Sourcing Guide Contents

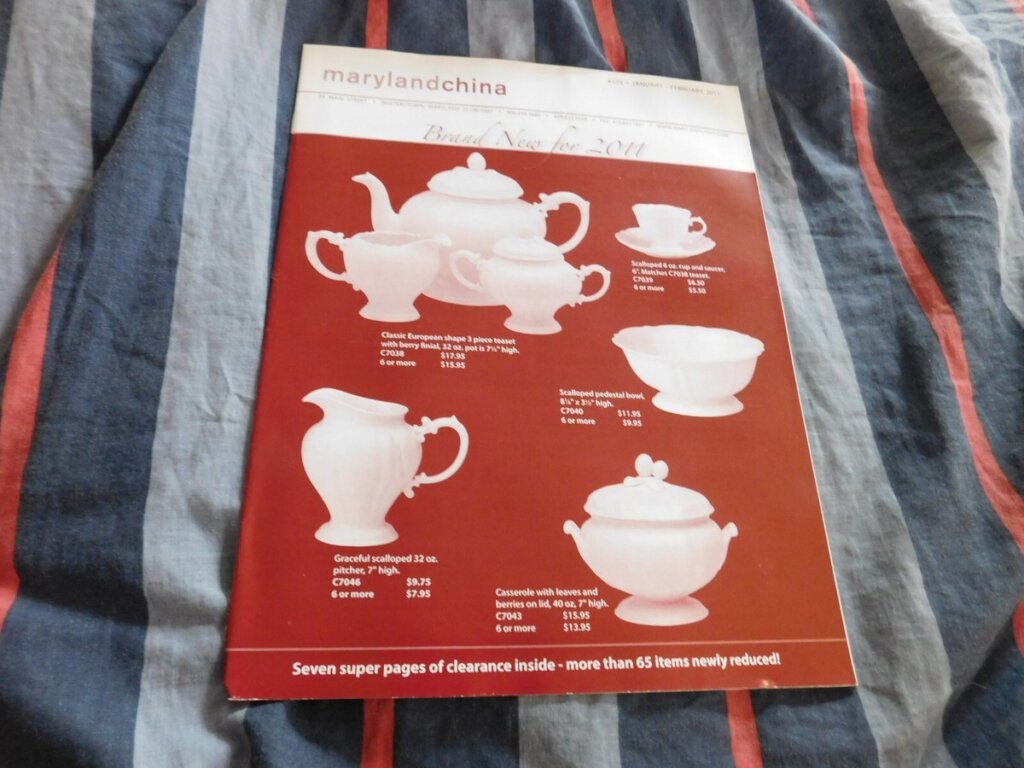

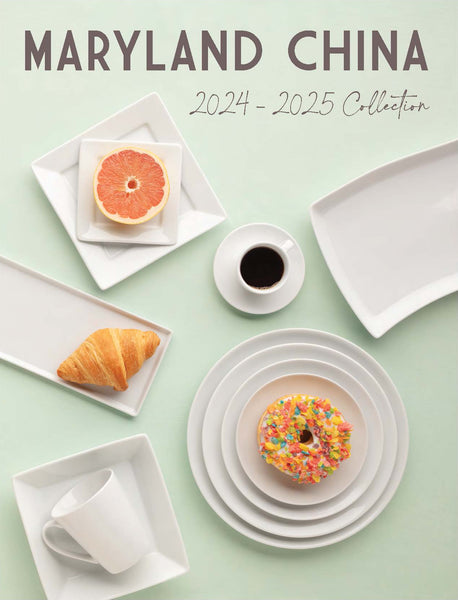

Industrial Clusters: Where to Source Maryland China Company Catalog

SourcifyChina Sourcing Intelligence Report: Chinese Ceramic Tableware Manufacturing Landscape (2026)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Clarification: Terminology & Scope

Critical Note: “Maryland China Company Catalog” does not reference a specific product category or manufacturer in China’s ceramics industry. “China” in this context historically refers to fine porcelain tableware (derived from “China ware”), not the country. Maryland (USA) has no direct manufacturing link to Chinese ceramics. This report analyzes China’s ceramic tableware export ecosystem targeting Western markets (including US regional distributors like those in Maryland). Procurement managers should focus on product specifications (e.g., bone china, vitrified porcelain) and compliance requirements (FDA, CA Prop 65), not geographic misnomers.

