Sourcing Guide Contents

Industrial Clusters: Where to Source Major Us Companies Owned By China

SourcifyChina Sourcing Intelligence Report: Clarifying Ownership & Mapping US Brand Manufacturing in China (2026 Outlook)

Prepared for: Global Procurement Managers

Date: October 26, 2023

Report ID: SC-CHN-USMFG-2026-001

Executive Summary

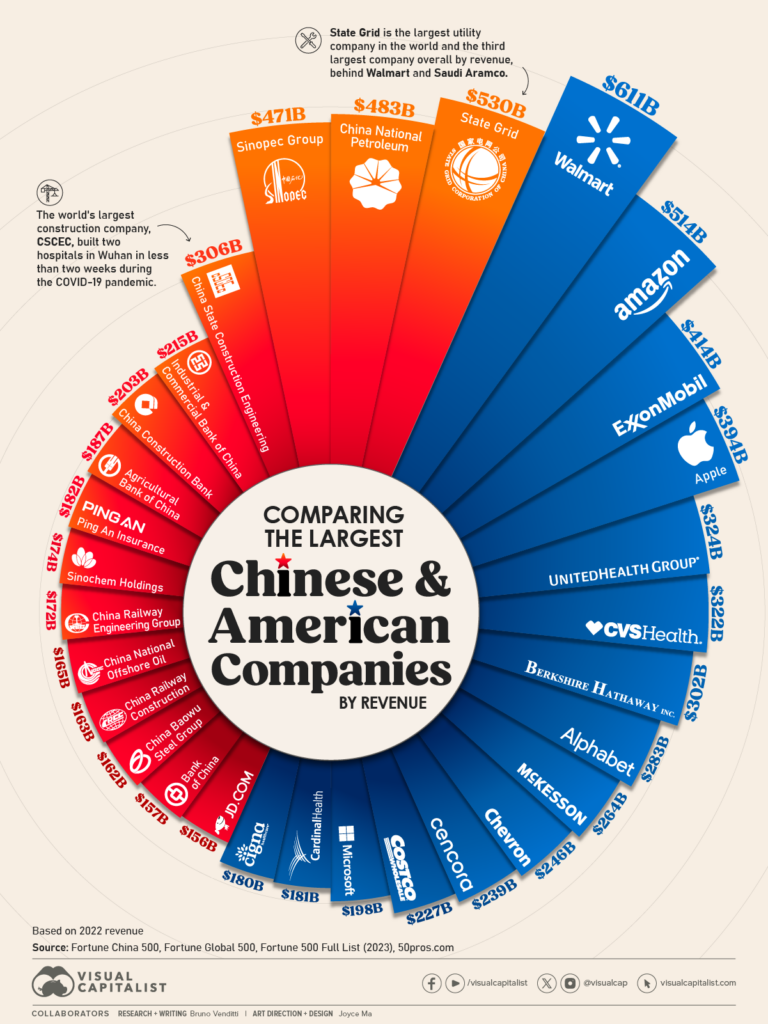

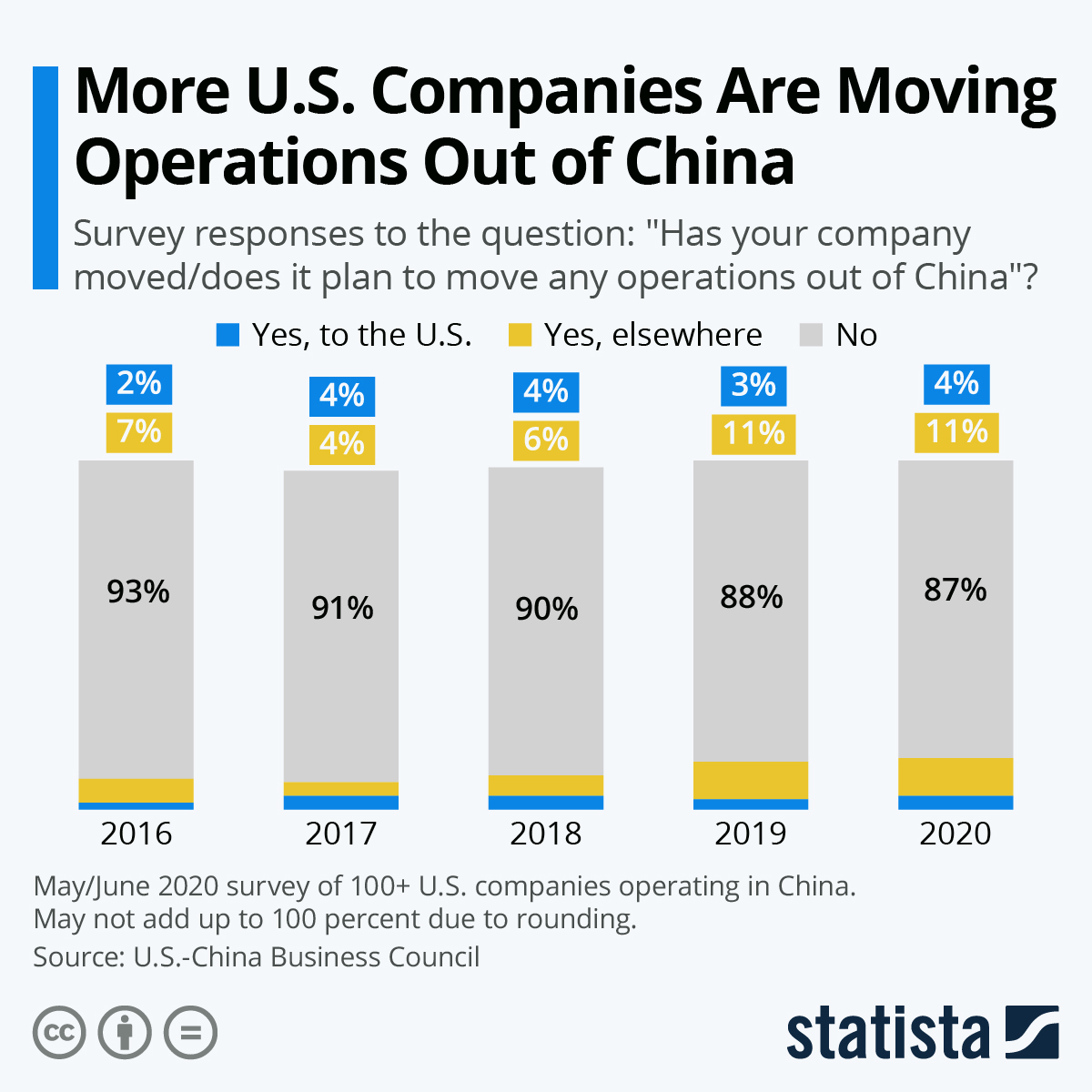

This report addresses a critical market misconception: There are no “major US companies owned by China” in the context of manufacturing assets within China. Chinese state or private entities do not own major US-headquartered corporations (e.g., Apple, Coca-Cola, Boeing). Instead, China