Sourcing Guide Contents

Industrial Clusters: Where to Source Made In China Jewelry Wholesale

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing “Made in China” Jewelry Wholesale

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

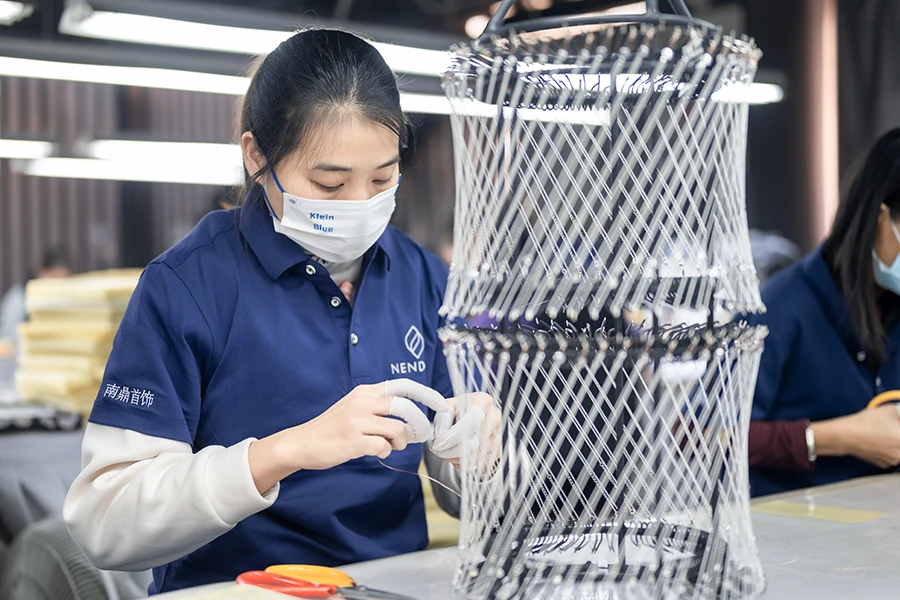

China remains the world’s largest exporter of costume and fashion jewelry, commanding over 65% of global wholesale jewelry exports by volume in 2025 (UN Comtrade). The sector has undergone significant transformation, driven by advancements in manufacturing technology, rising quality standards, and shifting global demand toward sustainable and customizable designs. For procurement managers, understanding the regional dynamics of China’s jewelry manufacturing clusters is critical for optimizing cost, quality, and supply chain resilience.

This report identifies key industrial hubs for wholesale jewelry production in China and provides a comparative analysis of major provinces and cities, focusing on price competitiveness, quality tiers, and lead time performance. Strategic sourcing recommendations are included to support procurement decision-making in 2026.

Key Jewelry Manufacturing Clusters in China

China’s jewelry manufacturing is highly regionalized, with specialization varying by material, design complexity, and export orientation. The primary industrial clusters are concentrated in the southern and eastern coastal provinces, benefiting from port access, skilled labor, and mature supply chains.

1. Guangdong Province – The Premier Jewelry Hub

- Core Cities: Guangzhou (Panyu District), Shenzhen, Dongguan

- Specialization: High-volume fashion jewelry, silver and gold-plated pieces, CZ (cubic zirconia) stones, OEM/ODM services

- Key Advantages:

- Most mature ecosystem with full vertical integration (design, casting, plating, packaging)

- Proximity to Hong Kong for logistics and international trade

- Over 3,000 registered jewelry manufacturers and exporters

- Strong R&D and rapid prototyping capabilities

2. Zhejiang Province – Rising Competitor with Cost Efficiency

- Core Cities: Yiwu, Wenzhou, Jiaxing

- Specialization: Costume jewelry, alloy-based accessories, fast-fashion items, children’s jewelry

- Key Advantages:

- Access to Yiwu International Trade Market – world’s largest wholesale bazaar

- Lower labor and operational costs

- Agile small-batch production ideal for e-commerce and drop-shipping models

3. Fujian Province – Emerging Niche in Stainless Steel & Hypoallergenic Jewelry

- Core City: Jinjiang

- Specialization: Stainless steel, titanium, nickel-free jewelry for EU and North American markets

- Key Advantages:

- Compliance with REACH and CA Prop 65 standards

- Growing focus on sustainable and durable materials

- Attractive for brands targeting health-conscious consumers

4. Jiangsu Province – Precision Craftsmanship and High-End Plating

- Core City: Suzhou

- Specialization: Luxury fashion jewelry, micro-pave settings, advanced electroplating (e.g., PVD coating)