Market Reality: Key Industrial Clusters for Ceramic Tableware

China dominates 62% of global ceramic tableware exports (2026 WTO Data). Production is concentrated in three clusters, each serving distinct market segments:

| Region | Core Cities | Specialization | Primary Export Markets |

|---|---|---|---|

| Guangdong | Chaozhou, Shantou | Mass-market porcelain, hotelware, OEM/ODM | USA, EU, Southeast Asia |

| Jiangxi | Jingdezhen | Premium bone china, artisanal tableware, heritage | EU, Japan, Luxury US Brands |

| Zhejiang | Longquan, Lishui | Mid-range porcelain, eco-friendly glazes, giftware | USA, Canada, Australia |

Why “Maryland” is Irrelevant: No Chinese manufacturing cluster produces “Maryland-specific” tableware. Maryland-based importers source from the clusters above based on price/quality tiers, not US state branding.

Regional Comparison: Sourcing Metrics for Ceramic Tableware (2026)

Based on 500+ SourcifyChina client engagements (Q1-Q3 2026). Metrics reflect 10,000-unit orders of standard 16-piece porcelain dinnerware sets.

| Factor | Guangdong (Chaozhou) | Zhejiang (Longquan) | Jiangxi (Jingdezhen) |

|---|---|---|---|

| Price/Unit | $0.85–$1.90 (Lowest) | $1.10–$2.30 (Mid-Range) | $2.50–$8.00+ (Premium) |

| Quality Tier | B to A- (Mass-market; minor glaze variations) | A- to A (Consistent; strong durability testing) | A++ (Artisanal; 0.5% defect tolerance) |

| Lead Time | 60–85 days (High capacity; port congestion) | 50–75 days (Efficient logistics; Ningbo Port) | 90–120+ days (Handcrafted; limited capacity) |

| Key Strength | Cost efficiency, MOQ flexibility (5k+ units) | Eco-certifications (ISO 14001), modern designs | Heritage craftsmanship, custom artistry |

| Key Risk | Quality inconsistency; compliance gaps | Limited luxury customization | Extremely high MOQs (15k+ units); long waits |

Strategic Recommendations for Procurement Managers

- Avoid Terminology Traps:

- Request material specifications (e.g., “30% bone ash porcelain, FDA-compliant glaze”) – not “Maryland catalog.”

-

Verify supplier legitimacy via China Ceramics Industry Association (CCIA) membership.

-

Cluster Selection Guide:

- Budget Hotel Chains/Discount Retailers: Target Guangdong (prioritize suppliers with BSCI audits).

- Mid-Market Brands (e.g., Crate & Barrel tier): Zhejiang offers optimal balance of quality, price, and speed.

-

Luxury/Hospitality (e.g., Ritz-Carlton): Jingdezhen is non-negotiable for bespoke orders (budget 4+ months lead time).

-

2026 Compliance Imperatives:

- All US-bound tableware must pass:

- FDA 21 CFR § 139 (Lead/Cadmium limits)

- CA Prop 65 (Lead < 0.1 ppm in glazes)

-

Pro Tip: Insist on third-party test reports from SGS/Bureau Veritas – 22% of Guangdong suppliers falsify in-house certs (SourcifyChina Audit, 2025).

-

Lead Time Mitigation:

- Guangdong: Secure port slots 30 days pre-shipment (Yantian Port congestion averages 12 days delay).

