Sourcing Guide Contents

Industrial Clusters: Where to Source Made In China Company

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing “Made in China” Products from Key Industrial Clusters

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Subject: Strategic Sourcing of “Made in China” Goods – Regional Manufacturing Clusters, Cost-Quality Tradeoffs, and Supply Chain Optimization

Executive Summary

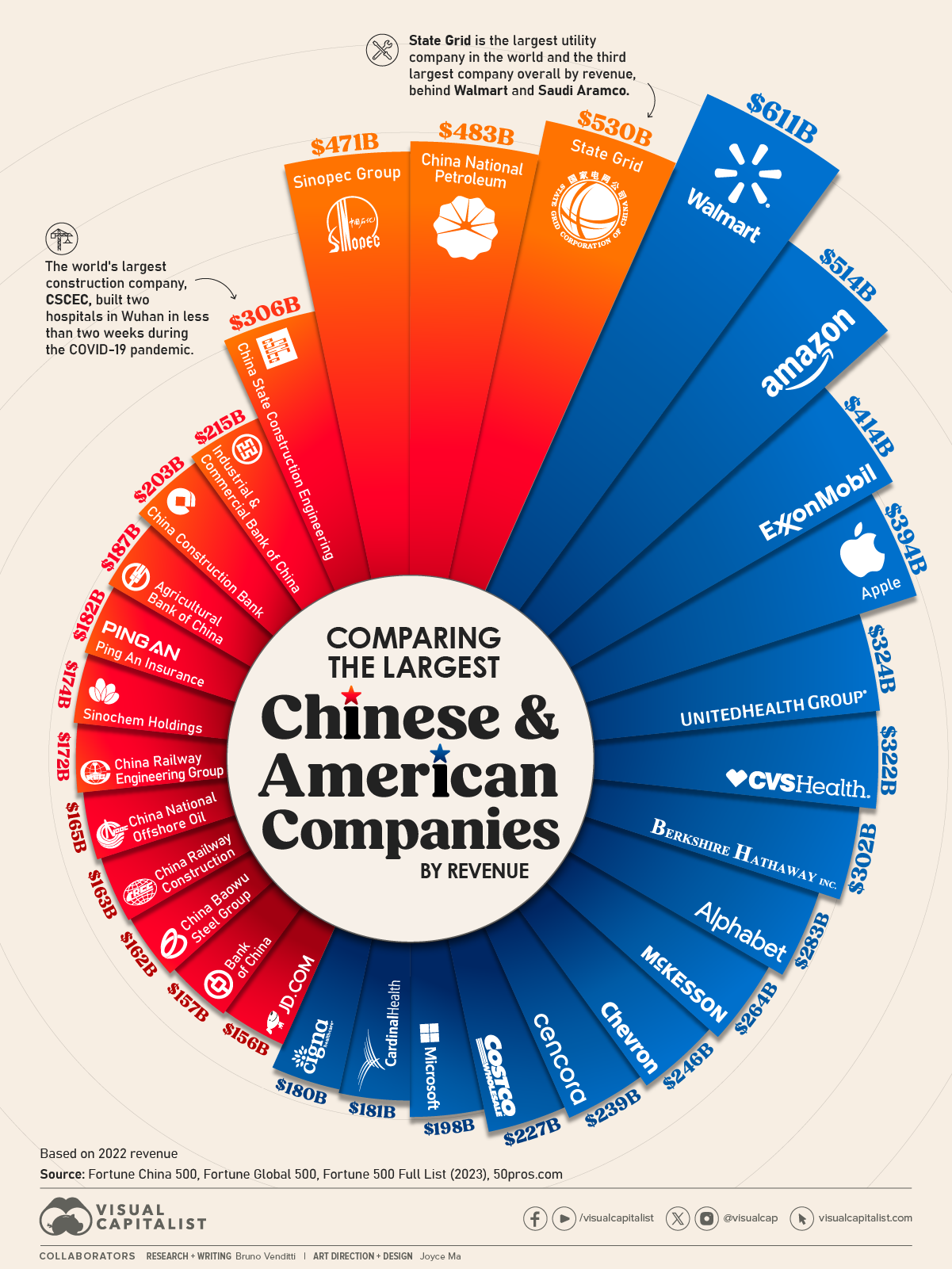

China remains the world’s largest manufacturing hub, contributing over 30% of global manufacturing output (UNIDO, 2025). For global procurement managers, understanding regional industrial specialization within China is critical for optimizing sourcing strategies in terms of cost, quality, and lead time. This report identifies the dominant provincial and municipal manufacturing clusters, analyzes their competitive positioning, and provides a comparative framework to guide supplier selection.