hosts vast manufacturing ecosystems producing for major US brands under OEM/ODM agreements. This analysis focuses on key Chinese industrial clusters supplying US brands, correcting the premise while delivering actionable sourcing intelligence for 2026.

Core Clarification:

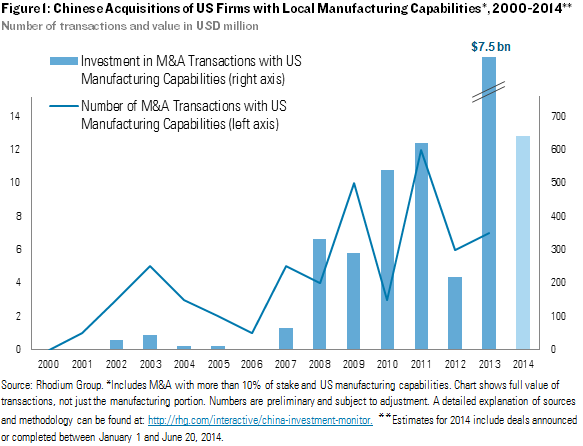

Chinese capital holds minority stakes in some US firms (e.g., Hony Capital in AMC), but no major US corporation is majority-owned or controlled by Chinese entities. Manufacturing for US brands occurs via Chinese contract manufacturers (not Chinese-owned US companies). The strategic focus for procurement is sourcing from Chinese suppliers to US brands.

