The global marine engine market is undergoing robust expansion, driven by rising maritime trade, fleet modernization, and stringent emissions regulations. According to a 2023 report by Mordor Intelligence, the market was valued at USD 21.5 billion in 2022 and is projected to grow at a CAGR of 5.8% through 2028. This growth is underpinned by increasing demand for fuel-efficient and low-emission propulsion systems across commercial shipping, offshore, and recreational sectors. As the industry shifts toward sustainable marine technologies — including hybrid, LNG-powered, and alternative fuel engines — innovation and reliability have become critical differentiators among manufacturers. In this evolving landscape, a select group of companies are leading through technological advancement, global service networks, and strong OEM partnerships. Based on market share, engineering excellence, and industry reputation, here are the top 10 marine engine manufacturers shaping the future of maritime propulsion.

Top 10 Marine Engine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

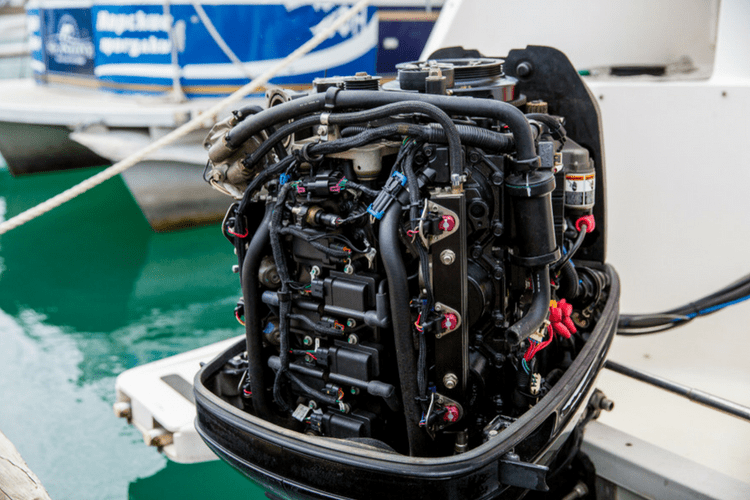

#1 Mercury Marine

Domain Est. 1995

Website: mercurymarine.com

Key Highlights: Mercury Marine is the world’s leading manufacturer of recreational marine propulsion engines. Get sales, service and parts info, and find a local dealer ……

#2 National Marine Manufacturers Association

Domain Est. 1995

Website: nmma.org

Key Highlights: NMMA is the leading trade association representing boat, marine engine and accessory manufacturers, dedicated to advocating for the recreational boating ……

#3 Indmar Marine Engines

Domain Est. 1997

Website: indmar.com

Key Highlights: Official Site of Indmar Marine Engines. The world’s most awarded and largest privately held manufacturer of gasoline powered inboard marine engines. POPULAR ……

#4 Ilmor Engineering

Domain Est. 1997

Website: ilmor.com

Key Highlights: Ilmor is a manufacturer of high performance racing and recreational marine engines. Ilmor Engines One-Drive Powered by Ilmor 5.3L GDI-S, 6.0L MPI-S, 6.2L GDI-S ……

#5 Reliable Marine Engines and Power Solutions

Domain Est. 1990

Website: cummins.com

Key Highlights: Industry-leading marine power solutions with over 100 years of experience. Discover Cummins marine engines fit for every application and a more sustainable ……

#6 Marine Engines

Domain Est. 1990

Website: deere.com

Key Highlights: Find John Deere marine propulsion, generator, and auxiliary engines for commercial and recreational applications, including; workboats, pleasure craft, ……

#7 Marine Diesel Engines

Domain Est. 1993

Website: cat.com

Key Highlights: MARINE SERVICES Caterpillar provides world-class marine service and product support for their engines and power solutions with parts, training, and maintenance….

