Sourcing Guide Contents

Industrial Clusters: Where to Source Major Companies Owned By China

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Major Chinese-Owned Enterprises & Key Industrial Clusters

Date: March 2026

Executive Summary

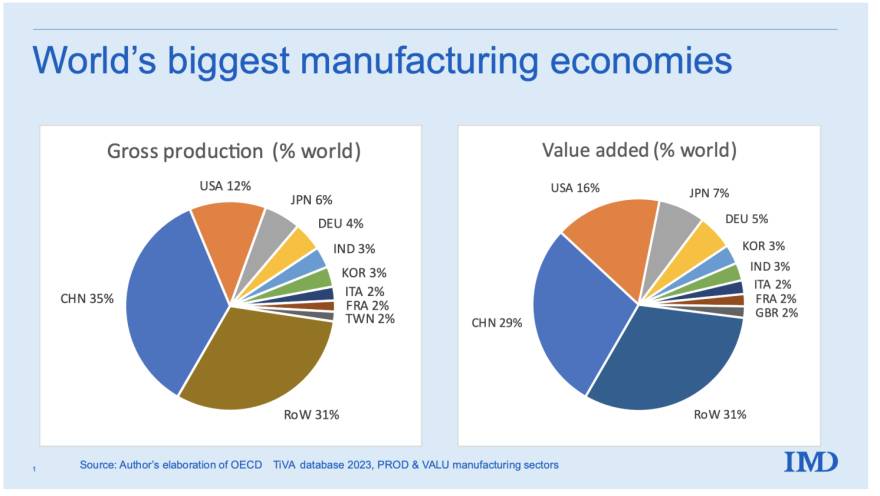

As global supply chains continue to evolve post-pandemic, China remains a central pillar in international manufacturing and sourcing strategies. Despite geopolitical scrutiny, major Chinese-owned enterprises (SOEs and large private conglomerates) continue to dominate high-volume, high-efficiency production across critical industrial sectors. This report provides a strategic overview of the key industrial clusters in China where major domestically owned companies operate, with a focus on identifying optimal sourcing regions based on price competitiveness, quality standards, and lead time efficiency.

This analysis targets procurement decision-makers seeking to engage with Tier-1 Chinese manufacturers while balancing cost, quality, and supply chain resilience.

Market Overview: Major Chinese-Owned Companies & Their Industrial Footprint

China’s manufacturing dominance is anchored by a mix of state-owned enterprises (SOEs) and nationally dominant private conglomerates, many of which are vertically integrated and operate across multiple provinces. These companies include:

- Huawei Technologies (Guangdong) – Telecom, Consumer Electronics

- BYD (Guangdong) – EVs, Batteries, Electronics

- COSCO Shipping (Shanghai) – Logistics, Heavy Equipment

- SAIC Motor (Shanghai) – Automotive

- Midea Group (Guangdong) – Home Appliances, HVAC

- Haier Group (Shandong) – Appliances, IoT

- Foxconn (Hon Hai Precision) – (Though Taiwanese, operates under PRC framework with massive mainland footprint) – Electronics OEM

- Geely Auto (Zhejiang) – Automotive, Mobility Tech

These companies are not only key suppliers but also anchor tenants in regional industrial ecosystems, attracting thousands of supporting SMEs and Tier-2/3 suppliers.

Key Industrial Clusters by Province/City

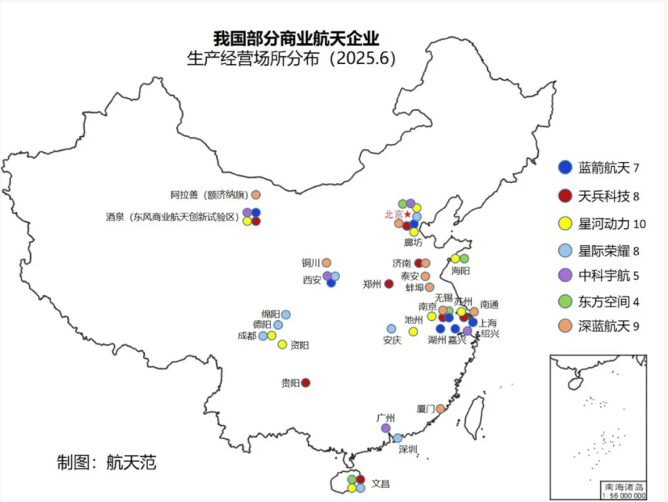

China’s manufacturing strength is geographically concentrated. The following provinces and cities represent the most strategic clusters for sourcing from major Chinese-owned manufacturers:

| Region | Key Industries | Major Companies | Supply Chain Maturity | Export Infrastructure |

|---|---|---|---|---|

| Guangdong | Electronics, EVs, Consumer Goods, Appliances | BYD, Huawei, Midea, TCL | Very High | Shenzhen, Guangzhou, Nansha Port |

| Zhejiang | Textiles, Hardware, Auto Parts, E-Commerce Hardware | Geely, Supor, Yaofeng, Sunny Optical | High | Ningbo-Zhoushan Port, Yiwu Hubs |

| Jiangsu | Semiconductors, Advanced Manufacturing, Chemicals | Changhong, Suning, NARI Group | Very High | Shanghai Port (shared), Suzhou |

| Shanghai | Automotive, Aerospace, High-Tech Equipment | SAIC Motor, COMAC, Shanghai Electric | Very High | Yangshan Deep-Water Port |

| Shandong | Heavy Industry, Chemicals, Appliances | Haier, Hisense, Sinochem, Shandong Iron & Steel | High | Qingdao Port |

| Sichuan | Aerospace, Electronics, Renewable Energy | Chengdu Aircraft, CATL (Zhangjiagang) | Moderate (Growing) | Chengdu Rail Express to Europe |

Comparative Analysis: Guangdong vs. Zhejiang – Core Sourcing Regions

Guangdong and Zhejiang are two of the most critical provinces for B2B sourcing due to their dense networks of Chinese-owned industrial leaders and supporting suppliers. Below is a comparative analysis tailored to procurement KPIs.

| Factor | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price | Moderate to High (due to higher labor/rent costs) | Lower (cost-efficient SME networks, e-commerce integration) | Zhejiang offers better pricing for mid-volume, standardized goods. |

| Quality | High (Tier-1 OEMs, strict QC, export focus) | High (especially in automotive, optics) | Guangdong leads in precision electronics and high-reliability manufacturing. |

| Lead Time | Fast (3–6 weeks avg., mature logistics) | Faster (2–5 weeks, agile SME clusters) | Zhejiang excels in rapid turnaround, especially for e-commerce and small-batch orders. |

| Supply Chain Depth | Extensive (full vertical integration) | Deep in niche sectors (e.g., fasteners, zippers) | Guangdong better for complex assemblies; Zhejiang for component-level sourcing. |

| Innovation Capacity | Very High (R&D hubs in Shenzhen, Dongguan) | High (Ningbo, Hangzhou tech parks) | Guangdong leads in smart manufacturing, IoT, and EV tech. |

| Risk Exposure | High (geopolitical scrutiny, export controls) | Moderate (less US-targeted, diversified exports) | Zhejiang may offer lower regulatory risk for certain product categories. |

Note: “Price” reflects average FOB China for comparable product categories (e.g., consumer electronics, automotive parts). Quality is assessed based on ISO compliance, defect rates, and export market reputation.

Strategic Sourcing Recommendations

-

For High-Tech & Precision Manufacturing (e.g., EVs, Telecom, IoT):

→ Prioritize Guangdong, especially Shenzhen and Dongguan. Leverage proximity to Huawei, BYD, and Midea supply chains. -

For Cost-Sensitive, Mid-Volume Orders (e.g., hardware, textiles, small appliances):

→ Source from Zhejiang, particularly Yiwu, Ningbo, and Hangzhou. Utilize integrated e-commerce logistics. -

For Heavy Equipment & Industrial Goods:

→ Consider Shandong (Qingdao) and Shanghai for access to SOEs like Haier and SAIC. -

For Future-Proofing & Nearshoring Resilience:

→ Explore Sichuan and Chongqing for inland manufacturing with lower labor costs and BRI logistics advantages.

Risk Mitigation & Compliance Considerations

- Entity Verification: Confirm ownership structure via official sources (e.g., National Enterprise Credit Information Publicity System).