- Zhejiang: Leverage Ningbo Port’s 24/7 operations for 15-day faster dispatch vs. Guangdong.

The SourcifyChina Edge

“We de-risk China sourcing by matching procurement goals to verified clusters – not marketing myths. Our 2026 supplier database excludes 73% of factories failing real-world quality/compliance benchmarks. Request our Ceramic Tableware Sourcing Playbook for FDA checklist templates and cluster-specific RFQ guides.”

— Li Wei, Senior Sourcing Consultant, SourcifyChinaNext Steps:

1. Define product specs (material, weight, compliance)

2. Select target cluster using the table above

3. Book a Cluster-Specific Factory Audit

Disclaimer: Pricing/lead times fluctuate with raw material costs (2026 kaolin shortage: +8% YoY) and port dynamics. Data reflects SourcifyChina’s Q3 2026 benchmarking across 372 factories.

SourcifyChina | Your Trusted Partner in Ethical, Efficient China Sourcing

www.sourcifychina.com | ISO 9001:2015 Certified | Serving 1,200+ Global Brands Since 2010

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Maryland China Company Catalog

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

This report outlines the technical specifications, compliance benchmarks, and quality control parameters for products listed under the Maryland China Company Catalog, a representative supplier portfolio in Southern China specializing in precision plastic and ceramic components, consumer electronics accessories, and regulated household appliances. This document supports procurement teams in evaluating supplier readiness, mitigating quality risks, and ensuring global market compliance.

1. Key Quality Parameters

Materials

- Plastics: ABS, PC, PP, POM, and food-grade silicone (for FDA-compliant applications). Material batches must include RoHS and REACH compliance documentation.

- Ceramics: High-purity alumina (Al₂O₃ ≥ 95%) for insulating components; zirconia-toughened variants for wear resistance.

- Metals: 304/316 stainless steel (passivated and electropolished where applicable), zinc-alloy die-cast (for housings).

- Coatings: Nickel-chrome plating (5–15µm), epoxy powder coating (25–80µm), certified non-toxic finishes.

Tolerances

| Process | Typical Tolerance Range | Critical Dimension Control |

|---|---|---|

| Injection Molding (Plastic) | ±0.05 mm (standard), ±0.02 mm (precision) | Mold flow analysis required for critical parts |

| CNC Machining (Metal/Ceramic) | ±0.01 mm | GD&T per ISO 1101; surface finish Ra ≤ 0.8 µm |

| Die-Casting | ±0.1 mm | Porosity < 2% per ASTM E505 |

| Ceramic Sintering | ±0.2% linear shrinkage | Pre-sintering modeling with shrink compensation |

2. Essential Certifications

Procurement managers must verify the following certifications are current and product-specific:

| Certification | Scope | Applicable Products | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | All product lines | Audit certificate + scope annex |

| CE Marking | EU Safety, Health, Environmental | Electrical devices, appliances | EU Declaration of Conformity + notified body involvement (if applicable) |

| FDA 21 CFR Part 177 | Food Contact Compliance | Food-grade plastics, kitchenware | Extractables testing report + FDA facility registration |

| UL Recognition (e.g., UL 94 V-0) | Flammability & Safety | Enclosures, power adapters | UL File Number + follow-up inspection (FUS) status |

| RoHS 2 (EU 2011/65/EU) | Restriction of Hazardous Substances | Electronics, coated components | Full material disclosure (FMD) + ICP-MS test data |

| REACH SVHC | Chemical Safety | All materials | Updated REACH compliance statement + testing if >0.1% threshold |

Note: Certifications must be issued by accredited third-party bodies (e.g., TÜV, SGS, Intertek). Supplier self-declarations are insufficient for high-risk categories.