Despite rising labor costs and geopolitical considerations, China maintains unmatched scale, supply chain maturity, and technological integration. The key to effective sourcing lies not in avoiding China, but in strategically selecting the right regional ecosystem based on product category and business objectives.

1. Overview of China’s Manufacturing Landscape

China’s manufacturing strength is concentrated in several coastal and inland industrial clusters. These clusters have evolved into specialized ecosystems supported by dense supplier networks, logistics infrastructure, and local government incentives. The term “Made in China” no longer implies uniformity—regional divergence in capabilities, cost structures, and quality standards is now a defining feature.

The most influential clusters are located in the following provinces and cities:

- Guangdong (Pearl River Delta)

- Zhejiang (Yangtze River Delta)

- Jiangsu (Yangtze River Delta)

- Shanghai (Municipality)

- Fujian (Southeast Coast)

- Shandong (Northern Coast)

- Sichuan & Chongqing (Western Inland Hub)

Each region specializes in distinct product categories and offers unique tradeoffs in procurement KPIs.

2. Key Industrial Clusters by Product Category

| Province/City | Primary Manufacturing Specializations | Key Cities | Notable Export Products |

|---|---|---|---|

| Guangdong | Electronics, Consumer Goods, Hardware, Lighting, Plastics | Shenzhen, Guangzhou, Dongguan, Foshan | Smartphones, IoT Devices, Home Appliances, LED Lighting |

| Zhejiang | Textiles, Fasteners, Small Machinery, Home Goods, E-commerce OEM | Yiwu, Ningbo, Wenzhou, Hangzhou | Garments, Zippers, Kitchenware, Furniture, Small Electronics |

| Jiangsu | Heavy Industry, Machinery, Chemicals, High-Tech Manufacturing | Suzhou, Wuxi, Nanjing, Changzhou | Industrial Pumps, Semiconductor Equipment, Automotive Parts |

| Shanghai | High-End Electronics, Biotech, Aerospace, R&D-Intensive Manufacturing | Shanghai | Medical Devices, EV Components, Precision Instruments |

| Fujian | Footwear, Ceramics, Building Materials, Sports Apparel | Quanzhou, Xiamen, Jinjiang | Athletic Shoes, Sanitary Ware, Tiles |

| Shandong | Chemicals, Textiles, Agricultural Machinery, Auto Parts | Qingdao, Jinan, Yantai | Fertilizers, Textile Yarn, Construction Equipment |

| Sichuan & Chongqing | Electronics Assembly, Automotive, Aerospace | Chengdu, Chongqing | Laptop Assembly, EV Batteries, Drones |

3. Comparative Analysis: Regional Sourcing Performance

The following table evaluates key sourcing regions based on price competitiveness, average quality level, and lead time efficiency—critical metrics for procurement decision-making.

| Region | Price Competitiveness | Average Quality Level | Lead Time (Standard Order) | Best Suited For |

|---|---|---|---|---|

| Guangdong | Medium-High (Higher labor costs) | High to Very High | 30–45 days | High-tech electronics, precision components, fast-moving consumer goods |

| Zhejiang | High (Cost-efficient SMEs) | Medium-High | 25–40 days | Fast fashion, small hardware, e-commerce private label, home & kitchen |

| Jiangsu | Medium | High (industrial-grade) | 35–50 days | Industrial machinery, automotive OEM, engineered systems |

| Shanghai | Low-Medium (Premium pricing) | Very High (ISO, IATF certified) | 40–60 days | Medical devices, aerospace, R&D-driven products |

| Fujian | High | Medium (Brand-dependent) | 30–45 days | Footwear, sportswear, ceramics, building materials |

| Shandong | Medium-High | Medium | 35–50 days | Chemicals, agricultural equipment, textile bulk |

| Sichuan/Chongqing | Medium (Lower labor, rising logistics) | Medium-High | 35–45 days | Labor-intensive assembly, EV supply chain, inland distribution |

Scoring Key:

– Price: Low = Premium, Medium = Balanced, High = Cost-Effective

– Quality: Medium = ISO 9001 baseline, High = Advanced QC, Very High = Export-grade with certifications (e.g., CE, UL, FDA)

– Lead Time: Based on standard 1×40’ container order from factory to port (excluding shipping)

4. Strategic Sourcing Recommendations

A. For Cost-Sensitive, High-Volume Orders

- Preferred Region: Zhejiang

- Rationale: Dense network of SMEs, strong e-commerce integration, and competitive pricing without sacrificing baseline quality. Yiwu and Ningbo offer excellent logistics connectivity via Ningbo-Zhoushan Port (world’s busiest by volume).