#8 Marine engines & boat motors for power

Domain Est. 1997

Website: volvopenta.com

Key Highlights: We offer state-of-the-art marine engines that deliver outstanding performance, reliability, and durability. Volvo Penta’s marine engines are designed to ……

#9

Domain Est. 1998

Website: mercuryracing.com

Key Highlights: Mercury Racing builds the best marine & automotive propulsion systems, accessories, and parts on the market. Learn the value of raw performance and power….

#10 Cox Marine Diesel Outboards

Domain Est. 2014

Website: coxmarine.com

Key Highlights: Cox Marine’s powerful diesel outboard engines. Engineered for durability, fuel savings, and reduced emissions. Power your fleet with next-gen marine ……

Expert Sourcing Insights for Marine Engine

H2: 2026 Marine Engine Market Trends – Navigating the Decade’s Midpoint

As the marine industry approaches the midpoint of the 2020s, the marine engine market in 2026 is characterized by a pivotal transition driven by stringent environmental regulations, technological innovation, and shifting global trade dynamics. The H2 outlook reveals a market accelerating towards decarbonization, digitalization, and fuel diversification, fundamentally reshaping propulsion systems across vessel segments.

1. Decarbonization as the Dominant Driver:

* IMO 2030/2050 Pressure: The primary force shaping the 2026 market is the escalating pressure from IMO greenhouse gas (GHG) reduction targets (20% reduction from 2008 levels by 2030, aiming for net-zero by 2050). This compels shipowners to invest in cleaner technologies now to ensure compliance and future-proof fleets.

* Regulatory Acceleration: Expect stricter enforcement of existing regulations (like EEDI/EEXI, CII) and potential new regional measures (e.g., EU ETS inclusion of maritime, FuelEU Maritime). This increases the operational cost of traditional fuels, making alternatives more economically viable.

* Focus on Lifecycle Emissions: Market analysis shifts beyond just tailpipe emissions to encompass Well-to-Wake (WtW) assessments, favoring solutions with genuinely low or zero carbon footprints.

2. Fuel Diversification and the Rise of Alternative Fuels:

* LNG as a Bridge, Not the Endgame: While Liquefied Natural Gas (LNG) remains significant, especially in newbuild LNG carriers and some container ships, its role as a long-term solution is increasingly questioned due to methane slip and the need for true zero-carbon fuels. Investment focus shifts beyond LNG.

* Ammonia and Methanol Gaining Traction: By 2026:

* Methanol: Emerges as a leading alternative, particularly for container ships and tankers. Major engine manufacturers (MAN ES, Wärtsilä) offer dual-fuel engines, and bunkering infrastructure is developing. Green methanol production scales up, improving sustainability credentials.

* Ammonia: Significant R&D and pilot projects progress. While safety concerns and infrastructure gaps remain major hurdles, ammonia is positioned as a key zero-carbon fuel for deep-sea shipping post-2030. Engine development (dual-fuel, combustion optimization) is a major focus area for 2026.

* Biofuels and e-Fuels: Drop-in biofuels (like FAME, HVO) see increased use for retrofits and existing fleets to reduce CII ratings. Synthetic e-fuels (e-methanol, e-ammonia) gain attention but face high costs and limited production.

* Hydrogen: Primarily confined to smaller vessels (ferries, tugs, inland waterways) and port applications in 2026 due to storage and infrastructure challenges. Fuel cell technology development is active.

* Bunkering Infrastructure Expansion: A critical bottleneck. Significant investments in port infrastructure for methanol and ammonia bunkering ramp up globally, but uneven development creates regional disparities.

3. Electrification and Hybridization Accelerate:

* Short-Sea and Inland Waterways: Battery-electric propulsion dominates newbuilds for ferries, tugs, and short-haul vessels, driven by cost savings, quiet operation, and zero emissions. Battery technology (energy density, cost, safety) improves.

* Hybrid Systems: Hybrid solutions (diesel-electric, LNG-electric, battery-diesel) become standard for many vessel types (cruise, RoPax, offshore support). They optimize fuel efficiency, reduce emissions during maneuvering/port stays, and provide flexibility.