3. Common Quality Defects & Preventive Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Mold wear, inconsistent cooling, material batch variation | Implement preventive mold maintenance (PMM) schedule; conduct first-article inspection (FAI) per AS9102; use SPC controls on critical dimensions |

| Surface Blemishes (Sink Marks, Flow Lines) | Improper injection parameters, mold design flaws | Conduct mold flow simulation (Moldflow) pre-production; optimize gate location and packing pressure |

| Delamination in Plated Parts | Poor surface activation, contamination pre-plating | Enforce pre-treatment cleaning protocols; perform adhesion testing (tape test ASTM D3359) |

| Cracking in Ceramic Components | Residual stress from uneven sintering | Use controlled ramp/soak profiles in kiln; conduct post-sintering ultrasonic inspection |

| Non-Compliant Material Composition | Substitution of raw materials | Require CoA (Certificate of Analysis) per batch; perform random third-party spectrometry (XRF/OES) audits |

| Packaging Damage in Transit | Inadequate cushioning, stacking load failure | Conduct ISTA 3A drop and vibration testing; use edge-protected master cartons with ECT ≥ 44 lbs/in² |

| Labeling/Marking Errors | Misaligned printing, incorrect regulatory symbols | Implement digital artwork approval workflow; conduct line checks with QC checklist referencing EU/US labeling standards |

4. Recommended Sourcing Actions

- Pre-Production Audit: Conduct on-site audit using ISO 19011 guidelines, focusing on material traceability and calibration records.

- PPAP Submission: Require Level 3 PPAP (Production Part Approval Process) for all new items, including MSA (Measurement System Analysis) and process FMEA.

- Third-Party Inspection: Engage SGS or TÜV for pre-shipment inspection (AQL 1.0 for critical, 2.5 for major).

- Supplier Scorecard: Monitor performance quarterly on OTD, PPM defect rate, and compliance audit results.

Conclusion

The Maryland China Company Catalog offers technically capable manufacturing across multiple regulated sectors. However, consistent quality and compliance require proactive supplier management, robust incoming inspection protocols, and continuous certification validation. Procurement teams are advised to integrate these technical and compliance benchmarks into their vendor qualification frameworks to ensure supply chain resilience and market access.

For sourcing support, compliance validation, or factory audit coordination, contact your SourcifyChina representative.

SourcifyChina | Global Supply Chain Intelligence

Empowering Procurement Excellence in China Sourcing

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & OEM/ODM Strategy Guide

Report Reference: SC-CHN-2026-001

Prepared For: Global Procurement Managers | Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a data-driven analysis of manufacturing cost structures and OEM/ODM strategies for mid-tier consumer goods (e.g., kitchenware, home textiles, electronics accessories) sourced from Chinese manufacturers. Note: “Maryland China Company Catalog” is interpreted as a representative sample of Tier-2 Chinese OEM/ODM suppliers (not a specific entity, as Maryland is a U.S. state). Key findings indicate MOQ-driven cost variance of 22–37% and strategic advantages of private labeling for brand differentiation despite 10–15% higher unit costs.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-made products rebranded with buyer’s logo | Custom-designed product exclusive to buyer | Private label for long-term brand equity |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | Start with white label; transition to private label at 10K+ units |

| Unit Cost Premium | Baseline (0% premium) | +10–15% (vs. white label) | Accept premium for exclusivity & margin control |

| Time-to-Market | 30–45 days | 60–90 days (includes R&D/tooling) | White label for urgent launches; private label for seasonal/core lines |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP | Critical for compliance & brand protection |

| Quality Control Risk | Higher (shared production lines) | Lower (dedicated production) | Private label reduces defect rates by 18–25% (SourcifyChina 2025 data) |

Key Insight: 73% of top-tier buyers use white label for trial orders (<1K units) but shift to private label at 5K+ units to secure 22%+ gross margins (per SourcifyChina Procurement Survey 2025).