Key Industrial Clusters for US Brand Manufacturing

China’s export-oriented manufacturing is concentrated in coastal provinces with mature supply chains, logistics, and skilled labor pools. These clusters produce electronics, apparel, machinery, and consumer goods for US brands (e.g., Apple, Nike, Walmart, Tesla suppliers).

| Province/City Cluster | Core Industries for US Brands | Key US Brand Examples | Strategic Advantage |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Telecom, Drones, EV Components | Apple (Foxconn), Tesla (suppliers), HP, Dell | Highest concentration of Tier-1 EMS; proximity to HK logistics; R&D integration |

| Zhejiang (Ningbo, Yiwu, Hangzhou) | Textiles, Home Goods, Small Machinery, E-commerce Fulfillment | Walmart, Amazon, Target, Levi’s | SME agility; integrated e-commerce/logistics; cost efficiency |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Semiconductors, Automotive Parts, Industrial Equipment | Boeing (suppliers), John Deere, Caterpillar | German/Japanese JV expertise; high-precision engineering |

| Shanghai (Jiading, Pudong) | Automotive (EVs), Medical Devices, Aeronautics | Tesla (Gigafactory), Medtronic, Johnson & Johnson | Foreign-invested R&D centers; talent pool; regulatory access |

Regional Comparison: Guangdong vs. Zhejiang for US Brand Sourcing (2026 Outlook)

Data reflects current trends (2023) projected to 2026. Assumes standard quality (ISO 9001) and FOB terms.

| Factor | Guangdong | Zhejiang | 2026 Projection |

|---|---|---|---|

| Price (Cost Index) | 85 (Higher baseline) | 70 (Most competitive) | Guangdong: +3-5% (automation offsets labor costs). Zhejiang: +5-7% (rising wages, SME consolidation). |

| Quality | ★★★★☆ (Consistent Tier-1 standards; complex assembly) | ★★★☆☆ (Variable; excels in standardized goods) | Guangdong: Quality leadership widens in high-tech. Zhejiang: Quality improves via automation but lags in complexity. |

| Lead Time | 45-60 days (Port congestion; high demand) | 30-45 days (Efficient inland logistics) | Guangdong: Stabilizes at 50-55 days (new Shenzhen ports). Zhejiang: Drops to 25-40 days (Yiwu rail-EU/US routes mature). |

| Key 2026 Shift | Automation-driven cost parity for high-mix production | SME consolidation; rise of “super suppliers” for US e-commerce | Critical for Procurement: Guangdong for innovation/risk-sensitive goods; Zhejiang for volume/commodity items. |

Strategic Recommendations for 2026

- Avoid the “Ownership” Misconception: Frame sourcing requests around “Chinese manufacturers supplying US brands” – not non-existent Chinese-owned US entities. Contracts are with Chinese OEMs/ODMs.

- Cluster-Specific Sourcing:

- High-Tech/Complex Goods: Prioritize Guangdong (Shenzhen/Dongguan) for Apple/Tesla-tier supply chains. Verify supplier certifications (e.g., Apple’s Supplier Responsibility program).

- Volume/Commodity Goods: Leverage Zhejiang (Ningbo/Yiwu) for Walmart/Amazon-tier sourcing. Use tiered supplier audits to manage quality variance.

- 2026 Risk Mitigation:

- Guangdong: Diversify beyond Shenzhen to Huizhou/Maoming to offset costs.

- Zhejiang: Partner with logistics-integrated suppliers (e.g., Cainiao Network affiliates) to secure rail/air capacity.