* Shore Power Adoption: Mandates and port incentives drive increased installation of Onshore Power Supply (OPS), allowing vessels to shut down engines while docked, significantly reducing local emissions.

4. Technological Innovation and Digitalization:

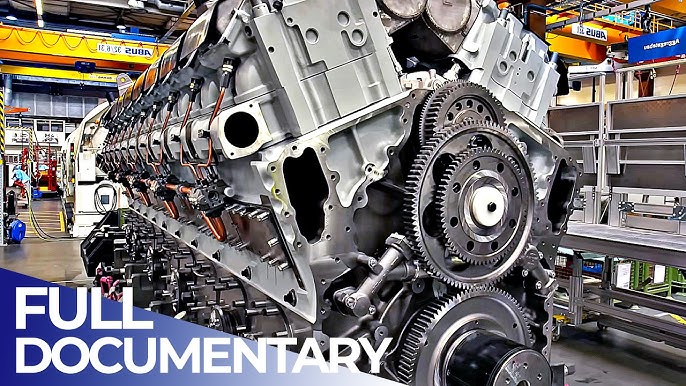

* Advanced Engine Efficiency: Continuous development of traditional ICEs (dual-fuel, improved combustion, waste heat recovery systems) to maximize efficiency and reduce fuel consumption.

* Digital Engine Management: AI and machine learning are increasingly integrated into engine control systems for predictive maintenance, real-time performance optimization, fuel consumption monitoring, and emission reporting (crucial for CII).

* Remote Monitoring & Diagnostics: Widespread adoption of IoT sensors enables remote monitoring of engine health, reducing downtime and maintenance costs.

5. Market Segmentation and Regional Dynamics:

* Container & Tanker Shipping: Focus on large-bore dual-fuel engines (methanol, ammonia-ready) for newbuilds and exploring retrofits. High fuel costs drive efficiency measures.

* Cruise & Ferry: Leading adopters of LNG, battery-electric, and hybrid systems. Strong focus on reducing local emissions (SOx, NOx, PM) in sensitive areas.

* Inland & Short-Sea: Dominated by electrification (batteries, hydrogen fuel cells) and biofuels.

* Fishing & Workboats: Slower adoption due to cost sensitivity, but hybrid and electrification begin to penetrate, supported by subsidies.

* Regional Leaders: Europe (driven by EU regulations), China (massive shipbuilding capacity, domestic green tech push), and key Asian economies lead in adoption and infrastructure development. North America sees growth, particularly in ferry electrification.

6. Challenges and Uncertainties:

* Fuel Availability & Cost: The “chicken-and-egg” problem for ammonia and green hydrogen/methanol persists. Scaling sustainable fuel production affordably is the biggest challenge.

* Infrastructure Investment: Massive global investment in bunkering, storage, and distribution is required but lags behind vessel development.

* Standardization & Safety: Lack of global standards for new fuels (especially ammonia) and safety protocols hinders widespread adoption. Regulatory frameworks need harmonization.

* Economic Viability: High upfront costs for new engine technologies and vessels remain a barrier, requiring supportive financing and policy.

H2 2026 Outlook Summary:

The 2026 marine engine market is in a state of active transition and strategic investment. While traditional engines persist, the focus is overwhelmingly on future-proofing. Key trends include:

* Mainstreaming of Methanol: Methanol dual-fuel engines become a commercially viable standard for new container and tanker builds.

* Ammonia Engine Maturation: Prototype ammonia engines move towards commercial readiness, with pilot vessels operational.

* Hybrid Dominance: Hybrid solutions become the norm across many segments for efficiency gains.

* Electrification Expansion: Battery power solidifies its position in short-sea and inland markets.

* Digital Integration: Data-driven engine optimization becomes essential for compliance and efficiency.