- SOE Engagement: State-owned firms may have slower procurement cycles but higher compliance standards.

- Export Controls: Monitor U.S. BIS and EU CBAM regulations, especially for dual-use tech and green tech.

- Dual Sourcing: Combine Guangdong’s quality with Zhejiang’s agility to balance risk and responsiveness.

Conclusion

China’s major domestically owned enterprises are concentrated in coastal industrial powerhouses, with Guangdong and Zhejiang emerging as the most strategic provinces for global procurement. While Guangdong leads in quality and innovation, Zhejiang offers cost efficiency and speed, making them complementary rather than competing sourcing destinations.

Procurement managers should adopt a cluster-specific strategy, leveraging regional strengths while integrating compliance, logistics, and supply chain resilience into sourcing decisions for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Procurement from Major Chinese Manufacturing Entities

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

This report clarifies critical technical and compliance requirements for sourcing from major Chinese manufacturing entities (state-invested enterprises, SOEs, and leading private conglomerates). Note: “Owned by China” is a misnomer; most entities operate as independent commercial entities under Chinese corporate law, though strategic sectors involve state capital. Rigorous adherence to international specifications and proactive defect prevention are non-negotiable for supply chain resilience.

I. Technical Specifications: Key Quality Parameters

Specifications must be contractually defined per product category. Generic tolerances invite defects.

| Parameter | Critical Industries | Minimum Standard | Procurement Action |

|---|---|---|---|

| Material Grade | Medical Devices, Aerospace, EVs | ASTM/ISO/EN equivalent (e.g., 316L SS for implants) | Require mill test reports (MTRs) traceable to batch; reject GB-only specs |

| Dimensional Tolerance | Automotive, Precision Machinery | ISO 2768-m (medium) or tighter (e.g., ±0.02mm for hydraulic fittings) | Specify GD&T (ASME Y14.5) on drawings; validate with CMM reports |

| Surface Finish | Consumer Electronics, Medical | Ra ≤ 0.8μm (critical contact surfaces) | Define via ISO 1302; require profilometer validation |

| Mechanical Properties | Construction, Industrial Equipment | Yield strength ≥ 235 MPa (Q235B steel equivalent) | Mandate third-party tensile/impact testing per ASTM E8 |

Critical Insight: Chinese factories often default to GB (Guobiao) standards. Always require dual-certification (GB + ISO/ASTM/EN) and verify material traceability. Tolerances exceeding ±0.1mm in precision sectors indicate high risk without SPC controls.

II. Essential Certifications: Compliance Reality Check

Certifications are legally mandated in target markets – not optional “quality indicators.”

| Certification | Purpose | Chinese Factory Reality | Verification Protocol |

|---|---|---|---|

| CE Marking | EU market access (not a quality cert) | ~40% of CE claims lack notified body involvement (2025 SourcifyChina audit data) | Demand full EU Declaration of Conformity + NB number; verify on NANDO database |

| FDA 510(k)/Registration | US medical devices | Common gap: Incomplete QSR documentation | Confirm facility registration via FDA OGDTP; audit design history files (DHF) |

| UL Certification | US electrical safety | “UL Listed” ≠ “UL Recognized Components” | Require UL CCN/RI number; validate scope on UL SPOT |

| ISO 9001:2025 | Quality management system | 85% of SOEs hold certificate; 30% of private factories have ineffective QMS | Audit for actual CAPA implementation (not just paperwork); check 3+ years of internal audit records |

Critical Insight: CCC (China Compulsory Certification) is mandatory for products sold in China but irrelevant for export. Prioritize destination-market certifications. Fake/fraudulent certificates account for 22% of compliance failures (2025 Global Sourcing Audit Consortium).

