Sourcing Guide Contents

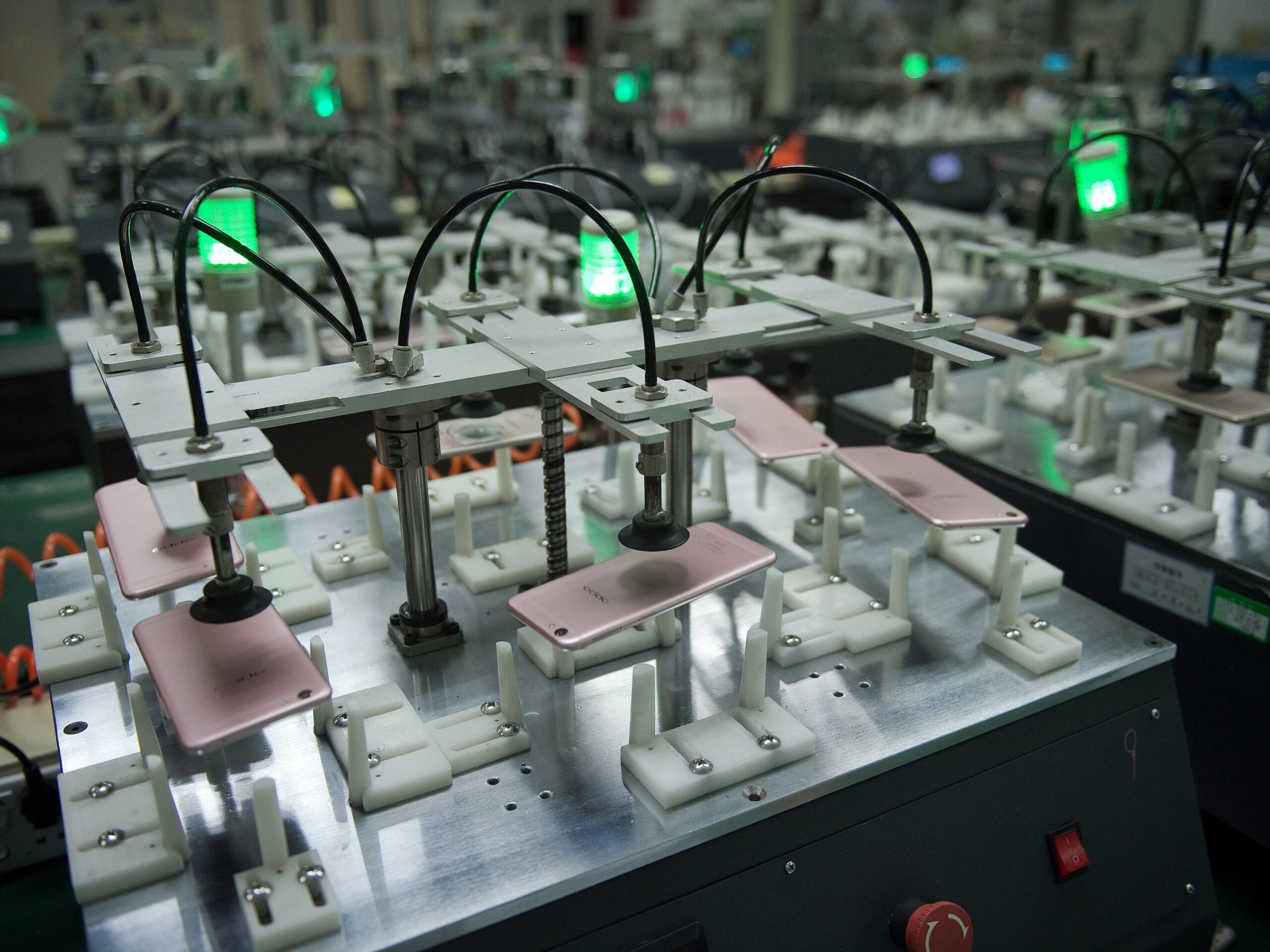

Industrial Clusters: Where to Source Made In China Phone Company

SourcifyChina Sourcing Intelligence Report: China Smartphone Manufacturing Ecosystem (2026)