Success in H2 2026 will depend on collaboration across the value chain (shipowners, engine makers, fuel producers, ports, regulators) to overcome infrastructure and cost hurdles. The market is moving beyond exploration towards implementation, setting the stage for the decisive decarbonization push in the latter half of the decade.

Common Pitfalls When Sourcing Marine Engines (Quality & Intellectual Property)

Sourcing marine engines involves significant investment and risk, particularly concerning quality assurance and intellectual property (IP) protection. Failing to address these areas can lead to operational failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Supplier Vetting

Many buyers select suppliers based solely on price or speed, neglecting a thorough evaluation of the manufacturer’s certifications, track record, and production standards. Engines from unverified suppliers may not meet maritime safety and performance regulations (e.g., IMO, SOLAS, or class society rules), resulting in costly downtime or non-compliance.

Lack of Factory Audits and Testing Protocols

Relying solely on product specifications or supplier claims without conducting on-site audits or witnessing engine testing can be risky. Without verifying manufacturing processes and quality control systems firsthand, buyers may receive engines with hidden defects or inconsistent performance.

Poor Documentation and Traceability

Engines lacking proper documentation—such as material certifications, test reports, and serial number traceability—can complicate maintenance, warranty claims, and regulatory inspections. Incomplete records may also indicate substandard manufacturing practices.

Use of Non-OEM or Counterfeit Components

Some suppliers offer “equivalent” or “compatible” parts that compromise engine reliability and longevity. Using non-original equipment manufacturer (OEM) components may void warranties and expose vessels to mechanical failure, especially in harsh marine environments.

Intellectual Property-Related Pitfalls

Unlicensed or Counterfeit Engines

A major risk is sourcing engines that infringe on intellectual property rights—such as cloned or reverse-engineered designs. These engines not only violate patents and trademarks but also lack performance validation and manufacturer support, exposing the buyer to legal liability and safety risks.

Ambiguous Licensing Agreements

When sourcing from third-party manufacturers or joint ventures, unclear licensing terms may mean the engine is not authorized for sale or use in certain jurisdictions. Buyers must verify that the supplier has legitimate rights to produce and distribute the engine design.

Lack of IP Clauses in Contracts

Purchase agreements often omit or poorly define IP ownership, warranty rights, and liability for infringement. Without explicit clauses, buyers may unintentionally become liable for IP violations or lose recourse if counterfeit parts are discovered.

Insufficient Due Diligence on OEM Partnerships

Some suppliers claim affiliation with reputable engine brands without formal authorization. Failing to verify OEM partnerships through official channels can result in procurement of unauthorized replicas, damaging both operational integrity and legal standing.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct comprehensive due diligence on suppliers, including audits and reference checks.

– Require full technical documentation and proof of compliance with marine standards.

– Include robust IP warranties and indemnification clauses in contracts.

– Verify the authenticity of OEM relationships and licensing status.

– Work with legal and technical experts during procurement to assess risk.

By proactively addressing quality and IP concerns, marine operators can ensure reliable engine performance and protect themselves from legal and operational vulnerabilities.

Logistics & Compliance Guide for Marine Engines

Overview

Transporting marine engines involves complex logistical planning and strict adherence to international regulations. This guide outlines key considerations for safe, efficient, and compliant logistics operations.

Regulatory Compliance

International Maritime Organization (IMO) Regulations

Marine engines must comply with IMO standards, particularly those related to emissions (MARPOL Annex VI), noise (Code on Noise Levels), and safety (SOLAS). Ensure engines are certified and documentation reflects compliance with applicable IMO codes.

Environmental Standards

Engines must meet emissions standards such as Tier III for NOx (in Emission Control Areas) and sulfur limits. Provide Engine International Air Pollution Prevention (EIAPP) certificates and Technical Files to customs and port authorities.

