The manufactured home industry has experienced steady growth over the past decade, driven by rising housing demand, affordability, and advancements in modular construction. According to Mordor Intelligence, the global prefabricated homes market was valued at USD 144.6 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2029, with interior components—particularly doors—playing a critical role in both functionality and aesthetic appeal. As manufactured home builders prioritize cost-efficiency, durability, and design flexibility, demand for high-quality interior doors has surged. This has led to the emergence of specialized manufacturers catering specifically to the unique dimensional, material, and installation requirements of modular and manufactured housing. The following list highlights the top nine manufacturers leading innovation and market presence in interior doors for manufactured homes, selected based on product range, customization capabilities, distribution reach, and industry reputation.

Top 9 Manufactured Home Interior Doors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Page

Domain Est. 1997

Website: blevinsinc.com

Key Highlights: Blevins, Inc. is America’s leading supplier to the manufactured housing industry and other building segments. Best Sellers. Windows · Skirting….

#2 Door and Window Manufacturer

Domain Est. 1998

Website: crystalwindows.com

Key Highlights: Crystal Windows is a leading U.S. door and window manufacturer delivering custom solutions known for quality, durability, and energy efficiency….

#3 Masonite Residential

Domain Est. 1995

Website: masonite.com

Key Highlights: Explore the best selection of interior and exterior doors for your home. Masonite doors are crafted from the highest quality materials for every home style….

#4

Domain Est. 1996

Website: jeld-wen.com

Key Highlights: Shop JELD-WEN windows and doors built for quality, energy effi ciency, and timeless design that enhance comfort, style, and performance in every home….

#5 Beautiful Custom Modern Interior & Exterior Doors

Domain Est. 1998

Website: trustile.com

Key Highlights: Browse 3D door styles, profiles, and materials and update your selections in real-time to design the perfect door for your project….

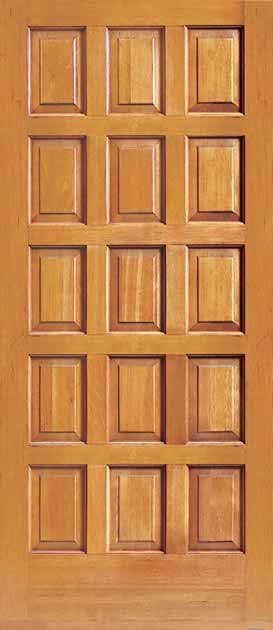

#6 Reeb

Domain Est. 2002

Website: reeb.com

Key Highlights: Interior Doors · Interior Doors Page · Wood Stile & Rail · Primed Stile & Rail · Flush and Molded · MDF Door · Commercial Doors · General Millwork · Resources….

#7 TMCobb Website – to TM Cobb

Domain Est. 2002 | Founded: 1935

Website: tmcobb.com

Key Highlights: Cobb brings you one of the largest inventories of doors and windows in California. Since 1935, we have been the builder’s choice for quality craftsmanship….

#8 MASTERCRAFT Doors

Domain Est. 2004

Website: mastercraftdoors.com

Key Highlights: MASTERCRAFT doors are built from the finest materials to create the best and most stylish door for your home. Available in wood, fiberglass, or steel doors….

#9 Doors & Windows

Domain Est. 2020

Website: mobilehomeoutfitters.com

Key Highlights: 30-day returnsMobile Home Outfitters offers mobile home replacement doors and windows to help you upgrade and beautify your home’s exterior, as well as wood grain doors for ……

Expert Sourcing Insights for Manufactured Home Interior Doors

H2: 2026 Market Trends for Manufactured Home Interior Doors

The manufactured housing sector is undergoing significant transformation, and interior doors are no exception. By 2026, the market for manufactured home interior doors will be shaped by evolving consumer preferences, regulatory shifts, technological advancements, and broader economic factors. Here’s a detailed analysis of key trends expected to define the landscape:

1. Elevated Design and Customization Demand

Homebuyers increasingly expect manufactured homes to rival site-built homes in aesthetics. By 2026, demand will shift toward interior doors that offer enhanced visual appeal and personalization:

– Premium Finishes: Growth in doors with realistic woodgrain laminates, painted finishes (especially matte and soft-touch), and textured surfaces.