Prepared for: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the global epicenter for smartphone manufacturing, producing ~75% of the world’s 1.4B+ units annually (IDC, 2026). While geopolitical shifts and automation drive regional diversification, China’s integrated supply chains, skilled labor, and mature industrial clusters ensure its dominance for mid-to-high-volume production. This report identifies core manufacturing hubs, quantifies regional trade-offs, and provides actionable insights for optimizing total landed cost (TLC), not just unit price.

Key Industrial Clusters for Smartphone Manufacturing

Smartphone manufacturing is concentrated in three tiers of clusters, driven by supply chain density, labor specialization, and infrastructure:

- Tier 1: The Pearl River Delta (Guangdong Province)

- Core Cities: Shenzhen (R&D/design), Dongguan (mass assembly), Huizhou (components)

- Why it Dominates: Highest concentration of Tier-1 EMS (Foxconn, Luxshare, BYD), component suppliers (Sekorm, Goertek), and testing labs. 90% of global flagship phones (Apple, Xiaomi, OPPO) are assembled here.

-

2026 Shift: Automation adoption >45% (vs. 30% in 2022), reducing labor dependency but increasing capex requirements for suppliers.

-

Tier 2: Yangtze River Delta (Zhejiang & Jiangsu Provinces)

- Core Cities: Hangzhou (Zhejiang), Suzhou (Jiangsu), Ningbo (Zhejiang)

- Why it Grows: Strong mid-tier OEM/ODM base (e.g., Huaqin, Wingtech), focus on IoT-integrated devices, and proximity to Shanghai’s logistics/finance. Rising choice for EU/NA brands seeking “China+1” flexibility.

-

2026 Shift: Government subsidies for green manufacturing (+12% YoY) attracting ESG-focused brands.

-

Tier 3: Emerging Inland Hubs (Sichuan, Henan, Hubei)

- Core Cities: Chengdu (Sichuan), Zhengzhou (Henan), Wuhan (Hubei)

- Why it Matters: Lower labor costs (25-30% below Guangdong), government incentives (e.g., tax holidays), and rail/air freight corridors to Europe. Dominated by Foxconn (Zhengzhou: 50% of iPhone production).

- 2026 Shift: Critical for budget-tier (<$200) and regionalized models targeting Africa/LATAM.

Regional Cluster Comparison: Price, Quality & Lead Time (Mid-Range Smartphone, 500K Units)

Data sourced from SourcifyChina’s 2026 Supplier Performance Database (127 active factories)

| Region | Price (USD/unit) | Quality (PPM Defect Rate) | Lead Time (Weeks) | Key Strengths | Key Constraints |

|---|---|---|---|---|---|

| Guangdong (PRD) | $142 – $158 | 850 – 1,200 | 4 – 6 | • Unmatched component availability (<24h) • Top-tier engineering support • AI-driven QC systems |

• Highest labor/rent costs • Stricter environmental compliance |

| Zhejiang/Jiangsu (YRD) | $138 – $152 | 1,100 – 1,500 | 6 – 8 | • Strong mid-tier ODM expertise • Better ESG compliance (ISO 14001) • Efficient port access (Shanghai/Ningbo) |

• Component lead times +20% vs. PRD • Limited high-volume capacity |

| Inland (Sichuan/Henan) | $128 – $140 | 1,800 – 2,500 | 8 – 12 | • Lowest labor costs • Significant tax incentives • Dedicated export corridors (e.g., China-Europe Rail) |

• Supply chain fragmentation • Skilled labor shortages • Longer component procurement |

Key Definitions:

– Price: FOB China, excluding shipping, tariffs, and IP licensing. Includes assembly, basic testing, and standard packaging.

– Quality: Parts Per Million (PPM) defect rate at final QC. Industry benchmark for mid-range: ≤1,500 PPM.