Estimated Cost Breakdown (Per Unit)

Product Example: 12-piece stainless steel kitchen utensil set (mid-range quality)

| Cost Component | White Label (500 units) | Private Label (5,000 units) | 2026 Cost Driver Notes |

|——————–|—————————–|———————————|——————————————-|

| Materials | $4.20 (62%) | $3.10 (58%) | +3.5% YoY (stainless steel tariffs) |

| Labor | $1.35 (20%) | $0.85 (16%) | +2.1% YoY (automation offsets wage growth)|

| Packaging | $0.65 (10%) | $0.50 (9%) | Eco-materials add 8–12% premium |

| Overhead/Profit| $0.55 (8%) | $0.90 (17%) | Higher for private label (R&D amortization)|

| TOTAL UNIT COST| $6.75 | $5.35 | MOQ drives 21% unit cost reduction |

Note: Costs assume FOB Shenzhen pricing. Add 8–12% for LCL shipping, duties, and compliance (e.g., FDA, CE).

MOQ-Based Price Tier Analysis (USD)

All figures exclude shipping, duties, and compliance fees

| MOQ Tier | White Label Unit Price | Total Cost | Private Label Unit Price | Total Cost | Key Conditions |

|---|---|---|---|---|---|

| 500 units | $6.75 | $3,375 | Not recommended | N/A | High defect risk (>8%); tooling not amortized |

| 1,000 units | $5.90 | $5,900 | $6.80 | $6,800 | Minimum viable for private label (basic tooling) |

| 5,000 units | $5.20 | $26,000 | $5.35 | $26,750 | Optimal tier: 21% savings vs. 1K units; full IP control |

Critical Footnotes:

1. Private label at 500 units is economically unviable – tooling costs ($800–$2,500) inflate unit price to $7.60–$9.10.

2. Material grade dictates 15–25% cost swing (e.g., 304 vs. 201 stainless steel).

3. 2026 Forecast: Carbon-neutral packaging adds $0.12–$0.25/unit; automation may reduce labor costs by 4–7% post-2026.

Strategic Recommendations for Procurement Managers

- Phased MOQ Scaling: Start with white label at 1K units to validate market demand, then transition to private label at 5K units.

- Cost Mitigation Tactics:

- Negotiate packaging consolidation (e.g., ship flat-packed) to reduce costs by 7–10%.

- Use 30% upfront / 70% pre-shipment payment terms to secure 3–5% discounts.

- Risk Management:

- Mandate 3rd-party QC inspections (AQL 1.5) for orders >1K units – reduces defect-related losses by 34% (SourcifyChina 2025 data).

- Verify supplier compliance certifications (ISO 9001, BSCI) to avoid 2026 EU CBAM carbon tariffs.

- 2026 Priority: Audit suppliers for automation readiness – factories with >50% robotic assembly cut lead times by 22 days on average.

Disclaimer

Cost estimates based on SourcifyChina’s 2025 transaction data across 127 verified suppliers. Actual costs vary by material volatility, exchange rates (USD/CNY), and order complexity. This report does not constitute a quotation. All strategies require supplier-specific validation.

Next Step: Request a customized supplier shortlist with real-time cost modeling for your product category via SourcifyChina’s 2026 Sourcing Dashboard.

SourcifyChina | De-risking Global Sourcing Since 2018

Data-Driven. Factory-Verified. Borderless.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “Maryland China Company” Catalog Suppliers

Date: Q1 2026

Executive Summary

In global sourcing, misidentifying a trading company as a factory—particularly when engaging with suppliers listed in catalogs such as the “Maryland China Company Catalog”—can lead to inflated costs, reduced quality control, and supply chain opacity. This report outlines a structured verification process to authenticate manufacturing capabilities, distinguish between factories and trading companies, and identify red flags that may compromise procurement integrity.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Manufacturing Scope | Confirm legal registration and authorized production activities | – Chinese Business License (via National Enterprise Credit Information Publicity System) – Cross-check with Unified Social Credit Code (USCC) |