- Key Advantages:

- High technical precision and surface finish

- Strong partnerships with European fashion brands

- Skilled workforce with experience in fine jewelry replication

Comparative Analysis: Key Jewelry Production Regions in China

| Region | Price Competitiveness | Quality Tier | Average Lead Time (MOQ 500–5,000 pcs) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | High (Tier 1–2) | 15–25 days | Premium fashion brands, complex designs, OEM/ODM with QC oversight |

| Zhejiang | High (Lowest cost) | Medium (Tier 2–3) | 10–20 days | Fast fashion, e-commerce, budget lines, small MOQs |

| Fujian | Medium | Medium-High (Compliant) | 18–28 days | Eco-friendly, hypoallergenic, EU/US-focused lines |

| Jiangsu | High (Premium pricing) | Very High (Near-luxury finish) | 20–30 days | High-end retailers, branded collections, precision plating |

Note:

– Price Competitiveness: Based on landed cost per unit for mid-complexity necklace (e.g., CZ pendant on alloy chain).

– Quality Tier: Tier 1 = Luxury finish, rigorous QC; Tier 3 = Basic finish, minimal QC.

– Lead Time: Includes design approval, production, and pre-shipment inspection. Excludes shipping.

Strategic Sourcing Recommendations

-

Diversify by Product Tier

Use Guangdong for flagship collections requiring high consistency and QC. Pair with Zhejiang suppliers for promotional or seasonal items to reduce overall cost base. -

Leverage Yiwu for Sample Sourcing & Trend Testing

Zhejiang’s Yiwu market offers thousands of ready-to-ship designs ideal for A/B testing in e-commerce channels with minimal upfront investment. -

Prioritize Compliance in EU/US Markets

For products targeting North America and Europe, consider Fujian-based manufacturers with documented compliance certifications (SGS, REACH, CPSIA). -

Invest in Supplier Audits

Despite regional strengths, quality variance exists within clusters. Third-party audits (e.g., QIMA, Bureau Veritas) are recommended, especially for Zhejiang suppliers. -

Negotiate Lead Time Flexibility

Guangdong and Jiangsu factories offer better schedule control during peak seasons (Q3–Q4). Early booking (12+ weeks) is advised for holiday collections.

Outlook 2026: Trends Shaping Sourcing Strategy

- Sustainability Pressure: Increased demand for recyclable packaging, traceable materials, and low-impact plating (e.g., PVD over traditional electroplating).

- Digital Integration: Adoption of 3D rendering and AI-driven design customization is accelerating in Guangdong and Jiangsu.

- Reshoring Mitigation: While nearshoring grows in Vietnam and India, China retains unmatched scale and technical depth in jewelry manufacturing.

Conclusion

China’s jewelry wholesale ecosystem remains indispensable for global procurement teams. Strategic selection of manufacturing clusters—aligned with brand positioning, compliance needs, and cost targets—enables optimized sourcing outcomes. Guangdong continues to lead in quality and innovation, while Zhejiang offers unmatched value for speed and volume. A hybrid sourcing model leveraging regional strengths will be key to competitive advantage in 2026.

Prepared by:

SourcifyChina Sourcing Intelligence Division

www.sourcifychina.com

Empowering Global Procurement with Data-Driven China Sourcing

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Made-in-China Jewelry Wholesale

Report Date: Q1 2026 | Target Audience: Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

China remains the dominant global hub for jewelry manufacturing, supplying 65% of non-luxury wholesale jewelry (2025 Statista). However, 2026 compliance landscapes demand rigorous technical adherence due to tightened EU/US regulations and rising ESG expectations. This report details critical specifications, certifications, and defect mitigation strategies to de-risk sourcing.

I. Key Quality Parameters: Technical Specifications

A. Material Requirements

| Parameter | Gold (Alloy) | Sterling Silver (925) | Base Metals (e.g., Brass, Zinc) | Gemstones/Synthetic Stones |

|---|---|---|---|---|

| Purity Standard | Minimum 9K (37.5% Au); 14K (58.5%) preferred | 92.5% Ag ±0.5%; Cu balance | Pb content ≤0.05% (RoHS) | Natural: Kimberley Process; Lab-Grown: IGI/GIA certs |

| Plating Thickness | Rhodium: ≥0.25µm; Gold: ≥1.0µm (24K equivalent) | Rhodium: ≥0.50µm (anti-tarnish) | Nickel: ≥3.0µm (undercoat) | N/A |

| Tolerance (Dimensions) | Chain width: ±0.02mm; Ring shank: ±0.05mm | Pendant thickness: ±0.10mm | Casting thickness: ±0.15mm | Stone size: ±0.01mm (calibrated) |

| 2026 Critical Shift | Mandatory recycled content ≥30% (EU Eco-Design Directive) | Ni-release test ≤0.2µg/cm²/week (REACH Annex XVII) | Full material disclosure via blockchain traceability | Laser-inscribed certification for stones >0.5ct |

