padded shoulders. Clear tolerance specs help maintain sizing consistency across markets.

4. Trims and Embellishments Quality

From chunky zippers to oversized buttons and bold sequins, trims significantly contribute to the authentic ’80s aesthetic. Specify the quality (e.g., nickel-free for jewelry hardware or abrasion resistance for sequin finishes) to minimize safety and durability issues, which are particularly relevant for markets with strict import regulations like the EU.

5. Packaging and Labelling Standards

International B2B transactions require adherence to destination-specific packaging (e.g., recyclable bags for Europe, bilingual care labels for Africa and South America) and correct labelling for fiber content and country of origin. Compliance simplifies customs clearance and builds consumer trust.

Common B2B Trade Terms for Eighties Outfits Sourcing

B2B buyers navigating bulk purchases of eighties-inspired attire should be fluent in essential industry terminology to avoid misunderstandings and optimize supplier negotiations.

-

MOQ (Minimum Order Quantity): The smallest batch a manufacturer will produce or sell—important for planning inventory and testing new markets. For example, an MOQ of 300 units per style may apply to blazers with structured shoulders.

-

OEM (Original Equipment Manufacturer): In apparel, this means a supplier that manufactures garments based on your design or branding. Buyers may request OEM services for on-trend variations like custom-printed bodysuits or jackets with exclusive colorways.

-

RFQ (Request for Quotation): Buyers issue an RFQ to obtain detailed pricing and terms from potential suppliers. This should include technical specs: fabric composition, color requirements, construction, and expected tolerances.

-

Incoterms (International Commercial Terms): Standardized trade terms (e.g., FOB—Free on Board, CIF—Cost Insurance Freight) define responsibility for shipping, insurance, and customs clearance at each stage of delivery. Selecting the right Incoterm helps manage costs and risk, especially on intercontinental routes to Africa or South America.

-

Lead Time: The period between order placement and delivery. With vintage-influenced seasonal trends, reliable lead times are vital for aligning stock with regional fashion calendars.

-

Compliance Certification: Proofs such as REACH (EU chemical safety), OEKO-TEX (textile safety), or BSCI (social compliance) are increasingly required, particularly in Europe and large Middle Eastern markets, to satisfy both legal and consumer demands.

Action Points for Buyers: Insist on complete technical datasheets for every style, verify supplier compliance, and clarify all trade terms during negotiations. A focus on these industry standards and terminology ensures a smoother procurement process and higher market success for authentic, high-quality eighties outfits across global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the best eighties outfits Sector

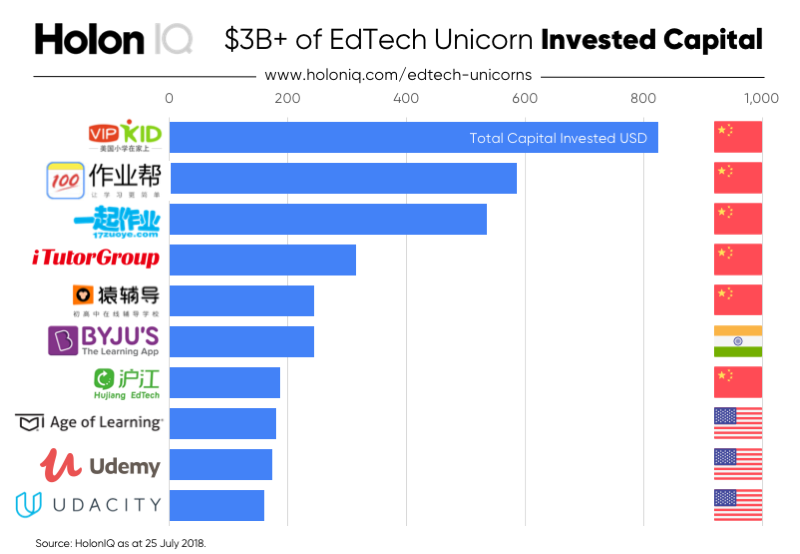

Market Overview and Key Trends

The global market for eighties-inspired fashion has surged in recent years, driven by nostalgia, influencer culture, and cyclical runway revivals. This resurgence reflects both a persistent demand from retro enthusiasts and a new wave of younger consumers seeking statement looks. For international B2B buyers, especially across Africa, South America, the Middle East, and Europe, several market dynamics are shaping sourcing and distribution strategies.

Key global drivers include the influence of pop icons and streaming platforms revitalizing ’80s aesthetics, an upswing in themed events, and the power of social media to transform boutique trends into mass-market essentials. Classic ’80s elements—such as bold-shouldered blazers, vibrant color-blocking, oversized silhouettes, chunky jewelry, and statement accessories—are proving popular with both retailers and event wardrobe suppliers.

Emerging sourcing trends for B2B buyers center on technology integration and speed-to-market. Digital showrooms and virtual sampling platforms are increasing efficiency and helping buyers assess fabrics, color accuracy, and designs remotely—significant for buyers based in markets like Argentina, Spain, Kenya, or the UAE where direct supplier visits may be costly or logistically complex. The proliferation of specialized suppliers in Asia (notably China and Bangladesh) combined with local manufacturing revival in Europe and North Africa offers buyers varied options for balancing price, speed, and quality.