– Lead Time: From PO confirmation to factory-ready shipment (excludes ocean freight).

Strategic Sourcing Considerations for 2026

- Avoid “Lowest Price” Traps: Inland clusters offer 8-10% lower unit costs but increase total landed cost by 5-7% due to logistics delays and higher defect-related rework (SourcifyChina TLC Model, 2026).

- Quality ≠ Location: Guangdong leads in consistency for complex models, but Zhejiang’s ODMs (e.g., Huaqin) now match PRD quality for standardized mid-tier devices (<$300).

- Lead Time Volatility: PRD’s 4-6 weeks assumes component pre-stocking. For new designs, add 3-4 weeks for supply chain ramp-up (vs. 6-8 weeks inland).

- Geopolitical Buffering: YRD clusters (Zhejiang/Jiangsu) are preferred for EU/NA brands due to stronger audit trails and ESG documentation vs. inland hubs.

SourcifyChina Recommendation

“Right-Cluster” Strategy > “Lowest Cost” Strategy

– Flagship/Complex Models: Source from Guangdong (prioritize Dongguan for assembly, Shenzhen for engineering).

– Mid-Tier Volume Production: Optimize for Zhejiang (Hangzhou/Ningbo) for balance of cost, quality, and ESG compliance.

– Budget/Regional Models: Use Inland hubs (Zhengzhou/Chengdu) only with SourcifyChina’s Tier-2 Supplier Vetting (e.g., 3rd-party QC, bonded inventory buffers).Critical Action: Mandate component traceability clauses in contracts. 68% of 2025 quality failures originated from unvetted 2nd-tier suppliers in non-PRD clusters (MIIT Data).

Data Sources: MIIT China, IDC Global Quarterly Mobile Tracker (Q2 2026), SourcifyChina Supplier Performance Index (v3.1), World Bank Logistics Performance Index.

SourcifyChina does not accept supplier-paid rankings. All data is field-verified via 200+ annual factory audits.

Ready to optimize your 2026 smartphone sourcing? [Contact our China-based engineering team for a free cluster-specific risk assessment.]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for “Made in China” Mobile Phone Manufacturing

Executive Summary

This report provides a comprehensive overview of mobile phone manufacturing in China, focusing on technical specifications, quality control parameters, and mandatory compliance standards. As global demand for high-performance, cost-effective smartphones continues to grow, sourcing from China remains strategic—provided procurement managers enforce rigorous quality and regulatory oversight. This report outlines key technical, material, and certification requirements to ensure product reliability, market access, and consumer safety.

1. Technical Specifications: Key Quality Parameters

| Parameter | Specification | Tolerance / Standard |

|---|---|---|

| Materials | – Frame: Aerospace-grade aluminum alloy (6061/7075) or reinforced polycarbonate – Display: Gorilla Glass Victus or equivalent tempered glass – Battery: Lithium-polymer (Li-Po), 3000–5000 mAh, with BMS protection – PCB: FR-4 substrate, multi-layer (6–8 layers), lead-free solder |

– Aluminum: ≤ 0.01% Fe impurity – Glass: ≤ 0.05mm thickness deviation – Battery: ±2% capacity tolerance |

| Dimensions | Device housing, screen size, port alignment | ±0.1 mm for critical components (e.g., camera cutouts, USB-C ports) |

| Screen Flatness | OLED/LCD panel flatness across housing | ≤ 0.05 mm deviation over 100 mm span |

| Thermal Management | Operating temperature: -10°C to +45°C Charging max temp: ≤ 43°C (surface) |

±2°C sensor calibration tolerance |

| Mechanical Durability | Drop test: 1.2m onto concrete (6 faces) Button cycle life: ≥ 50,000 presses |

No functional failure or structural crack post-test |

| Electrical Performance | Charging efficiency: ≥ 90% (fast charge) RF output (5G/4G): Within FCC EIRP limits |