Customs and Import Regulations

Each country has specific import requirements. Prepare:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Origin

– EIAPP Certificate

– Type Approval Certificates (e.g., from classification societies like DNV, ABS, LR)

Ensure Harmonized System (HS) codes are correctly classified—typically under 8408 (Internal combustion piston engines).

Packaging and Handling

Crating and Protection

Marine engines must be packed in weatherproof, ventilated wooden crates with anti-corrosion protection (e.g., VCI paper, desiccants). Secure engines with bracing to prevent shifting during transport.

Lifting and Weight Considerations

Engines are heavy and require proper lifting points. Provide clear rigging instructions and ensure transport vehicles and cranes meet load capacity requirements. Include center of gravity data in shipping documentation.

Transportation Modes

Ocean Freight

Most marine engines are shipped via container or roll-on/roll-off (RoRo) vessels. For oversized engines, consider breakbulk or heavy-lift shipping. Coordinate with freight forwarders experienced in heavy machinery logistics.

Overland Transport

Use specialized heavy-duty trailers for road or rail transport. Verify route clearance (bridges, tunnels), permits for oversized loads, and escort vehicle requirements.

Air Freight

Rarely used due to size and cost, but viable for urgent spare parts or smaller auxiliary engines. Confirm aircraft weight and cargo door dimensions.

Documentation Requirements

Mandatory Certificates

- Certificate of Conformity (CoC)

- EIAPP Certificate

- Noise Test Report

- Classification Society Approval (e.g., DNV Type Approval)

- Warranty and Technical Manuals

Shipping Documents

- Bill of Lading (B/L)

- Dangerous Goods Declaration (if applicable, e.g., residual oils)

- Customs Declaration

- Insurance Certificate

Risk Management

Insurance Coverage

Obtain comprehensive marine cargo insurance covering damage, delay, and total loss. Include coverage for loading/unloading operations and inland transit.

Hazardous Materials

Declare any residual fuels, lubricants, or batteries. Comply with IMDG Code if transporting hazardous components.

Port and Terminal Operations

Pre-Arrival Notifications

Submit advance cargo manifests and compliance documents to port authorities. Coordinate with terminal operators for crane availability and laydown areas.

On-Site Handling

Use certified personnel and appropriate equipment for offloading. Inspect engines upon arrival for transit damage before acceptance.

Classification Society Requirements

Engines must be approved by recognized classification societies (e.g., ABS, DNV, LR, BV). Maintain all inspection reports and type approval documentation for customs and installation verification.

Final Installation and Commissioning

Ensure logistics plan includes delivery to final installation site with clear access. Coordinate with shipyard or vessel operator for alignment with construction or dry-dock schedules.

Conclusion

Successful marine engine logistics depend on meticulous planning, regulatory compliance, and collaboration with experienced freight partners. Always verify country-specific requirements and maintain accurate, complete documentation throughout the supply chain.

Conclusion for Sourcing a Marine Engine:

Sourcing a marine engine is a critical decision that significantly impacts the performance, reliability, safety, and operational efficiency of a vessel. After thorough evaluation of technical specifications, engine type (diesel, outboard, inboard, hybrid, or electric), power requirements, fuel efficiency, compliance with environmental regulations (such as IMO Tier standards or EPA requirements), and lifecycle costs, it becomes evident that a tailored approach is essential.

Key factors such as engine manufacturer reputation, after-sales support, warranty terms, spare parts availability, and long-term serviceability must be prioritized to ensure uninterrupted operations and reduced downtime. Additionally, considering emerging trends like sustainability and digital integration (e.g., smart engines with remote monitoring) can future-proof the investment.

Ultimately, successful sourcing involves a balanced assessment of initial cost versus long-term value, supported by due diligence in supplier selection and alignment with the vessel’s operational profile. Engaging technical experts, conducting site visits or reference checks, and leveraging competitive bidding can further mitigate risks. By adopting a strategic and comprehensive sourcing process, stakeholders can secure a marine engine that delivers optimal performance, regulatory compliance, and cost-effectiveness over its service life.