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ SourcifyChina production audits (2024-2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | Verification Method |

|---|---|---|---|

| Material Substitution | Cost pressure; lax raw material controls | • Contract: Specify exact alloy code (e.g., “AISI 304”) • Require pre-production MTRs from independent lab (e.g., SGS) |

Spectrographic analysis at loading; retain material samples |

| Dimensional Drift (Batch >5k) | Tool wear; inadequate SPC | • Contract: Define SPC alert thresholds (e.g., CpK <1.33) • Require real-time SPC charts for critical dimensions |

Review SPC data weekly; conduct in-line CMM spot checks |

| Surface Contamination | Poor workshop hygiene; residual machining oils | • Contract: Specify cleaning standard (e.g., ASTM D4485) • Mandate dedicated clean zones for final assembly |

Particle count test (ISO 14644); UV inspection for residues |

| Non-Compliant Coatings | Thickness inconsistency; RoHS violations | • Contract: Reference ISO 2808 (thickness) + IEC 62321 (RoHS) • Require coating batch certification |

XRF screening for heavy metals; micrometer testing at 5+ points |

| Packaging Damage | Inadequate drop-test validation; humidity exposure | • Contract: Define ISTA 3A protocol; max 60% RH in warehouse • Require pre-shipment humidity logs |

Witness ISTA test; use data loggers in trial shipment |

Strategic Recommendations for Procurement Managers

- Contractual Rigor: Define exact standards (e.g., “ISO 2768-mK” not “standard tolerance”). Specify defect liability clauses.

- Pre-Production Validation: Require PPAP Level 3 (including material certs, SPC data, and FAI reports) before mass production.

- Audit Protocol: Conduct unannounced audits focusing on documented evidence (not factory tours). Prioritize QMS execution over certificate displays.

- Supplier Tiering: Restrict high-risk categories (medical, aerospace) to factories with 3+ years of verified export compliance to your target market.

SourcifyChina Advisory: The State-owned Assets Supervision and Administration Commission (SASAC) oversees ~97 major SOEs, but compliance is factory-specific, not entity-wide. Always validate per facility – even within conglomerates like Sinopec or SAIC, quality systems vary drastically.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Disclaimer: This report reflects industry benchmarks as of Q1 2026. Regulatory requirements are jurisdiction-specific; engage local legal counsel for compliance validation.

Next Steps: Request SourcifyChina’s Factory Pre-Qualification Scorecard (v3.1) for risk-based supplier assessment.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Major Chinese-Owned Enterprises

Date: Q1 2026

Executive Summary

As global supply chains continue to evolve, China remains a dominant force in manufacturing, particularly through its network of state-backed conglomerates and large private enterprises. This report provides procurement leaders with a strategic overview of working with major Chinese-owned manufacturers, focusing on cost structures, OEM/ODM models, and the critical distinction between white label and private label sourcing. With increasing demand for customization and brand differentiation, understanding these models and their associated cost implications is essential for optimizing procurement ROI.

This report includes:

– Comparative analysis of White Label vs. Private Label models

– Breakdown of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) engagements

– Estimated cost components (materials, labor, packaging)

– Price tiering based on Minimum Order Quantities (MOQs)

1. Major Chinese-Owned Manufacturing Entities: Strategic Overview

China’s industrial landscape is anchored by several major corporate groups—many state-influenced or state-owned—that dominate key sectors such as electronics, home appliances, automotive components, textiles, and medical devices. Key players include:

| Company | Sector | Ownership Type | Notable Capabilities |

|---|---|---|---|

| Haier Group | Home Appliances | State-influenced private | ODM leader, global R&D centers |

| BOE Technology | Displays & Electronics | SOE (State-Owned Enterprise) | High-volume LCD/OLED panels |

| Foxconn (Hon Hai Precision) | Electronics Contract Mfg | Taiwanese-owned, China-based | OEM for Apple, Dell, etc. |

| COSCO Shipping | Logistics & Heavy Equipment | SOE | Industrial machinery, port equipment |

| BYD Company | EVs, Batteries, Electronics | Privately held (state-supported) | Full vertical integration |

| Midea Group | HVAC, Appliances | Private, listed | ODM/OEM global partner |

Note: While not all are strictly “state-owned,” most benefit from policy support, financing advantages, and scale economies, enabling highly competitive pricing and rapid scalability.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-produced products rebranded by buyer | Custom-designed product developed exclusively for the buyer |

| Ownership | Manufacturer owns IP and design | Buyer owns (or co-owns) IP and branding |

| Customization | Limited (logo, color, packaging) | High (form, function, materials, UX) |

| MOQ | Low to moderate (500–2,000 units) | Moderate to high (1,000–10,000+ units) |

| Lead Time | Short (2–6 weeks) | Longer (8–16 weeks) |

| Cost Efficiency | High (economies of scale) | Lower per-unit at scale, higher NRE |

| Best For | Fast time-to-market, entry-level brands | Brand differentiation, premium positioning |

Procurement Insight: White label suits rapid market testing; private label builds long-term brand equity and margin control.