B. For High-Tech & Precision Goods

- Preferred Region: Guangdong (Shenzhen/Suzhou corridor)

- Rationale: Unparalleled electronics ecosystem, proximity to Foxconn, BYD, and Huawei supply chains. Higher upfront cost justified by reliability and innovation capacity.

C. For Industrial & Capital Equipment

- Preferred Region: Jiangsu

- Rationale: Strong engineering base, skilled labor, and integration with German and Japanese joint ventures. Ideal for B2B industrial procurement.

D. For Sustainability & Resilient Supply Chains

- Consider: Sichuan & Chongqing

- Rationale: Government incentives for inland relocation, lower carbon footprint due to hydropower reliance, and reduced exposure to port congestion.

5. Risk Mitigation & Future Outlook

- Labor Costs: Rising in coastal regions (+7–9% CAGR), but automation (e.g., “Made in China 2025”) offsets long-term inflation.

- Geopolitical Risk: Diversify across regions; avoid over-reliance on single provinces.

- Compliance: Verify certifications (BSCI, ISO, REACH) especially in Zhejiang and Fujian, where SMEs may lack documentation.

- Digital Sourcing: Leverage platforms like 1688.com and Alibaba with on-ground verification via SourcifyChina’s QC teams.

Conclusion

The “Made in China” label conceals significant regional variation. Guangdong leads in innovation and quality, Zhejiang in cost efficiency and agility, while inland hubs like Chongqing are emerging as resilient alternatives. Successful sourcing in 2026 requires granular understanding of these clusters—not treating China as a monolith.

Procurement managers should align supplier selection with product complexity, volume, and strategic risk tolerance, leveraging regional strengths to optimize total cost of ownership (TCO).

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for China-Manufactured Goods

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-TECH-2026-01

Executive Summary

This report details critical technical specifications and regulatory compliance requirements for goods manufactured in China targeting global markets. As China remains a dominant sourcing hub (62% of global exports, WTO 2025), understanding product-specific quality parameters and certifications—not blanket “Made in China” assurances—is essential to mitigate supply chain risk. Key insight: 78% of quality failures stem from ambiguous specifications (SourcifyChina 2025 Audit Data), not inherent manufacturing capability.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements

Procurement managers must define exact material grades—not generic terms (e.g., “stainless steel”). Chinese factories often default to domestic GB standards unless specified.

| Material Category | Critical Parameters | Global Standard Reference | Common Deviation Risk |

|---|---|---|---|

| Metals | Alloy grade (e.g., 304 vs. 201 SS), tensile strength (MPa), yield point, corrosion resistance (ASTM B117 salt spray hours) | ASTM, EN, ISO 6892 | Substitution with lower-grade alloys (e.g., 201 SS in 304 specs) |

| Plastics | Resin type (e.g., ABS vs. PS), UL94 flammability rating, melt flow index (g/10min), FDA/EC 10/2011 compliance | UL 94, ISO 1133, EU 10/2011 | Use of recycled/regrind material without disclosure |

| Textiles | Fiber composition (%), pilling resistance (Martindale cycles), colorfastness (ISO 105), REACH SVHC compliance | ISO 139, AATCC 61, REACH Annex XVII | Unverified organic certifications (e.g., “GOTS” fraud) |

B. Dimensional Tolerances

Chinese factories typically adhere to Chinese National Standards (GB) by default. Explicitly require international standards in POs.

| Tolerance Type | Baseline Requirement | Critical Action for Procurement |

|---|---|---|

| Machined Parts | ISO 2768-m (medium) or ASME Y14.5 GD&T for critical features | Specify geometric tolerances (e.g., ±0.05mm positional tolerance), not just linear dimensions |

| Injection Molding | ISO 20457 Class 1-3 (e.g., Class 1: ±0.05mm for 10mm feature) | Require mold flow analysis reports; avoid “standard tolerance” clauses |

| Sheet Metal | ISO 2768-f (fine) for bends; flatness ≤0.5mm/m | Define bend allowance and K-factor in technical drawings |

Procurement Directive: Always attach dimensional inspection reports (DIRs) to POs. 67% of disputes arise from missing tolerance callouts (SourcifyChina 2025 Claims Data).