– Modern Styles: Rise in popularity of shaker, flush-panel, and minimalist contemporary designs over traditional molded panel doors.

– Customization Options: Manufacturers and retailers will expand offering door sizes, colors, and hardware packages to allow buyers greater design control.

2. Lightweight, Durable Composite Materials

Material innovation will focus on balancing cost, weight, and durability—critical for transport and installation in manufactured homes:

– Increased Use of MDF and HDF Cores: With moisture-resistant coatings, these offer stability and a smooth surface for finishes.

– Advanced Composites: Growth in engineered wood and polymer-based doors that resist warping, swelling, and impact—ideal for tight spaces and frequent use.

– Sustainability Focus: Use of recycled content and low-VOC adhesives will become standard, driven by green building standards and consumer demand.

3. Integration with Smart Home Ecosystems

As smart technology penetrates affordable housing, interior doors will adapt:

– Smart Locks and Access Control: Interior passage and privacy doors in larger or luxury manufactured homes may support smart locks (e.g., for bathrooms or home offices).

– Compatibility with Sensors: Door frames may incorporate or support occupancy sensors, aiding HVAC efficiency and security systems.

– Pre-Wired Solutions: Modular door systems may come pre-routed for low-voltage wiring, simplifying smart home integration during factory installation.

4. Emphasis on Space Optimization and Functionality

With space efficiency paramount in manufactured homes, door solutions will prioritize flexibility:

– Barn Doors and Sliding Systems: Continued growth in space-saving sliding and barn-style doors for closets and bathrooms.

– Thinner Profiles: Adoption of narrower stiles and rails to maximize usable space in compact floor plans.

– Multi-Functional Designs: Doors with integrated mirrors, storage, or acoustic properties for dual utility.

5. Regulatory and Energy Efficiency Drivers

Building codes and energy standards will influence door specifications:

– Improved Thermal Performance: Doors with better insulation values (e.g., foam cores) to meet updated HUD Code or ENERGY STAR standards.

– Fire-Rated Options: Increased use of fire-rated doors between garage entries and living spaces, especially in larger multi-section homes.

– ADA-Compliant Solutions: Broader availability of wider doorways and accessible hardware in modular designs.

6. Supply Chain Resilience and Factory Integration

Manufacturers will optimize production by closely integrating door systems into the factory build process:

– Pre-Hung and Pre-Finished Units: Rise in factory-installed, pre-hung doors to reduce on-site labor and ensure alignment.

– Standardization with Flexibility: Adoption of modular door systems that allow for customization while maintaining production efficiency.

– Local Sourcing: Potential shift toward regional suppliers to mitigate global supply chain disruptions and reduce lead times.

7. Sustainability and Circularity

Environmental concerns will drive innovation in lifecycle management:

– Recyclable Materials: Development of doors designed for disassembly and material recovery.

– Low-Carbon Footprint: Manufacturers will highlight reduced emissions in production and transportation.

– Green Certifications: Demand for doors with certifications like FSC, Greenguard, or EPDs will grow.

Conclusion

By 2026, the manufactured home interior door market will be defined by a convergence of style, performance, and smart functionality. Success will depend on manufacturers’ ability to deliver cost-effective, durable, and customizable solutions that align with the rising expectations of modern homeowners and the operational realities of factory-built housing. Innovation in materials, design, and integration will position interior doors not just as functional components, but as key contributors to the overall value and appeal of manufactured homes.

Common Pitfalls When Sourcing Manufactured Home Interior Doors (Quality and Intellectual Property)

Sourcing interior doors for manufactured homes involves unique challenges, especially when balancing cost, quality, and compliance. Below are some of the most common pitfalls related to quality and intellectual property (IP) that suppliers, builders, and manufacturers should be aware of.