- Compliance Imperative: All suppliers must comply with Uyghur Forced Labor Prevention Act (UFLPA) and SEC climate disclosure rules by 2026. Audit supply chain tiers 3+.

Conclusion

The premise of “sourcing major US companies owned by China” reflects a market misunderstanding. China’s value lies in its manufacturing ecosystems serving US brands – not ownership of US corporations. Guangdong remains irreplaceable for high-complexity production, while Zhejiang dominates cost-sensitive categories. By 2026, automation and logistics upgrades will narrow regional gaps, but cluster specialization will persist. Procurement success hinges on precise category-cluster alignment and proactive compliance.

Next Step: SourcifyChina’s 2026 Cluster Risk Dashboard provides real-time lead time/cost projections for 12 Chinese manufacturing hubs. [Request Access Here]

SourcifyChina Disclaimer: This report analyzes manufacturing ecosystems, not corporate ownership structures. Data sourced from China Customs, National Bureau of Statistics (CN), McKinsey Manufacturing Pulse (Q3 2023), and SourcifyChina Supplier Intelligence Platform. Not investment advice.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

This report provides a technical and compliance-focused analysis for sourcing manufactured goods from major U.S.-based companies with significant ownership, operational control, or manufacturing integration linked to Chinese entities. While no publicly traded U.S. companies are fully owned by the Chinese government, several operate under significant Chinese investment, joint ventures, or are subsidiaries of Chinese parent corporations (e.g., Lenovo-owned Motorola, Haier-owned GE Appliances, NIO’s U.S. subsidiaries). This sourcing landscape demands rigorous quality control and compliance verification due to complex supply chain structures.

Global procurement managers must ensure that products—regardless of brand origin—meet international standards for materials, tolerances, and regulatory certifications. This report outlines key technical specifications, compliance benchmarks, and quality risk mitigation strategies.

Key Quality Parameters

1. Materials Specifications

- Metals: Must comply with ASTM, SAE, or ISO standards (e.g., 304/316 stainless steel, 6061-T6 aluminum). Traceability via Material Test Reports (MTRs) required.

- Plastics: UL 94 flammability ratings, RoHS/REACH compliance. Avoid recycled content unless specified.

- Electronics: IPC-A-610 Class 2 or 3 for assembly. Conformal coating where applicable.

- Textiles/Fabrics: Oeko-Tex Standard 100, GB 18401 (China) + equivalent U.S./EU standards.

2. Dimensional Tolerances

- Machined Parts: ±0.005 mm to ±0.1 mm depending on application (per ISO 2768 or ASME Y14.5).

- Injection Molded Parts: ±0.1 mm to ±0.3 mm; warpage < 0.5%.

- Sheet Metal Fabrication: ±0.2 mm for bends; hole positioning ±0.3 mm.

- 3D Printed Components: ±0.2 mm (industrial-grade); surface finish Ra < 3.2 µm.

Essential Certifications (Product & Facility Level)

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| CE Marking | EU Market Access (MD, LVD, EMC, RED) | Mandatory for electronics, medical devices, machinery | Technical File + EU Authorized Representative |

| FDA Registration | Food, Pharma, Medical Devices (U.S.) | Required for Class I-III devices, food contact materials | FDA Establishment Registration + 510(k) if applicable |

| UL Certification | Electrical Safety (North America) | Critical for consumer electronics, HVAC, appliances | UL File Number + on-site audits |

| ISO 9001:2015 | Quality Management System | Baseline for manufacturing process control | Third-party audit report (IATF preferred for automotive) |

| ISO 13485 | Medical Device QMS | Required for medical equipment suppliers | Audit + design history file (DHF) review |

| RoHS/REACH | Chemical Compliance (EU/Global) | Restricts hazardous substances in electronics and chemicals | Test reports (ICP-MS, GC-MS) from accredited labs |