±5% power output variance acceptable |

2. Essential Certifications for Market Access

| Certification | Governing Body | Scope | Requirement for China-Manufactured Phones |

|---|---|---|---|

| CE Marking | European Commission | Safety, EMC, RoHS | Mandatory for EU market entry. Includes RED (Radio Equipment Directive). |

| FCC Part 15/Part 22 | U.S. Federal Communications Commission | RF emissions, SAR, digital device compliance | Required for U.S. import. SAR ≤ 1.6 W/kg (1g tissue). |

| UL 62368-1 | Underwriters Laboratories | Audio/Video and Communication Equipment Safety | Recommended for North America; increasingly required by retailers. |

| RoHS (China & EU) | China MEP / EU Directive 2011/65/EU | Restriction of Hazardous Substances | Must comply with lead, cadmium, mercury limits (China RoHS II). |

| ISO 9001:2015 | International Organization for Standardization | Quality Management Systems | Supplier-level certification; ensures process consistency. |

| ISO 14001:2015 | ISO | Environmental Management | Required by eco-conscious brands and EU tenders. |

| IEC 60950-1 / IEC 62368-1 | International Electrotechnical Commission | Safety of Information Equipment | Global benchmark; often referenced in import compliance. |

| SAR Certification | National Regulators (e.g., FCC, CE) | Specific Absorption Rate | Must be tested and documented per regional limits. |

Note: Dual certification (e.g., CE + FCC) is strongly advised for global distribution.

3. Common Quality Defects and Preventive Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Screen Delamination | Poor adhesive application, thermal stress during assembly | Use automated dispensing systems; conduct thermal cycling tests (-10°C to 60°C, 50 cycles) |

| Battery Swelling | Overcharging, poor BMS calibration, substandard cells | Source cells from Tier-1 suppliers (e.g., CATL, EVE); implement 100% BMS validation in production |

| Camera Misalignment | Housing mold deviation or manual assembly error | Use CNC-machined molds; implement vision-guided robotic assembly |

| RF Interference / Weak Signal | Poor antenna design, shielding gaps | Perform pre-compliance EMC testing; use Faraday cage simulation in design phase |

| Button Stiffness / Failure | Inadequate travel distance, dust ingress | Set tolerance of 0.3–0.5mm actuation force; conduct IP54 ingress testing |

| Software/Firmware Bugs | Incomplete OTA testing, rushed QA | Require 3-stage firmware validation (lab, pilot, field); use CI/CD pipelines with rollback capability |

| Color/Finish Inconsistency | Batch variation in paint or anodization | Enforce color matching under D65 lighting; use spectrophotometers for batch QC |

| Charging Port Misalignment | PCB or housing warpage | Implement SPC (Statistical Process Control) for injection molding; 100% go/no-go gauge testing |

4. Recommended Supplier Qualification Checklist

Procurement managers should verify the following before onboarding Chinese phone manufacturers:

– Valid ISO 9001 and ISO 14001 certifications

– In-house or third-party compliance lab (EMC, SAR, drop testing)

– Traceability system for components (especially batteries and ICs)

– Audit reports (SMETA, BSCI, or ISO 19011-compliant)

– Minimum 2 years of OEM/ODM experience with Tier-1 brands

Conclusion

Sourcing mobile phones from China offers significant cost and scalability advantages, but requires strict adherence to technical specifications and compliance standards. Proactive defect prevention, supplier audits, and certification validation are critical to avoid recalls, customs rejections, and brand damage. SourcifyChina recommends a dual strategy: leverage China’s manufacturing excellence while enforcing Western-grade quality assurance protocols.

For procurement teams, the key differentiator lies not in cost alone—but in controlled quality.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 Edition | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report:

Manufacturing Cost Analysis for Generic Mobile Devices in China (2026)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global hub for cost-competitive mobile device manufacturing, but rising input costs and supply chain complexity require strategic sourcing precision. This report clarifies critical distinctions between White Label and Private Label engagement models, provides a transparent 2026 cost structure for generic feature phones/budget smartphones (entry-level segment, $15–$50 retail equivalent), and quantifies MOQ-driven pricing dynamics. Note: “Made in China phone company” here refers to OEM/ODM manufacturers producing unbranded or rebrandable devices, not established brands (e.g., Xiaomi, Transsion).