When assessing supply partnerships, many buyers are focusing not just on cost but on supplier transparency, agility, and their ability to handle small-batch or rapid-turnaround orders. This is particularly relevant for boutique retailers in Europe and Middle Eastern event companies seeking customized, short-run ‘best eighties outfits’ for weddings, corporate events, or themed festivals.

For buyers in Africa and South America, adaptation to local tastes is paramount. In many regions, incorporating local textiles or tailoring fits for climate (e.g., lighter fabrics in Nigeria or Brazil) can differentiate offerings. Meanwhile, European markets value authenticity and vintage detailing, while Middle Eastern buyers may seek modest adaptations (e.g., modified silhouettes, layering options).

In summary, competitive advantage lies in sourcing flexibility, digital integration for procurement, and a nuanced understanding of shifting consumer preferences across international markets.

Sustainability and Ethical Sourcing in B2B

Sustainability is rapidly becoming a pivotal concern in the ‘best eighties outfits’ sector, as companies adapt to both regulatory pressures and increasingly eco-conscious B2B and end-user clients. The fashion industry’s historic environmental impact—characterized by intensive water use, chemical dyes, and textile waste—places special scrutiny on retro-inspired garments, often reliant on synthetic or embellished fabrics.

Key priorities in the sustainable B2B supply chain include:

- Material Selection: There is rising demand for certified sustainable materials. Preferred options include organic or recycled cotton, Global Recycled Standard (GRS)-certified polyester, and plant-based dyes. Innovative suppliers are also offering recycled sequins and trims—important for ’80s-inspired designs heavy on embellishment.

- Certifications & Transparency: B2B buyers prioritize suppliers with third-party certifications such as OEKO-TEX, GOTS, or Fair Trade. These certifications provide assurance that not only are materials less environmentally damaging, but labor standards and social welfare are respected.

- Ethical Supply Chains: Responsibly sourced eighties outfits require transparency from fiber through final production. Auditable supply chains and digital traceability tools are increasingly favored, supporting compliance with stricter EU and Middle Eastern regulations on supply chain due diligence.

- Production Practices: Efficient water and energy use, closed-loop processing, and waste minimization are sought-after features, especially for buyers in Europe where environmental compliance is tightly regulated.

Many buyers from Africa and South America also see sustainability as a market differentiator—allowing them to command premium pricing or appeal to urban, sustainability-minded consumers. Middle Eastern and European buyers, facing growing government mandates, are increasingly unwilling to compromise on certifications, making sustainable sourcing a baseline expectation rather than a bonus.

Ultimately, integrating sustainability into procurement not only meets evolving regulatory and customer demands but also future-proofs B2B portfolios in the dynamic retro-fashion market.

Historical Evolution: Eighties Outfits in the B2B Context

The original 1980s era marked a turning point in global fashion retail, driven by mass media, celebrity endorsements, and the democratization of trendsetting. It was a decade defined by bold experimentation—think oversized silhouettes, power suits, maximalist accessories, and vivid palettes.

The revival of these trends in today’s B2B landscape is rooted not just in nostalgia but in their adaptability: eighties pieces can be restyled with modern twists, making them perennially relevant. For suppliers and buyers, legacy designs serve as blueprints that are constantly refreshed by advances in material science and digital design tools.

For international B2B buyers, understanding this historical context allows more effective portfolio curation—balancing iconic shapes and elements with regional adaptations and contemporary sustainability expectations. The enduring popularity of ‘best eighties outfits’ ensures this sector will remain a vibrant, innovative space within global fashion sourcing.

Related Video: How Trump’s tariffs will impact the global economy | DW News

Frequently Asked Questions (FAQs) for B2B Buyers of best eighties outfits

-

How can I effectively vet suppliers of eighties outfits to ensure reliability and authenticity?

Carry out comprehensive due diligence by reviewing supplier credentials, trade licenses, and third-party verifications. Request samples of eighties outfits to evaluate fabric quality and design accuracy, and ask for references from international clients in your region. Utilize B2B platforms with verified profiles and prioritize suppliers with established export experience to Africa, South America, the Middle East, or Europe. Monitor responsiveness and willingness to share detailed product and production information. Consider arranging a site visit via a local sourcing agent or third-party inspection company, especially for high-value or bulk orders. -

What customization options are typically available for bulk eighties outfit orders?

Reputable manufacturers often offer customization in fabrics, sizing, colors, and key design elements (e.g., sequins, shoulder pads, ruffles, prints) to reflect local market preferences. You can request custom labeling, packaging, or even adapt classic eighties styles for climate or cultural appropriateness—vital for diverse regions. For larger quantities, manufacturers may accept detailed tech packs or reference images. It’s important to confirm minimum order requirements for customizations, review prototypes, and clarify any extra charges and lead times tied to these adjustments. -

What are standard minimum order quantities (MOQs), lead times, and payment terms when sourcing eighties outfits?