Poor Material Quality and Construction

One of the most frequent issues is receiving doors made from substandard materials. Many low-cost suppliers use particleboard, low-density fiberboard (MDF), or thin veneers that are prone to warping, swelling, or delamination—especially in the tightly climate-controlled or variable environments of manufactured homes. These materials may not meet durability standards required for long-term residential use.

Inconsistent Dimensional Tolerances

Manufactured homes are built with precise specifications to maximize space efficiency. Interior doors that do not adhere to exact size tolerances can lead to installation problems, gaps, or misalignment with frames. Inconsistent sizing often results from poor manufacturing controls, especially when sourcing from overseas suppliers with less stringent quality assurance.

Lack of Structural Integrity

Some sourced doors lack the necessary sturdiness for repeated use. Hollow-core doors with flimsy internal structures can sag over time or fail to support standard hardware like hinges and locks. This compromises both functionality and safety, leading to higher long-term costs due to replacements and service calls.

Non-Compliance with Building Codes and Standards

Doors used in manufactured homes must comply with HUD Code (in the U.S.) and other relevant fire, safety, and energy efficiency standards. Sourcing doors that haven’t been tested or certified for these requirements can result in regulatory violations, failed inspections, or liability risks.

Inadequate Finish and Surface Quality

Low-quality finishes—such as uneven paint, peeling laminate, or poor staining—can detract from the home’s perceived value. These surface defects are often the result of rushed production processes or the use of inferior coating materials that don’t adhere well or resist wear.

Intellectual Property Infringement Risks

Sourcing doors from third-party suppliers, particularly overseas, increases the risk of inadvertently using designs, hardware, or patented construction methods protected by intellectual property rights. Copying branded door styles or using patented door core technologies without authorization can lead to legal disputes, product seizures, and financial penalties.

Counterfeit or Misrepresented Products

Some suppliers may falsely advertise doors as “solid wood” or “fire-rated” when they are not. This misrepresentation not only affects performance but may also expose the buyer to liability, especially if safety standards are compromised.

Limited Traceability and Supplier Accountability

Many low-cost suppliers, especially in unregulated markets, lack transparent supply chains. Without proper documentation or quality control certifications, it becomes difficult to trace defects back to their source or hold suppliers accountable for recurring quality issues.

Conclusion

To avoid these pitfalls, it is crucial to vet suppliers thoroughly, request product samples and certifications, and establish clear quality agreements. Additionally, conducting IP due diligence—such as reviewing design patents and trademarks—can prevent costly legal entanglements. Investing time upfront in sourcing reliable, compliant, and original interior doors pays off in durability, customer satisfaction, and legal safety.

Logistics & Compliance Guide for Manufactured Home Interior Doors

This guide outlines key considerations for the logistics and regulatory compliance of manufactured home interior doors, ensuring smooth operations from production to installation.

Product Specifications & Standards Compliance

Manufactured home interior doors must comply with federal and industry-specific standards. The U.S. Department of Housing and Urban Development (HUD) regulates manufactured homes under the HUD Code (24 CFR Part 3280). While interior doors are not subject to the same structural testing as exterior components, they must still meet relevant safety and material standards.

- HUD Code Requirements: Ensure doors contribute to overall home safety, including proper fit, operation, and fire resistance where applicable.

- Fire Safety: Interior doors in certain areas (e.g., utility rooms) may need to meet fire-rating standards such as those from the International Code Council (ICC) or NFPA 5000.

- Material Compliance: Use materials compliant with formaldehyde emission standards (e.g., CARB Phase 2 or TSCA Title VI) to ensure indoor air quality.

- ADA Considerations: For accessible units, door widths and hardware must comply with the Americans with Disabilities Act (ADA) standards, including maneuvering clearance and operable force.