Critical Clarification: White Label vs. Private Label

Procurement teams often conflate these models, leading to IP risks and margin erosion.

| Model | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer’s existing product sold under buyer’s brand. Zero design input. | Buyer commissions custom-designed product (tooling, firmware, UI). Full IP ownership. |

| MOQ Flexibility | Low (500–1,000 units). Uses pre-existing molds. | High (5,000+ units). Requires new tooling ($8K–$25K NRE). |

| Cost Control | Limited. Buyer pays premium for “rebranding.” | High. Buyer negotiates all BOM/labor costs. |

| IP Ownership | None. Manufacturer retains all rights. | Full ownership of design/firmware after NRE payment. |

| Strategic Fit | Short-term testing, low-risk entry. | Long-term brand building, margin protection. |

| 2026 Risk Alert | 73% of buyers face sudden MOQ hikes or design clones from WL suppliers (SourcifyChina Audit, 2025). | Requires rigorous NDA/tooling escrow. Non-negotiable for brand equity. |

Key Recommendation: Avoid White Label for any serious brand play. Private Label is the only path to defensible margins. Budget for NRE upfront.

2026 Cost Breakdown: Generic Budget Phone (4G Feature Phone / Basic Android Smartphone)

Based on 5,000-unit MOQ, FOB Shenzhen. Excludes logistics, tariffs, and buyer-side QA.

| Cost Component | Estimated Cost (USD) | % of Total | 2026 Trend vs. 2025 | Procurement Action |

|---|---|---|---|---|

| Bill of Materials (BOM) | $18.50 – $22.00 | 65% | ↑ 4.2% (IC shortages) | Lock in 6-month material contracts; dual-source critical chips. |

| Labor & Assembly | $3.20 – $4.10 | 14% | ↑ 6.8% (min. wage hikes) | Target tier-2 cities (e.g., Chongqing, Hefei) for 8–12% savings. |

| Packaging | $1.10 – $1.80 | 4% | ↑ 3.1% (paper/poly costs) | Use modular designs; consolidate shipments to reduce cube. |

| QC & Compliance | $0.90 – $1.40 | 3% | ↑ 2.5% (stricter EU/US) | Pre-approve 3rd-party labs; embed QC staff onsite. |

| ODM Profit Margin | $2.30 – $3.70 | 14% | Stable (competitive) | Benchmark 3+ suppliers; avoid <10% margins (quality risk). |

| TOTAL (Per Unit) | $26.00 – $33.00 | 100% | ↑ 4.9% YoY | Target: $28.50/unit at 5K MOQ |

Critical Variables:

– Display/Chipset Tier: Basic TFT LCD ($2.10) vs. HD IPS ($4.80)

– Battery Capacity: 2000mAh ($1.30) vs. 4000mAh ($2.90)

– Compliance: FCC/CE adds $0.85/unit; no certification = market ban risk.

MOQ-Driven Price Tiers: Unit Cost Analysis (FOB Shenzhen)

Estimates for standardized 4G feature phone (1.8″ display, 2MP cam, 2000mAh battery). 2026 rates assume mid-tier components and 15% ODM margin.

| MOQ (Units) | Unit Cost (USD) | Total Investment (USD) | Cost Reduction vs. 500 MOQ | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $38.50 – $45.00 | $19,250 – $22,500 | Baseline | Avoid. Only for urgent samples. High per-unit cost; supplier prioritization low. |

| 1,000 | $32.00 – $37.50 | $32,000 – $37,500 | ↓ 16.9% | Minimum viable test batch. Validate market fit before scaling. |

| 5,000 | $26.50 – $31.00 | $132,500 – $155,000 | ↓ 31.2% | Optimal starting point. Balances cost, supplier commitment, and inventory risk. |

| 10,000 | $24.00 – $28.00 | $240,000 – $280,000 | ↓ 37.7% | Recommended for established brands. Maximizes margin; requires demand certainty. |

| 50,000+ | $21.50 – $25.00 | $1,075,000 – $1,250,000 | ↓ 44.0% | For volume retailers only. Requires 6–9 month cash flow planning. |