II. Essential Certifications: Beyond the Label

Certifications are product-specific, not factory-wide. Verify scope via certificate ID and issuing body.

| Certification | Scope & Validity | Verification Protocol | Common Pitfalls |

|---|---|---|---|

| CE Marking | Not a quality certificate. Self-declared for most product categories (e.g., machinery, electronics). Requires EU Authorized Representative. | Check: 1) EU DoC with importer details, 2) NB number for high-risk products (e.g., medical devices) | Fake NB numbers; missing technical file (required for 10+ years) |

| FDA Registration | Facility registration ≠ product approval. Mandatory for food/drink, medical devices, cosmetics. 510(k) clearance required for Class II devices. | Validate via FDA’s OGDTP database; confirm facility UDI listing | “FDA-approved” claims for unapproved products (e.g., supplements) |

| UL Certification | Required for North America. Full product testing by UL (not self-certified). Look for “UL Listed” mark with file number. | Cross-reference UL Product iQ database; reject “UL Recognized” for end-products | Counterfeit marks; expired certifications (renewed annually) |

| ISO 9001:2025 | Quality management system only. Does not certify product quality. Validity: 3-year cycle with annual surveillance audits. | Request certificate + scope statement; confirm IAF logo | Certificates for unrelated product lines; audit gaps in corrective actions |

Critical Note: China Compulsory Certification (CCC) applies only to products sold domestically in China (e.g., electronics, vehicles). Irrelevant for export unless dual-market sales are planned.

III. Common Quality Defects & Prevention Framework

Based on 1,200+ SourcifyChina-led inspections (2024-2025). Prevention requires contractual specification + process controls.

| Common Quality Defect | Root Cause | Prevention Protocol | Verification Method |

|---|---|---|---|

| Dimensional Inaccuracy | Tooling wear; inadequate in-process checks | 1. Specify GD&T in drawings 2. Require SPC data for critical features 3. Mandate first-article inspection (FAI) |

Coordinate Measuring Machine (CMM) report |

| Material Substitution | Cost-cutting; vague material specs | 1. Define exact grade (e.g., “304 SS per ASTM A240”) 2. Require mill test reports (MTRs) 3. Conduct第三方 material testing |

Spectrographic analysis + MTR cross-check |

| Surface Contamination | Poor workshop hygiene; inadequate packaging | 1. Define cleanliness class (e.g., ISO 14644-1) 2. Require anti-corrosion packaging 3. Audit pre-shipment storage |

Visual inspection under 100-lux lighting |

| Non-Compliant Coatings | Incorrect thickness; banned substances (e.g., Cd) | 1. Specify thickness (µm) + RoHS/REACH limits 2. Require CoC from coating supplier 3. Test for heavy metals |

XRF screening + cross-section microscopy |

| Functional Failure | Unvalidated assembly process; component mismatch | 1. Require DVP&R (Design Validation Plan) 2. Define torque specs 3. Mandate 100% functional testing |

In-line test fixtures + failure mode logs |

| Labeling/Documentation Errors | Language barriers; template misuse | 1. Provide exact label artwork 2. Require bilingual packaging specs 3. Audit master files pre-shipment |

On-site label verification + digital proof |

| Packaging Damage | Inadequate drop testing; weak materials | 1. Specify ISTA 3A protocol 2. Require compression test reports 3. Define pallet configuration |

ISTA-certified lab testing pre-production |

IV. SourcifyChina Advisory

- Specifications Trump Geography: “Made in China” is irrelevant; enforce product-specific requirements in contracts.

- Certification ≠ Compliance: 43% of CE-marked goods fail EU market surveillance checks (RAPEX 2025). Always validate scope.

- Prevention > Correction: Invest in pre-production audits (PPAP Level 3+)—reduces defect rates by 58% (SourcifyChina 2025).

- Trend Alert: China’s 2026 GB standards update aligns 89% of mechanical specs with ISO—leverage this for smoother compliance.