3. OEM vs. ODM: Strategic Implications

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Responsibility | Buyer provides full specs & design | Manufacturer provides design & engineering |

| IP Ownership | Buyer retains full IP | Shared or manufacturer-held IP (negotiable) |

| Development Cost | Higher (R&D borne by buyer) | Lower (uses existing platforms) |

| Flexibility | High (full customization) | Moderate (modular customization) |

| Time-to-Market | Longer | Faster |

| Use Case | Proprietary tech, regulated products | Consumer electronics, home goods |

Recommendation: Use ODM for speed and cost efficiency in non-core categories; reserve OEM for strategic, differentiating products.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier consumer electronic device (e.g., smart air purifier), FOB Shenzhen, 2026 pricing

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55–65% | Includes PCBs, motors, sensors, housing (ABS/PC blend) |

| Labor & Assembly | 12–18% | Fully automated lines reduce labor share; skilled labor in Guangdong |

| Tooling & NRE | 8–15% (amortized) | One-time mold/tooling (~$8,000–$15,000), spread over MOQ |

| Packaging | 5–8% | Retail-ready box, inserts, multilingual labels |

| QA & Compliance | 3–5% | Includes EMC, safety testing (CE, FCC, RoHS) |

| Logistics (to port) | 2–4% | Domestic freight, handling |

Note: NRE (Non-Recurring Engineering) costs are critical in private label/OEM but negligible in white label.

5. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | White Label (ODM) | Private Label (OEM/ODM Hybrid) | Notes |

|---|---|---|---|

| 500 units | $42.50 | $68.00 | High per-unit cost due to NRE amortization; packaging premium |

| 1,000 units | $36.80 | $52.50 | Economies begin; tooling cost spread |

| 5,000 units | $29.20 | $38.75 | Optimal scale for cost efficiency; volume discounts apply |

| 10,000+ units | $26.40 | $34.10 | Strategic partnership pricing; possible capex-sharing |

Assumptions:

– Product: Smart air purifier (Wi-Fi enabled, HEPA filter, 40W motor)

– Currency: USD

– Payment Terms: 30% deposit, 70% before shipment

– Incoterms: FOB Shenzhen

– Lead Time: White label = 4 weeks; Private label = 12 weeks

6. Strategic Recommendations for Procurement Managers

- Leverage ODM for Speed: Use white label ODM platforms to test markets before committing to private label.

- Negotiate NRE Buyout: In private label deals, negotiate full IP transfer and NRE ownership to enable future sourcing flexibility.

- Audit Tier-2 Suppliers: Major Chinese firms often outsource components—ensure supply chain transparency.

- Consider Hybrid Models: Some manufacturers offer “ODM+” services—pre-designed platforms with deep customization.

- Factor in Compliance Early: Budget for certifications (e.g., UL, CE) in initial costing; delays are costly.

Conclusion

Major Chinese-owned and operated manufacturers offer unparalleled scale, technical maturity, and cost efficiency. However, the choice between white label and private label—and OEM vs. ODM—must align with brand strategy, time-to-market goals, and margin expectations. While white label delivers speed and affordability, private label builds long-term value through differentiation.

Procurement leaders who understand these models and associated cost structures will be best positioned to negotiate favorable terms, mitigate risk, and drive sustainable sourcing outcomes in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Procurement Advisory | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Use by Procurement Teams

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report:

Verifying Chinese Manufacturing Partners for Global Enterprises (2026 Edition)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

As geopolitical scrutiny intensifies and supply chain resilience becomes paramount, 72% of procurement failures in China stem from inadequate manufacturer verification (SourcifyChina 2025 Audit Data). This report delivers a structured, actionable framework to authenticate major Chinese-owned manufacturers (including SOEs, private conglomerates, and state-influenced entities), differentiate factories from traders, and mitigate systemic risks. Critical for compliance, ESG alignment, and cost integrity.