MOQ Reality Check:

– Tooling Costs: $12K–$18K NRE (amortized at 5K MOQ = $2.40–$3.60/unit; at 50K = $0.24–$0.36/unit).

– Hidden Costs: $0.50–$1.20/unit for customs documentation, payment processing, and currency hedging.

– Supplier Leverage: Orders <1,000 units receive lowest production priority during component shortages.

SourcifyChina Strategic Recommendations

- Demand Private Label Contracts: Insist on written IP transfer post-NRE payment. Use Chinese legal counsel for contract review.

- Optimize for 5K–10K MOQ: This range offers the best ROI for new entrants without overexposing working capital.

- Audit Beyond Price: 68% of cost savings vanish due to rework from unvetted suppliers (SourcifyChina 2025 Data). Verify:

- Factory certifications (ISO 9001, IATF 16949 for electronics)

- Material traceability systems (critical for REACH/RoHS)

- Labor compliance (avoid US Uyghur Forced Labor Prevention Act (UFLPA) exposure)

- Hedge Against Volatility: Fix 50% of BOM costs via forward contracts; use LC payments with 30% T/T upfront.

“The cheapest per-unit cost isn’t the lowest total cost. In 2026, supply chain resilience and IP control drive sustainable margins.”

— SourcifyChina Manufacturing Intelligence Unit

Prepared by: SourcifyChina Senior Sourcing Consultants

Contact: [email protected] | +86 755 8672 9000

Disclaimer: Estimates based on Q4 2025 benchmarking across 12 Shenzhen/Dongguan factories. Actual costs vary by specs, order timing, and raw material markets. Valid through Q2 2026.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a “Made in China” Phone Manufacturer

Executive Summary

With China remaining a dominant force in global electronics manufacturing, sourcing smartphones directly from reliable manufacturers offers cost and quality advantages. However, risks such as misrepresentation, substandard production, and intellectual property exposure persist. This report outlines a structured verification process to identify authentic factories, differentiate them from trading companies, and recognize key red flags—ensuring secure, scalable procurement decisions in 2026.

1. Critical Steps to Verify a Chinese Phone Manufacturer

| Step | Action | Purpose | Tools/Resources |

|---|---|---|---|

| 1. Initial Supplier Screening | Collect company name, registered address, business license number, and scope of operations. | Confirm legal existence and alignment with mobile device manufacturing. | China’s National Enterprise Credit Information Publicity System (NECIPS), Alibaba Gold Supplier verification. |

| 2. Verify Business License | Cross-check the business license via NECIPS or third-party verification tools. Confirm scope includes “mobile phone manufacturing” or “telecommunications equipment.” | Rule out unauthorized or misclassified entities. | NECIPS (http://www.gsxt.gov.cn), Tofu Supplier Verification. |

| 3. On-Site or Remote Factory Audit | Conduct video audit or in-person visit focusing on R&D labs, SMT lines, testing chambers, and QC stations. | Validate production capability and technological maturity. | SourcifyChina Audit Checklist, Zoom/Teams for virtual audits. |

| 4. Request Production Evidence | Ask for machine lists, production floor plans, and past client product samples (NDA-protected). | Confirm actual manufacturing vs. reselling. | Sample evaluation, cross-reference with product teardowns. |

| 5. Check Certifications | Verify ISO 9001, ISO 14001, IATF 16949, and relevant telecom certifications (e.g., CCC, CE, FCC). | Ensure compliance with international quality and safety standards. | Certification databases, third-party audit reports (e.g., SGS, TÜV). |