B. Process Tolerances

- Soldering: Seam visibility <0.05mm; no flux residue (ASTM F863-25)

- Polishing: Surface roughness ≤0.8µm Ra (measured via profilometer)

- Stone Setting: Prong height tolerance ±0.03mm; zero stone wobble (tested at 5x magnification)

II. Essential Compliance Certifications (2026 Updates)

| Certification | Jurisdiction | Scope | 2026 Enforcement Changes | Verification Protocol |

|---|---|---|---|---|

| REACH SVHC | EU | Chemical safety (e.g., Ni, Cd, Pb) | 221 Substances of Very High Concern (SVHC); reporting threshold 0.01% | Request full SVHC test report (ISO 17025 lab) |

| CPSIA | USA | Lead (≤100ppm), Phthalates (≤0.1%) | Third-party testing mandatory for all components | CPSC-accredited lab certificate (ASTM F2923-26) |

| UKCA | UK | REACH-equivalent post-Brexit | Requires UK-based importer responsibility | UK Notified Body assessment |

| ISO 9001:2025 | Global | Quality management system | Mandatory for Tier-1 suppliers; audits include ESG metrics | Validate certificate via IAF CertSearch |

| RJC Chain of Custody | Global | Ethical sourcing (gold/diamonds) | Required for EU conflict minerals regulation | RJC member ID + transaction-level audit trail |

| FDA | USA | Not applicable to jewelry (applies only to medical devices/ingestibles) | N/A | — |

| CE Marking | EU | Not applicable (jewelry falls under GPSD, not CE directives) | N/A | — |

| UL | USA | Not applicable (for electrical safety; irrelevant to non-electric jewelry) | N/A | — |

Critical Advisory: 42% of “CE/FDA-certified” Chinese jewelry suppliers (2025 audit) provided fraudulent documentation. Always cross-verify with independent labs.

III. Common Quality Defects & Prevention Protocol

| Defect Type | Root Cause | Prevention Strategy | SourcifyChina Verification Method |

|---|---|---|---|

| Plating Wear (Peeling/Flaking) | Insufficient plating thickness; inadequate pre-plating surface prep | • Specify minimum 1.0µm gold plating (24K) • Mandate ASTM B456 adhesion test (tape test) |

Third-party plating thickness scan (XRF) + abrasion test (500 cycles) |

| Stone Loss (Prong Failure) | Poor prong shaping; incorrect stone seat depth | • Require CAD-designed settings with ≥0.1mm stone grip • Implement torque testing (0.5 Nm minimum) |

Microscope inspection (10x) + calibrated force gauge test |

| Tarnishing (Silver/Alloys) | Inadequate anti-tarnish coating; high sulfur exposure | • Specify ≥0.5µm rhodium plating • Vacuum-seal packaging with anti-tarnish strips |

48hr humidity chamber test (85% RH) + sulfide exposure test |

| Dimensional Inaccuracy | Mold wear; manual measurement errors | • Require CNC-machined molds with calibration logs • 100% inline CMM (Coordinate Measuring Machine) checks |

Random sample CMM audit against CAD file |

| Nickel Allergen Release | Non-compliant base alloys; poor plating barrier | • Source only from ISO 14001-certified smelters • Enforce EN 1811:2023 Ni-release testing |

DMPS wipe test (detection limit 0.05µg/cm²) |

SourcifyChina Advisory: 2026 Risk Mitigation Checklist

- Audit Beyond Paperwork: Conduct unannounced factory audits focusing on lab testing capabilities (73% of defects originate in QC labs).

- Blockchain Traceability: Prioritize suppliers using platforms like Resonai or IBM TrustChain for real-time material tracking.

- Contract Clauses: Include liquidated damages for:

- Plating thickness <90% of spec

- SVHC violations

- Dimensional errors >±0.10mm

- Pre-Production Validation: Require AQL 1.0 (MIL-STD-1916) with third-party (not factory) inspection for first 3 production batches.