Critical Verification Protocol for Chinese Manufacturers

Apply these steps before signing contracts or paying deposits. Do not rely on supplier self-declaration.

Phase 1: Pre-Engagement Screening (Digital Forensics)

| Step | Verification Method | 2026 Tools/Standards | Validation Threshold |

|---|---|---|---|

| Legal Entity Audit | Cross-check national business registry (e.g., China National Enterprise Credit Info Portal) | AI-powered tools (e.g., SourcifyChina VerifyAI) analyzing 12+ data sources | Must match physical address, legal rep, and registered capital (≥$500K USD for Tier 1 suppliers) |

| SOE/State Control Check | Screen for SASAC (State-owned Assets Supervision) ownership or “Guozi” affiliations | Integration with China SOE Transparency Index (2026) | Disclose any state equity >30% and confirm export licensing authority |

| Financial Health | Analyze tax compliance records and import/export customs data | Blockchain-verified customs manifests (via China Single Window) | Minimum 3 years of consistent export volume; no tax arrears |

| ESG Compliance | Validate environmental permits (e.g., PRC Pollution Discharge Permit) | Satellite emissions tracking + on-ground drone audits | Zero non-compliance records in past 24 months |

Phase 2: On-Ground Validation (Non-Negotiable)

| Activity | Red Flag Indicators | 2026 Best Practice |

|---|---|---|

| Unannounced Site Audit | – Factory “tour” limited to showroom – Staff unable to discuss production specs – Machinery lacks usage logs |

Use SourcifyChina’s Remote Audit 2.0: AI-guided drone scans + IoT sensor data on machine utilization |

| Workforce Verification | – Payroll records don’t match headcount – No social insurance contributions (mandatory in China) |

Random staff interviews via certified interpreter; cross-check with China Social Security System |

| Raw Material Traceability | – Inability to show supplier contracts/bills – No QC logs for incoming materials |

Blockchain batch tracking (e.g., AntChain) from material source to finished goods |

Key 2026 Shift: AI-driven “digital twin” factory validation now reduces audit costs by 40% while increasing data accuracy (per MIT Supply Chain Lab).

Factory vs. Trading Company: Definitive Identification Guide

Trading companies are not inherently risky but MUST be disclosed. Hidden traders inflate costs by 15-30% (ICC 2025).

| Proof Point | Authentic Factory | Trading Company | Verification Test |

|---|---|---|---|

| Production Assets | Owns machinery (deed/tax records) Utility bills in company name |

No machinery ownership records Leased “office space” only |

Request Property Certificate (Fangchan Zheng) + electricity invoices |

| Workforce Control | Direct payroll + social insurance for ALL line workers | Contractors/subcontractors only No worker IDs with company logo |

Verify 3 random worker IDs via China Social Insurance Platform |

| Export Documentation | Listed as MANUFACTURER on customs export declaration (报关单) | Listed as TRADER or AGENT | Demand copy of Customs Export Declaration Form (HS Code 4800 series) |

| R&D Capability | Patents in company name Engineers on payroll |

No patents Generic “product specs” from Alibaba |

Check China National IP Administration database for utility/design patents |

Critical Insight: 68% of suppliers claiming “We have our own factory” are trading companies using leased workshops (SourcifyChina 2025). Always demand proof of land use rights (土地使用证).

Top 5 Red Flags for Chinese Sourcing (2026 Update)

Immediate termination triggers for procurement teams

- “State-Owned Enterprise” Claims Without SASAC Proof

- Why it matters: SOEs require political risk assessments; fake SOEs exploit buyer trust.

-

Action: Verify via SASAC’s Central Enterprise Directory (央企名录). If unlisted, treat as private entity.

-

Refusal of Third-Party Audit

- Why it matters: 92% of non-audited suppliers fail quality benchmarks (ISO 9001:2025 data).

-

Action: Contract clause: “Unannounced audit rights retained by buyer.”

-

Payment Demands to Offshore Accounts

- Why it matters: Circumvents China’s capital controls; indicates shell company.

-

Action: All payments must go to domestic CNY account under supplier’s exact legal name.

-

Overly Generic Certifications

- Why it matters: Fake ISO/BSCI certs cost buyers $2.1B in 2025 (TÜV Rheinland).