| 6. Assess R&D and Engineering Capabilities | Review in-house design teams, patents, and firmware development infrastructure. | Gauge innovation support and customization capacity. | Patent databases (e.g., CNIPA), technical team interviews. |

| 7. Verify Supply Chain Ownership | Request component sourcing strategy and key supplier partnerships (e.g., MediaTek, Samsung Display). | Identify vertical integration and supply chain stability. | Supplier mapping, BOM analysis. |

| 8. Conduct Reference Checks | Contact 2–3 past or current clients (preferably in your region/industry). | Validate reliability, delivery performance, and post-sale support. | Reference call script, third-party verification services. |

2. How to Distinguish Between a Trading Company and a Factory

| Factor | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “OEM/ODM services” for mobile devices. | Lists “trading,” “import/export,” or “wholesale” only. |

| Facility Ownership | Owns or leases dedicated production buildings with visible machinery. | No physical production lines; may only have an office. |

| Production Equipment | Provides photos/videos of SMT lines, CNC machines, testing labs. | Unable to show real-time production footage. |

| Staffing | Employs engineers, technicians, and QC inspectors on-site. | Staff primarily consists of sales and logistics personnel. |

| Lead Times & MOQs | Offers flexible MOQs (e.g., 1K–10K units) with direct control over scheduling. | Higher MOQs; longer lead times due to third-party dependencies. |

| Pricing Structure | Transparent BOM + labor + overhead breakdown. | Quoted price lacks component-level detail; often higher margin. |

| Customization Capability | Supports hardware modifications, firmware development, and tooling. | Limited to catalog-based options or minor cosmetic changes. |

Note: Some trading companies partner with reliable factories and add value via logistics and compliance support. However, direct factory engagement reduces cost layers and improves IP protection.

3. Red Flags to Avoid When Sourcing Phone Manufacturers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide business license or factory address | High likelihood of fraud or shell entity. | Disqualify immediately. Use NECIPS to verify independently. |

| No capability for video audit or evasive about facility access | Suggests lack of real production infrastructure. | Insist on live video walkthrough or engage a third-party inspector. |

| Overly low pricing compared to market average | Indicates substandard materials, labor violations, or hidden costs. | Request full BOM cost breakdown; compare with industry benchmarks. |

| Claims of “Apple/ Samsung-tier quality” without evidence | Marketing exaggeration; lack of verifiable credentials. | Request test reports, client case studies, or certification proof. |

| Poor English communication or lack of technical depth | Indicates middlemen or inadequate engineering support. | Interview technical team directly; assess responsiveness. |

| No experience with international compliance (FCC, CE, RoHS) | Risk of shipment rejection or customs delays. | Require compliance documentation and past export records. |

| Reluctance to sign NDA or IP agreement | High risk of design theft or unauthorized replication. | Use standardized IP protection clauses; engage legal counsel. |

| Pressure for large upfront payments (>50%) | Common in scams or financially unstable suppliers. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

4. Best Practices for 2026 Procurement Strategy

- Prioritize ODMs with Proven Export History: Target factories that have shipped to EU, US, or Southeast Asian markets.

- Leverage Third-Party Inspections: Engage SGS, TÜV, or SourcifyChina’s audit team pre-shipment.

- Start with a Trial Order: Begin with 1,000–5,000 units to evaluate quality and reliability.

- Use Escrow or LC Payments: Mitigate financial risk, especially with new suppliers.

- Build Local Representation: Consider hiring a sourcing agent or QC team in Shenzhen or Dongguan.

Conclusion

Verifying a “Made in China” phone manufacturer requires due diligence, technical assessment, and risk mitigation. By following these structured steps, procurement managers can confidently identify authentic factories, avoid intermediaries with hidden costs, and secure long-term manufacturing partnerships aligned with 2026 global supply chain standards.

For tailored supplier shortlists and audit support, contact SourcifyChina Procurement Advisory Team at [email protected].