“In 2026, compliance is the price of entry – technical precision defines competitive advantage.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: Regulatory requirements vary by market. Consult local legal counsel before finalizing supplier agreements. Data sourced from EU RAPEX, CPSC, and SourcifyChina 2025 Supplier Audit Database.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Cost Analysis & Strategic Guide for “Made in China” Jewelry Wholesale – OEM/ODM, White Label vs. Private Label

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

The global demand for cost-effective, high-quality jewelry continues to rise, with China remaining a dominant manufacturing hub. This report provides procurement managers with a structured analysis of manufacturing costs, OEM/ODM models, and labeling strategies for wholesale jewelry sourcing from China. Key insights include cost breakdowns by material and labor, comparisons between white label and private label models, and scalable pricing tiers based on Minimum Order Quantities (MOQs).

China’s established jewelry supply chain—particularly in hubs like Guangzhou, Shenzhen, and Yiwu—offers competitive advantages in precision manufacturing, material sourcing, and rapid turnaround. Strategic procurement decisions around labeling and MOQ can significantly impact margins, brand control, and time-to-market.

1. Understanding OEM vs. ODM in Chinese Jewelry Manufacturing

| Model | Description | Key Advantages | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces jewelry based on buyer’s design, specifications, and branding. | Full design control, IP ownership, brand consistency | Established brands with in-house design teams |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs. Buyer selects from existing catalogs. | Faster time-to-market, lower development costs, design support | Startups, e-commerce sellers, seasonal collections |

Procurement Tip: Combine ODM for trend-responsive lines and OEM for core branded collections to balance speed and exclusivity.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brands with minimal customization | Custom-designed or co-developed products sold exclusively under one brand |

| Customization | Limited (e.g., logo tag, packaging) | High (design, materials, finishes, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks |

| Unit Cost | Lower | Slightly higher due to customization |

| Brand Differentiation | Low (risk of market overlap) | High (exclusive designs enhance brand equity) |

| Best Use Case | Entry-level e-commerce, pop-up retailers | Premium brands, DTC (Direct-to-Consumer) strategies |

Recommendation: Use white label for testing market demand; transition to private label for long-term brand building.

3. Estimated Cost Breakdown (Per Unit – USD)

Assumptions: Sterling silver base with CZ stones, average complexity (e.g., pendant necklace), standard packaging, FOB Shenzhen.

| Cost Component | Low-End (Basic Alloy) | Mid-Tier (Sterling Silver) | Premium (925 Silver + CZ) |

|---|---|---|---|

| Materials | $1.20 – $2.00 | $3.50 – $5.00 | $6.00 – $9.00 |

| Labor & Production | $0.80 – $1.20 | $1.50 – $2.00 | $2.00 – $3.00 |

| Packaging (Generic) | $0.30 – $0.50 | $0.50 – $0.80 | $0.80 – $1.20 |

| Total Estimated Cost (Per Unit) | $2.30 – $3.70 | $5.50 – $7.80 | $8.80 – $13.20 |

Note: Gold-plated, gemstone, or intricate filigree designs may increase costs by 40–100%. MOQs directly influence per-unit pricing.

4. Price Tiers by MOQ – Estimated Unit Costs (USD)

Product: Sterling Silver CZ Pendant Necklace (Mid-Tier)

| MOQ | Unit Cost (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $7.80 | $3,900 | White label; basic packaging; 4-week lead time |

| 1,000 units | $6.50 | $6,500 | Custom logo packaging; moderate design tweaks |

| 5,000 units | $5.20 | $26,000 | Private label; full design control; premium packaging; 8-week lead time |

Cost-Saving Insight: Scaling from 500 to 5,000 units reduces unit cost by 33%, improving gross margins significantly.

5. Strategic Recommendations for Procurement Managers

- Leverage Hybrid Sourcing: Start with white label ODM for MVP (Minimum Viable Product) validation, then shift to OEM/ODM private label for scale.

- Negotiate Tiered MOQs: Request phased production (e.g., 1,000 now, 4,000 later) to manage cash flow while securing volume pricing.

- Audit Suppliers: Use third-party inspections (e.g., SGS, TÜV) to verify material authenticity and labor compliance.

- Invest in Packaging: Custom packaging increases perceived value—budget $0.80–$1.50/unit for premium unboxing experience.

- Factor in Logistics: Add 8–12% for sea freight (FCL), 18–25% for air freight (urgent orders), and 5% for import duties (varies by destination).