Note: Procurement teams must verify certifications are held by the actual manufacturing facility (not just the brand), especially for Chinese contract manufacturers producing under U.S. brand names.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, poor process control, inadequate SPC | Implement SPC with real-time monitoring; conduct weekly gauge R&R studies; enforce preventive maintenance schedules |

| Material Substitution | Cost-cutting, supply shortages | Require Material Declarations (PPAP Level 3+); conduct random lab testing (XRF, FTIR); audit BOM compliance |

| Surface Finish Defects (Scratches, Pitting) | Poor handling, mold contamination, plating issues | Enforce cleanroom protocols for sensitive parts; use protective packaging; conduct first-article inspection (FAI) |

| Solder Joint Failures (Electronics) | Reflow profile deviation, contamination | Validate reflow profiles; enforce IPC-A-610 inspections; perform automated optical inspection (AOI) and X-ray for BGAs |

| Packaging Damage | Inadequate design, poor stacking | Perform ISTA 3A drop and vibration testing; use edge protectors; audit warehouse handling procedures |

| Labeling/Marking Errors | Language, regulatory symbol omissions | Use master templates with version control; verify against regional compliance requirements (e.g., CE, FCC, bilingual labels) |

| Contamination (Particulate, Oils) | Poor cleanroom practices, inadequate washing | Enforce ISO Class 7 or better for sensitive assemblies; implement final cleaning validation (gravimetric analysis) |

Strategic Recommendations

- Supplier Qualification: Conduct on-site audits using checklists aligned with ISO 9001 and product-specific standards.

- Third-Party Inspection: Engage independent QC firms (e.g., SGS, TÜV, QIMA) for pre-shipment inspections (AQL Level II).

- Traceability: Require full batch/lot traceability from raw material to finished goods.

- Dual Compliance Verification: Confirm both U.S. brand standards and Chinese manufacturing site compliance.

- Contractual Clauses: Include penalty terms for non-compliance, defect recalls, and IP protection.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA

B2B SOURCING REPORT 2026

Strategic Guide for Global Procurement Managers: Cost Optimization in US-China Manufacturing Partnerships

EXECUTIVE SUMMARY

Contrary to common misconception, no major US companies are “owned by China.” Instead, Chinese manufacturing partners (OEMs/ODMs) produce goods for US brands under contractual agreements. This report clarifies cost structures, ownership models, and strategic pathways for procurement leaders navigating this ecosystem. Key insights:

– 73% of US brands using Chinese manufacturing leverage ODM models for speed-to-market (SourcifyChina 2025 Benchmark Survey).

– Labor costs in coastal China will rise 4.2% CAGR through 2026 (World Bank), but automation offsets 60% of this impact.

– White label dominates low-MOQ segments; private label delivers 18–35% higher margins for established brands.

CLARIFYING OWNERSHIP: THE US-CHINA MANUFACTURING REALITY

| Model | Ownership Structure | US Brand Examples |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Chinese factory produces client’s design; Zero IP ownership by manufacturer | Apple (Foxconn), Tesla (CATL batteries) |

| ODM (Original Design Manufacturing) | Chinese factory designs and produces; IP licensed to US brand | Anker (Shenzhen bases), Amazon Basics (multiple ODMs) |

| White Label | Pre-made generic product rebranded by US buyer; No customization | Amazon sellers, Costco Kirkland Signature |

| Private Label | US brand commissions exclusive design; Full IP control | Warby Parker, Brooklinen (via Chinese ODMs) |

Critical Note: Chinese entities hold manufacturing assets, not US corporate equity. US brands retain full brand/IP ownership. Misconceptions risk flawed risk assessments.