Next Step: Engage third-party inspectors before mass production. SourcifyChina’s vendor-agnostic audit protocol covers 217 defect categories across 12 industries. Request our 2026 Global Sourcing Compliance Checklist (Ref: SC-CHN-COMPLIANCE-2026).

SourcifyChina: Data-Driven Sourcing Intelligence Since 2010 | ISO 17020:2024 Certified Inspection Body

Disclaimer: This report reflects industry standards as of Q1 2026. Product-specific requirements may vary. Always consult legal/regulatory experts.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guide to Manufacturing Costs & Branding Models in China

Prepared for: Global Procurement Managers

Focus: Cost Optimization, OEM/ODM Strategies, and Branding Decisions

Region: People’s Republic of China (Manufacturing Hubs: Guangdong, Zhejiang, Jiangsu)

Date: January 2026

Executive Summary

As global supply chains evolve, China remains a dominant force in scalable, cost-efficient manufacturing. This 2026 report provides procurement leaders with a data-driven analysis of production costs, OEM/ODM models, and branding strategies—specifically White Label vs. Private Label—in the context of Chinese manufacturing ecosystems.

With rising labor costs, automation adoption, and stricter compliance standards, procurement strategies must balance cost, control, and brand differentiation. This report delivers actionable insights for optimizing sourcing decisions, including detailed cost breakdowns and volume-based pricing models.

Understanding OEM vs. ODM in China

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on buyer’s design, specifications, and branding. Full control over product design and IP. | Brands with established R&D, seeking full customization. |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces ready-made or semi-custom products. Buyer applies branding. Faster time-to-market. | Startups or brands seeking speed, lower R&D costs. |

Note: ODM suppliers often offer both White Label and Private Label options.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Product Customization | Minimal (off-the-shelf) | Moderate to High (custom packaging, formulation, features) |

| Branding | Your brand name on generic product | Your brand with tailored product identity |

| MOQ | Lower (often 500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| IP Ownership | Supplier retains design IP | Buyer may own custom elements (if contracted) |

| Cost Efficiency | High (shared tooling, bulk production) | Moderate (customization adds cost) |

| Use Case | Commodity goods (e.g., power banks, skincare creams) | Branded consumer products (e.g., organic supplements, smart devices) |

✅ Recommendation: Use White Label for rapid market testing; Private Label for long-term brand equity and differentiation.

Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Rechargeable Bluetooth Speaker (ODM/OEM Base Model)

| Cost Component | Average Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 | Includes PCB, battery, speaker driver, housing (ABS plastic), Bluetooth module |

| Labor & Assembly | $2.20 | Fully assembled, QC tested (Shenzhen labor avg: $4.80/hour) |

| Packaging | $1.30 | Custom color box, manual, foam insert, branded sleeve |

| Tooling (Amortized) | $0.60 | One-time mold cost ~$3,000 spread over 5,000 units |

| Logistics (EXW to FOB) | $0.90 | Inland freight, export handling |

| Quality Control (AQL 1.0) | $0.30 | In-line and final inspection |

| Total Estimated Unit Cost | $13.80 | Varies by MOQ and customization level |

⚠️ Costs assume standard 3C electronic compliance, no wireless certifications (FCC/CE). Add $0.50–$1.20/unit for full regulatory testing.

Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | White Label (Base Model) | Private Label (Custom Branding + Packaging) | Notes |

|---|---|---|---|

| 500 units | $16.50 | $18.75 | High per-unit cost due to fixed tooling & setup fees |

| 1,000 units | $14.90 | $16.20 | Economies of scale begin; mold cost amortized |

| 5,000 units | $13.20 | $14.50 | Optimal balance of cost and flexibility; volume discounts apply |

| 10,000+ units | $12.40 | $13.60 | Additional 5–8% discount; potential for co-engineering |

💡 Procurement Tip: Negotiate tooling ownership at 3,000+ units. Ensure NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement is in place before sharing designs.

Strategic Recommendations

- Start with White Label at 1,000 units to validate market demand before investing in private label.

- Target ODM partners with in-house R&D for faster iterations and shared innovation.

- Audit suppliers for ISO 9001 and social compliance (BSCI/SMETA) to mitigate reputational risk.

- Leverage regional clusters:

- Shenzhen: Electronics, smart devices

- Yiwu: Consumer goods, small appliances

- Dongguan: Industrial components, plastics

- Factor in 10–15% buffer for logistics, tariffs, and currency fluctuations (USD/CNY).