Packaging and Handling Protocols

Proper packaging protects doors during transport and storage, reducing damage and returns.

- Surface Protection: Apply durable film or paper wrapping to prevent scratches, dents, and moisture damage.

- Edge and Corner Guards: Use protective corner caps or foam tubing on edges to prevent chipping during handling.

- Secure Bundling: Group doors by size and type, securing them with non-abrasive straps on pallets. Avoid overstacking.

- Labeling: Clearly label each package with product ID, dimensions, quantity, handling instructions (e.g., “This Side Up”), and destination details.

Transportation and Distribution

Efficient logistics planning ensures timely delivery while minimizing damage and cost.

- Carrier Selection: Partner with freight carriers experienced in building materials and manufactured housing logistics.

- Load Optimization: Maximize trailer space with vertical racking or custom dunnage to prevent shifting. Use load bars or straps for stabilization.

- Climate Considerations: Avoid exposure to extreme temperatures or humidity during transit, which can cause warping or delamination.

- Delivery Coordination: Schedule deliveries with manufacturing facilities or distribution centers to align with assembly timelines. Confirm receiving hours and dock availability.

Inventory Management and Warehousing

Effective storage practices maintain product quality and support just-in-time manufacturing.

- Indoor Storage: Store doors in dry, climate-controlled environments off the ground on pallets or racks.

- Stacking Guidelines: Stack doors flat or vertically (using proper supports) to prevent sagging or warping. Limit stack height per manufacturer recommendations.

- First-In, First-Out (FIFO): Rotate stock to prevent long-term storage and potential material degradation.

- Inventory Tracking: Use barcode or RFID systems to monitor stock levels, locations, and order fulfillment accuracy.

Documentation and Traceability

Maintain accurate records for compliance, recalls, and customer service.

- Bill of Lading (BOL): Include detailed descriptions, quantities, and shipping information for each shipment.

- Certificates of Compliance: Provide documentation confirming adherence to material safety and emission standards.

- Serial or Batch Tracking: Enable traceability from production to delivery for quality assurance and recall readiness.

- Customs and Cross-Border Shipments: For international components, ensure Harmonized System (HS) code 4418.20 (wood doors) is correctly applied, with necessary import documentation.

Installation and Final Compliance

Ensure doors meet all final regulatory and performance requirements upon installation.

- On-Site Inspection: Verify correct door type, finish, and hardware match specifications before installation.

- Clearance and Operation: Confirm doors open and close smoothly with proper clearances as per HUD and manufacturer guidelines.

- Final Certification: Include doors in the manufactured home’s final inspection and certification process under HUD label requirements.

By adhering to this logistics and compliance framework, manufacturers and suppliers can ensure that interior doors for manufactured homes are delivered safely, meet all regulatory requirements, and support the integrity and quality of the final product.

Conclusion: Sourcing Manufactured Home Interior Doors

Sourcing interior doors for manufactured homes requires careful consideration of size, functionality, compliance, and cost. Unlike site-built homes, manufactured homes often use non-standard door dimensions and lightweight construction, necessitating doors specifically designed or adaptable to these specifications. Key factors in the sourcing process include measuring existing openings accurately, selecting appropriate materials (such as hollow or molded composite doors for weight and cost efficiency), and ensuring compliance with HUD standards where applicable.

Suppliers such as specialized manufactured housing retailers, national home improvement chains, and online vendors offer a range of options, with trade suppliers and wholesalers often providing better pricing for bulk or renovation projects. Additionally, considering pre-hung doors can simplify installation and improve alignment, especially in homes where wall integrity may vary.

In conclusion, successfully sourcing interior doors for manufactured homes involves balancing affordability, durability, and proper fit. By working with knowledgeable suppliers and understanding the unique structural requirements, homeowners and contractors can achieve both aesthetic appeal and long-term functionality in manufactured housing interiors. Planning, accurate measurement, and access to the right supply channels are essential for a smooth and cost-effective outcome.