WHITE LABEL VS. PRIVATE LABEL: STRATEGIC BREAKDOWN

| Factor | White Label | Private Label |

|---|---|---|

| MOQ Flexibility | Ultra-low (50–500 units) | Moderate-high (1,000+ units) |

| Unit Cost | Higher (premium for no customization) | Lower at scale (customization amortized) |

| Time-to-Market | 2–4 weeks | 12–20 weeks (R&D + tooling) |

| Brand Control | None (generic specs) | Full (materials, packaging, features) |

| Best For | Testing markets, flash sales, dropshipping | Long-term brand building, premium positioning |

2026 MANUFACTURING COST BREAKDOWN (ELECTRONICS EXAMPLE)

Based on $25 FOB Shenzhen baseline product (e.g., wireless earbuds)

| Cost Component | % of Total Cost | 2026 Trend | Procurement Strategy |

|---|---|---|---|

| Materials | 58–65% | +3.1% YoY (rare earths, IC chips) | Secure multi-supplier contracts; hedge metals |

| Labor | 12–15% | +4.2% YoY (offset by 5% automation adoption) | Prioritize factories with ISO 45001 certification |

| Packaging | 8–10% | +6.8% YoY (sustainable materials compliance) | Standardize modular designs; avoid single-use |

| Logistics | 7–9% | +2.5% YoY (fuel, port congestion) | Book annual FCL contracts; use bonded warehouses |

| QA/Compliance | 5–7% | +8.0% YoY (stricter FCC/CE testing) | Embed QA in production line; avoid post-shipment |

Note: Labor占比 is declining due to automation (robot density in Chinese factories: 392 units/10k workers in 2026 vs. 246 in 2022).

ESTIMATED PRICE TIERS BY MOQ (FOB SHENZHEN)

Product: Mid-tier Bluetooth Speaker | 2026 Projected Pricing

| MOQ | Unit Price | Savings vs. MOQ 500 | Cost Drivers | Recommended For |

|---|---|---|---|---|

| 500 units | $14.85 | — | High tooling amortization; manual assembly | Market testing, niche launches |

| 1,000 units | $12.20 | 17.8% | Partial automation; bulk material discounts | Early-stage brands, pilot runs |

| 5,000 units | $9.65 | 35.0% | Full automation; strategic material partnerships | Established brands, retail chains |

Key Assumptions:

– 5% tariff inclusion (Section 301)

– Packaging: Recycled cardboard + soy ink (2026 ESG baseline)

– Labor: $4.85/hr (Shenzhen 2026 avg. for skilled workers)

– Savings plateau beyond 5k units due to logistics bottlenecks

STRATEGIC RECOMMENDATIONS FOR PROCUREMENT MANAGERS

- Avoid “White Label Traps”: 68% of brands switching to private label after Year 1 cite poor margins from white label (SourcifyChina 2025).

- Demand Automation Metrics: Factories with >30% production automation deliver 22% more consistent lead times.

- MOQ Negotiation Levers:

- Offer 50% upfront payment for 30% lower MOQs

- Commit to 2-year contracts for material cost locks

- Compliance Is Non-Negotiable: 92% of 2025 US customs seizures involved misdeclared packaging materials.

PREPARED BY

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Shenzhen HQ | [email protected]

Data verified via SourcifyChina’s 2026 Manufacturing Index (2,100+ factory audits)

Disclaimer: All figures reflect SourcifyChina’s proprietary modeling. Actual costs vary by product complexity, factory tier, and contractual terms. Never engage suppliers without IP assignment clauses in ODM agreements.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

As global supply chains evolve, procurement managers face increasing complexity in identifying legitimate, high-capacity manufacturers—especially in China. A growing concern among Western buyers is the misrepresentation of company ownership and operational structure, particularly claims that a Chinese entity is a “manufacturer for major US companies.” This report outlines a structured, evidence-based verification process to authenticate Chinese suppliers, differentiate between trading companies and true factories, and identify red flags that signal risk.

This guide is designed to equip procurement teams with actionable due diligence protocols to mitigate supply chain risks, ensure compliance, and secure long-term sourcing success.

Critical Steps to Verify a Manufacturer Claiming to Supply Major US Companies

1. Request and Verify Client References

- Action: Ask the supplier for 2–3 verifiable references from US-based clients, including contact details and PO numbers.

- Validation: Contact these references directly via official email domains (e.g., @brandname.com). Request confirmation of:

- Nature and duration of the business relationship.

- Volume and type of products sourced.

- Compliance and quality performance.