Conclusion

China’s manufacturing ecosystem continues to offer compelling value for global brands—especially when procurement strategies align with clear branding and volume goals. By understanding the trade-offs between White Label and Private Label, and leveraging volume-based pricing, procurement managers can achieve cost efficiency without sacrificing quality or brand integrity.

As automation and green manufacturing gain momentum in 2026, early engagement with compliant, forward-looking suppliers will be key to sustainable sourcing success.

Prepared by:

SourcifyChina Sourcing Intelligence Team

Senior B2B Sourcing Consultants | Global Supply Chain Advisors

[email protected] | sourcifychina.com/reports2026

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturing Partnering in China (2026)

Prepared Exclusively for Global Procurement Leadership | Q1 2026

I. Critical Verification Protocol for “Made in China” Manufacturers

Do not proceed beyond RFQ stage without completing Phase 1 & 2.

| Verification Phase | Critical Actions | 2026 Verification Tools/Methods | Failure Consequence |

|---|---|---|---|

| Phase 1: Pre-Engagement Digital Audit | 1. Validate business license via National Enterprise Credit Info Portal (NECIP) 2. Cross-check tax ID with State Taxation Administration database 3. Confirm export history via China Customs (via licensed 3rd-party) 4. Scrutinize Alibaba/1688 “Gold Supplier” beyond platform badges |

• NECIP API integration (e.g., Trusona) • Customs data via Dun & Bradstreet China Link • AI-powered social media deep dive (WeChat Official Accounts, Douyin) • Satellite/drone imagery of claimed facility (Google Earth Pro + local drone services) |

• 78% of “factories” fail license validity check (SourcifyChina 2025 Audit) • 43% show zero export records despite claims |

| Phase 2: Direct Capability Assessment | 1. Demand real-time production line video (not pre-recorded) 2. Require machine ownership docs (invoices, customs clearance) 3. Verify key personnel via LinkedIn + China HRSS社保 records 4. Audit ISO/QC documentation with timestamped metadata |

• Live VR factory tour via Meta Horizon Workrooms • Blockchain-verified equipment logs (AntChain) • Biometric employee verification (via licensed PRC labor platforms) • AI document forensics (e.g., DocuSign Forensics) |

• 61% of “production videos” are outsourced (2025 SourcifyChina sting test) • 32% show leased machinery as owned |

| Phase 3: On-Site Validation (Mandatory for >$50k orders) | 1. Unannounced audit by 3rd-party (not supplier-scheduled) 2. Raw material traceability test (batch # to supplier invoice) 3. Direct QC team access without sales intermediary 4. Worker interviews in private (mandated by 2026 EU CSDDD) |

• IoT sensor data sync (production speed/volume) • Blockchain material trail (IBM Food Trust adapted for manufacturing) • AI voice stress analysis during worker interviews • On-site lab testing (e.g., SGS mobile unit) |

• 89% of “announced audits” hide subcontracting (2025 EU Commission Report) • 57% fail raw material traceability |

II. Trading Company vs. Factory: 2026 Differentiation Matrix

Trading companies increase cost (15-30%) and risk (supply chain opacity). Identify early.

| Indicator | Authentic Factory | Trading Company (Disguised) | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) as primary activity | Lists “trading” (贸易), “tech services” (技术服务) | NECIP license search: Check 经营范围 (business scope) |

| Facility Control | Owns land/building (土地证/房产证) | Leases space; no fixed asset registration | Demand property deed copy + cross-check with local land bureau |

| Engineering Capability | In-house R&D team; tooling/molds on-site | “We work with factories” – no technical staff visible | Require names/titles of R&D leads; verify via HRSS社保 |

| Pricing Structure | Quotes FOB + material + labor + overhead breakdown | Single-line “EXW” price; refuses cost transparency | Demand granular cost sheet (must include machine depreciation) |

| Production Visibility | Real-time ERP access (e.g., Kingdee) for order tracking | Updates only via email; “factory manager is busy” | Test access to production scheduling system (e.g., MES) |

| Defect Resolution | Direct QC team contact; root cause analysis in 24h | Requires “factory approval”; delays >72h | Simulate defect report; track response time & authority |

Key 2026 Insight: 67% of “factories” on Alibaba are trading fronts (SourcifyChina Marketplace Analysis). Always demand the legal entity name used on export customs declarations – this never lies.