MOQs typically range from 100 to 500 units per style, though some suppliers may accommodate mixed styles or negotiate lower quantities for initial orders. Lead times vary from 30 to 60 days, depending on order complexity, customization, and factory workload. Payment terms commonly offered include 30% advance and 70% upon shipment or via irrevocable letter of credit (L/C). Always clarify timelines and secure terms in writing to ensure mutual understanding, particularly for deliveries aligned to seasonal or event-driven sales. -

How do I verify the quality and safety of eighties outfits, and what certifications should I request?

Ensure that the supplier adheres to recognized quality standards by requesting documentation such as ISO 9001 or relevant industry certificates. For textiles, request fabric composition tests and check for compliance with safety and non-toxicity standards (e.g., OEKO-TEX Standard 100, REACH for Europe). Insist on third-party pre-shipment inspections to verify workmanship, labeling, and packaging. For markets with strict import regulations (such as the EU), confirm that products meet all applicable compliance requirements and that certifications are valid and current. -

What are practical logistics considerations for international B2B buyers of eighties outfits?

Assess shipping methods (air, sea, express courier) based on budget, order size, and delivery timelines. Confirm if the supplier provides FOB, CIF, or DDP shipping options, and clarify who manages customs clearance and local import duties. For African, South American, Middle Eastern, or European markets, review local regulatory requirements, tariff codes, and potential delays. Use reputable freight forwarders and track shipments with clear documentation to avoid losses, and ensure packaging is durable for long transit periods and local handling conditions. -

How can I handle disputes or quality claims with overseas suppliers?

Mitigate risks by having a clearly defined contract detailing product specifications, quality requirements, inspection protocols, and dispute resolution mechanisms. If a dispute arises, promptly document the issue with photos and formal communication. Refer to agreed terms on remediation—such as replacement, credit note, or partial refund. For significant discrepancies, consider involving third-party arbitration services or your country’s chamber of commerce. Where possible, use escrow services or payment platforms that offer buyer protection until goods pass inspection. -

Are there specific trends or features in eighties outfits that appeal to buyers in Africa, South America, the Middle East, or Europe?

Yes, regional preferences often dictate demand. African buyers may prefer vibrant prints and lightweight fabrics suited for warmer climates; South American markets might favor bold, colorful looks and adaptable sizing; Middle Eastern buyers could prioritize modesty through longer sleeves or layered looks; European buyers may seek authentic vintage detail and compliance with sustainability standards. Communicate your market’s needs directly to suppliers and request product catalogs showcasing available adaptations. -

What documentation is essential for importing eighties outfits into my country, and how can delays be minimized?

Crucial documents include the commercial invoice, packing list, bill of lading or airway bill, certificate of origin, and any necessary testing or compliance certificates. Some destinations may require import licenses or additional conformity assessments, so verify requirements with local customs or a freight forwarder before shipping. Ensuring paperwork accuracy, completeness, and timely delivery to local authorities helps prevent clearance delays and unexpected charges. Maintain ongoing communication with both your supplier and logistics partners to address issues proactively.

Strategic Sourcing Conclusion and Outlook for best eighties outfits

International demand for authentic eighties outfits continues to surge, driven by nostalgic fashion cycles, contemporary trends, and the universal appeal of bold self-expression. For B2B buyers across Africa, South America, the Middle East, and Europe, several actionable principles emerge from recent market insights:

Key B2B Takeaways

- Diversity of Styles: The eighties portfolio is rich and varied, encompassing structured blazers, vivid colors, oversized silhouettes, statement jewelry, and standout accessories. Sourcing a broad range of designs ensures alignment with varying regional preferences and retail channels.

- Quality and Authenticity: Modern consumers seek both genuine vintage pieces and high-quality reproductions. Strategic partnerships with manufacturers or suppliers specializing in period-accurate fabrics and detailing yield higher customer satisfaction and brand trust.

- Trend Responsiveness: Monitoring global and local fashion trends is critical. Successful buyers anticipate market upticks—such as the renewed popularity of sequins or bold shoulders—and act early to secure inventory.

Strategic Sourcing Advantages

- Competitive Differentiation: Robust supplier networks and agile procurement strategies enable B2B buyers to capture exclusive collections, capitalize on emerging sub-trends, and deliver unique offerings across their markets.

- Cost Optimization: Bulk purchasing and international negotiation leverage can drive down unit costs, especially for high-demand items like statement jackets and accessories prevalent in eighties fashion.

Looking Ahead

To harness the growing momentum of eighties fashion, buyers should deepen supplier relationships, invest in market intelligence, and prioritize adaptability. As this revival crosses borders and cultures, those who proactively source the best iconic pieces will secure lasting value and customer loyalty. Now is the time to strengthen your sourcing strategy—embrace boldness, pursue quality, and expand your eighties-inspired portfolio for tomorrow’s global marketplace.