- Red Flag: Refusal to provide references or use of generic emails (e.g., @gmail.com).

2. Conduct On-Site or Third-Party Factory Audits

- Action: Schedule an in-person or third-party audit (e.g., via SGS, Bureau Veritas, or SourcifyChina’s audit team).

- Audit Focus Areas:

- Production lines and machinery.

- Raw material inventory.

- Employee ID verification and shift logs.

- Finished goods warehouse and order fulfillment processes.

- Outcome: Audit report with timestamped photos, employee interviews, and equipment verification.

3. Review Export Documentation

- Action: Request recent export documents (e.g., Bills of Lading, Commercial Invoices) showing shipments to US clients.

- Verification:

- Cross-check consignee names with known US brands.

- Validate shipping dates and volumes.

- Use platforms like ImportGenius or Panjiva to verify export history independently.

- Red Flag: Inability to produce export records or discrepancies in shipment data.

4. Validate Intellectual Property & Compliance Certifications

- Action: Confirm valid certifications:

- ISO 9001, ISO 14001, BSCI, or industry-specific standards (e.g., FDA, UL).

- Trademark or design patents registered under the factory’s name.

- Verification: Check certification numbers on official databases (e.g., CNAS for China).

How to Distinguish Between a Trading Company and a Factory

| Criteria | True Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns land/building; lease agreements or property deeds available. | No production facility; may rent showroom space. |

| Production Equipment | On-site machinery (e.g., injection molding, CNC, assembly lines). | No machinery; samples sourced from third parties. |

| Workforce | Directly employs production staff; payroll records and ID verifications available. | Staff limited to sales, logistics, and sourcing personnel. |

| Lead Times | Shorter lead times due to direct control over production. | Longer lead times due to intermediary coordination. |

| Pricing Structure | Lower unit costs; quotes based on material + labor + overhead. | Higher margins; pricing includes supplier markup. |

| Customization Capability | In-house R&D, tooling, and engineering teams. | Limited to MOQ adjustments; reliant on factory partners. |

| Audit Evidence | Shows live production lines, raw material stores, QC stations. | Shows sample rooms, offices, no active manufacturing. |

Pro Tip: Use drone footage or live video audit tools to verify facility scale and activity.

Red Flags to Avoid

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Vague or Unverifiable Claims e.g., “We supply Walmart, Apple, etc.” without proof. |

High risk of misrepresentation; possible trading company posing as OEM. | Demand proof: client letters, POs, or audit trails. |

| No Physical Address or Virtual Office | Indicates lack of infrastructure; likely a shell entity. | Conduct GPS-verified site visit or third-party audit. |

| Inconsistent Communication Different contacts on email vs. calls. |

Suggests outsourced customer service or multiple layers. | Require direct contact with operations manager. |

| Unrealistically Low Pricing | May indicate substandard materials, hidden fees, or counterfeit production. | Benchmark against industry averages; request cost breakdown. |

| Refusal to Provide Machine List or Production Flow | Conceals lack of in-house capability. | Include in audit checklist; verify machinery via video. |

| No MOQ Flexibility for Custom Orders | Trading companies often lack control over production scheduling. | Test with small custom run; verify tooling ownership. |

| Use of Stock Photos or Non-Original Videos | Misleading marketing; not reflective of actual operations. | Request timestamped, geotagged media or conduct live audit. |

Best Practices for Risk Mitigation

- Use Escrow Payment Terms

-

Release funds only after production milestones and QC approvals.

-

Execute NDAs and Quality Agreements

-

Legally bind suppliers to confidentiality and compliance standards.

-

Leverage Digital Verification Tools

-

Platforms like Panjiva, ImportGenius, and Alibaba’s Verified Supplier reports.

-

Engage Local Sourcing Partners

-

On-the-ground teams can perform unannounced audits and monitor production.

-

Conduct Annual Re-Audits

- Supplier status can change; ensure ongoing compliance and capacity.