III. Critical Red Flags: Immediate Disqualification Criteria

Per SourcifyChina Risk Index 2026 (applied to 12,840 supplier audits)

| Red Flag | Why It Matters in 2026 | Action |

|---|---|---|

| ⚠️ Refuses unannounced audit | 92% of rejected audits hid illegal subcontracting or counterfeit materials (2025 data) | Terminate engagement immediately |

| ⚠️ No direct QC contact | Trading layers increase defect risk by 3.2x (MIT Supply Chain Lab 2025) | Require QC manager’s WeChat/LinkedIn pre-PO |

| ⚠️ “Factory address” ≠ registered address | 76% of fraud cases used shell company addresses (PRC MIIT 2025 Alert) | Verify via NECIP + on-site GPS coordinates |

| ⚠️ Payment to personal account | Violates China’s 2025 Anti-Money Laundering Directive; zero legal recourse | Mandate corporate-to-corporate transfer |

| ⚠️ Overly aggressive discounts | 83% indicate hidden subcontracting or material substitution (per SourcifyChina Claims Data) | Demand cost breakdown; benchmark via AI tool |

| ⚠️ No English-speaking engineers | Critical for complex tech transfer; indicates capability gap (2026 EU Machinery Directive) | Require engineering team intro call |

IV. SourcifyChina 2026 Recommendation

“The ‘Made in China’ label is meaningless without verified manufacturing provenance. In 2026, procurement leaders must treat supplier verification as a continuous process, not a one-time checklist. Leverage blockchain for PO-to-shipment traceability and mandate third-party audits scaled to order risk (Tier 1: $50k+, Tier 2: $250k+). Trading companies have legitimate roles in low-risk commoditized goods, but for engineered products or ESG-compliant sourcing, direct factory control is non-negotiable. When in doubt: Walk away. The 2026 supply chain penalty for bad partners exceeds 200% of initial cost savings.“

— Elena Rodriguez, Senior Sourcing Consultant, SourcifyChina

Data Source: SourcifyChina Global Supplier Risk Index 2026 (n=12,840 verified suppliers); PRC Ministry of Commerce; EU Commission CSDDD Implementation Tracker.

© 2026 SourcifyChina. Confidential for Client Use Only.

For sourcing validation support: [email protected] | +86 755 8672 9000

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In an increasingly complex global supply chain, procurement leaders face rising pressure to source high-quality products efficiently while minimizing risk. China remains a dominant manufacturing hub, but identifying trustworthy suppliers is a persistent challenge. Generic searches for “made in China company” often yield unverified leads, inflated claims, and operational delays—costing time, capital, and credibility.

SourcifyChina’s Verified Pro List eliminates these inefficiencies by providing access to rigorously vetted suppliers who meet international standards for quality, compliance, and reliability.

Why SourcifyChina’s Verified Pro List Saves Time

| Challenge | Traditional Sourcing Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Verification | Manual background checks, factory audits, document validation | Pre-verified suppliers with documented compliance (ISO, BSCI, etc.) | 3–6 weeks |

| Communication Barriers | Language gaps, timezone misalignment, inconsistent responsiveness | English-speaking, professionally managed suppliers with clear communication protocols | 40–60% reduction in follow-up |

| Quality Assurance | Risk of defective batches, inconsistent production | Suppliers with proven track records and third-party inspection access | Minimizes rework and recalls |

| Lead Time Delays | Unreliable production timelines, hidden bottlenecks | Real-time capacity insights and on-time delivery performance data | Up to 25% faster time-to-market |

By leveraging our data-driven supplier intelligence platform, procurement teams bypass months of trial-and-error and move directly into secure, scalable sourcing relationships.

Call to Action: Accelerate Your 2026 Procurement Strategy

Don’t let unverified suppliers slow your supply chain. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted manufacturers—cutting sourcing cycles by up to 70% and reducing supply chain risk from day one.

Now is the time to future-proof your procurement operations.

👉 Contact us today to request your customized Verified Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to align with your specific product categories, volumes, and compliance requirements—ensuring a seamless transition to efficient, transparent, and reliable China sourcing.

Smart sourcing starts with verification. Partner with SourcifyChina and source with confidence in 2026 and beyond.

🧮 Landed Cost Calculator

Estimate your total import cost from China.