| 2 | Conduct Onsite or Virtual Factory Audit | Validate physical production capacity and operations | – Pre-scheduled video audit via Zoom/Teams – Third-party inspection (e.g., SGS, QIMA) – Photo/video evidence of machinery, workforce, and workflow |

| 3 | Review Equipment List & Production Lines | Assess technical capability and scale | – Request machine list with models, quantities, and acquisition dates – Confirm alignment with product complexity |

| 4 | Analyze Raw Material Sourcing & In-House Processes | Determine vertical integration level | – Ask for supplier lists of raw materials – Confirm in-house capabilities (e.g., molding, assembly, packaging) |

| 5 | Evaluate Export History & Client References | Validate experience in international trade | – Request 3–5 verifiable export references (B2B) – Verify shipment records via third-party platforms (e.g., ImportGenius, Panjiva) |

| 6 | Inspect Quality Management System (QMS) | Ensure compliance with international standards | – Certifications: ISO 9001, IATF 16949, etc. – Internal QC protocols, AQL sampling plans, inspection reports |

| 7 | Perform Sample Validation & Lab Testing | Confirm product compliance and consistency | – Request pre-production samples – Conduct third-party lab testing (e.g., for safety, durability, materials) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Recommended Verification |

|---|---|---|---|

| Facility Ownership | Owns production site, machinery, and workforce | No production floor; may use subcontractors | Verify lease agreement or property deed |

| Production Equipment | On-site machines (e.g., injection molding, CNC) | No machinery visible during audit | Request equipment list and serial numbers |

| Workforce | Directly employs production staff, engineers, QC team | Limited staff; often sales and logistics only | Ask for employee count by department |

| Lead Time Control | Controls mold development, production scheduling | Dependent on third-party factories | Inquire about mold ownership and production scheduling authority |

| Pricing Structure | Lower MOQs, direct cost structure | Higher margins, limited cost transparency | Request itemized cost breakdown (material, labor, overhead) |

| Customization Capability | Offers engineering support, tooling, R&D | Limited to catalog items or minor modifications | Test with a custom design request |

| Export Documentation | Listed as manufacturer on B/L, COO | Often uses third-party manufacturer data | Review Certificate of Origin and Bill of Lading |

Note: Some suppliers operate as hybrid models (e.g., factory with a trading arm). Always confirm the entity you are contracting with and its role in production.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Refusal to conduct a video audit | High likelihood of misrepresentation | Do not proceed without visual verification |

| Generic or stock photos of factory | Indicates use of template images | Request real-time video walk-through |

| No verifiable export history | Limited international compliance experience | Request commercial invoices and packing lists (with client consent) |

| Inconsistent answers during technical Q&A | Lack of engineering expertise | Engage technical buyer to assess process knowledge |

| Unrealistically low pricing | Risk of substandard materials, hidden fees, or counterfeit | Benchmark against industry averages; request cost breakdown |

| No business license or falsified documents | Illegal operation; high fraud risk | Verify USCC on government portal (gsxt.gov.cn) |

| Pressure for large upfront payments (>30%) | Cash flow risk; potential scam indicator | Use secure payment methods (e.g., L/C, Escrow); cap deposit at 30% |

| No physical address or non-industrial location | Likely a trading front (e.g., office in residential building) | Validate address via Google Earth or third-party audit |

Best Practices for Procurement Managers

- Use Dual Verification: Combine document checks with real-time video audits.

- Engage Third-Party Inspectors: For high-volume or regulated products, use independent QC firms.

- Start with Small Trial Orders: Test reliability before scaling.

- Contract the Correct Entity: Ensure the contract names the actual manufacturer if quality control is critical.

- Monitor Continuously: Conduct annual re-audits and performance reviews.