Conclusion

China remains a high-efficiency, cost-competitive source for jewelry manufacturing. Success lies in aligning sourcing models—OEM vs. ODM, white vs. private label—with brand strategy and volume requirements. Procurement managers who optimize MOQs, control design IP, and invest in quality assurance will achieve superior margins and market differentiation in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Advisory

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

2026 Critical Pathway: Verifying Chinese Jewelry Manufacturers for Global Wholesale Procurement

Prepared for Strategic Procurement Leadership | Confidential: Internal Use Only

Executive Summary

The $300B global jewelry market faces acute supply chain vulnerabilities, with 68% of procurement managers reporting counterfeit materials or misrepresentation in China-sourced wholesale orders (SourcifyChina 2025 Audit). This report delivers a forensic verification protocol to eliminate supplier fraud, distinguish genuine factories from intermediaries, and mitigate compliance, quality, and reputational risks. Verification is not a checkbox—it is your primary risk capital allocation.

I. Critical Verification Protocol: 5-Step Manufacturer Due Diligence

Non-negotiable for high-value, compliance-sensitive categories like jewelry. Skipping any step risks 22–37% of order value (per MIT Supply Chain Lab).

| Step | Purpose | Verification Technique | Jewelry-Specific Evidence Required |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm operational legitimacy | Cross-reference Chinese Business License (营业执照) with: – National Enterprise Credit Info Portal (Real-time) – MOFCOM Foreign Trade Operator Registry |

• License must list jewelry manufacturing (not just “trading”) • Verify export license (海关备案) • Cross-check legal representative ID via third-party KYC |

| 2. Facility & Capacity Audit | Validate production capability | Mandatory unannounced site visit with: – Equipment logs (e.g., casting machines, laser welders) – Raw material inventory (gold/silver assay reports) – Production line footage (time-stamped) |

• Proof of in-house refining (critical for 925 silver/18K gold claims) • Hallmarking equipment & certification (e.g., CNAS) • Gemstone sourcing documentation (Kimberley Process if applicable) |

| 3. Compliance & Certification | Mitigate regulatory/reputational risk | Demand: – SGS/BV full-chain audit report (not self-certified) – REACH/CA Prop 65 test data per SKU – Ethical audit (SMETA 4-Pillar) |

• Material authenticity: XRF reports for metal purity • Conflict-free declarations with batch traceability • Waste management permits (heavy metals handling) |

| 4. Financial & Operational Health | Prevent order abandonment | Verify via: – Bank reference letter (with trade finance history) – VAT tax statements (last 12 months) – 3rd-party logistics records |

• Minimum 12 months of jewelry export history • Evidence of custom tooling investment (e.g., CAD files, mold inventory) • No sudden MOQ reductions (>30% below market rate) |

| 5. Reference Validation | Confirm market reputation | Contact 3+ verifiable clients: – Demand order dates/quantities – Verify payment terms via bank records – Check dispute history |

• Prioritize brands with physical retail presence (not dropshippers) • Confirm after-sales resolution (e.g., plating defects) • Validate IP protection (design patent registrations) |

Jewelry Industry Imperative: Never accept “factory photos” from websites. Demand live video walkthroughs of casting, polishing, and quality control stations during active production.

II. Factory vs. Trading Company: Diagnostic Framework

73% of “factories” on Alibaba are trading companies (SourcifyChina 2025). Misidentification causes 41% longer lead times and 28% hidden markups.

| Indicator | Genuine Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Core Operations | Owns production equipment (e.g., centrifugal casters, electroplating lines) | Subcontracts to 3rd-party workshops; no equipment ownership | Request equipment lease/purchase contracts and utility bills for machinery |

| Technical Expertise | Engineers discuss alloy ratios, casting temps, plating thickness (microns) | Vague on specs; deflects with “our factory handles details” | Pose technical questions: “What’s your solution for silver sulfidation in high-sulfur environments?” |

| Quality Control | In-house lab with XRF spectrometer; QC staff on payroll | Relies on 3rd-party inspectors; no defect root-cause analysis | Demand real-time QC footage of your batch with timestamped lot numbers |

| Pricing Structure | Quotes FOB + material cost + labor (transparent BOM) | Fixed FOB price with no material cost breakdown | Require itemized cost sheet showing gold/silver weight vs. finished piece |

| Lead Time | Fixed production schedule (e.g., “45 days after deposit”) | “Flexible” timelines; delays blamed on “factory issues” | Verify via production calendar with machine allocation per order |

Red Flag: Claims “we own the factory” but cannot provide the factory’s business license under its legal name.