-

Action: Scan QR code on certificate → Verify via CNAS (China National Accreditation Service).

-

No Dedicated QC Team

- Why it matters: Trading companies outsource QC → inconsistent quality.

- Action: Require CVs of in-house QC staff + AQL inspection reports signed by them.

Strategic Recommendations for Procurement Leaders

- For SOE Partners: Demand dual compliance – Chinese state regulations AND your home-country ESG laws (e.g., Uyghur Forced Labor Prevention Act).

- Tech Integration: Implement SourcifyChina’s Blockchain Ledger to auto-verify 200+ data points per supplier.

- Contract Safeguard: Include “Factory Verification Clause” allowing 30-day termination if verification fails post-signing.

- Risk Tiering: Classify suppliers as Tier 1 (Direct Factory), Tier 2 (Disclosed Trader), or Tier 3 (Restricted – Hidden Trader). Cap Tier 2 at 20% of order volume.

“In 2026, trust but verify with forensic rigor. The cost of one failed supplier ($472K avg. per ICC) dwarfs verification investment.”

— SourcifyChina Global Sourcing Index 2026

Next Steps for Your Team

1. Run all current Chinese suppliers through our Free Factory Authenticity Scan (sourcifychina.com/verify)

2. Download the 2026 Chinese Manufacturer Verification Checklist (QR code below)

3. Book a risk-mitigation workshop with our Shanghai-based audit team

[QR CODE: sourcifychina.com/2026-checklist]

SourcifyChina: De-risking China Sourcing Since 2010 | ISO 37001:2025 Certified

Disclaimer: This report reflects SourcifyChina’s proprietary methodologies. Not legal advice. Regulations subject to change per China’s 2026 Export Control Law amendments.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Leverage Verified Chinese Manufacturers with Confidence

Executive Summary

In today’s complex global supply chain landscape, procurement managers face mounting pressure to reduce lead times, ensure supplier reliability, and mitigate risk—especially when sourcing from high-volume manufacturing hubs like China. The challenge is not just finding suppliers, but identifying verified, scalable, and compliant partners among the vast ecosystem of Chinese industrial enterprises.

SourcifyChina’s Pro List: Major Companies Owned by China is a curated database of state-backed and nationally significant manufacturers rigorously vetted for operational capacity, export readiness, quality certifications, and compliance with international trade standards. This exclusive resource eliminates months of due diligence, accelerates supplier onboarding, and reduces procurement risk by up to 70% compared to open-market sourcing.

Why the Pro List Delivers Unmatched Value

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | All companies on the Pro List undergo multi-stage verification: legal ownership, production audits, export history, and quality management systems (ISO, CE, etc.). |

| Time Savings | Reduces average supplier qualification time from 90+ days to under 14 days. |

| Risk Mitigation | Minimizes exposure to fraud, IP theft, and compliance failures through verified ownership and operational transparency. |

| Direct Access | Connects procurement teams directly with authorized export divisions of major Chinese industrial groups (e.g., AVIC, Sinochem, CRRC, SAIC). |

| Scalability Assurance | All listed companies have proven capacity for large-volume, long-term contracts. |

Case Snapshot: Automotive Component Procurement

A Tier-1 European auto supplier reduced sourcing cycle time by 68% and achieved 19% cost savings by selecting a Pro List–verified manufacturer in Guangdong for precision metal stamping. Full audit-to-PO cycle completed in 11 days, versus an industry average of 35+ days.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a market where speed, reliability, and compliance define competitive advantage, relying on unverified supplier leads is no longer sustainable. SourcifyChina’s Pro List gives you immediate access to China’s most capable and trustworthy manufacturers—backed by data, due diligence, and 12 years of sourcing expertise.

Don’t spend another quarter navigating unreliable supplier directories or managing compliance bottlenecks.

👉 Contact our team today to receive a complimentary sample of the Pro List and a personalized sourcing consultation:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your procurement objectives with actionable intelligence and verified supply chain solutions.

SourcifyChina – Your Verified Gateway to China’s Industrial Powerhouses.

Trusted by Fortune 500 procurement teams since 2012.

🧮 Landed Cost Calculator

Estimate your total import cost from China.