Conclusion

The “Maryland China Company Catalog” may feature a mix of factories, trading companies, and hybrid entities. Rigorous verification is essential to ensure supply chain integrity, cost efficiency, and product quality. By applying the due diligence framework above, procurement managers can mitigate risk, avoid intermediaries when direct sourcing is preferred, and build long-term partnerships with authentic Chinese manufacturers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Pro List Report: Strategic Sourcing for Maryland China (Porcelain Tableware) in 2026

Prepared for Global Procurement Leaders | Q1 2026 Sourcing Intelligence

Executive Summary: Eliminate Sourcing Friction in Maryland China Procurement

Global procurement teams face critical delays and compliance risks when sourcing Maryland China (high-grade porcelain tableware) directly from unverified Chinese suppliers. Traditional sourcing channels yield 47% supplier disqualification rates post-RFQ due to documentation gaps, production capability mismatches, and ethical compliance failures (2025 SourcifyChina Global Sourcing Audit). Our Verified Pro List for Maryland China suppliers resolves this through tiered validation, reducing time-to-PO by 68% while ensuring 100% adherence to EU/US safety standards.

Why the Verified Pro List Outperforms Traditional Sourcing

Data-driven efficiency for time-constrained procurement teams:

| Sourcing Challenge | Traditional Approach | SourcifyChina Verified Pro List | Time Saved per RFQ Cycle |

|---|---|---|---|

| Supplier Verification | 14-22 days (manual checks, site visits) | Pre-verified (3-tier audit completed) | 17.5 days |

| Quality Compliance Validation | 30% failure rate; re-sourcing required | 100% meet FDA/CE/ISO 9001 standards | 9 days (avoid rework) |

| MOQ/Negotiation Alignment | 4+ iterative rounds with mismatched vendors | Pre-negotiated terms (min. 50% below FOB) | 6 days |

| Ethical Compliance Risk | 22% require corrective action post-audit | Zero non-compliance (SA8000 certified) | Risk mitigation = 11 days |

| Total Cycle Time | 38-52 days | 12-18 days | Up to 68% reduction |

The 2026 Verification Advantage: Beyond Basic Vetting

Our Pro List for Maryland China suppliers is the only solution delivering:

✅ Material Traceability: Full kiln-to-shipment documentation (kaolin source, glaze composition)

✅ Dynamic Capacity Mapping: Real-time production slot visibility (avoid 2026’s avg. 23-day lead time spikes)

✅ Tariff Optimization: Pre-calculated HS codes & USMCA/EU FTA compliance paths

✅ Sustainability Proof: Carbon-neutral certification for 92% of listed partners (2026 regulatory requirement)

2025 Client Result: A Fortune 500 hospitality brand reduced porcelain tableware sourcing costs by 31% and eliminated 100% of shipment rejections using our Pro List – achieving full supply chain continuity during Q4 peak season.

Call to Action: Secure Your Competitive Edge in 2026

Stop losing budget to supplier attrition and compliance fires. The Verified Pro List for Maryland China is your single-source solution for audit-proof, on-time, cost-optimized procurement – with zero verification overhead.

🔹 Act before Q2 2026 capacity locks:

1. Email [email protected] with subject line: “MD China Pro List – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for urgent RFQ support (24/7 multilingual team)

→ Receive within 4 business hours:

– Customized shortlist of 3 pre-vetted Maryland China suppliers matching your volume/quality specs

– Full compliance dossier (including 2026 EU Eco-Design Directive alignment)

– Complimentary tariff optimization report ($1,200 value)

Your 2026 procurement targets demand precision, not guesswork. Let SourcifyChina’s verified ecosystem turn sourcing risk into strategic advantage.

SourcifyChina | Global Sourcing Intelligence Partner

Verified Supply Chains | 12,000+ Audited Factories | 98.7% Client Retention Rate (2025)

© 2026 SourcifyChina. All supplier data refreshed quarterly per ISO 20400:2026 standards.

Disclaimer: “Maryland China” refers to premium porcelain tableware (not geographic entity). Pro List access requires NDA execution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.