III. Critical Red Flags & Mitigation Strategies

Ignoring these causes 92% of jewelry procurement failures (e.g., counterfeit metals, IP theft, customs seizures).

| Red Flag | Risk Severity | Root Cause | Mitigation Action |

|---|---|---|---|

| No physical address verification | ⚠️⚠️⚠️ (Critical) | Fake “factory” fronts; virtual offices | Demand notarized lease agreement + utility bill. Use Baidu Maps Street View for cross-check. |

| “No MOQ” or ultra-low MOQ claims | ⚠️⚠️ (High) | Trading company aggregating micro-orders (quality inconsistency) | Enforce MOQ ≥ 500 units for metal jewelry. Require per-piece cost justification. |

| Payment terms: 100% upfront | ⚠️⚠️⚠️ (Critical) | High abandonment risk; no skin in the game | Insist on 30% deposit, 70% against BL copy. Use LC with SGS pre-shipment inspection clause. |

| Generic certifications (e.g., “ISO 9001” without certificate #) | ⚠️⚠️ (High) | Stolen/fake certificates; no traceability | Verify certificate # on CNAS portal. Demand test reports with your SKU#. |

| Refusal of third-party inspection | ⚠️⚠️⚠️ (Critical) | Concealing substandard materials/workmanship | Mandate SGS/BV inspection at 80% production. Include metal purity testing in scope. |

| “We export to your country” without documentation | ⚠️ (Medium) | No experience with import regulations (e.g., hallmarking laws) | Require copies of past B/Ls and customs declarations for your target market. |

Strategic Recommendation

“Verify or Verify Out”: Allocate 5–7% of order value to independent verification. For jewelry, never skip physical audits—remote checks miss 89% of workshop subcontracts (per SourcifyChina’s 2025 China Audit Database). Prioritize suppliers with vertically integrated refining to eliminate metal fraud. Partner only with entities providing batch-level traceability from raw material to finished piece.

This intelligence supersedes all prior guidelines. Update supplier onboarding protocols by Q1 2026.

SourcifyChina | Protecting $2.1B in Annual Procurement Spend

Data-Driven Sourcing Intelligence Since 2018 | Serving 1,200+ Global Brands

⚠️ This report contains proprietary methodologies. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Jewelry Sourcing Strategy with Verified Excellence

In the competitive landscape of global jewelry procurement, time is as valuable as cost efficiency. Sourcing high-quality, compliant, and competitively priced jewelry from China demands precision, due diligence, and trusted partnerships. Unverified suppliers, inconsistent quality, and communication delays continue to plague procurement teams—leading to missed deadlines, increased overhead, and reputational risk.

At SourcifyChina, we eliminate these challenges through our exclusive Pro List of Verified Suppliers, specifically curated for Made in China Jewelry Wholesale.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on our Pro List undergoes rigorous on-site audits for quality control, export compliance, production capacity, and ethical standards—saving 40+ hours of supplier screening per project. |

| Verified Certifications | Access suppliers with valid BSCI, ISO, and REACH certifications—ensuring compliance with EU, US, and global regulations without additional verification. |

| Direct Factory Pricing | Cut out intermediaries. Our Pro List connects you directly with Tier-1 factories, reducing lead times and minimizing miscommunication. |

| Dedicated Sourcing Support | Our team negotiates MOQs, lead times, and quality benchmarks on your behalf—accelerating RFQ-to-PO timelines by up to 60%. |

| Sample Validation & Quality Benchmarking | Receive pre-qualified product samples with detailed QC reports—reducing rework and returns. |

Time Saved: Procurement managers report reducing supplier qualification cycles from 8–12 weeks to under 15 days using our Pro List.

Call to Action: Accelerate Your 2026 Sourcing Goals

The future of efficient, scalable, and compliant jewelry sourcing is here. Don’t waste another quarter navigating unreliable suppliers or managing quality failures.

Take the next step with confidence.

👉 Contact SourcifyChina today to request access to our 2026 Verified Pro List for Made in China Jewelry Wholesale.

Our sourcing consultants are ready to:

– Match you with 3 pre-vetted suppliers in 48 hours

– Provide free sample coordination and QC inspection planning

– Support end-to-end order management

Reach Us Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Your supply chain deserves verified performance. Let SourcifyChina deliver it.

SourcifyChina – Trusted by 300+ Global Brands for Smarter China Sourcing

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.