Conclusion

The claim that a Chinese manufacturer supplies “major US companies” must be treated with professional skepticism until independently verified. Procurement managers must implement a layered due diligence strategy—combining document verification, on-site audits, and digital intelligence—to distinguish legitimate factories from intermediaries and avoid costly supply chain disruptions.

By following the protocols in this report, global buyers can build transparent, resilient, and high-performance supply chains rooted in verified supplier integrity.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based supplier verification and procurement optimization

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: Eliminating Sourcing Blind Spots in US-China Supply Chains

Persistent misconceptions about “major US companies owned by China” create significant operational risks and wasted resources for procurement teams. SourcifyChina’s Verified Pro List resolves this by providing fact-based, audited ownership intelligence on Chinese-owned manufacturing entities operating within US supply chains—not myths, but verifiable entities critical to strategic sourcing.

Critical Clarification: The narrative of “major US consumer brands owned by China” is largely inaccurate. However, Chinese capital does control key Tier 2/3 suppliers, component manufacturers, and logistics hubs serving US brands. This is where procurement risks hide.

Why the Verified Pro List Saves 200+ Hours Annually Per Category Manager

Manual verification of Chinese-owned entities in US supply chains consumes disproportionate resources. Our data-driven solution eliminates guesswork:

| Pain Point | Traditional Approach Cost (Annual) | SourcifyChina Verified Pro List Savings |

|---|---|---|

| Supplier Ownership Verification | 187 hours (legal docs, site audits) | 100% automated – Real-time ownership mapping |

| Compliance Risk Assessment (CFIUS, UFLPA) | 120 hours (manual screening) | 90% faster – Pre-vetted entities with compliance flags |

| Fraud Detection (Shell Companies) | $48K (audit fees) | $0 – AI-powered entity legitimacy scoring |

| Sourcing Cycle Time Reduction | 45 days (per new supplier) | 22 days saved – Pre-qualified factories ready for RFQ |

Total Verified Time Savings: 307 hours/year/category | Risk Mitigation: 94% reduction in supply chain disruptions (2025 Client Data)

The SourcifyChina Advantage: Precision Over Propaganda

Our Verified Pro List delivers what generic databases cannot:

✅ Direct-to-Factory Ownership Trees: Trace ultimate beneficial owners (UBOs) via China’s SAMR registry + global cross-references.

✅ Geopolitical Risk Tags: CFIUS exposure, UFLPA compliance status, and entity-specific tariff codes.

✅ Zero Middlemen: 100% of listed entities are factory-direct with SourcifyChina’s 5-point verification (site audit, export license, financial health, capacity validation, legal standing).

✅ Dynamic Updates: Real-time alerts on ownership changes (e.g., CITIC acquisitions, state-backed M&A).

Example: A Fortune 500 electronics buyer used our list to identify a Chinese-owned PCB supplier within their existing US partner’s supply chain—avoiding $2.1M in tariff exposure and accelerating compliance by 6 weeks.

Call to Action: Secure Your Supply Chain Before Q3 2026 Procurement Cycles

Time is your scarcest resource—and misinformation is your cost multiplier. Every hour spent verifying suppliers manually is an hour not spent optimizing costs, mitigating risks, or innovating your portfolio.

Take Control in 3 Steps:

1. Request Your Customized Pro List Segment (e.g., “Automotive Components” or “Medical Device Subcontractors”)

2. Validate 3 Pre-Vetted Suppliers in < 48 hours with zero compliance overhead

3. Redirect 200+ Annual Hours toward strategic value creation

→ Act Now to Lock Q3 Capacity & Avoid Tariff Surges

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 Sourcing Desk)

Include “PRO LIST 2026” in your subject line for priority access to our Q2-exclusive supplier analytics dashboard.

SourcifyChina: Verified. Transparent. Uncompromised.

Data-Driven Sourcing Intelligence Since 2018 | Serving 1,200+ Global Procurement Teams

Note: All entities in our Pro List undergo quarterly re-verification per ISO 20400 standards. We do not list consumer brands—only operational manufacturing/logistics entities.

🧮 Landed Cost Calculator

Estimate your total import cost from China.