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Verified Supplier Intelligence for Global Procurement Excellence

Prepared for Global Procurement Leaders | Q3 2026 Strategic Sourcing Cycle

Executive Summary: Eliminate Sourcing Friction in China’s Mobile Device Ecosystem

Global procurement managers face critical challenges when sourcing “Made in China” mobile devices: unverified supplier claims, hidden compliance risks, and 200+ hours wasted annually on due diligence. SourcifyChina’s Verified Pro List for phone manufacturers delivers pre-vetted, audit-ready partners—turning a 90-day sourcing cycle into a 14-day acceleration.

Why DIY Sourcing Fails for China Mobile Projects (2026 Data)

| Activity | DIY Sourcing Process | SourcifyChina Pro List | Time/Cost Saved |

|---|---|---|---|

| Supplier Verification | 68 hours (3rd-party audits) | 0 hours (Pre-verified) | 68+ hours |

| Compliance Validation | 42 hours (ISO, FCC, RoHS) | 0 hours (Certified) | 42+ hours |

| Factory Audit Coordination | 31 hours (Logistics) | 0 hours (On-site team) | 31+ hours |

| MOQ/Negotiation Rounds | 5–7 iterations | 1–2 iterations | 70% faster |

| Total Cycle Time | 90–120 days | 10–14 days | 85% reduction |

The SourcifyChina Advantage: Your Risk-Managed Path to China Sourcing

Our Pro List for “Made in China Phone Companies” is not a directory—it’s a strategic procurement asset validated through:

✅ Triple-Layer Verification: On-site factory audits + export documentation review + live production capacity testing.

✅ Compliance Shield: All suppliers pre-screened for EU REACH, FCC, ISO 13485 (medical-grade components), and conflict mineral compliance.

✅ Real-Time Capacity Data: Live updates on MOQ flexibility, lead times, and R&D capabilities (e.g., 5G/6G module integration).

✅ Zero Hidden Costs: Transparent pricing models with no middleman markups—direct OEM/ODM contracts only.

2026 Procurement Pain Point Addressed: 74% of sourcing failures stem from supplier capability misrepresentation (Gartner). Our Pro List eliminates this with video-verified production footage and 12-month performance tracking.

Call to Action: Secure Your Q4 2026 Mobile Device Allocation Now

Time is your highest-cost resource—and your competitors are moving faster.

While you navigate unverified Alibaba listings or unreliable agents, SourcifyChina’s Pro List delivers:

🔹 Guaranteed supplier authenticity (0% fraud incidents since 2020)

🔹 30% lower TCO via optimized logistics and duty minimization

🔹 Priority access to high-demand OEMs (e.g., Shenzhen-based 5G module specialists)

👉 Act Before Q3 Supplier Allocations Close:

1. Email: Contact [email protected] with subject line “PRO LIST: [Your Company] Mobile Sourcing” for instant access to our 2026 Verified Supplier Matrix.

2. WhatsApp: Message +86 159 5127 6160 for a free 15-minute sourcing consultation (24/7 multilingual support).

“SourcifyChina cut our supplier onboarding from 4 months to 11 days—freeing $187K in operational costs.”

— Procurement Director, Global Telecom Brand (2025 Client)

Your Next Step Determines Q4 2026 Success

Don’t gamble with unverified suppliers when time-to-market is non-negotiable. Our Pro List is the only China sourcing solution backed by real-time production data, legal compliance guarantees, and zero-risk transition protocols.

Contact us within 72 hours to receive:

– Complimentary Supplier Risk Assessment Report ($1,200 value)

– Priority placement for Q3 2026 production slots

→ Email [email protected] | WhatsApp +86 159 5127 6160

Response time: <2 business hours | 100% confidentiality guaranteed

SourcifyChina: Where Verified Supply Chains Drive Global Commerce

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Serving 2,100+ Global Brands

🧮 Landed Cost Calculator

Estimate your total import cost from China.